Market overview

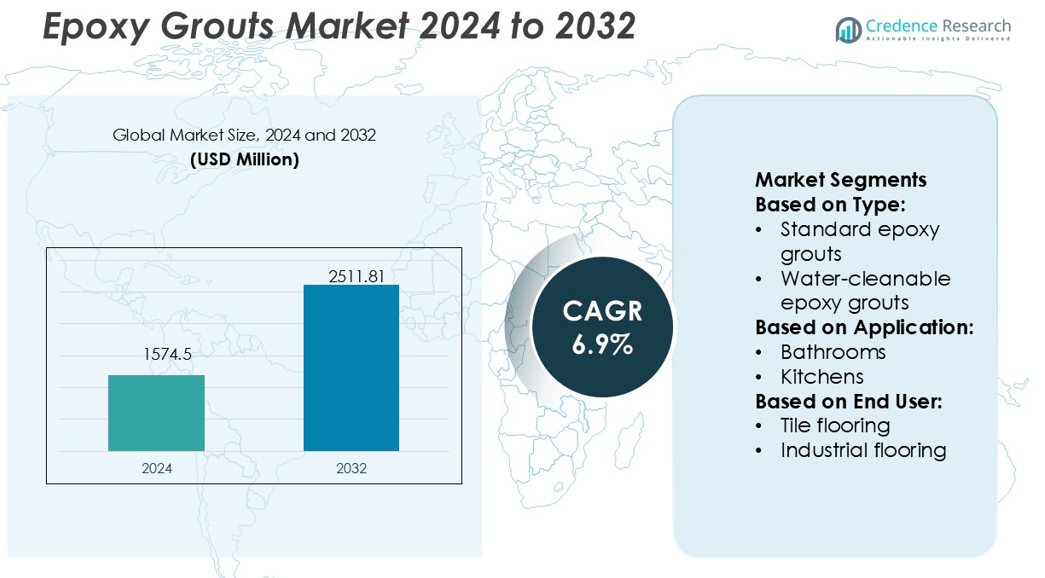

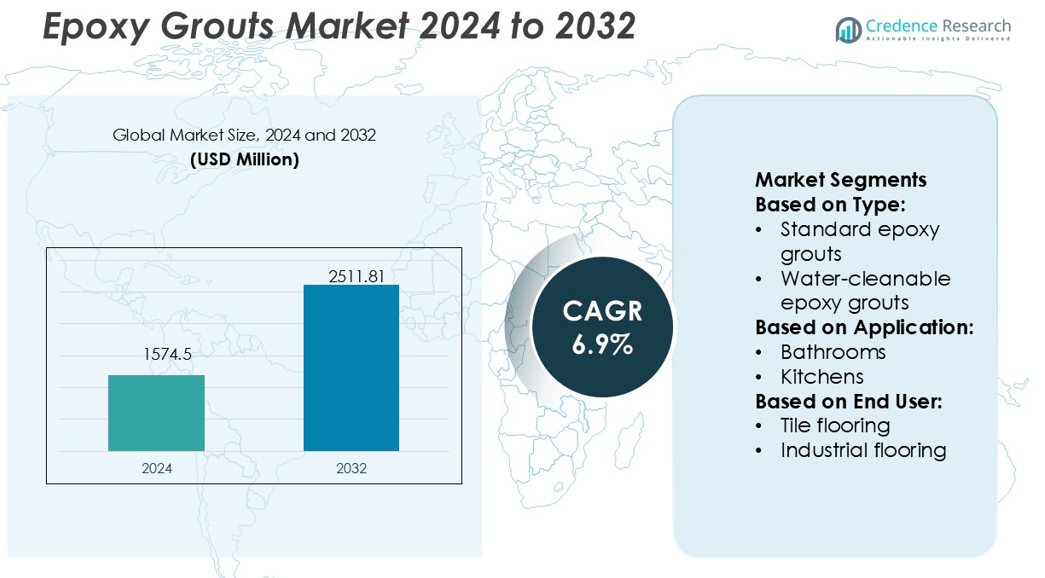

Epoxy Grouts Market size was valued USD 1574.5 million in 2024 and is anticipated to reach USD 2511.81 million by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Epoxy Grouts Market Size 2024 |

USD 1574.5 million |

| Epoxy Grouts Market, CAGR |

6.9% |

| Epoxy Grouts Market Size 2032 |

USD 2511.81 million |

The epoxy grouts market features strong competition among key players such as BASF SE, Solvay, Sika AG, Olin Corporation, Huntsman International LLC, Atul Ltd, NAN YA PLASTICS CORPORATION, Jiangsu Sanmu Group Co., Ltd., Jubail Chemical Industries LLC, and KUKDO CHEMICAL CO., LTD. These companies compete through product innovation, sustainability initiatives, and expansion into high-growth regions. Asia-Pacific leads the global epoxy grouts market with a 35% share, driven by rapid urbanization, large-scale residential and commercial projects, and government-backed infrastructure development. The region’s dominance is further supported by growing demand for durable and eco-friendly construction materials.

Market Insights

- The epoxy grouts market size was valued at USD 1574.5 million in 2024 and is projected to reach USD 2511.81 million by 2032, growing at a CAGR of 6.9% during the forecast period.

- Rising demand from construction, flooring, and tiling applications acts as a key driver, supported by growing preference for durable, chemical-resistant, and eco-friendly grout solutions across residential, commercial, and industrial projects.

- Market trends highlight a shift toward water-cleanable and sustainable epoxy grouts, with companies focusing on innovations that offer faster curing, improved aesthetics, and compliance with green building standards.

- Competitive intensity remains high as players such as BASF SE, Solvay, Sika AG, and Huntsman International LLC expand global reach through R&D, strategic partnerships, and regional manufacturing investments.

- Asia-Pacific dominates with a 35% market share, followed by North America at 28% and Europe at 25%, while tile flooring remains the leading end-user segment, holding 38% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Two-component epoxy grouts dominate the market with a 40% share, supported by superior bonding strength and durability. Their extensive use in both residential and industrial projects highlights their reliability in high-stress environments. Chemical-resistant epoxy grouts are also growing quickly due to rising demand in laboratories, factories, and healthcare facilities. Water-cleanable epoxy grouts appeal to residential users seeking easier application and cleaning. The overall segment is driven by construction growth, demand for high-performance materials, and rising adoption of sustainable grout technologies.

- For instance, Nan Ya’s NPEL-128 epoxy resin exhibits a viscosity of 12,000–15,000 cps at 25 °C, making it ideal for two-component systems. Their extensive use in both residential and industrial projects highlights their reliability in high-stress environments.

By Application

Kitchens account for the largest market share at 35%, driven by the need for stain-resistant and hygienic grout solutions. High demand in residential and commercial kitchens stems from frequent cleaning requirements and exposure to moisture and chemicals. Bathrooms and swimming pools are also strong sub-segments due to the need for waterproofing and mold resistance. Residential applications benefit from rising housing developments and renovation projects. The application segment is strengthened by consumer preference for durable, easy-to-maintain grouting solutions that enhance long-term performance and appearance.

- For instance, Huntsman markets the epoxy resin Araldite® GT 7004, which is a solid, medium-molecular-weight bisphenol A type resin. As a solid, it does not have a measurable viscosity at 25 °C.

By End User

Tile flooring leads the segment with a 38% market share, attributed to widespread use in residential, commercial, and industrial spaces. Epoxy grouts enhance durability, resist stains, and provide strong adhesion, making them the preferred choice for tile installations. Industrial flooring is another fast-growing area due to rising demand in warehouses, factories, and heavy-duty applications. Decorative flooring also sees traction in luxury residential and commercial projects. The segment’s growth is fueled by urbanization, infrastructure development, and an increasing focus on long-lasting, low-maintenance flooring solutions.

Key Growth Drivers

Rising Demand in Construction and Infrastructure

The expansion of residential, commercial, and industrial construction projects is a key driver for the epoxy grouts market. Urbanization, coupled with infrastructure modernization, has increased the adoption of epoxy grouts in flooring, tiling, and decorative applications. Their superior strength, chemical resistance, and waterproofing qualities make them a preferred choice over conventional cement-based grouts. The rising number of large-scale housing developments, malls, airports, and industrial facilities continues to fuel consistent demand. Government investment in smart cities and sustainable infrastructure further supports market growth.

- For instance, Solvay’s CYCOM® EP2190 epoxy prepreg achieves a dry of 188 °C and a wet of 144 °C. These properties support the use of this material in high-performance composite structures in humid or high-temperature environments.

Shift Toward High-Performance Flooring Solutions

The growing preference for durable and low-maintenance flooring solutions significantly drives epoxy grout adoption. Consumers and businesses alike are seeking products that withstand heavy traffic, stains, and exposure to chemicals. Tile and industrial flooring applications benefit most, where epoxy grouts provide long-lasting adhesion and aesthetic appeal. With rising demand from healthcare, food processing, and manufacturing facilities, the market is seeing accelerated growth. High-performance properties combined with compliance with hygiene and safety regulations further strengthen their demand across diverse industries.

- For instance, Sika’s Sikafloor®-262 AS N. A review of Sika’s public product data sheets confirms the compressive strength and flexural tensile strength figures under the specified conditions.

Technological Advancements and Product Innovation

Innovation in epoxy grout formulations is boosting market expansion. Manufacturers are introducing water-cleanable, eco-friendly, and stain-resistant variants to meet consumer and regulatory requirements. Improved ease of application, faster curing times, and enhanced resistance to harsh environments are increasing their adoption across both residential and industrial sectors. Advances in color stability and decorative finishes also attract consumers seeking aesthetic versatility. R&D investments by key players to develop sustainable and bio-based grouts further drive market growth, aligning with global trends toward green building materials.

Key Trends & Opportunities

Rising Adoption of Sustainable and Bio-Based Grouts

Sustainability is shaping the epoxy grouts market, with growing demand for eco-friendly formulations. Consumers and businesses prefer products with lower volatile organic compound (VOC) emissions and recyclable packaging. Bio-based epoxy grouts are gaining traction in regions with strict environmental regulations, such as Europe and North America. Green building certifications are further driving the adoption of such solutions in large-scale projects. This trend creates opportunities for manufacturers to differentiate through sustainable innovation, expand market share, and align with global decarbonization goals.

- For instance, Olin’s DLVE™-52 resin exhibits viscosity between 350 and 550 mPa·s at 25 °C, enabling high-solids, low-VOC coatings without solvents.

Increasing Penetration in Emerging Markets

Rapid urbanization and industrial growth in Asia-Pacific, Latin America, and the Middle East present strong opportunities for epoxy grout manufacturers. Rising disposable incomes and expanding real estate sectors are fueling demand for premium flooring and tiling materials. Government-led infrastructure projects, such as smart cities and commercial complexes, are accelerating adoption. Emerging economies also present significant potential for water-cleanable and cost-effective variants catering to residential applications. Players investing in distribution networks and localized production can capture early growth in these fast-expanding markets.

- For instance, BASF and Sika recently launched the Baxxodur EC 151 epoxy hardener, which cures fully at low temperatures between 5 °C and 10 °C, reducing curing time by up to two-thirds over conventional hardeners.

Key Challenges

High Cost of Epoxy Grouts Compared to Alternatives

One of the major challenges in the market is the higher cost of epoxy grouts compared to cement-based grouts. While epoxy options provide superior durability and resistance, their premium pricing often limits adoption in cost-sensitive residential projects. This price gap becomes a barrier in emerging economies where affordability influences purchasing decisions. Manufacturers face the challenge of balancing advanced performance with competitive pricing to reach a wider consumer base. Without addressing cost concerns, market penetration in low-income segments remains restricted.

Complexity in Application and Installation

Another challenge lies in the complexity of epoxy grout application, which requires skilled labor and proper handling. Incorrect mixing, curing, or installation can lead to poor results, reducing product effectiveness and customer satisfaction. The need for professional expertise increases project costs and deters DIY homeowners from choosing epoxy grouts. In regions with limited skilled workforce availability, adoption faces delays. Training programs and user-friendly formulations are needed to overcome these hurdles, but widespread implementation remains a challenge for many market players.

Regional Analysis

North America

North America accounts for 28% of the epoxy grouts market share, supported by strong adoption in residential, commercial, and industrial construction projects. The United States drives demand with large-scale infrastructure renovation, smart city developments, and the growing preference for durable flooring solutions. High penetration of premium kitchens, bathrooms, and swimming pool installations further strengthens regional growth. Regulatory emphasis on sustainable and VOC-compliant materials is accelerating the shift toward eco-friendly epoxy formulations. Canada adds to market expansion through rising housing projects and investments in modern infrastructure, making North America a key market with steady growth prospects.

Europe

Europe holds 25% of the epoxy grouts market share, driven by strict environmental regulations and widespread adoption of sustainable construction materials. Countries such as Germany, France, and the United Kingdom lead demand due to robust residential renovation and commercial infrastructure projects. Eco-friendly and water-cleanable epoxy grouts are gaining traction in the region, supported by green building certifications. Decorative and industrial flooring solutions see high adoption in the hospitality and manufacturing sectors. The growing focus on aesthetic finishes and compliance with EU sustainability directives positions Europe as a mature yet innovation-driven epoxy grouts market.

Asia-Pacific

Asia-Pacific dominates the epoxy grouts market with a 35% share, fueled by rapid urbanization, industrialization, and rising infrastructure investment. China and India are the primary growth engines, with large-scale residential projects, commercial complexes, and industrial facilities driving epoxy grout adoption. Japan and South Korea contribute with high demand for advanced and durable flooring in technology and manufacturing hubs. The region’s booming construction sector, combined with rising disposable incomes, strengthens demand for premium tile flooring and decorative finishes. Favorable government initiatives supporting smart city development further enhance Asia-Pacific’s position as the fastest-growing epoxy grouts market globally.

Latin America

Latin America represents 7% of the epoxy grouts market share, with Brazil and Mexico serving as major contributors. Rising middle-class incomes and increasing urban housing demand are key drivers of growth in residential applications, particularly kitchens and bathrooms. Commercial and hospitality projects also support market expansion, with epoxy grouts preferred for their durability and ease of maintenance. However, cost sensitivity remains a restraint, limiting widespread adoption of premium formulations. Investments in industrial flooring and infrastructure projects create future opportunities, especially as regional construction activity strengthens under government-backed development initiatives.

Middle East & Africa

The Middle East & Africa account for 5% of the epoxy grouts market share, with growth led by rapid infrastructure projects in the Gulf countries. The United Arab Emirates and Saudi Arabia dominate demand, supported by large-scale urban development, luxury housing, and hospitality projects. Industrial flooring applications in oil, gas, and manufacturing sectors further boost epoxy grout usage. In Africa, urbanization and housing developments are driving residential applications, though cost barriers remain significant. Growing interest in decorative flooring solutions and government investments in commercial infrastructure present opportunities for market expansion in this emerging region.

Market Segmentations:

By Type:

- Standard epoxy grouts

- Water-cleanable epoxy grouts

By Application:

By End User:

- Tile flooring

- Industrial flooring

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The epoxy grouts market is highly competitive, with leading players including NAN YA PLASTICS CORPORATION, Huntsman International LLC, Atul Ltd, Jubail Chemical Industries LLC, Solvay, Sika AG, Jiangsu Sanmu Group Co., Ltd., Olin Corporation, BASF SE, and KUKDO CHEMICAL CO., LTD. The epoxy grouts market is characterized by intense competition, driven by continuous innovation and expanding application areas. Companies are focusing on developing high-performance products with superior durability, chemical resistance, and easy maintenance to meet the needs of residential, commercial, and industrial flooring projects. Sustainability has emerged as a critical differentiator, with growing emphasis on low-VOC, bio-based, and water-cleanable formulations that align with global green building standards. Expanding distribution networks, strategic partnerships, and regional manufacturing capabilities are further shaping competitive strategies. Additionally, R&D investments aimed at faster curing, aesthetic versatility, and long-lasting adhesion are reinforcing market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, BASF SE concluded the sale of its stake in two joint ventures in Korla, China, to Verde Chemical Singapore Pte. Ltd. and moved to concentrate on its key business areas.

- In April 2025, Sika AG set up a new plant in Quito, Ecuador, helping the company provide mortar solutions such as epoxy grout, for South America. With this expansion, Sika serves the regional market better and grows its regional base.

- In March 2025, MAPEI launched its Construction and Restoration Systems, featuring new advanced epoxy grouts for various times in the construction process. As a result of this launch, MAPEI serves the construction industry with a variety of complete solutions.

- In February 2024, DCM Shriram announced the plan to invest over USD 10 billion in advanced material products manufacturing by setting up a greenfield plant in the next few years. The extensive line of advanced materials products includes liquid epoxy resins, solvent cuts, hardeners, formulated resins, and reactive diluents for a variety of industries such as electronics, wind turbines, electric vehicles (EVs), fireproofing, and lightweigh

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The epoxy grouts market will see strong demand from residential and commercial construction projects.

- Industrial flooring applications will expand as industries seek durable and chemical-resistant solutions.

- Eco-friendly and low-VOC epoxy grouts will gain wider adoption under green building standards.

- Technological innovation will focus on faster curing and water-cleanable grout formulations.

- Decorative flooring demand will rise, supported by preferences for aesthetic and long-lasting finishes.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will drive future growth.

- Infrastructure investments in smart cities will boost adoption of advanced epoxy grouts.

- Cost reduction strategies will be vital to penetrate price-sensitive residential markets.

- Training and skill development will improve adoption by reducing application complexities.

- Strategic mergers and collaborations will strengthen global supply chains and market reach.