Market Overview

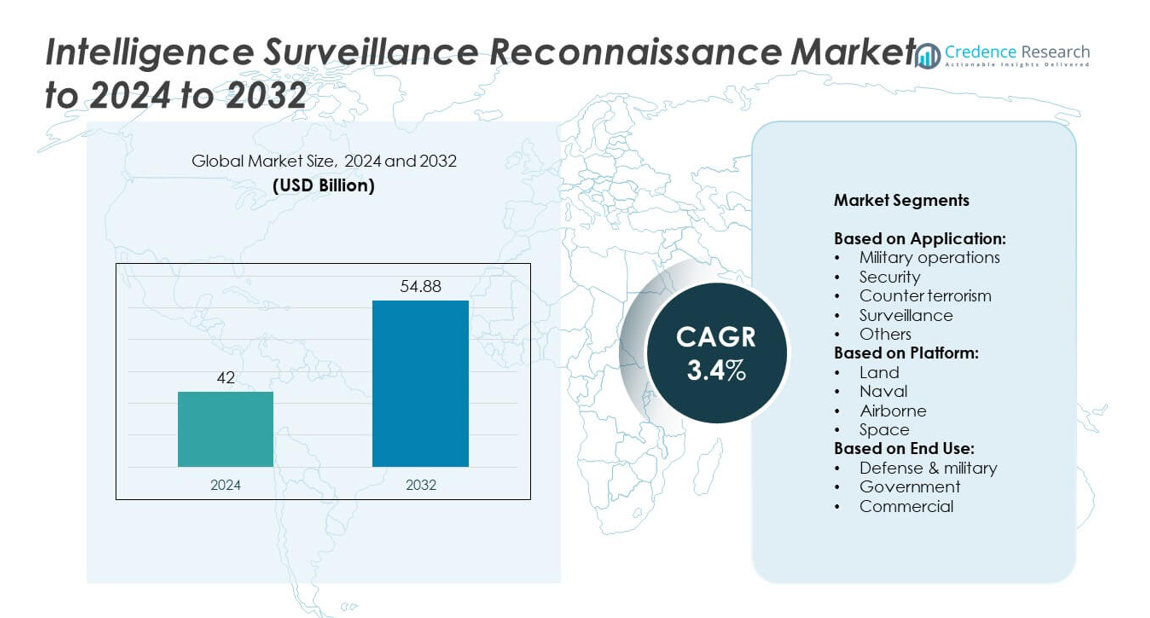

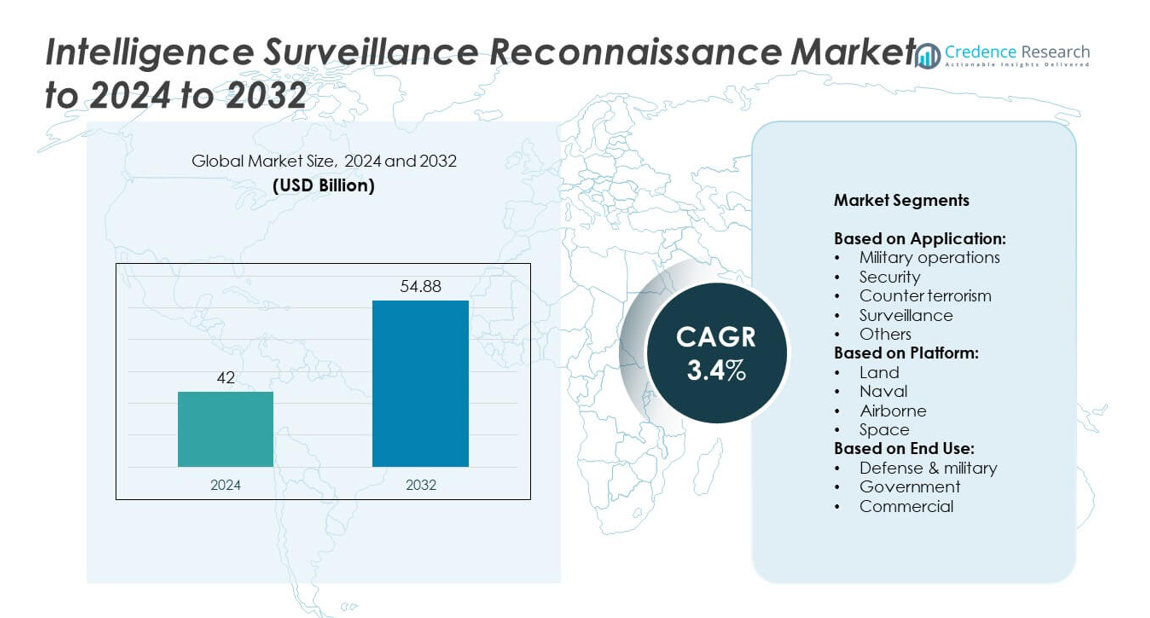

The Intelligence Surveillance Reconnaissance Market size was valued at USD 42 billion in 2024 and is anticipated to reach USD 54.88 billion by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligence Surveillance Reconnaissance Market Size 2024 |

USD 42 billion |

| Intelligence Surveillance Reconnaissance Market, CAGR |

3.4% |

| Intelligence Surveillance Reconnaissance Market Size 2032 |

USD 54.88 billion |

The intelligence surveillance reconnaissance market is shaped by major players such as Saab, Boeing, Lockheed Martin, Rheinmetall, Elbit Systems, Thales, BAE Systems, General Dynamics, Kratos Defense, Israel Aerospace Industries, Textron, General Atomics, Raytheon Technologies, L3Harris, and Northrop Grumman. These companies focus on advancing ISR platforms with AI integration, satellite-based solutions, and unmanned systems to strengthen operational efficiency and global security capabilities. Regional analysis highlights North America as the leading market, holding 38% share in 2024, driven by high defense budgets and rapid adoption of next-generation technologies, followed by Europe and Asia Pacific with strong modernization initiatives.

Market Insights

- The intelligence surveillance reconnaissance market was valued at USD 42 billion in 2024 and is projected to reach USD 54.88 billion by 2032, growing at a CAGR of 3.4%.

- Rising defense expenditure, coupled with increasing counterterrorism and border security requirements, continues to drive strong demand for advanced ISR systems.

- Trends such as the integration of AI, big data analytics, and space-based ISR platforms are enhancing real-time intelligence capabilities and broadening applications across defense and security.

- The market is highly competitive, with global players investing in R&D, partnerships, and advanced technologies to expand portfolios, while high development costs and cybersecurity risks restrain wider adoption.

- North America led with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 22%, while military operations dominated by application with over 42% share, highlighting the region-specific focus on modernization and defense readiness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Military operations dominated the Intelligence Surveillance Reconnaissance (ISR) market in 2024, accounting for over 42% of the share. The dominance is driven by the growing need for real-time situational awareness in modern combat and cross-border conflicts. Investments in unmanned aerial vehicles, radar systems, and satellite-based intelligence support this leadership. Counter terrorism and security segments are also growing, fueled by rising insurgencies and urban threats. The increasing adoption of advanced ISR systems ensures rapid intelligence gathering, aiding in decision-making and mission success, which continues to strengthen the military segment’s position.

- For instance, Northrop Grumman’s RQ-4 Block 40 flew a 34.3-hour mission in 2014. This shows long, persistent ISR for combat needs.

By Platform

Airborne platforms held the largest share of the ISR market in 2024, with over 38% of the revenue. This leadership stems from high demand for UAVs, aircraft-mounted sensors, and satellites that provide broad coverage and persistent surveillance. Airborne systems offer unmatched capabilities for both strategic and tactical missions, making them essential for border security and defense modernization. The space segment is gaining traction with new satellite launches, while naval and land platforms are seeing adoption in maritime security and ground operations. Continuous upgrades in drone technology further fuel airborne platform dominance.

- For instance, General Atomics’ Predator-series aircraft passed 8,000,000 flight hours by July 2023. Many of these hours are ISR missions.

By End Use

Defense and military end use led the ISR market in 2024, capturing more than 50% of the global share. Rising geopolitical tensions and large-scale investments in intelligence infrastructure drive this dominance. Nations are focusing on enhancing defense readiness through advanced ISR capabilities, including AI-powered analytics and integrated command systems. Government agencies follow, driven by internal security and border protection initiatives. Commercial applications, though smaller, are growing in areas like infrastructure monitoring and disaster management. The defense sector’s critical role in national security ensures its continued dominance over the forecast period.

Key Growth Drivers

Rising Defense Expenditure

The ISR market is strongly driven by increased global defense spending, particularly among leading economies modernizing their military capabilities. Governments are prioritizing investment in intelligence and surveillance technologies to enhance battlefield awareness and strengthen national security. Growing geopolitical conflicts and cross-border tensions further accelerate procurement of advanced ISR systems, including drones, radars, and satellite solutions. This steady increase in defense budgets ensures long-term growth, making rising defense expenditure the primary growth driver of the market.

- For instance, BAE Systems reported a 14 % increase in sales in 2024, reaching £28.335 billion, tied to growing defense budgets.

Technological Advancements in ISR Systems

Rapid innovations in artificial intelligence, machine learning, and sensor technologies are transforming ISR systems. These technologies enable faster data processing, predictive analysis, and enhanced real-time situational awareness. Integration of AI-powered analytics with ISR platforms supports decision-making accuracy in high-pressure environments. Development of miniaturized sensors and high-resolution imaging systems expands applications across airborne, naval, and space domains. Such advancements provide stronger operational efficiency, which fuels the adoption of next-generation ISR solutions across both defense and government applications.

- For instance, Raytheon has delivered over 700 AN/APG-79 AESA radar systems to the U.S. Navy and Royal Australian Air Force.

Increasing Counterterrorism and Border Security Needs

The rise in terrorism threats and transnational crimes has intensified demand for ISR systems in counterterrorism and border surveillance operations. Governments are deploying advanced ISR solutions to monitor suspicious activities, detect unauthorized movements, and support law enforcement agencies. UAVs and satellite-based platforms provide continuous monitoring in challenging terrains, strengthening security against asymmetric threats. This growing requirement for counterterrorism operations and secure border control plays a vital role in accelerating ISR market adoption worldwide, especially in high-risk regions.

Key Trends & Opportunities

Integration of Artificial Intelligence and Big Data

One of the major trends in the ISR market is the integration of AI and big data analytics into surveillance systems. These technologies enhance real-time data interpretation, automate threat detection, and reduce operator workload. AI-powered ISR platforms provide predictive insights and improve decision-making for defense and security forces. The shift toward data-driven intelligence solutions presents significant opportunities for technology providers. This trend not only improves efficiency but also expands ISR applications beyond military use to include law enforcement and disaster management.

- For instance, Airbus has built over 648 OneWeb satellites to support its LEO constellation efforts.

Growing Adoption of Space-Based ISR Systems

Space-based ISR systems are emerging as a strong opportunity for global defense and government agencies. Satellites provide long-range, persistent surveillance with high-resolution imagery and signals intelligence. Increasing investments in satellite constellations by countries such as the U.S., China, and India highlight this growth potential. Space-based ISR offers strategic advantages in monitoring adversaries, disaster response, and maritime security. With advancing satellite technology and declining launch costs, this trend is expected to play a pivotal role in shaping the market’s future growth.

- For instance, In mid-2022, ICEYE had launched over 20 satellites, with 18 of those being available for user access. The company has since expanded its Synthetic Aperture Radar (SAR) constellation, and by June 2025, it had reached 54 satellites in orbit, continuing to provide radar-based imagery intelligence.

Key Challenges

High Development and Maintenance Costs

One of the main challenges in the ISR market is the high cost associated with developing and maintaining advanced systems. ISR platforms require significant investments in R&D, integration, and upgrades, which create barriers for smaller economies. The lifecycle costs, including training and operational expenses, further strain defense budgets. While major powers continue heavy investments, developing nations face difficulty adopting these solutions. The high cost factor limits widespread adoption, restraining overall market growth, particularly in cost-sensitive regions.

Data Overload and Cybersecurity Risks

The massive volume of data collected by ISR platforms presents challenges in storage, processing, and analysis. Without advanced data management systems, operators face difficulties in extracting actionable intelligence. Moreover, ISR networks are highly vulnerable to cyberattacks, which can compromise sensitive information and disrupt operations. As reliance on digital platforms increases, ensuring cybersecurity and secure communication channels becomes critical. Addressing data overload and cyber risks remains a pressing challenge for defense organizations and technology providers within the ISR market.

Regional Analysis

North America

North America held the largest share of the intelligence surveillance reconnaissance market in 2024, accounting for 38%. The region’s dominance is supported by significant defense spending from the United States, along with ongoing investments in advanced ISR technologies, including UAVs, satellite systems, and AI-driven analytics. Strong presence of key defense contractors and continuous government-led modernization programs further enhance regional growth. Border security initiatives and counterterrorism efforts also drive demand. Canada contributes with investments in defense modernization, although the U.S. remains the primary revenue generator, consolidating North America’s leadership in the global ISR market.

Europe

Europe accounted for 27% of the intelligence surveillance reconnaissance market in 2024. The region benefits from collective defense initiatives under NATO and increasing cross-border surveillance requirements. Countries such as the United Kingdom, Germany, and France are investing in space-based ISR systems and advanced UAV platforms to enhance situational awareness. Rising geopolitical tensions in Eastern Europe and border control requirements add to demand. Additionally, the European Union’s defense research programs are supporting ISR innovation. These factors collectively ensure steady growth for the market in Europe, particularly in strengthening regional and allied security operations.

Asia Pacific

Asia Pacific represented 22% of the global intelligence surveillance reconnaissance market in 2024. The region’s growth is driven by rapid military modernization in China, India, and Japan. Territorial disputes, rising defense budgets, and maritime security requirements have accelerated ISR system adoption across land, naval, and airborne platforms. Countries are heavily investing in UAV development, satellite constellations, and electronic warfare capabilities. Growing emphasis on counterterrorism and border surveillance further supports market expansion. With strong demand from emerging economies and regional tensions in the South China Sea, Asia Pacific is expected to witness robust growth during the forecast period.

Middle East & Africa

The Middle East and Africa accounted for 8% of the intelligence surveillance reconnaissance market in 2024. Rising threats from terrorism, cross-border conflicts, and regional instability have fueled demand for ISR systems in the region. Countries such as Saudi Arabia, Israel, and the UAE are investing in UAVs, satellite systems, and advanced surveillance networks to secure national borders and critical infrastructure. Africa is gradually adopting ISR technologies for counterterrorism and peacekeeping missions, though at a smaller scale. Continued defense modernization and security initiatives are likely to sustain steady market growth in the region.

Latin America

Latin America held a 5% share of the intelligence surveillance reconnaissance market in 2024. The region’s demand is primarily driven by increasing focus on border surveillance, drug trafficking control, and disaster management applications. Countries such as Brazil and Mexico are leading adopters, with investments in UAVs and maritime surveillance systems. While overall defense budgets are limited compared to other regions, government initiatives to strengthen homeland security contribute to gradual ISR adoption. Latin America’s market growth remains steady, supported by ongoing efforts to enhance national security infrastructure and address transnational security challenges effectively.

Market Segmentations:

By Application:

- Military operations

- Security

- Counter terrorism

- Surveillance

- Others

By Platform:

- Land

- Naval

- Airborne

- Space

By End Use:

- Defense & military

- Government

- Commercial

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Saab, Boeing, Lockheed Martin, Rheinmetall, Elbit Systems, Thales, BAE Systems, General Dynamics, Kratos Defense, Israel Aerospace Industries, Textron, General Atomics, Raytheon Technologies, L3Harris, and Northrop Grumman are among the leading companies shaping the intelligence surveillance reconnaissance market. The competitive landscape is characterized by heavy investment in advanced technologies, including artificial intelligence, machine learning, and satellite-based ISR platforms. Companies are focusing on integrated solutions that combine land, naval, airborne, and space-based systems to provide comprehensive situational awareness. Strategic partnerships with defense agencies and cross-border collaborations are driving innovation pipelines and enhancing global reach. Many firms are expanding their portfolios through R&D initiatives, mergers, and acquisitions to strengthen technological capabilities. Emphasis on miniaturized sensors, high-resolution imaging, and secure communication networks highlights the ongoing push for operational efficiency. The competitive environment remains dynamic, with each player prioritizing modernization programs to meet evolving security and defense demands worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Saab

- Boeing

- Lockheed Martin

- Rheinmetall

- Elbit Systems

- Thales

- BAE Systems

- General Dynamics

- Kratos Defense

- Israel Aerospace Industries

- Textron

- General Atomics

- Raytheon Technologies

- L3Harris

- Northrop Grumman

Recent Developments

- In 2025, RTX (Raytheon) launched the MTS-A HD (Multispectral Targeting System-A High Definition) variant, offering enhanced visual capability, targeting precision, and imaging clarity for naval helicopter operations, building on a sensor family already on over 400 US Navy helicopters.

- In 2025, L3Harris Technologies delivered the first missionized Bombardier Global 6500 business jet equipped with advanced radar, electronic, and communications intelligence capabilities.

- In 2025, Northrop Grumman continued to secure and execute contracts related to advanced sensors and systems critical for the Joint All-Domain Command and Control (JADC2) framework, with a sustained focus on next-generation solutions that enable real-time data fusion across all military domains (Air, Land, Sea, Space, Cyber).

Report Coverage

The research report offers an in-depth analysis based on Application, Platform, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with consistent demand from defense and government sectors.

- Artificial intelligence integration will enhance real-time data analysis and decision-making.

- Unmanned aerial vehicles will remain central to ISR modernization programs.

- Space-based ISR platforms will gain importance for long-range surveillance and strategic monitoring.

- Cross-border conflicts and geopolitical tensions will continue driving ISR adoption.

- Cybersecurity measures will become critical to safeguard ISR networks and intelligence data.

- Commercial applications will gradually expand in infrastructure, disaster management, and law enforcement.

- Miniaturization of sensors will enable lighter and more flexible ISR platforms.

- Collaboration between defense contractors and governments will strengthen innovation pipelines.

- Emerging economies will increase investments in ISR systems to enhance security capabilities.