Market Overview:

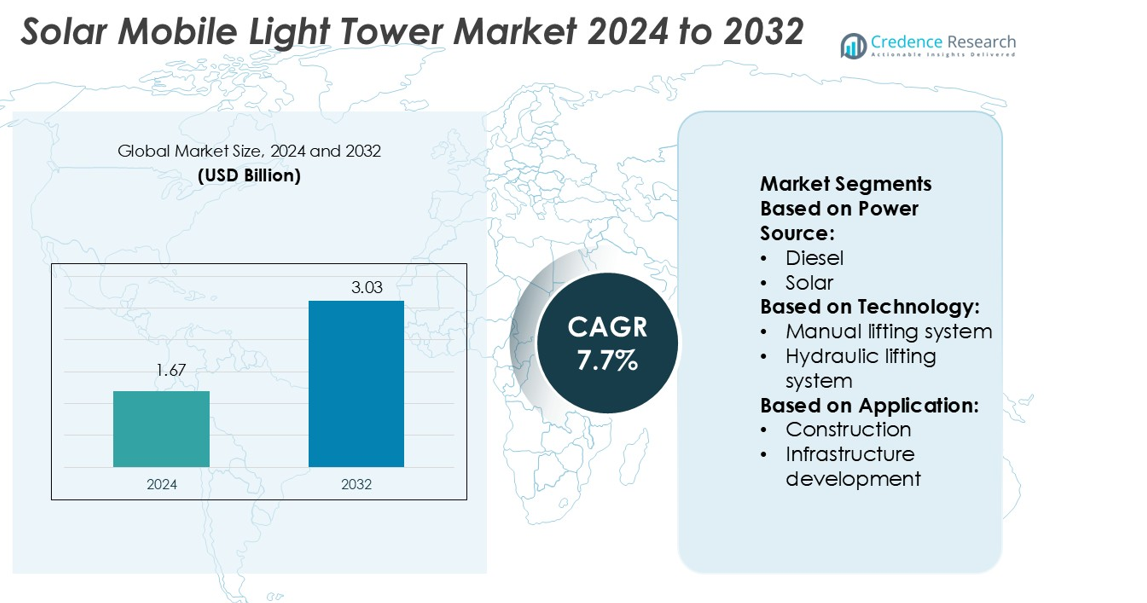

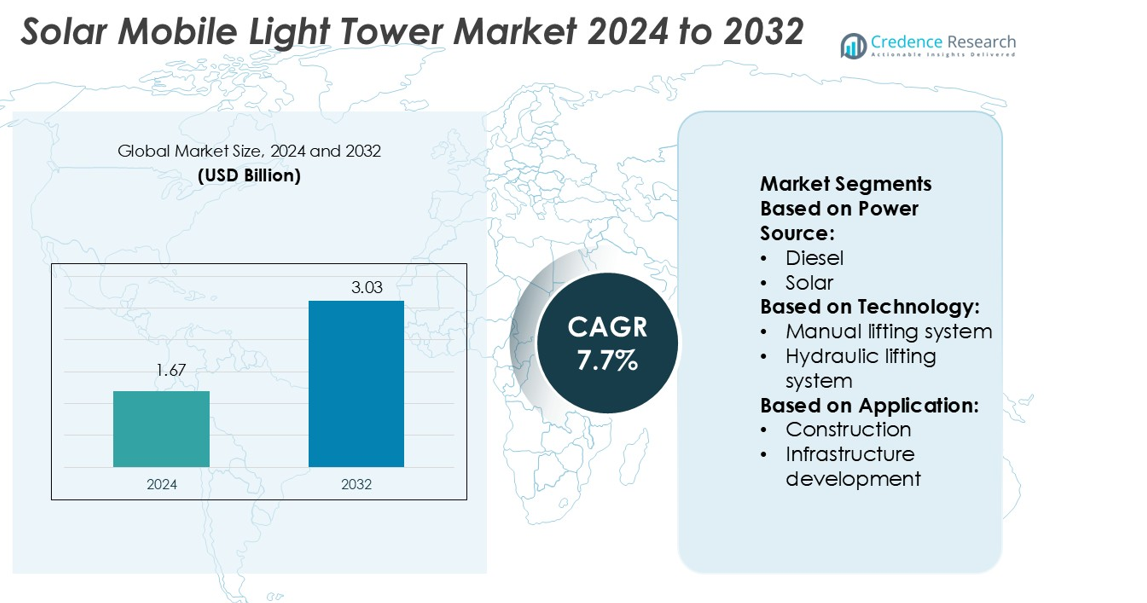

Solar Mobile Light Tower Market size was valued USD 1.67 billion in 2024 and is anticipated to reach USD 3.03 billion by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Mobile Light Tower Market Size 2024 |

USD 1.67 billion |

| Solar Mobile Light Tower Market, CAGR |

7.7% |

| Solar Mobile Light Tower Market Size 2032 |

USD 3.03 billion |

The solar mobile light tower market is highly competitive, with top players including Atlas Copco, Caterpillar, Generac Power Systems, Allmand Bros., Chicago Pneumatic, Larson Electronics, Colorado Standby, Light Boy, Aska Equipments, and DMI. These companies focus on advancing solar technologies, improving energy storage, and offering hybrid solutions to meet diverse industry needs. North America leads the global market with a 32% share, driven by extensive adoption in construction, oil & gas, and emergency applications. Strong regulatory support for renewable energy and the presence of established manufacturers position the region as the key growth hub.

Market Insights

- The Solar Mobile Light Tower Market size was valued at USD 1.67 billion in 2024 and is projected to reach USD 3.03 billion by 2032, registering a CAGR of 7.7% during the forecast period.

- Growing demand for sustainable energy solutions, combined with rising infrastructure and construction activities, is driving strong adoption of solar-powered towers across industries.

- The market is witnessing a trend toward hybrid models integrating solar with diesel or battery backup, alongside advancements in energy storage and high-efficiency solar panels.

- Competition is intense, with companies like Atlas Copco, Caterpillar, Generac Power Systems, and others focusing on innovation, cost efficiency, and rental-based business models to strengthen market share.

- North America leads with a 32% regional share, supported by strict renewable energy regulations, while construction applications account for over 35% of the global segment share, reflecting the sector’s dominance in market demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Source

Solar-powered light towers dominate the market, holding a share of over 40% in 2024. Their popularity stems from zero fuel costs, reduced carbon emissions, and suitability for remote operations. Rising sustainability goals, coupled with government initiatives promoting renewable energy adoption, continue to drive demand. Diesel-powered units remain relevant due to high power output and reliability in extreme conditions, but rising fuel prices and emission regulations limit growth. Direct and other hybrid sources serve niche needs, especially in applications requiring continuous backup where renewable-only solutions face limitations.

- For instance, Hybrid light towers are available in the market from various manufacturers, offering solar and battery power to significantly reduce diesel consumption. Some models can provide over 72 hours of continuous runtime, with potential annual diesel savings of thousands of gallons.

By Technology

The hydraulic lifting system leads the market with a share exceeding 55% in 2024. Its dominance is attributed to enhanced operational efficiency, quicker deployment, and the ability to handle larger mast heights. These systems are increasingly adopted in demanding projects such as oil and gas and large infrastructure works. Manual lifting systems maintain presence in small-scale operations due to lower costs and simpler maintenance. However, the trend strongly favors hydraulic systems as industries prioritize time efficiency, workforce safety, and automation, reinforcing their position as the preferred technology.

- For instance, Generac’s V20 PRO uses a hydraulic mast with 340° rotation. Wind resistance is 110 km/h and tank capacity is 100 liters. Hybrid runtime reaches 471 hours, with generator runtime 165 hours.

By Application

Construction applications account for the largest share, representing more than 35% of the market in 2024. The sector’s dominance comes from the rising number of infrastructure projects and the need for round-the-clock operations. Mining and oil & gas follow, driven by harsh environments requiring reliable illumination. Emergency and disaster relief, along with military and defense, represent growing segments as portable, sustainable lighting becomes essential in mission-critical scenarios. Infrastructure development projects further expand adoption, while other uses such as outdoor events sustain moderate growth, reflecting the broadening utility of mobile light towers.

Market Overview

Shift Toward Sustainable Energy Solutions

The growing emphasis on reducing carbon emissions is driving the adoption of solar mobile light towers. Industries and governments are increasingly replacing diesel-powered units with solar-powered alternatives to align with environmental regulations. Solar light towers reduce fuel dependency, lower operating costs, and minimize maintenance requirements. Their ability to provide clean, renewable energy makes them highly suitable for off-grid and remote projects. This transition toward sustainability continues to accelerate demand, especially in construction, mining, and emergency operations where reliable, eco-friendly lighting solutions are essential.

- For instance, Progress Solar’s HELIOS-2 unit is equipped with 1,350 W of solar panels and a standard 600 Ah battery bank. The system’s four LED floodlights yield a total output of 60,000 lumens, and it is designed to provide over 32 hours of autonomous runtime.

Rising Infrastructure and Construction Activities

The surge in global infrastructure projects is a major growth driver for the solar mobile light tower market. Large-scale construction of roads, railways, bridges, and urban developments requires consistent nighttime illumination. Solar-powered towers provide a cost-effective and sustainable solution compared to diesel units, offering long-term savings. Governments and private contractors are adopting these towers to meet strict energy efficiency and environmental standards. As urbanization accelerates across emerging economies, demand for reliable, portable, and renewable lighting solutions is expected to continue growing significantly in the construction sector.

- For instance, Allmand offers a range of light towers, including the Hybrid LT-Series and the Maxi-Lite. The Hybrid LT-Series combines a diesel generator with a battery system to extend runtime, with some settings offering over 850 hours of continuous operation.

Advancements in Solar and Battery Technologies

Technological progress in solar panels and energy storage systems is fueling market expansion. Modern solar mobile light towers integrate high-efficiency photovoltaic panels and advanced lithium-ion batteries, delivering longer operational hours with reduced downtime. Improved energy storage enables continuous performance during cloudy weather or at night. Lightweight designs and enhanced durability further strengthen adoption across diverse industries. These innovations not only improve performance but also reduce lifetime costs, making solar towers more attractive to budget-conscious buyers. Continuous R&D in solar technologies will further enhance reliability and market acceptance.

Key Trends & Opportunities

Integration of Hybrid Power Solutions

The market is witnessing a growing trend of hybrid light towers that combine solar with battery or diesel backup. This integration ensures uninterrupted performance even under low sunlight conditions. Hybrid systems are gaining popularity in industries like mining and oil & gas, where 24/7 operations demand consistent illumination. Companies offering versatile hybrid models create opportunities to serve diverse application needs while ensuring energy efficiency. This trend expands the addressable market, especially in regions with variable weather conditions, where pure solar solutions may face limitations.

- For instance, Larson Electronics’ SPLT-2.1K hybrid light tower uses (8) 265 W solar panels, (8) 250 Ah SLA batteries, and a 10,000 W hybrid inverter, delivering 86,400 lumens and 10 kW AC output under backup mode.

Adoption in Disaster Relief and Military Operations

Solar mobile light towers are increasingly used in disaster management and defense sectors. Their portability, quick setup, and independence from fuel supply chains make them ideal for emergency relief operations. Military and defense units also rely on solar towers to reduce logistical challenges associated with fuel transport. This adoption trend creates new opportunities for manufacturers to design rugged, high-capacity models tailored for critical applications. The demand in these sectors is expected to rise as governments prioritize renewable, mobile energy solutions in strategic and humanitarian missions.

- For instance, Atlas Copco’s HiLight MS 5 solar tower deploys 4 × 150 W SMD LEDs producing 117,000 lumens over 5,278 m² at 20 lux, supports autonomy of 85 hours, and recharges fully in 5 hours.

Key Challenges

High Initial Investment Costs

Despite long-term savings, the upfront cost of solar mobile light towers remains a key challenge. Advanced solar panels and lithium-ion batteries significantly increase initial pricing compared to diesel-powered alternatives. This higher capital expenditure can deter small contractors and organizations with limited budgets. While operational savings and government incentives partially offset these costs, affordability remains a barrier in price-sensitive markets. Manufacturers must focus on offering cost-efficient designs and financing models to improve adoption among SMEs and developing regions.

Performance Limitations in Low Sunlight Conditions

Solar mobile light towers face operational challenges in areas with limited sunlight or extended cloudy weather. Although energy storage technologies have improved, performance limitations persist, especially for continuous, high-demand applications. Industries such as oil & gas and mining, which require consistent 24/7 illumination, may hesitate to fully rely on solar units. This constraint limits adoption in certain geographies. The integration of hybrid systems provides a partial solution, but manufacturers must continue innovating to enhance reliability and reduce dependence on sunlight availability.

Regional Analysis

North America

North America holds a market share of 32% in the solar mobile light tower market. The region’s dominance is supported by rising adoption in construction, oil & gas, and emergency services. Stringent environmental regulations and government policies encouraging renewable energy use further drive demand. The United States leads with large infrastructure projects and increasing use of solar-powered solutions in disaster relief operations. Canada follows with mining and remote site deployments. Strong technological innovation and established manufacturers in the region continue to support growth, making North America a mature yet steadily expanding market.

Europe

Europe accounts for 27% of the market share, driven by strict carbon reduction targets and green energy adoption. Countries such as Germany, the United Kingdom, and France lead in deployment, particularly in infrastructure development and defense operations. The European Union’s renewable energy policies encourage companies to transition from diesel to solar-based mobile towers. Growing construction activities, urban redevelopment projects, and a strong emphasis on sustainability further strengthen market prospects. The region’s high acceptance of advanced technologies ensures steady adoption, while manufacturers continue to innovate hybrid solutions to meet regional energy security needs.

Asia-Pacific

Asia-Pacific commands 28% of the solar mobile light tower market, making it one of the fastest-growing regions. Rapid urbanization, infrastructure expansion, and mining activities in China, India, and Australia are major growth drivers. Governments in the region actively promote renewable energy adoption through incentives and subsidies. Demand from large-scale construction projects and oil & gas operations adds to market strength. The region also benefits from domestic manufacturing of solar components, which lowers costs and boosts adoption. Asia-Pacific is expected to witness robust growth as sustainability initiatives and industrialization continue at a large scale.

Latin America

Latin America captures 4% of the solar mobile light tower market, representing a smaller yet expanding segment. Countries like Brazil, Mexico, and Chile are leading adoption, driven by infrastructure projects, mining operations, and disaster relief efforts. Government initiatives supporting renewable energy integration are gradually pushing industries to adopt solar alternatives over diesel-powered units. While cost sensitivity remains a challenge, the region shows strong potential as construction activities expand and sustainability goals gain traction. Increased deployment in remote and off-grid areas further supports growth, positioning Latin America as an emerging market for solar mobile light towers.

Middle East & Africa

The Middle East & Africa region holds a 9% share of the solar mobile light tower market. Growth is primarily fueled by oil & gas projects, mining operations, and large-scale infrastructure development. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption due to their focus on sustainable energy solutions in industrial projects. Solar towers are preferred in remote desert and mining sites where fuel logistics are challenging. Rising government investments in renewable energy infrastructure and the growing need for off-grid power solutions further strengthen the region’s adoption outlook.

Market Segmentations:

By Power Source:

By Technology:

- Manual lifting system

- Hydraulic lifting system

By Application:

- Construction

- Infrastructure development

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the solar mobile light tower market features key players such as Colorado Standby, Generac Power Systems, Light Boy, Allmand Bros., Larson Electronics, Atlas Copco, DMI, Caterpillar, Aska Equipments, and Chicago Pneumatic. The solar mobile light tower market is shaped by innovation, sustainability, and adaptability. Manufacturers are increasingly investing in research and development to integrate high-efficiency solar panels, advanced battery storage, and hybrid systems that ensure continuous performance. The market is also witnessing strong competition in terms of cost efficiency, with companies focusing on modular designs and rental-based models to appeal to budget-conscious customers. Strategic partnerships with construction firms, mining companies, and defense organizations are further expanding market reach. Overall, competition is driven by the need to deliver reliable, eco-friendly, and versatile lighting solutions across diverse applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, ITI Limited issued a tender for the establishment of a 500 MW fully automated solar photovoltaic (SPV) module manufacturing line on a turnkey basis.

- In January 2025, Chinese solar module manufacturer JinkoSolar Holding Co Ltd announced that it has achieved a conversion efficiency of 33.84% for its N-type TOPCon-based perovskite tandem solar cell, surpassing the previous record of 33.24%.

- In June 2024, Tongwei launched the TNC-G12/G12R series modules marked a significant industry milestone. These modules offer superior power output, efficiency, and quality, leveraging its proprietary solar cell technology and setting a new benchmark for high-performance solar solutions.

- In January 2024, Generac Mobile introduced the GLT Series, a new line of mobile lighting towers designed for improved performance and sustainability. These towers feature compact designs, enhanced fuel efficiency, and low noise emissions, making them suitable for urban and sensitive environments.

Report Coverage

The research report offers an in-depth analysis based on Power Source, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as industries accelerate the shift toward renewable energy solutions.

- Advancements in solar panel efficiency will enhance performance and reduce operating costs.

- Battery technology improvements will extend operating hours and reliability in all weather conditions.

- Hybrid solar-diesel systems will gain traction in regions with inconsistent sunlight availability.

- Adoption in construction and infrastructure development projects will remain a primary growth driver.

- Mining and oil & gas sectors will increasingly deploy solar towers for remote operations.

- Emergency and disaster relief applications will see higher demand for portable, sustainable lighting.

- Military and defense will adopt solar towers to reduce fuel dependence and logistics challenges.

- Rental and leasing models will grow as cost-sensitive users seek flexible deployment options.

- Sustainability regulations will continue to encourage investment in eco-friendly mobile lighting solutions.