Market Overview

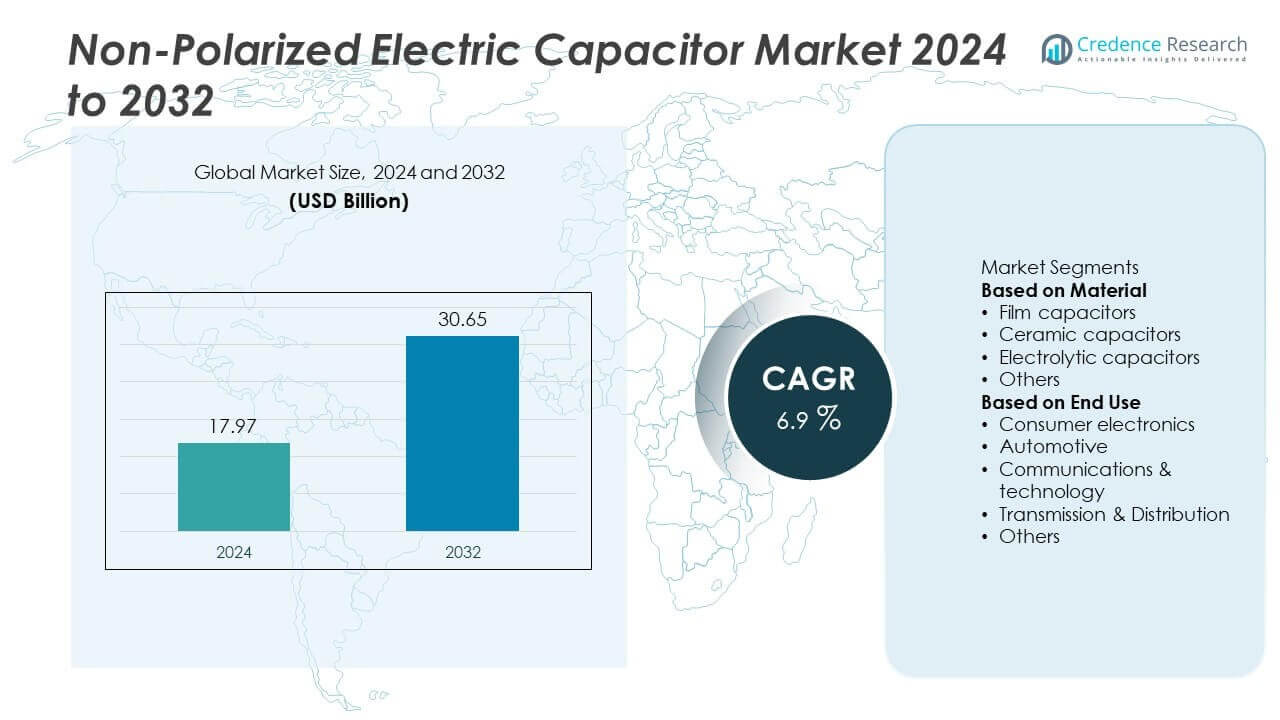

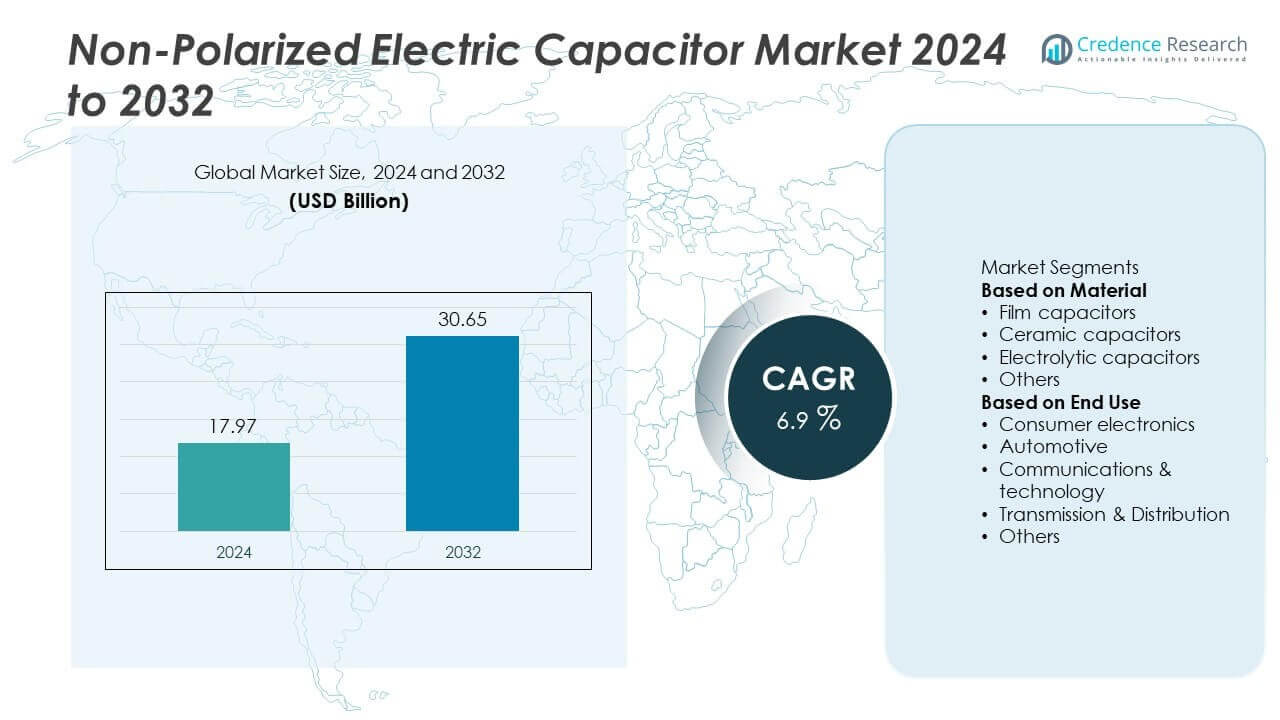

The Non-Polarized Electric Capacitor Market was valued at USD 17.97 billion in 2024 and is projected to reach USD 30.65 billion by 2032, growing at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non-Polarized Electric Capacitor Market Size 2024 |

USD 17.97 Billion |

| Non-Polarized Electric Capacitor Market, CAGR |

6.9% |

| Non-Polarized Electric Capacitor Market Size 2032 |

USD 30.65 Billion |

The non-polarized electric capacitor market is shaped by key players including Havells India, Samsung Electro-Mechanics, Cornell Dubilier, Siemens, Elna, Panasonic, Murata Manufacturing, Schneider Electric, Kyocera AVX Components, and Kemet. These companies drive growth through product innovation, advanced material development, and strategic partnerships with electronics, automotive, and energy sectors. They focus on enhancing capacitor performance to meet rising demand in consumer electronics, renewable energy, and electric vehicles. Regionally, Asia-Pacific led the market with 33% share in 2024, supported by large-scale electronics and automotive production. Europe followed with 29% share, while North America held 27% share, reinforcing their strong positions in global adoption.

Market Insights

Market Insights

- The non-polarized electric capacitor market was valued at USD 17.97 billion in 2024 and is projected to reach USD 30.65 billion by 2032, growing at a CAGR of 6.9% during the forecast period.

- Rising demand from consumer electronics, which held 38% share in 2024, along with expanding automotive and renewable energy applications, drives strong adoption of non-polarized capacitors.

- Key trends include miniaturization of capacitors for compact devices, growing integration in electric vehicles, and increasing use in renewable power and smart grid infrastructure.

- The market is competitive with major players such as Havells India, Samsung Electro-Mechanics, Cornell Dubilier, Siemens, Elna, Panasonic, Murata Manufacturing, Schneider Electric, Kyocera AVX Components, and Kemet focusing on advanced materials and global expansion.

- Regionally, Asia-Pacific led with 33% share, followed by Europe at 29%, North America at 27%, while Latin America and the Middle East & Africa accounted for 6% and 5% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Film capacitors dominated the non-polarized electric capacitor market in 2024, holding 42% share. Their leadership is driven by superior stability, low energy loss, and long operational life, making them widely used in power electronics, lighting systems, and industrial equipment. Film capacitors also support high-voltage applications and offer strong resistance to temperature fluctuations, which strengthens demand across critical sectors. Increasing adoption in renewable energy systems, particularly in solar and wind power, further supports their dominance. While ceramic capacitors are also gaining traction, film capacitors remain the preferred material for reliability and durability.

- For instance, KYOCERA AVX, a leading manufacturer, produces a wide range of film capacitors with voltage ratings up to thousands of volts and low dielectric loss, which are extensively used in renewable energy inverters and industrial power supplies.

By End Use

Consumer electronics led the non-polarized electric capacitor market in 2024, accounting for 38% share. The dominance stems from widespread use in smartphones, laptops, televisions, and wearable devices, where compact and reliable capacitors are essential. Growing demand for high-performance gadgets and connected devices continues to fuel adoption. Additionally, advancements in miniaturization technologies enhance their integration into portable electronics. Automotive applications are expanding rapidly, supported by electric vehicle (EV) growth and increasing demand for energy-efficient electronic systems. However, consumer electronics remains the largest end-use category due to constant innovation and rising global device penetration.

- For instance, Murata Manufacturing, a leading supplier for consumer electronics, supplied hundreds of billions of multilayer ceramic capacitors (MLCCs) in 2024, featuring a wide range of capacitance values in miniature sizes and with operating temperature characteristics suitable for use in smartphones and wearable technology.

Key Growth Drivers

Expanding Consumer Electronics Demand

The surge in demand for smartphones, laptops, televisions, and wearable devices strongly drives the non-polarized electric capacitor market. These capacitors provide reliability, compactness, and energy stability essential for modern gadgets. With global consumer electronics shipments rising annually, manufacturers prioritize capacitors that support miniaturization and improved efficiency. Technological advancements, such as 5G-enabled devices and IoT integration, further expand usage. This sustained growth in electronics consumption, coupled with increasing adoption of smart home appliances, ensures continuous demand for non-polarized capacitors across developed and emerging markets worldwide.

- For instance, Samsung Electro-Mechanics expanded its multilayer ceramic capacitor (MLCC) lineup in 2024 with various new products for applications such as 5G and automotive technology, supporting the miniaturization and performance needs of the latest devices.

Growth of Renewable Energy and Power Infrastructure

Investments in renewable energy and modern power grids significantly boost capacitor adoption. Non-polarized electric capacitors play a critical role in power factor correction, voltage stabilization, and smooth integration of renewable sources like solar and wind energy. Governments worldwide invest heavily in smart grids and energy-efficient transmission and distribution systems. Utilities rely on capacitors to enhance grid reliability and efficiency. This push toward sustainable energy infrastructure directly increases market demand, as capacitors remain essential components for ensuring consistent power delivery and system resilience.

- For instance, KYOCERA AVX, having rebranded from AVX Corporation in 2021, manufactures high-voltage film capacitors rated up to 1,200 V DC and higher for demanding applications such as solar inverters and wind turbines, which enhance grid stability and energy conversion efficiency.

Rising Automotive and EV Adoption

The automotive sector, especially electric vehicles (EVs), is emerging as a key driver for the market. Non-polarized electric capacitors are vital in EV power electronics, battery management systems, and charging infrastructure. Automakers are integrating advanced capacitors to improve energy efficiency and extend vehicle performance. With global EV sales growing rapidly, demand for high-quality capacitors continues to rise. Additionally, automotive electronics, including infotainment, safety systems, and advanced driver assistance systems (ADAS), create further opportunities. This trend positions the automotive industry as a long-term growth catalyst for the capacitor market.

Key Trends and Opportunities

Miniaturization and High-Performance Design

The trend toward compact and lightweight electronics fuels innovation in miniaturized non-polarized capacitors. Manufacturers focus on delivering higher capacitance in smaller packages, supporting advanced consumer electronics and portable devices. This trend aligns with rising demand for slim smartphones, wearables, and compact IoT solutions. Enhanced performance, such as higher temperature resistance and durability, creates new opportunities in automotive and industrial applications. As technology advances, miniaturized designs will remain a critical factor in market expansion.

- For instance, ROHM Semiconductor launched its BTD1RVFL series silicon capacitors in November 2023, initially featuring the 01005 size, which was then the smallest mass-produced surface mount silicon capacitor. The device offers a mounting area reduction of about 55% compared to the standard 0201 size, while providing high capacitance, stability, and ESD resistance, and is used widely in smartphones and wearable devices.

Integration with 5G and Digital Infrastructure

The rollout of 5G networks and expansion of data centers create strong opportunities for the capacitor market. Non-polarized capacitors are crucial for maintaining voltage stability, noise filtering, and energy reliability in advanced communication systems. The rapid adoption of cloud computing and edge technologies further supports their use in server infrastructure. As global investments in digital connectivity increase, capacitors will continue to play a central role in enabling faster and more reliable communications.

- For instance, Empower Semiconductor launched its EC1005P silicon capacitor in 2024 featuring 16.6 µF capacitance in an ultra-compact package optimized for high-frequency performance at 1 GHz, making it ideal for 5G base stations and data center applications demanding high reliability and efficiency.

Key Challenges

Fluctuating Raw Material Prices

The production of non-polarized electric capacitors relies on raw materials such as aluminum, ceramics, and specialty films. Fluctuations in raw material costs impact production expenses, leading to pricing pressures for manufacturers. Supply chain disruptions further exacerbate the challenge, especially in regions dependent on imports. These uncertainties affect profit margins and limit the ability of manufacturers to offer competitive pricing. Managing raw material volatility remains a critical issue for sustaining market growth.

Performance Limitations in Extreme Conditions

Non-polarized capacitors face performance challenges in high-frequency and extreme environmental conditions. Issues such as reduced capacitance stability, shorter lifespans, and thermal degradation limit their adoption in advanced applications. Industries like aerospace, defense, and high-performance automotive require capacitors that can withstand harsh operating environments. Without continued innovation in materials and design, these limitations may restrict wider adoption. Overcoming such performance barriers is essential to unlocking growth in demanding end-use industries.

Regional Analysis

North America

North America accounted for 27% share of the non-polarized electric capacitor market in 2024, driven by strong demand from consumer electronics, automotive, and renewable energy sectors. The United States leads adoption with extensive use of capacitors in advanced electronics, electric vehicles, and grid modernization projects. Growing investments in renewable energy infrastructure and electric vehicle production further accelerate regional demand. Canada supports growth through rising clean energy projects and industrial applications. The presence of major technology companies and robust R&D activities strengthens innovation, ensuring North America remains a significant market for non-polarized electric capacitors.

Europe

Europe held 29% share of the non-polarized electric capacitor market in 2024, supported by strong industrial, automotive, and renewable energy applications. Germany, France, and the United Kingdom are key markets, with automotive electrification and advanced manufacturing driving adoption. European Union initiatives to reduce carbon emissions encourage the use of capacitors in renewable energy systems and power distribution. The growing popularity of electric vehicles and charging infrastructure also supports market expansion. Europe’s focus on sustainability, energy efficiency, and high-quality components ensures steady demand for non-polarized capacitors across various end-use sectors.

Asia-Pacific

Asia-Pacific led the non-polarized electric capacitor market with 33% share in 2024, making it the largest regional market. China, Japan, South Korea, and India dominate adoption due to their massive consumer electronics production and growing automotive industries. Expanding renewable energy projects and rapid urbanization further strengthen demand. Asia-Pacific benefits from large-scale manufacturing capabilities, lower production costs, and strong government initiatives promoting digitalization and electrification. With rising exports of electronic devices and increasing electric vehicle adoption, the region remains the fastest-growing market for non-polarized capacitors, solidifying its leadership in global production and consumption.

Latin America

Latin America represented 6% share of the non-polarized electric capacitor market in 2024, with Brazil and Mexico driving demand. Expanding consumer electronics adoption, combined with automotive manufacturing and renewable energy projects, fuels growth in the region. Brazil’s focus on clean energy development and Mexico’s role as a manufacturing hub support capacitor demand in industrial and electronic applications. However, economic volatility and limited local production capacity constrain rapid expansion. Partnerships with global manufacturers and rising interest in electric mobility create new opportunities for market penetration in the coming years.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the non-polarized electric capacitor market in 2024, with adoption concentrated in Gulf countries and South Africa. The region’s demand is primarily supported by transmission and distribution infrastructure projects, renewable energy expansion, and consumer electronics growth. Governments are investing in large-scale solar and wind power projects, boosting the role of capacitors in energy systems. Rising urbanization and digital connectivity also contribute to growth. However, challenges such as limited awareness and slower industrial development restrict wider adoption, though long-term prospects remain favorable with ongoing infrastructure investments.

Market Segmentations:

By Material

- Film capacitors

- Ceramic capacitors

- Electrolytic capacitors

- Others

By End Use

- Consumer electronics

- Automotive

- Communications & technology

- Transmission & Distribution

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the non-polarized electric capacitor market features leading players such as Havells India, Samsung Electro-Mechanics, Cornell Dubilier, Siemens, Elna, Panasonic, Murata Manufacturing, Schneider Electric, Kyocera AVX Components, and Kemet. These companies compete by offering a broad portfolio of film, ceramic, and electrolytic capacitors tailored for consumer electronics, automotive, power distribution, and industrial applications. Strategic priorities include expanding manufacturing capabilities, enhancing product miniaturization, and developing high-performance capacitors for renewable energy systems and electric vehicles. Companies are also investing in advanced materials to improve energy efficiency, stability, and durability under varying conditions. Collaborations with electronics and automotive manufacturers strengthen market presence, while acquisitions and regional expansions help widen customer bases. The growing focus on sustainability and compliance with global energy efficiency standards further drives innovation. Competition remains intense as players seek differentiation through technological advancements, cost efficiency, and reliable supply chains in a rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Havells India

- Samsung Electro-Mechanics

- Cornell Dubilier

- Siemens

- Elna

- Panasonic

- Murata Manufacturing

- Schneider Electric

- Kyocera AVX Components

- Kemet

Recent Developments

- In July 2025, Murata Manufacturing began mass production of the 0402-inch MLCC (multilayer ceramic capacitor) with 47 µF capacitance.

- In 2025, Murata also updated its portfolio of high- and medium-voltage low-loss laminated ceramic capacitors for automotive on-board charger (OBC), wireless power transfer, and server power supplies.

- In October 2024, Murata Manufacturing added a new production line at its Caen, France plant, further expanding its Integrated Passive Solutions offering. This new 200-mm mass production line is intended to strengthen the company’s capabilities to manufacture Silicon Capacitors for the consumer electronics market. It will enhance Murata’s offerings in the local market and aid development in the regional market.

Report Coverage

The research report offers an in-depth analysis based on Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand from consumer electronics and portable devices.

- Electric vehicle adoption will strongly boost capacitor usage in automotive electronics.

- Renewable energy projects will drive demand for capacitors in power factor correction systems.

- Film capacitors will maintain leadership due to durability and performance advantages.

- Miniaturization of capacitors will support growth in compact and high-performance gadgets.

- Transmission and distribution networks will increasingly rely on capacitors for grid stability.

- Asia-Pacific will continue leading the market with strong manufacturing and consumption growth.

- Europe will strengthen its position with demand from EVs and renewable energy systems.

- North America will sustain growth with modernization of power infrastructure and consumer demand.

- Competition will intensify as players invest in advanced materials and global expansion strategies.

Market Insights

Market Insights