Market Overview

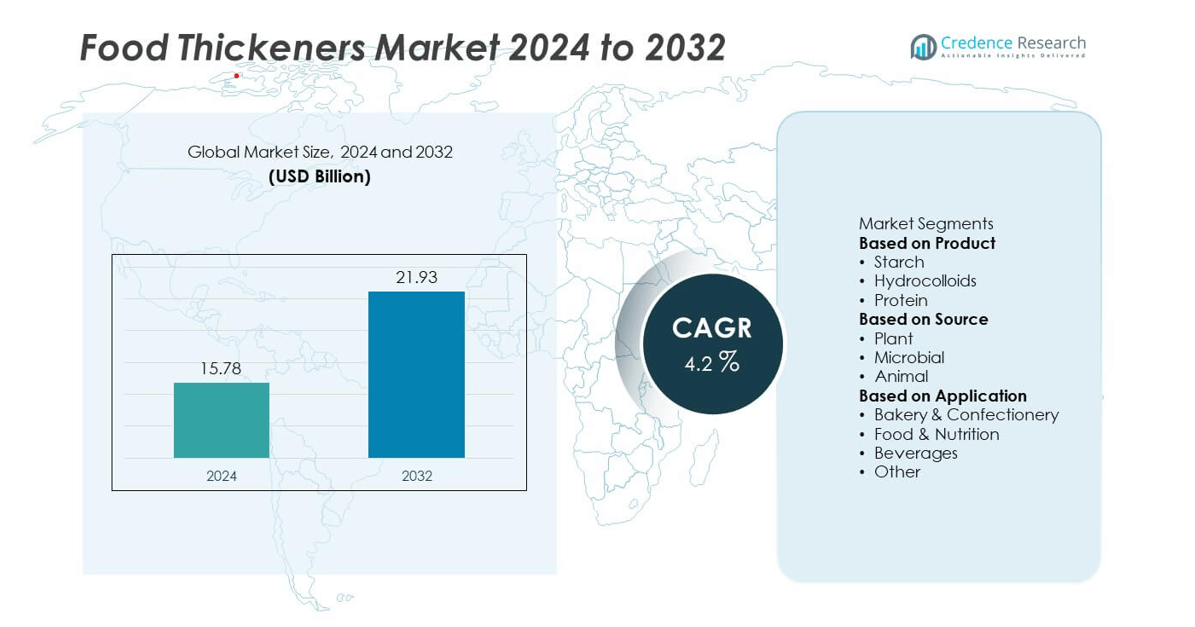

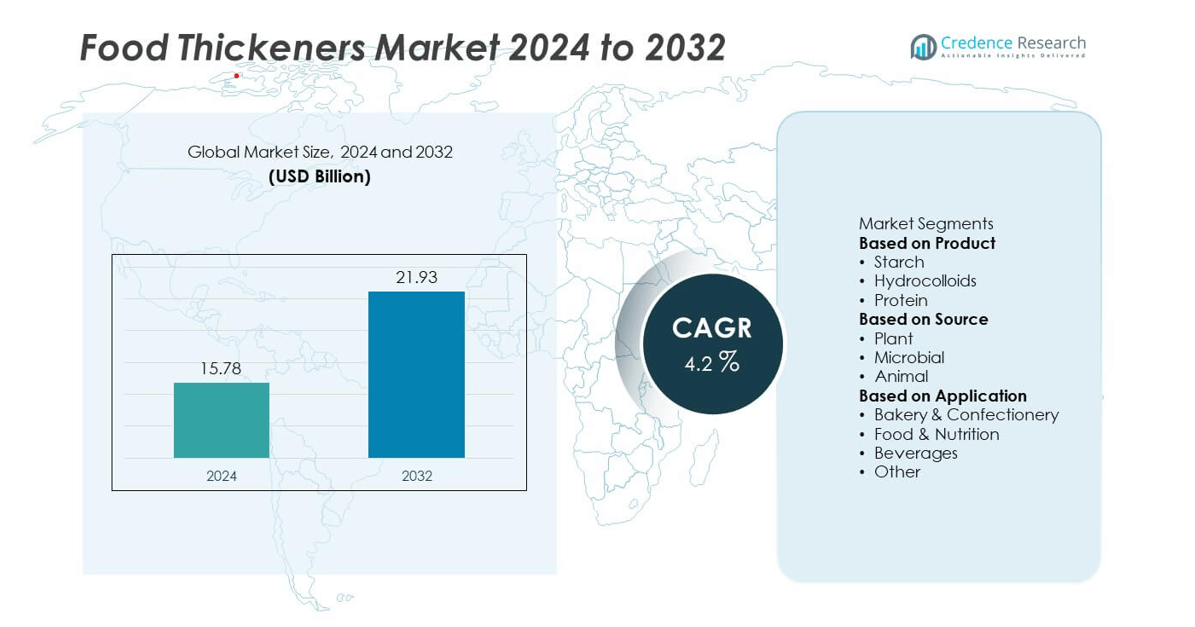

The Food Thickeners Market was valued at USD 15.78 billion in 2024 and is projected to reach USD 21.93 billion by 2032, growing at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Thickeners Market Size 2024 |

USD 15.78 billion |

| Food Thickeners Market, CAGR |

4.2% |

| Food Thickeners Market Size 2032 |

USD 21.93 billion |

The food thickeners market is driven by major players including ADM Company, Jungbunzlauer, Ingredion, Cargill, DowDuPont, Ashland Specialty Ingredients, Fooding Group, Edesang, C P Kelco, and Tate & Lyle. These companies leverage extensive product portfolios, advanced processing technologies, and strong global supply chains to maintain leadership. North America emerged as the leading region in 2024, holding over 35% of the global market share, supported by high demand for processed foods, bakery products, and dairy innovations. Europe followed with 28% share, driven by clean-label and plant-based trends, while Asia Pacific, with 22% share, remained the fastest-growing region due to rising urbanization, population growth, and expanding convenience food consumption.

Market Insights

- The food thickeners market was valued at USD 15.78 billion in 2024 and is projected to reach USD 21.93 billion by 2032, growing at a CAGR of 4.2% during the forecast period.

- Growth is driven by rising demand for processed and convenience foods, coupled with increasing applications of starch, hydrocolloids, and protein-based thickeners across bakery, confectionery, dairy, and beverages.

- Key trends include the shift toward plant-based and clean-label ingredients, along with growing opportunities in functional and specialty foods requiring natural thickeners.

- The competitive landscape features major players such as ADM Company, Cargill, Ingredion, Tate & Lyle, DowDuPont, and C P Kelco, who focus on innovation, sustainable sourcing, and expanding global reach.

- Regionally, North America leads with 35% share, followed by Europe at 28%, and Asia Pacific at 22%, while starch remains the leading product segment with 45% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Starch dominated the food thickeners market in 2024, accounting for over 45% of total revenue. Its wide use in bakery, confectionery, and processed foods is a key driver, as starch enhances texture, viscosity, and shelf life. Modified starches have gained popularity due to their stability under varying pH and temperature conditions. Growing demand for convenience foods and instant formulations further supports starch leadership. Hydrocolloids, including pectin, guar gum, and carrageenan, follow closely due to their functional benefits in beverages and dairy, while protein-based thickeners hold a smaller but growing niche.

- For instance, Ingredion supplies modified and native starches used in bakery mixes and instant sauces to improve viscosity and stability. The company has expanded its specialty starches capacity globally, including in Asia, to meet rising customer demand.

By Source

Plant-based thickeners held the largest share of over 50% in 2024, driven by rising consumer preference for natural and clean-label products. Sources like corn, tapioca, and potato starch dominate global supply, supported by abundant availability and cost efficiency. Growing vegan and vegetarian diets further accelerate adoption of plant-derived options across bakery, dairy, and beverage segments. Microbial sources, such as xanthan gum, are gaining momentum in specialty applications, while animal-derived gelatin maintains a steady role in confectionery. Increasing regulatory push for plant-based formulations sustains the segment’s leadership.

- For instance, Cargill operates extensive corn milling facilities in Iowa, including a plant in Fort Dodge and the facility it acquired in Cedar Rapids in 1967. These operations produce a variety of corn-based food ingredients, such as starches and sweeteners, that serve the global bakery, dairy, and beverage industries.

By Application

The bakery and confectionery segment led the market in 2024 with a share exceeding 35%, reflecting the strong demand for thickeners in cakes, sauces, puddings, and fillings. These ingredients improve texture, stability, and mouthfeel, making them indispensable in large-scale bakery operations. Rising consumption of packaged baked goods and confectionery items globally drives this dominance. Food and nutrition applications form the next major category, fueled by functional foods and dietary supplements. Beverages also contribute significantly, with thickeners used in juices, smoothies, and dairy drinks to ensure consistency and product appeal.

Key Growth Drivers

Rising Demand for Convenience and Processed Foods

The growing popularity of ready-to-eat and packaged food products significantly drives the food thickeners market. Consumers seek convenient meal solutions that offer consistent taste, appealing texture, and longer shelf life. Thickeners like starches and hydrocolloids enhance viscosity, improve product stability, and maintain freshness. Urbanization and busier lifestyles are increasing dependence on processed foods, baked goods, and beverages, especially in emerging economies. This shift fuels strong demand for food thickeners across diverse categories, strengthening their role as essential additives in modern food manufacturing.

- For instance, Tate & Lyle produces a wide variety of modified tapioca and corn starches in its facilities in Thailand and the U.S., which support global food and beverage manufacturers with texture-enhancing solutions for products like soups, sauces, and packaged foods.

Increasing Health and Nutrition Awareness

The rising focus on health-conscious diets boosts demand for functional food products enriched with thickeners. Hydrocolloids and proteins are widely used in fortified foods, dietary supplements, and low-fat formulations to improve mouthfeel and texture without compromising nutritional quality. Consumers increasingly prefer natural, plant-based thickeners due to clean-label trends and reduced reliance on synthetic ingredients. The expansion of health-focused product lines by global food brands further accelerates growth. This awareness continues to shift the market toward sustainable, nutrient-rich, and natural formulations, ensuring long-term demand.

- For instance, CP Kelco manufactures gellan gum, which is widely applied in low-fat fortified beverages and dietary supplements to improve stability and mouthfeel without adding calories or synthetic additives.

Expanding Applications in Beverages and Dairy

Food thickeners are witnessing growing usage in beverages and dairy products, supporting their market expansion. In beverages, thickeners improve consistency in juices, smoothies, and flavored drinks, while in dairy they enhance stability in yogurts, creams, and frozen desserts. Rising global dairy consumption and the surge in demand for plant-based dairy alternatives are driving adoption. Hydrocolloids and starches play a vital role in delivering desired texture in these products. The rapid growth of functional beverages and dairy innovations continues to strengthen this application-driven demand.

Key Trends & Opportunities

Shift Toward Plant-Based and Clean-Label Ingredients

A major trend is the rising preference for natural, plant-based, and clean-label thickeners. Consumers are increasingly avoiding artificial additives, boosting demand for starches derived from corn, tapioca, and potato, along with plant-derived hydrocolloids. This trend aligns with vegan and vegetarian dietary shifts, creating opportunities for manufacturers to launch sustainable, label-friendly products. Regulatory support for clean-label claims further strengthens this movement. Companies innovating with natural thickening agents that meet consumer transparency expectations are well-positioned to capture long-term growth opportunities.

- For instance, Jungbunzlauer produces xanthan gum at its production sites in Austria and Canada, supplying clean-label thickeners for plant-based beverages and sauces that require viscosity and stability with usage levels often below 1%.

Innovation in Functional and Specialty Foods

The growing functional food and nutraceutical industry offers significant opportunities for food thickeners. Hydrocolloids and proteins are being incorporated into low-fat, gluten-free, and high-fiber formulations to enhance product performance. Advances in food technology allow thickeners to provide not only texture and stability but also added nutritional value. Rising demand for specialty foods targeting digestive health, weight management, and fitness nutrition fuels innovation. Manufacturers investing in R&D for multifunctional thickeners can leverage this opportunity to expand into high-value segments.

- For instance, ADM supplies soy protein concentrates and isolates, which serve as protein fortifiers and functional thickeners in a wide range of products including gluten-free baked goods and high-protein nutrition bars.

Key Challenges

Volatility in Raw Material Prices

Price fluctuations of raw materials such as corn, potato, and guar gum pose a major challenge for the food thickeners market. Unpredictable supply chain disruptions, climate-related risks, and rising energy costs impact production expenses. These fluctuations directly affect profit margins for manufacturers and create uncertainty in long-term planning. Companies are increasingly seeking alternative sourcing strategies and investing in sustainable raw material cultivation to minimize risk. However, ongoing volatility remains a barrier to cost stability in the industry.

Stringent Regulatory Standards

The food thickeners market faces challenges from strict regulations related to food safety, labeling, and additive use. Regulatory bodies such as the FDA and EFSA closely monitor the approval and usage levels of thickeners. Manufacturers must ensure compliance with varying regional standards, increasing operational complexity. Clean-label expectations further restrict the use of synthetic or chemically modified thickeners, pushing companies toward more expensive natural alternatives. Navigating these regulations while maintaining cost efficiency is a continuing challenge for market players worldwide.

Regional Analysis

North America

North America held the largest share of the food thickeners market in 2024, accounting for over 35% of global revenue. Strong demand for processed foods, bakery products, and dairy innovations drives regional growth. The U.S. leads due to its advanced food processing industry and widespread adoption of starch- and hydrocolloid-based thickeners. Rising consumer preference for clean-label and plant-based ingredients further boosts demand. Canada and Mexico contribute through expanding beverage and confectionery sectors. Continuous product innovation, coupled with regulatory support for safe additives, ensures the region maintains a dominant position throughout the forecast period.

Europe

Europe captured around 28% of the global food thickeners market share in 2024, supported by strong bakery, confectionery, and dairy industries. Countries like Germany, France, and the U.K. lead adoption, driven by high demand for premium and functional foods. Regulatory emphasis on natural, plant-based, and clean-label ingredients shapes market trends. Hydrocolloids such as pectin and carrageenan are widely used in beverages and dairy products. The rising popularity of vegan diets also strengthens demand for plant-derived thickeners. Europe’s established food processing infrastructure and innovation in specialty formulations keep the region a strong contributor to global growth.

Asia Pacific

Asia Pacific accounted for over 22% of the food thickeners market share in 2024, driven by rapid urbanization, population growth, and rising consumption of processed foods. China, India, and Japan are key markets, with starch dominating due to its use in bakery, confectionery, and traditional food applications. Expanding middle-class populations are fueling demand for convenience and packaged foods. The beverage sector, particularly dairy alternatives and functional drinks, also supports growth. Increasing investments by global players and local manufacturers in plant-based thickeners position Asia Pacific as the fastest-growing regional market during the forecast period.

Latin America

Latin America represented around 8% of the global food thickeners market share in 2024, supported by strong demand for confectionery, beverages, and dairy applications. Brazil and Mexico lead due to expanding food processing sectors and rising consumer interest in convenience foods. Plant-based thickeners dominate, with corn starch widely used across multiple food categories. Growing adoption of hydrocolloids in beverages and confectionery is also contributing to regional growth. Rising disposable incomes and urban lifestyle changes support further expansion. However, economic fluctuations and supply chain challenges remain barriers that influence overall growth potential in the region.

Middle East & Africa

The Middle East & Africa held around 7% of the global food thickeners market share in 2024, driven by increasing urbanization and rising demand for packaged food and beverages. Gulf countries such as Saudi Arabia and the UAE lead adoption, supported by growing food imports and expanding retail infrastructure. The bakery and confectionery segment remains a key growth area, while hydrocolloids see rising usage in dairy and beverage industries. Local demand for plant-based and natural thickeners is also increasing. Despite limited manufacturing capacity, the region’s expanding food industry supports steady market growth.

Market Segmentations:

By Product

- Starch

- Hydrocolloids

- Protein

By Source

By Application

- Bakery & Confectionery

- Food & Nutrition

- Beverages

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the food thickeners market is shaped by leading players such as ADM Company, Jungbunzlauer, Ingredion, Cargill, DowDuPont, Ashland Specialty Ingredients, Fooding Group, Edesang, C P Kelco, and Tate & Lyle. These companies maintain dominance through diverse product portfolios, global distribution networks, and strong partnerships with food manufacturers. Innovation in clean-label, plant-based, and multifunctional thickeners is a core strategy, aligning with shifting consumer preferences. Key players invest heavily in research and development to enhance product functionality, stability, and nutritional value, while also ensuring compliance with stringent food safety regulations. Strategic mergers, acquisitions, and capacity expansions strengthen market presence, especially in high-growth regions like Asia Pacific. Competitive intensity is further driven by the need for sustainable sourcing and cost efficiency, as raw material volatility impacts pricing strategies. Collectively, these players emphasize customer-focused solutions and product innovation to maintain leadership in a rapidly evolving global food industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ADM Company

- Jungbunzlauer

- Ingredion

- Cargill

- DowDuPont

- Ashland Specialty Ingredients

- Fooding Group

- Edesang

- C P Kelco

- Tate & Lyle

Recent Developments

- In August 2025, Cargill announced expansion of its pectin production facility in Iowa, increasing capacity for fruit-based & nutritional products.

- In 2025, CP Kelco introduced a new high-ester pectin formulation in Georgia geared for low-sugar jams and beverages, improving gel strength and clarity in clean-label formulations.

- In November 2024, Tate & Lyle completed acquisition of CP Kelco, bringing its hydrocolloid and specialty thickener assets into its portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for processed and convenience foods.

- Starch will continue to dominate as the most widely used thickening agent.

- Plant-based thickeners will gain higher traction due to clean-label and vegan trends.

- Hydrocolloids will see strong growth in beverages and dairy applications.

- Functional food and nutraceutical sectors will create new opportunities for protein-based thickeners.

- Asia Pacific will emerge as the fastest-growing regional market during the forecast period.

- North America and Europe will sustain leadership through advanced food processing industries.

- Innovation in natural and sustainable sourcing will shape future product development.

- Regulatory support for food safety and labeling will influence product adoption.

- Strategic collaborations and R&D investments by key players will drive competitive advantage.