Market Overview

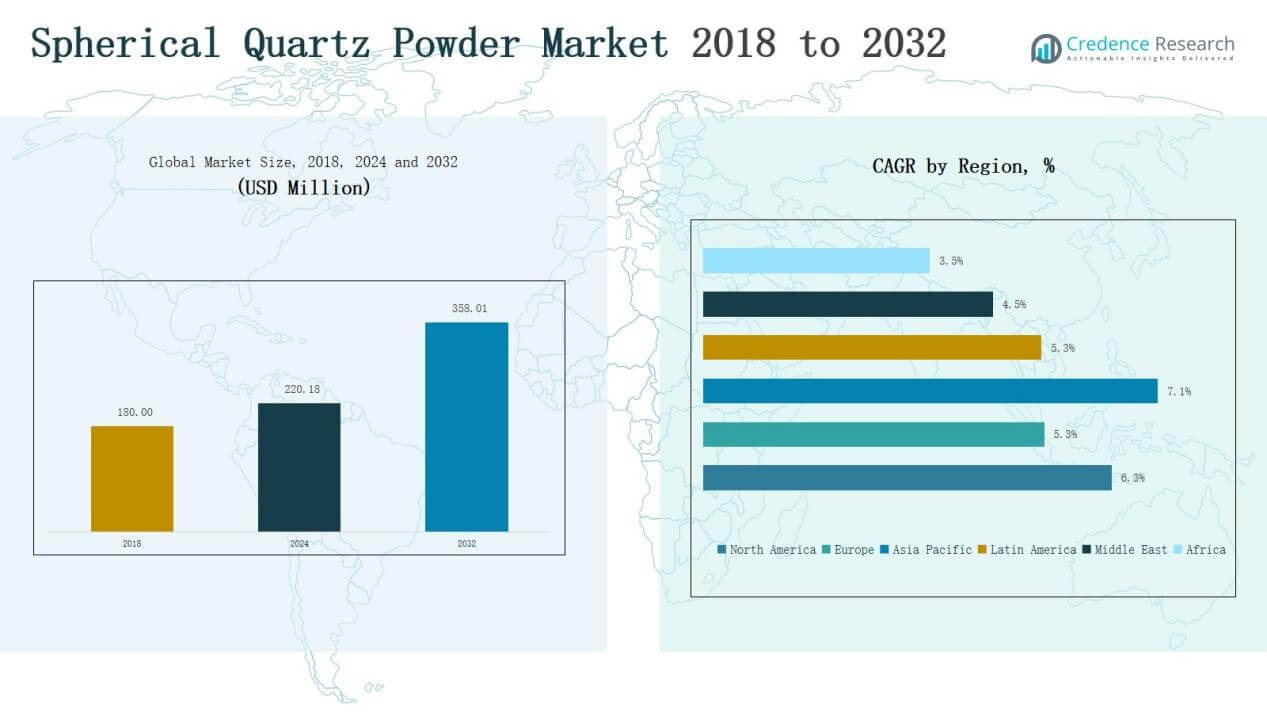

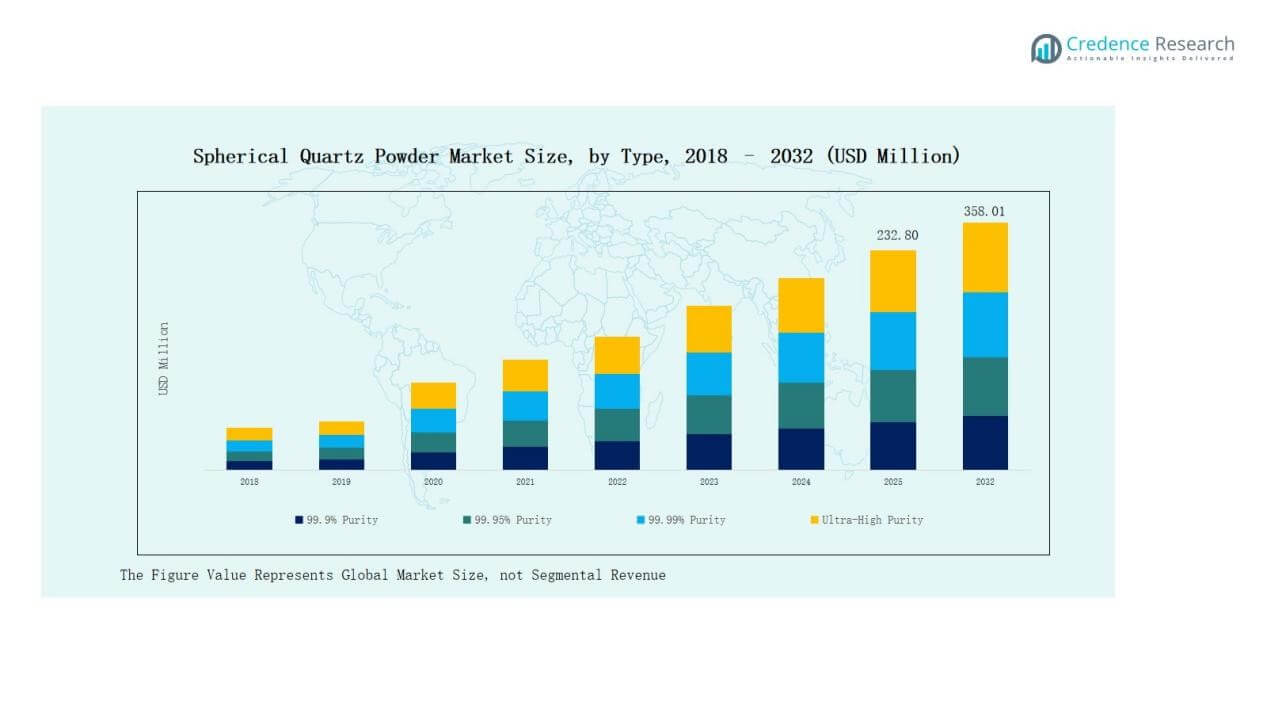

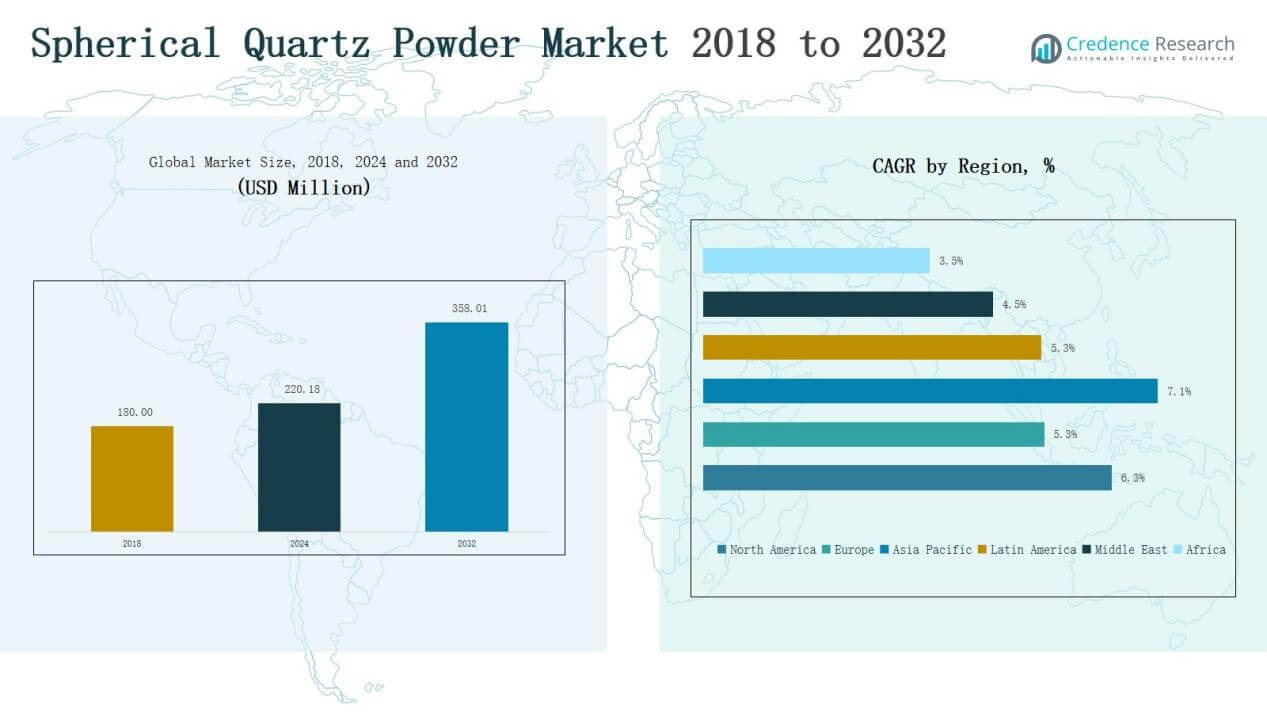

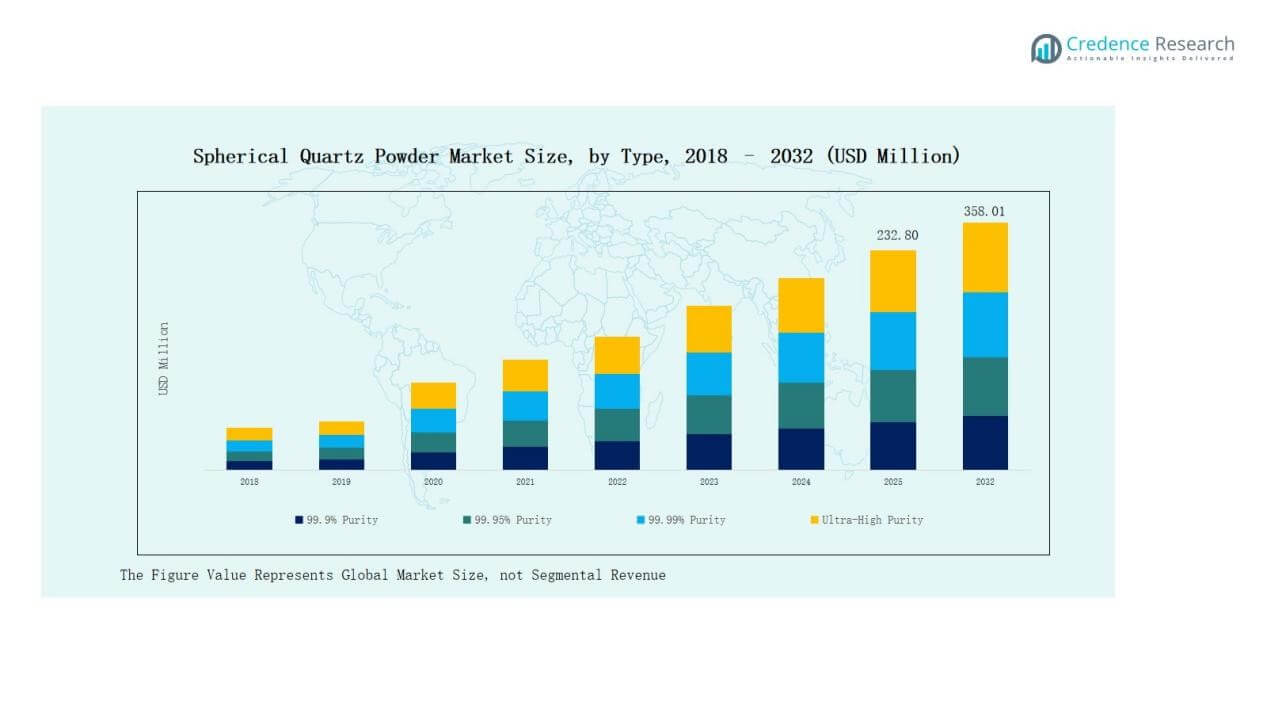

The Spherical Quartz Powder Market size was valued at USD 180.00 million in 2018, reached USD 220.18 million in 2024, and is anticipated to reach USD 358.01 million by 2032, growing at a CAGR of 6.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spherical Quartz Powder Market Size 2024 |

USD 220.18 Million |

| Spherical Quartz Powder Market, CAGR |

6.34% |

| Spherical Quartz Powder Market Size 2032 |

USD 358.01 Million |

The Spherical Quartz Powder Market is characterized by the presence of prominent global and regional players focusing on purity levels, technological advancements, and application-specific solutions. Leading companies include SINOENERGY Group, ALPA Powder Technology, Sinonine, Micron, Denka, Tatsumori, Shin-Etsu Chemical, Tanki New Materials, Tongrun Nano Technology, NOVORAY, Admatechs, FUSO Chemical, Sibelco, Nippon Chemical, and Pacific Quartz, all of which compete through product innovation, high-purity offerings, and strong supply networks. Regionally, Asia Pacific dominated the market in 2024 with a 49% share, supported by robust semiconductor manufacturing, rapid electronics adoption, and expanding automotive and industrial applications.

Market Insights

Market Insights

- The Spherical Quartz Powder Market grew from USD 180.00 million in 2018 to USD 220.18 million in 2024 and is projected at USD 358.01 million by 2032, expanding at a 34% CAGR.

- The 99% purity type segment led with a 38% share in 2024, supported by demand in semiconductor and electronics manufacturing requiring superior chemical stability and minimal impurities.

- By application, semiconductor packaging dominated with 41% share in 2024, driven by rising chip production, miniaturization trends, and growing use in fan-out and wafer-level packaging.

- The semiconductor and electronics industry held 47% share in 2024, with growth driven by digitalization, 5G deployment, and consumer electronics demand, while automotive and aerospace added steady contributions.

- Asia Pacific commanded 49% share in 2024, valued at USD 103.23 million, supported by semiconductor hubs in China, Japan, South Korea, and India, making it the fastest-growing region globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

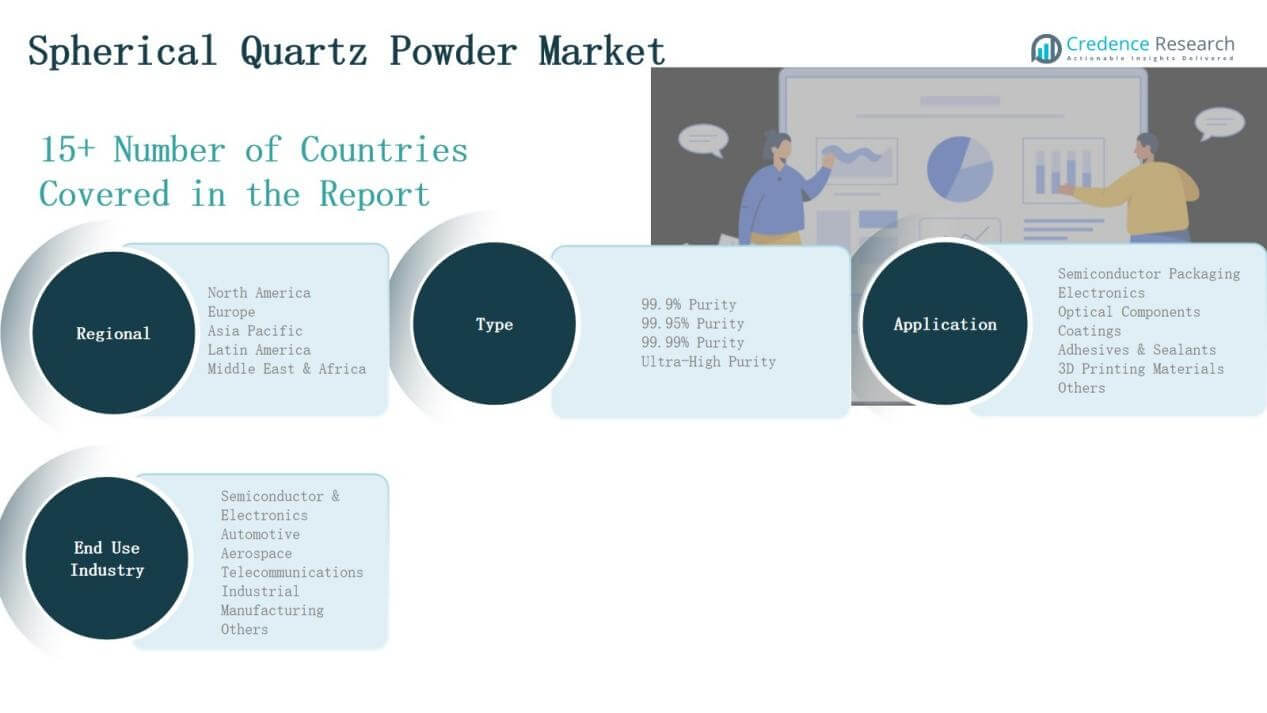

By Type

The 99.99% purity segment dominated the market in 2024 with a 38% revenue share, driven by its widespread use in high-end semiconductor and electronics manufacturing. Its superior chemical stability, low thermal expansion, and minimal impurities make it ideal for advanced integrated circuit packaging. Rising demand for high-performance chips in 5G, AI, and cloud computing continues to strengthen this segment. Ultra-high purity grades are also gaining traction, fueled by growth in aerospace and optical applications requiring extreme material reliability.

For instance, Merck KGaA introduced new electronic-grade specialty materials designed for AI-driven chip manufacturing processes.

By Application

Semiconductor packaging led the market in 2024 with a 41% share, supported by surging chip production and miniaturization trends. Spherical quartz powder ensures uniform filling, low shrinkage, and thermal conductivity in encapsulation materials, enabling higher device performance. The growing adoption of advanced packaging techniques, including fan-out and wafer-level processes, boosts demand. Electronics and optical components followed closely, driven by consumer devices and communication systems. Expanding use in coatings, adhesives, and emerging 3D printing applications is broadening growth opportunities across industries.

For instance, Kyocera developed a new optical substrate using fine spherical silica powder, enhancing reliability in 5G components and fueling its use in high-speed communication devices.

By End-Use Industry

The semiconductor and electronics segment accounted for the largest share at 47% in 2024, owing to rising investments in chip manufacturing and next-generation technologies. Spherical quartz powder plays a vital role in insulation, encapsulation, and precision component manufacturing. Rapid digitalization, 5G deployment, and demand for consumer electronics fuel this dominance. The automotive and aerospace industries also contribute significantly, leveraging quartz powder in advanced sensors and lightweight components. Industrial manufacturing and telecommunications add steady demand across specialized technical applications.

Key Growth Drivers

Rising Demand from Semiconductor Packaging

Semiconductor packaging remains the largest demand driver, with spherical quartz powder widely used in encapsulants and fillers. Its properties—low thermal expansion, high purity, and strong insulation—support high-performance chips. The boom in consumer electronics, 5G networks, and AI-driven applications amplifies demand. Increasing wafer-level and fan-out packaging adoption also boosts consumption. Leading semiconductor hubs in Asia-Pacific and North America continue to expand capacity, further solidifying the importance of quartz powder as a strategic material for advanced chip manufacturing processes.

For instance, TSMC announced plans to expand its advanced packaging facility in Chiayi, Taiwan, investing $2.9 billion to enhance capacity for wafer-level system-on-integrated-chips (SoIC).

Advancements in Electronics and Optical Applications

Electronics and optical component producers increasingly favor spherical quartz powder for its clarity, durability, and thermal stability. Its applications range from LEDs and displays to precision optical lenses. The rapid growth in smartphones, IoT devices, and connected consumer electronics creates sustained demand. In optics, high-purity quartz supports the performance of photonics and laser systems. With industries moving toward miniaturization and energy-efficient solutions, the reliability of quartz powder ensures its continued integration into new product designs, strengthening market growth globally.

For instance, Jiangsu Shengtian New Material Co., Ltd from China manufactures high-purity spherical silica powder used in optical lenses and photonics due to its excellent fluidity and small surface area.

Expansion of Aerospace and Automotive Industries

The aerospace and automotive sectors are steadily increasing adoption of spherical quartz powder in high-performance components. Its role in lightweight composites, thermal coatings, and advanced sensors enhances efficiency and safety. Automotive electrification, autonomous driving technologies, and in-flight communication systems demand advanced materials with superior heat resistance and stability. Quartz powder’s unique characteristics meet these needs effectively. Continuous investment in electric vehicles and aerospace innovation provides long-term growth opportunities, positioning quartz powder as a vital input for critical applications.

Key Trends & Opportunities

Key Trends & Opportunities

Shift Toward Ultra-High Purity Grades

An increasing trend toward ultra-high purity quartz powder is evident, especially for semiconductors and aerospace. With rising miniaturization and stringent reliability requirements, manufacturers prefer 99.99% purity and above. These grades ensure minimal contamination, stable performance, and compatibility with advanced fabrication processes. The opportunity lies in scaling production technologies to consistently deliver such high-purity products. Companies investing in purification and precision processing techniques are well-positioned to capture market share as industries shift toward ultra-reliable, next-generation material solutions.

For instance, in aerospace, ultra-high purity quartz is essential for producing optical fibers used in communication systems on aircraft, where impurities could compromise signal clarity and safety.

Emerging Use in 3D Printing Materials

3D printing presents a growing opportunity for spherical quartz powder as industries explore new material applications. Its flowability, thermal resistance, and ability to enhance composite structures make it valuable for additive manufacturing. Aerospace, automotive, and industrial sectors are experimenting with quartz-based powders for high-strength, heat-resistant prototypes and components. As adoption of additive manufacturing broadens, demand for specialized powders is expected to accelerate. This trend creates a new growth pathway for suppliers diversifying beyond traditional electronics and semiconductor markets.

For instance, TRUNNANO, a reputable supplier, offers spherical quartz powder with a mass fraction of up to 90.5% in resin composites, enhancing thermal stability and matching the thermal expansion of monocrystalline silicon for electronic components.

Key Challenges

High Production and Processing Costs

Producing high-purity spherical quartz powder involves advanced purification, energy-intensive processes, and strict quality control. These steps significantly raise production costs, making the material more expensive than substitutes. Price sensitivity in downstream industries, especially automotive and consumer electronics, often limits widespread adoption. Small and mid-tier manufacturers face difficulties competing with global players that achieve economies of scale. Managing production costs while maintaining required purity levels is a critical challenge, slowing adoption in cost-conscious markets despite growing technical demand.

Environmental and Regulatory Constraints

The extraction and processing of quartz powder raise environmental concerns, including dust emissions, energy usage, and waste management. Governments are enforcing stricter environmental regulations and occupational safety standards for quartz mining and handling. Compliance increases operational costs for manufacturers. In some regions, tightening regulations restrict quartz production capacity, creating supply chain risks. Companies must invest in cleaner production technologies and ensure compliance, but these measures add cost and complexity. Failure to adapt may result in supply disruptions and penalties.

Supply Chain Dependence and Raw Material Availability

The market faces risks from raw material supply dependence, particularly in regions with limited quartz mining resources. A few countries dominate the supply of high-purity quartz, creating potential vulnerabilities from trade restrictions, geopolitical tensions, or export bans. Transportation delays and rising logistics costs also add pressure to global supply chains. As demand rises from electronics and aerospace, ensuring consistent and secure raw material access becomes a major challenge. Diversifying sourcing and building resilient supply chains are critical priorities.

Regional Analysis

North America

North America accounted for a 24% market share in 2024, valued at USD 53.19 million, up from USD 44.28 million in 2018. By 2032, the market is projected to reach USD 86.32 million, growing at a CAGR of 6.3%. Growth is driven by strong semiconductor and electronics manufacturing in the U.S., coupled with increasing adoption in aerospace and automotive industries. Expanding investments in advanced packaging technologies and defense applications further strengthen demand. The region benefits from a robust industrial base and technological innovations, positioning it as a key growth hub within the global spherical quartz powder market.

Europe

Europe captured a 18% share of the global market in 2024, generating USD 40.13 million, compared to USD 34.65 million in 2018. By 2032, the market is forecasted to reach USD 60.24 million, reflecting a CAGR of 5.3%. Growth is supported by advancements in electronics, automotive components, and optical industries. Germany, France, and the UK lead demand with strong semiconductor supply chains and industrial manufacturing. Regulatory emphasis on high-quality materials and energy-efficient technologies drives adoption. Despite moderate growth, Europe remains a significant contributor to global demand, supported by established manufacturing clusters and steady end-user industry expansion.

Asia Pacific

Asia Pacific dominated the global spherical quartz powder market with a 49% share in 2024, valued at USD 103.23 million, up from USD 82.44 million in 2018. The market is anticipated to reach USD 177.32 million by 2032, registering the fastest growth with a CAGR of 7.1%. China, Japan, South Korea, and India drive demand, supported by strong semiconductor manufacturing, rapid electronics adoption, and expanding automotive production. The region’s role as a global hub for chip fabrication and industrial innovation solidifies its dominance. Favorable government policies and rising investments in advanced technologies continue to accelerate regional market expansion.

Market Segmentations:

Market Segmentations:

By Type

- 9% Purity

- 95% Purity

- 99% Purity

- Ultra-High Purity

By Application

- Semiconductor Packaging

- Electronics

- Optical Components

- Coatings

- Adhesives & Sealants

- 3D Printing Materials

- Others

By End-Use Industry

- Semiconductor & Electronics

- Automotive

- Aerospace

- Telecommunications

- Industrial Manufacturing

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The spherical quartz powder market is moderately consolidated, with a mix of global leaders and regional specialists competing on purity levels, product innovation, and application-specific solutions. Key players such as SINOENERGY Group, ALPA Powder Technology, Shin-Etsu Chemical, Denka, Tatsumori, Admatechs, NOVORAY, FUSO Chemical, and Sibelco dominate through advanced manufacturing technologies and established supply networks. These companies focus on developing ultra-high purity grades to meet stringent requirements of the semiconductor and electronics sectors, which remain the largest demand drivers. Partnerships with downstream industries, capacity expansions, and investments in precision processing strengthen market positions. Smaller regional firms, including Tongrun Nano Technology and Tanki New Materials, compete through customization and cost-effective offerings, particularly in emerging markets. Competition is also shaped by environmental compliance and supply chain security, pushing manufacturers to adopt sustainable processes. Overall, innovation, purity assurance, and strategic alliances are critical factors determining competitive advantage in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- SINOENERGY Group

- ALPA Powder Technology

- Sinonine

- Micron

- Denka

- Tatsumori

- Shin-Etsu Chemical

- Tanki New Materials

- Tongrun Nano Technology

- NOVORAY

- Admatechs

- FUSO Chemical

- Sibelco

- Nippon Chemical

- Pacific Quartz

Recent Developments

- In July 2025, Cabot Corporation launched LITX® 95F conductive carbon for energy storage systems, highlighting its focus on advanced materials innovation.

- In January 2025, Wacker Chemie AG opened new specialty silicone production facilities in Japan and South Korea, strengthening its high-purity chemicals presence.

- In July 2025, Wacker Chemie AG commissioned the Etching Line Next for ultra-pure semiconductor silicon production, reinforcing its capabilities in high-purity material processing.

- In October 2024, Momentive Technologies acquired Sibelco’s spherical alumina and spherical silica businesses in South Korea, strengthening its advanced materials portfolio.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand from semiconductor packaging will continue to dominate due to advanced chip designs.

- Adoption of ultra-high purity quartz powder will rise in electronics and aerospace applications.

- Expansion of 5G networks and AI-driven technologies will increase material requirements.

- Growing use of spherical quartz powder in optical components will support precision manufacturing.

- Automotive electrification will drive adoption in sensors, coatings, and advanced components.

- Emerging applications in 3D printing will create new growth opportunities.

- Industrial manufacturing will expand usage in adhesives, sealants, and coatings.

- Sustainability practices in production will gain importance due to regulatory pressures.

- Asia Pacific will maintain its leadership with strong semiconductor and electronics industries.

- Strategic collaborations among suppliers and end users will accelerate product innovation.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: