Market overview

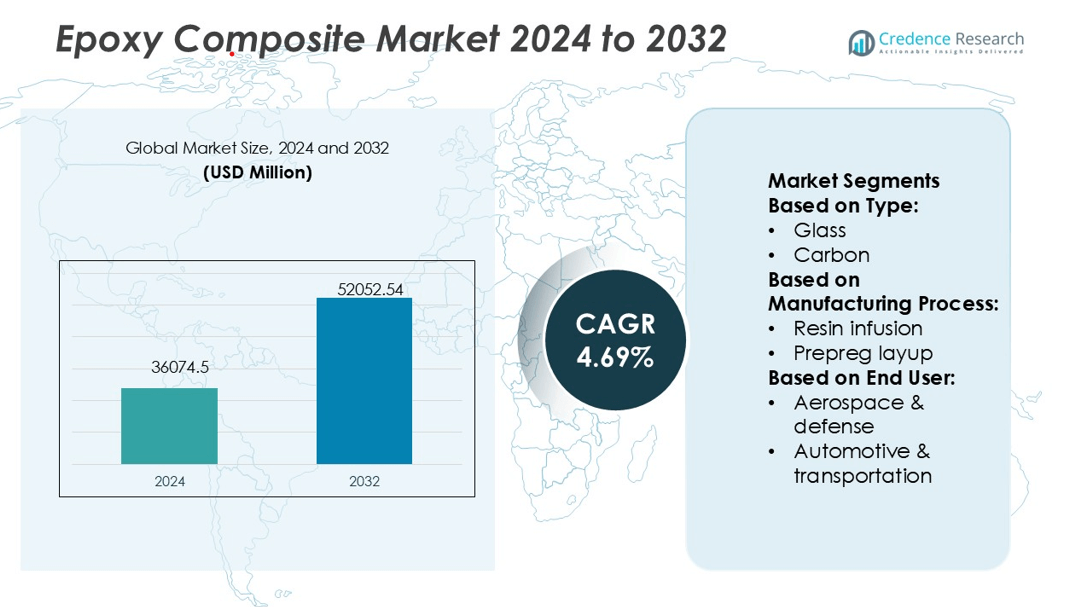

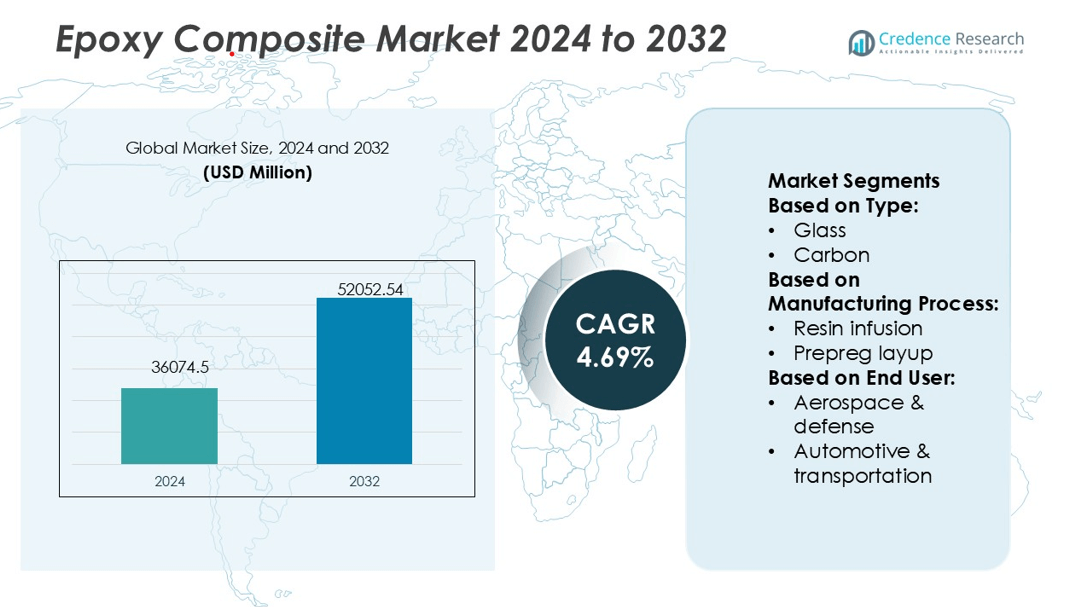

Epoxy Composite Market size was valued USD 36074.5 million in 2024 and is anticipated to reach USD 52052.54 million by 2032, at a CAGR of 4.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Epoxy Composite Market Size 2024 |

USD 36074.5 million |

| Epoxy Composite Market, CAGR |

4.69% |

| Epoxy Composite Market Size 2032 |

USD 52052.54 million |

The epoxy composite market is shaped by prominent players including Owens Corning, Hexcel Corporation, Gurit Holding AG, Mitsubishi Chemical Corporation, Solvay S.A., Huntsman Corporation, Ashland Global Holdings Inc., AOC, LLC, Sika AG, and Hexion Inc. These companies compete through innovation in resin formulations, fiber reinforcements, and advanced processing technologies to serve aerospace, automotive, wind energy, and construction sectors. Strategic investments in sustainable solutions and global expansion strengthen their market presence. Regionally, Asia-Pacific leads the epoxy composite market with a 35% share, driven by rapid industrialization, expanding automotive production, and significant wind energy projects, positioning it as the most dynamic growth hub worldwide.

Market Insights

- The Epoxy Composite Market size was valued at USD 36,074.5 million in 2024 and is projected to reach USD 52,052.54 million by 2032, expanding at a CAGR of 4.69% during the forecast period.

- Market drivers include rising demand for lightweight, high-strength materials in aerospace and automotive sectors, along with increased adoption in renewable energy, particularly wind turbine blade production.

- Key trends focus on sustainability with investments in bio-based epoxy resins and recyclable composites, while carbon fiber epoxy composites gain traction in premium aerospace and EV applications.

- Competitive analysis highlights leading players such as Owens Corning, Hexcel, Gurit, Mitsubishi Chemical, Solvay, Huntsman, Ashland, AOC, Sika, and Hexion, all advancing innovations in resin systems, fiber reinforcements, and automated manufacturing processes.

- Regionally, Asia-Pacific dominates with a 35% share, driven by industrialization and energy projects, while glass fiber epoxy composites hold the largest segment share, favored for cost-effectiveness and wide industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the epoxy composites market, glass fiber composites dominate with over 55% share due to their cost-effectiveness, durability, and wide application in construction, automotive, and wind energy sectors. Their balanced properties, including strength-to-weight ratio and corrosion resistance, make them suitable for mass production needs. Carbon fiber composites hold a smaller but rapidly growing share, driven by aerospace and high-performance automotive applications where lightweight and high stiffness are critical. Other fiber types, such as aramid and natural fibers, are niche but gaining traction in specialty and eco-friendly applications.

- For instance, Hexcel reports that a HexPly® 8552 laminate using HexTow® IM7 fiber shows a 0° tensile strength of 2723 MPa and a 0° tensile modulus of 164 GPa under dry conditions. The higher values of 3310 MPa and 190 GPa, as originally stated, are for a laminate made with HexTow® IM10 fiber, a product known for its higher strength and modulus.

By Manufacturing Process

Among manufacturing processes, prepreg layup holds the largest share of nearly 40% due to its strong adoption in aerospace and defense for precision, performance, and quality consistency. Resin infusion and compression molding are also widely used, offering scalability for automotive and energy applications. Filament winding and pultrusion are key for pipes, pressure vessels, and structural components in power and construction industries. The choice of process depends on end-user requirements, balancing performance, cost, and production speed. Growing automation and digital monitoring technologies are driving further efficiency in epoxy composite manufacturing.

- For instance, Gurit produces structural foam core materials, such as Corecell™ and PVC, in a range of densities, including variants around 100 kg/m³. Different foam types are used for different sections of the blade.

By End User

The aerospace and defense sector leads with a 35% market share, driven by strict weight reduction needs and high-performance standards. Epoxy composites are integral in aircraft fuselages, wings, and defense equipment, where strength-to-weight ratio directly impacts fuel efficiency and safety. Automotive and transportation follow closely, benefiting from rising EV adoption and sustainability goals. Electrical and electronics leverage composites for insulation, while energy and power sectors use them in wind turbine blades and grid applications. Sporting goods and industrial products form emerging segments, fueled by demand for lightweight, durable, and high-performance materials.

Key Growth Drivers

Lightweight and High-Strength Properties

The demand for lightweight, high-strength materials is a primary growth driver in the epoxy composites market. Aerospace, defense, and automotive industries rely heavily on epoxy composites to reduce overall weight while maintaining structural integrity. Reduced vehicle and aircraft weight enhances fuel efficiency and lowers emissions, aligning with global sustainability targets. Manufacturers increasingly prefer epoxy composites over metals and traditional plastics due to superior stiffness-to-weight ratios. This advantage strengthens adoption across transportation sectors, boosting long-term market growth and creating steady opportunities for material innovation.

- For instance, Mitsubishi Chemical Corporation (MCC) announced the development of a CFRP with a phenolic resin matrix. This phenolic-based CFRP has been publicly stated by the company to withstand high temperatures up to 300 °C.

Rising Adoption in Renewable Energy

The renewable energy sector, particularly wind energy, significantly drives epoxy composites demand. Epoxy-based composites are widely used in wind turbine blades due to their fatigue resistance, structural strength, and ability to withstand harsh environments. With global investments in wind energy capacity expansion, the need for durable and lightweight blade materials is increasing. Emerging markets in Asia-Pacific and Latin America are deploying larger wind farms, further fueling growth. The sector’s focus on efficiency and long operating life of turbines ensures long-term epoxy composite consumption.

- For instance, Solvay launched its CYCOM® EP2190 epoxy prepreg, which demonstrates excellent toughness and in-plane compression strength under hot/wet and cold/dry conditions, enabling its use in both wing and fuselage primary structures.

Technological Advancements in Manufacturing

Continuous innovations in manufacturing processes boost epoxy composite adoption. Automated prepreg layup, resin infusion, and advanced curing technologies enhance production speed, reduce costs, and improve quality consistency. Integration of digital monitoring and Industry 4.0 techniques helps optimize resin flow, curing cycles, and performance testing. Such advancements expand large-scale applications across automotive, aerospace, and industrial markets. Manufacturers also focus on hybrid composites and new resin formulations to improve heat resistance and recyclability, supporting wider adoption. These improvements lower entry barriers and strengthen competitiveness in high-demand industries.

Key Trends & Opportunities

Shift Toward Carbon Fiber Epoxy Composites

Carbon fiber-based epoxy composites are witnessing increased adoption due to their superior strength and stiffness. Although more expensive than glass fiber composites, they are increasingly used in aerospace, high-performance vehicles, and sporting goods. Growing demand for electric vehicles (EVs) further accelerates their use in lightweight battery housings and structural components. Opportunities lie in cost-reduction techniques for carbon fiber manufacturing, which would expand accessibility across mid-range automotive markets. This shift reflects a broader industry trend toward high-performance, durable, and sustainable material solutions.

- For instance, Huntsman’s ARALDITE® FST 40020 resin system cures in 3–5 minutes at 115 °C in CFRP systems designed for battery housing applications. While other products in the Araldite FST line, such as the ARALDITE® FST 40004 / ARALDITE® FST 40007 system.

Sustainability and Recycling Initiatives

Sustainability is becoming a major opportunity for epoxy composites manufacturers. Companies are investing in bio-based epoxy resins and recyclable composite systems to meet regulatory and consumer demands. Innovations in thermoplastic-epoxy hybrids and chemical recycling processes are enabling improved circularity of composite products. Green certifications and environmental standards are also influencing procurement in aerospace, automotive, and energy industries. Businesses focusing on eco-friendly solutions will gain a competitive edge as industries align with global decarbonization goals. This trend creates new markets for sustainable epoxy composite products.

- For instance, AOC’s resin systems were used in a 2,000-gallon spa structure: the composite backing employed AOC’s Altek® H100 vinyl ester skin coat for adhesion and corrosion resistance, followed by Altek® C949 in the main laminate.

Key Challenges

High Production and Material Costs

One of the main challenges in the epoxy composites market is high production cost. Raw materials like carbon fibers and epoxy resins are expensive compared to traditional metals or plastics. Complex manufacturing processes such as prepreg layup also increase labor and equipment expenses. These factors limit adoption in cost-sensitive industries, particularly in mid-tier automotive and consumer products. Reducing costs through process automation, alternative resins, or low-cost fiber reinforcements is essential for broader application. Without cost optimization, market penetration faces significant limitations.

Recycling and End-of-Life Management

Recycling epoxy composites remains a critical challenge due to their thermoset nature. Unlike metals, which can be easily re-melted and reused, epoxy composites require complex chemical or mechanical processes for recycling. Limited end-of-life solutions increase environmental concerns, especially with rising use in wind turbine blades and aerospace structures. The lack of large-scale recycling infrastructure also raises disposal costs for industries. Addressing this challenge requires innovation in recyclable resin formulations and effective collection systems. Failure to resolve sustainability issues may hinder long-term market acceptance.

Regional Analysis

North America

North America holds a 28% share of the epoxy composites market, supported by strong demand from aerospace, defense, and automotive industries. The United States leads the region with extensive use of epoxy composites in aircraft manufacturing, wind energy projects, and high-performance automotive parts. Government investments in defense modernization and renewable energy projects further drive growth. Canada also contributes with rising wind energy adoption and automotive applications. Strong research and development, coupled with a focus on lightweight and fuel-efficient materials, ensures continuous market expansion, positioning North America as a significant hub for advanced composite innovations.

Europe

Europe accounts for 25% of the epoxy composites market, driven by stringent environmental regulations and widespread adoption across aerospace, automotive, and renewable energy sectors. Countries like Germany, France, and the UK are leading in automotive lightweighting initiatives, while offshore wind projects in the North Sea significantly boost epoxy demand. The region emphasizes sustainability, with growing interest in recyclable and bio-based epoxy composites. Major aerospace manufacturers such as Airbus further strengthen regional growth by incorporating advanced composite materials into next-generation aircraft. Europe remains highly competitive, combining regulatory support and advanced manufacturing capabilities to expand market opportunities.

Asia-Pacific

Asia-Pacific dominates the epoxy composites market with a 35% share, led by rapid industrialization and infrastructure growth. China, Japan, and India drive adoption in automotive, electronics, aerospace, and energy sectors. China leads in large-scale wind turbine blade production, while Japan focuses on aerospace applications. India’s growing automotive sector also boosts demand for lightweight materials. Expanding electric vehicle adoption across the region presents strong opportunities for epoxy composites. With significant manufacturing capacity, lower production costs, and strong government support for renewable energy, Asia-Pacific remains the fastest-growing and largest regional market for epoxy composites.

Latin America

Latin America captures a 6% market share, with growth largely centered on Brazil and Mexico. The automotive industry in Mexico and renewable energy projects in Brazil drive steady epoxy composites demand. Wind energy investments, especially in Brazil, are creating opportunities for epoxy-based turbine blade production. The aerospace sector also contributes, as regional aircraft manufacturers incorporate lightweight composites for efficiency. However, high production costs and limited technological infrastructure restrict faster expansion. International partnerships and increasing investment in renewable energy are expected to support growth, making Latin America an emerging but developing market for epoxy composites.

Middle East & Africa

The Middle East and Africa hold a 6% share of the epoxy composites market, supported by infrastructure development, aerospace investment, and renewable energy initiatives. Gulf countries, including the UAE and Saudi Arabia, are incorporating composites in construction and defense applications. South Africa drives demand in wind energy projects, leveraging epoxy composites in turbine blade manufacturing. However, limited local production capacity and reliance on imports restrain wider adoption. Growing government focus on diversifying economies and investing in renewable power creates opportunities. Although smaller compared to other regions, MEA’s market shows potential for steady long-term growth in specialized applications.

Market Segmentations:

By Type:

By Manufacturing Process:

- Resin infusion

- Prepreg layup

By End User:

- Aerospace & defense

- Automotive & transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The epoxy composite market features a competitive landscape shaped by leading companies such as Owens Corning, Hexcel Corporation, Gurit Holding AG, Mitsubishi Chemical Corporation, Solvay S.A., Huntsman Corporation, Ashland Global Holdings Inc., AOC, LLC, Sika AG, and Hexion Inc. The epoxy composite market is highly competitive, driven by continuous innovation, technological advancements, and expanding application areas across industries. Companies focus on developing lightweight, high-strength, and durable materials to meet growing demand in aerospace, automotive, wind energy, and construction sectors. Sustainability has become a major competitive factor, with increasing investments in bio-based resins and recyclable composite solutions to align with global environmental goals. Market participants also prioritize cost reduction through automation, advanced curing technologies, and efficient manufacturing processes. Strategic collaborations, mergers, and geographic expansion are key approaches adopted to strengthen global presence and capture emerging opportunities in high-growth markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Owens Corning

- Hexcel Corporation

- Gurit Holding AG

- Mitsubishi Chemical Corporation

- Solvay S.A.

- Huntsman Corporation

- Ashland Global Holdings Inc.

- AOC, LLC

- Sika AG

- Hexion Inc.

Recent Developments

- In June 2024, Plastics processor Ensinger is investing in production capacity expansion for its composites division. Very soon, a high-performance double belt press will begin operation in Rottenburg-Ergenzingen. The new facility enables the efficient production of thermoplastics composite materials.

- In April 2024, Aurora Flight Sciences (Bridgeport, W.Va., U.S.), a Boeing Company, expanded its manufacturing facility in Bridgeport, West Virginia. The expansion adds almost 50,000 square feet to the facility to support significant growth for building high-quality composite components and assemblies across both current production programs and new opportunities in the aerospace industry.

- In March 2024, Toray Advanced Composites launched the new product Toray Cetex TC915 PA+ into its extensive portfolio. Toray Cetex TC915 PA+ is excellent for sporting goods, high-performance industrial applications, automotive structures, energy (oil/gas & hydrogen), Urban Air Mobility (UAM), and Unmanned Aerial Systems (UAS) applications.

- In February 2023, the Epsilon Composite unveiled a significant technological advancement in CFRP Pultrusion and pull winding processes. This enhancement is expected to further drive the demand for high-performance epoxy composites in various industrial applications

Report Coverage

The research report offers an in-depth analysis based on Type, Manufacturing Process, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see stronger adoption in aerospace and defense for lightweight, high-performance structures.

- Automotive manufacturers will increase epoxy composite use to improve fuel efficiency and support EV growth.

- Wind energy projects will expand demand for epoxy composites in larger and more durable turbine blades.

- Electrical and electronics applications will grow due to superior insulation and heat resistance properties.

- Advanced manufacturing processes will enhance cost efficiency and scalability of composite production.

- Sustainability efforts will drive investment in recyclable and bio-based epoxy resin solutions.

- Carbon fiber epoxy composites will gain traction despite higher costs, especially in premium applications.

- Asia-Pacific will remain the fastest-growing regional market, supported by industrial expansion and renewable energy projects.

- Strategic collaborations and acquisitions will intensify competition among leading composite manufacturers.

- Digitalization and Industry 4.0 technologies will improve process control and product quality in composite manufacturing.