Market Overview:

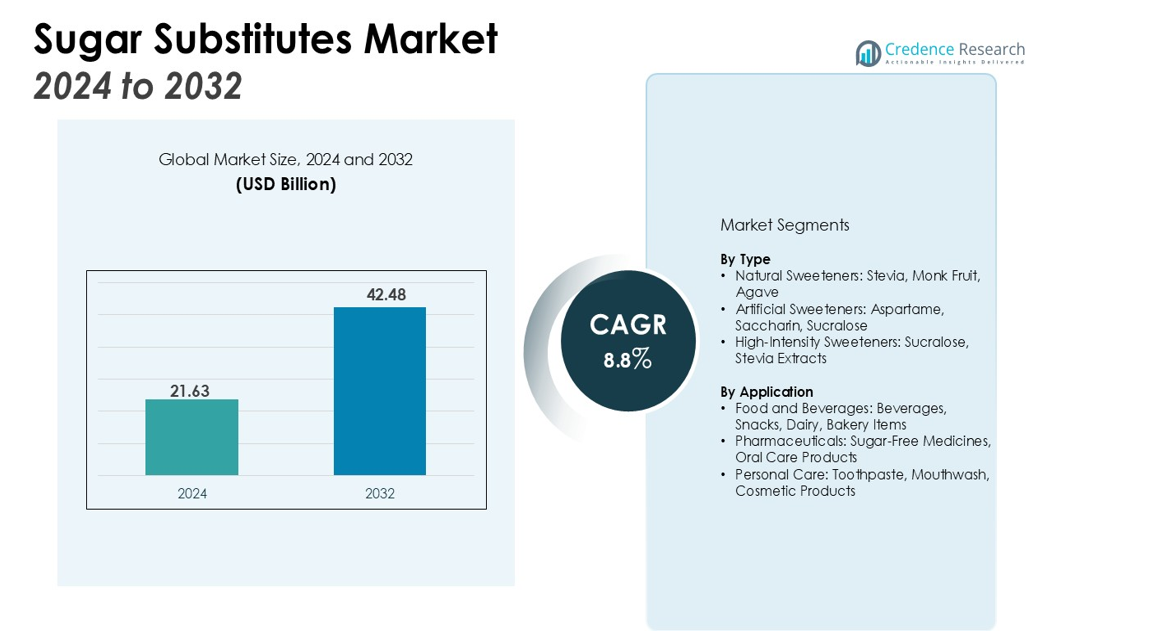

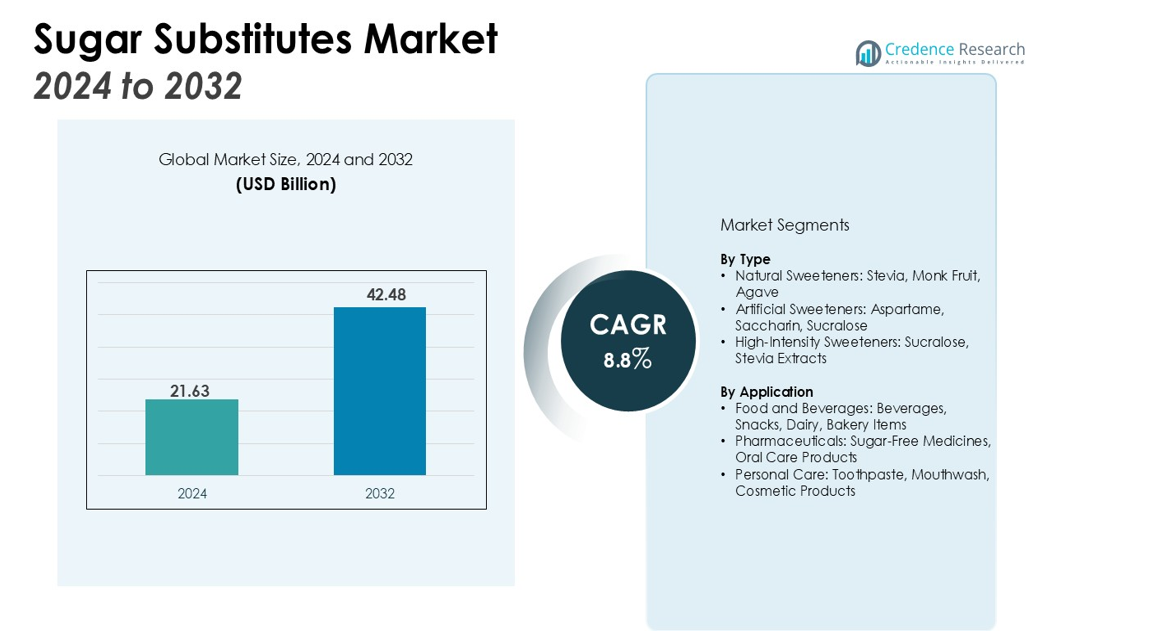

The Sugar Substitutes Market size was valued at USD 21.63 billion in 2024 and is anticipated to reach USD 42.48 billion by 2032, at a CAGR of 8.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sugar Substitutes Market Size 2024 |

USD 21.63 billion |

| Sugar Substitutes Market, CAGR |

8.8% |

| Sugar Substitutes Market Size 2032 |

USD 42.48 billion |

Key drivers of the market include the rising prevalence of obesity and diabetes, driving the shift toward healthier eating habits and sugar alternatives. Growing awareness about the health risks associated with excessive sugar consumption, along with increasing demand for natural and plant-based substitutes like stevia and monk fruit, further propel market expansion. Additionally, innovations in the production of sugar substitutes and the increasing adoption of sugar-free products in the food and beverage industry contribute significantly to market growth. The rising preference for clean and sustainable ingredients also supports the market’s upward trajectory.

Regionally, North America holds the largest market share, driven by the growing health-conscious population and a strong demand for low-calorie sweeteners. Europe follows closely, with increasing focus on clean-label and natural ingredients in food products. The Asia-Pacific region is expected to witness the highest growth, fueled by rising disposable income, changing lifestyles, and an expanding demand for sugar substitutes in emerging economies such as China and India. The growing penetration of e-commerce and online retail channels also contributes to expanding product availability and consumer reach in these regions.

Market Insights:

- The Sugar Substitutes Market was valued at USD 21.63 billion in 2024 and is projected to reach USD 42.48 billion by 2032, growing at a CAGR of 8.8% during the forecast period.

- The rising prevalence of obesity and diabetes is driving the demand for healthier alternatives to sugar.

- Increasing consumer preference for natural and plant-based substitutes like stevia and monk fruit is expanding market opportunities.

- Innovations in production methods and the availability of zero-calorie, sugar-free alternatives are boosting market growth.

- Government regulations and the clean label trend are pushing manufacturers to replace sugar with healthier substitutes.

- North America holds the largest market share of 35%, driven by strong demand for low-calorie sweeteners.

- The Asia-Pacific region, with a market share of 22%, is experiencing rapid growth due to rising disposable incomes and health awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Obesity and Diabetes

The growing prevalence of obesity and diabetes is one of the key drivers of the Sugar Substitutes Market. As these chronic conditions continue to affect a significant portion of the global population, the demand for healthier alternatives to sugar has surged. Consumers are increasingly seeking low-calorie, low-sugar, and functional food options to manage weight and maintain better health. Sugar substitutes are seen as an effective way to reduce calorie intake without compromising taste, further boosting their popularity.

- For instance, PepsiCo launched its Pepsi Prebiotic Cola in July 2025, an innovative beverage containing just 5 grams of sugar and 3 grams of prebiotic fiber per can to provide a functional, low-sugar option.

Health Consciousness and Demand for Natural Alternatives

A growing awareness of the health risks associated with excessive sugar consumption has led to a shift toward natural and plant-based sugar substitutes. Consumers are becoming more health-conscious, opting for alternatives like stevia, monk fruit, and erythritol, which are perceived as safer and healthier options. This shift in consumer preferences is creating a surge in demand for sugar substitutes, with the market witnessing a significant uptick in the adoption of these natural alternatives in everyday food and beverages.

- For instance, after investing 300,000 hours of research into the stevia leaf, Cargill Inc. developed its EverSweet® sweetener, which utilizes a fermentation process and can achieve complete sugar replacement in applications like beverages and dairy.

Product Innovation and Technological Advancements

Innovation in the production of sugar substitutes has been a critical driver of market growth. Advances in technology have led to the development of newer, more efficient, and more cost-effective sweeteners. These innovations are making sugar substitutes more accessible and appealing to a broader consumer base. The food and beverage industry is particularly benefiting from the increased availability of sugar-free, zero-calorie, and low-sugar products, expanding the reach and appeal of sugar substitutes.

Regulatory Support and Clean Label Trends

Government regulations and the clean label trend are further driving the adoption of sugar substitutes. Governments across the globe are implementing policies to limit sugar intake, due to its links with obesity, heart disease, and diabetes. In response to these regulations, many food and beverage manufacturers are reformulating products to reduce sugar content, replacing it with healthier sugar substitutes. This aligns with the growing consumer demand for transparency in food labeling, propelling the adoption of natural and sustainable sugar alternatives.

Market Trends:

Rising Demand for Natural and Plant-Based Sugar Substitutes

One of the most prominent trends in the Sugar Substitutes Market is the increasing demand for natural and plant-based alternatives. Consumers are becoming more aware of the benefits of natural sweeteners like stevia, monk fruit, and agave, which are viewed as healthier alternatives to artificial sweeteners. These substitutes not only provide the sweetness consumers desire but also come with fewer side effects and lower health risks. The shift toward plant-based diets and clean-label products is fueling this demand, as more consumers seek natural options free from chemicals and artificial additives. As a result, manufacturers are focusing on sourcing and producing these natural sugar alternatives to meet the growing consumer preference for transparency and sustainability.

- For instance, in April 2024, Ingredion Incorporated launched its PURECIRCLE™ Clean Taste Solubility Solution, a natural origin sweetener, this technological innovation in stevia is more than 100 times more soluble than conventional Reb M stevia, allowing it to serve as a one-to-one replacement for sugar in various food and beverage applications.

Growth of Sugar-Free and Low-Calorie Product Offerings in the Food and Beverage Industry

The demand for sugar-free and low-calorie food and beverage products is another significant trend driving the Sugar Substitutes Market. With a greater emphasis on health and wellness, many consumers are opting for products that help them manage weight, improve metabolic health, and prevent diseases related to sugar consumption, such as diabetes. This shift is prompting food and beverage manufacturers to innovate with sugar substitutes that offer the same taste and texture as sugar but with fewer calories and no glycemic impact. As health trends continue to evolve, sugar substitutes are increasingly integrated into a wide range of products, including snacks, beverages, and dairy, expanding the market for these alternatives. The growing popularity of keto, paleo, and diabetic-friendly diets also contributes to this trend, driving higher adoption rates of sugar substitutes.

- For instance, in July 2024, Tate & Lyle launched a new proprietary formulation tool, Tate & Lyle Sensation, to showcase its advanced capabilities in improving texture and mouthfeel for sugar-reduced food and beverage products.

Market Challenges Analysis:

High Cost of Production for Natural Sugar Substitutes

One of the major challenges facing the Sugar Substitutes Market is the high cost of production, especially for natural alternatives. The production of plant-based sweeteners such as stevia and monk fruit involves complex processes that increase their cost compared to traditional sugar. This higher cost can limit their accessibility and restrict their use in mass-market products. Despite their health benefits, the premium pricing of these natural substitutes may deter price-sensitive consumers and slow the adoption of these products in certain regions. Reducing production costs and improving the scalability of manufacturing processes are key hurdles that need to be addressed to ensure wider market penetration.

Consumer Skepticism and Limited Awareness

Consumer skepticism regarding the safety and effectiveness of sugar substitutes also presents a challenge for the market. While sugar substitutes are considered safer alternatives, some consumers remain cautious due to concerns about potential long-term health effects, especially with artificial sweeteners. Limited awareness about the benefits of certain sugar alternatives and misconceptions about their side effects may hinder market growth. Educating consumers about the advantages and safety of these products is crucial for building trust and encouraging widespread adoption. Overcoming this skepticism requires ongoing research, transparent labeling, and effective marketing strategies.

Market Opportunities:

Expansion of Sugar Substitutes in Emerging Markets

Emerging markets present a significant opportunity for the Sugar Substitutes Market. As urbanization and disposable incomes rise in regions like Asia-Pacific, Latin America, and the Middle East, there is an increasing shift toward healthier diets. With growing awareness of lifestyle diseases such as diabetes and obesity, consumers in these regions are increasingly seeking sugar alternatives. Manufacturers can leverage this growing demand by introducing affordable, accessible, and culturally appropriate sugar substitutes. The expansion of retail networks and e-commerce platforms further supports the growth potential in these markets, offering greater product availability and convenience for consumers.

Integration of Sugar Substitutes into Functional Foods and Beverages

The increasing demand for functional foods and beverages presents a key opportunity for sugar substitutes. Consumers are not only looking for low-calorie and low-sugar products but also those that offer added health benefits, such as enhanced nutritional value and improved gut health. Sugar substitutes play a crucial role in reformulating products to meet these needs, especially in functional snacks, beverages, and dietary supplements. By incorporating sugar substitutes into these categories, manufacturers can cater to the growing demand for products that support overall wellness while providing a healthier alternative to traditional sugar.

Market Segmentation Analysis:

By Type

The Sugar Substitutes Market is segmented by type into natural, artificial, and high-intensity sweeteners. Natural sweeteners, including stevia, monk fruit, and agave, dominate the market due to their appeal to health-conscious consumers seeking organic and plant-based alternatives. These products are preferred for their lower calorie content and perceived health benefits. Artificial sweeteners, such as aspartame and saccharin, continue to be widely used in food and beverages, especially in products marketed for diabetes management. High-intensity sweeteners, such as sucralose and stevia extracts, offer potent sweetness with minimal or zero calories, making them popular in low-calorie and sugar-free products. This segmentation shows a clear consumer shift towards natural and plant-based options, supporting significant growth in the natural segment.

- For instance, food-tech company Elo Life Systems is developing a novel natural sweetener derived from monk fruit through molecular farming, this technological process allows the company to produce a sweetener that is approximately 300 times sweeter than table sugar, offering a high-intensity, plant-based alternative for various products.

By Application

The Sugar Substitutes Market is widely applied across various sectors, including food and beverages, pharmaceuticals, and personal care. The food and beverage segment holds the largest share, driven by the increasing consumer demand for low-calorie, sugar-free, and healthier alternatives. Sugar substitutes are used in a variety of products, including beverages, snacks, dairy, and bakery items. The pharmaceutical application is growing, with sugar substitutes being used in formulations of sugar-free medicines and oral care products. Personal care products, such as toothpaste and mouthwash, also leverage sugar substitutes for their sweetness and minimal caloric impact. Each application is expanding as consumer demand for healthier options in food and personal care continues to rise.

- For instance, a significant technological application in the food and beverage industry is the use of sucralose by companies like Tate & Lyle, their manufacturing process creates a versatile sweetener that is 600 times sweeter than sugar, enabling its use in a vast array of zero-calorie products.

Segmentations:

By Type

- Natural Sweeteners: Stevia, Monk Fruit, Agave

- Artificial Sweeteners: Aspartame, Saccharin, Sucralose

- High-Intensity Sweeteners: Sucralose, Stevia Extracts

By Application

- Food and Beverages: Beverages, Snacks, Dairy, Bakery Items

- Pharmaceuticals: Sugar-Free Medicines, Oral Care Products

- Personal Care: Toothpaste, Mouthwash, Cosmetic Products

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Leading the Market

North America holds the largest share of the Sugar Substitutes Market, accounting for 35% of the global revenue. The region’s strong demand for low-calorie and low-sugar alternatives in food and beverages is driven by high rates of obesity and diabetes. The U.S. market benefits from a well-established regulatory framework that supports the use of sugar substitutes. Major players are investing heavily in the development of natural and plant-based sweeteners to meet consumer demand for clean-label and sustainable products. The rise in health-conscious consumers further drives the adoption of sugar substitutes, especially in snacks, beverages, and dairy segments.

Europe: A Focus on Health-Conscious Consumers and Clean Labels

Europe holds a significant share of the Sugar Substitutes Market, with a market share of 30%. Regulatory pressures in countries like the UK and Germany have driven a shift toward reducing sugar in packaged foods. The growing demand for natural, organic, and plant-based alternatives is met with increasing consumer interest in clean-label products. Additionally, the rise of functional foods and beverages that integrate sugar substitutes provides a solid growth opportunity. Manufacturers are focusing on innovation to meet consumer demands for transparency and sustainability, enhancing their presence in this health-conscious region.

Asia-Pacific: Rapid Growth in Sugar Substitutes Demand

Asia-Pacific is the fastest-growing region, with a market share of 22%. The rapid economic development, increasing disposable incomes, and changing dietary habits in countries like China and India are contributing to the growing demand for sugar substitutes. Rising awareness of health issues such as diabetes is accelerating the adoption of sugar alternatives. The growing consumption of sugar-free and low-calorie beverages in urban areas offers substantial opportunities for market expansion. Manufacturers are strategically positioning their products to cater to the diverse preferences of consumers in this dynamic and rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ingredion Incorporated

- Tate & Lyle

- Cargill, Incorporated

- I. DuPont De Nemours

- Archer Daniels Midland Company (ADM)

- Ajinomoto Co.

- Roquette Freres

- The NutraSweet Company

- JK Sucralose Inc.

- PureCircle

Competitive Analysis:

The Sugar Substitutes Market is highly competitive, with several key players leading the sector. Major companies include Cargill, Tate & Lyle, and Stevia First Corporation, which dominate the market with their extensive portfolios of natural and artificial sweeteners. Cargill, for instance, is recognized for its investment in natural sweeteners like stevia and monk fruit, catering to the growing consumer demand for clean-label products. Tate & Lyle focuses on high-intensity sweeteners and has strengthened its market position through strategic acquisitions and innovations. Emerging players such as Pure Circle and Ingredion also contribute to market dynamics by offering unique products and expanding their reach through new partnerships. Companies in this market are actively investing in research and development to introduce new, healthier, and more sustainable alternatives. The market’s competitive landscape is shaped by these efforts to meet evolving consumer preferences for natural, low-calorie, and plant-based sugar substitutes.

Recent Developments:

- In September 2025, Tate & Lyle announced a strategic partnership with MassChallenge to support and mentor early-stage startups and accelerate innovation in food technology.

- In September 2025, ADM and Alltech agreed to form a joint venture combining their North American animal feed businesses to better serve their customers.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing consumer demand for natural and plant-based sweeteners will drive product innovation.

- The food and beverage sector will continue to be the largest application for sugar substitutes.

- Growing awareness about the health risks of sugar will further accelerate market adoption.

- Manufacturers will invest in sustainable production practices to meet clean-label trends.

- Technological advancements in sweetener production will make sugar substitutes more cost-effective.

- Sugar substitutes will become more prevalent in functional foods and beverages targeting wellness.

- The Asia-Pacific region will experience the highest growth due to rising disposable incomes and health consciousness.

- Regulatory pressures on sugar content in food products will encourage further adoption of substitutes.

- Rising popularity of low-carb and sugar-free diets will expand the market in North America and Europe.

- Consumer education on the benefits and safety of sugar substitutes will foster trust and adoption.