Market Overview

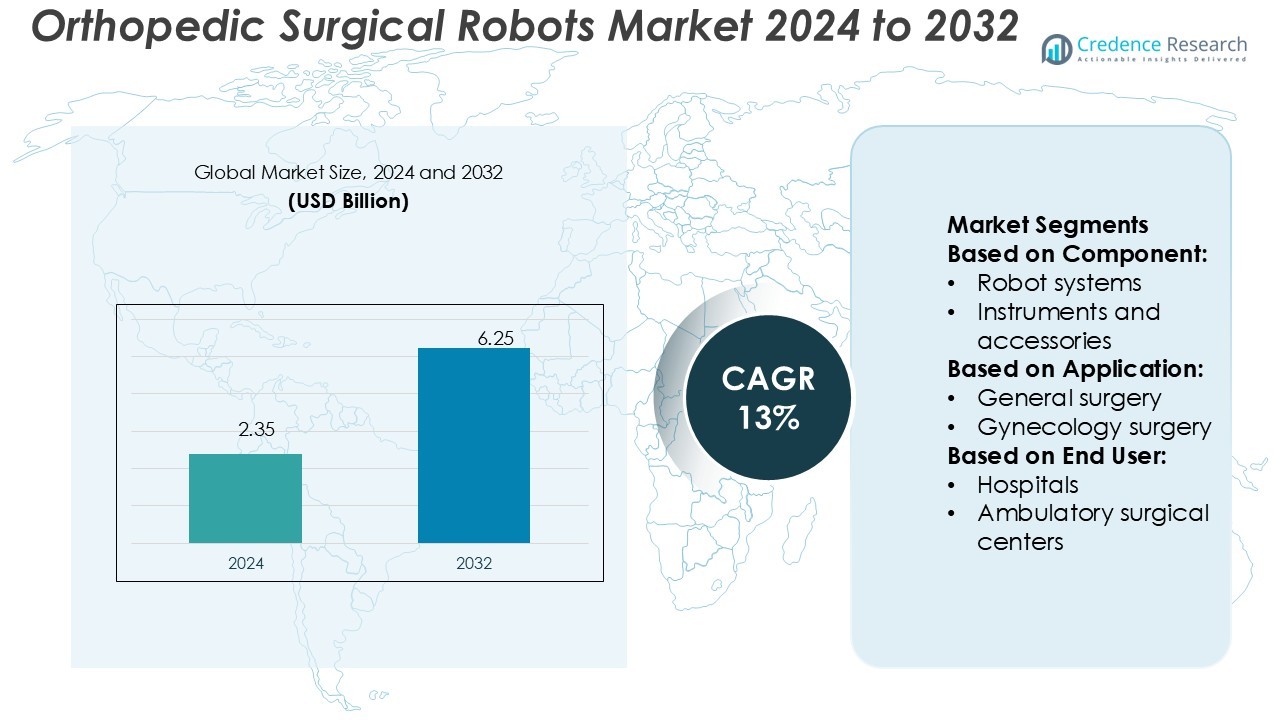

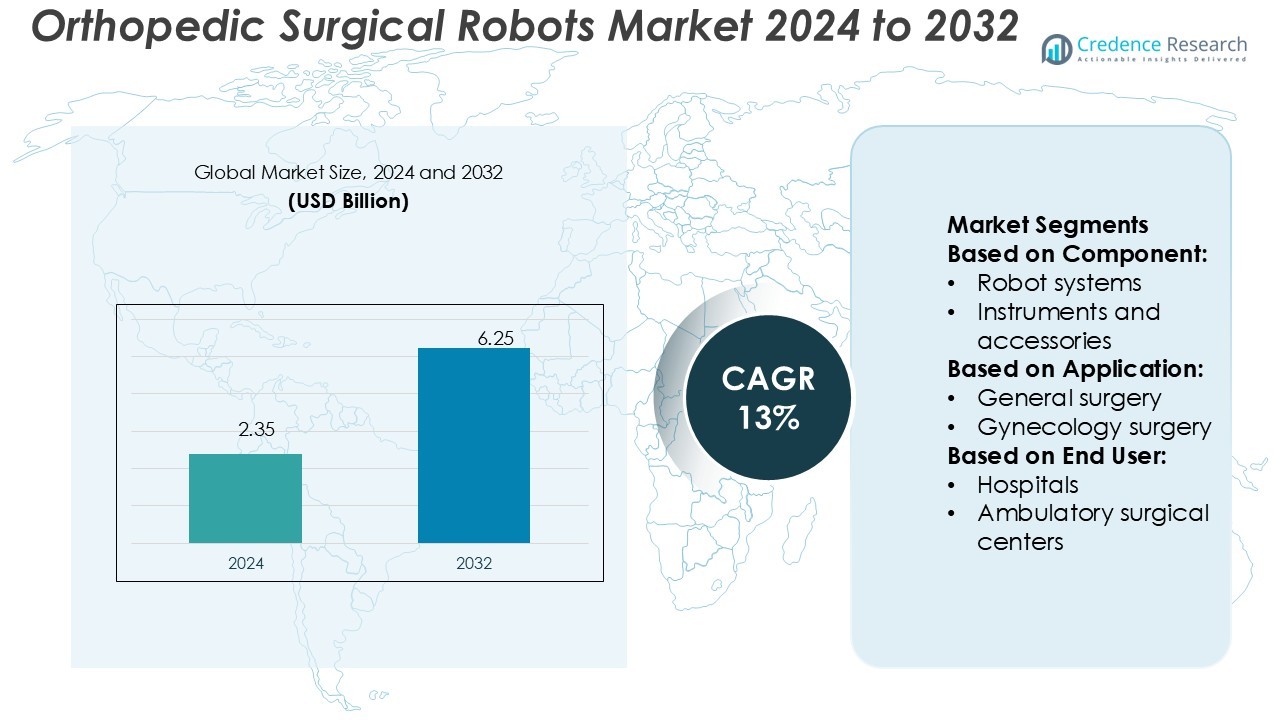

Orthopedic Surgical Robots Market size was valued USD 2.35 billion in 2024 and is anticipated to reach USD 6.25 billion by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Surgical Robots Market Size 2024 |

USD 2.35 Billion |

| Orthopedic Surgical Robots Market, CAGR |

13% |

| Orthopedic Surgical Robots Market Size 2032 |

USD 6.25 Billion |

The orthopedic surgical robots market is shaped by prominent players such as Distalmotion, INTUITIVE, ELMED MEDICAL SYSTEMS, meerecompany, ACCURAY, CMR SURGICAL, GLOBUS MEDICAL, Medtronic, CASCINATION, and ASENSUS SURGICAL. These companies drive innovation through advanced robotic platforms, AI integration, and minimally invasive solutions tailored for joint replacement and spine surgeries. North America leads the global market with a 42% share, supported by advanced healthcare infrastructure, favorable reimbursement policies, and high adoption rates of robotic-assisted procedures. Strong investments, combined with extensive surgeon training programs, position the region as the hub of technological advancements in orthopedic robotic surgery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Orthopedic Surgical Robots Market size was valued at USD 2.35 billion in 2024 and is anticipated to reach USD 6.25 billion by 2032, at a CAGR of 13% during the forecast period.

- Rising demand for precision-driven joint replacement and spine surgeries, coupled with technological advancements in robotic platforms, is driving market expansion globally.

- Leading companies including Distalmotion, INTUITIVE, Medtronic, GLOBUS MEDICAL, and others focus on AI integration, minimally invasive solutions, and product innovation to strengthen competitiveness.

- High capital costs and maintenance expenses, along with the need for extensive surgeon training, remain key restraints that challenge adoption in smaller hospitals and emerging economies.

- North America dominates with 42% share, supported by strong healthcare infrastructure and high adoption of robotic procedures, while orthopedic surgery leads application segments with nearly 40% share, and Asia-Pacific shows fastest growth due to rising healthcare investments and increasing musculoskeletal disorder prevalence.

Market Segmentation Analysis:

By Component

The orthopedic surgical robots market by component is led by robot systems, holding the largest share due to their role as the primary platform enabling precision surgeries. These systems account for more than 45% of the market, driven by the increasing adoption of advanced robotic platforms that improve surgical accuracy and reduce recovery time. Instruments and accessories follow, with recurring demand supported by frequent replacement needs during surgical procedures. The high replacement cycle makes this sub-segment a steady revenue generator, further complementing the dominance of robot systems.

- For instance, Paragon Medical operates a 34,000 square-foot additive manufacturing facility dedicated to 3D printing porous titanium implant architectures, and its subtractive capabilities include machining tolerances down to 20 millionths of an inch with surface finishes reaching 1 microinch (40 millionths of an inch) in polishing.

By Application

Orthopedic surgery dominates the application segment, contributing nearly 40% of the market share. This dominance stems from the growing burden of musculoskeletal disorders and joint replacement procedures worldwide. Robot-assisted orthopedic surgeries enhance precision in bone alignment and implant placement, reducing revision surgery rates. While neurosurgery and urologic surgery are emerging with advanced robotics adoption, orthopedic surgery continues to lead due to rising elderly populations and increased sports injuries, making it the most established application area in robotic-assisted healthcare.

- For instance, ARCH Medical Solutions operates over 700,000 square feet of manufacturing capacity across numerous ISO 13485-certified and FDA-registered U.S. facilities, leveraging a large network to enable scalable and large-volume production of implants and instruments.

By End User

Hospitals represent the dominant end-user segment, accounting for over 60% of the orthopedic surgical robots market. Their leadership is supported by large-scale investments in advanced surgical infrastructure and higher patient inflows. Hospitals also benefit from reimbursement policies that encourage robotic adoption for complex procedures. Ambulatory surgical centers, while smaller in market share, are growing rapidly as they offer cost-effective robotic surgeries in outpatient settings. Their increasing adoption of compact robotic systems highlights a shift toward decentralized healthcare, though hospitals remain the core revenue driver for the industry.

Key Growth Drivers

Rising Prevalence of Musculoskeletal Disorders

The growing incidence of musculoskeletal conditions, including arthritis and osteoporosis, is a major driver for the orthopedic surgical robots market. Increasing joint replacement procedures and spine surgeries have created strong demand for precision-based robotic systems that improve implant alignment and reduce revision rates. With an aging global population, healthcare providers are prioritizing technologies that ensure faster recovery and lower complication risks. Robotic systems meet these needs effectively, positioning them as an essential tool in addressing the rising orthopedic disease burden worldwide.

- For instance, Tecomet’s casting line can produce net-shape CoCr implant blanks with geometries within ±0.2 mm across 50 mm span, before final machining and polishing.

Technological Advancements in Robotic Systems

Continuous innovations in robotic platforms, navigation software, and imaging integration are accelerating market growth. Advanced robots now offer improved haptic feedback, enhanced 3D visualization, and AI-enabled decision support, enabling surgeons to perform highly complex orthopedic procedures with greater accuracy. These advancements not only improve patient outcomes but also expand the scope of robotic surgeries beyond joint replacements to spine and trauma cases. The integration of data analytics and connectivity further strengthens adoption, as hospitals seek smarter, more efficient surgical solutions to improve care delivery.

- For instance, CRETEX runs Direct Metal Printing (DMP) builds in its 30,000 sq ft additive hub, enabling the delivery of custom titanium implants from powder to finished part through a vertically integrated process.

Growing Investments and Healthcare Infrastructure Expansion

Hospitals and healthcare systems are increasing investments in robotic-assisted surgical infrastructure to enhance clinical capabilities. Favorable reimbursement frameworks and rising healthcare spending are enabling the adoption of advanced technologies, particularly in developed regions. Emerging economies are also expanding healthcare infrastructure, creating opportunities for first-time robotic installations. Strategic collaborations between medical device companies and hospitals further support training, financing, and deployment, driving wider adoption. These investments are reshaping orthopedic care delivery and creating sustainable demand for surgical robots in diverse healthcare markets.

Key Trends & Opportunities

Integration of Artificial Intelligence and Data Analytics

AI-driven robotic platforms are gaining momentum as they enable real-time surgical planning and predictive outcomes. Data analytics improves decision-making by analyzing patient-specific anatomy and surgical history, allowing for more personalized interventions. These capabilities not only enhance clinical precision but also support post-surgical recovery monitoring. As hospitals increasingly adopt AI-enabled systems, opportunities arise for vendors to integrate robotics with digital health platforms. This trend reflects the growing convergence of robotics, data science, and personalized medicine in orthopedic surgery.

- For instance, Viant expanded its Costa Rica medical device facility in Heredia in late 2022, adding over 90,000 square feet of cleanroom space and significantly enhancing production capacity for complex medical devices.

Shift Toward Outpatient and Minimally Invasive Procedures

Ambulatory surgical centers are emerging as key growth areas for orthopedic robots, supported by demand for minimally invasive procedures. Compact robotic systems designed for outpatient settings reduce hospital stays and overall treatment costs. Patients benefit from faster recovery and reduced complication risks, driving acceptance of these technologies. This shift creates opportunities for manufacturers to develop cost-effective, portable, and user-friendly robotic systems tailored for smaller healthcare facilities. The trend highlights a growing emphasis on affordability and accessibility in robotic-assisted orthopedic surgery.

- For instance, Globus reported that its ExcelsiusGPS system achieved these sub-millimeter deviations, and the study’s findings, as presented in a table (Table 2), explicitly document that the mean radiation time was 18.3 ± 13.3 s.

Key Challenges

High Capital and Maintenance Costs

The adoption of orthopedic surgical robots faces a significant barrier due to their high capital cost, often exceeding several million dollars per system. In addition to purchase costs, ongoing expenses for software updates, maintenance, and disposable accessories add financial pressure. Smaller hospitals and ambulatory centers often face budget constraints, limiting adoption. Despite the long-term benefits of precision and reduced revision rates, the steep upfront investment remains a challenge, particularly in emerging markets where healthcare budgets are more restricted.

Surgeon Training and Workflow Integration Issues

Successful deployment of robotic surgical systems requires extensive surgeon training and adaptation to new workflows. The steep learning curve and extended procedure times during the initial adoption phase can deter hospitals from investing. Integrating robotic systems with existing imaging and navigation tools also presents interoperability challenges. Without standardized training programs and smoother integration, adoption rates may slow, especially in resource-limited healthcare facilities. Addressing these barriers is essential to maximize the benefits of orthopedic surgical robots and ensure wider market penetration.

Regional Analysis

North America

North America dominates the orthopedic surgical robots market with a market share of 42%, supported by strong healthcare infrastructure, high adoption of advanced technologies, and favorable reimbursement policies. The U.S. leads the region due to widespread joint replacement procedures, a large geriatric population, and significant investments in robotic-assisted surgery. Canada is also witnessing increased adoption, driven by healthcare modernization initiatives and growing demand for minimally invasive procedures. Strategic collaborations between hospitals and technology providers strengthen the regional market, ensuring continued leadership through robust innovation pipelines and extensive integration of robotics in orthopedic care delivery.

Europe

Europe holds a 28% market share in the orthopedic surgical robots market, driven by rapid adoption in countries such as Germany, the UK, and France. High prevalence of musculoskeletal disorders, combined with government initiatives supporting digital healthcare transformation, fuels regional growth. The region benefits from advanced hospital networks and strong regulatory support for innovative surgical technologies. Germany leads due to its advanced healthcare infrastructure and high orthopedic surgery volumes. Southern and Eastern Europe are emerging as attractive markets as healthcare systems expand robotic surgery programs, further strengthening Europe’s position as the second-largest global market.

Asia-Pacific

Asia-Pacific accounts for 20% of the orthopedic surgical robots market, with rapid growth fueled by rising healthcare spending and expanding hospital infrastructure. China and Japan lead the region, supported by significant government investments in robotics and growing orthopedic disease prevalence. India is also emerging as a key market, driven by rising joint replacement surgeries and increasing awareness of robotic-assisted procedures. Favorable policies encouraging technology adoption, coupled with strong demand for minimally invasive solutions, support regional expansion. The Asia-Pacific market demonstrates high growth potential as affordability improves and leading manufacturers strengthen local production and training facilities.

Latin America

Latin America represents 6% of the orthopedic surgical robots market, with Brazil and Mexico leading adoption. Growth is supported by rising healthcare investments, expanding private hospital networks, and increasing awareness of robotic-assisted orthopedic procedures. Brazil dominates the region due to its advanced medical facilities and higher patient inflow for orthopedic surgeries. However, cost barriers and limited access to advanced robotic systems remain challenges in smaller economies. Despite these constraints, the region shows potential for steady growth as governments and private players focus on modernizing healthcare infrastructure and improving access to advanced surgical technologies.

Middle East & Africa

The Middle East & Africa region holds a 4% market share in the orthopedic surgical robots market, with growth concentrated in Gulf Cooperation Council (GCC) countries and South Africa. Wealthier nations such as the UAE and Saudi Arabia lead adoption due to heavy investments in advanced healthcare infrastructure and medical tourism initiatives. South Africa represents a growing hub in sub-Saharan Africa, supported by increasing demand for specialized orthopedic care. However, limited affordability and infrastructure gaps in other parts of the region restrain growth. Strategic collaborations and government investments are expected to gradually expand market penetration.

Market Segmentations:

By Component:

- Robot systems

- Instruments and accessories

By Application:

- General surgery

- Gynecology surgery

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The orthopedic surgical robots market features strong competition among leading players including Distalmotion, INTUITIVE, ELMED MEDICAL SYSTEMS, meerecompany, ACCURAY, CMR SURGICAL, GLOBUS MEDICAL, Medtronic, CASCINATION, and ASENSUS SURGICAL. The orthopedic surgical robots market is highly competitive, driven by rapid technological advancements and increasing demand for precision-based surgical solutions. Companies are focusing on expanding their product portfolios with advanced robotic systems that integrate imaging, navigation, and AI-driven decision support. Strategic collaborations with hospitals and research institutions are enhancing training, adoption, and system integration, strengthening market presence. Innovation in minimally invasive procedures and the development of compact, cost-effective robotic platforms are also gaining momentum. Competitive strategies center on improving surgical efficiency, reducing complication risks, and expanding accessibility to advanced orthopedic care globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Distalmotion

- INTUITIVE

- ELMED MEDICAL SYSTEMS

- meerecompany

- ACCURAY

- CMR SURGICAL

- GLOBUS MEDICAL

- Medtronic

- CASCINATION

- ASENSUS SURGICAL

Recent Developments

- In July 2025, Care Hospitals in Hyderabad introduced the AI-driven Stryker Mako Robotic System to aid in robotic-assisted joint replacement surgeries. The system combines 3D CT-based surgical planning with real-time guidance, aiming to improve surgical accuracy while minimizing tissue damage.

- In June 2025, SS Innovations performed the first robotic cardiac surgery in the Americas using its SSi Mantra 3 system at Interhospital, Ecuador, with successful patient outcomes. The company is expanding globally, aiming for FDA clearance in 2026, and has 80 systems installed across 75 hospitals in India and other countries.

- In April 2025, Johnson & Johnson MedTech announced the successful completion of the first clinical cases using the OTTAVA Robotic Surgical System for gastric bypass surgery at Memorial Hermann-Texas Medical Center.

- In February 2024, THINK Surgical announced the collaboration with Maxx Orthopedics. Under this collaboration, Think Surgical will add Maxx Orthopedic implants with the TMINITM Miniature Robotic system. This collaboration aims to provide an open platform for orthopedic surgical robots to support implants.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness stronger adoption of AI-driven surgical planning and decision support.

- Hospitals will continue to dominate demand with higher investments in robotic-assisted platforms.

- Ambulatory surgical centers will expand their role as outpatient robotic procedures increase.

- Orthopedic surgery will remain the leading application with growing joint replacement procedures.

- Compact and cost-effective robotic systems will gain traction in emerging healthcare markets.

- Strategic collaborations between hospitals and technology providers will accelerate global adoption.

- Training programs and simulation platforms will improve surgeon expertise and reduce learning curves.

- Integration of robotics with advanced imaging and navigation will enhance surgical precision.

- Aging populations and rising musculoskeletal disorders will sustain long-term demand.

- Regional expansion in Asia-Pacific and Latin America will provide strong growth opportunities.