Market overview

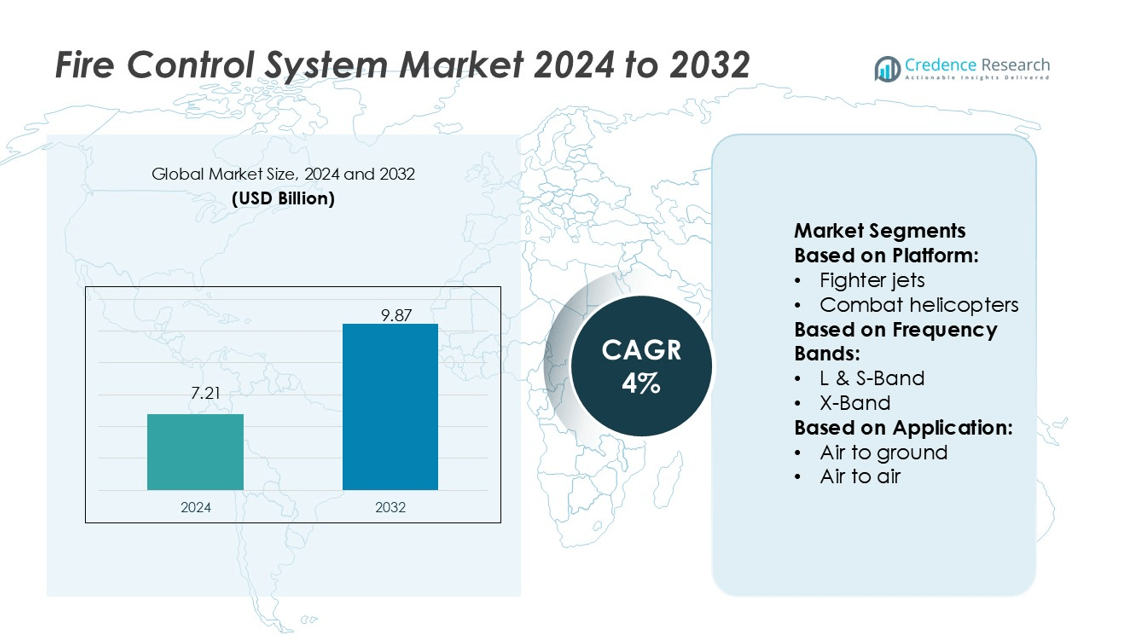

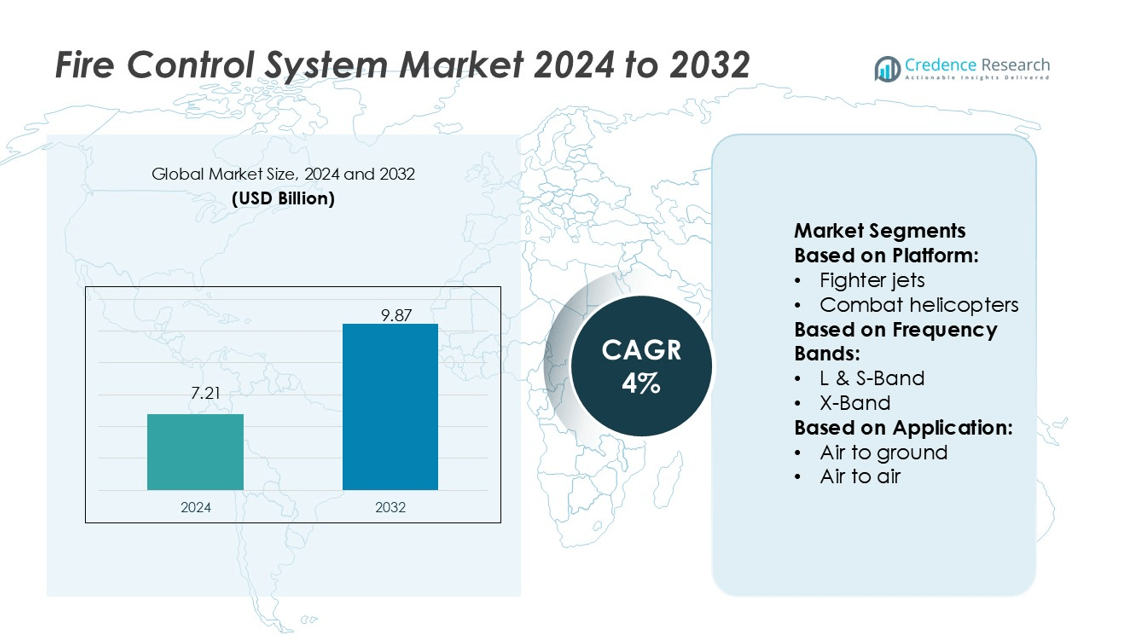

Fire Control System Market size was valued USD 7.21 billion in 2024 and is anticipated to reach USD 9.87 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fire Control System Market Size 2024 |

USD 7.21 billion |

| Fire Control System Market, CAGR |

4% |

| Fire Control System Market Size 2032 |

USD 9.87 billion |

The fire control system market is driven by leading players such as Raytheon Technologies Corporation, Honeywell International, Siemens AG, Robert Bosch GmbH, Johnson Controls, Hitachi Ltd., Halma plc, GENTEX CORPORATION, Eaton, and Iteris, Inc. These companies focus on developing advanced radar, electro-optical sensors, and AI-enabled solutions to enhance precision and interoperability across combat platforms. Strategic partnerships, government contracts, and continuous R&D investment strengthen their global positions. Regionally, North America dominates the market with a 36% share, supported by high defense spending, strong technological capabilities, and the presence of major defense contractors spearheading modernization programs.

Market Insights

- The Fire Control System Market size was valued at USD 7.21 billion in 2024 and is expected to reach USD 9.87 billion by 2032, growing at a CAGR of 4%.

- Growing demand for precision-guided weapons and AI-enabled targeting solutions acts as a major driver, with fighter jets holding the largest platform share due to high procurement and modernization programs.

- A key trend includes the integration of multi-domain interoperability and advanced radar frequency bands, enhancing accuracy and real-time data sharing across platforms.

- High development and integration costs remain a restraint, particularly impacting adoption in regions with limited defense budgets.

- North America leads the market with a 36% share, driven by strong defense spending, while Asia-Pacific emerges as the fastest-growing region due to increasing military modernization and indigenous defense manufacturing initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Platform

Fighter jets hold the dominant share of the fire control system market, accounting for nearly 42% of total revenue. Their dominance is driven by rising defense modernization programs and the integration of advanced radar, targeting pods, and precision-guided munitions. Nations are prioritizing next-generation fighter aircraft with network-centric capabilities to ensure superiority in contested environments. Increasing global procurement of stealth fighters, such as the F-35 and Rafale, reinforces demand for advanced fire control solutions, as these platforms require high-performance targeting and tracking systems to enhance accuracy in multi-domain combat operations.

- For instance, Raytheon provides the AN/APG-79 Active Electronically Scanned Array (AESA) radar for the U.S. Navy’s F/A-18E/F Super Hornet. It is capable of tracking multiple air targets simultaneously and has a detection range of up to approximately 150 kilometers (about 93 miles) against a standard 1-square-meter target.

By Frequency Bands

The X-Band segment dominates with 38% market share, supported by its precision in tracking and targeting applications. X-Band radars are widely adopted in fire control systems for fighter jets, helicopters, and naval platforms due to their superior resolution and ability to detect small, fast-moving targets. The adoption is further fueled by rising investments in phased-array radar technology and electronic countermeasure resistance. Defense programs across the U.S., Europe, and Asia-Pacific continue to favor X-Band systems, driving their leadership over L & S-Band and higher Ku/K/Ka-Band applications.

- For instance, Iteris introduced its Vantage Apex hybrid sensor combining 4D/HD radar and 1080p video, supporting stop-bar and advance detection out to 600 feet, with object tracking in up to 64 zones.

By Application

Air-to-ground applications lead with 44% market share, supported by the growing use of precision strike weapons and guided munitions. Modern combat increasingly requires accurate targeting of surface installations and armored formations, driving investment in fire control systems optimized for ground attack missions. Integration of laser designators, electro-optical sensors, and AI-enabled targeting enhances strike precision and minimizes collateral damage. The rise of asymmetric warfare and cross-border conflicts further strengthens demand for advanced air-to-ground capabilities, making this application segment the most significant contributor to overall market growth.

Key Growth Drivers

Rising Defense Modernization Programs

Global defense forces are heavily investing in modernizing their fleets of fighter jets, combat helicopters, and UAVs, fueling demand for advanced fire control systems. These upgrades focus on precision targeting, automated tracking, and multi-domain integration to improve battlefield effectiveness. Nations such as the U.S., China, and India are expanding procurement of advanced radar and sensor technologies, reinforcing this demand. Increased government spending on defense modernization ensures sustained adoption of fire control solutions across land, air, and naval platforms, making it a crucial growth driver.

- For instance, Honeywell secured a $103 million U.S. Army contract to deliver its Next-Gen APN-209 radar altimeter system, which replaces legacy units and enhances reliability in adverse weather and harsh environments.

Increasing Focus on Precision-Guided Weapons

The rising use of precision-guided munitions is significantly driving fire control system adoption. Modern warfare demands higher accuracy and reduced collateral damage, creating a strong need for advanced targeting and sensor integration. Fire control systems with electro-optical sensors, laser designators, and AI-based solutions are widely deployed to enhance strike effectiveness. As both developed and emerging nations expand their guided missile and smart munition inventories, the integration of advanced fire control systems becomes essential, ensuring higher operational efficiency in diverse combat environments.

- For instance, Bosch’s new radar SoCs, SX600 and SX601, built on 22-nm RF CMOS, extend detection range by about 30% over conventional sensors and use four transmit / four receive channels.

Growing Adoption of UAVs in Combat Operations

Unmanned Aerial Vehicles (UAVs) are becoming vital for surveillance, reconnaissance, and precision strikes, directly driving fire control system demand. Armed UAVs equipped with advanced targeting pods, radar systems, and AI-enabled fire control technologies provide strategic advantages in asymmetric warfare. Defense programs in countries such as Israel, the U.S., and Turkey highlight the growing reliance on UAVs for combat missions. The ability to conduct precision strikes with minimal human risk positions UAV-based fire control solutions as a major driver, supporting both tactical and strategic defense operations globally.

Key Trends & Opportunities

Integration of AI and Machine Learning

Artificial intelligence and machine learning are transforming fire control systems by enabling predictive targeting, automated decision-making, and enhanced accuracy. AI-driven algorithms analyze battlefield data in real time, supporting faster and more precise engagements. Defense contractors are actively embedding AI in radar, electro-optical sensors, and tracking modules, creating a competitive edge. This trend represents a significant opportunity for manufacturers to deliver next-generation fire control solutions that address evolving combat scenarios, ensuring technological superiority in highly contested environments.

- For instance, Johnson Controls unveiled an Illustra Edge AI LPR (License Plate Recognition) camera at GSX 2024 that performs onboard object analytics. It supports license plate recognition and runs deep neural networks on the edge. The camera is capable of streaming video at up to 30 frames per second, allowing for real-time AI processing of events.

Shift Toward Multi-Domain Operations

Modern combat strategies increasingly emphasize integration across land, sea, air, and space, driving the adoption of interoperable fire control systems. Defense forces seek systems capable of sharing data seamlessly across domains, improving situational awareness and response. Programs like the U.S. Joint All-Domain Command and Control (JADC2) highlight this shift, creating opportunities for manufacturers that can deliver network-enabled fire control solutions. Companies investing in interoperability and data fusion technologies are positioned to capture significant market share in this evolving defense landscape.

- For instance, Navtech Radar, a Halma subsidiary, builds 360° scanning radar systems for applications in ground surveillance and traffic management. Its AdvanceGuard ground surveillance system, for instance, offers high-definition radar that can detect and track targets, such as pedestrians and vehicles, with its longest-range sensor providing a detection radius of up to 5 kilometers.

Key Challenges

High Development and Integration Costs

Fire control systems are technologically complex, requiring advanced radar, sensors, and AI integration, which significantly raises development costs. Defense contractors face challenges in managing expenses while meeting the demand for cutting-edge capabilities. Additionally, integrating these systems into existing platforms often requires extensive customization, further increasing costs. This financial burden limits adoption among smaller defense budgets, particularly in developing nations, creating a barrier for market expansion despite rising global demand for modernized defense systems.

Vulnerability to Cybersecurity Threats

The growing digitization and network connectivity of fire control systems expose them to cybersecurity risks. Advanced systems rely heavily on data integration, AI, and satellite communication, making them susceptible to hacking, spoofing, and electronic warfare attacks. Such vulnerabilities can compromise mission-critical operations and reduce system reliability in combat. Ensuring robust cybersecurity frameworks and secure communication channels adds complexity and cost to development. Addressing these risks remains a key challenge for manufacturers and defense agencies aiming to safeguard operational effectiveness.

Regional Analysis

North America

North America leads the fire control system market with a 36% share, supported by strong defense spending and technological leadership. The U.S. spearheads advancements with large-scale investments in radar, electro-optical systems, and AI-based targeting solutions integrated into fighter jets, combat helicopters, and UAVs. Key defense contractors such as Lockheed Martin, Raytheon, and Northrop Grumman strengthen the region’s dominance by delivering next-generation solutions under major modernization programs. The demand is further driven by initiatives like JADC2, enhancing interoperability across platforms. Continuous innovation and export opportunities to allied nations ensure North America’s sustained leadership in the global market.

Europe

Europe holds a 25% share of the fire control system market, driven by increasing defense budgets and collaborative programs across NATO members. Countries such as France, Germany, and the U.K. prioritize upgrades in air and naval platforms, deploying advanced radar and precision-guided weapon systems. The European Defence Fund encourages joint R&D projects, accelerating technology adoption across the region. Rising geopolitical tensions in Eastern Europe have intensified procurement of modern combat systems, including AI-enabled fire control solutions. Strong contributions from companies like BAE Systems, Thales Group, and Leonardo S.p.A. further consolidate Europe’s position as a critical market player.

Asia-Pacific

Asia-Pacific accounts for 28% of the global fire control system market, with rapid growth fueled by military modernization and territorial disputes. China, India, Japan, and South Korea are leading contributors, investing heavily in advanced fighter jets, UAVs, and naval combat systems. Rising tensions in the South China Sea and Indo-Pacific region drive significant demand for precision-guided weapons and integrated fire control systems. Local manufacturing initiatives and indigenous defense programs boost market expansion, supported by collaborations with global players. With increasing procurement and defense partnerships, Asia-Pacific is emerging as a high-growth market with strong future potential.

Latin America

Latin America contributes 3% to the global fire control system market, with moderate growth influenced by limited defense budgets but increasing modernization needs. Brazil and Mexico lead the region’s adoption, focusing on upgrading air and naval capabilities with advanced targeting and radar solutions. Defense spending is primarily directed toward enhancing border security and counter-narcotics operations, driving demand for UAV-based fire control systems. Partnerships with U.S. and European manufacturers support technology transfer and deployment of modern systems. While budget constraints remain a challenge, gradual investments in modernization programs are expected to sustain market growth in the region.

Middle East & Africa

The Middle East & Africa region holds an 8% share, shaped by regional conflicts, counterterrorism efforts, and investments in defense modernization. Countries such as Saudi Arabia, Israel, and the UAE prioritize advanced targeting systems for both aerial and ground platforms. High reliance on imports from U.S. and European defense companies drives adoption of radar and electro-optical fire control solutions. African nations, though constrained by budgets, are increasingly investing in UAV-based systems for surveillance and counterinsurgency. Rising security concerns and defense procurement initiatives position the region as a steadily growing market segment, though challenges remain in affordability and local manufacturing.

Market Segmentations:

By Platform:

- Fighter jets

- Combat helicopters

By Frequency Bands:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fire control system market is shaped by key players including Raytheon Technologies Corporation, Iteris, Inc., Honeywell International, Inc., Siemens AG, Robert Bosch GmbH, Johnson Controls, Hitachi Ltd., Halma plc, GENTEX CORPORATION, and Eaton. The fire control system market is highly competitive, characterized by continuous innovation, technological integration, and strong defense modernization initiatives. Companies in this sector focus on developing advanced radar systems, electro-optical sensors, and AI-enabled targeting solutions to meet the growing demand for precision and multi-domain operations. Strategic partnerships, joint ventures, and defense contracts play a pivotal role in strengthening global presence and expanding product portfolios. The market also sees significant investments in interoperability and cybersecurity, ensuring system reliability in modern combat environments. Overall, competition is driven by innovation, operational efficiency, and long-term defense collaborations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, Edwards, a subsidiary of Carrier, introduced a new Optica duct smoke detector for commercial and industrial areas. It is specially designed to detect HVAC smoke in commercial and industrial premises.

- In January 2024, Lockheed Martin Corporation and Northrop Grumman collaborated to supply the U.S. Navy’s E-2D Advanced Hawkeye with the 75th APY-9 radar. The latest iteration of the Advanced Hawkeye is equipped with Lockheed Martin’s APY-9 radar system. The E-2, manufactured by Northrop Grumman, demonstrates exceptional proficiency in monitoring air, land, and sea simultaneously.

- In August 2023, Johnson Controls International Plc launched a new simplex foundation series of fire protection systems, which is suitable for industrial and commercial applications. In this series, the company introduced four fire alarm control units that offer features such as reliability, innovation, and cost-efficiency.

- In May 2023, Raytheon unveiled that its PhantomStrike radar will be incorporated into the FA-50 light combat aircraft by Korea Aerospace Industries (KAI). This advanced radar is entirely air-cooled and serves as a fire-control radar, offering extensive capabilities for detecting, tracking, and targeting threats over long range

Report Coverage

The research report offers an in-depth analysis based on Platform, Frequency Bands, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of AI-enabled targeting and tracking systems.

- Defense modernization programs will continue to drive procurement of advanced fire control solutions.

- UAV integration with precision strike capabilities will create new growth opportunities.

- Multi-domain interoperability will become a key requirement across land, air, and naval platforms.

- Cybersecurity measures will play a critical role in securing next-generation fire control systems.

- Demand for precision-guided weapons will strengthen adoption across both developed and emerging markets.

- Regional conflicts and border tensions will accelerate investments in advanced targeting systems.

- Collaborations between defense contractors and governments will shape long-term technology development.

- Indigenous manufacturing and defense localization initiatives will gain momentum in Asia-Pacific and Middle East.

- Continued innovation in radar frequency bands and electro-optical sensors will enhance market competitiveness.