Market Overview

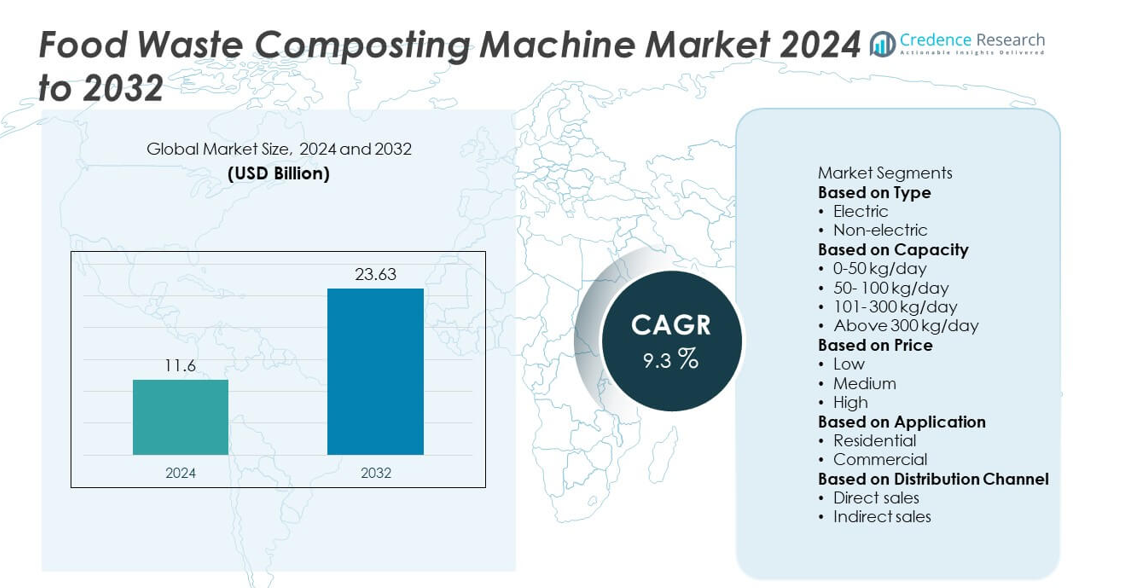

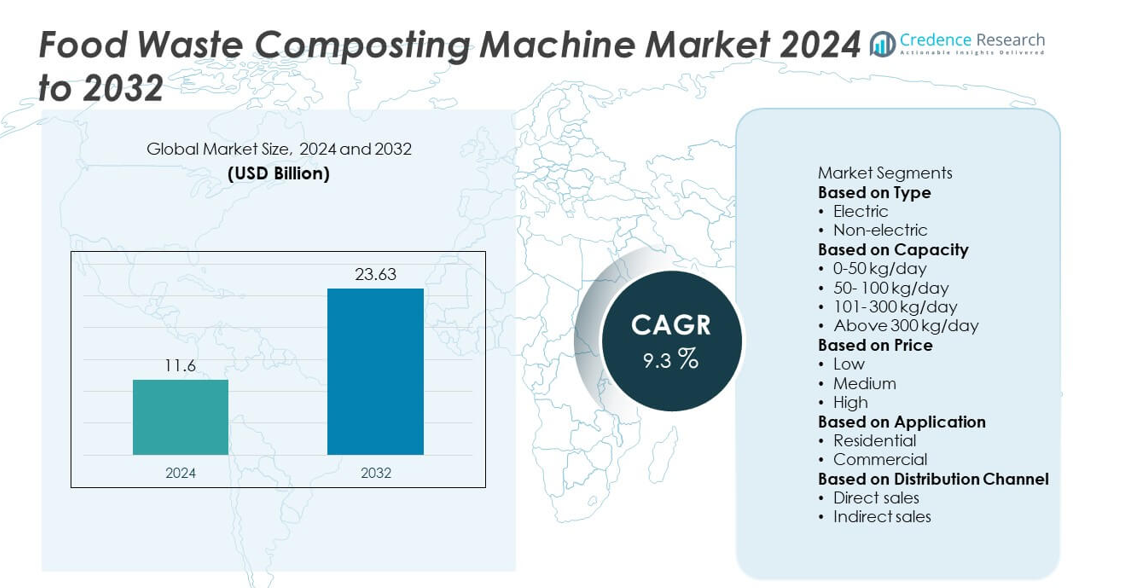

The global food waste composting machine market was valued at USD 11.6 billion in 2024 and is projected to reach USD 23.63 billion by 2032, growing at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Waste Composting Machine Market Size 2024 |

USD 11.6 billion |

| Food Waste Composting Machine Market, CAGR |

9.3% |

| Food Waste Composting Machine Market Size 2032 |

USD 23.63 billion |

The food waste composting machine market is led by key players including FoodCycler, HotBin, Bhor, EcoRich, Full Circle, Fornnax, Green Planet, Bokashicycle, CleanRobotics, and Earth Care. These companies focus on delivering efficient composting solutions with features such as automation, odor control, and energy efficiency to meet the needs of residential, commercial, and institutional users. Regionally, North America dominated the market with 34% share in 2024, supported by strong regulatory frameworks and high adoption in commercial facilities. Europe followed with 29% share, driven by strict waste reduction policies and circular economy initiatives, while Asia-Pacific accounted for 25% share, emerging as the fastest-growing region due to rapid urbanization, rising food waste volumes, and government-backed sustainability programs.

Market Insights

- The global food waste composting machine market was valued at USD 11.6 billion in 2024 and is projected to reach USD 23.63 billion by 2032, growing at a CAGR of 9.3% during the forecast period.

- Rising concerns over food waste and stricter government regulations on sustainable waste management drive demand, with electric composting machines holding 62% share due to efficiency and faster processing.

- Key trends include the adoption of smart, automated, and IoT-enabled machines, alongside growing demand for mid-capacity units (101–300 kg/day) which led the market with 37% share in 2024.

- Major players such as FoodCycler, HotBin, EcoRich, Fornnax, and CleanRobotics focus on innovation, odor control technologies, and cost-effective solutions, though high upfront costs and limited awareness remain key restraints.

- Regionally, North America leads with 34% share, Europe follows with 29%, and Asia-Pacific holds 25% driven by urbanization and sustainability initiatives, while Latin America (7%) and Middle East & Africa (5%) show steady adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In 2024, the electric segment dominated the market with 62% share, driven by rising demand for efficient, automated, and odor-free composting solutions in urban areas, hotels, and large institutions. Electric composting machines are favored for their faster processing times, compact design, and ability to handle diverse waste streams. Growing adoption in residential complexes and commercial kitchens further supports their dominance. Non-electric machines retain relevance in rural and small-scale operations due to low operational costs, but the shift toward sustainable, time-saving solutions ensures electric models remain the leading segment.

- For instance, EcoRich manufactures commercial electric composters with models capable of processing up to 1,000 kg of food waste per day, reducing waste volume by over 90% within 24 hours and supplying installations to hotels and corporate campuses.

By Capacity

The 101–300 kg/day capacity segment held 37% share in 2024, making it the leading category in the food waste composting machine market. This segment’s dominance is attributed to its suitability for mid-scale applications such as hotels, restaurants, residential societies, and corporate offices. These machines strike a balance between handling significant volumes of food waste and maintaining cost-effectiveness. While smaller machines (0–50 kg/day) are popular in households, and large units (above 300 kg/day) cater to industrial or municipal setups, the 101–300 kg/day range remains the most widely adopted due to versatility and scalability.

- For instance, Bhor Engineering supplies various models of composters, including those with capacities such as 25kg/day, 50kg/day, and 500kg/day. The company’s composters, used by various clients including housing societies, convert food scraps into compost, with some models completing the process within 20 hours.

By Price

The medium-priced segment accounted for 44% share in 2024, establishing itself as the dominant category in the food waste composting machine market. These machines balance affordability with advanced features like automation, energy efficiency, and odor control, making them attractive for both commercial and institutional users. The low-priced category appeals to small-scale consumers but often lacks durability and efficiency, while high-priced machines serve premium buyers and industrial-scale users. The growing demand for reliable yet cost-effective composting systems across residential complexes, hospitality, and small businesses drives the leadership of medium-priced machines globally.

Key Growth Drivers

Rising Concerns Over Food Waste Management

Increasing global food waste generation is a primary driver of the composting machine market. Governments and municipalities are emphasizing sustainable waste treatment solutions to reduce landfill burden and greenhouse gas emissions. Composting machines provide an eco-friendly method to convert organic waste into nutrient-rich compost, supporting circular economy goals. Institutions, hotels, and residential complexes are adopting these systems to comply with waste management regulations. Growing awareness of environmental impact and stricter disposal norms continue to accelerate adoption, making food waste composting machines a vital solution for urban sustainability.

- For instance, CleanRobotics deployed TrashBot units that use artificial intelligence to sort waste at the point of disposal, reducing recycling stream contamination rates through its 95% to 96% sorting accuracy. Units have been deployed in high-traffic facilities such as airports, hospitals, and stadiums across North America.

Supportive Government Regulations and Incentives

Policy support from governments significantly fuels market growth. Regulations mandating on-site composting in residential societies, hotels, and industrial facilities create direct demand. Additionally, financial incentives, tax benefits, and subsidies encourage investment in composting technologies. Municipalities worldwide are also promoting decentralized waste treatment to ease pressure on centralized systems. This regulatory backing helps overcome adoption barriers related to cost and infrastructure. As countries prioritize sustainable development goals, supportive frameworks will remain a strong growth enabler for the food waste composting machine market.

- For instance, Bhor Engineering manufactures a range of decentralized composting machines, including models that process between 100 and 250 kilograms of food waste daily, which helps bulk waste generators comply with India’s Solid Waste Management Rules.

Growing Adoption in Commercial and Institutional Sectors

Rapid adoption by hotels, restaurants, and residential complexes is boosting market expansion. These sectors generate high volumes of organic waste daily and require efficient on-site disposal solutions. Composting machines offer quick, hygienic, and odor-free processing, making them highly suitable for commercial kitchens and hospitality industries. Increasing pressure to reduce operational waste footprints and enhance sustainability credentials drives investments in these machines. Educational institutions and corporate campuses are also adopting composting solutions to meet green building standards and sustainability certifications, further reinforcing long-term demand.

Key Trends & Opportunities

Integration of Smart and Automated Features

Technological innovation is creating new opportunities in the market, with manufacturers integrating smart controls, IoT-based monitoring, and automation. These features allow real-time performance tracking, remote control, and efficient waste-to-compost conversion. Automated odor control, energy efficiency, and faster processing enhance usability in both residential and commercial applications. Such innovations attract eco-conscious consumers and support large-scale adoption in cities. The move toward digitized, user-friendly composting solutions aligns with broader trends in smart city development and sustainable infrastructure projects.

- For instance, CleanRobotics’ TrashBot uses AI-driven sensors and cloud-based monitoring, achieving up to 90% sorting accuracy across more than 100 deployed units, each capable of processing hundreds of kilograms of mixed waste monthly with real-time performance analytics.

Expansion in Residential and Small-Scale Applications

The rising awareness of household-level waste segregation and composting presents growth opportunities. Compact, low-capacity machines are gaining traction in urban apartments, gated communities, and smaller establishments. Affordable models enable households to contribute to sustainability efforts while reducing municipal waste load. With increasing consumer preference for eco-friendly practices, residential adoption is expected to rise significantly. Manufacturers catering to this segment with low-maintenance, user-friendly solutions stand to capture a growing share of the market, particularly in developed and rapidly urbanizing regions.

- For instance, FoodCycler’s Eco 3 model, adopted in more than 300,000 households globally, processes 3.5 liters of food scraps per cycle using less than 1 kWh of electricity, producing a soil amendment within 4 to 9 hours.

Key Challenges

High Initial Investment and Maintenance Costs

One of the main challenges in the food waste composting machine market is the high upfront cost of advanced machines. Units equipped with automation, odor control, and energy-efficient features often come with premium pricing, which restricts adoption among small businesses and households. Maintenance requirements and operational expenses add to the burden, discouraging price-sensitive consumers. Without wider subsidies or financing options, the cost factor remains a critical barrier, particularly in emerging markets where waste management infrastructure is still developing.

Limited Consumer Awareness and Segregation Practices

Low awareness about the benefits of composting and poor waste segregation practices hinder market growth. In many regions, households and small businesses lack knowledge of how composting machines function or the environmental advantages they provide. Mixed waste streams often lead to operational inefficiencies, reducing machine effectiveness. Educating users about proper organic waste separation and promoting the benefits of on-site composting is crucial to overcoming this challenge. Without strong awareness campaigns, adoption rates in residential and small-scale applications will remain below potential.

Regional Analysis

North America

North America accounted for 34% share of the food waste composting machine market in 2024, driven by advanced waste management infrastructure and strong regulatory frameworks promoting sustainable practices. The United States leads adoption, supported by municipal mandates, corporate sustainability goals, and growing awareness among residential communities. Commercial sectors such as hotels, universities, and food processing facilities are significant contributors to demand. Technological innovation and availability of smart composting machines further boost adoption. Rising consumer preference for eco-friendly waste solutions positions North America as the largest regional market with consistent growth prospects.

Europe

Europe held 29% share of the food waste composting machine market in 2024, supported by stringent EU directives on waste reduction and circular economy initiatives. Countries such as Germany, the U.K., and France lead the market, with high adoption in both residential complexes and institutional facilities. Growing focus on zero-waste targets and renewable compost production fuels demand for efficient composting solutions. The hospitality sector and foodservice industries are major end-users, responding to strict regulations on food waste disposal. With sustainability at the core of policymaking, Europe continues to invest heavily in decentralized composting technologies.

Asia-Pacific

Asia-Pacific represented 25% share of the food waste composting machine market in 2024, emerging as the fastest-growing region due to rapid urbanization and increasing food waste volumes. China, India, and Japan drive demand, supported by government initiatives to improve waste segregation and promote sustainable practices. Rising adoption in commercial establishments such as hotels and restaurants contributes significantly. Population growth and expanding middle-class awareness of sustainability create additional demand for small and medium-capacity machines. Investments in smart city projects and sustainable infrastructure further strengthen Asia-Pacific’s position as a key growth engine for the global market.

Latin America

Latin America accounted for 7% share of the food waste composting machine market in 2024, led by Brazil and Mexico. Growth is fueled by increasing food waste generation in urban areas and rising adoption in commercial sectors such as hospitality and foodservice. Government initiatives promoting sustainable waste disposal practices are gradually improving adoption rates. However, high equipment costs and limited awareness among households act as restraints. International investments in waste management infrastructure and the expansion of local manufacturing capabilities are expected to support steady growth in the region over the forecast period.

Middle East & Africa

The Middle East & Africa held 5% share of the food waste composting machine market in 2024, reflecting slow but growing adoption. GCC countries, particularly the UAE and Saudi Arabia, are driving demand through sustainability targets and investments in eco-friendly waste management systems. In Africa, adoption remains limited due to affordability challenges and lack of infrastructure, though urban centers are beginning to implement composting initiatives. Demand is gradually increasing in institutional and commercial sectors, especially within hospitality and foodservice industries. Long-term growth is expected as governments prioritize sustainable waste management strategies across the region.

Market Segmentations:

By Type

By Capacity

- 0-50 kg/day

- 50- 100 kg/day

- 101- 300 kg/day

- Above 300 kg/day

By Price

By Application

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the food waste composting machine market is defined by leading players such as FoodCycler, HotBin, Bhor, EcoRich, Full Circle, Fornnax, Green Planet, Bokashicycle, CleanRobotics, and Earth Care. These companies compete by offering a range of machines catering to households, commercial kitchens, institutions, and municipal applications. Innovation in automation, odor control, and energy efficiency has become a critical differentiator, with several players integrating smart and IoT-enabled features to enhance performance. Many manufacturers focus on mid-capacity and medium-priced segments, which account for strong demand across residential complexes and hospitality sectors. Strategic partnerships with municipalities, hotels, and corporate facilities are common, enabling companies to expand their market reach. Furthermore, rising emphasis on sustainability, user-friendly designs, and localized composting solutions drives competition. As regulations tighten and awareness grows, the market is expected to witness intensified rivalry, with players prioritizing technological advancements and cost-effective solutions to strengthen their positions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FoodCycler

- HotBin

- Bhor

- EcoRich

- Full Circle

- Fornnax

- Green Planet

- Bokashicycle

- CleanRobotics

- Earth Care

Recent Developments

- In July 2024, FoodCycler launched the Eco 3 model with a 3.5 L bucket capacity and enhanced grinding ability, producing “Foodilizer” within 4 to 9 hours.

- In 2023, CleanRobotics announced new features for its TrashBot autonomous sorting bin, allowing it to deliver custom educational content via its built-in screen when users deposit items.

- In 2023, CleanRobotics secured new contracts and partnerships, expanding deployment of its waste sorting technology in commercial settings

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Price, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising global focus on sustainable waste management.

- Electric composting machines will remain the leading type due to efficiency and convenience.

- Non-electric models will continue serving rural and small-scale users with low operating costs.

- Mid-capacity machines will see strong demand from hotels, restaurants, and residential complexes.

- Smart and IoT-enabled composting solutions will gain traction in urban and institutional markets.

- Government regulations and incentives will further accelerate adoption across regions.

- North America and Europe will maintain dominance with strong regulatory support.

- Asia-Pacific will emerge as the fastest-growing region with rapid urbanization and food waste volumes.

- High-priced machines will gain adoption in industrial and municipal projects requiring large-scale solutions.

- Rising awareness among households will expand demand for compact and affordable composting machines.