Market Overview

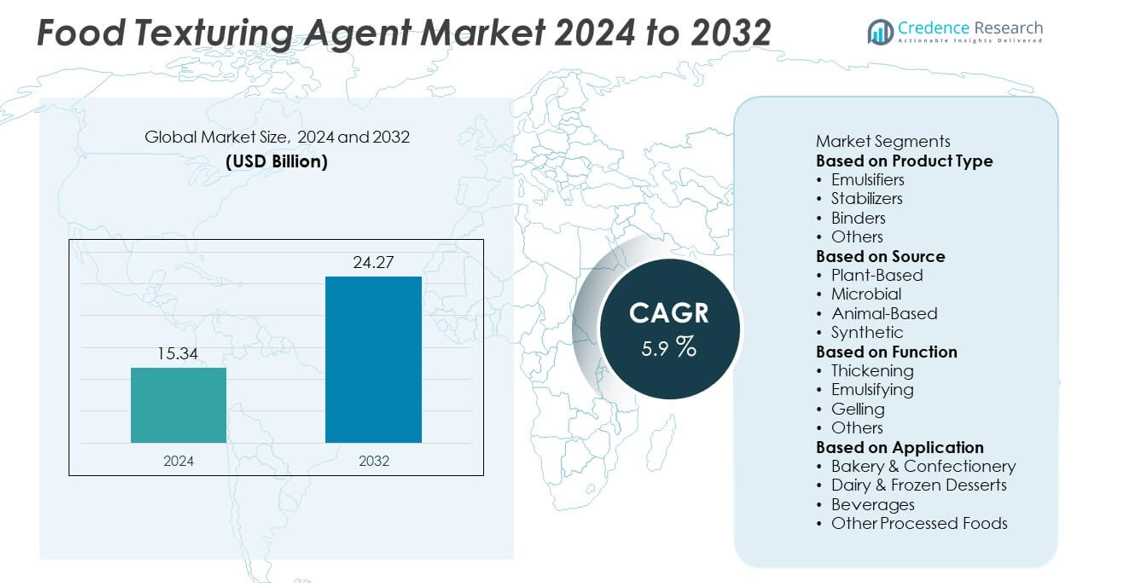

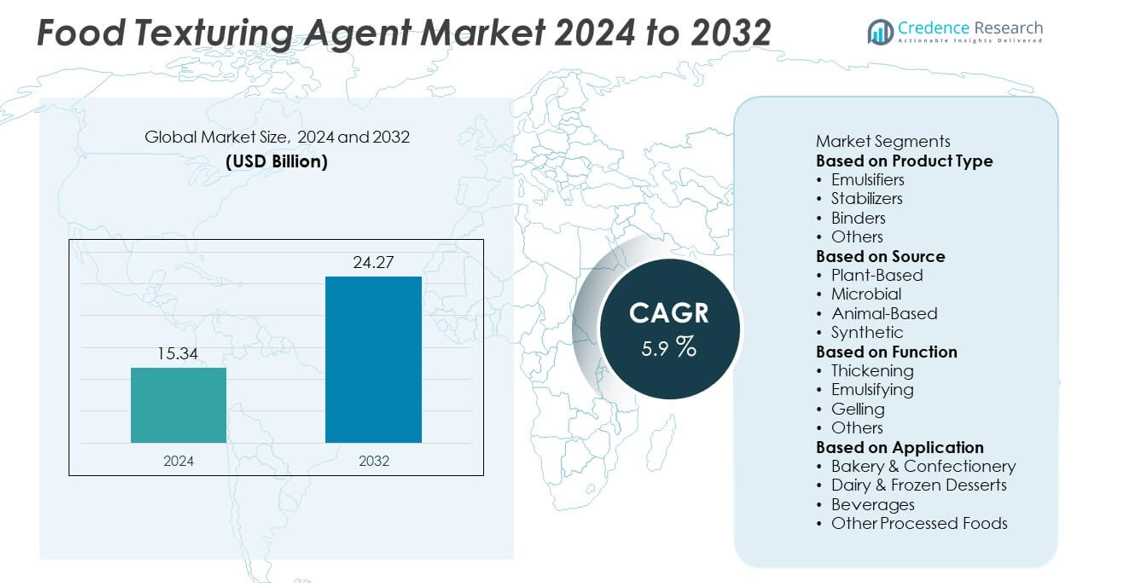

The Food Texturing Agent Market was valued at USD 15.34 billion in 2024 and is projected to reach USD 24.27 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Texturing Agents Market Size 2024 |

USD 15.34 billion |

| Food Texturing Agents Market, CAGR |

5.9% |

| Food Texturing Agents Market Size 2032 |

USD 24.27 billion |

The food texturing agent market is driven by top players including Ajinomoto, Archer Daniels Midland, Kerry Group, Fiberstar, Tate & Lyle, CP Kelco, Penford, E.I. DuPont De Nemours & Company, Cargill, and Ingredion. These companies lead through extensive product offerings, advanced formulation capabilities, and strategic partnerships across the food processing industry. North America emerged as the leading region in 2024, holding 34% of the global market share, supported by strong demand for processed foods, bakery products, and dairy innovations. Europe followed with 29% share, driven by clean-label and plant-based adoption, while Asia Pacific captured 23% share, establishing itself as the fastest-growing market due to urbanization, rising disposable incomes, and expanding packaged food consumption.

Market Insights

- The food texturing agent market was valued at USD 15.34 billion in 2024 and is expected to reach USD 24.27 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- Rising demand for processed, convenience, and plant-based foods is a key driver, with emulsifiers dominating the product type segment at 35% share in 2024.

- Major trends include the shift toward clean-label and natural texturing solutions, alongside increasing opportunities in functional and specialty foods targeting health-conscious consumers.

- The competitive landscape is led by Ajinomoto, Archer Daniels Midland, Kerry Group, Fiberstar, Tate & Lyle, CP Kelco, Penford, DuPont, Cargill, and Ingredion, who focus on innovation, acquisitions, and sustainable sourcing.

- Regionally, North America leads with 34% share, followed by Europe at 29%, while Asia Pacific accounts for 23% and remains the fastest-growing region, supported by urbanization, rising disposable incomes, and packaged food expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Emulsifiers dominated the food texturing agent market in 2024, holding over 35% of total revenue share. Their ability to improve texture, extend shelf life, and stabilize mixtures in bakery, dairy, and confectionery applications drives this dominance. Rising demand for processed and convenience foods has increased reliance on emulsifiers like lecithin and mono- and diglycerides. Stabilizers and binders also show steady growth, particularly in sauces, beverages, and meat products, where consistency and moisture retention are critical. The “others” category, including specialty texturizers, continues to expand through niche functional applications.

- For instance, Kerry Group introduced Puremul™, a plant-based emulsifier system made from acacia that is capable of replacing sunflower lecithin and mono-/diglycerides, and is intended to support bakery and beverage manufacturers.

By Source

Plant-based texturing agents led the market in 2024, accounting for over 45% of global share. Ingredients derived from corn, soy, and seaweed dominate due to sustainability, clean-label appeal, and wide availability. The growing vegan and vegetarian population drives higher adoption of plant-based options across bakery, dairy alternatives, and beverages. Microbial sources such as xanthan gum are also expanding due to efficiency in low concentrations, while animal-based sources like gelatin maintain strong use in confectionery. Synthetic options continue to face regulatory and consumer scrutiny, limiting their growth but sustaining niche industrial applications.

- For instance, CP Kelco produces pectin and xanthan gum, supplying plant-based dairy alternatives and beverages that require high textural stability. These ingredients are effective in low concentrations, often under 0.5% per formulation, to provide the desired functionality.

By Function

Thickening emerged as the leading function in 2024 with over 40% of total market share, reflecting its broad application across bakery, sauces, dairy, and beverages. Thickening agents improve viscosity, stability, and mouthfeel, making them indispensable in processed foods. Emulsifying follows closely, driven by its critical role in blending oil and water-based ingredients in spreads, dressings, and bakery. Gelling agents also see strong demand in confectionery and dairy desserts. The “others” category, including coating and binding functions, remains relevant in specialized processed food segments where performance consistency is vital.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The increasing consumption of processed and convenience foods strongly drives the food texturing agent market. Consumers seek products with consistent taste, appealing appearance, and improved shelf life, which texturing agents deliver. Emulsifiers and stabilizers are widely used in bakery, confectionery, and ready-to-eat meals to enhance stability and texture. Urban lifestyles, rapid foodservice expansion, and the popularity of packaged meals contribute to this rising demand. Manufacturers continue to rely on texturing agents to meet evolving consumer preferences and maintain product quality across fast-growing food categories.

- For instance, Cargill offers a broad range of lecithin solutions for bakery and snack manufacturers, supplying emulsifiers that improve dough handling, extend shelf life, and enhance texture consistency. Lecithin is also used to increase moisture retention and improve the release characteristics in baked goods.

Expansion of Dairy and Beverage Industry

The global dairy and beverage industries provide significant momentum for food texturing agents. Thickeners, stabilizers, and emulsifiers are integral in yogurts, ice creams, flavored drinks, and smoothies, where they ensure stability and smooth mouthfeel. Rising demand for dairy alternatives, including plant-based beverages, further boosts adoption of plant-based emulsifiers and stabilizers. The growth of functional and fortified beverages also increases reliance on advanced texturing solutions. With consumer focus shifting toward premium and healthier products, the beverage and dairy sectors are expected to sustain long-term demand for texturing agents.

- For instance, CP Kelco supplies carrageenan to dairy and beverage producers, helping stabilize protein-rich drinks and prevent phase separation in plant-based alternatives and flavored milk beverages.

Clean-Label and Plant-Based Product Demand

The clean-label and plant-based movement is reshaping the food texturing agent market. Consumers increasingly prefer natural, sustainable, and minimally processed ingredients. Plant-based texturing agents derived from soy, corn, and seaweed are seeing high adoption in bakery, dairy alternatives, and sauces. Regulatory support and brand commitments to transparency further accelerate this transition. Companies are investing in R&D to develop multifunctional agents that align with clean-label requirements. This trend not only drives new opportunities but also compels market players to differentiate through natural and eco-friendly product offerings.

Key Trends & Opportunities

Innovation in Functional and Specialty Foods

The rising demand for functional foods, dietary supplements, and nutraceuticals creates opportunities for advanced food texturing agents. Hydrocolloids, proteins, and emulsifiers are increasingly used in low-fat, gluten-free, and fortified products to enhance stability and appeal. Functional foods targeting digestive health, weight management, and energy support rely on multifunctional texturing agents. Manufacturers are innovating to deliver products that balance health benefits with desirable texture and taste. This innovation trend is likely to expand the market into high-value niches, strengthening its role in specialty food categories.

- For instance, Ingredion manufactures Nutraflora prebiotic fiber, validated in more than 200 studies for digestive health, and it is widely incorporated into functional beverages, supplements, and fortified snacks.

Growth of Plant-Based Alternatives

The rapid growth of plant-based food and beverage alternatives presents major opportunities for texturing agent suppliers. Consumers demand dairy-free yogurts, meat substitutes, and plant-based beverages with authentic texture and taste. Texturing agents such as starches, gums, and emulsifiers play a vital role in replicating the creaminess and bite of animal-derived products. Rising investment by food companies in vegan and flexitarian product lines supports strong growth in this area. As plant-based products gain mainstream acceptance, demand for innovative natural texturing agents will continue to accelerate.

- For instance, Givaudan screened more than 2,000 plant proteins at its innovation centers to design texture systems for vegan meat substitutes, enabling large-scale production of plant-based burgers with improved juiciness and meat-like bite.

Key Challenges

Raw Material Price Volatility

The market faces challenges from fluctuating prices of raw materials such as corn, soy, and guar gum. Supply chain disruptions, climate change impacts, and rising global demand for agricultural commodities increase input cost variability. These fluctuations directly affect production costs and profit margins for manufacturers. Companies are adopting sustainable sourcing strategies and diversifying raw material bases to mitigate risks. However, persistent price volatility remains a major barrier to stable growth in the food texturing agent market, forcing players to balance cost efficiency with quality.

Stringent Regulatory and Labeling Standards

Strict regulatory frameworks governing food additives and labeling present a challenge for manufacturers of texturing agents. Authorities such as the FDA and EFSA enforce rigorous guidelines on ingredient safety, permissible usage levels, and labeling transparency. The growing demand for clean-label products intensifies compliance pressures, as synthetic or chemically modified agents face stricter scrutiny. Meeting these regulatory expectations often requires costly reformulations and innovation in natural alternatives. Ensuring compliance while maintaining performance and affordability remains a critical challenge for companies in the global food texturing agent market.

Regional Analysis

North America

North America led the food texturing agent market in 2024, holding over 34% of global revenue share. The U.S. dominates regional growth due to its advanced food processing industry and strong demand for bakery, dairy, and beverage products. Consumers in the region prioritize convenience, clean-label, and plant-based formulations, driving high adoption of emulsifiers and stabilizers. Canada and Mexico also contribute through expanding packaged food and confectionery markets. Continuous innovation, coupled with supportive regulatory frameworks for safe additives, ensures North America remains a leading region for texturing agent consumption during the forecast period.

Europe

Europe accounted for 29% of the global food texturing agent market share in 2024, supported by its established bakery, confectionery, and dairy industries. Countries such as Germany, France, and the U.K. lead regional demand, driven by premium and functional food preferences. Emphasis on natural and plant-based ingredients strengthens the role of hydrocolloids and emulsifiers across multiple applications. The region’s clean-label movement further accelerates innovation in natural texturing solutions. With a mature food processing industry and strong consumer focus on quality and health, Europe remains a key contributor to the overall market.

Asia Pacific

Asia Pacific captured 23% of the global food texturing agent market share in 2024, emerging as the fastest-growing region. Rapid urbanization, rising disposable incomes, and population growth drive increased demand for packaged and convenience foods. China, India, and Japan dominate regional consumption, with starch and plant-based emulsifiers widely used in bakery, dairy alternatives, and beverages. The surge in plant-based diets and functional food categories also supports growth. Multinational companies are investing in local manufacturing and R&D, positioning Asia Pacific as a central hub for future expansion in food texturing agents.

Latin America

Latin America represented 8% of the global food texturing agent market share in 2024, driven by growing demand for dairy, confectionery, and beverage products. Brazil and Mexico are the leading markets due to expanding food processing industries and increased consumption of convenience foods. Corn-based and plant-derived agents dominate regional supply, while hydrocolloids see growing use in sauces and beverages. Rising disposable incomes and changing consumer lifestyles further support growth. However, economic fluctuations and supply chain challenges create hurdles for consistent expansion, though opportunities remain in premium and functional food segments.

Middle East & Africa

The Middle East & Africa accounted for 6% of the global food texturing agent market share in 2024, supported by increasing urbanization and rising demand for packaged foods. Gulf nations such as Saudi Arabia and the UAE lead adoption due to growing imports and strong retail infrastructure. Bakery and confectionery applications dominate usage, while beverages and dairy products also contribute significantly. Demand for plant-based and natural texturing solutions is rising with shifting consumer preferences. Although limited manufacturing capacity presents challenges, the region’s expanding food industry ensures steady growth prospects during the forecast period.

Market Segmentations:

By Product Type

- Emulsifiers

- Stabilizers

- Binders

- Others

By Source

- Plant-Based

- Microbial

- Animal-Based

- Synthetic

By Function

- Thickening

- Emulsifying

- Gelling

- Others

By Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Other Processed Foods

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the food texturing agent market is shaped by leading companies such as Ajinomoto, Archer Daniels Midland, Kerry Group, Fiberstar, Tate & Lyle, CP Kelco, Penford, E.I. DuPont De Nemours & Company, Cargill, and Ingredion. These players strengthen their market presence through diverse product portfolios, large-scale distribution networks, and continuous investments in research and development. A strong focus is placed on plant-based, clean-label, and multifunctional texturing solutions to align with shifting consumer preferences. Companies are expanding production capacities, forming strategic partnerships, and acquiring regional players to enhance competitiveness in high-growth markets. Regulatory compliance, sustainability in raw material sourcing, and advanced formulation technologies remain central to competitive strategies. Innovation in functional applications, such as dairy alternatives, nutraceuticals, and convenience foods, is further intensifying competition. Collectively, these players maintain leadership by balancing product performance, cost efficiency, and evolving consumer demands in the global food texturing agent industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ajinomoto

- Archer Daniels Midland

- Kerry Group

- Fiberstar

- Tate & Lyle

- CP Kelco

- Penford

- I. DuPont De Nemours & Company

- Cargill

- Ingredion

Recent Developments

- In July 2025, Tate & Lyle unveiled a new Mouthfeel Lab during IFT FIRST, showcasing four texture prototypes combining pectins and gums for improved mouthfeel in reduced-sugar and fiber-fortified foods.

- In April 2025, Fiberstar expanded its Citri-Fi citrus fiber applications, demonstrating usage levels below 1% to improve texture and water binding in yogurts, sauces, and frozen meals.

- In 2025, Ajinomoto Health & Nutrition (AHN) launched “Salt Answer” and “Palate Perfect” solution platforms, designed to help reduce sodium (by up to 30%).

- In November 2024, Tate & Lyle completed the acquisition of CP Kelco (pectin, specialty gums) to strengthen their texture and mouthfeel ingredient offerings globally

Report Coverage

The research report offers an in-depth analysis based on Product Type, Source, Function, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for processed and convenience foods.

- Emulsifiers will remain the dominant product type due to wide application across food categories.

- Plant-based texturing agents will gain more traction as clean-label and vegan trends strengthen.

- Functional and fortified food applications will create new growth opportunities for innovative agents.

- Asia Pacific will continue to be the fastest-growing regional market during the forecast period.

- North America and Europe will maintain leadership supported by mature food processing industries.

- Technological advancements will enhance multifunctional performance of texturing agents in diverse products.

- Sustainability and natural sourcing will increasingly influence product development and supplier strategies.

- Regulatory frameworks on food safety and labeling will shape adoption of advanced solutions.

- Strategic collaborations, mergers, and R&D investments will intensify competition and drive innovation.