Market Overview

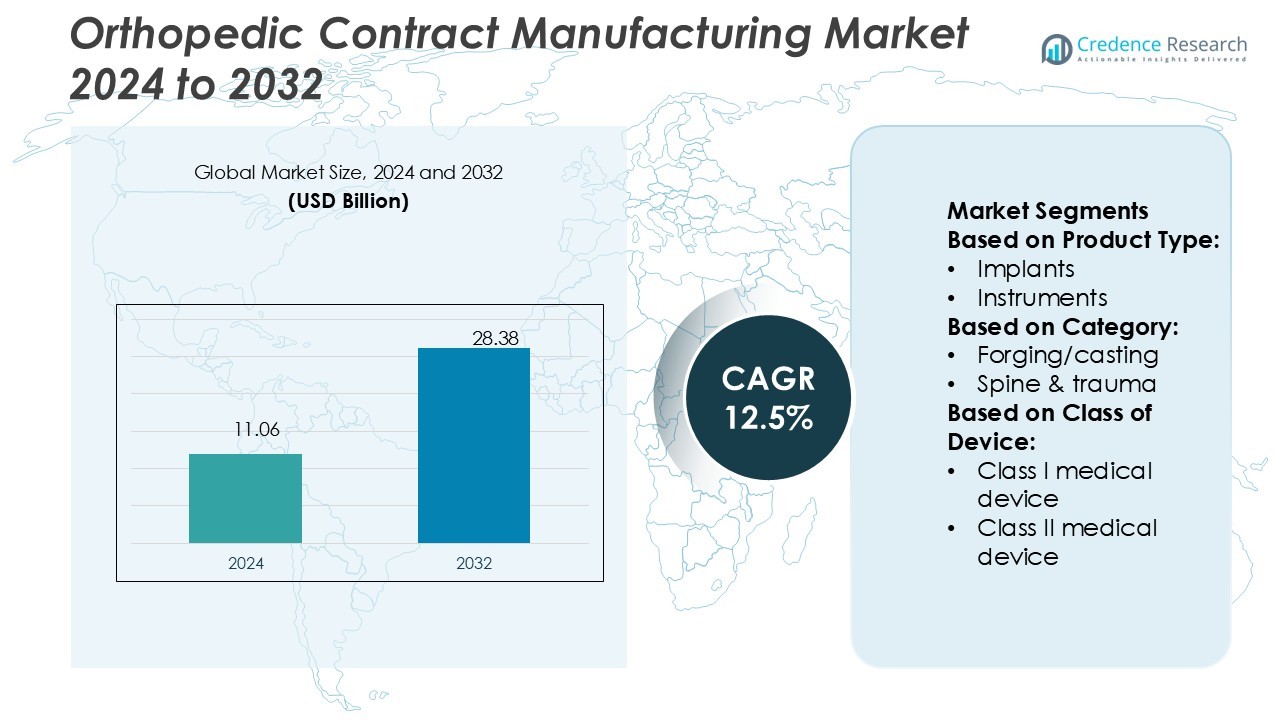

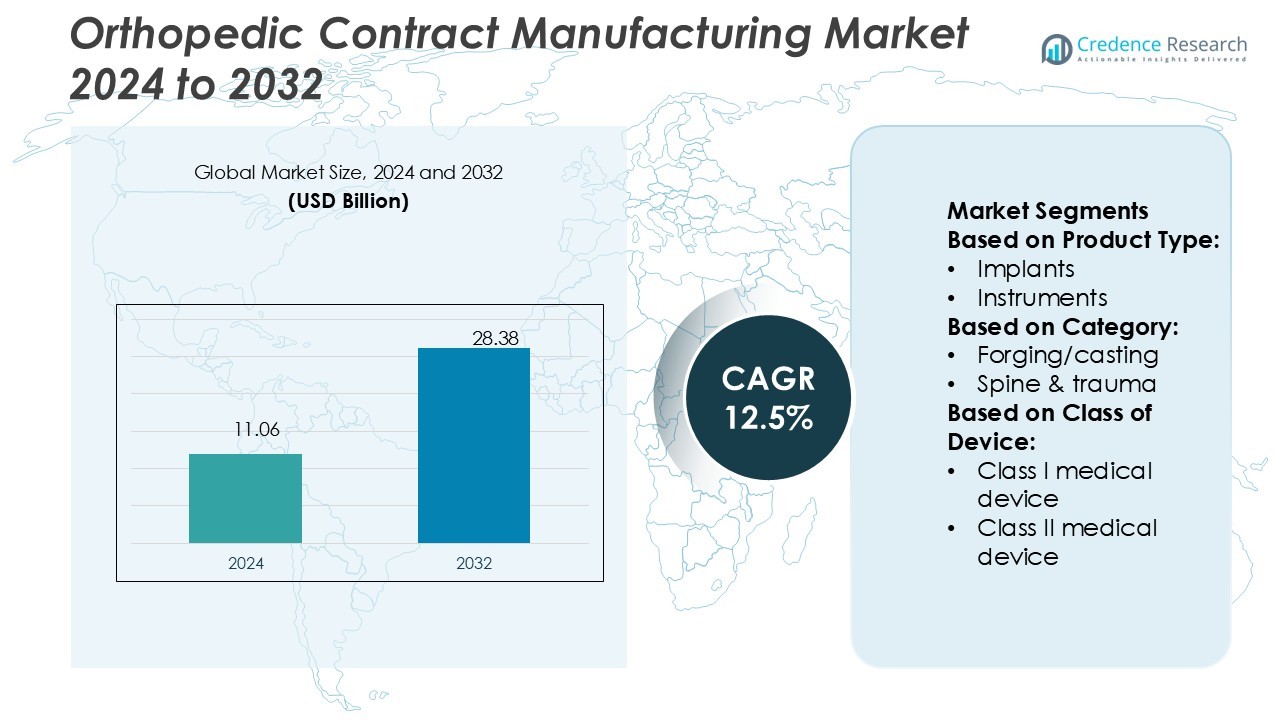

Orthopedic Contract Manufacturing Market size was valued USD 11.06 billion in 2024 and is anticipated to reach USD 28.38 billion by 2032, at a CAGR of 12.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Contract Manufacturing Market Size 2024 |

USD 11.06 Billion |

| Orthopedic Contract Manufacturing Market, CAGR |

12.5% |

| Orthopedic Contract Manufacturing Market Size 2032 |

USD 28.38 Billion |

The orthopedic contract manufacturing market is driven by top players such as Orchid MPS Holdings, LLC, Norman Noble, Inc., Autocam Medical, Paragon Medical, ARCH Medical Solutions Corp., LISI Medical, Tecomet, Inc., CRETEX Medical, Viant, and Avalign Technologies, which collectively provide advanced solutions in implants, instruments, and surgical cases. These companies leverage precision machining, forging, additive manufacturing, and regulatory expertise to meet the rising demand for high-quality orthopedic devices. North America leads the global market with a 39% share in 2024, supported by advanced healthcare infrastructure, strong OEM partnerships, and high adoption of innovative orthopedic procedures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Orthopedic Contract Manufacturing Market size was valued at USD 11.06 billion in 2024 and is projected to reach USD 28.38 billion by 2032, growing at a CAGR of 12.5% during the forecast period.

- Key growth is driven by rising demand for implants, which hold a 52% share, supported by increasing joint replacement surgeries and technological advancements in machining and finishing processes.

- The market is witnessing trends such as adoption of additive manufacturing, patient-specific implants, and automation, which enhance customization, efficiency, and regulatory compliance across global supply chains.

- Leading players including Orchid MPS Holdings, LLC, Norman Noble, Inc., Tecomet, Inc., and others compete by expanding production capabilities, forming OEM partnerships, and investing in innovation, though high manufacturing costs and strict regulatory frameworks act as restraints.

- North America leads the market with a 39% share in 2024, followed by Europe with 27% and Asia-Pacific with 23%, reflecting strong healthcare infrastructure and growing regional demand.

Market Segmentation Analysis:

By Product Type

Implants dominate the orthopedic contract manufacturing market, holding a 52% share in 2024. The growth of implants is driven by rising cases of osteoarthritis, hip fractures, and trauma-related injuries, which increase demand for knee, hip, and spinal implants. Contract manufacturers focus on precision engineering, biocompatible materials, and advanced machining technologies to meet strict regulatory requirements. Instruments and cases/trays remain essential for surgical support, but implants lead due to their critical role in long-term patient mobility and increasing adoption of customized and 3D-printed implant solutions.

- For instance, Norman Noble, Inc. invested in ultrafast femtosecond laser machining systems that achieve cut widths as small as 5 microns, enabling the production of highly complex geometries for orthopedic implants and instruments while maintaining burr-free edges and superior surface integrity.

By Category

Knee machining and finishing hold the dominant position, accounting for 35% of the market share in 2024. Rising prevalence of knee osteoarthritis and sports-related injuries is fueling demand for high-quality knee implants. Contract manufacturers invest in advanced CNC machining, additive manufacturing, and surface finishing technologies to improve implant durability and compatibility. Spine and trauma categories follow closely, supported by aging demographics and accident-related cases. Forging/casting continues to play a strong role in mass production, but knee machining’s focus on precision, patient-specific designs, and minimally invasive compatibility strengthens its lead.

- For instance, Paragon Medical operates a 34,000 square-foot additive manufacturing facility dedicated to 3D printing porous titanium implant architectures, and its subtractive capabilities include machining tolerances down to 20 millionths of an inch with surface finishes reaching 1 microinch (40 millionths of an inch) in polishing.

By Class of Device

Class III medical devices lead the market, holding 61% of the share in 2024. This dominance stems from their critical role in life-sustaining orthopedic applications, including implants for hip, knee, and spinal reconstruction. Stringent regulatory standards drive manufacturers to adopt advanced manufacturing practices and extensive quality validation to ensure safety and reliability. The growing demand for custom implants, bioresorbable materials, and next-generation prosthetics further enhances this segment’s importance. While Class I and II devices remain significant in surgical tools and accessories, Class III devices dominate due to their high value and clinical necessity.

Key Growth Drivers

Rising Demand for Orthopedic Implants

The global rise in musculoskeletal disorders and joint replacement surgeries drives demand for orthopedic implants. Aging populations, particularly in developed regions, increase the need for knee, hip, and spinal implants. Contract manufacturers benefit from outsourcing trends as OEMs seek specialized partners with advanced machining and regulatory expertise. The integration of additive manufacturing and custom implant design also supports growth. These dynamics position implants as the fastest-growing segment, creating consistent opportunities for contract manufacturing companies to scale production and deliver high-value medical solutions.

- For instance, ARCH Medical Solutions operates over 700,000 square feet of manufacturing capacity across numerous ISO 13485-certified and FDA-registered U.S. facilities, leveraging a large network to enable scalable and large-volume production of implants and instruments.

Technological Advancements in Manufacturing

The orthopedic contract manufacturing market is advancing through innovations in precision engineering and digital technologies. Additive manufacturing, CNC machining, and robotics enable manufacturers to produce complex and patient-specific components with higher accuracy. Surface modification techniques improve implant longevity and biocompatibility, while automation reduces production costs and errors. Contract manufacturers adopting smart factories and quality assurance systems gain competitive advantages. These advancements not only enhance efficiency but also allow manufacturers to meet stringent global regulatory standards, fostering trust with OEMs and accelerating long-term market expansion.

- For instance, Tecomet’s casting line can produce net-shape CoCr implant blanks with geometries within ±0.2 mm across 50 mm span, before final machining and polishing.

Increasing Outsourcing by OEMs

Original equipment manufacturers (OEMs) increasingly outsource orthopedic device production to focus on innovation and market expansion. Outsourcing helps reduce capital investment in manufacturing infrastructure while leveraging the expertise of specialized partners. Contract manufacturers provide integrated solutions, including design, prototyping, machining, and regulatory compliance support. Rising complexity in Class III devices further strengthens reliance on outsourcing. This shift creates consistent revenue streams for contract manufacturing firms and drives consolidation through strategic partnerships, mergers, and acquisitions, positioning contract manufacturers as vital stakeholders in the global orthopedic device supply chain.

Key Trends & Opportunities

Adoption of 3D Printing and Customization

The adoption of 3D printing in orthopedic manufacturing is reshaping product design and development. Patient-specific implants and instruments improve surgical outcomes and recovery rates, making customization a key differentiator. Additive manufacturing also reduces waste, shortens lead times, and supports prototyping efficiency. Contract manufacturers leveraging 3D printing technologies can offer cost-effective, precise, and innovative solutions that align with patient-centric care models. This trend positions customization as both a growth driver and an opportunity, enabling firms to secure stronger partnerships with OEMs seeking advanced personalized solutions.

- For instance, CRETEX runs Direct Metal Printing (DMP) builds in its 30,000 sq ft additive hub, enabling the delivery of custom titanium implants from powder to finished part through a vertically integrated process.

Growth in Emerging Markets

Emerging markets in Asia-Pacific and Latin America present strong growth opportunities for orthopedic contract manufacturers. Rapid urbanization, rising healthcare expenditure, and expanding access to advanced medical care drive demand for implants and surgical instruments. Governments are also investing in healthcare infrastructure, supporting the availability of orthopedic procedures. Lower-cost manufacturing environments in these regions encourage global OEMs to collaborate with local contract manufacturers. Expanding into emerging economies enables manufacturers to capture new patient bases, diversify their geographic presence, and reduce reliance on mature markets such as North America and Europe.

- For instance, Viant expanded its Costa Rica medical device facility in Heredia in late 2022, adding over 90,000 square feet of cleanroom space and significantly enhancing production capacity for complex medical devices.

Key Challenges

Stringent Regulatory Compliance

Compliance with international regulatory frameworks remains a significant challenge for orthopedic contract manufacturers. Class III devices require extensive clinical validation, quality testing, and adherence to ISO and FDA standards. Meeting these requirements demands continuous investment in quality management systems and documentation. Delays in approvals can hinder product launches, impacting OEM partnerships and revenue streams. Smaller manufacturers may struggle with high compliance costs, while larger firms must constantly adapt to evolving global standards. This regulatory complexity creates barriers to entry and adds pressure on profitability.

High Manufacturing Costs and Pricing Pressure

Orthopedic contract manufacturing involves advanced machining, precision engineering, and costly biocompatible materials, contributing to high production expenses. Additionally, OEMs exert pricing pressure to maintain competitiveness in end markets, squeezing contract manufacturers’ margins. Rising raw material costs and supply chain disruptions further add to financial strain. Manufacturers must balance cost efficiency with quality assurance to remain competitive. Investments in automation and lean processes help mitigate costs, but sustaining profitability while meeting OEM demands remains a key challenge, particularly for mid-sized and smaller players in the market.

Regional Analysis

North America

North America leads the orthopedic contract manufacturing market with a 39% share in 2024. The region benefits from advanced healthcare infrastructure, high orthopedic surgery volumes, and strong adoption of innovative implants and instruments. Contract manufacturers here specialize in precision machining, regulatory compliance, and patient-specific solutions. The growing elderly population and prevalence of osteoarthritis drive demand for knee and hip replacements. Strategic partnerships between OEMs and contract manufacturers strengthen supply chains and support innovation. Favorable FDA frameworks and high healthcare expenditure further consolidate North America’s position as the leading regional hub for orthopedic device manufacturing.

Europe

Europe holds a 27% share of the orthopedic contract manufacturing market in 2024, supported by strong demand in Germany, France, and the UK. The region benefits from advanced surgical procedures, government healthcare funding, and growing use of minimally invasive orthopedic solutions. European contract manufacturers excel in forging, casting, and advanced machining of implants and instruments. Regulatory alignment under MDR standards ensures stringent product quality, reinforcing global competitiveness. Rising demand for spinal and trauma implants also contributes to market growth. The presence of established OEMs and a skilled manufacturing base further enhances Europe’s strategic role in this industry.

Asia-Pacific

Asia-Pacific accounts for 23% of the orthopedic contract manufacturing market in 2024 and is the fastest-growing region. Countries like China, India, and Japan drive growth through expanding healthcare access, large patient populations, and rising adoption of orthopedic procedures. Local manufacturers gain traction with cost-effective solutions, attracting global OEMs to outsource production. Governments’ focus on healthcare infrastructure and favorable regulatory changes encourage regional expansion. Rising medical tourism in India and Thailand further boosts demand for orthopedic implants and instruments. Asia-Pacific’s strong cost advantage and evolving technological capabilities position it as a key growth hub for contract manufacturing.

Latin America

Latin America represents 6% of the orthopedic contract manufacturing market in 2024, with Brazil and Mexico leading regional demand. Growth is fueled by expanding healthcare systems, increasing joint replacement surgeries, and rising medical tourism. Contract manufacturers collaborate with global OEMs to supply implants and instruments at competitive costs. However, limited access to advanced manufacturing technologies and slower regulatory approvals remain challenges. Regional demand for trauma and knee implants is rising due to accident-related injuries and an aging population. Partnerships and investments in local manufacturing facilities are expected to enhance Latin America’s share in the coming years.

Middle East & Africa

The Middle East & Africa account for 5% of the orthopedic contract manufacturing market in 2024. Growth is supported by increasing investments in healthcare infrastructure and rising prevalence of bone-related disorders. Gulf countries, particularly the UAE and Saudi Arabia, are expanding orthopedic care facilities, creating demand for advanced implants and instruments. Africa’s growth remains gradual due to affordability challenges, but South Africa leads in regional demand. International OEMs are entering joint ventures with local manufacturers to strengthen regional supply chains. The shift toward advanced surgical procedures and government healthcare initiatives support long-term market opportunities in this region.

Market Segmentations:

By Product Type:

By Category:

- Forging/casting

- Spine & trauma

By Class of Device:

- Class I medical device

- Class II medical device

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The orthopedic contract manufacturing market players such as Orchid MPS Holdings, LLC, Norman Noble, Inc., Autocam Medical, Paragon Medical, ARCH Medical Solutions Corp., LISI Medical, Tecomet, Inc., CRETEX Medical, Viant, and Avalign Technologies. The orthopedic contract manufacturing market is highly competitive, shaped by technological innovation, regulatory compliance, and growing demand for advanced implants and instruments. Companies in this space focus on precision machining, forging, and finishing to deliver high-quality products that meet stringent global standards. The rise of additive manufacturing and patient-specific implant solutions is reshaping competitive dynamics, enabling manufacturers to differentiate through customization and faster turnaround times. Strategic partnerships with OEMs, along with global expansion into cost-effective manufacturing regions, further intensify competition. Continuous investments in automation, quality assurance, and integrated supply chains ensure market leaders maintain a strong position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Straits Orthopaedics, mentioned the acquisition completion of Medin Technologies. Based in the U.S., Medin produces sterilization cases and trays for the orthopedic sector and runs operations in Totowa, New Jersey, and Manchester, New Hampshire.

- In April 2025, MicroPort Orthopedics, announced the introduction of its flagship second-generation solution, the Evolution Medial-Pivot Knee, in India. The solution is designed to deliver superior flexion stability, anatomic motion, and a wear-limiting design, aiming to replicate the natural stability and motion of the knee to allow superior patient outcomes after total knee replacement surgery.

- In March 2025, Jabil mentioned the plans to establish a new manufacturing facility in Gujarat, marking its second site in India. This expansion follows MoU, which was signed in November 2024 aimed at exploring long-term objectives, potential opportunities, and regional support within Gujarat.

- In March 2025, Johnson & Johnson MedTech showcased its latest digital orthopaedics advancements at the AAOS 2025 Annual Meeting in San Diego from March 10-14. Building on last year’s innovations, the company is introducing advanced implants, techniques, and data-driven technologies across various orthopaedic specialties, including joint reconstruction, trauma, extremities, and spine, all aimed at meeting the needs of surgeons and patients.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Category, Class of Device and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for orthopedic implants and instruments.

- Outsourcing by OEMs will continue to strengthen contract manufacturers’ role in supply chains.

- Additive manufacturing will accelerate the production of customized and patient-specific implants.

- Automation and robotics will improve efficiency and reduce operational costs.

- Emerging markets will create new opportunities through expanding healthcare infrastructure.

- Regulatory compliance will remain a critical factor shaping global competitiveness.

- Strategic partnerships and acquisitions will drive consolidation across the industry.

- Demand for minimally invasive and bioresorbable devices will increase.

- Investments in advanced surface modification technologies will enhance implant durability.

- Supply chain resilience and cost optimization will remain priorities for manufacturers.