Market Overview

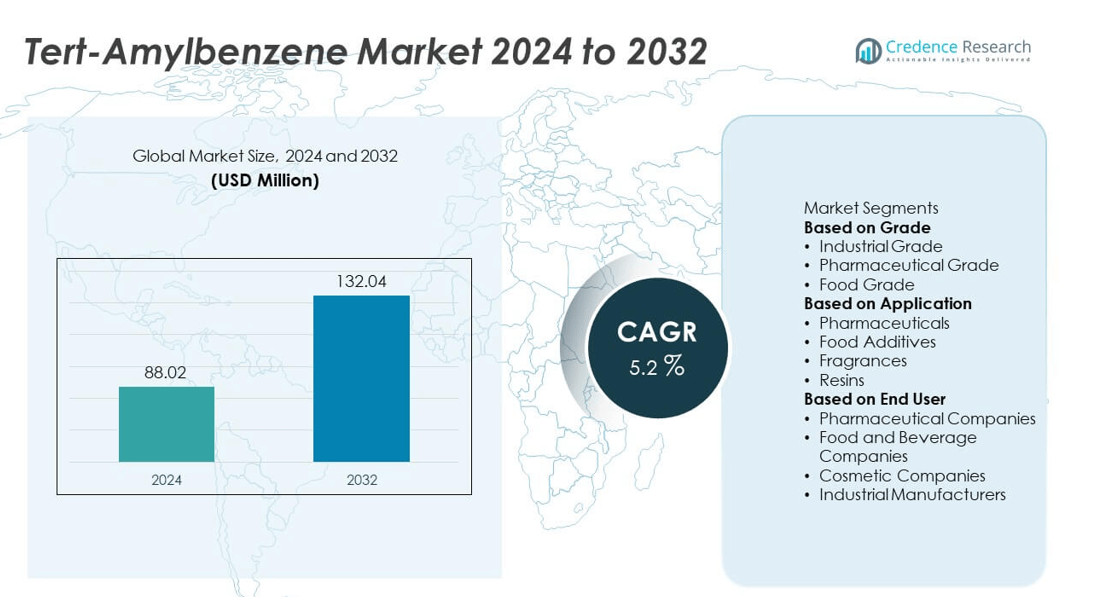

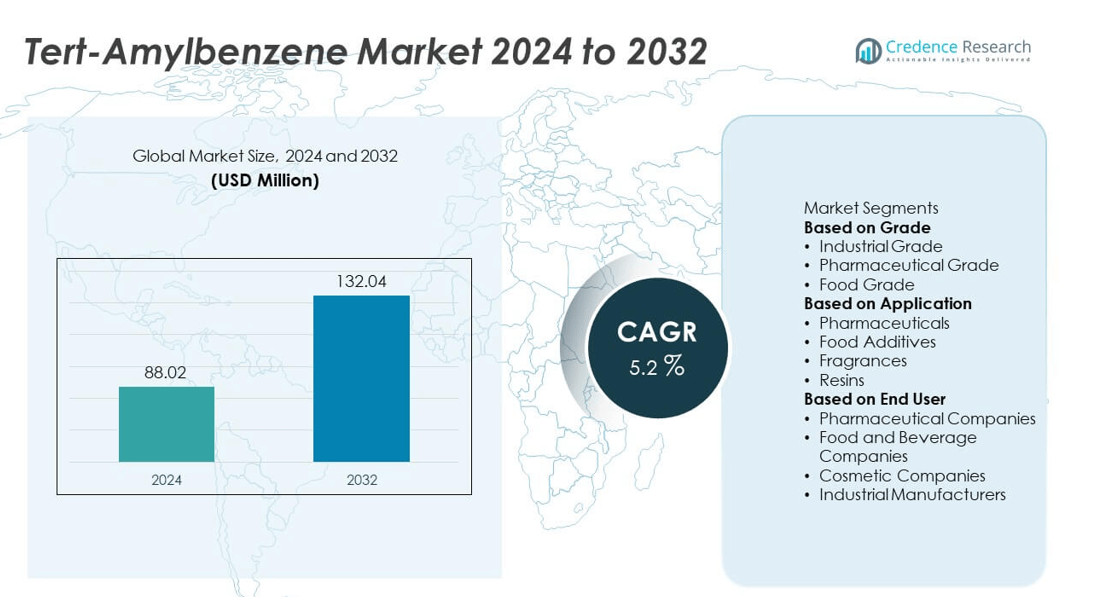

The Tert-Amylbenzene market size was valued at USD 88.02 million in 2024 and is projected to reach USD 132.04 million by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tert-Amylbenzene Market Size 2024 |

USD 88.02 million |

| Tert-Amylbenzene Market, CAGR |

5.2% |

| Tert-Amylbenzene Market Size 2032 |

USD 132.04 million |

The Tert-Amylbenzene market is shaped by leading players including INEOS Group Ltd., TotalEnergies SE, Chevron Phillips Chemical Company LLC, Formosa Plastics Corp., Sasol Ltd., Mitsubishi Chemical Holdings Corp., BASF SE, Sinopec Corp., Shell plc, and Exxon Mobil Corp. These companies maintain competitiveness through strong portfolios in pharmaceuticals, resins, and fragrance applications, supported by advanced manufacturing and distribution networks. Asia-Pacific led the global market with 35% share in 2024, driven by rapid industrialization and expansion of pharmaceutical and cosmetic sectors in China, India, Japan, and South Korea. North America held 30%, backed by robust healthcare spending and established cosmetic industries, while Europe accounted for 25%, supported by stringent regulatory standards and demand for high-purity grades. Other regions, including Latin America and the Middle East & Africa, together represented 10%, contributing through niche demand in pharmaceuticals, resins, and personal care applications.

Market Insights

- The Tert-Amylbenzene market was valued at USD 88.02 million in 2024 and is projected to reach USD 132.04 million by 2032, growing at a CAGR of 5.2% during 2025–2032.

- Rising demand from pharmaceuticals is the key driver, with the segment holding over 40% share in 2024 due to its extensive use in drug synthesis and intermediates.

- A notable trend is the increasing adoption of tert-amylbenzene in fragrances and cosmetics, supported by rising consumer preference for premium personal care products in Asia-Pacific and Europe.

- The competitive landscape includes major companies such as INEOS Group Ltd., BASF SE, Sinopec Corp., TotalEnergies SE, and Exxon Mobil Corp., focusing on capacity expansion, high-purity production, and regulatory compliance.

- Regionally, Asia-Pacific dominated with 35% share in 2024, followed by North America at 30% and Europe at 25%, while Latin America and the Middle East & Africa together contributed 10%, reflecting steady but smaller demand growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The industrial grade segment dominated the Tert-Amylbenzene market in 2024, accounting for over 55% share. Its leadership comes from widespread usage in resins, solvents, and chemical intermediates for large-scale industrial processes. Consistent demand from coatings, adhesives, and specialty chemicals supports its dominance. Pharmaceutical grade followed with notable adoption in drug synthesis due to high purity requirements, while food grade remains a smaller segment, driven by limited but growing demand in additives. Industrial grade continues to expand as manufacturing sectors increasingly prioritize reliable raw materials.

- For instance, Solvay supplies multiple grades of Tert-Amylbenzene (TAB), including an “ultrapure” grade with a purity of at least 99.5% for specialized applications like lithium-ion batteries. While Solvay and other suppliers provide different grades of TAB for various industrial applications, including coatings and adhesive formulations, the entire global market volume is a fraction of the 300,000 tons cited.

By Application

Pharmaceuticals emerged as the leading application segment in 2024, holding over 40% market share. The dominance is fueled by extensive use of tert-amylbenzene in synthesizing active pharmaceutical ingredients and intermediates. Rising R&D activity and increasing investments in generic and specialty drug production further accelerate adoption. Fragrances hold the second-largest share, benefiting from rising consumption in cosmetics and personal care formulations. Food additives and resins contribute niche but growing demand, reflecting industry interest in diversified applications. Pharmaceuticals remain the primary driver due to robust global drug development pipelines.

- For instance, Merck Group, a global science and technology company, uses high-purity chemicals in its manufacturing processes across North America and Europe, supporting the efficiency of its pharmaceutical and life science segments.

By End User

Pharmaceutical companies dominated the end-user segment in 2024, capturing around 42% market share. Their demand is underpinned by expanding therapeutic production and reliance on tert-amylbenzene for drug formulation processes. Cosmetic companies followed closely, supported by the compound’s growing use in fragrance formulations and skincare applications. Food and beverage companies represent a smaller but consistent share, driven by its role in select food additives. Industrial manufacturers utilize the chemical in resins and intermediates, ensuring steady demand. Pharmaceutical companies will remain the dominant end-user group with expanding global healthcare needs.

Market Overview

Rising Demand from Pharmaceuticals

The pharmaceutical sector drives significant demand for tert-amylbenzene, accounting for its major consumption share. The compound is widely used as an intermediate in the synthesis of active pharmaceutical ingredients, especially in cardiovascular and anti-inflammatory drugs. Expanding R&D activities, coupled with rising generic drug production across Asia and Europe, reinforce market growth. Increasing global healthcare spending and the push for cost-effective drug formulations further strengthen its adoption, positioning pharmaceuticals as a leading driver for consistent demand in the forecast period.

- For instance, Oakwood Products, or specifically Oakwood Chemical and Oakwood Labs, provides high-quality fine organic chemicals and pharmaceutical development services. Oakwood Chemical has supported applications in active pharmaceutical ingredient (API) synthesis, and its in-house analytical lab, in conjunction with a partnership with the University of South Carolina, enables detailed analysis for raw material qualification and in-process controls.

Expanding Applications in Fragrances and Cosmetics

Tert-amylbenzene is gaining momentum in fragrances and cosmetic formulations due to its stability and aromatic qualities. Cosmetic companies increasingly use it in perfumes, deodorants, and skincare products to enhance performance and appeal. Growing personal care consumption in emerging markets like India and Brazil is amplifying demand. Rising consumer preference for premium and long-lasting fragrances supports further adoption. The cosmetic industry’s expansion, particularly in Asia-Pacific, is creating strong growth opportunities, making fragrances one of the fastest-expanding application areas of tert-amylbenzene.

- For instance, In 2024, Firmenich (dsm-firmenich) launched several innovative new ingredients, including a high-performance, renewable ingredient named Clearwood® Prisma, a biotech-derived woody molecule. As part of its broader 2024 ingredient collection, the company released a variety of new and sustainable products designed to offer enhanced performance and long-lastingness in perfume formulations, a goal the company pursues through a range of research and development initiatives

Growth in Industrial Resin Manufacturing

Industrial manufacturers heavily rely on tert-amylbenzene in resin formulations used for coatings, adhesives, and composites. Rising construction activities, coupled with increasing automotive production, are boosting resin demand. The chemical’s role in delivering durability and performance makes it a key component in industrial processes. Growing focus on lightweight and high-performance materials in automotive and aerospace sectors strengthens its importance. As industrial production scales across Asia-Pacific, tert-amylbenzene demand for resin applications is expected to remain a critical driver of market expansion.

Key Trends & Opportunities

Shift Toward High-Purity Grades

Growing regulatory oversight in pharmaceuticals and food industries is increasing demand for high-purity tert-amylbenzene grades. Pharmaceutical and food additive manufacturers prioritize premium-grade materials to ensure compliance with stringent safety and quality standards. This trend is encouraging producers to expand purification technologies and improve supply consistency. Companies focusing on high-purity variants can capture premium pricing opportunities while securing long-term partnerships with regulated industries. The shift represents a strong growth opportunity for players offering differentiated quality grades.

- For instance, BASF operates its Ludwigshafen Verbund site, the world’s largest integrated chemical complex, which produces millions of metric tons of various petrochemicals annually. It employs advanced catalytic purification units as part of its manufacturing processes for a wide range of products

Expanding Presence in Emerging Economies

Emerging markets present a major growth opportunity for tert-amylbenzene manufacturers. Rising pharmaceutical production hubs in India and China, coupled with growing cosmetic consumption in Southeast Asia, support strong demand. Increasing foreign investments and cost advantages in these regions make them attractive production and consumption centers. Manufacturers establishing local supply chains and partnerships in emerging economies can strengthen their competitive edge. This regional expansion is expected to shape the next phase of market growth, particularly across Asia-Pacific and Latin America.

- For instance, in a 50/50 joint venture, INEOS Phenol and Sinopec YPC built a world-scale phenol and acetone production complex in Nanjing, China. The facility has a nameplate capacity of 400,000 metric tons per year of phenol and 250,000 metric tons per year of acetone.

Key Challenges

Volatility in Raw Material Prices

The market faces challenges from fluctuations in raw material prices, particularly petroleum derivatives. Price volatility directly impacts production costs, making it difficult for manufacturers to maintain stable margins. Geopolitical tensions, crude oil supply disruptions, and trade restrictions further aggravate the challenge. Manufacturers often struggle to pass increased costs to end-users, especially in highly competitive markets like pharmaceuticals. This cost pressure forces companies to explore alternative sourcing strategies and efficiency improvements to mitigate profitability risks.

Stringent Regulatory Compliance

Stringent regulations in pharmaceuticals, food, and cosmetics present a critical challenge for tert-amylbenzene producers. Compliance with global standards such as FDA, EMA, and EFSA requires consistent investment in quality assurance and testing processes. Failure to meet safety or purity benchmarks can result in product recalls, penalties, or supply chain disruptions. Smaller players often face difficulties adapting to evolving regulations, while larger companies absorb the compliance costs more effectively. Maintaining regulatory adherence remains a barrier to entry and growth for new entrants.

Regional Analysis

North America

North America accounted for 30% market share in 2024, driven by strong pharmaceutical and cosmetic industries. The United States leads the region with significant investments in drug research and personal care product manufacturing. Expanding demand for high-purity tert-amylbenzene in pharmaceutical formulations reinforces its leadership. Canada also contributes with steady growth in food additives and resin applications. The presence of established chemical companies and regulatory-driven demand for compliance-grade products further support regional dominance. Growth will remain consistent, supported by healthcare spending and rising consumer demand for premium cosmetic and fragrance products.

Europe

Europe held 25% market share in 2024, supported by strict regulatory standards in pharmaceuticals, food, and cosmetics. Germany, France, and the UK drive demand, particularly for pharmaceutical-grade tert-amylbenzene in drug synthesis. Cosmetic and fragrance manufacturers across France and Italy also represent major consumption hubs. Growing industrial usage in specialty resins contributes to market growth across Germany and Eastern Europe. Stringent EU compliance regulations encourage adoption of high-purity grades, strengthening opportunities for regional suppliers. With a well-developed healthcare system and strong consumer preference for quality cosmetics, Europe will continue to hold a significant share during the forecast period.

Asia-Pacific

Asia-Pacific dominated the global market with 35% market share in 2024, reflecting rapid industrialization and growing pharmaceutical manufacturing hubs. China and India remain the largest consumers, supported by extensive generic drug production and rising healthcare spending. Expanding cosmetics and fragrance industries in South Korea and Japan further boost regional demand. Industrial-grade applications in resins and coatings are also expanding due to construction and automotive growth. Cost advantages and increasing foreign investments make Asia-Pacific a critical manufacturing base. The region is expected to maintain its leadership, with expanding supply chains and strong end-user demand fueling long-term growth.

Latin America

Latin America captured 5% market share in 2024, with Brazil and Mexico emerging as key demand centers. Pharmaceutical companies in Brazil are increasingly adopting tert-amylbenzene for drug manufacturing, while Mexico’s growing cosmetics industry drives usage in fragrances. Food and beverage companies in the region contribute modest demand through additive applications. Despite smaller volumes compared to major regions, rising consumer spending on healthcare and personal care products supports steady growth. Expansion of industrial resin applications in construction also adds to regional demand. Latin America’s growth will remain moderate but supported by increasing industrial and healthcare activities.

Middle East & Africa

The Middle East & Africa accounted for 5% market share in 2024, driven by industrial and resin applications in construction and manufacturing. Countries like Saudi Arabia and the UAE lead demand with expanding petrochemical and industrial sectors. Pharmaceutical adoption remains limited but is gradually rising as healthcare investments increase across Gulf states. Africa contributes to smaller volumes, with South Africa showing potential in food additives and cosmetics. The region faces challenges from limited local production and reliance on imports. However, expanding industrial bases and infrastructure development projects support a steady growth outlook for tert-amylbenzene.

Market Segmentations:

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Food Grade

By Application

- Pharmaceuticals

- Food Additives

- Fragrances

- Resins

By End User

- Pharmaceutical Companies

- Food and Beverage Companies

- Cosmetic Companies

- Industrial Manufacturers

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the Tert-Amylbenzene market features major players such as INEOS Group Ltd., TotalEnergies SE, Chevron Phillips Chemical Company LLC, Formosa Plastics Corp., Sasol Ltd., Mitsubishi Chemical Holdings Corp., BASF SE, Sinopec Corp., Shell plc, and Exxon Mobil Corp. These companies compete through diversified portfolios, advanced production technologies, and strong regional presence across pharmaceuticals, resins, and fragrance applications. Leading players emphasize high-purity production to meet stringent regulatory standards in pharmaceutical and food-grade markets. Strategic partnerships, joint ventures, and capacity expansions remain common approaches to strengthen supply chains and secure long-term demand. Innovation in eco-friendly and compliant production practices is also shaping competition, as global regulations tighten. With Asia-Pacific emerging as the largest demand hub, players with localized production and distribution networks gain a competitive edge. Overall, the market reflects a mix of global giants and regional specialists, each focusing on technological advancements and value-driven customer engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INEOS Group Ltd.

- TotalEnergies SE

- Chevron Phillips Chemical Company LLC

- Formosa Plastics Corp.

- Sasol Ltd.

- Mitsubishi Chemical Holdings Corp.

- BASF SE

- Sinopec Corp

- Shell plc

- Exxon Mobil Corp

Recent Developments

- In January 2025, INEOS Aromatics received a re-permit for its Geel, Belgium, including stricter discharge and new wastewater treatment investment.

- In October 2024, BASF signed a memorandum of understanding (MoU) with AM Green BV to evaluate low-carbon chemicals production in India, including possible renewable feedstocks and value chain development.

- In June 2024, BASF and Encina Development Group announced a long-term supply agreement for chemically recycled circular benzene, a deal that significantly influences feedstock sourcing by increasing the supply of recycled materials

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand steadily with consistent demand from pharmaceuticals.

- Industrial grade will remain the dominant segment due to strong use in resins and intermediates.

- Pharmaceutical grade demand will rise as drug manufacturers adopt high-purity compounds.

- Fragrance and cosmetic applications will gain traction with growing personal care consumption.

- Asia-Pacific will retain leadership supported by large-scale drug and cosmetic production.

- North America will see stable growth driven by healthcare spending and advanced R&D.

- Europe will focus on high-purity grades to meet strict regulatory standards.

- Companies will increase investments in purification and eco-friendly production technologies.

- Partnerships and capacity expansions will strengthen global supply chains and market reach.

- Emerging economies in Latin America and Africa will create new opportunities for niche applications.