Market Overview

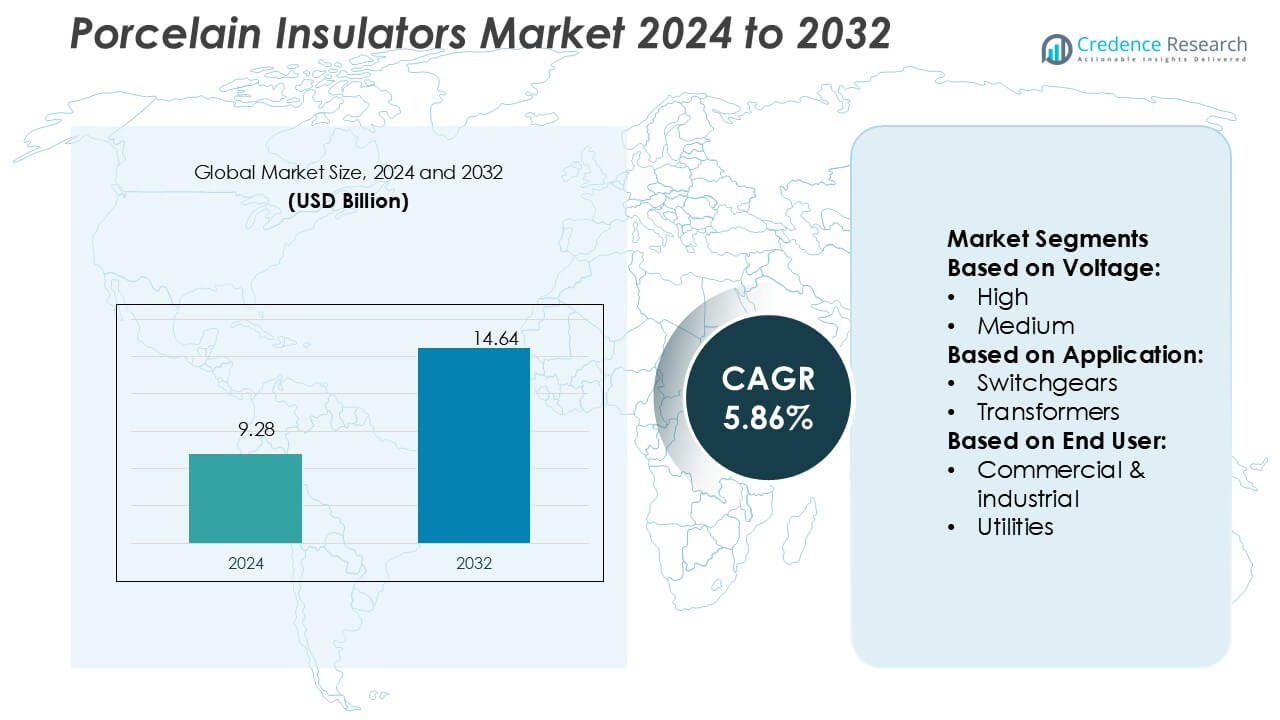

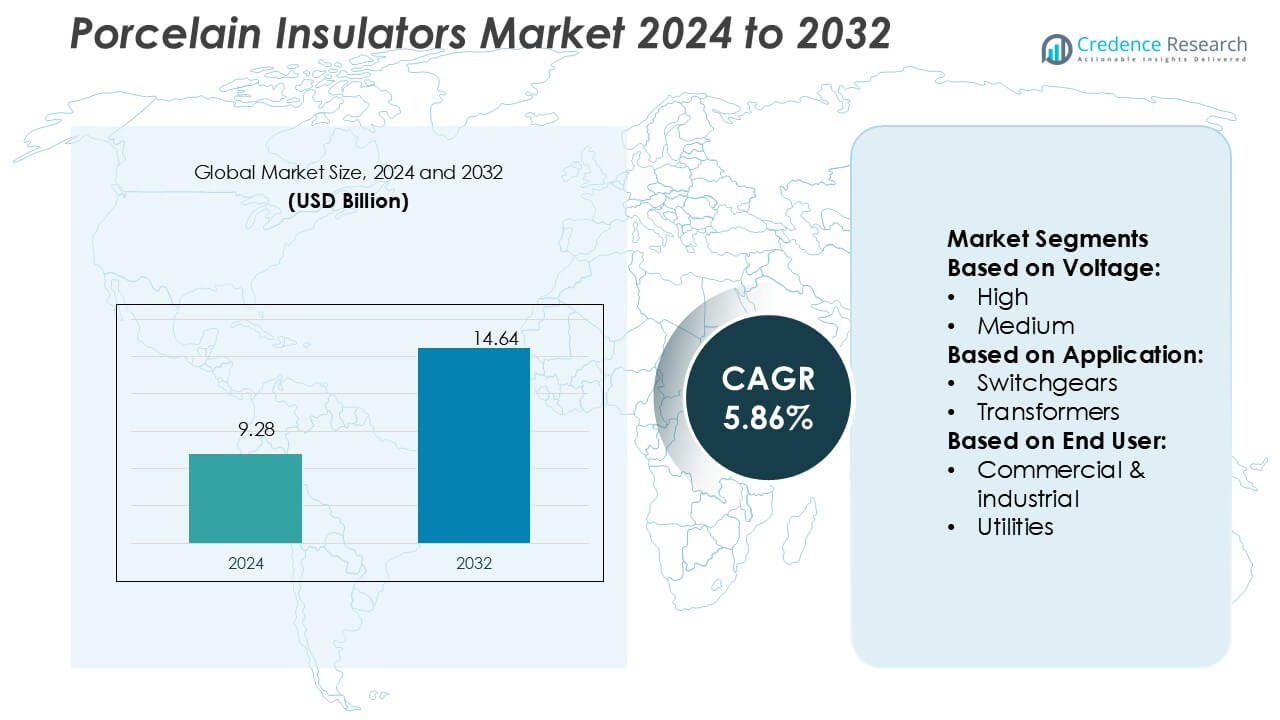

Porcelain Insulators Market size was valued USD 9.28 billion in 2024 and is anticipated to reach USD 14.64 billion by 2032, at a CAGR of 5.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Porcelain Insulators Market Size 2024 |

USD 9.28 Billion |

| Porcelain Insulators Market, CAGR |

5.86% |

| Porcelain Insulators Market Size 2032 |

USD 14.64 Billion |

The porcelain insulators market is driven by key players such as NEPTUNE-INDIA, POINSA, LAPP Insulators, Newell Porcelain, Hubbell, Meister International, LLC, Aditya Birla Insulators, MAPEI S.p.A., NS Transmission Pvt. Ltd., and Metsch Refractories Inc., who compete through innovation, capacity expansion, and strong regional presence. These companies focus on enhancing product durability, meeting stringent quality standards, and expanding their global distribution networks to serve utilities and industrial customers. Asia-Pacific leads the market with a 36% share, supported by large-scale grid expansion, renewable energy integration, and rapid urbanization across major economies like China and India, making it the most influential region for growth.

Market Insights

Market Insights

- The porcelain insulators market size was valued at USD 9.28 billion in 2024 and is anticipated to reach USD 14.64 billion by 2032, registering a CAGR of 5.86% during the forecast period.

- Market growth is driven by rising electricity demand, grid modernization, and renewable energy integration, with utilities being the largest end-user segment due to large-scale deployment in transmission and distribution networks.

- A key trend shaping the market is the adoption of advanced ceramic technologies to enhance strength, durability, and resistance, while manufacturers expand global networks to capture industrial and utility demand.

- Competitive dynamics remain strong, with leading companies such as NEPTUNE-INDIA, POINSA, LAPP Insulators, and Hubbell focusing on product innovation and cost efficiency, while facing restraints from increasing competition with composite insulators offering lighter weight and lower maintenance.

- Asia-Pacific dominates with a 36% share, led by China and India, while high-voltage insulators remain the leading segment due to extensive long-distance transmission requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage

High-voltage porcelain insulators dominate the market, holding the largest share due to their widespread use in power transmission and distribution networks. Their ability to withstand extreme electrical stress makes them essential for grid reliability. Growing investments in high-voltage transmission infrastructure, including cross-country lines and renewable energy integration, strengthen their adoption. Utilities prioritize high-voltage insulators to ensure safety, reduce losses, and support efficient long-distance electricity transfer. This demand positions the high-voltage segment as the leading contributor to market growth, supported by rapid urbanization and industrial expansion worldwide.

- For instance, Royal Doulton’s fine bone china uses a soft-paste porcelain formula containing greater than 35 % tricalcium orthophosphate, enhancing hardness, translucency, and resistance to fluid absorption.

By Application

Cables and transmission lines represent the largest application segment, commanding the highest market share. The rising demand for uninterrupted electricity supply and grid modernization projects drive this dominance. Porcelain insulators in cables and transmission lines ensure high mechanical strength, resistance to weather conditions, and minimal leakage currents. Governments and utilities invest heavily in upgrading transmission infrastructure, particularly to integrate renewable power sources. This trend reinforces the application of porcelain insulators in high-capacity lines, making them vital for achieving efficiency, reliability, and reduced maintenance in energy distribution networks.

- For instance, Rosenthal operates its own combined heat and power plant and uses multiple heat recovery systems in its German factories to reduce energy losses. Rosenthal uses 100 % ecologically generated electricity at all sites (production + administration) to reduce carbon footprint.

By End-User

Utilities account for the dominant share in the end-user segment, reflecting their extensive use of porcelain insulators in transmission and distribution systems. Utilities drive demand through large-scale infrastructure projects, rural electrification, and network modernization efforts. The growing need to replace aging grid components and expand renewable energy integration further boosts adoption. Porcelain insulators offer cost efficiency, long service life, and high reliability, aligning with utilities’ operational goals. Their large procurement volumes and regulatory mandates for safe, uninterrupted power supply make utilities the primary growth driver in this segment.

Key Growth Drivers

Expansion of Power Transmission Infrastructure

The global push for reliable electricity transmission drives strong demand for porcelain insulators. Expanding power grids, particularly in developing economies, require durable high-voltage insulators to manage long-distance transmission. Governments and utilities invest heavily in cross-border projects and smart grid modernization. Porcelain insulators are favored for their high mechanical strength, resistance to environmental stress, and cost-effectiveness. Their role in minimizing power losses and ensuring grid stability supports their dominance. Rising renewable integration further accelerates demand, as transmission lines require robust insulation for higher capacity operations.

- For instance, Lenox bone china production plant The Kinston plant was approximately 218,000 square feet in size. At the time of its closure, the plant employed around 159 people.

Increasing Renewable Energy Integration

The growth of renewable energy projects significantly boosts the porcelain insulators market. Solar and wind power plants require efficient transmission networks, often located far from consumption centers. This drives higher demand for porcelain insulators that can withstand fluctuating loads and harsh outdoor environments. Governments worldwide support renewable adoption through favorable policies, creating opportunities for insulator deployment. Utilities invest in upgrading substations and transmission lines to accommodate green energy flow. These factors position porcelain insulators as critical components in enabling the shift toward sustainable energy systems.

- For instance, Wedgwood has launched Jasper 250, a generative AI design tool, allowing users to co-create new Jasperware patterns; the winning design will be 3D printed and added to their V&A collection.

Rising Urbanization and Industrialization

Rapid urbanization and industrial growth create rising energy consumption, fueling demand for transmission and distribution upgrades. Expanding cities and industrial zones need efficient electricity delivery, driving large-scale deployment of porcelain insulators. Industries rely on stable power supply, requiring insulators for switchgears, transformers, and bus bars. Governments and private players allocate significant budgets toward infrastructure development, supporting market growth. Porcelain insulators remain attractive due to their long service life and low maintenance costs. Their widespread use across utilities and industrial networks strengthens their role in meeting rising energy demand.

Key Trends & Opportunities

Shift Toward Grid Modernization

The porcelain insulators market benefits from ongoing grid modernization projects. Utilities replace outdated systems with advanced infrastructure to ensure efficiency and reliability. Modern grids require high-performance insulators capable of supporting smart technologies and high-capacity lines. This trend creates opportunities for manufacturers to design innovative porcelain insulators with improved mechanical and electrical performance. Growing focus on sustainable grid operations further strengthens this demand. As modernization accelerates in both developed and emerging economies, the market gains momentum from steady replacement and upgrade cycles.

- For instance, Portmeirion’s Sophie Conran line offers a set of four measuring cups in fine porcelain, consisting of 1 cup, ½ cup, ⅓ cup, and ¼ cup sizes. The largest cup can hold up to 250 ml of liquid, and the set can be reliably used in home kitchens, as each piece is dishwasher, microwave, and freezer safe.

Opportunities in Emerging Economies

Emerging economies present significant growth opportunities due to their expanding electricity networks. Countries in Asia, Africa, and Latin America experience rising energy demand from industrialization and urban expansion. Governments invest heavily in rural electrification and renewable energy integration, creating large-scale deployment needs for porcelain insulators. Local manufacturing initiatives further support growth, reducing reliance on imports and lowering costs. With large-scale infrastructure development and energy access programs, emerging regions are becoming critical growth hubs for insulator suppliers. This shift ensures long-term market expansion opportunities.

- For instance, Royal Copenhagen offers a 27 cm dinner plate in its Blue Fluted Plain collection, made of porcelain and hand-painted with three cobalt waves on the underside, and this exact size is central to their tableware line.

Key Challenges

Competition from Composite Insulators

The growing adoption of composite insulators poses a major challenge for porcelain insulators. Composite variants offer lighter weight, higher hydrophobicity, and easier handling during installation. Their superior performance in polluted and coastal environments attracts utilities seeking reduced maintenance and longer service life. This competitive pressure compels porcelain manufacturers to innovate and improve efficiency. Although porcelain insulators retain strong demand, especially in cost-sensitive markets, the rising popularity of composites threatens long-term dominance. Addressing this challenge requires differentiation and investment in advanced porcelain technologies.

High Maintenance and Replacement Costs

Porcelain insulators face challenges due to their maintenance and replacement needs. While durable, they are prone to mechanical damage and require regular inspection, particularly in high-voltage applications. Breakage during handling and installation increases costs for utilities and industrial users. Additionally, replacement cycles can disrupt power transmission, impacting reliability. In comparison, advanced polymer-based alternatives reduce such risks. These factors increase the total cost of ownership, limiting porcelain’s appeal in certain projects. Overcoming this challenge demands stronger material innovation and improved lifecycle management strategies.

Regional Analysis

North America

North America accounts for 27% of the porcelain insulators market, driven by extensive transmission and distribution infrastructure. The region emphasizes grid modernization and renewable integration, particularly wind and solar energy, creating consistent demand for high-voltage insulators. Utilities across the United States and Canada invest in replacing aging infrastructure with durable components that ensure safety and reliability. Environmental factors, including extreme weather conditions, strengthen the adoption of porcelain due to its resilience. Strong regulatory frameworks and investment in energy security further support market expansion, positioning North America as a mature yet steadily growing segment.

Europe

Europe holds 24% of the market share, supported by advanced power networks and strong renewable energy initiatives. Countries like Germany, France, and the UK lead in offshore wind and solar projects, requiring robust insulation for long-distance transmission. The European Union’s decarbonization goals drive replacement of outdated systems with efficient porcelain insulators. Adoption in utilities remains strong due to high grid reliability standards. Additionally, technological innovation and a strong focus on sustainability support regional growth. Europe’s stringent safety regulations and rising investment in cross-border energy exchange reinforce demand across high-voltage and medium-voltage applications.

Asia-Pacific

Asia-Pacific dominates the porcelain insulators market with a 36% share, fueled by rapid industrialization, urbanization, and massive energy demand. China and India lead in grid expansion projects, including rural electrification and renewable integration. High-voltage porcelain insulators are widely adopted to manage long-distance transmission, particularly for renewable-rich regions. Government-backed infrastructure programs and significant foreign investments strengthen market growth. Southeast Asian nations also contribute, focusing on transmission upgrades and industrial growth. The region’s emphasis on cost-effective solutions, combined with large-scale electricity demand, ensures its position as the fastest-growing and most influential market globally.

Latin America

Latin America captures 7% of the porcelain insulators market, with Brazil and Mexico driving most of the demand. Expanding electricity access and renewable projects, particularly hydropower and solar, create opportunities for adoption. Utilities invest in strengthening transmission infrastructure to reduce energy losses and improve reliability. Porcelain insulators remain preferred due to their cost efficiency and ability to handle high-voltage networks. Economic development and urban expansion further fuel demand across industrial applications. While growth is moderate compared to Asia-Pacific, increasing foreign investments and government-backed electrification programs support steady market expansion in the region.

Middle East & Africa

The Middle East & Africa region holds a 6% market share, supported by rising electricity demand and infrastructure development. GCC countries drive growth with investments in transmission networks to support industrialization and urban projects. Africa contributes through large-scale electrification programs and renewable energy expansion, particularly in solar and hydropower. Porcelain insulators are favored for their durability in harsh climates, including desert conditions. Regional governments emphasize energy security and grid reliability, strengthening adoption. Although smaller in share, the region shows high growth potential, driven by ongoing infrastructure investments and increasing focus on reliable power delivery.

Market Segmentations:

By Voltage:

By Application:

By End User:

- Commercial & industrial

- Utilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The porcelain insulators market features strong competition among leading players such as NEPTUNE-INDIA, POINSA, LAPP Insulators, Newell Porcelain, Hubbell, Meister International, LLC, Aditya Birla Insulators, MAPEI S.p.A., NS Transmission Pvt. Ltd., and Metsch Refractories Inc. The porcelain insulators market is highly competitive, with manufacturers focusing on innovation, quality, and cost efficiency to strengthen their market position. Companies are investing in advanced ceramic technologies to enhance mechanical strength, durability, and resistance to harsh environmental conditions. The market is shaped by increasing demand from utilities and industrial sectors, driving the need for high-voltage insulators that ensure reliable power transmission. Strategic priorities include expanding global distribution networks, securing long-term contracts with utilities, and developing sustainable manufacturing practices. Competition also revolves around offering products with lower maintenance costs and longer service life to meet evolving industry needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, British artist Luke Edward Hall launched his second collection with Italian luxury porcelain brand Ginori 1735, titled “Il Viaggio di Nettuno. A New Chapter.” This series draws inspiration from Greco-Roman pottery and the Bloomsbury Group, featuring hand-drawn elements on porcelain tableware items like plates and mugs.

- In April 2025, British designer Faye Toogood introduced a porcelain collection named “Rose” in collaboration with Japanese ceramics brand Noritake during Milan Design Week. The collection includes 14 hand-painted pieces and 111 limited-edition platters, blending traditional Japanese porcelain painting with contemporary artistic spontaneity.

- In May 2024, LAPP Insulators showcased their products at the IEEE PES T&D exhibition in Anaheim. The event drew over 10,000 industry professionals worldwide. The company highlighted their porcelain insulators, emphasizing their durability and eco-friendly qualities. These products support the circular economy and meet power industry needs.

- In February 2023, Mar-Bal, Inc. has launched new Slim Line insulators for low and medium voltage uses. These insulators are smaller but keep the same electrical properties, making them good for tight spaces. They can often replace porcelain and epoxy types in medium and high voltage settings.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising investments in transmission and distribution infrastructure.

- High-voltage porcelain insulators will remain the dominant choice for long-distance electricity transmission.

- Renewable energy integration will continue to drive demand for durable and efficient insulators.

- Grid modernization projects will create steady replacement opportunities for porcelain insulators.

- Emerging economies will contribute significantly through rural electrification and industrial growth.

- Technological advancements in ceramics will enhance product durability and performance.

- Utilities will prioritize insulators that reduce maintenance costs and extend service life.

- Competition from composite insulators will intensify, pushing porcelain producers to innovate.

- Strategic partnerships and regional manufacturing will improve supply chain efficiency.

- Sustainability initiatives will influence production practices and shape long-term market strategies.

Market Insights

Market Insights