Market Overview

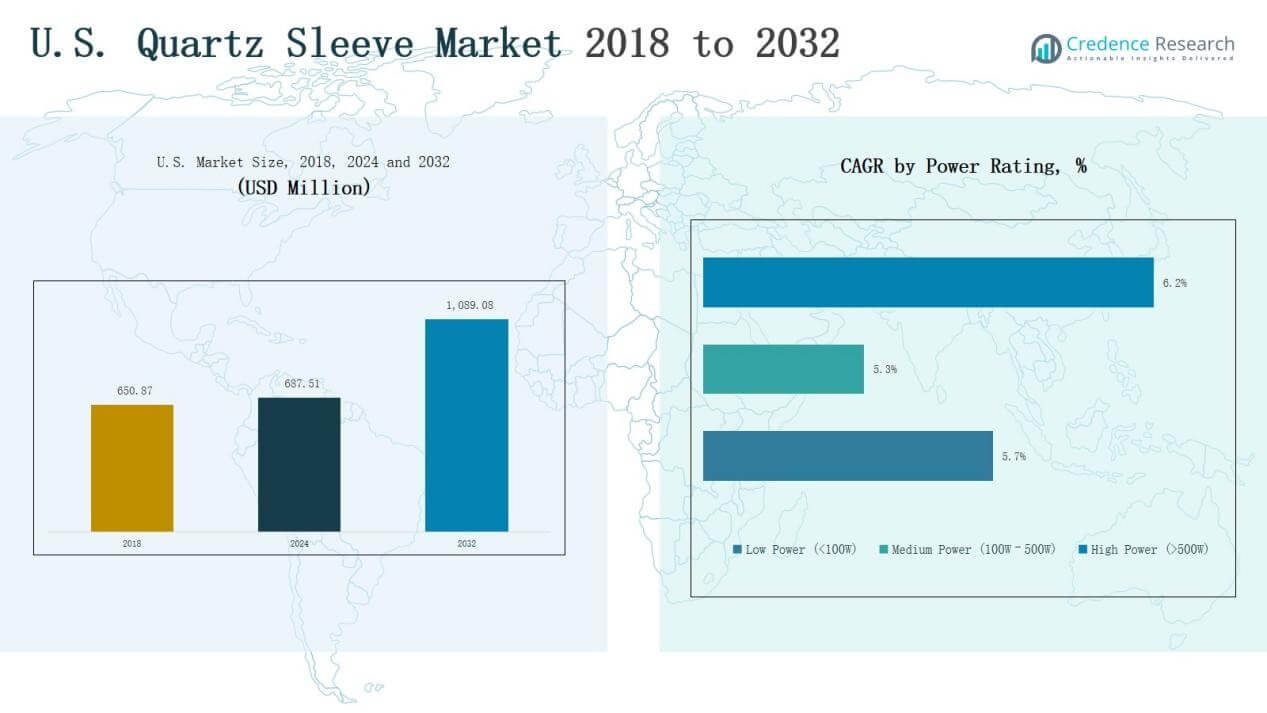

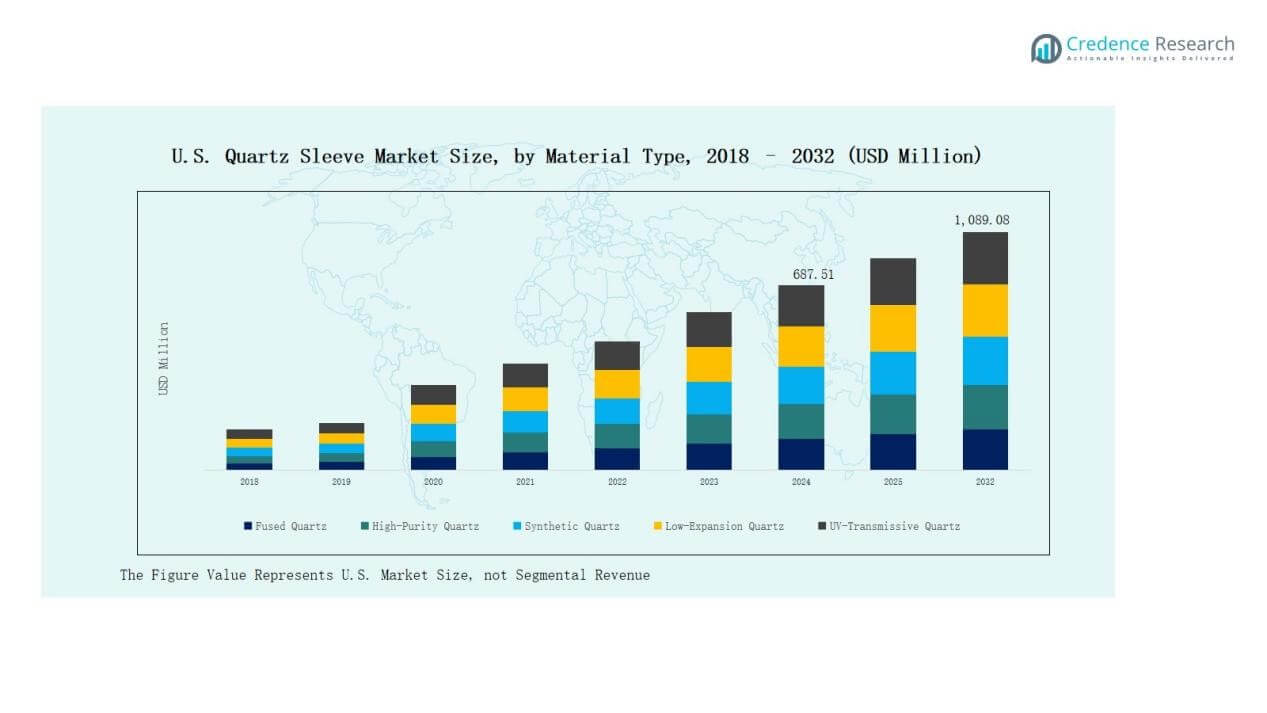

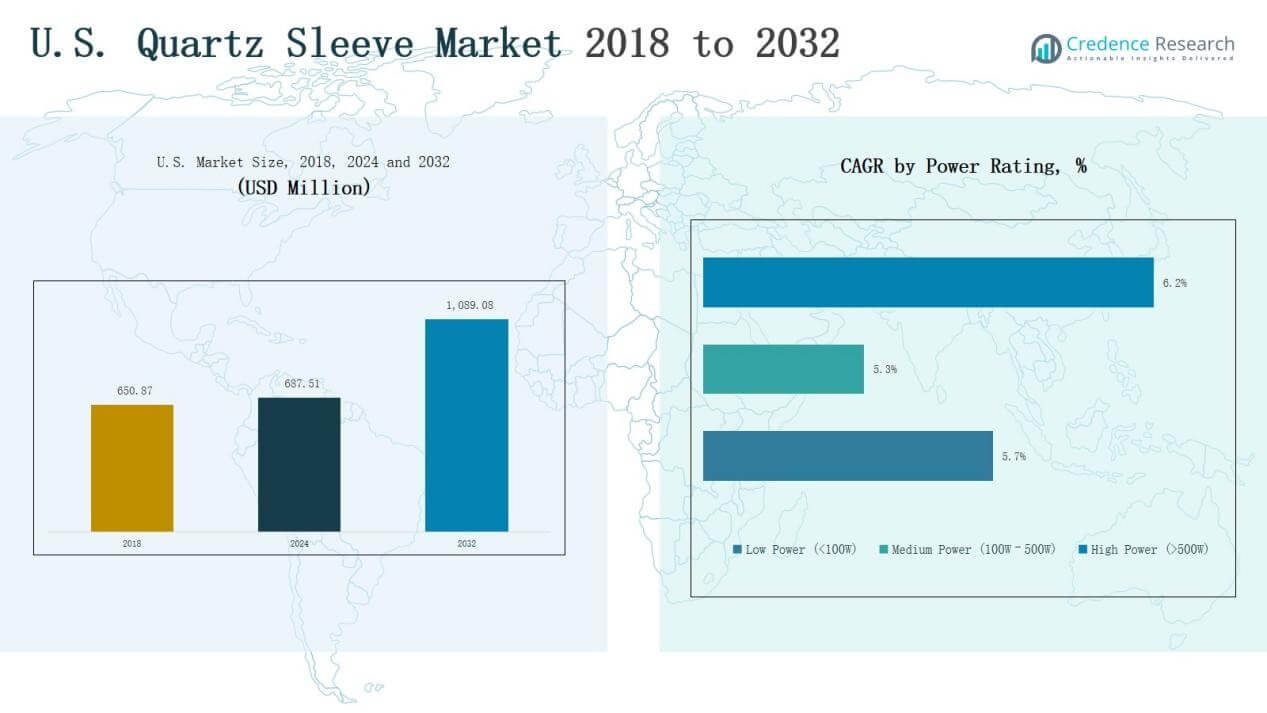

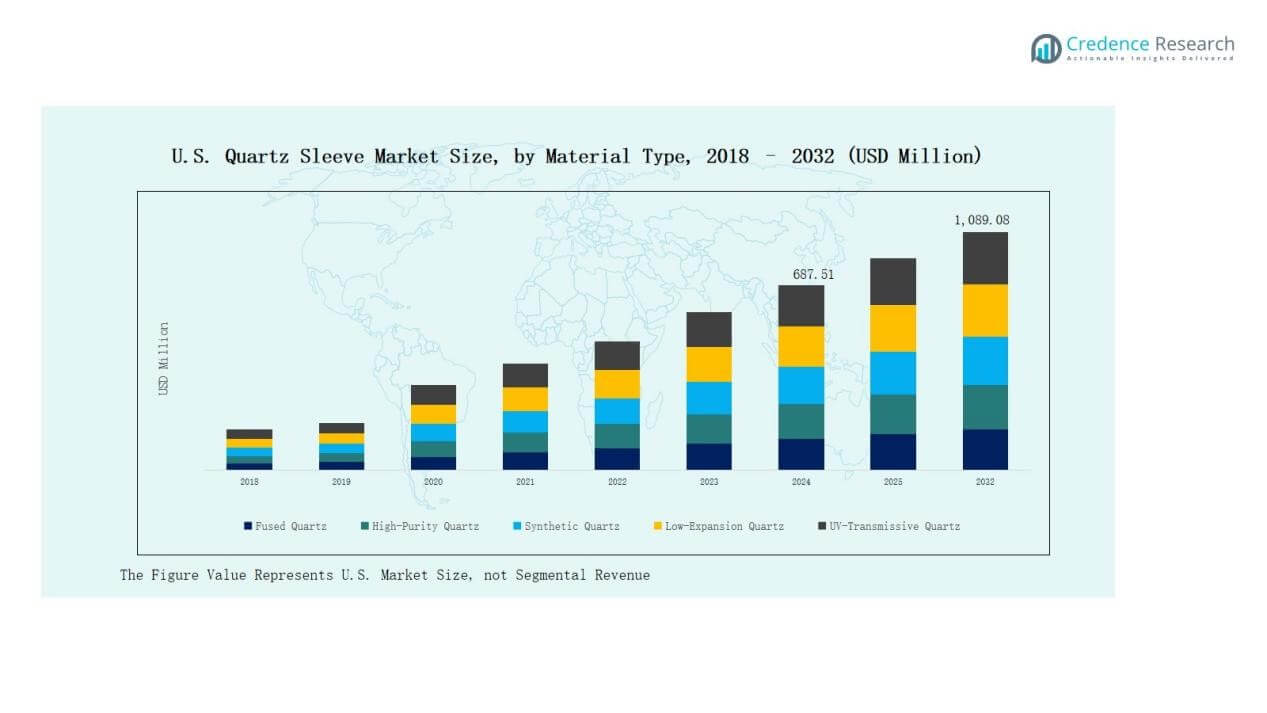

U.S. Quartz Sleeve Market size was valued at USD 650.87 million in 2018, reached USD 687.51 million in 2024, and is anticipated to reach USD 1,089.08 million by 2032, at a CAGR of 5.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spherical Quartz Powder Market Size 2024 |

USD 687.51 Million |

| Spherical Quartz Powder Market, CAGR |

5.92% |

| Spherical Quartz Powder Market Size 2032 |

USD 1,089.08 Million |

The U.S. Quartz Sleeve Market is shaped by a mix of global leaders and domestic specialists that focus on innovation, material quality, and application-specific solutions. Key players include Heraeus, Saint-Gobain, Momentive Performance Materials, Tosoh Corporation, SGL Carbon, Quartz Scientific, QSI Quartz, Maxsil, Vesuvius, and Mondi Group, each strengthening their positions through advanced manufacturing, strong distribution networks, and product customization for water treatment, semiconductors, and pharmaceuticals. Among regions, the Northeast commanded the largest share at 28% in 2024, supported by robust municipal water projects, healthcare infrastructure, and pharmaceutical industry concentration.

Market Insights

Market Insights

- The U.S. Quartz Sleeve Market was valued at USD 650.87 million in 2018, reached USD 687.51 million in 2024, and is projected to hit USD 1,089.08 million by 2032, growing at 5.92%.

- Fused quartz dominated by material type with 36% share in 2024, driven by thermal resistance, chemical stability, and demand from UV disinfection systems and semiconductor applications.

- UV water disinfection led by application with 41% share in 2024, supported by municipal water projects, rising residential adoption, and industrial demand for safe and reliable water solutions.

- Water treatment was the leading end-user with 39% share in 2024, fueled by regulatory standards, municipal projects, and industrial use, followed by food, pharmaceuticals, and semiconductor industries.

- Regionally, the Northeast commanded 28% share in 2024, supported by dense urban infrastructure, municipal water treatment initiatives, strong healthcare systems, and pharmaceutical industry presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Material Type

Fused quartz dominated the U.S. Quartz Sleeve Market in 2024 with a 36% share. Its strong thermal resistance, chemical stability, and durability make it the preferred material for UV disinfection systems and semiconductor applications. Demand is further supported by its ability to withstand extreme operating conditions and maintain high UV transmission levels. High-purity quartz follows closely, driven by expanding use in electronics and pharmaceuticals where superior optical clarity and low impurity levels are critical.

For instance, Heraeus launched a new line of fused quartz sleeves designed for advanced UV-C disinfection equipment, ensuring high transmission stability under extreme operating conditions.

By Application

UV water disinfection accounted for the largest share at 41% of the U.S. Quartz Sleeve Market in 2024. This dominance stems from rising concerns over safe drinking water, municipal water treatment initiatives, and increasing adoption of UV-based systems in residential and industrial settings. UV air and surface disinfection are also gaining traction, particularly post-pandemic, due to heightened demand for sterilization solutions in healthcare and commercial facilities. Chemical processing remains a niche but steady growth contributor.

For instance, Atlantic Ultraviolet Corporation reported increased shipments of its GERMICIDAL UV-C fixtures for hospitals and laboratories, highlighting the growing demand for quartz-sleeve-based air and surface disinfection solutions.

By End-User

Water treatment led the U.S. Quartz Sleeve Market with a 39% share in 2024. Regulatory pressure for clean water standards, rising municipal projects, and industrial adoption drive this segment. Food and beverage follows, fueled by demand for hygienic processing environments and regulatory compliance. The pharmaceutical sector also contributes significantly, with quartz sleeves enabling sterilization in sensitive manufacturing processes. Semiconductor and electronics applications are expanding, leveraging quartz’s purity and precision. Oil and gas remains smaller but steady, focused on specialized applications.

Key Growth Drivers

Rising Demand for UV Disinfection Technologies

The U.S. Quartz Sleeve Market benefits from increasing adoption of UV-based water, air, and surface disinfection systems. Growing awareness of waterborne diseases, coupled with strict environmental regulations, drives municipal and industrial sectors to invest in UV disinfection. Quartz sleeves play a crucial role in ensuring lamp efficiency and durability, supporting long-term system performance. Expanding urbanization and the need for reliable sanitation infrastructure further reinforce demand, making UV disinfection one of the most influential drivers shaping market growth across the country.

For instance, in 2025, UV Smart rolled out its D60 device across medical facilities, enabling hospitals to reduce annual CO2 emissions by approximately 19,180 pounds while cutting chemical and water usage from disinfection routines.

Expansion of Semiconductor and Electronics Manufacturing

Quartz sleeves are essential in high-purity applications within semiconductor manufacturing due to their thermal resistance and optical clarity. The U.S. semiconductor industry continues to expand with investments in advanced chip fabrication and cleanroom facilities. Demand for precision-engineered quartz sleeves is rising, as manufacturers require high-quality materials to support wafer processing and lithography. Government-backed initiatives promoting domestic chip production amplify this trend, positioning the semiconductor sector as a critical growth driver for quartz sleeves in advanced technology applications.

For instance, SemiMat delivered ultra-pure quartz rings and process chambers for chipmakers in Germany, supporting homogeneous layer growth in epitaxy and high-temperature wafer processing applications.

Growth in Pharmaceutical and Food Industries

Pharmaceutical and food processing industries in the U.S. are increasingly reliant on quartz sleeves for sterilization and contamination control. The sleeves support UV systems that ensure product safety, meeting strict regulatory standards for hygiene. Rising consumption of packaged foods and expanding biologics manufacturing boost the adoption of quartz sleeves in these industries. Their ability to maintain high UV transmittance while withstanding demanding operating conditions makes them vital components. This growing dependence strengthens their role as a driver of sustained market growth.

Key Trends & Opportunities

Key Trends & Opportunities

Shift Toward High-Purity and Synthetic Quartz

The market is witnessing a transition toward high-purity and synthetic quartz materials, driven by rising demand in electronics, pharmaceuticals, and UV disinfection. These grades offer improved optical performance, minimal impurities, and greater reliability in sensitive applications. Manufacturers are investing in advanced processing technologies to meet growing specifications from end-users. This trend is opening opportunities for companies to differentiate their offerings through quality and innovation, strengthening competitive positioning in industries that require precision, durability, and strict compliance with performance standards.

For instance, AGC Inc. revealed it had delivered customized high-purity quartz glass tubes for next-generation UV-C disinfection systems, emphasizing their improved transmission and low-impurity composition documented in product datasheets

Increasing Adoption of E-Commerce and Direct Sales Channels

The distribution landscape for quartz sleeves is evolving, with growing reliance on online and direct sales platforms. End-users, including smaller facilities and laboratories, prefer digital channels for cost efficiency, faster procurement, and wider product availability. This shift presents opportunities for manufacturers to enhance customer engagement and streamline supply chains. By expanding online presence and offering customizable solutions, companies can access broader markets while improving responsiveness to demand fluctuations, creating growth potential beyond traditional distributor-led sales models in the U.S.

For instance, VIQUA’s site lists 17 quartz sleeve SKUs and a Parts Finder tool, enabling quick self-service purchases. This reduces support load and shortens procurement steps. It supports both residential and professional users.

Key Challenges

High Production Costs and Material Limitations

Quartz sleeve manufacturing requires advanced processes and high-purity raw materials, leading to significant production costs. Dependence on specialized techniques and limited global sources of raw quartz add to the expense. These cost pressures often result in higher product prices, restricting adoption in cost-sensitive applications. Manufacturers face ongoing challenges in balancing quality with affordability. Any fluctuation in raw material availability or pricing can disrupt supply chains, making cost management a critical barrier to achieving broader market penetration in the U.S.

Intense Competition Among Domestic and Global Players

The U.S. Quartz Sleeve Market is highly competitive, with domestic manufacturers and global leaders competing for market share. Continuous innovation, product customization, and service differentiation are vital to maintaining an edge. However, price competition intensifies as regional players offer alternatives at lower costs, putting pressure on established firms. This competitive environment challenges profitability and makes it harder for companies to sustain margins. Players must focus on R&D investment, partnerships, and efficiency improvements to withstand competition and secure growth.

Stringent Regulatory and Compliance Requirements

Quartz sleeves used in water treatment, food processing, and pharmaceuticals must meet strict performance and safety standards. Compliance with U.S. regulations and international certifications requires continuous testing, documentation, and investment in quality assurance. These regulatory burdens increase operational costs and can delay product launches. Smaller manufacturers often struggle to keep pace with compliance requirements, limiting their ability to compete with larger firms. Meeting evolving standards remains a key challenge, as industries demand higher levels of transparency, durability, and reliability.

Regional Analysis

Northeast

The Northeast held 28% share of the U.S. Quartz Sleeve Market in 2024. The region benefits from dense urban infrastructure and strong demand for municipal water treatment projects. It supports high adoption of UV disinfection systems in residential and commercial facilities. The pharmaceutical hubs in states like New Jersey and Massachusetts increase reliance on quartz sleeves for sterilization processes. Rising healthcare and biotech investments further enhance demand. It is positioned as a key region with growth supported by regulatory-driven adoption and advanced industrial clusters.

Midwest

The Midwest accounted for 23% share of the U.S. Quartz Sleeve Market in 2024. The region’s dominance is supported by its large manufacturing base, including food and beverage processing plants and industrial facilities. Municipal water treatment projects across states such as Illinois and Ohio boost demand. Growing semiconductor activities also strengthen adoption of high-purity quartz materials. The presence of agricultural processing units expands UV disinfection applications. It continues to show steady demand supported by industrial and municipal infrastructure investments.

South

The South represented 27% share of the U.S. Quartz Sleeve Market in 2024. The region benefits from population growth, urban expansion, and rising investments in water and wastewater treatment plants. The food and beverage industry in Texas and surrounding states creates strong demand for sterilization solutions. Expanding oil and gas operations add niche requirements for quartz sleeves. Growing healthcare facilities and pharmaceutical production also reinforce adoption. It remains a competitive region with broad demand across multiple industries.

West

The West held 22% share of the U.S. Quartz Sleeve Market in 2024. California leads with demand from advanced semiconductor and electronics industries, supported by Silicon Valley’s expansion. Water scarcity issues drive heavy investment in UV water treatment systems across the region. Rising adoption of sustainable technologies strengthens market presence. Food and beverage processing and healthcare sectors also support steady demand. It remains a dynamic region where innovation and industrial diversity sustain market momentum.

Market Segmentations:

Market Segmentations:

By Material Type

- Fused Quartz

- High-Purity Quartz

- Synthetic Quartz

- Low-Expansion Quartz

- UV-Transmissive Quartz

By Application

- UV Water Disinfection

- UV Air Disinfection

- UV Surface Disinfectio

- Chemical Processing

- Others

By End-User

- Water Treatment

- Food & Beverage

- Pharmaceutical

- Semiconductor & Electronics

- Oil & Gas

- Others

By Power Rating

- Low Power (<100W)

- Medium Power (100W–500W)

- High Power (>500W)

By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Aftermarket / Distributors

- Direct Sales

- Online / E-Commerce

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Quartz Sleeve Market is highly competitive, shaped by global leaders and specialized domestic players. Companies such as Heraeus, Saint-Gobain, Momentive Performance Materials, Tosoh Corporation, and SGL Carbon maintain strong positions through advanced manufacturing capabilities, high-purity product offerings, and extensive distribution networks. Domestic firms including Quartz Scientific, QSI Quartz, Maxsil, and regional specialists enhance competitiveness by providing customized solutions tailored to water treatment, semiconductor, and pharmaceutical applications. Competition intensifies as players emphasize product quality, UV transmittance performance, and durability to address regulatory standards in water and food safety. Strategic focus on partnerships, R&D investments, and capacity expansions is evident, with many companies aligning portfolios toward high-purity and UV-transmissive quartz. Price competition persists, particularly from regional suppliers targeting niche end users and aftermarket sales. The market structure highlights a blend of global scale and localized expertise, making innovation, cost efficiency, and compliance adherence crucial for sustaining long-term leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Heraeus

- Quartz Scientific, Inc.

- Saint-Gobain

- Momentive Performance Materials

- Tosoh Corporation

- Vesuvius

- Maxsil

- Mondi Group

- SGL Carbon

- QSI Quartz

Recent Developments

- In June 2025, Trojan Technologies launched the TrojanUV AOP Demonstration System to showcase advanced water disinfection.

- In mid-2025, Alpha-Purify joined a newly formed UV Alliance as one of its first members.

- In September 2024, Southern Lamps announced the acquisition of the medium pressure division of Superior Quartz Products, strengthening its presence in the U.S. quartz sleeve and UV lamp market.

- In 2024, Alpha-Cure Ltd. acquired the amalgam lamp technology division from Superior Quartz Products, Inc.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End User, Power Rating, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for UV disinfection systems will continue to drive quartz sleeve adoption across industries.

- Water treatment projects will remain the leading contributor to market growth nationwide.

- Semiconductor and electronics manufacturing will increase reliance on high-purity quartz materials.

- Pharmaceutical and food industries will expand quartz sleeve usage for sterilization and hygiene compliance.

- E-commerce and direct sales channels will grow as preferred distribution models for end users.

- Rising investments in sustainable technologies will strengthen adoption of UV-based solutions.

- Product innovation will focus on enhancing UV transmittance and material durability.

- Competition between global leaders and domestic players will intensify, pushing for cost efficiency.

- Regulatory standards in water and food safety will reinforce steady demand for quartz sleeves.

- Regional growth will remain diverse, with the South and West expected to show robust expansion.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: