Market Overview

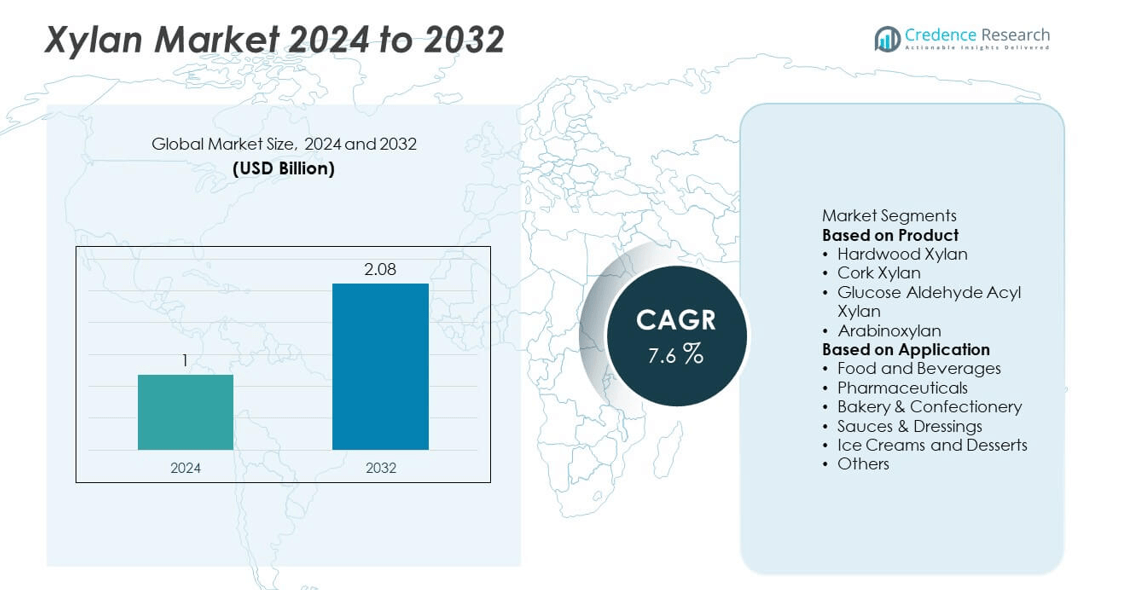

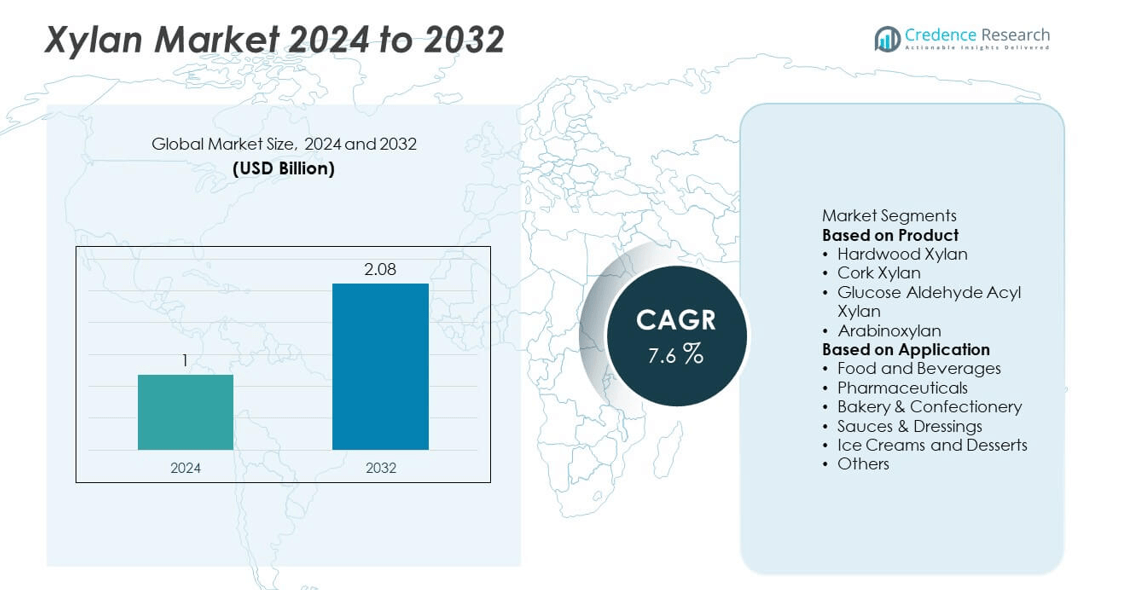

The xylan market was valued at USD 1 billion in 2024 and is projected to reach USD 2.08 billion by 2032, growing at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Xylan Market Size 2024 |

USD 1 billion |

| Xylan Market, CAGR |

7.6% |

| Xylan Market Size 2032 |

USD 2.08 billion |

The xylan market is driven by leading players including Thomson Biotech, Soyoung, Jinan Haohua Industry, Xylan Corporation, Chemos GmbH, Richman Chemical, ZhongYun, Southwestern Plating Company, and Biochemical Group. These companies focus on developing high-purity xylan for applications in food, pharmaceuticals, and bakery industries, with strategies centered on sustainable sourcing and advanced processing technologies. North America leads the market with 33% share, driven by strong adoption in functional foods and pharmaceuticals, while Asia-Pacific holds 30% share supported by growing production and demand for fortified foods. Europe accounts for 28% share, driven by stringent clean-label regulations and innovation in natural additives. Together, these regions represent the core growth hubs of the global xylan industry.

Market Insights

- The xylan market was valued at USD 1 billion in 2024 and is projected to reach USD 2.08 billion by 2032, growing at a CAGR of 7.6% during the forecast period.

- Rising demand for functional foods, dietary supplements, and pharmaceuticals drives market growth, with hardwood xylan holding over 40% share due to its solubility and nutritional benefits.

- Key trends include growing adoption of natural and clean-label ingredients, innovation in enzyme-assisted extraction technologies, and increasing use of xylan in bio-based packaging and pharmaceutical drug delivery systems.

- The market is moderately competitive with players like Thomson Biotech, Chemos GmbH, Xylan Corporation, and Richman Chemical focusing on capacity expansion, sustainable sourcing, and product innovations to meet global demand.

- North America leads with 33% share, Asia-Pacific follows with 30%, and Europe accounts for 28%, while Latin America and Middle East & Africa collectively hold 9% share supported by rising food and feed production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Hardwood xylan dominated the market with over 40% share in 2024, supported by its widespread use in food and pharmaceutical applications due to its high solubility and functional properties. It is commonly used as a dietary fiber and prebiotic ingredient, promoting gut health and enhancing product texture. Arabinoxylan follows as a fast-growing segment, driven by its increasing use in nutraceuticals and functional foods. Cork xylan and glucose aldehyde acyl xylan remain niche segments, primarily applied in specialized biochemical and industrial formulations requiring high-purity xylan derivatives.

- For instance, a 2025 study in Food Quality and Safety on arabinoxylan derived from corn bran reported prebiotic effects that can support the growth of Bifidobacterium longum subspecies, particularly in the presence of bile acids.

By Application

Food and beverages accounted for over 35% share in 2024, making it the dominant application segment. Rising demand for fiber-enriched products and functional foods is driving xylan adoption in beverages, health supplements, and fortified snacks. Bakery and confectionery hold a significant share, benefiting from xylan’s water-binding capacity and ability to improve dough stability. Pharmaceutical applications are growing steadily as xylan is used in drug delivery systems and as a stabilizing agent in formulations, supporting controlled release and bioavailability.

- For instance, Research has shown xylan can be coated with other polymers, such as Eudragit, to create microparticles for targeted delivery to the colon, where it can be degraded by microbiota.

Market Overview

Rising Demand for Functional and Nutraceutical Ingredients

Growing consumer focus on gut health and immunity is fueling demand for xylan as a prebiotic dietary fiber, contributing to over 35% of market growth in 2024. Food and beverage companies are incorporating xylan into health drinks, fortified snacks, and supplements to enhance nutritional value. Its ability to support digestive health and improve product texture makes it an attractive ingredient for functional foods, driving adoption across both developed and emerging markets.

- For instance, one study using bamboo shoots showed a hydrothermal pretreatment yielded 21.24 % xylo-oligosaccharides (XOS) in the hydrolysate, and further enzymatic hydrolysis raised the proportion of X2-X3 fractions from 38.87 % to 68.21 %, which improved probiotic growth.

Expanding Applications in Pharmaceuticals

Pharmaceutical demand accounts for nearly 30% of xylan market growth as it is increasingly used in drug delivery systems and as a stabilizer in formulations. Xylan’s biocompatibility and film-forming properties enable its use in controlled-release drugs, wound healing materials, and targeted delivery systems. Rising investment in biopolymers for medical applications and research on xylan-based nanocarriers are further driving this segment, opening opportunities for high-value medical-grade xylan production.

- For instance, a study synthesized quercetin-conjugated xylan polymer (QT-xylan) via carbodiimide reaction, achieving nanoparticles in the size range of 200 nanometres for improved delivery and P-glycoprotein inhibition.

Shift Toward Clean-Label and Plant-Based Products

Consumers are seeking natural, plant-derived ingredients, boosting demand for xylan sourced from hardwood and cereal crops. This shift contributes to over 25% of market expansion as manufacturers reformulate products to replace synthetic additives with natural hydrocolloids. The trend is especially strong in bakery, dairy alternatives, and sauces, where xylan improves viscosity, texture, and stability. Regulatory support for clean-label claims and rising awareness of sustainable sourcing are also encouraging adoption among food producers globally.

Key Trends & Opportunities

Growth in Research for Bio-Based Materials

Research is accelerating into xylan’s use in bio-based films, packaging materials, and biodegradable coatings, presenting new opportunities beyond food and pharmaceuticals. This aligns with global sustainability goals and supports development of eco-friendly solutions to replace petrochemical-derived products. Companies investing in green technologies can capitalize on this trend and diversify revenue streams.

- For instance, a study in the journal Biomacromolecules reported the creation of high-performance, water-soluble, pure xylan-based films with tensile strengths that could be controlled from 105.0 to 132.6 MPa. This demonstrates that xylan derivatives can have competitive mechanical properties with petroleum-based plastics.

Innovation in Extraction and Processing Technologies

Technological advancements in xylan extraction from hardwood, cereal husks, and agricultural residues are improving yield, purity, and cost-efficiency. Enzyme-assisted and eco-friendly processing methods are gaining traction, making xylan more affordable and accessible for industrial-scale applications. This creates opportunities for manufacturers to expand production capacity and cater to rising demand across food, pharma, and specialty chemical sectors.

- For instance, academic research has explored enzyme-assisted extraction methods for xylan, comparing them with traditional alkaline extraction. A 2017 study on pretreated sugarcane bagasse found that enzymatic extraction, while yielding a high-purity product (less than 4% lignin), had a lower recovery rate of 22%, compared to an alkaline extraction process that achieved a 53% yield with lower purity.

Key Challenges

High Production and Processing Costs

The cost of xylan production, particularly high-purity or pharmaceutical-grade variants, remains a key restraint. Complex extraction and purification processes require significant capital investment and energy consumption, which can limit adoption by cost-sensitive industries. Addressing these challenges through process optimization is crucial for market scalability.

Regulatory and Quality Compliance Hurdles

Strict regulatory requirements for food-grade and pharmaceutical applications pose challenges for xylan manufacturers. Ensuring consistent quality, safety, and compliance across regions increases operational complexity. Delays in approval processes and lack of standardized global regulations can slow product launches, impacting market growth potential.

Regional Analysis

North America

North America held 33% share in 2024, driven by strong demand for xylan in functional foods, dietary supplements, and pharmaceuticals. The United States leads the region with significant adoption in bakery and beverage industries, where xylan is used to enhance texture and fiber content. Rising awareness of gut health and clean-label products supports consistent demand. Pharmaceutical companies are incorporating xylan into controlled-release formulations and drug delivery systems. Favorable regulatory approvals and innovation in extraction technologies further strengthen the market, while investments in research expand xylan’s applications in nutraceutical and medical-grade products.

Europe

Europe accounted for 28% share in 2024, supported by a mature food and beverage sector and stringent regulations promoting natural and clean-label ingredients. Germany, France, and the U.K. are key consumers, with rising use of xylan in bakery, dairy alternatives, and confectionery. The region’s focus on sustainable sourcing and circular economy initiatives encourages production of xylan from agricultural by-products. Pharmaceutical and cosmetic applications are gaining momentum due to xylan’s biocompatibility. Investments in green processing technologies and R&D programs enhance product quality, supporting growth across industries seeking bio-based and eco-friendly alternatives to synthetic additives.

Asia-Pacific

Asia-Pacific led the global xylan market with 30% share in 2024, making it the fastest-growing region. China, India, and Japan are major contributors, driven by rising demand for functional foods, fortified beverages, and dietary supplements. Expanding middle-class populations and growing health awareness are fueling adoption in packaged foods. Local production of xylan from cereal husks and hardwood residues is increasing, reducing costs and improving availability. Pharmaceutical applications are expanding, with regional players exploring xylan for drug formulations and wound-healing products. Government initiatives supporting food safety and biopolymer development further accelerate market growth in the region.

Latin America

Latin America captured 5% share in 2024, with growth concentrated in Brazil, Mexico, and Argentina. Demand is driven by increasing consumption of processed foods and beverages, where xylan is used as a natural stabilizer and fiber enhancer. The bakery and confectionery industries are adopting xylan to improve texture and shelf life. Expansion of the livestock and feed industry also contributes to demand for xylan-based feed additives. Economic challenges and limited awareness may slow adoption, but opportunities exist for affordable, locally sourced xylan solutions that cater to both food manufacturers and pharmaceutical companies.

Middle East & Africa

The Middle East & Africa region held 4% share in 2024, with demand supported by growing packaged food and beverage consumption in GCC countries and South Africa. Xylan is increasingly used in bakery, sauces, and dairy products to improve quality and stability. Pharmaceutical applications are gradually emerging, driven by healthcare infrastructure development and rising awareness of natural excipients. Limited production capacity and higher import costs present challenges, but investments in local manufacturing and partnerships with global suppliers are expected to boost availability. The region shows potential for steady growth as urbanization and retail expansion continue.

Market Segmentations:

By Product

- Hardwood Xylan

- Cork Xylan

- Glucose Aldehyde Acyl Xylan

- Arabinoxylan

By Application

- Food and Beverages

- Pharmaceuticals

- Bakery & Confectionery

- Sauces & Dressings

- Ice Creams and Desserts

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the xylan market features key players such as Thomson Biotech, Soyoung, Jinan Haohua Industry, Xylan Corporation, Chemos GmbH, Richman Chemical, ZhongYun, Southwestern Plating Company, and Biochemical Group. These companies are actively engaged in developing high-quality xylan products for food, pharmaceutical, and industrial applications. Their strategies include expanding production capacity, optimizing extraction technologies, and investing in R&D to improve purity and functional properties. Collaborations with food manufacturers and pharmaceutical firms are helping strengthen supply chains and broaden application areas. Many players are also focusing on sustainable sourcing of raw materials, aligning with global clean-label and eco-friendly trends. Competitive differentiation is driven by product innovation, cost-effectiveness, and compliance with regulatory standards. With increasing demand from nutraceuticals, bakery, and specialty chemical sectors, leading companies are targeting emerging markets, enhancing distribution networks, and developing customized solutions to cater to diverse end-use industries and boost global market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thomson Biotech

- Soyoung

- Jinan Haohua Industry

- Xylan Corporation

- Chemos GmbH

- Richman Chemical

- ZhongYun

- Southwestern Plating Company

- Biochemical Group

- Chemos GmbH

Recent Developments

- In June 2025, PPG highlighted its Xylan coating as part of its latest industrial coating innovations. This reinforced Xylan’s role in high-performance and sustainable applications.

- In 2024, Richman Chemical expanded its custom manufacturing and technology-driven service offerings, targeting higher demand from pharmaceutical and specialty chemical sectors.

- In June 2023, Richman Chemical promoted Christopher Kulp to Chief Operating Officer, strengthening its leadership team and aligning operations for future growth.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for xylan will grow with rising consumption of functional and fortified foods.

- Hardwood xylan will remain the leading product type due to its high availability and solubility.

- Pharmaceutical applications will expand as xylan is adopted in drug delivery and wound care systems.

- Clean-label and natural ingredient trends will boost development of bio-based xylan solutions.

- Asia-Pacific will witness the fastest growth driven by local production and rising health awareness.

- Advances in enzyme-assisted extraction will lower costs and improve product purity.

- Food and beverage segment will retain the largest share supported by packaged food growth.

- Collaborations between food manufacturers and biotech firms will strengthen innovation in formulations.

- Regulatory approvals will encourage use of xylan in more nutraceutical and medical applications.

- Investment in sustainable sourcing and circular economy initiatives will shape future market strategies.