Market Overview

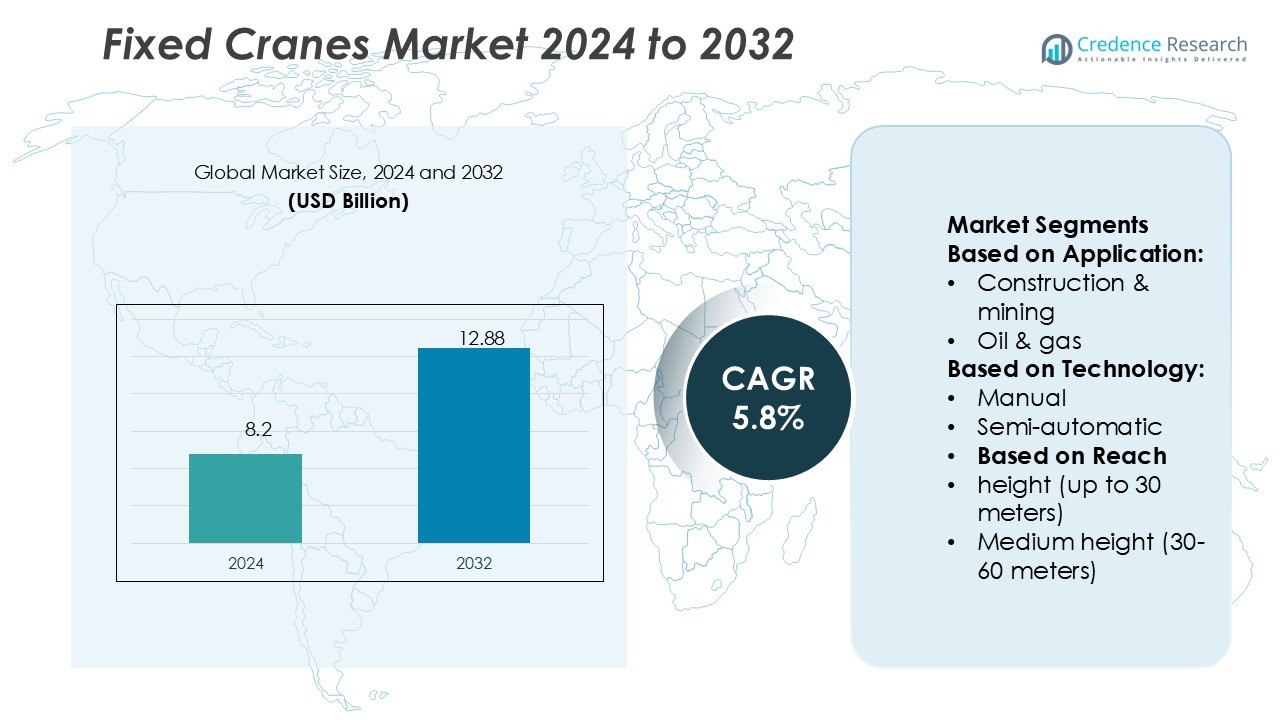

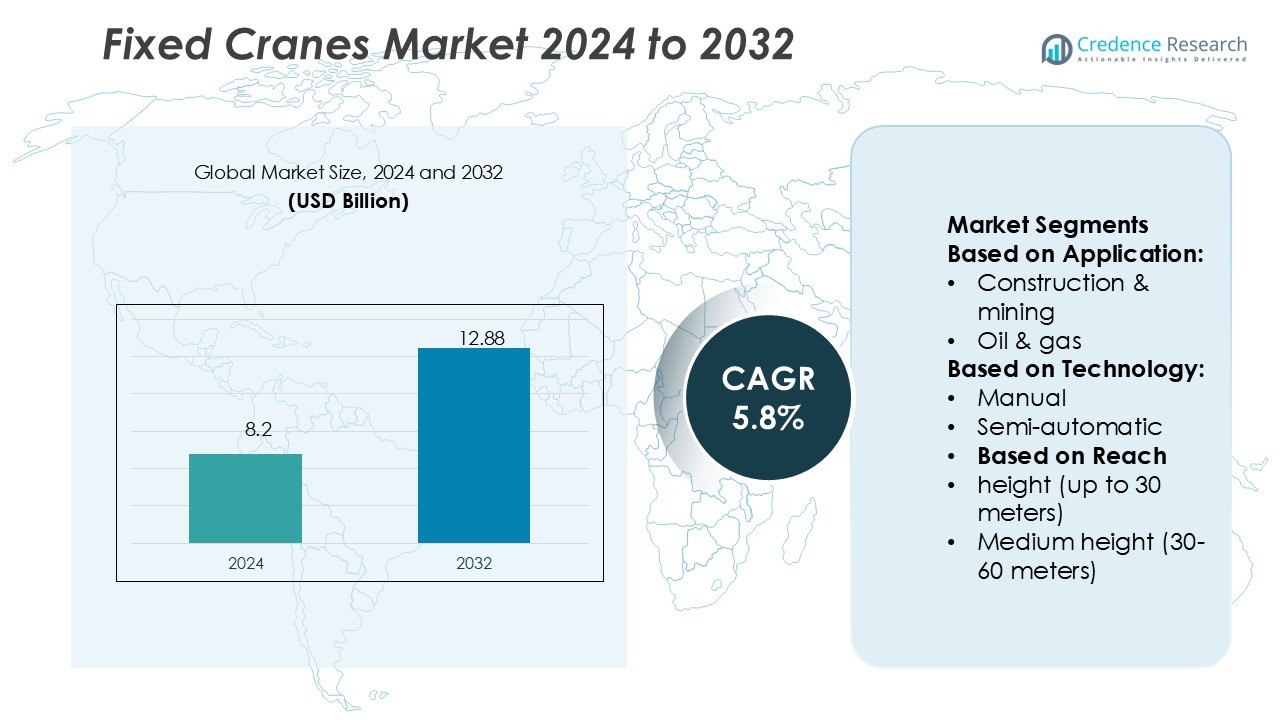

Food Flavors and Enhancers Market size was valued USD 9.24 billion in 2024 and is anticipated to reach USD 14.51 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Flavors and Enhancers Market Size 2024 |

USD 9.24 Billion |

| Food Flavors and Enhancers Market, CAGR |

5.8% |

| Food Flavors and Enhancers Market Size 2032 |

USD 14.51 Billion |

The food flavors and enhancers market is shaped by top players such as Givaudan S.A, Archer Daniels Midland Company, A&B Ingredients, Ajinomoto Group, Sensient Technologies Corporation, B&G Foods Inc, International Flavors and Fragrances, Kerry Group, Koninklijke DSM N.V., and Cargill Inc. These companies drive competition through innovation, sustainability initiatives, and expanding portfolios of natural and functional flavor solutions. They focus on catering to consumer demand for clean-label and plant-based products while leveraging advanced technologies for product stability and taste enhancement. Regionally, Asia Pacific leads the market with a dominant 34% share, supported by rapid urbanization, growing disposable incomes, and strong demand for processed food and beverages across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Flavors and Enhancers Market size was USD 9.24 billion in 2024 and is projected to reach USD 14.51 billion by 2032, growing at a CAGR of 5.8%.

- Rising demand for natural, clean-label, and plant-based products is a major driver, supported by health-conscious consumers and stricter regulations on artificial additives.

- Key players including Givaudan, ADM, Ajinomoto, Kerry, and Cargill focus on innovation, sustainability, and advanced technologies such as biotechnology and encapsulation to maintain competitiveness.

- Volatility in raw material prices and high regulatory compliance requirements act as restraints, increasing production costs and creating challenges for manufacturers.

- Asia Pacific leads with 34% share due to urbanization, rising incomes, and strong processed food demand, while fruit flavors dominate with 38% share and beverages remain the top application with 42% share globally.

Market Segmentation Analysis:

By Type

The food flavors and enhancers market is segmented into natural and synthetic flavors. Natural flavors dominate with a 61% market share, driven by rising consumer preference for clean-label and organic products. Health-conscious buyers actively seek plant-based and minimally processed ingredients, which fuels steady demand for natural alternatives. Regulatory restrictions on artificial additives and growing premium product launches in beverages, dairy, and snacks further strengthen the dominance of natural flavors. Synthetic flavors remain significant due to cost-effectiveness and stability, but natural options continue to lead global adoption trends.

- For instance, Givaudan’s Taste & Wellbeing division delivers a large volume of unique natural flavor and functional ingredient formulations, supporting its leadership in the naturals space. The company manages over 300,000 customer briefs and submissions annually across its business units.

By Flavor

Within flavor categories, fruit-based flavors hold the largest share at 38%, supported by strong demand in beverages, dairy, and confectionery. Consumers increasingly prefer refreshing and familiar fruit tastes such as citrus, berry, and tropical variants. The segment benefits from the surge in flavored water, yogurt, and snack launches that highlight fruit-derived profiles. Chocolate and vanilla also remain critical sub-segments, but fruit flavors outperform due to wide versatility and strong regional acceptance across both developed and emerging markets. This trend is reinforced by innovation in natural fruit extracts and plant-derived concentrates.

- For instance, Ajinomoto began a strategic alliance with Solar Foods to develop Solein, a microbial protein that uses CO₂ as feedstock. Prototype food products using Solein have been developed, with plans for commercialization in Singapore.

By Application

Beverages represent the leading application segment with a 42% share, reflecting high consumption of flavored soft drinks, energy beverages, teas, and fortified waters. Growth is driven by continuous product innovations, including sugar-free and functional drink variants. Flavors enhance taste in health-oriented beverages, meeting consumer expectations without compromising nutritional claims. Dairy products and bakery applications also contribute strongly, but beverages consistently dominate due to frequent consumption and broader flavor experimentation. Manufacturers focus on regional taste customization and natural flavor infusions to capture consumer loyalty in this dynamic segment.

Key Growth Drivers

Rising Demand for Natural and Clean-Label Products

Consumer preference for natural, organic, and clean-label products drives significant growth in the food flavors and enhancers market. Growing awareness of health risks linked with artificial additives has shifted demand toward plant-based and minimally processed flavoring solutions. Manufacturers increasingly invest in natural extracts, essential oils, and botanical-based enhancers to meet this demand. Regulatory pressure on artificial ingredients further strengthens the market for natural options. This shift also aligns with the global wellness movement, making natural flavors the leading growth driver across beverages, snacks, and dairy sectors.

- For instance, frozen-vegetable operations of Growers Express, adding manufacturing capacity for Green Giant Riced Veggies and Veggie Spirals with ~155 transferred employees, giving B&G direct control over novel frozen vegetable formats.

Expansion of Processed and Packaged Food Consumption

The rising consumption of processed and packaged food products globally is boosting demand for flavors and enhancers. Rapid urbanization, busy lifestyles, and the growing trend of ready-to-eat meals create opportunities for flavor innovation. Food companies rely on enhancers to improve taste, shelf life, and product appeal. Emerging economies such as India, China, and Brazil are witnessing higher packaged food adoption, accelerating flavor use. This driver is particularly strong in bakery, confectionery, and savory snacks, where flavors are vital to differentiate products in a competitive market.

- For instance, Kerry launched a Digital Centre of Excellence in Naas, supported by a €7.5 million grant, to drive AI-led process improvements across R&D, operations, and sales.

Innovation in Functional and Fortified Foods

Functional and fortified foods are gaining strong traction, and flavors play a critical role in ensuring consumer acceptance. Nutrient-enriched products, such as protein bars, fortified dairy, and functional beverages, often require flavor masking solutions to improve taste. Food enhancers help balance bitterness and enhance palatability, boosting adoption. The increasing popularity of sports nutrition, plant-based protein, and immunity-boosting products provides strong opportunities for flavor and enhancer applications. Companies focus on customized solutions to meet specific nutritional trends, making this a key driver shaping the market’s expansion in the coming years.

Key Trends & Opportunities

Technological Advancements in Flavor Formulation

The industry is witnessing rapid advancements in biotechnology, encapsulation, and fermentation to develop sustainable and stable flavor solutions. These technologies improve flavor release, shelf stability, and cost efficiency, enabling manufacturers to meet diverse consumer demands. Biotech-driven natural flavors, such as those derived from precision fermentation, offer scalability and sustainability advantages. Encapsulation technologies also help preserve delicate flavor compounds in challenging food matrices. These innovations present opportunities for companies to differentiate through advanced product development and align with consumer demand for high-quality and consistent taste experiences.

- For instance, Hasegawa expanded its U.S. R&D center in Cerritos by more than 50 %, adding new chemist labs and pilot scale capabilities to accelerate flavor development.

Growing Demand in Emerging Economies

Emerging markets in Asia-Pacific, Africa, and Latin America present vast opportunities for flavor and enhancer producers. Rising disposable incomes, urbanization, and expanding retail infrastructure drive consumption of processed food and beverages in these regions. Local tastes encourage global players to develop region-specific flavor profiles, strengthening market penetration. The rising middle-class population further accelerates premium product adoption, favoring natural and exotic flavor demand. Partnerships with regional food producers and investments in localized production facilities enhance competitiveness, creating a strong opportunity for companies to expand their geographic footprint.

- For instance, Nature’s Flavors multiple sources, including the company’s LinkedIn and RocketReach profiles, state that Nature’s Flavors has “over 8,000 Natural and Organic products.

Key Challenges

High Regulatory Compliance and Ingredient Restrictions

The food flavors and enhancers market faces strict regulatory frameworks governing ingredient approvals, labeling, and safety standards. Compliance with agencies such as the FDA, EFSA, and regional authorities requires continuous investment in testing and documentation. Frequent changes in regulations on artificial additives and flavoring substances create uncertainties for manufacturers. Non-compliance risks product recalls, reputational damage, and financial losses. Companies must balance innovation with stringent compliance, which increases operational costs and slows product launches, posing a key challenge in sustaining competitive advantage.

Volatility in Raw Material Availability and Pricing

Flavors and enhancers depend heavily on agricultural raw materials such as vanilla, cocoa, fruits, and herbs, which are subject to seasonal fluctuations and climate risks. Price volatility due to crop failures, supply chain disruptions, or geopolitical tensions impacts production costs and profitability. Synthetic substitutes offer some relief, but natural flavor demand continues to rise, intensifying pressure on limited supply sources. Manufacturers must develop resilient sourcing strategies, diversify suppliers, and invest in sustainable farming initiatives to mitigate risks. This remains a persistent challenge in ensuring stable market growth.

Regional Analysis

North America

North America holds a 32% share of the food flavors and enhancers market, driven by strong demand for processed food, beverages, and functional nutrition products. Consumers increasingly seek natural and clean-label flavor solutions, prompting companies to expand botanical and plant-based offerings. The United States dominates regional consumption, with significant investments in flavor innovation for beverages, dairy, and snacks. Canada also shows rising adoption of fortified food products, supporting flavor demand. The region benefits from advanced R&D infrastructure, established food brands, and strict quality standards, ensuring steady growth and maintaining its position as a leading market contributor.

Europe

Europe accounts for 28% of the global market, led by strong consumer preference for natural, organic, and sustainable flavors. Countries like Germany, France, and the United Kingdom dominate consumption due to mature food industries and strict regulations on synthetic additives. European manufacturers emphasize clean-label, allergen-free, and plant-derived flavors to align with evolving consumer expectations. Rising demand for bakery, confectionery, and dairy products further supports market expansion. The region also benefits from strong technological capabilities in flavor formulation and sustainability-driven innovations, which help maintain its competitive position as one of the largest global markets.

Asia Pacific

Asia Pacific leads the food flavors and enhancers market with a commanding 34% share, driven by rapid urbanization, rising disposable incomes, and a growing appetite for processed food and beverages. China and India are the largest contributors, with strong demand for bakery, dairy, and savory snack products. Japan and South Korea also demonstrate high adoption of functional and fortified foods, boosting flavor demand. Multinational companies are expanding production facilities across the region to meet rising consumption and adapt to local taste preferences. This region continues to be the fastest-growing, supported by its vast consumer base and dynamic food industry.

Latin America

Latin America captures 4% of the market, with growth led by Brazil and Mexico. Rising consumption of processed and packaged foods, combined with expanding retail channels, drives regional demand for flavors and enhancers. Consumers in this region show strong interest in fruit-based and traditional flavors, particularly in beverages and confectionery products. Economic improvements and urbanization further support flavor adoption across mid-tier and premium food categories. While the region remains smaller in share compared to others, investments by global flavor houses and local partnerships position Latin America as an emerging growth hub for the industry.

Middle East & Africa

The Middle East & Africa region holds a 2% market share, with increasing opportunities driven by urbanization, a growing youth population, and the expansion of modern retail infrastructure. Countries like South Africa, the UAE, and Saudi Arabia lead adoption due to rising demand for processed food and beverages. Consumers favor innovative and exotic flavors, particularly in snacks, dairy, and beverages. Despite challenges from limited local production and economic disparities, the market benefits from rising disposable incomes and global investments in food processing industries, positioning the region as a developing yet promising contributor to future growth.

Market Segmentations:

By Type:

- Natural Flavor

- Synthetic Flavor

By Flavor:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The food flavors and enhancers market is highly competitive, with leading players including Givaudan S.A, Archer Daniels Midland Company, A&B Ingredients, Ajinomoto Group, Sensient Technologies Corporation, B&G Foods Inc, International Flavors and Fragrances, Kerry Group, Koninklijke DSM N.V., and Cargill Inc. The food flavors and enhancers market is marked by intense competition, driven by continuous innovation and evolving consumer preferences. Companies in the industry focus on developing natural, clean-label, and sustainable flavor solutions to cater to health-conscious buyers and regulatory demands. Investments in advanced technologies such as biotechnology, fermentation, and encapsulation play a vital role in improving flavor quality, stability, and shelf life. Strategic initiatives, including product launches, regional expansions, and partnerships, help strengthen global reach and customer base. The market also witnesses growing emphasis on customized solutions for functional foods, beverages, and plant-based products, reinforcing competitiveness across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Givaudan S.A

- Archer Daniels Midland Company

- A&B Ingredients

- Ajinomoto Group

- Sensient Technologies Corporation

- B&G Foods Inc

- International Flavors and Fragrances

- Kerry Group

- Koninklijke DSM N.V.

- Cargill Inc

Recent Developments

- In May 2025, Galactic launched a new natural oregano flavoring ingredient aimed at enhancing the taste and extending the shelf life of both meat and plant-based protein products. Debuting at IFFA 2025 in Frankfurt, Galimax Flavor O-50 joins the company’s Galimax range.

- In January 2025, McCormick & Company unveiled Aji Amarillo as its Flavour of the Year, highlighting the pepper’s fruity, tropical notes with moderate heat. This selection reflects the company’s commitment to exploring diverse global flavours and catering to evolving consumer tastes.

- In September 2024, The Hershey Company declared a new addition to its Kit Kat lineup: Kit Kat Vanilla. The brand’s new flavor features crisp wafers enrobed in vanilla-flavored crème. It is now available in standard and king sizes at retailers nationwide.

- In April 2024, according to the company, Glanbia PLC is growing its better nutrition platforms by acquiring Flavor Producers LLC from Aroma Holding Co., LLC. for an initial plus deferred consideration.

Report Coverage

The research report offers an in-depth analysis based on Type, Flavor, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with rising demand for natural and clean-label flavors.

- Functional and fortified food products will drive greater use of enhancers.

- Emerging economies will become major growth hubs due to rising processed food consumption.

- Innovation in biotechnology and fermentation will reshape flavor development.

- Plant-based and vegan food trends will accelerate demand for natural extracts.

- Beverage applications will remain the largest segment with strong flavor adoption.

- Regulatory pressure will increase the shift toward sustainable and compliant ingredients.

- Customization of regional and ethnic flavors will gain stronger consumer acceptance.

- Strategic partnerships and acquisitions will strengthen global market positioning.

- Sustainable sourcing of raw materials will remain a critical competitive priority.