Market overview

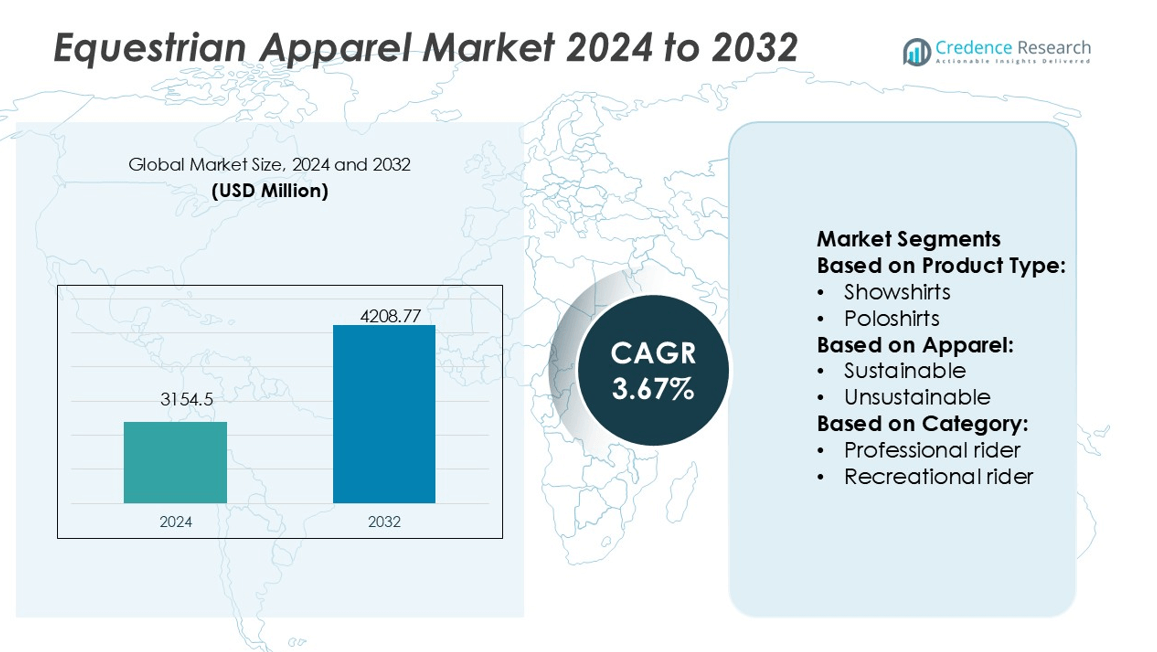

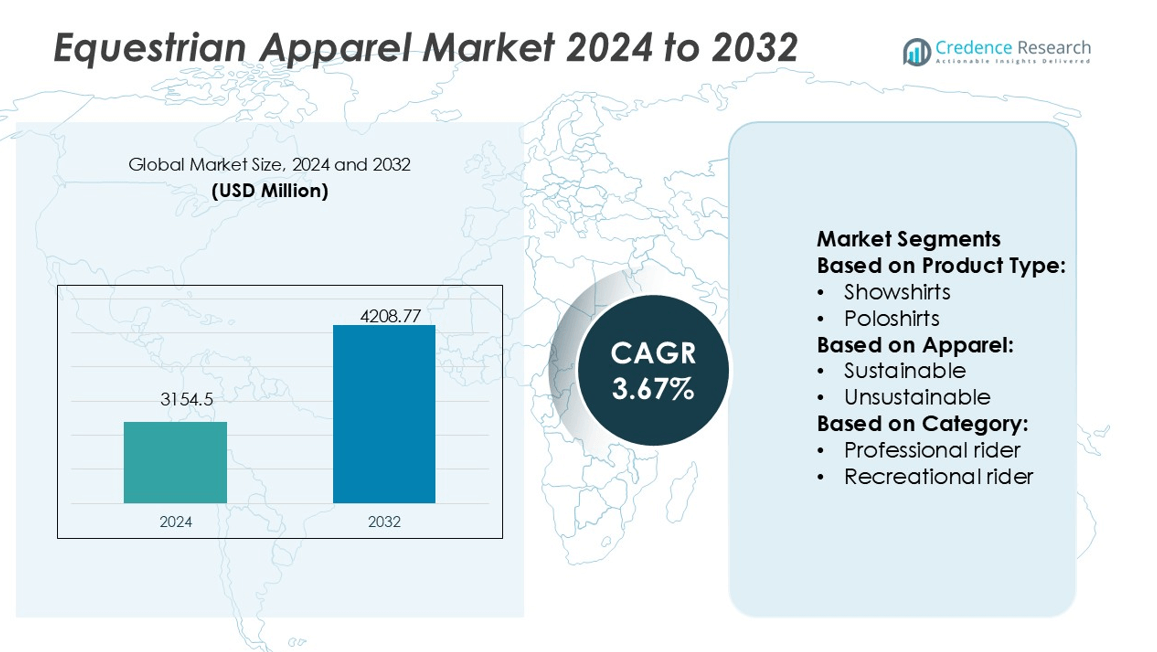

Equestrian Apparel Market size was valued USD 3154.5 million in 2024 and is anticipated to reach USD 4208.77 million by 2032, at a CAGR of 3.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Equestrian Apparel MarketSize 2024 |

USD 3154.5 million |

| Equestrian Apparel Market, CAGR |

3.67% |

| Equestrian Apparel Market Size 2032 |

USD 4208.77 million |

The equestrian apparel market features strong competition from leading players such as Kingsland Equestrian, Horze, Pikeur, Goode Rider, Equi-Star, Eskadron, Dublin, Kentucky Horsewear, Helite, and Charles Owen. These companies focus on innovation, safety, sustainability, and performance-driven designs to strengthen their market presence across professional and recreational segments. North America leads the global equestrian apparel market with a 35% share, supported by high participation in equestrian sports, strong consumer spending on premium riding gear, and extensive distribution through both retail and e-commerce channels. This regional dominance is further reinforced by established equestrian culture, international competitions, and rising demand for sustainable and technologically advanced apparel.

Market Insights

- The equestrian apparel market size was valued at USD 3154.5 million in 2024 and is projected to reach USD 4208.77 million by 2032, registering a CAGR of 3.67% during the forecast period.

- Market growth is driven by increasing participation in equestrian sports, demand for performance-oriented apparel, and rising adoption of sustainable fabrics in riding gear.

- Key players strengthen competitiveness by focusing on safety-certified helmets, eco-friendly materials, and innovative product designs that cater to both professional and recreational riders.

- High pricing of premium apparel and seasonal demand variations remain restraints, creating challenges for affordability and inventory management across regions.

- North America leads with a 35% share, Europe follows with 30%, while breeches in the product category hold the dominant segment share at 42%, supported by their superior durability and rider comfort.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the equestrian apparel market, topwear remains the leading sub-segment, holding 38% market share. Showshirts and polos drive steady sales due to their functionality and appeal in both training and competition. Showjackets, although niche, sustain demand in formal events, while outwear supports seasonal growth. In bottomwear, breeches dominate with 42% share, driven by their design for durability, grip, and rider comfort. Riding tights gain traction among young and recreational riders for their affordability and ease of use. Socks and thermal wear serve as add-on purchases that enhance overall category revenue.

- For instance, Block, Inc., a financial services and digital payments company, reported a total workforce of around 11,300 employees as of late 2024, following strategic layoffs earlier in the year. Its consumer payments app, Cash App, served 57 million monthly active users as of early 2025.

By Apparel

Sustainable equestrian apparel has gained momentum, capturing 33% of total market share. Riders increasingly prefer eco-friendly fabrics and responsibly sourced materials that offer both performance and environmental value. Brands focusing on recycled textiles and biodegradable packaging attract environmentally conscious buyers. Companies introducing durable, high-performance sustainable breeches and jackets secure strong brand loyalty. This trend is reinforced by younger demographics prioritizing sustainability in purchase decisions. Demand is further fueled by international events highlighting sustainable equestrian fashion, encouraging wider adoption across competitive and recreational segments.

- For instance, PayPal’s fraud detection system saw significant performance improvements by integrating Aerospike as a real-time caching layer. This enabled a 5x throughput increase for the caching component, supporting scaling from 200,000 to 1,000,000 transactions per second.

By Category

Professional riders account for the dominant share at 55%, driven by high spending power and the need for premium-grade apparel. Their demand centers on performance-oriented gear such as breeches, showjackets, and advanced fabrics designed for flexibility and endurance. Sponsorship deals and brand endorsements further strengthen this segment, ensuring steady product innovation. Recreational riders, though price-sensitive, represent a growing customer base with rising interest in casual and leisure riding apparel. This group favors affordable tights, polos, and sustainable clothing, contributing to consistent category expansion. Growing participation in leisure riding strengthens long-term opportunities.

Key Growth Drivers

Rising Participation in Equestrian Sports

The equestrian apparel market benefits from growing participation in horse riding, dressage, and show jumping worldwide. Rising awareness of horse-related activities as a lifestyle and fitness option increases apparel demand. Expanding equestrian clubs, riding schools, and international competitions support consistent product uptake. High-performance gear that combines safety, comfort, and durability appeals to both professional and amateur riders. This trend is particularly visible in developed regions such as Europe and North America, where equestrian sports enjoy long-standing popularity and structured industry support.

- For instance, FIS reduced legacy tech workload share from 48 % to 9 %, shifting the majority of processing onto its new public and hybrid cloud platform, with its Investment Data Platform (IDP) processing billions of data records daily via Snowflake infrastructure.

Increased Focus on Performance-Oriented Apparel

Demand for performance-oriented equestrian apparel is driving significant growth, supported by innovations in fabric technology and design. Breeches, jackets, and riding shirts now incorporate moisture-wicking, stretchable, and breathable materials that enhance rider comfort during extended use. Safety features such as reinforced stitching and ergonomic fits also improve riding performance and protection. Professional riders increasingly demand apparel that combines durability with style, boosting premium product sales. This emphasis on functionality ensures strong repeat purchases and brand loyalty among competitive riders.

- For instance, Adyen routes every transaction through real-time ML inference models using its “Uplift” payments optimization system. This system has been shown to boost authorization rates, with some pilots demonstrating an uplift of up to 6% points compared to previous routing.

Shift Toward Sustainable and Ethical Products

Sustainability is a leading growth driver as consumers increasingly prioritize eco-friendly products. Brands investing in recycled fabrics, biodegradable materials, and ethical manufacturing practices are capturing rising market share. Younger demographics, in particular, value transparency in sourcing and production, pushing companies to adopt greener practices. International equestrian fashion shows and global sustainability movements further highlight eco-conscious apparel. This shift not only drives new product launches but also strengthens brand positioning among environmentally aware riders, creating long-term opportunities for manufacturers and retailers.

Key Trends & Opportunities

Integration of Smart and Functional Textiles

The market is witnessing growing adoption of smart textiles designed to improve rider safety and comfort. Wearable technologies, such as apparel with integrated sensors, provide posture monitoring, body temperature control, and performance feedback. Lightweight and breathable fabrics embedded with functional properties like UV protection and antibacterial resistance are gaining traction. This trend opens opportunities for brands to differentiate through innovation. As riders seek higher-value products, integrating technology into equestrian clothing becomes a pathway for premium pricing and expanded market appeal.

- For instance, OpenPayd processes an annualized transaction volume exceeding €130 billion via its API infrastructure, supporting over 5 million connected accounts and guaranteeing 99.99% platform uptime, which demonstrates its capacity to embed finance at scale.

Expansion of E-commerce Channels

E-commerce growth is creating strong opportunities for equestrian apparel brands to access broader consumer bases. Online platforms offer convenience, product variety, and customization options that traditional retail often lacks. Brands are leveraging digital marketing, influencer collaborations, and virtual fitting tools to attract riders globally. The pandemic accelerated consumer comfort with online shopping, a trend that continues to benefit niche apparel categories. International sales through e-commerce also allow emerging brands to compete alongside established players, strengthening market competitiveness.

- For instance, Rio Tinto’s BlueSmelting™ pilot plant at its Sorel-Tracy site can process up to 40,000 tonnes of ilmenite ore annually, enabling production of high-grade TiO₂ feedstock with a reduction in greenhouse gas emissions of up to 95% compared to conventional reduction methods.

Key Challenges

High Pricing of Premium Apparel

Premium equestrian apparel often comes with elevated costs due to advanced fabrics, tailored designs, and safety certifications. While professionals can afford high-performance gear, recreational riders may find prices restrictive. This creates a demand gap between affordable and premium segments, limiting wider adoption. Brands must balance cost efficiency and product innovation to sustain growth. Without addressing affordability, companies risk losing price-sensitive customers who may shift to lower-quality alternatives or limit purchases to essential items only.

Seasonal and Regional Demand Variations

The equestrian apparel market faces challenges from fluctuating seasonal and regional demand. Cold-weather gear such as jackets and thermal wear experience high sales in winter but lower volumes in warmer months. Similarly, regions with limited equestrian culture or infrastructure present slower adoption rates. This uneven demand complicates inventory management and supply chain planning. Companies need adaptive production cycles and flexible distribution networks to address these variations. Failure to manage seasonal fluctuations may lead to excess inventory or supply shortages.

Regional Analysis

North America

North America holds the largest share of the equestrian apparel market at 35%, driven by a strong culture of equestrian sports and well-established industry infrastructure. The United States leads with widespread participation in horse riding, competitive events, and recreational activities, while Canada contributes through growing adoption of equestrian leisure pursuits. High disposable income and preference for premium-quality apparel strengthen the demand for performance-driven products such as breeches, showjackets, and sustainable riding gear. Expanding e-commerce platforms also enable wider access to niche brands, consolidating North America’s dominant position in global equestrian apparel sales.

Europe

Europe accounts for 30% of the equestrian apparel market, supported by its long-standing equestrian traditions and extensive participation in horse sports. Countries such as Germany, the United Kingdom, and France dominate, hosting numerous professional competitions that drive apparel sales. European consumers place strong emphasis on sustainability and innovation, boosting demand for eco-friendly fabrics and advanced performance apparel. The region also benefits from established manufacturing hubs and globally recognized equestrian brands. Professional riders in Europe represent a significant customer base, driving steady adoption of high-end products that enhance both functionality and style in competitive settings.

Asia-Pacific

Asia-Pacific captures 20% of the equestrian apparel market, with growth led by rising equestrian sports participation in China, Japan, and Australia. Growing middle-class income and increasing interest in horse riding as a leisure and lifestyle activity fuel market expansion. China’s rapid development of equestrian clubs and training facilities is driving demand for affordable as well as premium riding gear. Australia contributes significantly through recreational riding culture and international competition presence. Expanding e-commerce platforms and growing brand penetration further strengthen the regional outlook, making Asia-Pacific a key emerging hub for equestrian apparel growth.

Latin America

Latin America holds 8% of the equestrian apparel market, supported by the popularity of horse-related sports such as polo in Argentina and rodeo traditions in Brazil and Mexico. Rising urbanization and disposable incomes are driving interest in leisure equestrian activities, creating opportunities for apparel brands. While the market remains smaller compared to North America and Europe, demand for affordable riding apparel and sustainable options is increasing. Local events and growing awareness of equestrian culture also contribute to steady market expansion. Limited infrastructure remains a challenge, but rising participation supports long-term growth prospects.

Middle East & Africa

The Middle East and Africa collectively account for 7% of the equestrian apparel market, supported by cultural and recreational interest in horse riding. The Middle East, particularly the UAE and Saudi Arabia, shows strong demand due to equestrian sports being deeply rooted in heritage. High spending power in the region sustains demand for luxury and premium riding apparel. Africa’s market is comparatively smaller, with South Africa leading through established riding clubs and events. While growth is moderate, increasing exposure to international competitions and rising recreational interest contribute to steady demand for equestrian apparel in these regions.

Market Segmentations:

By Product Type:

By Apparel:

- Sustainable

- Unsustainable

By Category:

- Professional rider

- Recreational rider

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The equestrian apparel market is shaped by key players including Kingsland Equestrian, Horze, Pikeur, Goode Rider, Equi-Star, Eskadron, Dublin, Kentucky Horsewear, Helite, and Charles Owen. The equestrian apparel market is highly competitive, characterized by innovation, brand differentiation, and expanding product portfolios. Companies focus on developing high-performance riding gear that combines safety, comfort, and style to appeal to both professional and recreational riders. Sustainability is becoming a major competitive factor, with brands investing in eco-friendly fabrics and ethical production processes. Digital sales channels, particularly e-commerce platforms, play a critical role in expanding global reach and enabling direct consumer engagement. Partnerships with equestrian events and endorsements from professional riders further strengthen brand visibility, while affordability and premium quality continue to define market positioning strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Ariat International, Inc. teamed up with American rodeo champion Trevor Brazile to launch the Relentless Futurity collection. This new line features boots designed for competition, riding, and everyday wear, signifying an expansion of Ariat product offerings.

- In July 2024, Samshield, renowned for its innovative approach to horse riding helmets, launched a new line of helmets 2.0. These cutting-edge helmets represent the culmination of four years of research, offering exceptional comfort and top-tier safety.

- In June 2024, Horse Racing Ireland responded to an investigative documentary exposing mistreatment within the horse racing industry. HRI pledged a investment in welfare and integrity services, while the Irish Minister for Agriculture announced an investigation into equine slaughter supply practices, underscoring a commitment to animal welfare.

- In February 2023, US Equestrian reported an extension to their partnership with UK based sportswear Charles Owen. They will continue serving as the official helmet supplier for US Equestrian.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Apparel, Category and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The equestrian apparel market will expand with rising global participation in horse riding activities.

- Demand for sustainable and eco-friendly fabrics will continue to strengthen brand positioning.

- Technological integration such as smart textiles will enhance rider safety and performance.

- E-commerce platforms will play a greater role in boosting global sales and visibility.

- Premium product demand will rise as professional riders seek high-performance apparel.

- Affordable collections will attract recreational riders and expand customer reach.

- Regional growth will accelerate in Asia-Pacific with increasing equestrian clubs and events.

- Strategic collaborations with equestrian associations will support brand recognition.

- Product customization and personalization will gain importance among younger riders.

- Sustainability certifications and ethical sourcing will become key differentiators for long-term competitiveness.