Market Overview:

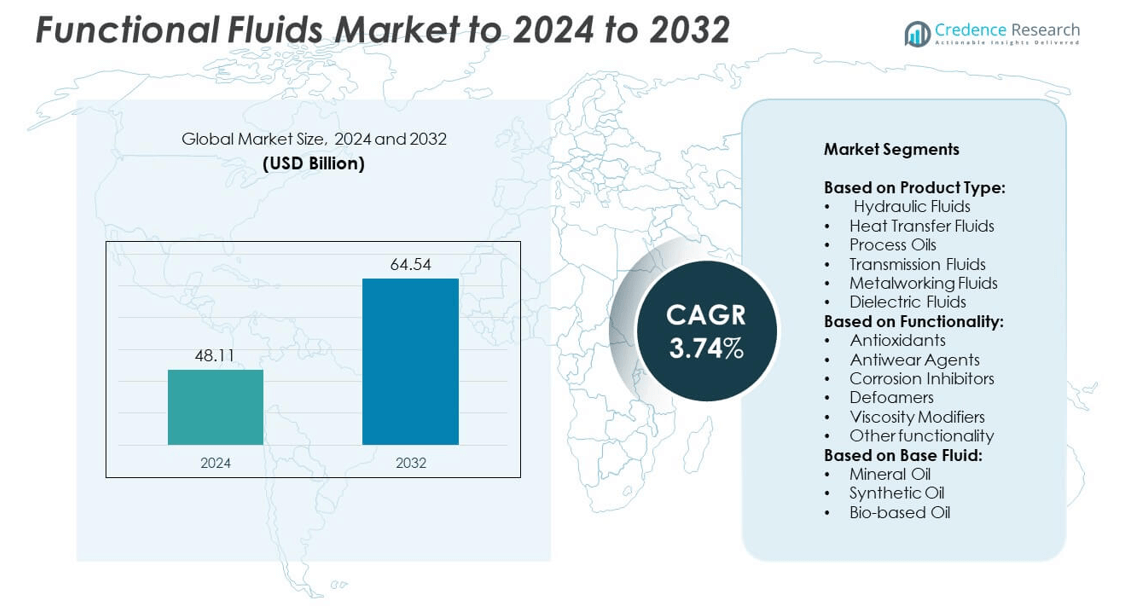

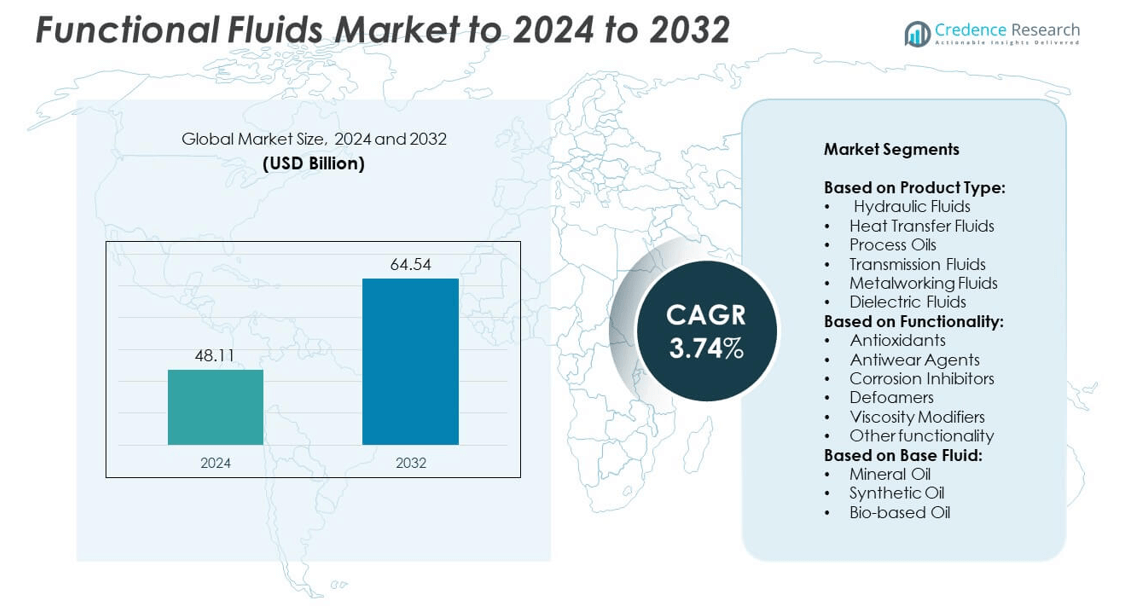

Functional Fluids Market size was valued at USD 48.11 Billion in 2024 and is anticipated to reach USD 64.54 Billion by 2032, at a CAGR of 3.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Fluids Market Size 2024 |

USD 48.11 Billion |

| Functional Fluids Market, CAGR |

3.74% |

| Functional Fluids Market Size 2032 |

USD 64.54 Billion |

The functional fluids market is led by prominent players including BASF SE, TotalEnergies SE, Solvay, Shell plc, Infineum International Ltd., Chevron Phillips Chemical Company LP, Idemitsu Kosan Co., Ltd., 3M, Castrol Limited, BP p.l.c., Exxon Mobil Corporation, Fuchs Petrolub SE, JXTG Nippon Oil Energy Corporation, The Chemours Company, and DowDuPont. These companies compete through advanced formulations, sustainability initiatives, and global expansion strategies. Regionally, Asia Pacific dominates the market with a 33% share in 2024, supported by rapid industrialization, high automotive production, and infrastructure development. North America follows with 32%, driven by strong automotive and industrial demand, while Europe holds 27%, supported by strict environmental regulations and advanced manufacturing.

Market Insights

- The functional fluids market was valued at USD 48.11 billion in 2024 and is projected to reach USD 64.54 billion by 2032, expanding at a CAGR of 3.74% during the forecast period.

- Rising demand from automotive, industrial machinery, and construction sectors drives market growth, with hydraulic fluids leading the product segment holding over 30% share in 2024.

- Key trends include the shift toward synthetic and bio-based fluids, supported by environmental regulations and increasing adoption of high-performance formulations in aerospace, automotive, and energy industries.

- The competitive landscape is shaped by global companies investing in advanced R&D, sustainability-focused products, and digital monitoring technologies, while raw material price volatility and strict compliance requirements act as major restraints.

- Regionally, Asia Pacific leads with 33% share in 2024, followed by North America at 32% and Europe at 27%, while Latin America and the Middle East & Africa collectively account for the remaining 8%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Hydraulic fluids held the dominant share of the functional fluids market in 2024, accounting for over 30% of total revenue. Their leadership is supported by widespread use in construction, manufacturing, and automotive machinery, where fluid power efficiency and equipment reliability are critical. Increasing infrastructure development and industrial automation have further fueled demand. While heat transfer fluids and metalworking fluids are gaining traction in specialized sectors such as chemical processing and automotive manufacturing, hydraulic fluids remain the largest sub-segment due to their broad applicability and rising global heavy equipment sales.

- For instance,In a case study involving a customer manufacturing automotive parts (Volkswagen AG), ExxonMobil reported an average energy savings of 3.7% after switching 22 injection-molding systems to Mobil DTE 10 Excel 46 hydraulic oil

By Functionality

Antiwear agents represented the leading functionality segment in 2024, contributing more than 28% of the market share. Their dominance is driven by the growing need for enhanced equipment durability and reduced downtime in high-load applications. Rising industrialization in Asia-Pacific and increased adoption of high-performance machinery across automotive and aerospace sectors further stimulate demand. Antiwear agents also play a critical role in extending lubricant life and reducing maintenance costs, making them indispensable for end-users. Other functionalities such as antioxidants and corrosion inhibitors continue to grow but hold smaller shares compared to antiwear agents.

- For instance, Lubrizol documented an engine test failure at 23 hours with a non-approved oil versus 96 hours with an approved oil.

By Base Fluid

Mineral oil-based fluids dominated the market in 2024 with over 55% share, owing to their cost-effectiveness, availability, and suitability for large-scale industrial applications. These fluids remain the preferred choice in automotive, power generation, and heavy equipment sectors. However, the synthetic oil sub-segment is witnessing faster growth due to superior thermal stability, lower volatility, and extended service life, appealing to high-performance industries. Bio-based oils are steadily gaining adoption in regions emphasizing sustainability, but their penetration is limited by higher production costs. Overall, mineral oils continue to lead the market, driven by cost-sensitive end-users and wide commercial use.

Key Growth Drivers

Expanding Industrial and Automotive Applications

The functional fluids market is strongly driven by rising demand in automotive and industrial machinery applications. Hydraulic and transmission fluids are essential for efficiency and durability in vehicles and heavy equipment. The growth of electric and hybrid vehicles also supports advanced fluid formulations for cooling and lubrication. In addition, expanding infrastructure projects and industrial automation fuel the use of hydraulic fluids in construction and manufacturing sectors. This broad application base positions automotive and industrial demand as a primary growth driver for the market.

- For instance, ZF produced its 1 millionth TraXon transmission in September 2023.

Shift Toward High-Performance Fluids

The need for fluids with enhanced thermal stability, oxidation resistance, and extended service life has become a major growth factor. Synthetic and specialty fluids are gaining traction in industries where equipment downtime must be minimized. Aerospace, power generation, and high-end automotive applications increasingly require advanced formulations. As companies prioritize operational efficiency and regulatory compliance, demand for premium fluids is rising. This shift supports higher-value product adoption, making the move toward high-performance functional fluids a crucial market driver.

- For instance, INEOS will lift LaPorte HV PAO capacity to almost 40,000 tpa by mid-2025.

Sustainability and Bio-based Alternatives

Growing focus on sustainability has accelerated demand for bio-based and eco-friendly functional fluids. Environmental regulations and corporate sustainability targets are pushing end-users to adopt biodegradable, low-toxicity formulations. Bio-based oils, although smaller in share, are witnessing strong growth in Europe and North America. Their ability to reduce carbon footprint while meeting performance standards makes them a key driver. Companies are investing in research to improve cost efficiency and scalability of bio-based alternatives, further strengthening their market potential as environmental concerns intensify.

Key Trends & Opportunities

Rising Demand for Synthetic Oils

Synthetic oils are becoming a major trend in the functional fluids market due to their superior performance. These fluids offer higher thermal stability, better viscosity control, and extended equipment life. Adoption is strong in aerospace, high-performance automotive, and chemical processing industries. Growing consumer preference for longer oil-change intervals in vehicles also supports demand. The increasing industrial shift toward efficiency and reliability makes synthetic oils a key opportunity segment, with high growth potential in both developed and emerging markets.

- For instance, in August 2025, Chevron Phillips Chemical announced the completion of an expansion at its Beringen, Belgium, low-viscosity polyalphaolefin (LV PAO) unit. The project doubled the site’s LV PAO capacity to 120,000 metric tons per year, making it the largest decene-based LV PAO facility in Europe by volume.

Integration of Smart Monitoring Technologies

A notable trend is the integration of IoT-enabled monitoring and predictive maintenance in fluid management. Advanced sensors track viscosity, temperature, and contamination levels in real time, improving fluid performance and reducing downtime. This creates opportunities for fluid suppliers to offer value-added solutions combining products with digital services. As industries adopt Industry 4.0 standards, demand for smart fluid management systems is expected to rise. This technology-driven trend strengthens the competitive advantage of suppliers innovating beyond conventional product offerings.

- For instance, Parker’s icountPD operates at a working pressure of 2–420 bar. It has an internal sensor with an optimal flow rate of 60 mL/min and also provides cleanliness codes according to ISO 4406 standards.

Regional Expansion in Emerging Economies

Rapid industrial growth in Asia-Pacific and Latin America is creating significant opportunities for functional fluids. Rising automotive production, infrastructure development, and manufacturing activities are fueling demand for hydraulic, transmission, and process fluids. Countries such as China, India, and Brazil are witnessing strong industrial investments, making them critical growth hubs. The availability of cost-effective labor and supportive government policies further enhance adoption. Expansion in these regions offers suppliers opportunities to strengthen distribution networks and gain long-term competitive advantage.

Key Challenges

Volatility in Raw Material Prices

The market faces significant challenges due to fluctuations in crude oil prices, which directly affect the cost of mineral oil-based fluids. Price volatility impacts profitability for manufacturers and limits end-user adoption in cost-sensitive industries. Sudden increases in feedstock costs can disrupt supply chains and reduce margins. This volatility also pressures companies to diversify their raw material sources and invest in alternative base fluids. Managing raw material uncertainty remains a critical barrier to stable market growth in functional fluids.

Environmental and Regulatory Pressures

Strict environmental regulations present another key challenge for the functional fluids market. Compliance with emission standards, waste disposal rules, and chemical safety requirements increases production costs and limits the use of conventional formulations. Regions such as the EU and North America enforce stringent regulations that drive up R&D and testing expenses. Smaller companies often struggle to meet these requirements, impacting competitiveness. At the same time, growing demand for eco-friendly solutions forces continuous innovation. This regulatory landscape poses ongoing hurdles for market participants.

Regional Analysis

North America

North America accounted for 32% of the functional fluids market in 2024, driven by strong automotive, aerospace, and industrial activity. The United States leads demand with extensive use of hydraulic and transmission fluids in automotive manufacturing and construction equipment. Canada and Mexico further contribute through expanding industrial production and growing vehicle sales. Regulatory emphasis on performance efficiency and lower emissions is encouraging adoption of advanced synthetic and bio-based fluids. Continuous investment in infrastructure and the presence of global manufacturers consolidate the region’s dominant role, supported by innovation in specialty fluids tailored for high-performance industries.

Europe

Europe held 27% of the functional fluids market share in 2024, supported by stringent environmental regulations and demand for sustainable solutions. Germany, France, and the United Kingdom remain the largest contributors due to advanced automotive and industrial sectors. The region’s focus on reducing carbon emissions is accelerating the adoption of synthetic and bio-based fluids. Rising investments in renewable energy and green mobility are also fueling demand for heat transfer and process oils. The presence of leading chemical manufacturers and strong research capabilities position Europe as a critical hub for innovation and regulatory compliance-driven growth.

Asia Pacific

Asia Pacific dominated the market with a 33% share in 2024, making it the largest regional segment. China, India, and Japan are key drivers, with rapid industrialization, high automotive production, and strong infrastructure development fueling demand for hydraulic, transmission, and metalworking fluids. Growing energy projects and chemical processing industries further support market expansion. Increasing adoption of synthetic oils, particularly in Japan and South Korea, highlights the region’s shift toward performance-driven solutions. With supportive government policies and cost advantages in manufacturing, Asia Pacific remains the fastest-growing and most influential region in the global functional fluids landscape.

Latin America

Latin America captured 5% of the functional fluids market in 2024, with Brazil and Mexico leading demand. The region’s automotive sector and expanding industrial base drive the consumption of hydraulic and process oils. Infrastructure investments and increased mining activities further boost demand for functional fluids across various applications. However, reliance on imports and limited local manufacturing capacity pose challenges. Growing partnerships with global suppliers and rising adoption of synthetic fluids in automotive and industrial applications create opportunities for future expansion. Despite its smaller share, Latin America shows potential for steady growth through industrial development.

Middle East and Africa

The Middle East and Africa represented 3% of the functional fluids market share in 2024, supported by oil and gas, construction, and mining sectors. Countries such as Saudi Arabia, South Africa, and the United Arab Emirates drive regional demand. Hydraulic and process fluids remain dominant due to extensive industrial and resource-based activities. However, rising investments in manufacturing and renewable energy projects are creating new opportunities for synthetic and high-performance fluids. Limited local production and dependence on imports remain key constraints, yet the region offers growth prospects with infrastructure expansion and diversification initiatives in emerging economies.

Market Segmentations:

By Product Type:

- Hydraulic Fluids

- Heat Transfer Fluids

- Process Oils

- Transmission Fluids

- Metalworking Fluids

- Dielectric Fluids

By Functionality:

- Antioxidants

- Antiwear Agents

- Corrosion Inhibitors

- Defoamers

- Viscosity Modifiers

- Other functionality

By Base Fluid:

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The functional fluids market features strong competition among leading players such as BASF SE, TotalEnergies SE, Solvay, Shell plc, Infineum International Ltd., Chevron Phillips Chemical Company LP, Idemitsu Kosan Co., Ltd., 3M, Castrol Limited, BP p.l.c., Exxon Mobil Corporation, Fuchs Petrolub SE, JXTG Nippon Oil Energy Corporation, The Chemours Company, and DowDuPont. The competitive landscape is shaped by continuous investment in advanced formulations, sustainability-driven innovation, and expansion into high-growth regions. Companies are focusing on developing synthetic and bio-based fluids to meet evolving environmental standards and performance demands. Strategic partnerships, mergers, and acquisitions are common strategies to strengthen global presence and broaden product portfolios. Market leaders also prioritize digital integration, offering monitoring and predictive maintenance solutions that enhance operational efficiency for end-users. Competition is further driven by price differentiation, regional manufacturing capabilities, and the ability to deliver tailored solutions across automotive, industrial, aerospace, and energy applications, ensuring sustained market relevance

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- TotalEnergies SE

- Solvay

- Shell plc

- Infineum International Ltd.

- Chevron Phillips Chemical Company LP

- Idemitsu Kosan Co., Ltd.

- 3M

- Castrol Limited

- BP p.l.c.

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- JXTG Nippon Oil Energy Corporation

- The Chemours Company

- DowDuPont

Recent Developments

- In 2025, TotalEnergies SE Acquired Corsave and Lubesave’s fire-resistant hydraulic fluids. This acquisition expands TotalEnergies Lubrifiants’ portfolio of high-performance, low-VOC (volatile organic compound) products, particularly for the mining and tunneling industries.

- In 2024, Chevron Corporation introduced Clarity BioEliteSyn AW, a new, high-performance hydraulic fluid. This product is over 90% renewable carbon-based and designed for marine and construction equipment, adhering to strict eco-standards while maintaining durability.

- In 2024, ExxonMobil Corporation Invested heavily in R&D to develop high-performance and environmentally responsible fluids.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Functionality, Base Fluid and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by expanding industrial and automotive applications.

- Synthetic fluids will gain higher adoption due to superior performance and extended service life.

- Bio-based fluids will witness rising demand as sustainability regulations strengthen globally.

- Asia Pacific will remain the fastest-growing region, led by industrialization and automotive output.

- North America and Europe will focus on innovation in high-performance and eco-friendly formulations.

- Demand for smart monitoring technologies in fluid management will increase with Industry 4.0 adoption.

- Volatility in raw material prices will continue to challenge cost stability for manufacturers.

- Environmental compliance will drive higher R&D investments across fluid categories.

- Strategic partnerships and regional expansions will help companies capture emerging market opportunities.

- Customization of fluids for niche sectors like aerospace and renewable energy will expand growth avenues.