Market Overview

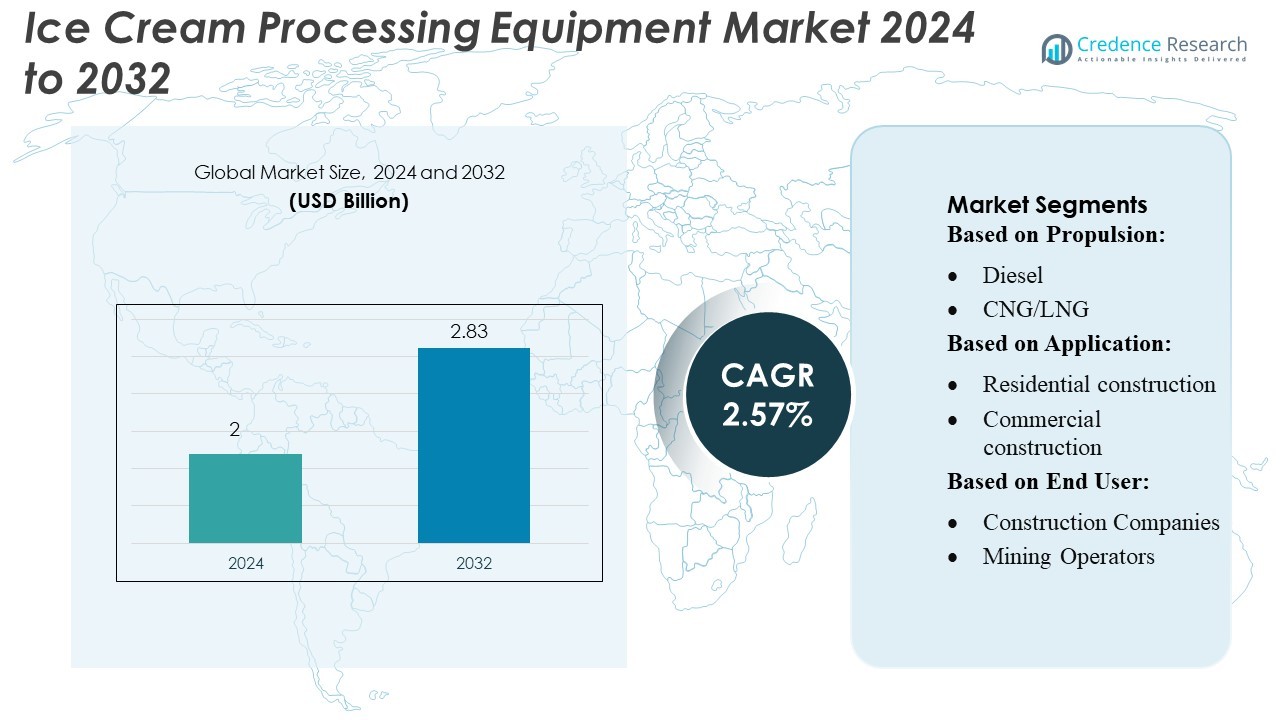

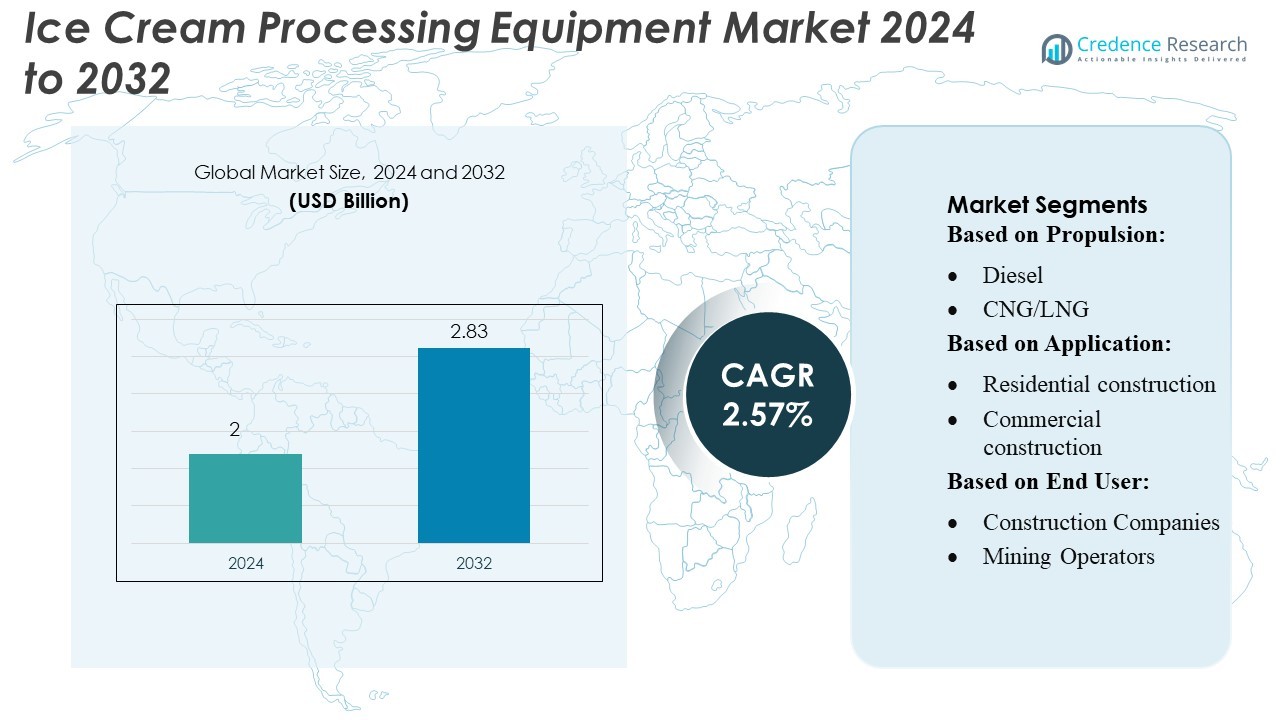

Ice Cream Processing Equipment Market size was valued USD 2 billion in 2024 and is anticipated to reach USD 2.83 billion by 2032, at a CAGR of 2.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ice Cream Processing Equipment Market Size 2024 |

USD 2 Billion |

| Ice Cream Processing Equipment Market, CAGR |

2.57% |

| Ice Cream Processing Equipment Market Size 2032 |

USD 2.83 Billion |

The Ice Cream Processing Equipment Market is shaped by strong competition among leading global manufacturers such as Tetra Pak, GEA Group, Carpigiani, SPX FLOW, and Alfa Laval, all of which continue to expand their portfolios with automated, energy-efficient freezing, mixing, and filling technologies. These players focus on modular system design, digital monitoring capabilities, and sustainability-led innovations to support producers’ demand for flexibility and operational reliability. Asia-Pacific leads the global market with an approximate 32% share, driven by rapid urbanization, expanding cold-chain infrastructure, and rising investments in high-capacity processing lines across China, India, and Southeast Asia, positioning the region as the dominant growth hub.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ice Cream Processing Equipment Market was valued at USD 2 billion in 2024 and is expected to reach USD 2.83 billion by 2032, growing at a CAGR of 2.57%, supported by steady upgrades in processing automation and rising global production capacity.

- Rising demand for premium, plant-based, and clean-label ice cream drives the adoption of advanced freezing, homogenizing, and continuous mixing technologies across industrial facilities.

- Automation, digital monitoring, modular system design, and sustainability-focused processing trends continue to dominate as manufacturers prioritize energy efficiency and improved hygiene standards.

- Competitive intensity strengthens as Tetra Pak, GEA Group, Carpigiani, SPX FLOW, and Alfa Laval expand product lines, while high capital investment requirements and limited technical expertise in developing regions act as key restraints.

- Asia-Pacific leads with 32% regional share, while continuous freezers remain the top-performing equipment segment with about 28% share, driven by expanding cold-chain networks and high-capacity production investments across China, India, and Southeast Asia.

Market Segmentation Analysis:

By Propulsion

Diesel-powered units dominate the ice cream processing equipment market with an estimated 45–50% share, supported by their high torque output and suitability for continuous, heavy-duty operations such as large-batch freezing, mixing, and hardening. Manufacturers favor diesel systems for their reliability in environments with fluctuating power supply and the ability to maintain consistent RPM for uniform texture formation. While CNG/LNG units gain traction for lower emissions and operational costs, and electric systems expand with advancements in high-efficiency variable-speed drives, diesel remains the preferred choice due to its performance stability and long service intervals.

- For instance, Blue Bell Creameries adopted an electrically-powered continuous ice cream freezer early on that could produce 80 US gallons per hour, illustrating the type of reliable, high-throughput performance that electric motors and industrial power grids support in long-running production environments.

By Application

Commercial construction applications hold the dominant position with a 40–45% share, driven by rapid expansion of foodservice manufacturing units, cold chain hubs, and mid-scale processing facilities requiring modular ice cream production lines. These users prefer equipment that integrates automated blast freezing, continuous mixers, and CIP-enabled sanitation systems to support high throughput and regulatory compliance. Industrial construction follows closely as large-scale dairy plants invest heavily in automated hardening tunnels and energy-optimized refrigeration units. Meanwhile, residential construction and mining/quarrying segments remain niche as they involve limited or specialized deployment of cooling and processing systems.

- For instance, NadaMoo! applied Foodberry’s patented coating technology—backed by more than 20 utility patents—to create frozen snack bites, each of which encapsulates its coconut-milk ice cream and weighs just 25–35 calories per piece.

By End User

Construction companies lead this segment with approximately 35–40% market share, as they directly procure and install ice cream processing systems during new facility setup and expansion projects. Their demand is driven by the rising number of greenfield dairy plants, QSR-linked manufacturing units, and cold-chain infrastructure upgrades requiring integrated freezing, mixing, and packaging solutions. Mining operators and industrial users hold smaller shares with specialized needs for industrial cooling systems. Rental companies expand gradually due to growing preference for temporary equipment during seasonal production peaks, while government and municipal bodies contribute through infrastructure modernization initiatives.

Key Growth Drivers

- Rising Global Demand for Premium and Artisanal Ice Cream

The growing popularity of premium, artisanal, and specialty ice cream varieties drives higher investments in advanced processing equipment. Consumers increasingly prefer products with unique flavors, clean-label ingredients, and customizable textures, prompting manufacturers to adopt equipment with precise mixing, continuous freezing, and automated inclusion technology. This shift accelerates the need for machines capable of delivering consistent quality, improved overrun control, and reduced batch variability. As premium segments expand globally, equipment suppliers benefit from higher-value sales and demand for flexible, modular production systems.

- For instance, Unilever made 12 of its ice cream reformulation patents freely available to the wider industry in late 2023. This technology allows ice cream products to remain stable at a warmer freezer temperature of –12 °C (10.4 °F), instead of the industry standard –18 °C (–0.4 °F).

- Expansion of Large-Scale Industrial Production Capacities

Increasing industrial-scale production of packaged ice cream boosts demand for high-throughput equipment capable of sustaining continuous operations. Global brands are expanding capacity to serve urbanizing populations, driving adoption of automated homogenizers, pasteurizers, filling lines, and extrusion systems. The need to improve productivity, reduce operational downtime, and minimize waste encourages manufacturers to upgrade to energy-efficient and digitally monitored equipment. This industrial expansion particularly favors integrated processing lines that support rapid changeovers and consistent product quality across high-volume production cycles.

- For instance,Wells Enterprises also operates is a 12-storey, free-standing freezer (a high-bay warehouse). It is located at their production plant in Le Mars, Iowa. It has the capacity to hold over 70,000 pallets of frozen product.

- Advancements in Automation and Hygiene-Centric Technologies

Automation-driven improvements such as PLC-based controls, real-time monitoring, and predictive maintenance increase equipment reliability and reduce labor dependence. Increasing regulatory emphasis on food safety pushes the adoption of hygienic-design equipment featuring CIP/SIP capability, stainless-steel construction, and reduced contamination risk. These technologies enable manufacturers to maintain strict quality standards while optimizing energy and water usage. As production environments shift toward digitalized and connected factories, automated ice cream processing systems become essential for ensuring compliance, operational efficiency, and uniform product quality.

Key Trends & Opportunities

- Growing Shift Toward Energy-Efficient and Sustainable Equipment

Energy optimization and sustainability have become central purchasing criteria, creating opportunities for equipment with heat-recovery systems, low-energy compressors, and eco-friendly refrigerants. Manufacturers are investing in technologies that reduce carbon footprint while maintaining output efficiency. The rise in ESG reporting and regulatory pressure regarding refrigerants accelerates the adoption of advanced cooling systems that meet global environmental standards. This trend opens significant opportunities for suppliers offering green technology solutions that reduce long-term operational costs for ice cream producers.

- For instance, Snow and Avalanche Research in Switzerland, using an X-ray tomography machine that observes ice crystals in ice cream at temperatures between 0 °C and –20 °C, enabling analysis of crystal size and shape to improve texture stability.

- Customization and Flexibility in Production Lines

Manufacturers increasingly seek flexible equipment platforms capable of producing multiple product types, including dairy-free, high-protein, low-sugar, and functional ice creams. This demand drives the adoption of modular systems that support rapid recipe changeovers, adjustable overrun settings, and enhanced ingredient-inclusion mechanisms. The shift toward diversified product portfolios creates opportunities for equipment suppliers specializing in scalable, customizable, and multi-format production solutions. As product innovation accelerates, flexible lines become essential for achieving speed-to-market advantages.

- For instance, Paris-Saclay Research & Innovation Center, employing over 550 scientists, includes a pilot-scale production site for new formulations, making rapid changeovers between dairy and plant-based products possible.

- Integration of Digital Monitoring and Smart Manufacturing

The adoption of Industry 4.0 technologies is rising as producers seek better control of production parameters, quality consistency, and asset performance. Sensors, smart analytics, IoT connectivity, and cloud-based dashboards are increasingly incorporated into ice cream processing lines. These capabilities enable predictive maintenance, reduced downtime, and optimized resource use. Equipment manufacturers offering digitally integrated solutions gain a competitive edge as producers shift toward data-driven manufacturing environments.

Key Challenges

- High Initial Investment and Maintenance Costs

Ice cream processing equipment involves substantial upfront costs due to the need for high-precision components, hygienic construction, and automation features. Small and mid-sized producers often struggle with capital constraints, delaying upgrades or limiting adoption of advanced technologies. Ongoing maintenance and energy costs further increase the total cost of ownership, presenting a barrier for emerging businesses. This financial challenge slows equipment modernization and pushes buyers to opt for refurbished systems, influencing the market’s growth trajectory.

- Compliance with Strict Food Safety and Refrigeration Regulations

Global food safety standards, including HACCP, FDA, and EU hygiene directives, impose strict requirements on processing equipment design, materials, and operational protocols. Additionally, evolving refrigerant regulations under frameworks such as the Kigali Amendment require manufacturers to redesign systems to reduce environmental impact. Meeting these requirements increases design complexity and development costs for equipment suppliers. Non-compliance risks production disruptions, recalls, and financial penalties, making regulatory alignment a major challenge for both equipment manufacturers and end users.

Regional Analysis

North America

North America holds roughly 30% of the global ice cream processing equipment market, driven by strong demand for premium, artisanal, and functional ice cream varieties. Manufacturers in the U.S. and Canada increasingly invest in automated continuous freezers, high-efficiency homogenizers, and advanced pasteurizers to improve operational throughput and product consistency. The region benefits from well-established dairy infrastructure and high per-capita ice cream consumption, encouraging equipment upgrades and capacity expansion. Rising investments by mid-scale producers and the rapid adoption of hygienic, energy-efficient designs further accelerate market penetration across both retail and foodservice applications.

Europe

Europe accounts for nearly 28% of the market, supported by robust dairy processing standards, strong export-oriented manufacturing, and high consumer preference for clean-label and plant-based ice cream. Equipment demand grows due to tightening EU food safety regulations that push producers to adopt automated CIP systems, advanced blending units, and precision-controlled aging tanks. Italy, Germany, and France lead adoption as producers modernize legacy lines to improve efficiency and reduce operational energy costs. The region also observes increasing investment in customizable equipment that supports flavor innovation, dietary-specific formulations, and small-batch production flexibility.

Asia-Pacific

Asia-Pacific leads the market with around 32% share, driven by rapid urbanization, expanding cold-chain networks, and rising disposable incomes across China, India, and Southeast Asia. Manufacturers increasingly install high-capacity freezers, automated ingredient dosing systems, and continuous mixing technologies to meet mass-market ice cream demand. Local producers invest heavily in line modernization to support premium categories, including low-sugar and fruit-based products. Government incentives for food processing modernization further accelerate regional adoption. Strong growth of quick-service restaurants and modern retail formats also boosts demand for standardized, high-output production lines across emerging economies.

Latin America

Latin America holds close to 6% of the global market, with demand rising steadily in Brazil, Mexico, Argentina, and Colombia. Growth is supported by expanding dairy processing capacity and rising consumer interest in affordable packaged ice cream products. Manufacturers increasingly adopt modular equipment, energy-efficient mixing systems, and semi-automated filling machines to optimize production costs in price-sensitive markets. Seasonal demand peaks drive higher uptake of flexible equipment capable of quick flavor changeovers. Investments by international food processing firms and government support for modernization also strengthen regional adoption, though supply chain limitations moderate growth.

Middle East & Africa

Middle East & Africa represent nearly 4% of the market, supported by growing demand for packaged frozen desserts in the Gulf countries and emerging urban centers across Africa. The region experiences increasing adoption of compact and automated equipment suited for small-to-mid-scale production, driven by expanding retail distribution and rising tourism activity. Investments in cold-chain infrastructure, especially in UAE, Saudi Arabia, and South Africa, enhance the feasibility of large-scale production. Manufacturers focus on integrating hygienic stainless-steel processing systems and energy-efficient refrigeration units to meet safety standards and optimize cost structures.

Market Segmentations:

By Propulsion:

By Application:

- Residential construction

- Commercial construction

By End User:

- Construction Companies

- Mining Operators

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Ice Cream Processing Equipment Market remains moderately consolidated, with leading food and dairy producers such as Blue Bell Creameries, NadaMoo, General Mills, Inc., Unilever PLC, Cold Stone Creamery, Wells Enterprises, Inspire Brands, Inc. (Baskin Robbins), Nestlé SA, Danone S.A., and American Dairy Queen Corporation. The Ice Cream Processing Equipment Market remains defined by steady innovation, rising automation, and increasing emphasis on production efficiency. Manufacturers focus on developing high-capacity continuous freezers, precision-controlled pasteurizers, and automated ingredient-dosing systems that enhance product consistency and reduce operational costs. Competition intensifies as suppliers integrate digital monitoring, IoT-enabled performance tracking, and predictive maintenance tools to improve line reliability and minimize downtime. Sustainability is becoming a core differentiator, with companies introducing energy-efficient refrigeration technologies and hygienic designs that support faster cleaning cycles and reduced water consumption. Additionally, growing demand for clean-label, premium, and plant-based ice cream drives equipment providers to offer flexible, modular systems capable of supporting rapid formulation changes and scalable production.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Blue Bell Creameries

- NadaMoo

- General Mills, Inc.

- Unilever PLC

- Cold Stone Creamery

- Wells Enterprises

- Inspire Brands, Inc. (Baskin Robbins)

- Nestlé SA

- Danone S.A.

- American Dairy Queen Corporation

Recent Developments

- In May 2024, GEA Farm Technologies acquired South West Dairy Services, a family-owned business in Cullompton, Devon. The acquisition strengthens GEA’s market position in South West England, enhances its product and service offerings to local dairy farmers, and complements its previous acquisition of Venture Dairy Services.

- In April 2024, Unilever’s Magnum brand introduced the Magnum Pleasure Express, a trio of mood-inspired ice cream flavors. This range represents a significant innovation as Magnum’s first foray into “mood-food” ice creams with a surprising core.

- In March 2024, Dairy Queen Announces Inaugural Opening of the DQ FREEZER, an Extraordinary Freezer Holding All Blizzard Treat Flavors of the Past Blizzard Treat flavors. To celebrate, two iconic flavors-Frosted Animal Cookie and Brownie Batter-will return for a limited time as part of the Summer Blizzard Treat Menu.

- In March 2024, Krones AG’s subsidiary Milkron presented its latest membrane filtration systems at Anuga Food Tec Germany. The latest system is developed to cater to various applications, including dairy products and plant-based alternatives.

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt automated and digitally connected processing lines to enhance throughput and reduce labor dependency.

- Manufacturers will prioritize energy-efficient refrigeration and low-carbon processing technologies to meet rising sustainability expectations.

- Demand for flexible, modular equipment will grow as producers expand premium, seasonal, and limited-edition product portfolios.

- Adoption of hygienic, quick-clean designs will accelerate to support faster changeovers and higher compliance with global safety standards.

- Integration of AI-based quality monitoring and predictive maintenance will strengthen operational reliability across facilities.

- Plant-based and functional ice cream products will drive the need for specialized mixing, texturizing, and freezing technologies.

- Mid-scale and emerging-market producers will increasingly upgrade lines to compete with multinational brands.

- Equipment suppliers will expand customization options to support diverse formulations and regional taste profiles.

- Cold-chain expansion in developing economies will stimulate higher investments in advanced processing systems.

- Strategic collaborations between equipment manufacturers and dairy producers will accelerate technology commercialization and innovation.