Market Overview

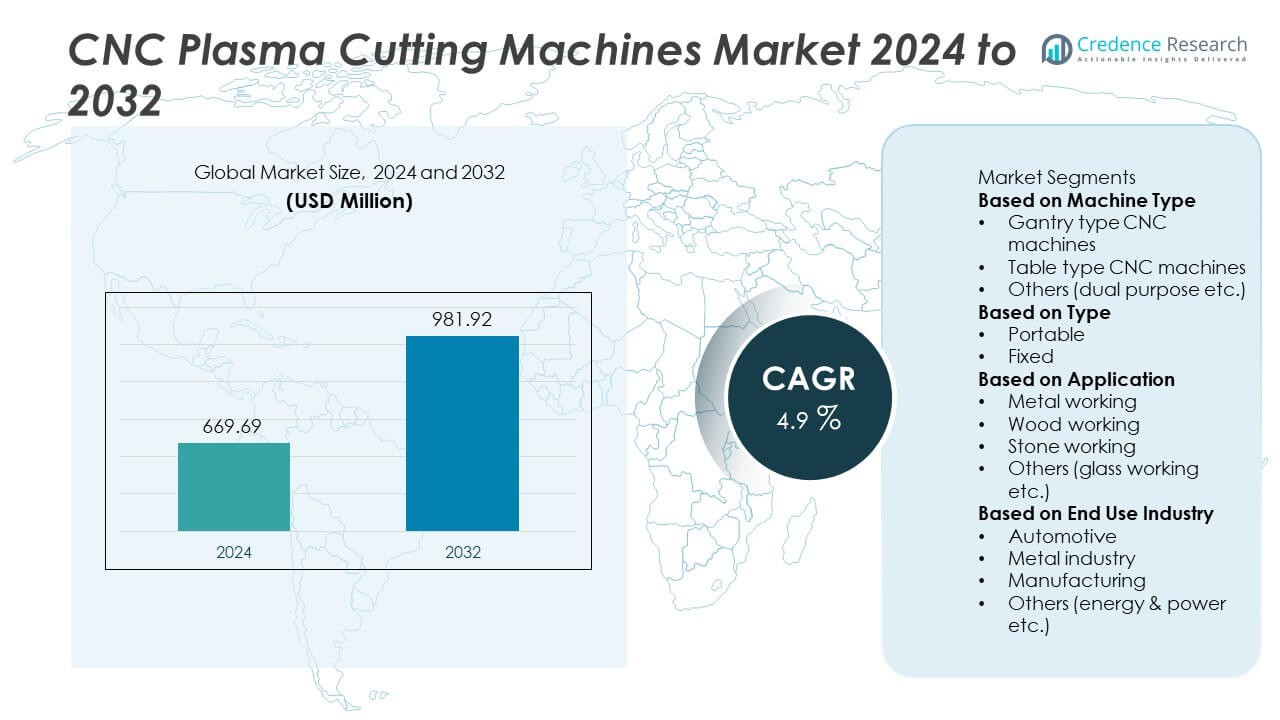

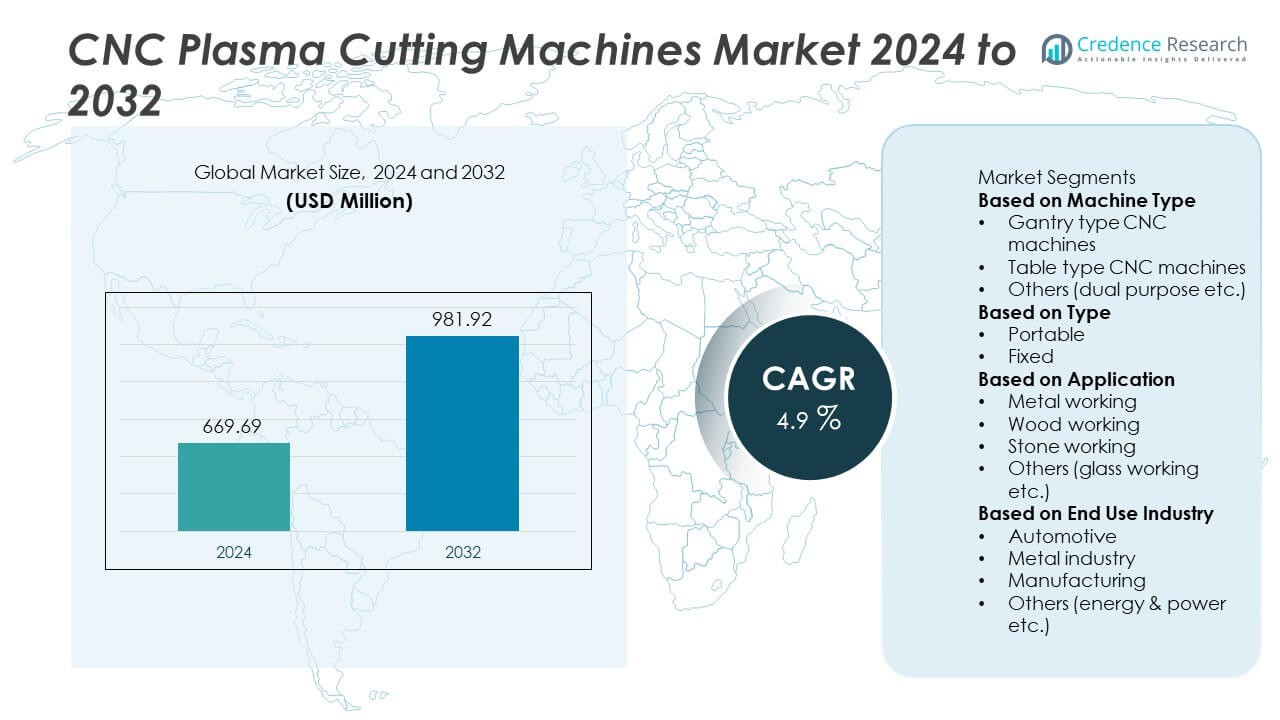

The CNC Plasma Cutting Machines Market was valued at USD 669.69 million in 2024. The market is projected to reach USD 981.92 million by 2032, registering a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| CNC Plasma Cutting Machines MarketSize 2024 |

USD 669.69 Million |

| CNC Plasma Cutting Machines Market, CAGR |

4.9% |

| CNC Plasma Cutting Machines Market Size 2032 |

USD 981.92 Million |

The top players in the CNC Plasma Cutting Machines market include Hypertherm, Hildebrand Machinery, Daihen, Kinetic, ALLtra, Hornet Cutting Systems, AKS Cutting Systems, Ajan Electronics, Fengwei, and Ador Welding, each focusing on high-definition cutting technology, automated motion control, and CAD/CAM integration to improve fabrication speed and edge precision. Asia Pacific leads the market with a 34% share, driven by expanding steel fabrication, automotive production, and infrastructure development in China, India, Japan, and South Korea. North America follows with 27%, supported by strong demand from industrial machinery, metal service centers, and automated manufacturing lines, while Europe holds a 25% share due to advanced adoption in shipbuilding, engineering, and renewable energy component fabrication.

Market Insights

Market Insights

- The CNC Plasma Cutting Machines market reached USD 669.69 million in 2024 and is projected to reach USD 981.92 million by 2032, registering a CAGR of 4.9% during the forecast period.

- Rising demand for precision metal fabrication in automotive, construction, and machinery manufacturing drives market growth, with gantry-type CNC machines holding the largest 47% segment share due to high-speed cutting and large-format industrial applications.

- Key trends include adoption of high-definition plasma technology, multi-axis cutting systems, and CAD/CAM-integrated digital workflows that reduce material waste and enhance cutting accuracy across fabrication facilities.

- Hypertherm, Hildebrand Machinery, Daihen, Kinetic, ALLtra, Hornet Cutting Systems, AKS Cutting Systems, Ajan Electronics, Fengwei, and Ador Welding lead the competitive landscape, focusing on automation-enabled plasma systems, energy-efficient power sources, and advanced nesting software.

- Asia Pacific leads regional demand with a 34% share, followed by North America at 27% and Europe at 25%, supported by growing infrastructure projects, steel structure manufacturing, and ongoing modernization of metalworking and fabrication operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Machine Type

Gantry type CNC machines hold the leading 47% share of the CNC Plasma Cutting Machines market. Their dominance is driven by strong demand in heavy fabrication, shipbuilding, and steel structure manufacturing, where large work areas and precision cutting are essential. Gantry systems support high-speed, multi-axis cutting and accommodate thick metal sheets, making them suitable for industrial-scale production. Table type machines follow with strong adoption in mid-size fabrication workshops due to compact design and lower installation costs. Increasing focus on automation and improved cutting quality continues to support gantry machine adoption across global manufacturing facilities.

- For instance, Hypertherm’s XPR300 system delivers cutting power up to 300 A, enabling processing of up to 80 mm mild steel with consistent precision in shipbuilding yards.

By Type

Fixed CNC plasma cutting machines account for the largest 64% segment share, supported by widespread use in automotive component manufacturing, industrial machinery, and structural steel processing. Their rigid frame structure ensures steady cutting performance, higher repeatability, and compatibility with high-power plasma torches for demanding workloads. Portable CNC plasma cutters gain traction in repair and on-site construction applications, offering flexibility for maintenance teams and field service operations. Growth in portable systems is further supported by advances in lightweight frames and wireless CNC controls, although fixed machines remain the preferred choice for continuous production environments.

- For instance, Kinetic K5000 integrated cutting systems handle plate sizes up to 3,048 mm x 12,192 mm and support drilling spindles operating at 4,000 rpm for heavy-duty part processing.

By Application

Metal working is the dominant segment with a 72% share of the CNC Plasma Cutting Machines market, driven by extensive use in sheet metal fabrication, pipe cutting, equipment manufacturing, and custom metal processing. The demand for high-precision, clean-edge cutting in mild steel, stainless steel, and aluminum applications strengthens market expansion. Wood working and stone working remain secondary niches, supported by specialized plasma-compatible technology for creative design and decorative applications. Increasing adoption of Industry 4.0-ready plasma equipment, integrated CAD/CAM software, and real-time process monitoring further enhances efficiency and strengthens the leading position of metal working in the overall market.

Key Growth Drivers

Rising Demand for Precision Metal Fabrication

Manufacturers in automotive, construction, and industrial machinery sectors increase the use of CNC plasma cutting machines to achieve high precision and consistent edge quality in metal fabrication. These systems reduce material waste, shorten production cycles, and support complex geometric cutting. Growth in customized metal parts, along with expanding fabrication workshops and metal processing plants, strengthens adoption. As industries shift toward lightweight and high-strength metals, CNC plasma systems offer cost-effective cutting capabilities, boosting market growth across both large-scale and mid-sized production facilities.

- For instance, ESAB’s Cutmaster True Series 120 delivers cutting output up to 120 A. This capacity allows it to pierce up to 25 mm (1 inch) of stainless steel. This improved technical capability is designed to enhance precision in component processing for automotive suppliers.

Expansion of Infrastructure and Industrial Construction

Global investment in infrastructure, energy facilities, and structural steel fabrication drives the need for efficient cutting technologies. CNC plasma machines support steel beams, pipelines, heavy equipment frames, and plant assembly materials, enabling faster production and reduced rework. Growth in shipbuilding, railways, and renewable energy components further supports adoption. Modern construction firms prefer CNC plasma solutions to improve productivity and meet stricter quality standards. These factors enhance equipment demand among contractors, fabrication yards, and engineering service providers.

- For instance, Koike Aronson’s Mastergraph EX2 system handles cutting widths up to 12 feet (approximately 3,658 mm) and achieves traverse speeds of up to 35,560 mm/min (1,400 inches per minute), allowing fabrication yards to cut large steel sections for bridge and port infrastructure projects.

Increasing Adoption of Automation and CAD/CAM Integration

The growing shift toward automated production lines encourages industries to integrate CNC plasma systems with CAD/CAM software for real-time design-to-cut execution. Automated torch height control, digital nesting, and motion optimization improve operational reliability and cutting accuracy. This supports Industry 4.0 implementation and reduces dependency on manual programming. Manufacturers deploy CNC plasma systems to enhance throughput in repetitive production runs and reduce downtime. These capabilities attract industries aiming to modernize workshops and transition to data-driven cutting operations.

Key Trends & Opportunities

Growth of Portable CNC Plasma Cutting Systems

Demand for portable CNC plasma machines rises in repair, shipyard maintenance, and on-site industrial service operations. Compact and lightweight designs support remote construction, agricultural equipment repair, and pipeline maintenance. Wireless CNC control, quick setup interfaces, and battery-compatible power units enhance field usability. This trend creates opportunities for manufacturers to provide modular, rugged, and energy-efficient portable plasma cutting solutions tailored to field technicians and service contractors.

- For instance, Hypertherm’s Powermax30 AIR operates on a 240 V input and weighs 13.5 kg, enabling maintenance teams to cut up to 16 mm steel plate during offshore and pipeline repair operations without external air compressors.

Adoption of High-Definition and Multi-Axis Cutting Technologies

High-definition (HD) plasma systems and multi-axis capabilities gain traction as industries require cleaner cuts, lower dross formation, and improved tolerances. These technologies support advanced fabrication applications such as signage, robotic welding preparation, and aerospace-grade components. Equipment integrated with AI-assisted cutting path optimization and IoT-based monitoring creates new product development opportunities. The trend promotes partnerships between plasma equipment manufacturers and automation technology providers.

- For instance, Kjellberg’s Smart Focus 400 system utilizes Contour Cut technology for cutting mild steel with a diameter to material thickness ratio of 1:1, or the even faster Contour Cut Speed, to achieve high-quality results in applications like general steel fabrication.

Key Challenges

High Operational and Maintenance Costs

CNC plasma cutting machines involve significant costs related to power consumption, electrode and nozzle replacements, gas supplies, and system calibration. Smaller fabrication shops may struggle to justify investment or sustain recurring expenses, limiting adoption. Maintenance downtime and skilled technician requirements add further cost pressures. These factors can slow market penetration, especially in cost-sensitive manufacturing environments.

Limited Precision Compared to Laser Cutting in Thin Materials

While CNC plasma systems perform well on thicker metals, they face precision limitations compared with fiber laser cutting in thin-gauge materials. Laser systems offer finer kerf width, reduced heat distortion, and higher cutting speed for intricate designs. Industries with strict tolerance requirements may prefer laser solutions, restricting plasma usage in certain applications. Continuous technology improvements are necessary to reduce the performance gap and strengthen competitiveness in high-precision cutting segments.

Regional Analysis

North America

North America holds a 27% share of the CNC Plasma Cutting Machines market, driven by strong adoption in automotive component production, industrial machinery fabrication, and metal service centers. The United States leads demand due to advanced manufacturing infrastructure, widespread use of automated cutting lines, and rising investment in robotic welding and precision metal processing. Growth in construction equipment and agricultural machinery manufacturing also supports equipment sales. The region’s strong focus on Industry 4.0, integration of CAD/CAM software, and IoT-enabled cutting controls further enhances market expansion. Increasing reshoring of manufacturing activities continues to strengthen long-term demand for CNC plasma systems.

Europe

Europe accounts for a 25% market share, supported by well-established metal fabrication industries, stringent manufacturing quality standards, and strong demand from transportation, shipbuilding, and industrial engineering sectors. Germany, Italy, and the United Kingdom drive equipment adoption with continued investments in high-definition plasma cutting and automated production cells. Growth in renewable energy infrastructure and steel structure fabrication increases the need for advanced cutting technologies. Manufacturers emphasize energy-efficient plasma systems and improved fume extraction standards to comply with workplace safety regulations. Digital monitoring, CNC upgrades, and software-driven nesting optimization further encourage equipment modernization across European fabrication facilities.

Asia Pacific

Asia Pacific holds the largest 34% share of the market, driven by rapid industrialization, infrastructure development, and strong steel fabrication demand in China, India, Japan, and South Korea. Expanding automotive and heavy engineering industries create significant growth opportunities for gantry and table-type CNC plasma systems. Local manufacturers offer cost-competitive plasma equipment, increasing accessibility for small and mid-sized fabrication workshops. Government-led investments in construction, shipbuilding, and energy projects support long-term market growth. Rising adoption of automated metalworking technologies and integration of CNC systems with factory digitalization platforms reinforce Asia Pacific’s leading position in global demand.

Latin America

Latin America holds an 8% market share, with growth led by Brazil and Mexico due to expanding industrial manufacturing, construction equipment fabrication, and metal structure production. Adoption increases in automotive components, agricultural machinery, and mining equipment manufacturing. Cost-effective CNC plasma systems gain preference among small and medium fabrication workshops. Infrastructure development initiatives and nearshoring of manufacturing operations contribute to rising equipment demand. However, economic fluctuations and limited access to advanced automation technology can affect market growth, making aftersales support and financing options important for further penetration.

Middle East and Africa

Middle East and Africa represent a 6% share of the market, supported by steel fabrication demand in construction, oil and gas infrastructure, and heavy equipment maintenance. Countries such as Saudi Arabia, the UAE, and South Africa drive adoption of CNC plasma systems for metal structure production, pipeline fabrication, and industrial plant maintenance. Growth in logistics hubs, ship repair facilities, and industrial free zones supports broader adoption of automated cutting systems. The region continues to increase investments in fabrication workshops and digital manufacturing capabilities, although skill shortages and limited high-end automation infrastructure may moderate growth in some markets.

Market Segmentations:

By Machine Type

- Gantry type CNC machines

- Table type CNC machines

- Others (dual purpose etc.)

By Type

By Application

- Metal working

- Wood working

- Stone working

- Others (glass working etc.)

By End Use Industry

- Automotive

- Metal industry

- Manufacturing

- Others (energy & power etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Hypertherm, Hildebrand Machinery, Daihen, Kinetic, ALLtra, Hornet Cutting Systems, AKS Cutting Systems, Ajan Electronics, Fengwei, and Ador Welding lead the competitive landscape of the CNC Plasma Cutting Machines market. The market is characterized by strong emphasis on high-definition plasma technology, automated motion control systems, and advanced nesting software to improve cutting accuracy and operational efficiency. Key players prioritize product enhancements such as multi-axis cutting, integrated fume extraction, and IoT-enabled monitoring for predictive maintenance. Partnerships with robotics manufacturers strengthen adoption in automated fabrication lines. Companies expand their global distribution networks and after-sales support to capture growing demand from metal fabrication, industrial machinery, and construction sectors. Continuous investment in portable CNC plasma models and energy-efficient power sources also contributes to competitive differentiation. As manufacturing transitions toward Industry 4.0, leading vendors focus on software-driven optimization, remote CNC programming, and real-time production analytics to enhance productivity and reduce material waste across industrial cutting environments.

Key Player Analysis

- Hypertherm

- Hildebrand Machinery

- Daihen

- Kinetic

- ALLtra

- Hornet Cutting Systems

- AKS Cutting Systems

- Ajan Electronics

- Fengwei

- Ador Welding

Recent Developments

- In May 2024, Hypertherm Associates launched the Powermax45 SYNC as a new member of its Powermax SYNC family.

- In November 2023, Daihen Corporation and Hypertherm announced a partnership to showcase their robotic plasma-cutting system at the International Robot Exhibition 2023 in Japan.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Type, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will increase as manufacturers expand automated metal fabrication capabilities.

- High-definition plasma systems will gain wider use for cleaner and faster cutting.

- Portable CNC plasma units will grow in demand for on-site industrial maintenance.

- Integration with CAD/CAM and nesting software will improve material utilization.

- Multi-axis and robotic plasma cutting cells will expand in advanced fabrication plants.

- IoT-enabled monitoring and predictive maintenance will reduce machine downtime.

- Energy-efficient plasma power sources will support sustainability and lower operating costs.

- Growth in shipbuilding, construction, and heavy equipment manufacturing will drive equipment upgrades.

- Asia Pacific will remain the fastest-growing region due to strong industrialization.

- After-sales service, training, and software support will become key revenue drivers for suppliers.

Market Insights

Market Insights