Market Overview

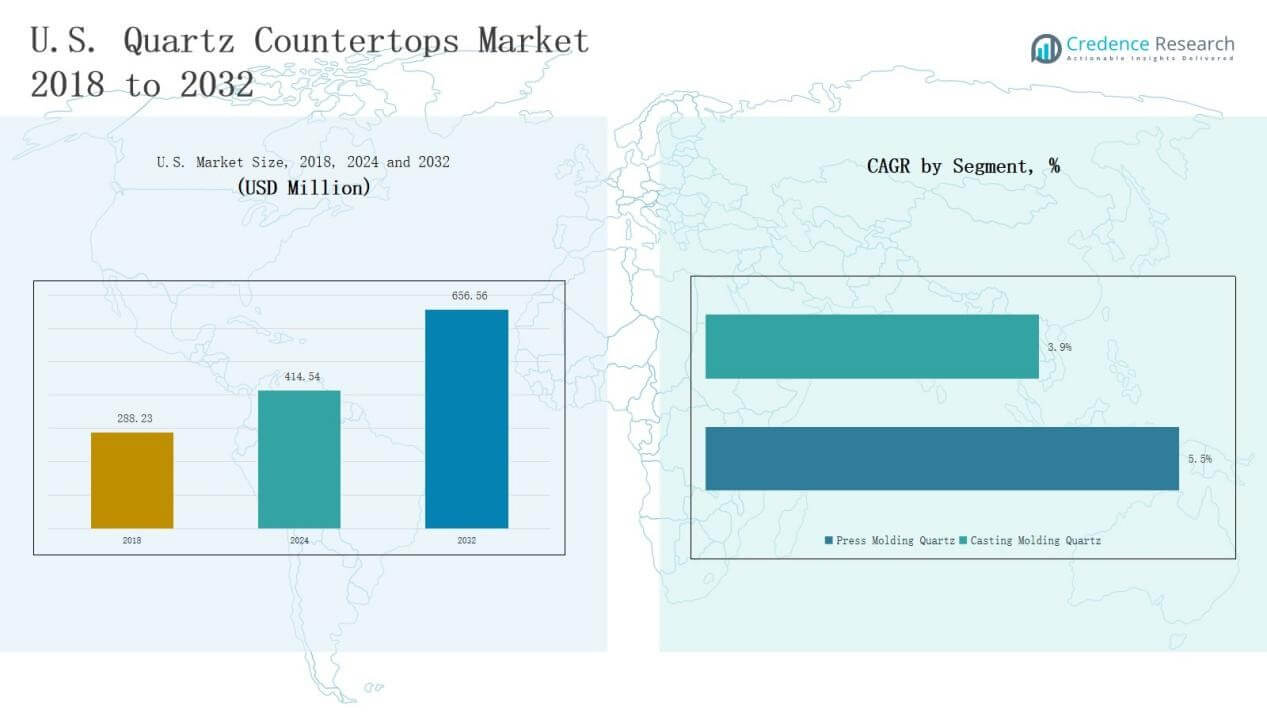

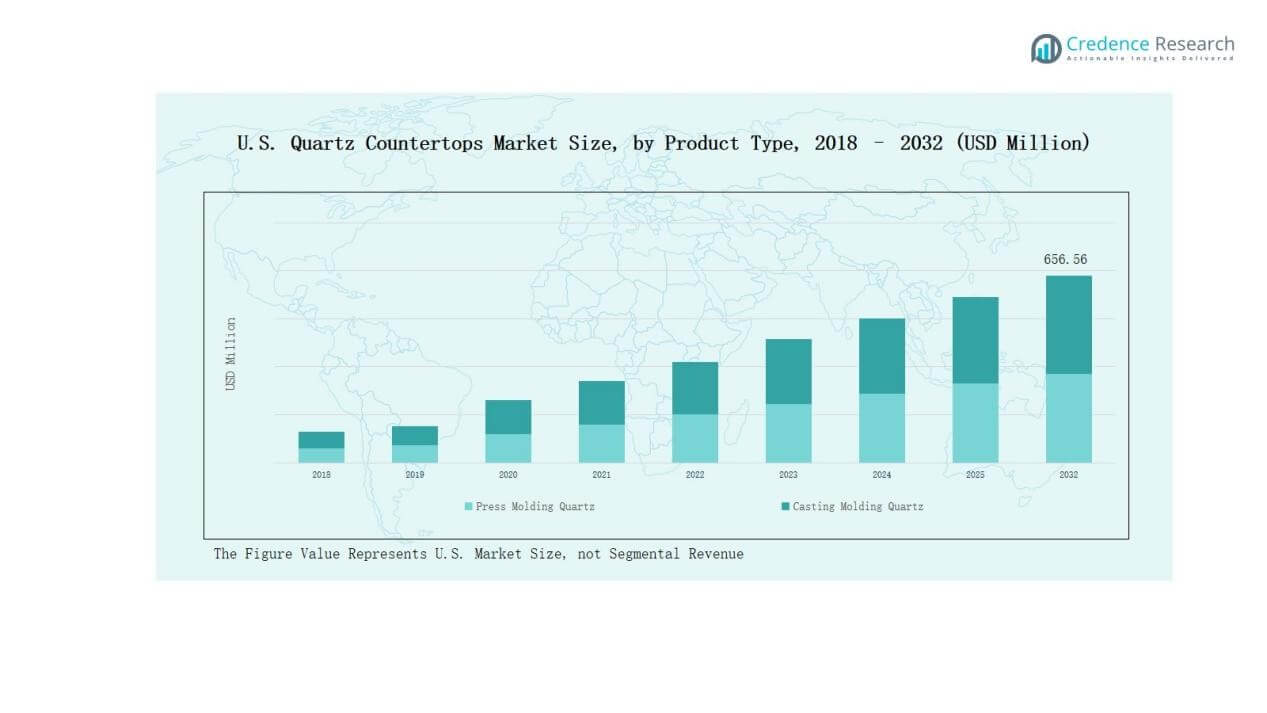

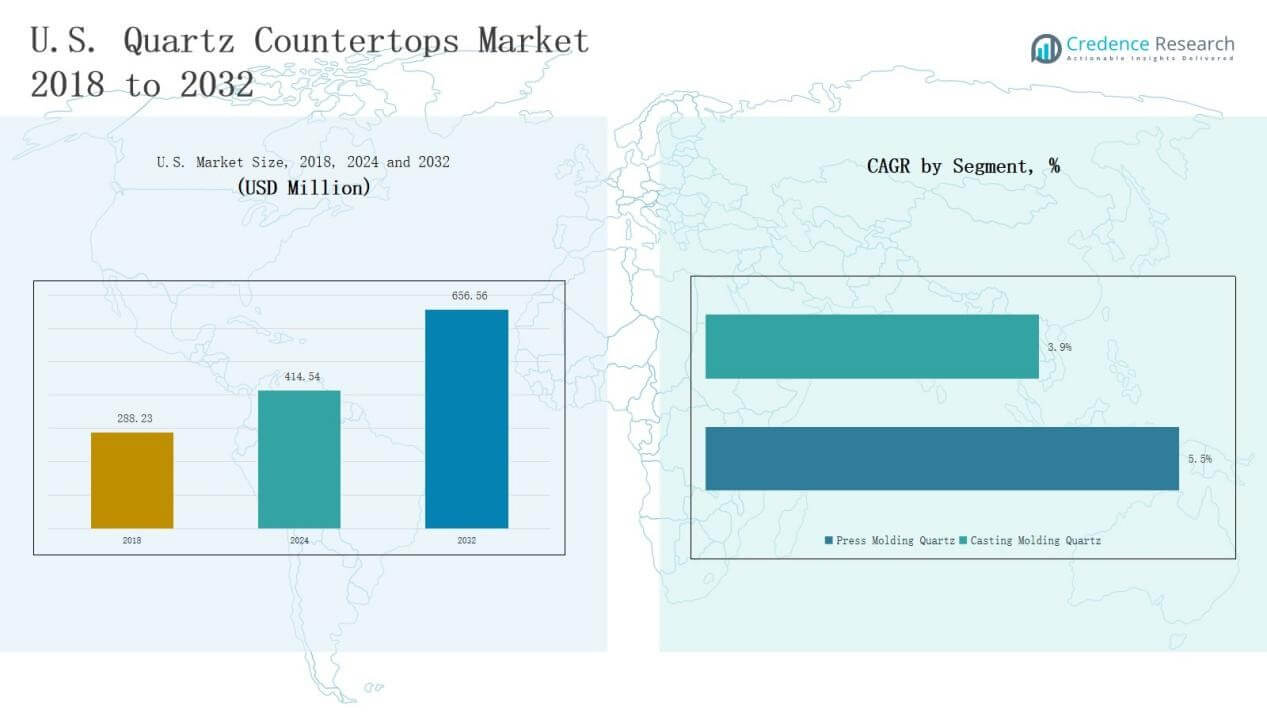

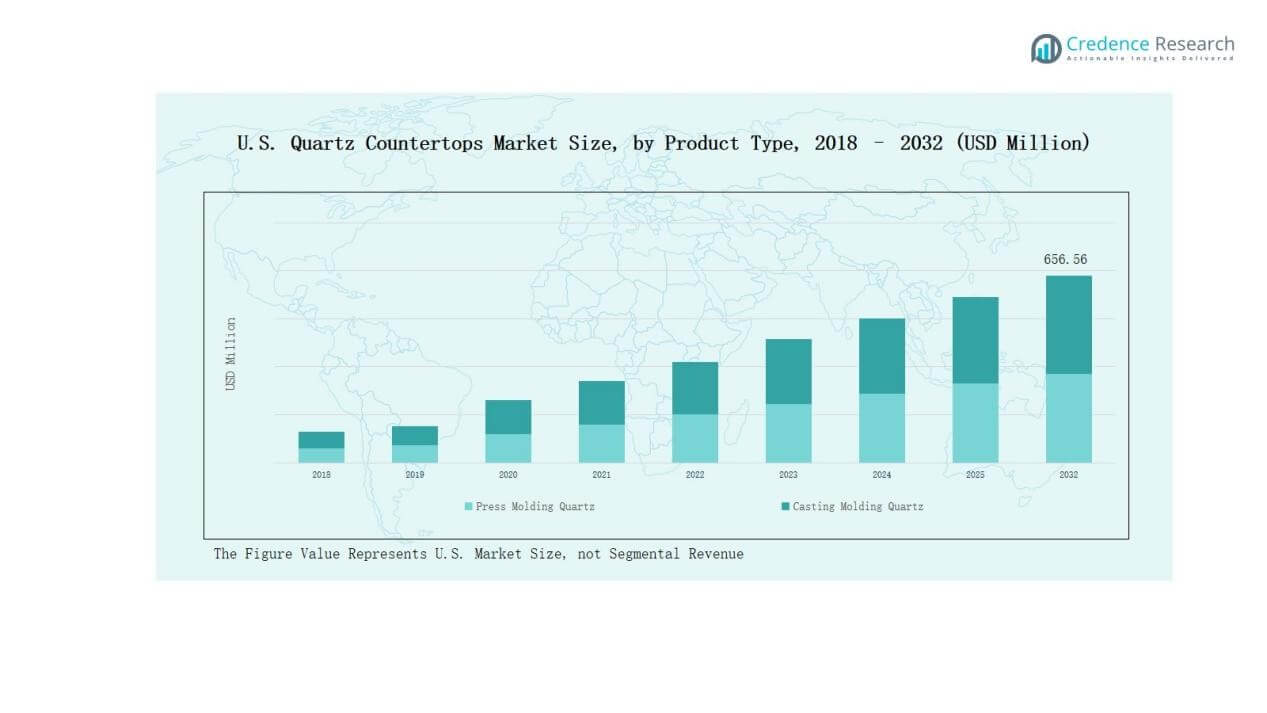

The U.S. Quartz Countertops Market size was valued at USD 288.23 million in 2018, reached USD 414.54 million in 2024, and is anticipated to reach USD 656.56 million by 2032, at a CAGR of 5.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Countertops Market Size 2024 |

USD 414.54 Million |

| U.S. Quartz Countertops Market, CAGR |

5.51% |

| U.S. Quartz Countertops Market Size 2032 |

USD 656.56 Million |

The U.S. Quartz Countertops Market is shaped by strong competition among leading players such as Cambria, MSI Surfaces, Caesarstone, Silestone (Cosentino), Daltile ONE Quartz, LX Hausys Viatera, Corian Quartz (DuPont), Vicostone USA, Wilsonart Quartz, and Meta Surfaces. These companies strengthen their positions through wide product portfolios, innovative designs, sustainable offerings, and strong distribution networks targeting both residential and commercial segments. The South region led the market with 31% share in 2024, supported by robust housing construction, large-scale remodeling activity, and expanding commercial real estate investments.

Market Insights

Market Insights

- The U.S. Quartz Countertops Market was USD 288.23 million in 2018, reached USD 414.54 million in 2024, and is expected at USD 656.56 million by 2032, growing at 5.51% CAGR.

- Leading players include Cambria, MSI Surfaces, Caesarstone, Silestone (Cosentino), Daltile ONE Quartz, LX Hausys Viatera, Corian Quartz (DuPont), Vicostone USA, Wilsonart Quartz, and Meta Surfaces, competing with innovation and sustainable offerings.

- By product type, press molding quartz held 62% share in 2024, driven by strength and affordability, while casting molding quartz gained traction through premium customization and luxury appeal.

- By application, the residential segment dominated with 64% share in 2024, followed by commercial at 28% and others at 8%, supported by institutional and healthcare usage.

- Regionally, the South led with 31% share in 2024, followed by the Northeast at 27%, Midwest at 22%, and West at 20%, highlighting diverse regional growth drivers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Press molding quartz dominated the U.S. Quartz Countertops Market with nearly 62% share in 2024, driven by its strength, uniform finish, and suitability for both residential and commercial installations. Casting molding quartz accounted for the remaining share, supported by its flexibility in creating customized designs and premium aesthetics. Growing demand for personalized interiors and luxury projects is expected to enhance adoption of casting molding quartz, although press molding remains the most cost-effective and widely accepted option.

For instance, Cambria introduced its Inverness collection of press‑molded quartz surfaces in 2024, offering durability and seamless looks tailored for high‑use kitchens.

By Application

The residential segment led with around 64% share in 2024, supported by demand in kitchens, bathrooms, and home renovation projects. Its stain resistance, low maintenance, and variety of finishes make quartz the preferred household surface material. The commercial segment held about 28%, with usage in hotels, offices, and restaurants requiring durable and premium finishes. The “Others” category contributed 8%, including institutional and healthcare applications, where hygienic surfaces and long-term performance continue to drive adoption.

For instance, Cambria partnered with Marriott hotels to feature its surfaces in lobby and bar designs, highlighting quartz’s premium look in hospitality spaces.

Key Growth Drivers

Rising Demand for Home Renovation Projects

The U.S. Quartz Countertops Market benefits from increasing home remodeling and renovation activities, particularly kitchen and bathroom upgrades. Homeowners prioritize materials that combine durability, aesthetic appeal, and low maintenance. Quartz provides stain resistance and a wide range of design options, making it a preferred choice over natural stone. Rising disposable income, coupled with growing interest in premium finishes, continues to fuel residential adoption. Renovation trends in urban and suburban areas remain a key growth driver, sustaining strong market demand.

For instance, quartz countertops are recognized for resisting stains, scratches, and heat better than traditional surfaces, which encourages busy homeowners to choose them for high-traffic kitchen areas.

Expansion of Commercial Real Estate and Hospitality Sector

Commercial real estate growth, especially in offices, hotels, and retail interiors, significantly supports quartz countertop adoption. Developers and architects favor quartz for its durability, modern design appeal, and long lifecycle performance in high-traffic areas. Hospitality investments in premium interiors, particularly in luxury hotels, further drive demand. Increasing use in reception counters, restaurants, and workspaces strengthens quartz’s position as a reliable surface material. This ongoing expansion of commercial construction projects acts as a vital driver in boosting market growth.

For instance, Imperial Vanities highlights quartz’s popularity in office buildings where quartz surfaces create a professional atmosphere in reception and meeting areas while enduring heavy daily use.

Shift Toward Sustainable and Eco-Friendly Materials

Sustainability has become a central driver in the U.S. Quartz Countertops Market. Manufacturers increasingly promote quartz surfaces made with recycled content, eco-friendly resins, and energy-efficient production processes. Consumers prioritize sustainable materials without compromising performance, encouraging wider adoption. Green building certifications and rising awareness of environmental impact push builders and homeowners toward quartz as a viable alternative to natural stone. This eco-conscious shift not only enhances brand reputation but also expands the customer base among environmentally aware buyers.

Key Trends & Opportunities

Growing Popularity of Customization and Premium Designs

Consumers are demanding greater customization in countertop designs, colors, and textures, creating opportunities for manufacturers to diversify portfolios. Digital fabrication and advanced casting methods enable marble-look, matte, and textured finishes that mimic natural stone while retaining quartz durability. Premium aesthetics attract both residential and commercial buyers seeking unique interiors. This trend supports stronger competition among leading brands and encourages product innovation. The increasing preference for tailored surfaces positions customization as a major growth opportunity in the market.

For instance, Caesarstone introduced its Pebbles Collection with soft earth-inspired hues and unique textures, catering to the demand for nature-inspired customization.

Rising E-Commerce Distribution Channels

Online platforms are emerging as important sales channels, offering consumers greater access to product information, pricing, and design visualization tools. Virtual showrooms and augmented reality applications allow homeowners to preview quartz countertops in their spaces before purchase. This digital shift expands reach beyond traditional specialty stores and distributors, creating new growth avenues. Retailers and manufacturers adopting omnichannel strategies can capture a broader audience, particularly younger homeowners who prefer online research and direct purchasing options for home improvement materials.

For instance, Ultra Decking, a UK-based e-commerce platform, specializes in composite decking by providing detailed product descriptions, side-by-side comparisons, and expert installation guides, enabling customers to make confident purchasing decisions from home.

Key Challenges

High Manufacturing and Installation Costs

Quartz countertops remain more expensive than laminate or solid surface alternatives, creating affordability barriers for price-sensitive customers. Production involves advanced equipment and resins, while installation requires skilled labor, further increasing overall project costs. Although durability offsets long-term expenses, upfront investment often limits adoption in mid-range housing projects. Competition from lower-cost substitutes poses a challenge for manufacturers targeting broad consumer segments. Balancing premium features with competitive pricing continues to be a critical challenge for market expansion.

Supply Chain Disruptions and Raw Material Dependence

The U.S. Quartz Countertops Market faces supply chain constraints linked to raw material sourcing and international trade dynamics. Quartz slabs and resins are often imported, exposing the industry to tariffs, shipping delays, and fluctuating costs. Geopolitical issues and global disruptions, such as container shortages, further impact availability and pricing. These uncertainties create challenges for manufacturers in maintaining consistent supply and meeting growing demand. Developing localized production and diversifying supply networks remain essential to mitigate these risks.

Competition from Natural Stone and Alternative Surfaces

Despite quartz’s rising popularity, competition from granite, marble, and engineered alternatives persists. Natural stone appeals to customers seeking authenticity and uniqueness, while solid surfaces and laminates offer affordability. Some high-end consumers still view natural marble as more prestigious, limiting quartz penetration in luxury projects. Continuous innovation in alternative materials, including porcelain slabs and sintered stone, intensifies competition. To sustain growth, quartz manufacturers must emphasize design innovation, sustainability, and performance advantages to differentiate against rival surface materials.

Regional Analysis

Regional Analysis

Northeast

The Northeast held 27% share in 2024, supported by high demand from urban housing and luxury remodeling projects. The region benefits from dense metropolitan areas where homeowners seek durable and modern finishes for kitchens and bathrooms. Growth in premium residential projects and strong adoption in commercial spaces such as hotels and offices drive quartz usage. The U.S. Quartz Countertops Market in the Northeast is also shaped by eco-friendly preferences, encouraging sustainable product adoption. It remains a critical hub for market expansion.

Midwest

The Midwest accounted for 22% share in 2024, driven by steady construction activity and home improvement demand. Consumers favor quartz for its affordability compared to natural stone while maintaining design appeal. The region’s mix of suburban housing and commercial development supports balanced growth across residential and commercial applications. The U.S. Quartz Countertops Market in the Midwest benefits from strong distribution networks and growing acceptance of engineered surfaces. It continues to show consistent demand supported by lifestyle upgrades and durability needs.

South

The South led with 31% share in 2024, reflecting robust housing construction, large-scale remodeling, and expanding commercial real estate. Demand is fueled by population growth, rising disposable incomes, and preference for low-maintenance surfaces in fast-growing cities. Builders increasingly specify quartz countertops for residential and mixed-use projects, strengthening regional dominance. The U.S. Quartz Countertops Market in the South also benefits from strong retail presence and competitive pricing options. It is expected to maintain leadership due to ongoing infrastructure and housing investments.

West

The West held 20% share in 2024, supported by demand in luxury housing, hospitality projects, and modern office interiors. High consumer focus on premium finishes and sustainable materials strengthens quartz adoption. The region’s design-conscious population drives preference for marble-look and customized surfaces. The U.S. Quartz Countertops Market in the West also benefits from green building initiatives and strong remodeling activity. It continues to expand with innovation-led adoption, particularly in metropolitan areas like California and Washington.

Market Segmentations:

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Molding Quartz

By Application

- Residential

- Commercial

- Others

By Region

Competitive Landscape

The U.S. Quartz Countertops Market is highly competitive, with a mix of global brands and strong domestic players. Leading companies such as Cambria, MSI Surfaces, Caesarstone, Silestone (Cosentino), and Daltile ONE Quartz maintain significant presence through extensive product portfolios and robust distribution networks. LX Hausys Viatera, Corian Quartz (DuPont), Vicostone USA, Wilsonart Quartz, and Meta Surfaces further strengthen the landscape by offering diverse designs and customized solutions. Competition focuses on premium finishes, sustainability, and technological advancements in fabrication. Companies emphasize durable, stain-resistant, and eco-friendly products to address consumer demand across residential and commercial applications. Strategic investments in showrooms, digital sales platforms, and partnerships with builders and distributors enhance visibility and market penetration. Innovation in textures, colors, and sustainable resins continues to differentiate offerings. The market reflects strong rivalry, with companies competing on design variety, pricing, and service quality to capture share in both mainstream and luxury countertop segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cambria

- MSI Surfaces

- Caesarstone

- Silestone (Cosentino)

- Daltile ONE Quartz

- LX Hausys Viatera

- Corian Quartz (DuPont)

- Vicostone USA

- Wilsonart Quartz

- Meta Surfaces

Recent Developments

- In August 2024, Vadara Quartz Surfaces launched four new distribution partnerships to strengthen its presence in U.S. East Coast markets.

- In August 2025, Cambria announced an $80 million quartz processing plant and rail center in Dakota County, U.S., while also reshoring some operations from Canada.

- In May 2025, LX Hausys launched the Taj Duna color in its Viatera Quartzite collection and enhanced Cloud Ridge in Suprema.

- In early 2025, Wilsonart introduced new Quartz designs with bold greens and blues at KBIS.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise in residential remodeling, especially kitchens and bathrooms.

- Commercial adoption will expand with growth in hospitality and office interiors.

- Sustainable and eco-friendly quartz surfaces will gain stronger preference.

- Customized finishes and marble-look designs will see higher consumer interest.

- Digital fabrication and advanced casting will improve design flexibility.

- Online and omnichannel sales platforms will strengthen market access.

- Luxury housing projects will continue to boost premium quartz demand.

- Local production and supply chain diversification will reduce import reliance.

- Innovation in antibacterial and hygienic surfaces will expand institutional adoption.

- Competitive differentiation will focus on product variety, sustainability, and service quality.

Market Insights

Market Insights Regional Analysis

Regional Analysis Market Segmentations:

Market Segmentations: