Market Overview

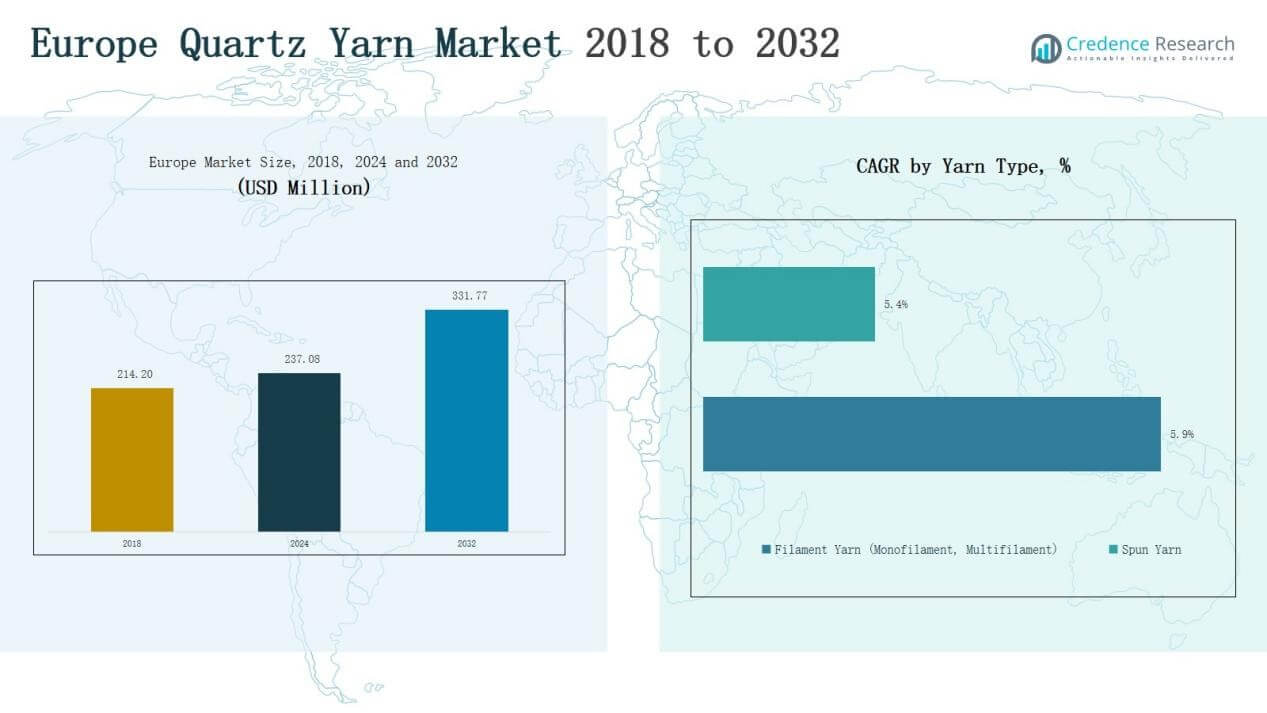

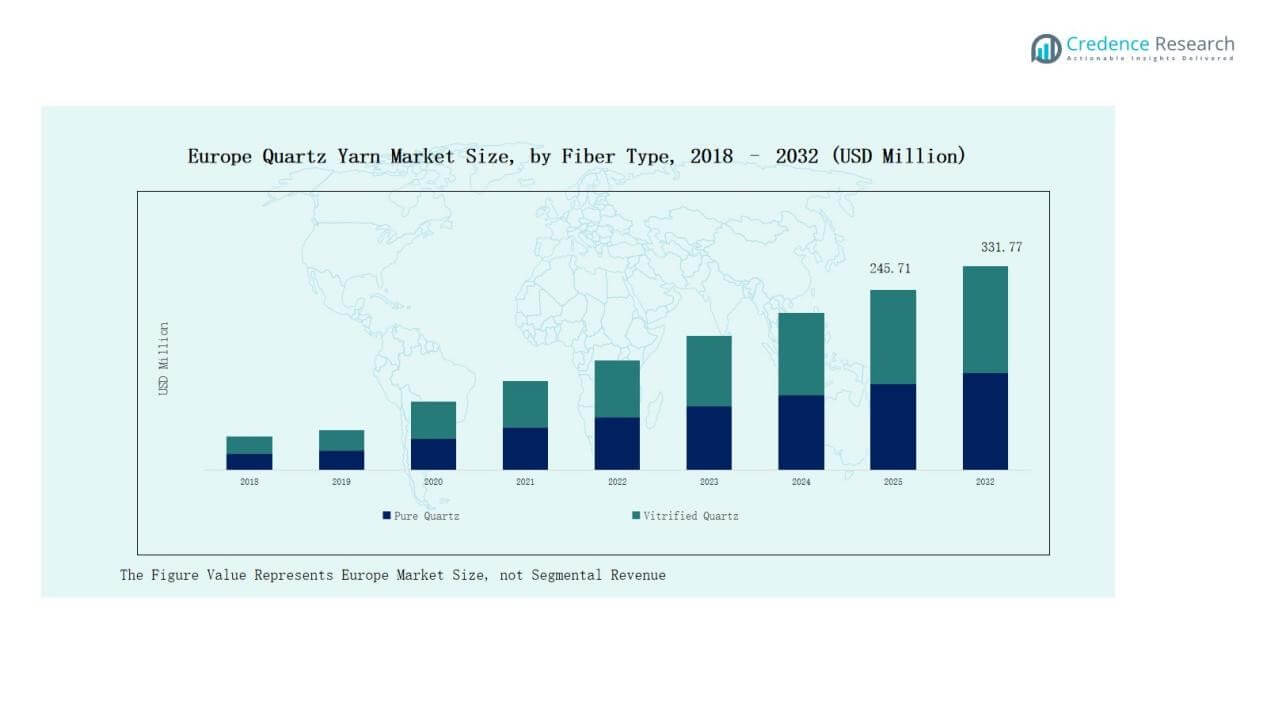

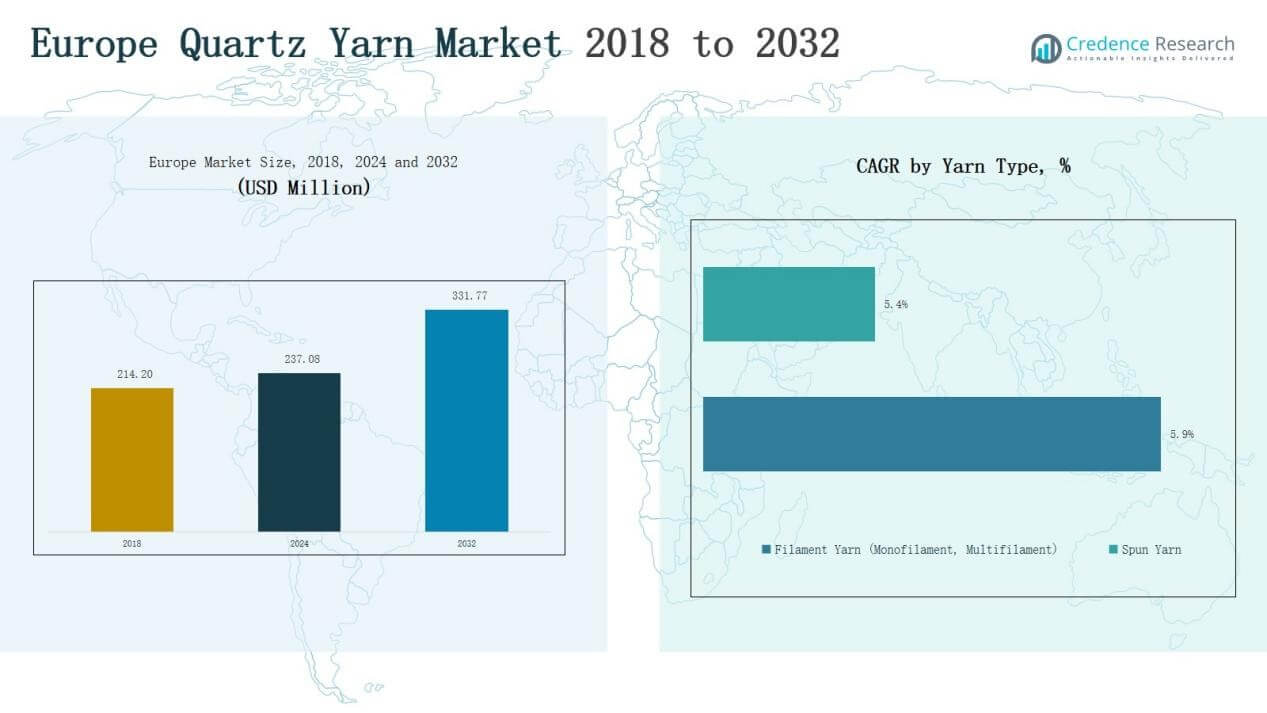

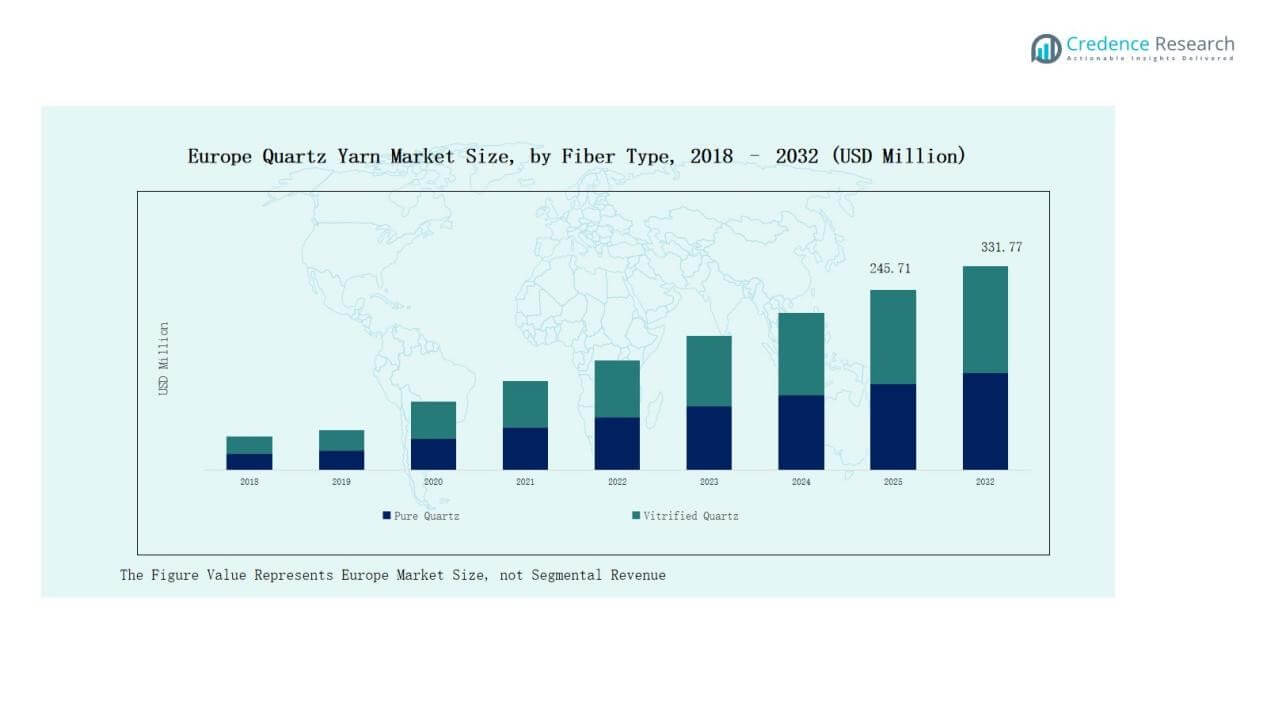

Europe Quartz Yarn Market size was valued at USD 214.20 million in 2018, reached USD 237.08 million in 2024, and is anticipated to reach USD 331.77 million by 2032, at a CAGR of 3.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Yarn Market Size 2024 |

USD 237.08 Million |

| Europe Quartz Yarn Market, CAGR |

3.17% |

| Europe Quartz Yarn Market Size 2032 |

USD 331.77 Million |

The Europe Quartz Yarn Market features strong competition among established players, including Saint-Gobain Quartz, Heraeus, Morgan Advanced Materials, WONIK Quartz, Quartztec, AngleTex, Shin-Etsu Chemical, and JPS Composite Materials. These companies strengthen their positions through advanced product portfolios, R&D investments, and strategic collaborations across aerospace, defense, automotive, and industrial applications. The market is shaped by innovation in high-purity fibers, capacity expansions, and sustainability-driven manufacturing practices. Germany leads the regional landscape with a 28% share in 2024, supported by its advanced aerospace and automotive industries, making it the largest contributor to market growth.

Market Insights

Market Insights

- The Europe Quartz Yarn Market grew from USD 214.20 million in 2018 to USD 237.08 million in 2024 and is forecasted to reach USD 331.77 million by 2032.

- Pure quartz leads the fiber type segment with 62% share in 2024, supported by its superior strength, purity, and high demand across aerospace, defense, and electronics applications.

- Filament yarn dominates by yarn type with 68% share in 2024, with multifilament driving growth due to flexibility and broad usage in aerospace composites and filtration applications.

- Aerospace and defense hold the largest end-use industry share at 35% in 2024, followed by automotive, chemical processing, construction, and oil & gas sectors requiring durable high-performance fibers.

- Germany leads the regional landscape with 28% share in 2024, benefiting from advanced aerospace and automotive industries, strong R&D capabilities, and government-backed defense and green technology projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Fiber Type

The pure quartz segment dominates the Europe Quartz Yarn Market, accounting for nearly 62% share in 2024. Its leadership stems from superior purity, high tensile strength, and resistance to thermal shock, making it vital in aerospace and electronics applications. Vitrified quartz, while smaller, is gaining steady traction for cost-sensitive industries such as construction and automotive. Rising demand for high-performance materials in energy, defense, and advanced manufacturing continues to reinforce the dominance of pure quartz in this segment.

For instance, Saint-Gobain introduced high-purity quartz yarns designed for thermal protection systems in aerospace applications, highlighting the segment’s suitability for extreme conditions.

By Yarn Type

Filament yarn leads the Europe Quartz Yarn Market, holding about 68% share in 2024, supported by its consistent diameter, strength, and suitability for composite reinforcement. Within this category, multifilament yarn outpaces monofilament due to its flexibility and broader application in aerospace and filtration. Spun yarn remains a niche segment, mainly used in insulation and sealing threads. The strong growth of composites in automotive lightweighting and defense manufacturing drives demand for filament yarn, especially multifilament, across European industries.

For instance, Saint-Gobain introduced advanced multifilament quartz yarns tailored for filtration media and high-temperature applications, enhancing product offerings for industrial customers in Europe.

By End-Use Industry

The aerospace and defense sector dominates with nearly 35% market share in 2024, driven by stringent requirements for heat resistance, lightweight composites, and durability. Quartz yarn is widely applied in thermal protection systems, aircraft components, and defense-grade composites. Automotive ranks second, supported by increasing demand for lightweight materials that improve fuel efficiency. Chemical processing, construction, and oil & gas follow, benefiting from quartz yarn’s resistance to corrosion and high temperatures, making it suitable for insulation, sealing, and filtration applications.

Key Growth Drivers

Key Growth Drivers

Expanding Aerospace and Defense Applications

The aerospace and defense sector remains the largest growth driver, accounting for significant demand in Europe. Quartz yarn’s exceptional resistance to heat, corrosion, and mechanical stress makes it indispensable for thermal protection systems, composite reinforcement, and defense-grade insulation. Increasing investments in aircraft modernization, defense programs, and space exploration amplify its adoption. European manufacturers benefit from government-backed aerospace projects, ensuring long-term demand. The reliability and durability of quartz yarn position it as a critical material for mission-critical applications in this sector.

For instance, Saint-Gobain’s Quartzel® yarn (SiO₂ ≥99.95%) offers dk≈3.74 and loss≈0.0002 at 10 GHz, aiding low-loss radomes and RF structures; datasheets note insulation integrity up to ~1050 °C and ablative behavior above ~1600 °C.

Rising Adoption in Automotive Lightweighting

Automotive industries across Europe are actively incorporating lightweight materials to meet fuel efficiency and emission reduction targets. Quartz yarn composites provide superior strength-to-weight ratios, making them suitable for structural reinforcement and insulation. The shift toward electric vehicles further strengthens demand, as thermal management materials are crucial in battery systems. With Germany, Italy, and France leading automotive production, the region is witnessing strong quartz yarn uptake. Automakers’ emphasis on sustainability and safety standards reinforces quartz yarn’s role in next-generation automotive manufacturing.

For instance, BMW Group announced expanded use of advanced composite materials for lightweight structural parts in its Neue Klasse EV lineup, focusing on thermal management and insulation performance.

Growth in Chemical Processing and Industrial Applications

Quartz yarn’s chemical resistance, thermal stability, and durability are key enablers in industrial processing. In Europe, demand is expanding across chemical plants, refineries, and advanced material industries. Applications in filtration, insulation, and protective layers drive consumption where extreme temperature and corrosion resistance are required. Government regulations promoting safety and sustainability in industrial operations further encourage adoption. The integration of high-performance quartz yarn products in processing plants highlights the material’s importance in supporting efficiency, reliability, and compliance with stringent operational standards.

Key Trends & Opportunities

Advancements in Composite Manufacturing

The increasing focus on advanced composite manufacturing offers a major opportunity for quartz yarn suppliers. Europe is witnessing strong growth in aerospace, automotive, and renewable energy sectors, all demanding lightweight yet durable materials. New technologies in weaving and coating enhance quartz yarn performance, enabling broader applications in high-stress environments. Partnerships between material suppliers and OEMs are rising, focusing on customized solutions. This trend supports the expansion of quartz yarn usage in structural reinforcements, contributing to innovation and cost efficiency across industries.

For instance, JPS Composite Materials’ Astroquartz uses 99.99% fused silica yarn and meets AMS 3846 for aerospace-grade fabrics; the line traces back to NASA Gemini and Apollo missions.

Sustainability and Eco-Friendly Materials

Sustainability has become a defining opportunity in the Europe Quartz Yarn Market. Manufacturers are investing in cleaner production methods and recyclable materials to align with European Union climate goals. Eco-friendly processes reduce carbon footprints while appealing to industries with green procurement policies, such as automotive and construction. Increasing consumer awareness and regulatory emphasis on circular economy practices strengthen the adoption of sustainable quartz yarn solutions. Companies focusing on environmentally responsible production are well-positioned to differentiate themselves and secure long-term growth.

For instance, 3M has committed to reduce its Scope 1 & 2 greenhouse gas emissions by 52.6 % by 2030 (relative to 2019) under SBTi validation.

Key Challenges

High Production Costs

Quartz yarn production requires advanced technology, high-purity raw materials, and energy-intensive processes. These factors significantly elevate manufacturing costs, limiting affordability compared to alternatives. European companies face added challenges with fluctuating energy prices and raw material sourcing constraints. The cost barrier reduces adoption in price-sensitive sectors like construction and general automotive parts. Unless suppliers achieve economies of scale or breakthroughs in cost-efficient manufacturing, high production costs will remain a significant restraint on market growth and competitiveness.

Competition from Alternative Materials

Alternative high-performance fibers, including carbon, aramid, and glass fibers, present strong competition to quartz yarn. These materials offer cost advantages and established supply chains, particularly in automotive and industrial sectors. While quartz yarn excels in thermal and chemical resistance, its niche positioning limits broader adoption. End-users often opt for lower-cost substitutes unless specialized properties are essential. This competitive pressure forces quartz yarn producers to focus on high-value applications, product innovation, and differentiation strategies to sustain their market presence in Europe.

Supply Chain and Raw Material Constraints

The quartz yarn industry heavily depends on high-purity quartz sand, which is limited in availability. Supply chain disruptions, particularly from global suppliers, increase lead times and procurement risks for European manufacturers. Dependence on imports makes the market vulnerable to geopolitical risks and trade fluctuations. Maintaining consistent quality standards in raw materials also challenges producers. Companies are increasingly investing in securing local sourcing, vertical integration, and strategic partnerships to overcome supply risks, but the issue continues to hinder market stability and scalability.

Regional Analysis

Germany

Germany leads the Europe Quartz Yarn Market with a 28% share in 2024. It benefits from a strong aerospace and automotive manufacturing base, supported by advanced R&D capabilities. Demand is fueled by the country’s leadership in composite materials and high-performance fibers. Industries rely on quartz yarn for thermal protection, filtration, and reinforcement applications. Government support for defense and green technologies enhances adoption. It continues to position Germany as a central hub for innovation and large-scale production within the regional market.

France

France holds a 17% share in 2024, driven by its strong aerospace and defense industry. The presence of leading aircraft manufacturers sustains high demand for quartz yarn in composites and insulation systems. Automotive and chemical processing industries further support consumption. It benefits from well-established industrial clusters and a focus on advanced materials. Investments in space and defense projects accelerate quartz yarn use in specialized applications. France maintains its position as a key contributor to the growth of the regional market.

UK

The UK accounts for a 14% share in 2024, supported by its advanced aerospace and automotive sectors. Demand is concentrated in composite reinforcement, insulation, and high-temperature applications. It benefits from growing adoption of lightweight materials in defense and renewable energy projects. Strong academic research and collaborations with material suppliers boost product innovation. The UK’s focus on electric vehicle manufacturing also drives demand for high-performance yarn solutions. It remains an important regional market with steady long-term growth potential.

Italy

Italy represents a 12% share in 2024, primarily driven by its automotive and construction industries. The country has a significant demand for lightweight and durable materials to enhance efficiency and safety. It shows rising consumption in chemical processing and industrial applications. Strong emphasis on sustainable production practices supports adoption of eco-friendly quartz yarn solutions. It also benefits from Italy’s manufacturing expertise in advanced fibers and composites. The market continues to strengthen through innovation and industry partnerships across key sectors.

Spain

Spain holds a 9% share in 2024, supported by automotive, construction, and renewable energy applications. Demand grows with increasing infrastructure investments and the adoption of lightweight materials. It plays a vital role in composite reinforcement and insulation applications. The aerospace sector contributes moderately to growth, supported by collaborative European projects. Spain’s industrial development and export-oriented economy sustain consumption. It remains a promising market within Southern Europe for quartz yarn applications.

Russia

Russia captures a 7% share in 2024, with demand concentrated in defense and oil & gas industries. Quartz yarn is used in sealing threads, insulation, and reinforcement applications where durability is critical. It benefits from government investments in defense and energy infrastructure. The domestic market faces supply challenges but continues to expand. Russia emphasizes self-reliance in advanced materials, which supports local production efforts. It holds strategic importance within Eastern Europe despite geopolitical and trade constraints.

Rest of Europe

The Rest of Europe collectively accounts for a 13% share in 2024, including markets such as the Netherlands, Switzerland, and Nordic countries. It shows rising demand in renewable energy, construction, and industrial applications. High adoption of eco-friendly practices supports the growth of sustainable quartz yarn solutions. It benefits from the presence of niche industries requiring specialized high-performance fibers. Collaborative research programs across universities and manufacturers stimulate innovation. It continues to strengthen the overall regional market contribution.

Market Segmentations:

Market Segmentations:

By Fiber Type

- Pure Quartz

- Vitrified Quartz

By Yarn Type

- Filament Yarn

- Monofilament

- Multifilament

- Spun Yarn

By End-Use Industry

- Aerospace & Defense

- Automotive

- Chemical Processing

- Construction

- Oil & Gas

By Application

- Composite Reinforcement

- Filtration

- Insulation

- Sealing Threads

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Quartz Yarn Market is characterized by moderate consolidation, with a mix of global leaders and regional specialists competing for market share. Major players such as Saint-Gobain Quartz, Heraeus, Morgan Advanced Materials, WONIK Quartz, Quartztec, AngleTex, Shin-Etsu Chemical, and JPS Composite Materials dominate through advanced product portfolios and established supply networks. It is defined by continuous investments in R&D to improve purity, strength, and thermal resistance of yarn solutions. Companies focus on expanding applications across aerospace, defense, and automotive sectors, where demand for lightweight and durable composites remains high. Strategic collaborations with OEMs, capacity expansions, and sustainability-driven manufacturing practices strengthen competitive positions. Smaller regional players compete by offering niche products and customized solutions, particularly for industrial and construction uses. Intense competition, technological innovation, and supply chain resilience are shaping the market, driving companies to differentiate through innovation, pricing strategies, and long-term partnerships with end users.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Saint-Gobain Quartz

- Heraeus

- Morgan Advanced Materials

- WONIK Quartz

- Quartztec

- AngleTex

- Shin-Etsu Chemical

- JPS Composite Materials

Recent Developments

- On September 15, 2025, Triumph Composites Pvt. Ltd. and Quartz Fibre Private Limited acquired the entire shareholding of IPM Inc. and OC NL Invest Cooperatief U.A. in Owens-Corning (India) Pvt. Ltd., which is a part of Owens Corning’s glass fibre reinforcement business

- In 2025, SCHOTT acquired QSIL, strengthening its quartz glass production capabilities and expanding its advanced materials presence across Europe.

- In 2024, Teijin / Renegade Materials Corp. achieved NCAMP certification for a low-dielectric quartz fiber prepreg used in radomes.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Yarn Type, End Use Industry, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand from aerospace and defense will continue to drive product innovation.

- Automotive lightweighting will strengthen the adoption of quartz yarn composites.

- Chemical processing industries will expand usage for insulation and filtration.

- Construction applications will grow with rising need for durable materials.

- Oil and gas sector will sustain demand for high-temperature sealing solutions.

- Sustainability goals will push manufacturers toward eco-friendly production methods.

- Regional players will focus on customized solutions to capture niche markets.

- Strategic partnerships with OEMs will enhance long-term supply agreements.

- Investments in R&D will improve performance and broaden application scope.

- Supply chain resilience will remain a priority to secure raw materials.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: