Market overview

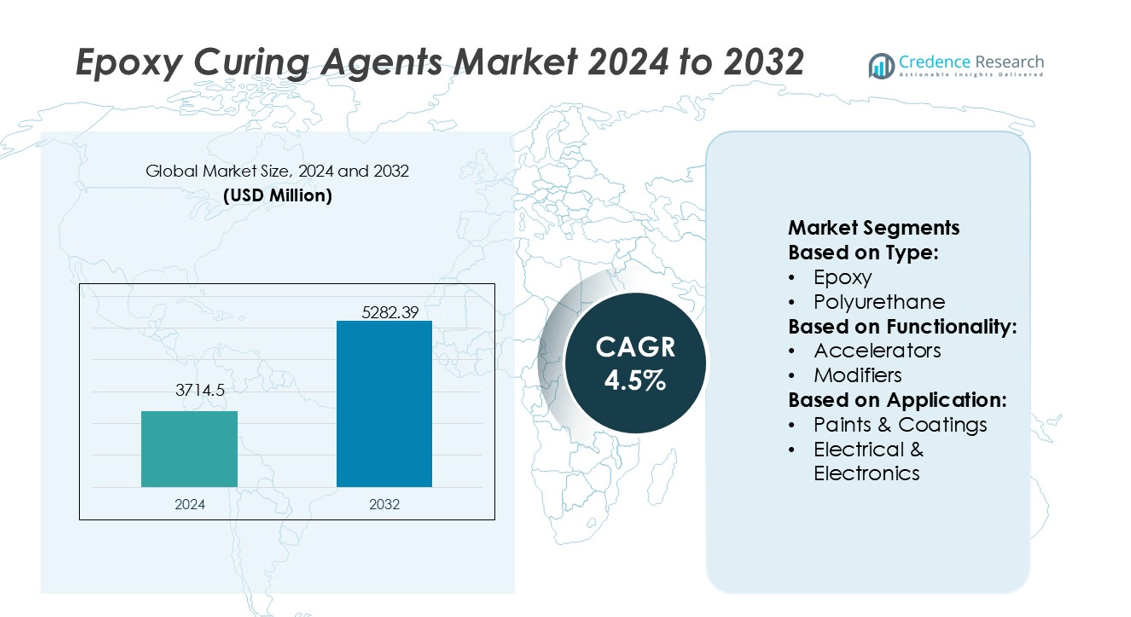

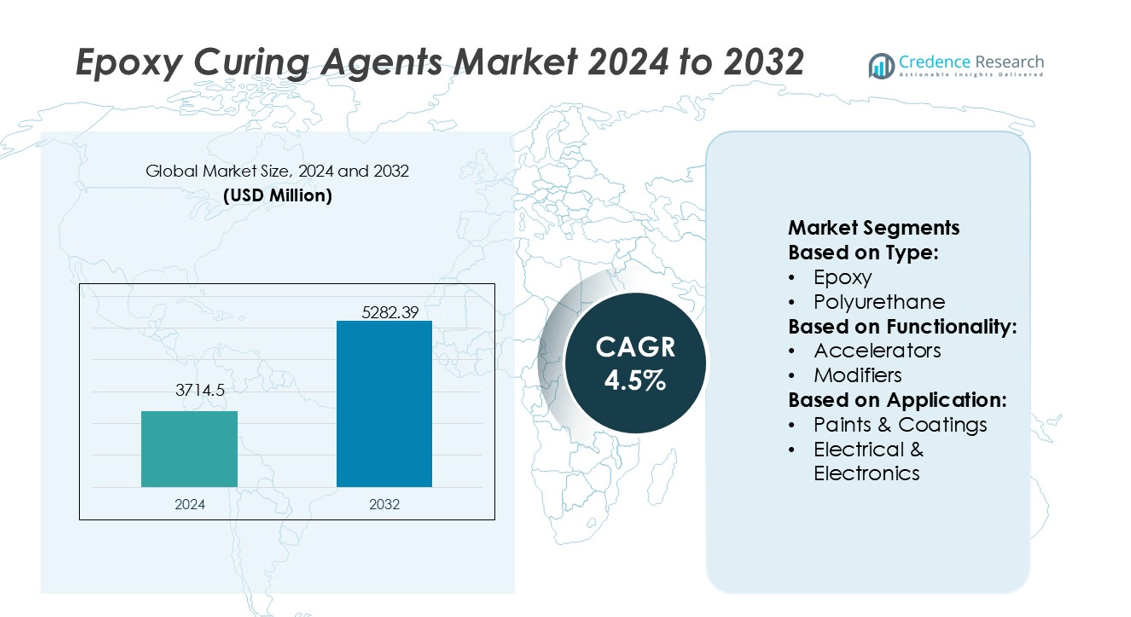

Epoxy Curing Agents Market size was valued USD 3714.5 million in 2024 and is anticipated to reach USD 5282.39 million by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Epoxy Curing Agents Market Size 2024 |

USD 3714.5 million |

| Epoxy Curing Agents Market, CAGR |

4.5% |

| Epoxy Curing Agents Market Size 2032 |

USD 5282.39 million |

The epoxy curing agents market is driven by prominent players including BASF SE, Evonik Industries, Hexion, Olin Corporation, Mitsubishi Chemical Corporation, Huntsman International LLC, DIC Corporation, Cardolite Corporation, Alfa Chemicals, and Supreme Polytech Pvt. Ltd. These companies compete through innovations in curing technologies, expansion of sustainable and bio-based solutions, and strong global distribution networks. Strategic mergers, product diversification, and investments in R&D further enhance their market positions across key end-use sectors such as construction, automotive, wind energy, and electronics. Among regions, Asia-Pacific leads the epoxy curing agents market with a 42% share, supported by rapid industrialization, infrastructure growth, and strong demand from electronics and renewable energy industries.

Market Insights

- The Epoxy Curing Agents Market size was valued at USD 3714.5 million in 2024 and is projected to reach USD 5282.39 million by 2032, growing at a CAGR of 4.5% during the forecast period.

- Market growth is driven by rising demand from construction, automotive, wind energy, and electronics industries where epoxy curing agents offer durability, strength, and corrosion resistance.

- Key trends include a strong shift toward bio-based and low-VOC curing agents, along with technological innovations in composites and fast-curing systems for high-performance applications.

- Competition remains intense, with leading players such as BASF SE, Evonik Industries, Hexion, Olin Corporation, and Huntsman International LLC investing in R&D, sustainability, and strategic collaborations to strengthen global reach.

- Asia-Pacific leads the global market with a 42% share, followed by North America at 25% and Europe at 20%, while paints and coatings remain the dominant application segment with a 35% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the Epoxy Curing Agents Market, the epoxy segment dominates with a market share of over 45%. Its leadership is driven by widespread use in structural composites, coatings, and adhesives due to high mechanical strength and chemical resistance. Epoxy curing agents are critical for aerospace, automotive, and industrial applications, where performance reliability is essential. Polyurethane follows closely, favored for flexible coatings and sealants, while acrylic and rubber-based agents find niche roles in specialty applications. The strong demand for epoxy resins in construction and electronics reinforces this segment’s leading position globally.

- For instance, Supreme Polytech Pvt. Ltd. is a manufacturer of epoxy resins, including products under the Superdite® brand. The product numbering system (SER 530 and hardener SEH 751) is consistent with the company’s other products.

By Functionality

The accelerators segment holds the dominant position with a market share exceeding 40%, driven by its ability to reduce curing time and enhance productivity in large-scale manufacturing. Accelerators are especially critical in wind energy and automotive sectors, where faster processing translates into cost savings. Modifiers contribute significantly by improving toughness, flexibility, and impact resistance of cured systems. Stabilizers maintain material durability under thermal and chemical stress, supporting demand in electronics and coatings. The preference for accelerators reflects industries’ increasing emphasis on efficiency and throughput.

- For instance, BASF’s Baxxodur® EC 151 (developed jointly with Sika) acts as an advanced accelerator/hardener: it enables epoxy resin flooring systems to cure under cold conditions (5–10 °C), reduces curing time by up to two thirds compared to conventional hardeners, and enables formulation of ultra-low VOC systems (with up to 90 % less VOC emissions) while maintaining high gloss and color stability.

By Application

The paints and coatings segment leads the market with a share of nearly 35%, supported by rising infrastructure development and protective coating needs in automotive and construction. Epoxy curing agents in coatings deliver superior corrosion resistance, adhesion, and durability, making them indispensable for marine and industrial use. Electrical and electronics follow as a strong segment, fueled by miniaturization trends and demand for high-performance insulation. Wind energy applications are also gaining momentum, driven by turbine blade production. The dominance of paints and coatings underscores the sector’s reliance on epoxy systems for long-term performance.

Key Growth Drivers

Expanding Construction and Infrastructure Projects

The growth of construction and infrastructure projects is a major driver in the epoxy curing agents market. Demand for high-performance coatings, adhesives, and sealants in commercial and residential buildings continues to rise. Epoxy curing agents are widely used due to their durability, corrosion resistance, and strong bonding properties. Governments investing in smart cities and sustainable infrastructure also accelerate adoption. The need for long-lasting materials in bridges, roads, and industrial facilities ensures steady market growth, positioning the construction sector as a critical demand source.

- For instance, Hexion’s INFINIUM™ low-yellowing epoxy system (EPON LY Resin 1810 combined with EPIKURE LY Curing Agent 3801) enables five-times lower yellowing compared to standard systems, while retaining full cure overnight.

Rising Demand in Wind Energy Applications

Wind energy expansion significantly drives epoxy curing agent consumption, particularly in turbine blade manufacturing. These agents provide superior mechanical strength and chemical resistance required for long-lasting composite blades. Global renewable energy targets and investments in wind farms increase production volumes of wind turbines. Countries such as China, India, and the U.S. lead this expansion, creating consistent demand. The growing focus on carbon-neutral energy sources reinforces the importance of epoxy curing agents in producing durable and efficient wind energy components.

- For instance, Olin Epoxy, a division of Olin Corporation, produces a range of epoxy resins and curing agents. D.E.H.® 622 is a modified amine curing agent within their portfolio.

Advancements in Electrical and Electronics Industry

The electrical and electronics industry plays a crucial role in driving the market. Epoxy curing agents are essential for encapsulation, insulation, and coating applications, protecting devices from moisture, heat, and chemical exposure. With rising adoption of smart devices, 5G infrastructure, and electric vehicles, demand for reliable insulation solutions has surged. Miniaturization of electronics and the need for high-performance materials further enhance product use. This sector’s growth ensures steady opportunities for manufacturers focused on delivering curing agents with improved thermal and electrical performance.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Bio-Based Curing Agents

Sustainability is shaping new opportunities in the epoxy curing agents market. Manufacturers are investing in bio-based and low-VOC curing systems to comply with stringent environmental regulations. Green building certifications and consumer demand for eco-friendly solutions are reinforcing this shift. Companies developing recyclable and bio-derived formulations gain competitive advantages. This trend aligns with global decarbonization goals, supporting long-term adoption of environmentally responsible curing agents across construction, automotive, and coatings industries.

- For instance, Mitsubishi Chemical recently launched its BiOpreg 500 series of carbon-fiber and glass-fiber prepregs using plant-derived epoxy resin (mass balance approach), acquiring ISCC PLUS certification.

Technological Innovations in Composite Manufacturing

Advances in composite processing technologies create new opportunities for epoxy curing agents. Faster-curing formulations, improved mechanical performance, and enhanced resistance to chemicals and heat are enabling broader applications. Automation and high-pressure resin transfer molding (HP-RTM) in aerospace and automotive sectors are expanding product demand. Companies focusing on customized curing agents for lightweight, high-strength composites can capture growth. This trend underscores the role of innovation in meeting industry-specific performance requirements while improving cost-efficiency.

- For instance, Evonik’s Ancamine® 2859 curing agent delivers faster set times: when paired with standard liquid epoxy resin (LER), the thin film set time (phase 3) at 23 °C is reduced from 9 hours (Ancamine 2280) to about 5 hours.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in raw material costs pose a significant challenge for the epoxy curing agents market. Key feedstocks such as amines and epoxides are derived from petrochemicals, which are highly sensitive to oil price variations and supply disruptions. Unstable pricing affects production costs and profit margins for manufacturers. Dependence on imports in certain regions further amplifies risks. Companies must manage supply chains effectively and explore alternative raw materials to counter this challenge and ensure consistent availability for end-use industries.

Stringent Environmental and Safety Regulations

Regulatory compliance remains a critical barrier for market growth. Epoxy curing agents often involve hazardous chemicals that pose environmental and health risks. Governments are tightening restrictions on emissions, worker safety, and disposal processes. Compliance requires investment in research to develop safer, low-toxicity, and sustainable formulations, which can increase costs. Manufacturers unable to meet evolving standards risk losing market access. This challenge highlights the importance of innovation and adherence to environmental and safety regulations to maintain competitiveness.

Regional Analysis

North America

North America holds 25% of the epoxy curing agents market, led by the U.S. with strong demand across aerospace, automotive, and electronics industries. Advanced manufacturing and high adoption of composites drive market expansion. Infrastructure renovation programs and government-backed renewable energy projects further support growth. The region’s stringent environmental regulations encourage development of low-VOC and sustainable formulations, benefiting specialized suppliers. With established players investing in R&D and a mature industrial base, North America remains a critical hub for technological innovations, ensuring consistent market growth and a competitive edge in high-performance applications.

Europe

Europe accounts for 20% of the epoxy curing agents market, driven by advanced automotive production, construction, and renewable energy expansion. Germany, France, and the U.K. dominate regional consumption, particularly in wind energy and protective coatings. Strict EU environmental directives encourage the use of bio-based and low-toxicity curing agents, prompting continuous innovation. The region’s automotive sector supports strong demand for lightweight composites, while sustainable construction standards add to adoption. Europe maintains steady growth momentum by aligning industrial practices with environmental goals, ensuring continued opportunities for eco-friendly solutions in high-performance applications.

Asia-Pacific

Asia-Pacific leads the global epoxy curing agents market with a 42% share, reflecting strong industrialization, urbanization, and large-scale infrastructure development. China and India dominate demand, supported by rapid growth in construction, wind energy, and electronics manufacturing. The region’s role as a global electronics and automotive hub accelerates epoxy curing agent consumption. Government initiatives promoting renewable energy and green construction further boost adoption. With competitive regional suppliers and expanding end-use industries, Asia-Pacific is both the largest and fastest-growing market, reinforcing its leadership position in global demand and future development opportunities.

Latin America

Latin America contributes 7% to the epoxy curing agents market, with Brazil and Mexico at the forefront. Growth is mainly driven by rising construction projects, infrastructure development, and expansion in automotive and industrial applications. The paints and coatings segment accounts for the largest demand share in the region. Limited domestic production and reliance on imports create challenges in supply and pricing. However, ongoing investments in renewable energy and modernization projects support future expansion. With infrastructure growth accelerating, Latin America is projected to register steady but moderate market development.

Middle East & Africa (MEA)

The Middle East & Africa represent 6% of the epoxy curing agents market, supported by large-scale construction, oil and gas, and industrial applications. Saudi Arabia and the UAE lead regional demand due to mega infrastructure projects and protective coatings in the energy sector. South Africa also contributes significantly in construction and industrial coatings. Limited local production capacity and dependence on imports hinder rapid growth. However, increasing renewable energy projects and diversification initiatives create new opportunities. MEA is positioned for gradual expansion, driven by infrastructure investments and industrial development.

Market Segmentations:

By Type:

By Functionality:

By Application:

- Paints & Coatings

- Electrical & Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The epoxy curing agents market is shaped by leading players such as Supreme Polytech Pvt. Ltd., BASF SE, Hexion, Olin Corporation, Mitsubishi Chemical Corporation, Evonik Industries, Hunstman International LLC, Alfa Chemicals, Cardolite Corporation, and DIC Corporation. The epoxy curing agents market is highly competitive, characterized by a mix of global leaders and regional suppliers focusing on performance, sustainability, and cost efficiency. Companies are prioritizing innovation in low-VOC, bio-based, and high-performance formulations to meet evolving regulatory standards and customer demands across construction, automotive, wind energy, and electronics industries. Strategic collaborations, mergers, and acquisitions are being leveraged to expand product portfolios and strengthen geographic presence. Continuous investment in research and development remains essential to improve curing efficiency, mechanical strength, and environmental compliance, ensuring long-term competitiveness in this dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Supreme Polytech Pvt. Ltd.

- BASF SE

- Hexion

- Olin Corporation

- Mitsubishi Chemical Corporation

- Evonik Industries

- Hunstman International LLC

- Alfa Chemicals

- Cardolite Corporation

- DIC Corporation

Recent Developments

- In March 2025, Westlake Epoxy (a subsidiary of Westlake Corporation) launched its LIpoVIVE portfolio at ECS 2025, featuring sustainable epoxy systems including the EPICURE 6874-WZ-50 curing agent and other products to enhance durability while reducing VOC emissions.

- In November 2024, Evonik Industries, AG broke ground on a specialty amines expansion in Nanjing, deepening its commitment to epoxy and polyurethane curing systems.

- In April 2024, Evonik announced the launch of its new range of curing agents by introducing Ancamine 2844, a groundbreaking hardener for epoxy cures designed explicitly for use in multi-component spray processes. This advanced, high-performance aliphatic amine hardener provides extremely rapid curing and accelerates property development under challenging temperature conditions, both low and high.

- In December 2023, BASF SE announced the completion of its capacity expansion for essential specialty amines in the U.S. The expansion aimed to produce more key polyether amines and amine catalysts marketed under the Baxxodur and Lupragen brands.

Report Coverage

The research report offers an in-depth analysis based on Type, Functionality, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand from construction and infrastructure projects.

- Growth in wind energy installations will increase the need for high-performance curing agents.

- The electronics industry will continue driving demand for advanced insulation and encapsulation materials.

- Bio-based and eco-friendly curing agents will gain wider adoption under stricter environmental rules.

- Technological innovations will improve curing efficiency and reduce processing time in composites.

- Automotive lightweighting trends will strengthen the use of curing agents in structural applications.

- Emerging economies will provide significant growth opportunities with industrialization and urbanization.

- Strategic partnerships and acquisitions will shape competitive dynamics in global markets.

- Supply chain resilience and raw material optimization will become critical for manufacturers.

- Continuous R&D investment will support the development of safer and sustainable curing solutions