Market Overview

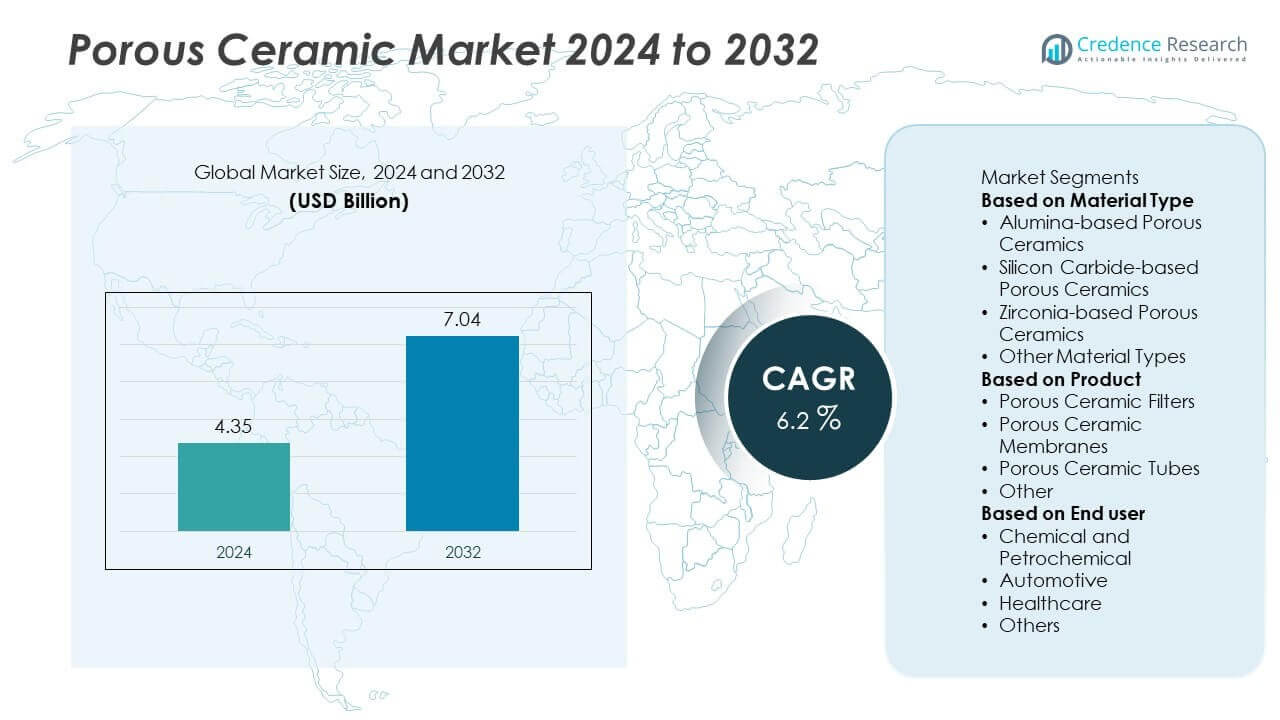

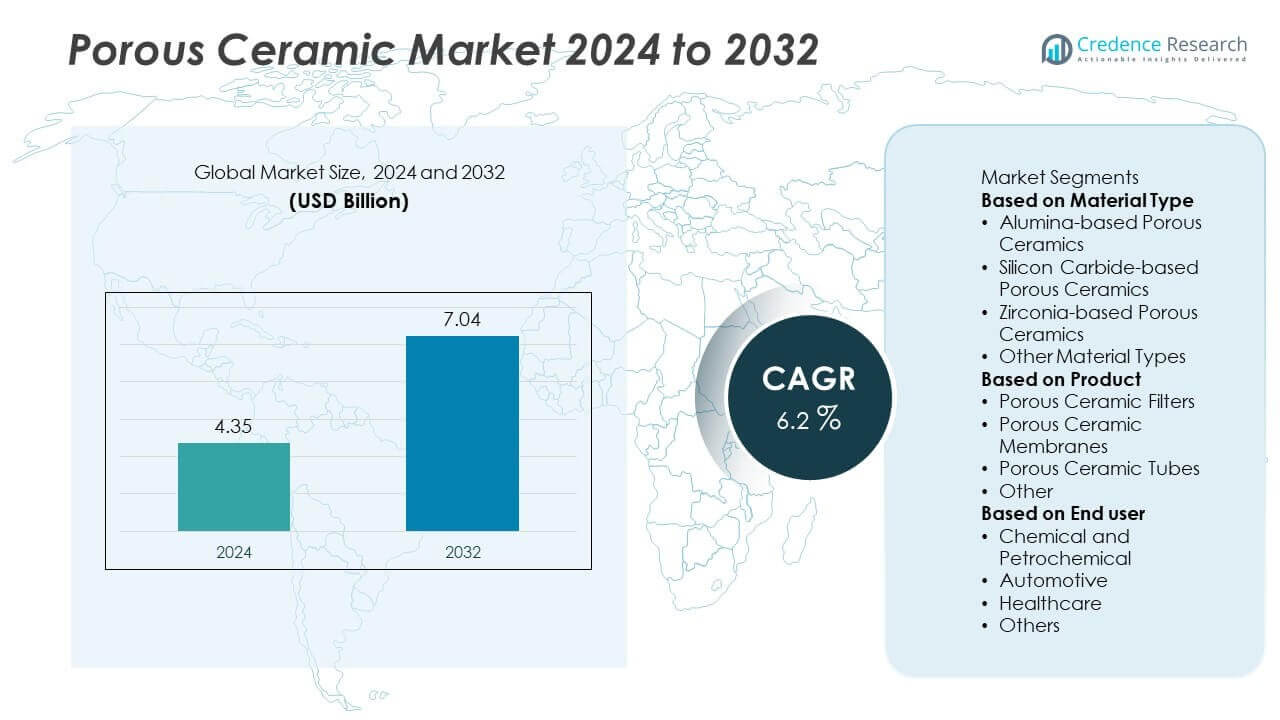

The global Porous Ceramic Market was valued at USD 4.35 billion in 2024. It is projected to reach USD 7.04 billion by 2032, expanding at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Porous Ceramic Market Size 2024 |

USD 4.35 Billion |

| Porous Ceramic Market, CAGR |

6.2% |

| Porous Ceramic Market Size 2032 |

USD 7.04 Billion |

The porous ceramic market is driven by leading players such as Saint-Gobain, Kyocera Corporation, CoorsTek Inc., Morgan Advanced Materials plc, CeramTec GmbH, Filtech, Lianyungang Baibo New Material Co., Ltd., Rauschert GmbH, Innovacera, and Applied Ceramics Inc. These companies emphasize product innovation, material performance, and application-specific solutions across industries including healthcare, automotive, petrochemicals, and environmental engineering. Regionally, North America led the market in 2024 with 33% share, supported by strong demand in healthcare and filtration applications. Europe followed with 29% share, driven by emission regulations and medical usage, while Asia Pacific accounted for 26% share, fueled by rapid industrialization, water treatment projects, and growing adoption in automotive emission control systems.

Market Insights

Market Insights

- The global porous ceramic market was valued at USD 4.35 billion in 2024 and is projected to reach USD 7.04 billion by 2032, growing at a CAGR of 6.2% during the forecast period.

- Key drivers include rising demand in filtration, automotive emission control, and healthcare, with alumina-based porous ceramics holding 40% share in 2024 due to their thermal stability and cost-effectiveness.

- Market trends highlight the growing adoption of porous ceramic membranes in wastewater treatment and renewable energy applications such as solid oxide fuel cells, supporting long-term sustainability goals.

- The market is highly competitive with players like Saint-Gobain, Kyocera Corporation, CoorsTek Inc., Morgan Advanced Materials plc, and CeramTec GmbH focusing on product innovation, partnerships, and regional expansion strategies.

- Regionally, North America led with 33% share, followed by Europe at 29% and Asia Pacific at 26%, while Latin America and the Middle East & Africa accounted for 7% and 5% shares, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Alumina-based porous ceramics dominated the market in 2024 with 40% share. Their high mechanical strength, thermal stability, and chemical resistance make them widely used in filtration, catalysis, and biomedical applications. The material’s affordability and versatility compared to zirconia and silicon carbide also enhance adoption across industries. Silicon carbide-based ceramics followed with notable demand, especially in applications requiring superior hardness and high-temperature resistance, such as automotive and energy. Zirconia-based ceramics, while holding a smaller share, are gaining attention in medical implants due to excellent biocompatibility and wear resistance.

- For instance, CeramTec’s zirconia ceramic components achieve Vickers hardness values above 1,200 HV and fracture toughness over 8 MPa·m½, making them widely adopted in hip joint prostheses and dental implants.

By Product

Porous ceramic filters held the largest share in 2024 with 45% of the market. Their widespread use in water treatment, air purification, and molten metal filtration drives dominance. Industries prioritize these filters for their efficiency in removing fine particles and providing durability under harsh conditions. Porous ceramic membranes followed, supported by growing demand in chemical processing and wastewater treatment for precise molecular separation. Tubes and other products, while smaller in share, are steadily expanding in niche applications like catalyst supports and fuel cells, reflecting the growing diversity of porous ceramic technologies.

- For instance, Morgan Technical Ceramics produces extruded ceramic tubes in various lengths, with outside diameters ranging from 0.5 mm to 50 mm, which can be optimized for permeability to suit specific applications, including next-generation power solutions like fuel cells.

By End User

The chemical and petrochemical sector accounted for the leading share in 2024 with 38% of the porous ceramic market. Demand is fueled by the use of porous ceramics in filtration, catalyst carriers, and gas separation processes. Their ability to withstand extreme temperatures and corrosive environments makes them highly suitable for refining and processing applications. The automotive sector followed, leveraging porous ceramics in emission control systems and filtration technologies. Healthcare is another key segment, where biocompatible ceramics are increasingly used in implants and medical devices, while other industries such as electronics and environmental engineering contribute steadily to overall growth.

Key Growth Drivers

Rising Demand in Filtration Applications

Filtration needs across industries are a key driver for porous ceramics, which held strong demand in 2024. Their high porosity, chemical resistance, and durability make them ideal for water purification, air separation, and industrial fluid management. Industries such as petrochemical, automotive, and power generation increasingly rely on porous ceramic filters to improve efficiency and reduce environmental impact. Stricter regulations on emissions and wastewater treatment further boost adoption, positioning porous ceramics as an essential solution for modern industrial filtration requirements.

- For instance, Saint-Gobain’s Crystar® porous SiC filters operate with porosity levels up to 40% and high permeability, allowing for high-efficiency water purification at operational temperatures up to 40°C and during chemical cleaning up to 80°C, while meeting stringent EU wastewater standards.

Expansion of Healthcare and Biomedical Applications

Healthcare is emerging as a critical growth area for porous ceramics. Their biocompatibility and ability to support bone tissue integration make them ideal for medical implants and regenerative medicine. Growing demand for dental implants, orthopedic applications, and drug delivery systems is fueling this trend. Research investments in advanced biomaterials further strengthen adoption. With aging populations and rising healthcare expenditure globally, porous ceramics are increasingly integrated into high-value medical devices, enhancing long-term growth prospects for this sector.

- For instance, CeramTec produces high-performance ceramic components, such as their dense and durable BIOLOX® delta material, which is a zirconia-toughened alumina ceramic used in millions of hip prostheses and has excellent biocompatibility that creates a favorable environment for bone integration.

Growth in Automotive and Environmental Applications

Porous ceramics are widely used in automotive emission control systems, such as diesel particulate filters, to meet stringent global regulations. Their thermal shock resistance and filtration efficiency make them essential for reducing harmful emissions. Rising automobile production, coupled with strict emission standards in Europe, North America, and Asia, drives market demand. Environmental applications, including catalytic converters and air purification, also contribute significantly. As industries push toward cleaner technologies, porous ceramics provide an effective material solution, driving steady growth in automotive and environmental markets.

Key Trends & Opportunities

Advancement in Porous Ceramic Membranes

Porous ceramic membranes are gaining traction due to their superior chemical and thermal resistance compared to polymeric membranes. They are increasingly applied in chemical processing, wastewater treatment, and food and beverage industries. The trend toward sustainable solutions and zero-liquid-discharge systems enhances demand. Their long lifespan and efficiency in high-temperature operations provide cost benefits, creating opportunities for widespread industrial adoption. Investments in membrane technology innovation further support expansion into new application areas.

- For instance, Rauschert GmbH’s inopor® ceramic membranes are available in different configurations to suit various applications, including nanofiltration membranes with a 0.9 nm pore size for wastewater treatment operating at temperatures up to 200°C.

Shift Toward Renewable Energy and Fuel Cells

Porous ceramics are finding new opportunities in renewable energy, particularly in solid oxide fuel cells and energy storage systems. Their thermal stability and ion conductivity make them suitable for energy-efficient power generation. As global energy demand shifts toward low-carbon solutions, porous ceramics are positioned as a key enabling material. Growing adoption of hydrogen technologies and green energy infrastructure creates new applications and accelerates market growth. This trend aligns with long-term decarbonization goals across major economies.

- For instance, Kyocera manufactures solid oxide fuel cell (SOFC) stacks with porous ceramic components, delivering power outputs of around 700 W per unit. These stacks support residential cogeneration systems that utilize natural gas to produce both electricity and heat.

Key Challenges

High Production and Processing Costs

The complex manufacturing processes and high material costs remain a challenge for porous ceramic adoption. Advanced sintering techniques and precision control of porosity increase production expenses, limiting accessibility for cost-sensitive industries. While the performance benefits are strong, affordability issues hinder adoption in smaller-scale applications. Manufacturers must focus on scaling production and developing cost-effective methods to expand market reach and maintain competitiveness.

Brittleness and Limited Mechanical Strength

Despite their advantages, porous ceramics face challenges related to brittleness and mechanical weakness under certain conditions. Their fragile structure makes them vulnerable in applications involving high mechanical stress or impact. This limits adoption in industries requiring materials with both porosity and structural strength. Ongoing research in composite materials and surface treatments is essential to overcome these limitations and unlock broader industrial applications for porous ceramics.

Regional Analysis

North America

North America held 33% share of the porous ceramic market in 2024, making it the leading region. Strong demand is driven by advanced healthcare applications, strict environmental regulations, and the widespread adoption of filtration technologies across petrochemical and automotive industries. The United States leads with investments in medical implants, emission control systems, and water purification projects. Canada also contributes with rising adoption of porous ceramic filters in industrial and environmental applications. The region’s focus on sustainability, coupled with government-backed clean energy initiatives, supports the steady growth of porous ceramic demand.

Europe

Europe accounted for 29% share of the porous ceramic market in 2024. Stringent EU emission regulations and a strong automotive base in Germany, France, and the United Kingdom drive demand for porous ceramics in exhaust and filtration systems. Healthcare also plays a vital role, with expanding use of biocompatible ceramics in dental and orthopedic implants. Water treatment and renewable energy projects further enhance adoption. Investments in sustainable technologies and material innovation strengthen Europe’s competitive edge. The region’s regulatory framework ensures continued demand for advanced porous ceramic solutions across industries.

Asia Pacific

Asia Pacific captured 26% share of the porous ceramic market in 2024, driven by rapid industrialization and healthcare expansion. China leads the region with strong adoption in chemical processing, water treatment, and automotive emission control systems. Japan and India also contribute, focusing on healthcare implants and renewable energy applications such as solid oxide fuel cells. The region benefits from growing government initiatives to curb pollution and improve water quality. Expanding manufacturing capacity and rising R&D investment make Asia Pacific one of the fastest-growing markets for porous ceramics globally.

Latin America

Latin America represented 7% share of the porous ceramic market in 2024. Brazil and Mexico are the key contributors, with growing adoption of porous ceramic filters in water treatment and industrial processing. Demand is also rising in the healthcare sector, supported by an increasing need for dental and orthopedic implants. However, infrastructure challenges and limited R&D capacity restrain broader adoption. Government efforts to improve industrial and environmental standards, along with rising healthcare spending, are expected to create new opportunities. The region is gradually strengthening its position in the global porous ceramic market.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the porous ceramic market in 2024. Growth is driven by increasing demand for industrial filtration in petrochemical and oil refining sectors, particularly in Gulf countries such as Saudi Arabia and the United Arab Emirates. South Africa also contributes with applications in mining and healthcare. Limited local production capacity and high import dependence are challenges. However, rising investments in water treatment projects and industrial modernization are expected to support future growth. The region is emerging as a developing market for porous ceramic adoption.

Market Segmentations:

By Material Type

- Alumina-based Porous Ceramics

- Silicon Carbide-based Porous Ceramics

- Zirconia-based Porous Ceramics

- Other Material Types

By Product

- Porous Ceramic Filters

- Porous Ceramic Membranes

- Porous Ceramic Tubes

- Other

By End user

- Chemical and Petrochemical

- Automotive

- Healthcare

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the porous ceramic market is shaped by key players including Saint-Gobain, Filtech, Kyocera Corporation, CoorsTek Inc., Morgan Advanced Materials plc, CeramTec GmbH, Lianyungang Baibo New Material Co., Ltd., Rauschert GmbH, Innovacera, and Applied Ceramics Inc. These companies compete by focusing on innovation, advanced material technologies, and tailored product offerings for industries such as healthcare, automotive, petrochemical, and environmental engineering. Strategies include expanding product portfolios in porous ceramic filters, membranes, and tubes, along with strengthening regional distribution networks. Many players invest in R&D to enhance thermal stability, mechanical strength, and biocompatibility, particularly for medical and energy applications. Partnerships and acquisitions are common, enabling companies to broaden capabilities and expand into high-growth markets like Asia Pacific. With rising demand for sustainable and high-performance solutions, competition emphasizes cost-effectiveness, precision manufacturing, and regulatory compliance, ensuring these companies remain at the forefront of the porous ceramic industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Rauschert also revealed new ceramic solutions for the Food & Beverage / Drinktec 2025 segment using their inopor® membranes.

- In 2025, Saint-Gobain Ceramics / NorPro announced plans to build a new manufacturing facility in Wheatfield, New York (≈ 125,000 sq ft), to expand its production of ceramic catalyst carriers and support materials.

- In 2024, CeramTec’s subsidiary CeramTec-ETEC highlighted their provision of ceramic membranes, wear & corrosion protection, and sealing discs in their product mix.

- In 2023, Saint-Gobain launched a new business arm, Saint-Gobain Advanced Ceramic Composites, expanding its capabilities in fused quartz, ceramic fibers, and ceramic composite systems.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product, End user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for porous ceramics will grow in filtration applications across water, air, and industrial processes.

- Alumina-based porous ceramics will maintain dominance due to cost-effectiveness and versatile applications.

- Healthcare adoption will expand with increasing use in dental, orthopedic, and implantable devices.

- Automotive applications will strengthen as emission control systems rely more on porous ceramic filters.

- Porous ceramic membranes will see rising demand in wastewater treatment and chemical processing.

- Renewable energy growth will boost usage in solid oxide fuel cells and hydrogen technologies.

- Asia Pacific will record the fastest growth, supported by rapid industrialization and infrastructure investment.

- Europe and North America will remain strong markets, driven by regulations and advanced healthcare sectors.

- High production costs will continue to challenge adoption in cost-sensitive industries.

- Partnerships, R&D investments, and product innovation will shape competition in the porous ceramic market.

Market Insights

Market Insights