Market Overview:

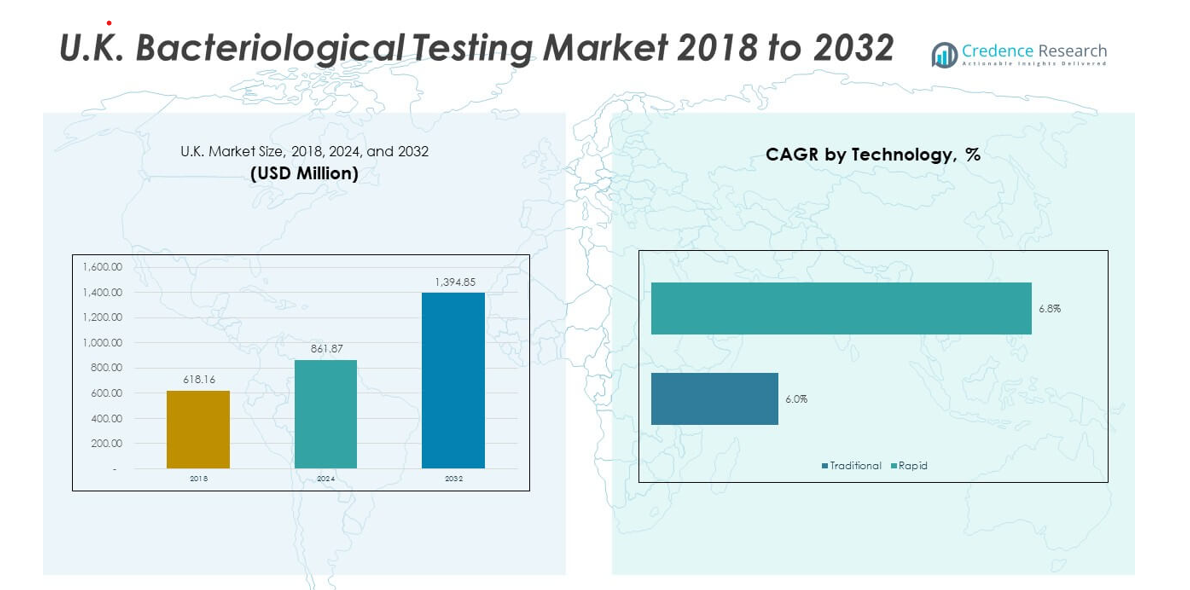

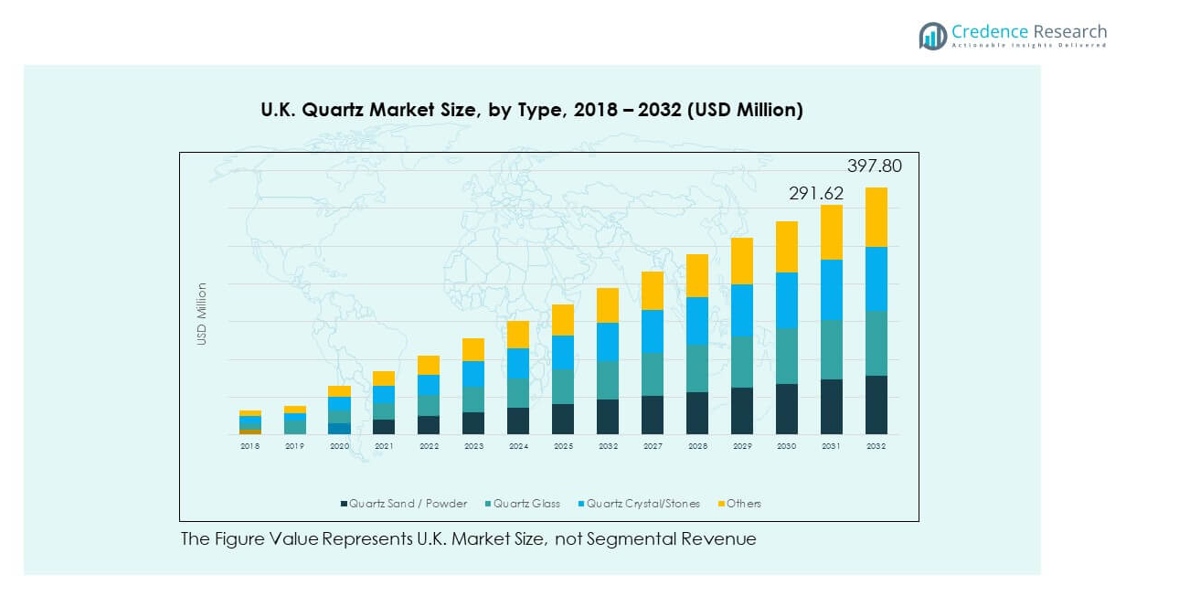

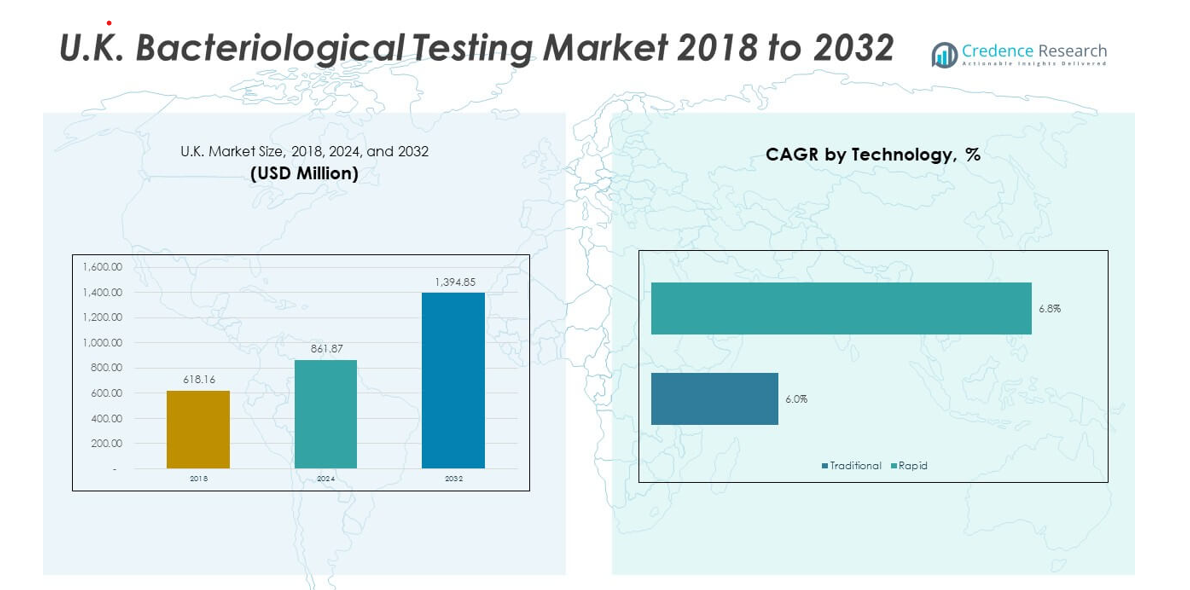

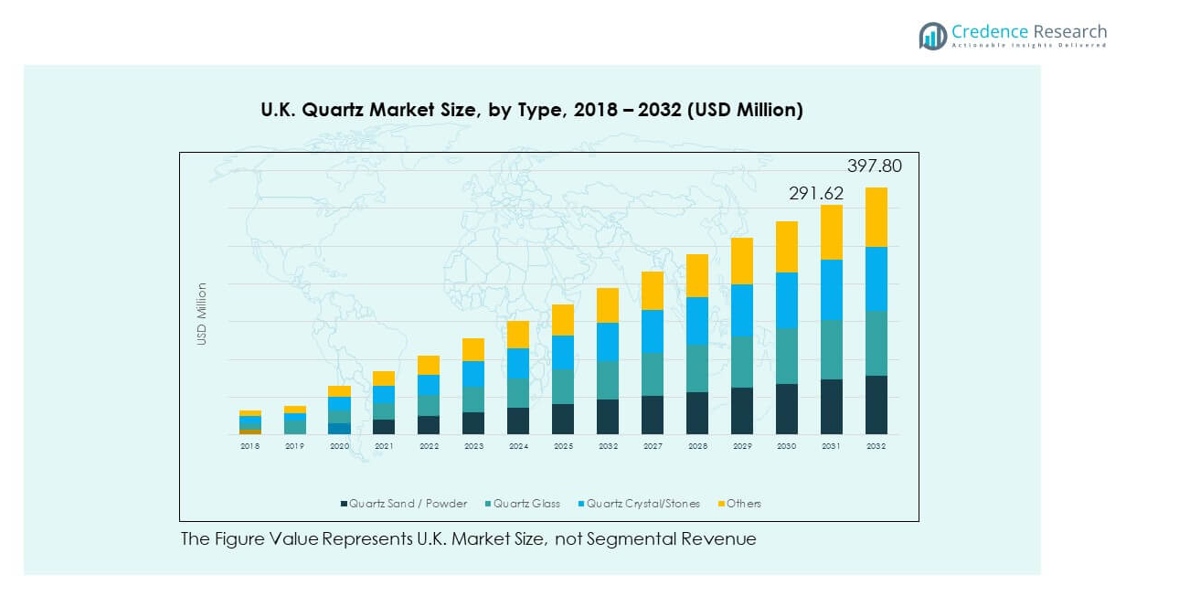

The U.K. Quartz Market size was valued at USD 224.75 million in 2018 to USD 280.20 million in 2024 and is anticipated to reach USD 397.80 million by 2032, at a CAGR of 4.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Quartz Market Size 2024 |

USD 280.20 million |

| U.K. Quartz Market, CAGR |

4.45% |

| U.K. Quartz Market Size 2032 |

USD 397.80 million |

Growth in the U.K. Quartz Market is fueled by demand from construction, electronics, and solar industries. Rising adoption of engineered quartz in interior applications, especially in kitchen and bathroom surfaces, adds momentum. Expanding semiconductor production enhances quartz demand due to its purity and stability. Growth in solar energy projects further increases usage in photovoltaic components. Innovation in quartz-based materials and enhanced distribution networks are supporting wider market penetration. Industrial applications in optics and telecommunication expand steadily. Strong investments in infrastructure projects provide a consistent demand outlook.

In the U.K. Quartz Market, Europe remains the leading region, driven by advanced manufacturing bases and mature construction markets. North America also commands a significant share, supported by technological adoption and consumer preferences for quartz in residential remodeling. Asia-Pacific emerges as the fastest-growing region due to rising industrialization and infrastructure expansion. Latin America shows growing interest, led by increasing construction activity. The Middle East is expanding quartz demand through investments in renewable energy. Africa represents an emerging market with gradual adoption in construction and healthcare industries. The U.K. benefits from being integrated into these global trends through both trade and domestic projects.

Market Insights:

- The U.K. Quartz Market was valued at USD 224.75 million in 2018, reached USD 280.20 million in 2024, and is expected to hit USD 397.80 million by 2032, growing at a CAGR of 4.45%.

- England held the largest share at 58% in 2024, supported by strong construction and housing demand, followed by Scotland at 18% and Wales & Northern Ireland together at 24%.

- England leads due to urbanization and commercial remodeling, while Scotland benefits from infrastructure upgrades and renewable projects, and Wales & Northern Ireland show stable growth through construction and healthcare demand.

- Among types, quartz sand/powder and quartz glass together contributed more than 60% share in 2024, driven by applications in semiconductors, solar, and healthcare.

- Quartz crystal/stone accounted for around 25% share in 2024, with growing adoption in electronics and telecom, while other specialized forms supported niche but steady growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expanding Use of Quartz in Residential and Commercial Construction

The U.K. Quartz Market benefits from rapid adoption of quartz in construction and interior design. Homeowners and builders favor quartz surfaces for durability, low maintenance, and aesthetic value. Rising urbanization increases demand for modern housing units, driving quartz countertop and flooring installations. Commercial spaces such as offices, hotels, and retail stores invest in quartz for premium finishes. Architects and designers recommend quartz for long-lasting, stain-resistant performance. Growing preference for sustainable and engineered stone supports this demand. Quartz’s ability to mimic natural stone with added strength attracts consumers. It continues to hold strong relevance in both new construction and renovation projects.

- For instance, Cambria launched four new quartz designs in early 2025—including Remington Brass and Remington Steel—with patent-pending alloy veining and was the first to commercialize ultra-thin 1 cm quartz slabs featuring a Cambria Satin finish for expanded surface applications.

Growing Role of Quartz in Electronics and Semiconductor Applications

Quartz plays a vital role in electronic and semiconductor industries, driving demand in the U.K. Quartz Market. Its high purity and thermal stability make it essential in wafers, oscillators, and other components. Rising demand for smartphones, laptops, and advanced consumer electronics pushes growth. The U.K. benefits from being part of the global semiconductor supply chain. Quartz glass and crystals support telecom infrastructure and precision instruments. Growing adoption of smart technologies further increases demand. R&D investments in microelectronics and communication devices enhance quartz applications. It continues to support critical innovations in high-tech industries across the region.

Increasing Contribution from Renewable Energy and Solar Applications

Solar energy expansion fuels consistent growth in the U.K. Quartz Market. Quartz is widely used in photovoltaic cells, panels, and supporting components. Growing government incentives for renewable adoption accelerates this demand. Solar farms across the U.K. and Europe boost installations. Quartz purity ensures efficiency and longevity of solar modules. Rising awareness of environmental sustainability strengthens investment in clean energy. Strong demand for silicon-based applications connects directly to quartz supply. It positions quartz as an indispensable material for the energy transition. The market gains long-term benefits from expanding renewable infrastructure.

Innovation in Quartz Materials and Product Development

Ongoing product innovations expand the application scope of the U.K. Quartz Market. Engineered quartz surfaces come with new textures, finishes, and color ranges. Manufacturers develop quartz with improved durability and scratch resistance. High-performance quartz glass meets demands from optics and telecommunication. Digital fabrication techniques enable customized quartz solutions. Industrial customers benefit from quartz innovations in medical instruments and laboratory equipment. Enhanced supply chains ensure better distribution and availability. Partnerships with design firms and manufacturers expand end-user adoption. It supports sustained growth and competitiveness within the quartz industry.

Market Trends

Rising Demand for Engineered Quartz Surfaces in Interior Applications

The U.K. Quartz Market shows a clear trend toward engineered quartz adoption in kitchens and bathrooms. Consumers prefer quartz countertops over granite due to superior performance and maintenance ease. Design preferences shift toward customized colors and finishes. Builders adopt quartz surfaces in premium housing projects. Renovation activities in urban households further support this demand. Hotels and restaurants invest in quartz installations to ensure long-term aesthetics. The trend aligns with increasing disposable incomes and design-conscious consumers. It reinforces quartz as a luxury yet practical choice in interiors.

- For instance, at the 2025 Kitchen & Bath Industry Show, Cambria introduced several new quartz designs, including Remington Brass and Remington Steel. Cambria promoted the performance of its quartz surfaces, including their resistance to scratches, and showcased the capability for high-quality custom fabrication.

Growing Focus on Sustainable and Eco-Friendly Quartz Products

Sustainability emerges as a major trend shaping the U.K. Quartz Market. Manufacturers develop quartz surfaces using recycled materials and eco-friendly processes. Green building certifications drive adoption in residential and commercial projects. Consumers increasingly prioritize sustainable materials in remodeling projects. Low-carbon manufacturing practices gain traction among leading quartz suppliers. Companies promote quartz products with high recyclability. Governments encourage eco-friendly construction through regulations and incentives. The trend supports alignment with long-term environmental goals. It ensures quartz remains competitive against alternative materials.

- For instance, Elkem ASA’s 2025 recycled silicone product line achieved a 70% reduction in carbon footprint compared to standard-grade silicones, as validated through over 150 technical pilot tests during its commercial rollout in the U.K. and EU markets.

Technological Integration in Quartz Manufacturing and Design

Advancements in digital fabrication influence the U.K. Quartz Market. CNC machining and 3D printing improve precision in quartz product design. AI-driven modeling supports customized quartz patterns for architects. Automation in quartz cutting and finishing reduces production time. Manufacturers deploy IoT-enabled systems for efficient plant operations. Digital marketing platforms expand consumer awareness of quartz options. Virtual reality tools help customers visualize quartz applications. The trend integrates design, production, and customer engagement seamlessly. It ensures sustained innovation and customer satisfaction.

Expanding Role of Quartz in Healthcare and Optical Industries

Healthcare and optics create fresh opportunities in the U.K. Quartz Market. Quartz’s durability and purity support medical instruments and lab equipment. Optical fibers and telecom devices rely heavily on quartz glass. Growth in telecommunication services adds demand for high-quality quartz components. Medical research institutions adopt quartz for precision instruments. Emerging uses in diagnostic devices enhance adoption. Increased investment in healthcare infrastructure boosts quartz demand. The trend diversifies quartz applications beyond construction and electronics. It strengthens quartz’s position in advanced industries.

Market Challenges Analysis

Volatility in Raw Material Supply and Pricing Pressures

The U.K. Quartz Market faces challenges from fluctuations in raw material availability. Limited quartz deposits and high extraction costs create supply pressures. Import dependence increases exposure to global trade disruptions. Price volatility affects profit margins for manufacturers and distributors. Rising energy costs intensify operational expenses. Small and mid-sized players struggle to maintain consistent supply. Competition from alternative materials also limits pricing flexibility. It requires efficient sourcing strategies and supplier partnerships. Ensuring stability in raw material supply remains a priority for long-term growth.

Regulatory Compliance and Market Competition Constraints

Strict regulations present another challenge for the U.K. Quartz Market. Compliance with environmental standards raises production costs. Certification requirements slow product launches in construction and healthcare segments. Intense competition among domestic and international players reduces pricing power. Brand differentiation becomes difficult in a crowded market. Distribution challenges limit access to emerging customer bases. Global players with strong supply chains create entry barriers for smaller firms. Economic uncertainties such as inflation further impact consumer spending. It increases the complexity of maintaining steady growth in the market.

Market Opportunities:

Expanding Adoption Across Emerging Industrial Applications

The U.K. Quartz Market holds opportunities in sectors like optics, healthcare, and advanced telecom. Quartz purity ensures reliable performance in precision equipment. Telecom growth accelerates quartz use in fiber optics. Healthcare infrastructure investments create demand for quartz in lab and diagnostic devices. New applications in aerospace and defense are under exploration. Quartz adoption in next-generation electronics expands steadily. It opens untapped markets and strengthens growth potential.

Increasing Investments in Renewable Energy Projects

The U.K. Quartz Market benefits from opportunities in renewable energy. Expanding solar power projects require quartz components for photovoltaic systems. Government incentives accelerate the deployment of solar technologies. Investments in wind and hybrid energy projects indirectly support quartz demand. Growth in silicon-based technologies enhances quartz’s importance. Companies focusing on green energy markets gain long-term returns. It positions quartz as a material aligned with sustainable energy transitions.

Market Segmentation Analysis:

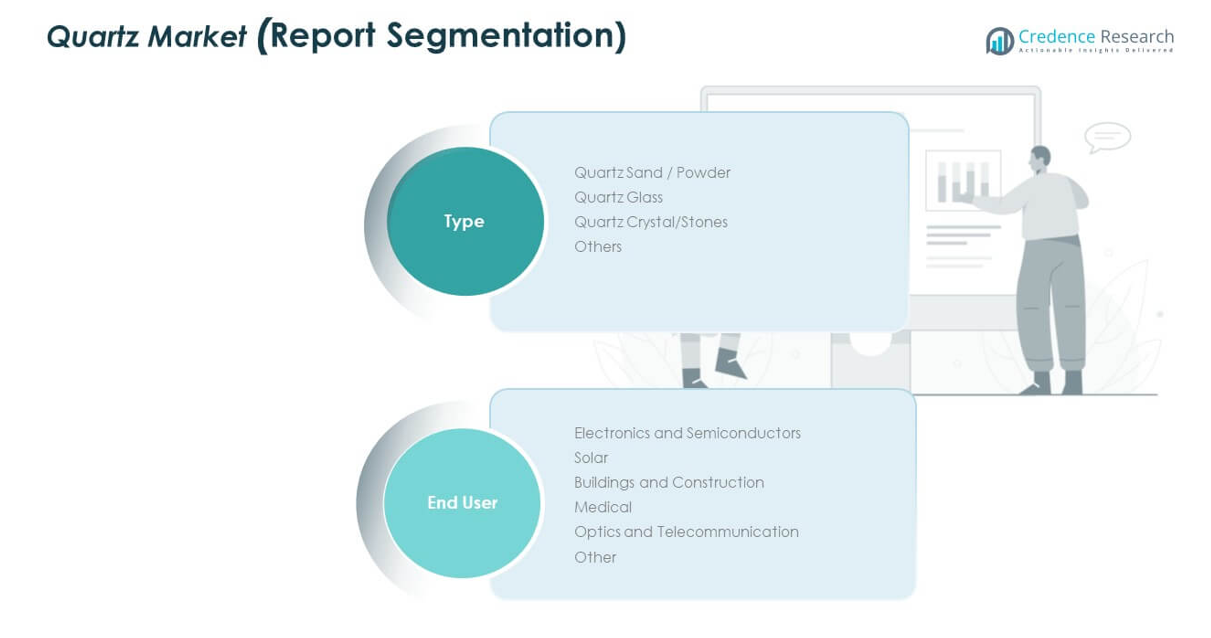

By Type

The U.K. Quartz Market shows strong demand across sand, glass, and crystal categories. Quartz sand dominates applications in construction, semiconductors, and solar. Quartz glass serves healthcare, optics, and telecommunication needs with high reliability. Quartz crystals are favored in electronics and precision instruments. Other forms of quartz target niche industries but provide steady growth opportunities.

By End User

Electronics and semiconductors account for significant share, driven by U.K.’s integration with global supply chains. Solar projects provide strong growth momentum. Construction applications maintain steady demand across residential and commercial projects. Healthcare and optics expand quartz adoption into advanced industries. Telecommunications also remain a growing end-use sector. It reflects quartz’s broad versatility and diverse industrial appeal in the U.K.

- For instance, Heraeus Covantics, a division of Heraeus Holding, supplied high-purity fused quartz components to numerous global semiconductor and photonics facilities, contributing to advancements in smart device, telecom, and optics development in the first half of 2025.

Segmentation:

By Type

- Quartz Sand / Powder

- Quartz Glass

- Quartz Crystal/Stone

- Others

By End User

- Electronics and Semiconductor

- Solar

- Buildings and Construction

- Medical

- Optics and Telecommunication

- Others

Regional Analysis:

England

England dominated the U.K. Quartz Market with nearly 58% share in 2024, supported by its large construction and housing sector. Demand for quartz countertops, flooring, and wall claddings remains strong in urban centers such as London, Manchester, and Birmingham. Commercial spaces, including offices, hotels, and retail outlets, increasingly adopt engineered quartz for premium finishes. The electronics and semiconductor industry also contributes, with quartz applications in high-tech manufacturing hubs. Renewable energy projects drive additional demand for quartz glass and solar applications. England benefits from well-established distribution networks and a design-driven consumer base. It remains the central growth engine of the U.K. market.

Scotland

Scotland accounted for around 18% share of the U.K. Quartz Market in 2024, with growth supported by infrastructure development and renewable energy projects. Quartz demand is rising in residential and commercial construction, particularly in urban centers like Edinburgh and Glasgow. The country’s investment in solar and wind energy strengthens adoption of quartz-based components. Local manufacturers also support small-scale supply to the construction industry. Healthcare institutions increase quartz use in laboratory and diagnostic applications. Consumer preference for sustainable and durable materials further drives interest. It continues to establish itself as a promising contributor within the national market.

Wales and Northern Ireland

Wales and Northern Ireland together held nearly 24% share of the U.K. Quartz Market in 2024. Wales shows strong demand from housing projects and public infrastructure upgrades. Quartz is also used in energy projects, with increasing adoption in solar applications. Northern Ireland contributes through construction growth and rising demand for quartz in healthcare and optical instruments. Both regions benefit from expanding distribution networks that connect them with suppliers in England and Europe. Consumer awareness of engineered quartz products is improving, enhancing long-term demand. It reflects the gradual but steady integration of these regions into the broader U.K. quartz industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cambria

- MSI Q Quartz

- London Quart Stone

- Elkem ASA

- Prestige Marble & Granite

- Heraeus Holding

- HanStone Quartz

- Santa Margherita Quartz

- Athena Surfaces

- Nilestone

Competitive Analysis:

The U.K. Quartz Market is highly competitive, shaped by global and domestic players. Companies differentiate through product quality, design variety, and supply chain strength. Cambria and MSI Q Quartz lead in engineered quartz surfaces, while Heraeus focuses on quartz glass and advanced applications. Elkem ASA integrates quartz within diversified industrial operations. Santa Margherita and Nilestone strengthen their presence in premium interior solutions. Distribution partnerships enhance accessibility for end users. Innovation in eco-friendly quartz adds competitive advantage. It positions the market for both steady growth and heightened rivalry.

Recent Developments:

- In September 2025, Santa Margherita announced its participation at Cersaie 2025 in Bologna, showcasing the new Inciso Collection alongside its SM Marble line. The Inciso Collection is defined by artistic surface textures and innovative design, reinforcing Santa Margherita’s commitment to international best practices and sustainable building through its partnership with the Society of British and International Design in London.

- In August 2025, Cambria unveiled four striking new quartz designs—Traymore Bay™, St. Isley™, Claremont™, and Kenwood™—to the U.K. market, emphasizing organic textures and emotional depth tailored for both residential and commercial spaces. This launch reflects Cambria’s ongoing commitment to innovation and trendsetting finishes, including exclusive Cambria Satin and Matte, and aims to redefine interior aesthetics through craftsmanship and performance.

- In July 2025, Athena Gold Corporation reported a 24% expansion of its Laird Lake project in Ontario by acquiring 995 additional hectares, reflecting the company’s active push for growth through mineral acquisitions and exploration. This strategic move supports Athena’s robust exploration programs and strengthens its asset base for current and future mineral development initiatives.

Report Coverage:

The research report offers an in-depth analysis based on type and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will increase from residential and commercial construction projects.

- Electronics and semiconductor industries will continue driving quartz adoption.

- Solar energy expansion will create sustained demand.

- Healthcare applications will grow through diagnostic and laboratory uses.

- Optics and telecom sectors will expand quartz integration.

- Engineered quartz surfaces will gain higher consumer preference.

- Sustainability initiatives will influence manufacturing processes.

- Asia-Pacific trade links will shape supply availability.

- Product innovations will enhance customization and performance.

- Competitive pressures will encourage consolidation and partnerships.