Market Overview:

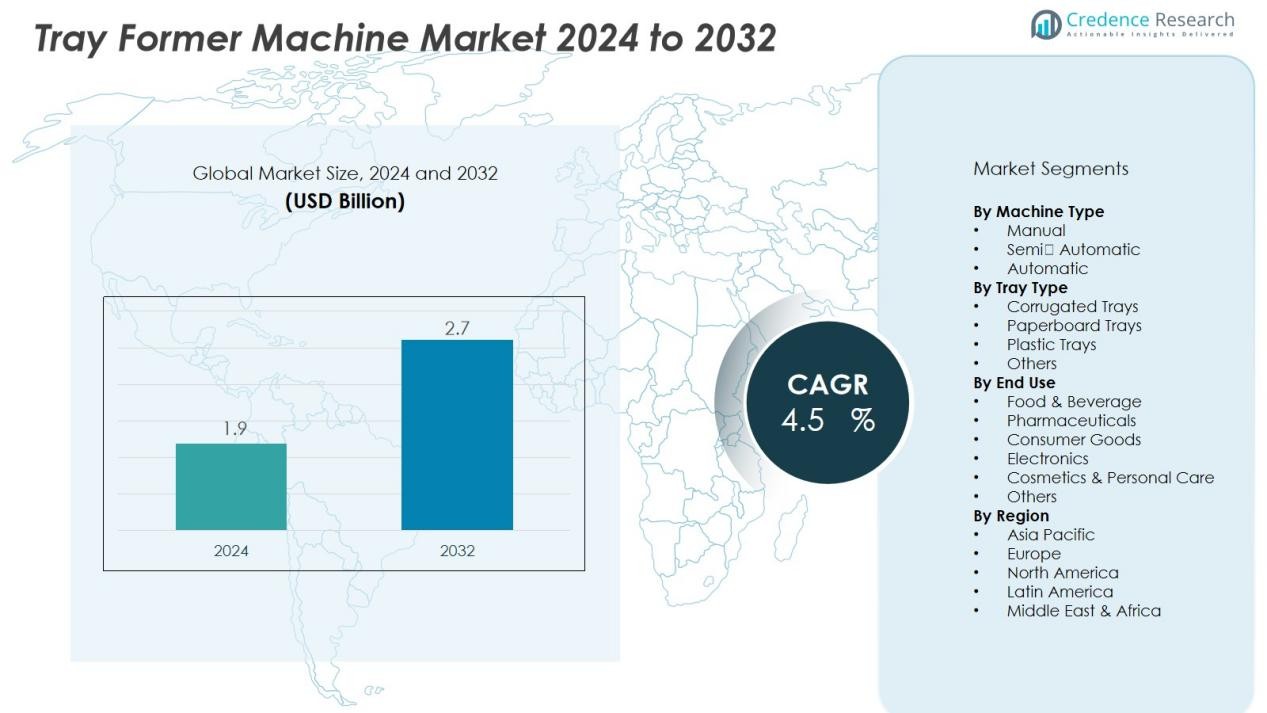

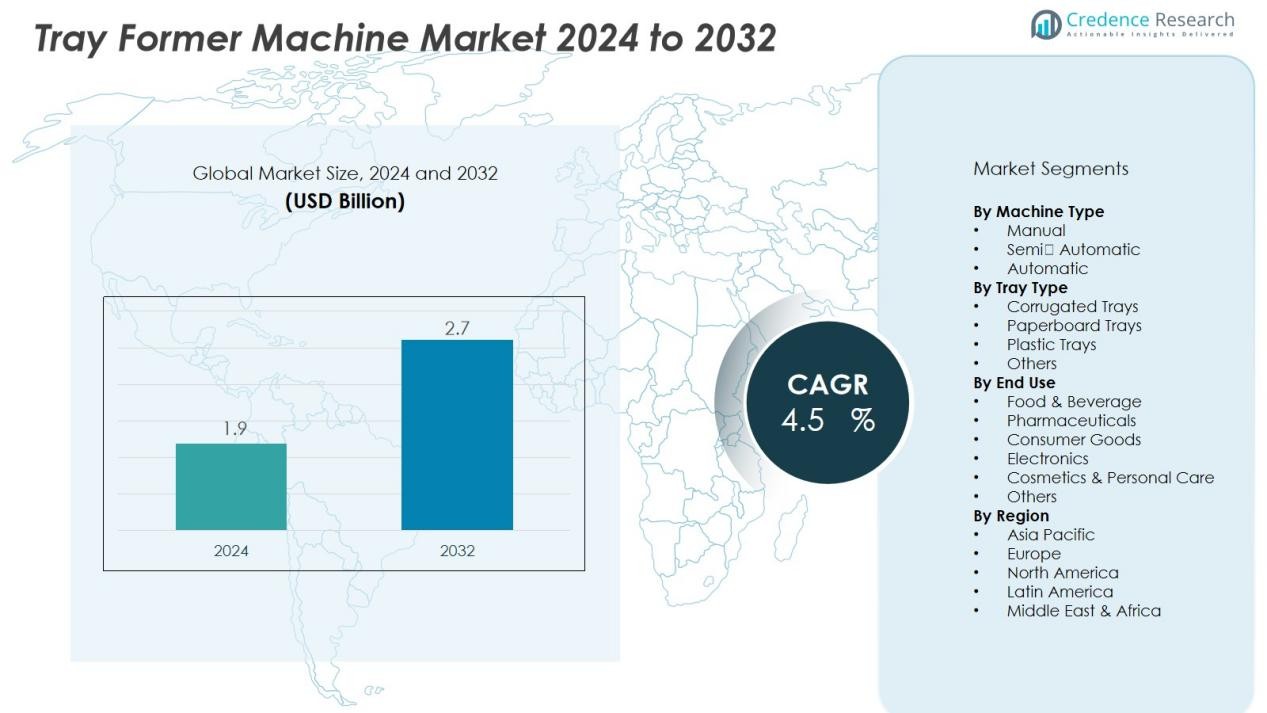

The Tray Former Machine Market size was valued at USD 1.9 billion in 2024 and is anticipated to reach USD 2.7 billion by 2032, at a CAGR of 4.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tray Former Machine Market Size 2024 |

USD 1.9 Billion |

| Tray Former Machine Market, CAGR |

4.5 % |

| Tray Former Machine Market Size 2032 |

USD 2.7 Billion |

Key drivers for the growth of the tray former machines market include the growing demand for packaged goods in industries such as food, beverages, pharmaceuticals, and consumer products. As these industries experience rapid expansion, the need for efficient and automated packaging systems becomes critical. Additionally, the ongoing shift toward automation and the adoption of Industry 4.0 technologies are driving manufacturers to invest in high-speed, low-labor tray forming solutions. The push for sustainability also plays a pivotal role, as companies seek machines capable of handling recyclable and biodegradable materials to comply with stringent environmental regulations.

Regionally, North America holds a prominent share in the market, bolstered by advanced manufacturing infrastructure and a high rate of automation adoption. Europe also remains a strong market, driven by regulatory pressures and high demand for automated packaging solutions. However, the Asia-Pacific region is expected to experience the fastest growth, primarily due to rapid industrialization, urbanization, and the expansion of the food processing and e-commerce sectors in countries such as China and India. This region is poised to lead the market in terms of growth, driven by increasing demand for efficient packaging machinery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Tray Former Machine Market size was valued at USD 1.9 billion in 2024 and is projected to reach USD 2.7 billion by 2032, growing at a CAGR of 4.5% during the forecast period.

- North America holds a 35% market share, driven by advanced manufacturing infrastructure, high automation adoption, and strong demand from the food, beverage, and pharmaceutical sectors.

- Asia Pacific leads with a 37% market share, supported by rapid industrialization, increasing disposable incomes, and expanding e-commerce and food processing industries in countries like China and India.

- Europe holds 25% of the market share, bolstered by strict environmental regulations, high demand for sustainable packaging, and a high degree of automation in packaging plants.

- The automatic machine segment dominates the market, accounting for the largest share, while the semi-automatic and manual segments serve smaller-scale operations with lower initial investment needs.

Market Drivers:

Market Drivers:

Increasing Demand for Packaged Goods

The Tray Former Machine Market is primarily driven by the growing demand for packaged goods across industries such as food, beverages, pharmaceuticals, and consumer products. Consumer preferences for convenience, shelf‑ready packaging, and extended product shelf life are fueling this trend. Companies in these sectors are investing in automated tray forming solutions to keep up with rising production volumes while ensuring product quality. The increasing global consumption of processed foods and beverages also contributes significantly to the demand for efficient packaging systems.

- For Instance, Tetra Pak has reduced its operational greenhouse gas emissions by 54% and implemented new technologies such as AI-powered optical sorting for improved carton recycling.

Shift Toward Automation and Industry 4.0

The ongoing shift towards automation and the implementation of Industry 4.0 technologies are major drivers for the Tray Former Machine Market. Manufacturers are seeking high‑speed, low‑labor packaging solutions to improve operational efficiency, reduce human error, and minimize production costs. Automation helps in optimizing production lines, making it essential for companies to adopt these advanced systems to remain competitive. The rise of smart factories and digital connectivity further enhances the appeal of automated tray former machines.

- For Instance, MULTIVAC offers advanced traysealers, including the TX series, recognized for rapid format changes and high efficiency, sometimes described as having format changes that require minimal interruption.

Focus on Sustainability and Eco-Friendly Packaging

Sustainability continues to be a crucial driver in the Tray Former Machine Market. Companies are increasingly under pressure to adopt environmentally friendly practices, such as using recyclable and biodegradable packaging materials. As regulations around packaging waste become stricter globally, manufacturers are turning to tray former machines that can handle sustainable materials. This shift toward green packaging solutions boosts demand for machines that are adaptable to recyclable and compostable trays.

Rapid Growth in E-Commerce and Retail Sectors

The rapid growth of the e-commerce sector is another key driver for the Tray Former Machine Market. Online retailers and logistics companies require packaging solutions that can handle large volumes of products while ensuring safe delivery. Tray former machines enable quick and efficient packaging of goods for online sales, particularly in food, electronics, and consumer goods. With the expansion of e-commerce across various regions, demand for high‑speed, customizable tray forming solutions continues to rise.

Market Trends:

Integration of Advanced Automation and Smart Technology

A notable trend in the Tray Former Machine Market is the increasing integration of advanced automation and smart technology into packaging systems. Manufacturers are adopting machines that incorporate sensors, IoT capabilities, and real‑time data analytics to optimize production efficiency. These innovations help track performance, predict maintenance needs, and adjust processes for optimal output. The growing focus on Industry 4.0 technologies is encouraging companies to integrate these smart systems to stay competitive. The demand for tray former machines that offer enhanced automation, such as automated loading and stacking systems, is growing. These machines reduce labor costs and increase throughput, making them highly sought after by businesses aiming for higher operational efficiency.

- For instance, Schubert Group deployed its advanced TLM packaging system incorporating collaborative robots and servo-driven automation technology, achieving 671 products per minute across multiple tray sizes with an efficiency rate exceeding 98%, while requiring only 2 operators for normal production.

Shift Toward Sustainable Packaging Solutions

Sustainability has become a central trend driving the Tray Former Machine Market. With growing environmental concerns and increasing regulatory pressures on packaging waste, companies are transitioning towards eco‑friendly materials and processes. Machines that can handle recyclable, compostable, or biodegradable tray materials are gaining significant traction. The push for sustainable packaging is encouraging manufacturers to invest in tray forming equipment that can process a variety of eco-friendly substrates. This shift aligns with the broader consumer trend toward sustainability, as consumers and businesses increasingly prioritize environmentally responsible practices. Tray former machine manufacturers are responding to this trend by developing equipment capable of adapting to these new materials while maintaining efficiency and cost-effectiveness.

- For instance, ULMA Packaging launched its TSA tray sealer, which is capable of processing 100% recyclable mono-material trays, achieving a production throughput of up to 17 trays per minute in large-scale European retail operations in 2024.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the primary challenges facing the tray former machine market is the high upfront capital required for purchasing and installing automated tray forming systems. These machines often come with substantial initial costs, which can be a barrier for small and mid-sized companies that lack the financial resources for such investments. In addition to the purchase price, ongoing maintenance and operational expenses can further strain the budget of companies, especially if frequent repairs or upgrades are necessary. The need for skilled personnel to operate and maintain these systems also adds to the overall cost burden. These factors can limit the adoption of tray former machines, particularly in industries with tight profit margins or those in developing regions.

Technological Complexity and Integration Issues

Another challenge is the technological complexity of tray former machines, which may require significant integration with existing production lines. Businesses often face difficulties when trying to integrate advanced tray forming systems with legacy equipment, as compatibility issues may arise. This integration process can lead to delays in production and unexpected costs. Moreover, frequent technological advancements mean that machines can quickly become outdated, requiring constant upgrades to maintain efficiency and competitiveness in the market. This rapid pace of innovation can leave companies grappling with the decision of when to invest in new technologies, further complicating the decision-making process.

Market Opportunities:

Expansion into Emerging Economies and Untapped Markets

The Tray Former Machine Market reveals substantial opportunities in developing regions where food and e‑commerce volumes continue to climb. Manufacturers in Asia‑Pacific, Latin America and the Middle East are actively expanding operations, creating demand for tray forming equipment in packaging lines. These regions benefit from rising urbanisation, increased disposable income and the spread of supermarket and retail chains. It therefore makes strategic sense for machine suppliers to establish local service networks and offer cost‑effective models adapted to local needs. Firms that tailor outreach to small and mid‑sized enterprises can capture early‑stage growth, while those that build training and after‑sales capabilities will enhance customer retention.

Innovative Automation and Sustainable Materials Adoption

Another promising opportunity lies in driving machine upgrades and material diversification in the tray forming sector. With manufacturers under pressure to reduce labour costs and increase throughput, demand grows for higher‑speed, servo‑driven tray formers that integrate with digital production systems. At the same time, sustainability targets and regulation push firms to shift toward recyclable, compostable or fibre‑based tray materials — and it becomes advantageous for providers to launch machines compatible with those substrates. Suppliers that invest in modular designs, quick‑change tooling and smart sensors will therefore stand out in the market. By combining automation and eco‑friendly material support, machine vendors can offer differentiated value and meet two major industry imperatives simultaneously.

Market Segmentation Analysis:

By Machine Type

The machine type segment divides the market into manual, semi-automatic, and automatic machines. The automatic segment dominates revenue share, thanks to its high speed, consistent output, and minimal labor requirement. Semi-automatic and manual machines serve smaller-scale operations and companies with limited budgets; they retain significance in niche applications where full automation is not viable. The higher upfront cost of automatic systems limits uptake in some regions, giving smaller machines a role in market penetration. Demand for automatic models continues to grow due to rising production volumes and efficiency targets.

- For instance, Bosch Packaging Technology’s automatic cartoning machines are capable of processing up to 400 cartons per minute in industrial pharmaceutical lines, consistently delivering output for major drug manufacturers.

By Tray Type

The tray type segment covers corrugated trays, paperboard trays, plastic trays, and others. Corrugated trays hold a large share because of their strength, durability, and recyclability. Paperboard trays gain traction through sustainability focus, while plastic trays maintain presence where durability and moisture resistance matter. The variation in tray material influences machine specifications, changeover tooling, and maintenance demands, which suppliers must accommodate.

- For instance, Graphic Packaging International’s KeelClip paperboard solution enables a significant reduction in single-use plastic by replacing traditional plastic rings on beverage multipacks. One notable implementation for Coca-Cola in Europe is projected to save an estimated 2,000 tonnes of plastic and 3,000 tonnes of CO2 annually across the region

By End Use

In the end-use segment, key industries include food & beverage, pharmaceuticals, consumer goods, electronics, and automotive. The food & beverage sector leads, driven by packaged meals, ready-to-eat products, and shelf-ready displays. Pharmaceuticals, though smaller in volume, exhibit higher growth due to strict packaging requirements and traceability demands. Consumer goods and electronics apply tray forming for transport and display packaging. Automotive uses applications for parts and components. Suppliers that tailor machine features to industry-specific end-use requirements will gain an advantage in this market.

Segmentations:

By Machine Type

- Manual

- Semi‑Automatic

- Automatic

By Tray Type

- Corrugated Trays

- Paperboard Trays

- Plastic Trays

- Others

By End Use

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Electronics

- Cosmetics & Personal Care

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Regional Performance

North America holds a market share of roughly 35 % in the Tray Former Machine Market. It enjoys strong growth driven by robust demand across the food, beverage, and pharmaceutical sectors. It benefits from well‑established manufacturing infrastructure and high adoption of automation technologies. Regulatory standards around packaging safety and sustainability further support equipment investment here. Producers focus on integrating smart sensors and servo‑driven tray formers to maintain competitiveness. The region’s mature retail sector demands shelf‑ready packaging formats, which drives tray‑forming machine uptake.

Asia Pacific Regional Performance

Asia Pacific commands a market share of about 37 % in the tray former machine segment. Rapid industrialisation in countries such as China and India fuels packaging equipment demand for processed foods, e‑commerce goods, and pharmaceuticals. It sees cost‑effective manufacturing models and rising disposable incomes that raise demand for packaged products. Local machine suppliers complement global vendors by offering regionally adapted solutions. The region’s government initiatives promoting automation and modernisation of manufacturing lines enhance adoption rates. It also faces infrastructure and logistics challenges that create opportunities for flexible tray forming systems.

Europe & Middle East & Africa Regional Performance

Europe holds approximately 25 % share and the Middle East & Africa contribute the remaining 3–4 % share combined in the tray former machine arena. Europe benefits from demand for sustainable packaging and stringent environmental regulations which prompt investment in machines capable of handling recycled or fibre‑based trays. It also features a high degree of automation in packaging plants. In the Middle East & Africa, growth remains moderate but opportunities emerge from expanding food processing plants and logistics infrastructure. It requires manufacturers to offer machines that suit regional service capabilities and power supply conditions.

Key Player Analysis:

- Wayne Automation

- Wexxar Packaging, Inc.

- AFA Systems Inc.

- ADCO Manufacturing.

- Combi Packaging Systems, LLC

- Paxiom

- Crown Packaging Corp.

- Sacmi

- DS Smith

- Gietz

- Econcorp

- Boix Maquinaria, S.L.

- Mibox

- Heiber + Schröder Maschinenbau GmbH

- H. Leary

Competitive Analysis:

The competitive landscape for the Tray Former Machine Market features significant players including Wayne Automation, Wexxar Packaging, Inc., AFA Systems Inc., ADCO Manufacturing, Combi Packaging Systems, LLC and Paxiom. Wayne Automation leads with high‑speed tray formers capable of producing up to 55 trays per minute, highlighting its strong capabilities in automation and customized solutions. Wexxar Packaging offers fully automatic tray formers integrated with sealing and stacking functions, indicating a broad system‑level approach. AFA Systems provides compact and glue‑style tray formers tailored for precise material handling applications. ADCO Manufacturing competes by offering modular configurations suited for evolving production needs. Combi Packaging focuses on modular, flexible tray forming machines targeting mid‑sized operations. Paxiom delivers solutions that emphasize advanced integration and smart factory compatibility. Collectively, these key suppliers shape the market’s trajectory through heavy investment in automation, service networks and versatility, which intensifies competition around performance, uptime and total cost of ownership.

Recent Developments:

- In March 2025, ADCO Manufacturing was acquired by Massman Companies, combining ADCO’s cartoning automation strengths with Massman’s broader packaging solutions portfolio.

- In September 2025, Combi Packaging Systems launched its new 2EZ-A Series case erectors, designed for rapid deployment and enhanced packaging efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Machine Type, Tray Type, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Tray Former Machine Market will benefit from increased adoption of smart manufacturing solutions, with machine vendors integrating IoT capabilities and real‑time analytics into equipment.

- Rising demand for sustainable packaging will drive it towards machines that handle recyclable, fibre‑based and biodegradable tray materials, creating a shift in equipment design and material compatibility.

- E‑commerce growth and the need for shelf‑ready packaging formats will push it to serve high‑volume, flexible production lines capable of rapid changeovers and smaller batch sizes.

- Geographic expansion into emerging regions will offer it new revenue streams; suppliers that establish local service and spare‑parts networks will gain competitive advantage.

- Machine modularity and quick‑change tooling will emerge as key differentiators, enabling it to support multiple tray formats and materials within a single equipment platform.

- Collaborative robotics and human‑machine interfaces will increase, allowing it to reduce operator fatigue and increase throughput in mid‑sized manufacturing plants.

- Raw‑material price volatility and supply‑chain disruptions will compel it to focus on predictive maintenance and spare‑parts optimisation to maintain uptime.

- Machine manufacturers that offer turnkey services—installation, training, digital support—will benefit, because it raises the total value proposition beyond hardware.

- OEMs that target niche end‑use segments such as pharmaceuticals, premium consumer goods or fresh produce will benefit, since it demands highly precise, small‑batch tray solutions.

- Strategic partnerships between machine suppliers and tray‑material manufacturers will emerge, enabling it to align machine capabilities with evolving substrate technologies and regulatory requirements.

Market Drivers:

Market Drivers: