Market overview

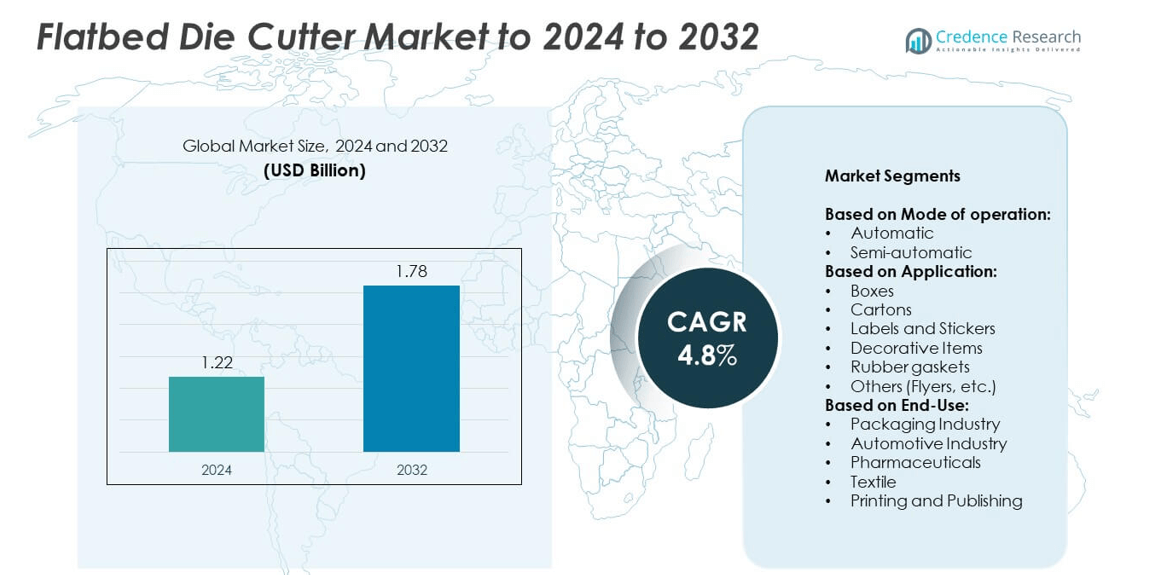

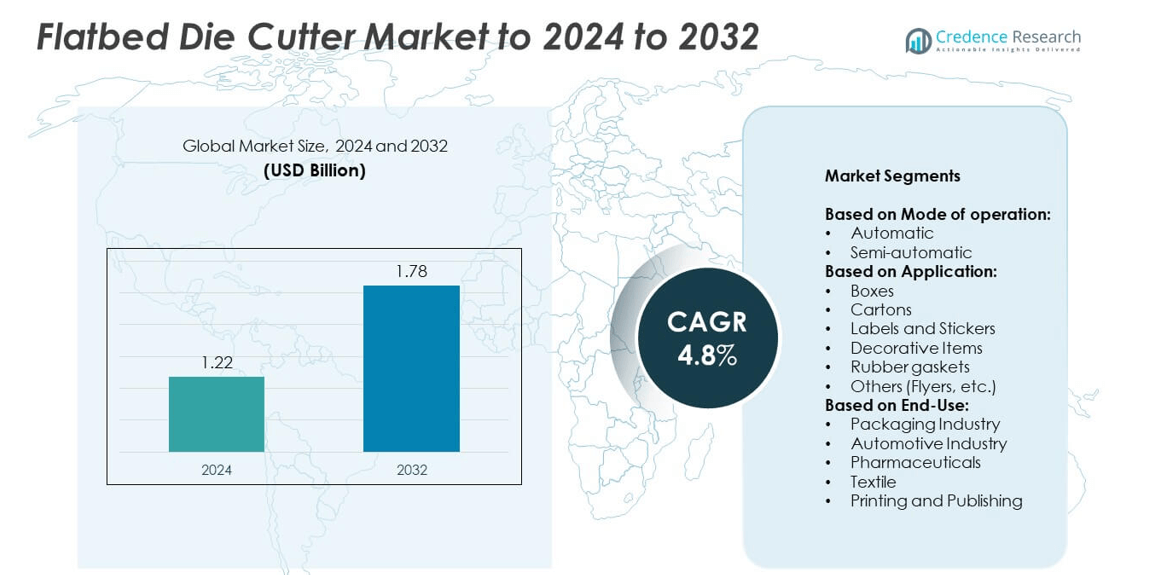

Flatbed Die Cutter Market size was valued USD 1.22 Billion in 2024 and is anticipated to reach USD 1.78 Billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flatbed Die Cutter Market Size 2024 |

USD 1.22 Billion |

| Flatbed Die Cutter Market, CAGR |

4.8% |

| Flatbed Die Cutter Market Size 2032 |

USD 1.78 Billion |

The flatbed die cutter market is driven by major players such as Heidelberger Druckmaschinen, Komori, Highcon, SANWA, BOBST, DeltaModTech, Winkler+Dünnebier, Yawa Printing Machinery, Sysco Machinery, Koenig & Bauer, Masterwork Machinery, Duplo International, Berhalter, ASAHI MACHINERY, DIMO TECH, and Hunkeler. These companies focus on automation, precision, and sustainable solutions to meet the evolving needs of packaging, labeling, and printing applications. Regionally, Asia Pacific dominated the market in 2024 with a 34% share, supported by large-scale manufacturing and rising e-commerce packaging demand. North America followed with 32%, driven by advanced automation adoption, while Europe accounted for 28%, supported by strong regulatory and sustainability initiatives.

Market Insights

- The flatbed die cutter market size reached USD 1.22 Billion in 2024 and is projected to reach USD 1.78 Billion by 2032, expanding at a CAGR of 4.8%.

- Rising demand for packaging across e-commerce, food, and pharmaceuticals is a major driver, with the automatic segment leading the market by holding over 60% share in 2024 due to efficiency and precision.

- Sustainability-focused packaging and the integration of digital technologies such as IoT and smart monitoring are key trends reshaping the industry, supporting higher adoption of advanced flatbed die cutters.

- The market is highly competitive with global and regional players focusing on automation, precision, and energy-efficient solutions to strengthen their presence, while high equipment costs remain a restraint for small and medium enterprises.

- Asia Pacific led the market with 34% share in 2024, followed by North America at 32% and Europe at 28%, while Latin America and Middle East & Africa accounted for smaller shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Mode of Operation

In 2024, the automatic segment dominated the flatbed die cutter market, accounting for more than 60% of the overall share. The preference for automatic machines stems from their higher cutting precision, faster processing speed, and reduced labor dependency compared to semi-automatic systems. These machines are increasingly adopted in large-scale packaging and printing operations where efficiency and consistency are critical. The semi-automatic segment continues to serve small and mid-sized enterprises, but automation trends and demand for mass production in the packaging sector firmly establish automatic flatbed die cutters as the leading sub-segment.

- For instance, Koenig & Bauer Iberica’s Ipress 106 K PRO reaches up to 8,500 sheets per hour and handles stock including corrugated board up to 3 mm thick

By Application

Boxes held the largest share of the market in 2024, contributing around 35% of the total demand. This dominance is driven by the surging global packaging industry, particularly in e-commerce, food, and consumer goods sectors. The rising need for durable and customizable packaging solutions has made flatbed die cutters essential for box manufacturing. Cartons and labels also show strong growth as branding and product differentiation become critical in competitive markets. While decorative items and rubber gaskets remain niche applications, the box segment continues to be the primary growth driver in terms of market volume.

- For instance, Young Shin GIANT 210 supports sheets up to 82.67″ × 60.50″ and runs up to 3,000 sheets per hour for large box formats.

By End-Use

The packaging industry emerged as the dominant end-use segment, accounting for over 45% of the flatbed die cutter market in 2024. Growing consumption of packaged foods, beverages, pharmaceuticals, and personal care products has significantly increased the demand for high-quality die-cut packaging. The rise of e-commerce platforms further supports the expansion of packaging applications, requiring reliable and large-scale die-cutting solutions. Although automotive, pharmaceuticals, textiles, and publishing sectors utilize flatbed die cutters for specialized needs such as gaskets, labels, or printed materials, the packaging industry remains the undisputed leader, driven by continuous innovation and strong global demand.

Key Growth Drivers

Rising Demand from Packaging Industry

The packaging industry stands as the primary growth driver for the flatbed die cutter market. Increasing consumption of packaged food, beverages, pharmaceuticals, and consumer goods continues to fuel demand. The expansion of e-commerce and home delivery services has further heightened the need for durable and customizable packaging formats. Flatbed die cutters enable precise, large-scale production of boxes, cartons, and labels, ensuring brand differentiation and operational efficiency. With packaging accounting for the largest application share, this segment firmly establishes itself as the most influential growth driver for the market.

- For instance, KAMA ProCut 76 Foil runs at 5,500 sheets/hour with 165 t punching force and max format 760 × 600 mm.

Shift Toward Automation and Precision

The growing preference for automated solutions is driving adoption of advanced flatbed die cutters. Automatic machines reduce manual labor, enhance cutting precision, and allow higher throughput, aligning with the industry’s push for efficiency. Manufacturers are integrating digital controls and smart monitoring features, supporting mass production needs in printing and packaging. The rising labor costs in many regions further accelerate automation uptake. This transition not only strengthens productivity but also ensures quality consistency, positioning automation as a vital factor propelling market expansion in the coming years.

- For instance, Sanwa 1060-series lists 8,000 sheets/hour maximum punching speed with chase and plate quick-locks.

Expansion in Labeling and Branding Needs

A surge in demand for labels and stickers is contributing to market growth. Companies across FMCG, pharmaceuticals, and retail are focusing heavily on brand visibility and compliance-driven labeling. Flatbed die cutters provide high flexibility for producing custom shapes, sizes, and intricate designs that enhance product appeal. With growing competition in consumer markets, packaging aesthetics and informative labeling are crucial. This demand for personalization and precise die-cutting capabilities supports the rising adoption of advanced systems, making labeling and branding requirements another key driver in the industry.

Key Trends & Opportunities

Sustainability and Eco-Friendly Packaging

Sustainability is becoming a defining trend in the flatbed die cutter market. Packaging manufacturers are increasingly shifting toward recyclable and biodegradable materials, which require accurate cutting and shaping to maintain structural integrity. Flatbed die cutters are well-suited for processing eco-friendly substrates, creating opportunities for equipment suppliers to expand offerings. Companies that provide machines optimized for sustainable packaging will gain a competitive edge. The global push for reducing plastic waste and meeting environmental regulations ensures that sustainability remains a long-term opportunity in the die-cutting landscape.

- For instance, Highcon Beam 2C supports digital cutting and creasing up to 4,000 sheets/hour on corrugated formats 760 × 1060 mm.

Integration of Digital and Smart Technologies

The integration of digital monitoring, IoT connectivity, and AI-driven controls is shaping the flatbed die cutter industry. These advancements enable predictive maintenance, remote diagnostics, and real-time quality monitoring, which improve efficiency and reduce downtime. Manufacturers are developing hybrid solutions that combine die cutting with digital finishing, catering to evolving customer needs for shorter production runs and customized outputs. The adoption of smart die-cutting technologies presents a major opportunity for market players, as it aligns with Industry 4.0 trends and helps businesses improve competitiveness in high-demand sectors.

- For instance, Kongsberg Ultimate reaches >165 m/min with up to 2.7 G acceleration for rapid cycle times.

Key Challenges

High Equipment Costs and Investment Barriers

The high initial investment required for flatbed die cutters poses a significant challenge, particularly for small and medium enterprises. Advanced automatic machines with smart features involve substantial costs, including installation and maintenance expenses. This creates entry barriers for new adopters and slows down adoption in cost-sensitive regions. While leasing and financing options are emerging, affordability remains a restraint. Balancing cost efficiency with technological advancements is essential, as the challenge of high capital investment continues to limit broader market penetration, especially among smaller manufacturers.

Competition from Alternative Cutting Technologies

Flatbed die cutters face strong competition from alternative technologies such as rotary die cutting and laser cutting systems. These methods offer benefits like faster speed, lower tooling costs, or greater flexibility for specific applications. As industries seek versatile solutions, laser cutting in particular has gained traction due to its non-contact precision and suitability for complex designs. This competition challenges flatbed die cutters to differentiate through efficiency, reliability, and advanced automation features. Without continuous innovation, the threat from alternative cutting technologies could restrict the long-term market share of flatbed systems.

Regional Analysis

North America

North America accounted for nearly 32% of the flatbed die cutter market share in 2024, making it one of the leading regions. Growth in this region is supported by strong demand from the packaging, printing, and publishing sectors, particularly driven by e-commerce and retail expansion. The United States remains the largest contributor, with rising investments in automation and advanced cutting equipment. Canada also supports market growth with increasing adoption in pharmaceuticals and food packaging industries. Technological advancements and sustainability initiatives continue to strengthen the regional outlook, keeping North America a key market driver.

Europe

Europe held around 28% of the flatbed die cutter market share in 2024, ranking as the second-largest region. The dominance of Germany, France, and Italy is supported by their established printing and packaging industries. The region benefits from high adoption of automated systems and strong demand for eco-friendly packaging solutions in line with EU sustainability regulations. Pharmaceutical labeling and luxury packaging further add to regional demand. With a strong focus on precision, quality, and compliance, Europe maintains its competitive edge in the market, while ongoing digital transformation in industrial production drives further adoption.

Asia Pacific

Asia Pacific captured the largest share, accounting for nearly 34% of the flatbed die cutter market in 2024. The region is led by China, Japan, and India, driven by rapid industrialization and high-volume packaging requirements in food, electronics, and consumer goods. The growth of e-commerce platforms further accelerates demand for boxes, cartons, and labeling. Increasing investments in automation and low-cost production capacity also position the region as a global manufacturing hub. Strong government support for industrial modernization, coupled with rising adoption of sustainable packaging, ensures that Asia Pacific remains the fastest-growing market segment.

Latin America

Latin America accounted for about 4% of the flatbed die cutter market share in 2024. Brazil and Mexico are the main contributors, driven by expanding food and beverage packaging demand and a growing retail sector. Rising pharmaceutical and personal care industries also add to regional adoption. However, high equipment costs and reliance on imports limit broader penetration in smaller economies. Opportunities exist in upgrading manual operations to semi-automatic and automatic systems, particularly in mid-sized packaging businesses. With economic stabilization and gradual modernization, Latin America is expected to post moderate growth in the coming years.

Middle East and Africa

The Middle East and Africa represented nearly 2% of the global flatbed die cutter market in 2024. Market growth is supported by the increasing adoption of modern packaging solutions in the food, beverage, and pharmaceutical industries. The United Arab Emirates and South Africa are the major contributors, with rising retail and consumer goods demand fueling equipment adoption. However, the market faces challenges from limited local manufacturing and high dependence on imports. Gradual industrial development, combined with growing investments in automated packaging systems, is expected to create opportunities for regional growth over the forecast period.

Market Segmentations:

By Mode of operation:

By Application:

- Boxes

- Cartons

- Labels and Stickers

- Decorative Items

- Rubber gaskets

- Others (Flyers, etc.)

By End-Use:

- Packaging Industry

- Automotive Industry

- Pharmaceuticals

- Textile

- Printing and Publishing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The flatbed die cutter market is shaped by leading players such as Heidelberger Druckmaschinen, Komori, Highcon, SANWA, BOBST, DeltaModTech, Winkler+Dünnebier, Yawa Printing Machinery, Sysco Machinery, Koenig & Bauer, Masterwork Machinery, Duplo International, Berhalter, ASAHI MACHINERY, DIMO TECH, and Hunkeler. These companies collectively drive innovation through advanced automation, precision cutting, and integration of smart technologies into their equipment portfolios. Market competition is centered around offering high-speed operations, customization capabilities, and sustainability-focused solutions to meet the growing needs of packaging, labeling, and printing industries. Continuous investments in research and development enhance product performance, improve energy efficiency, and extend the compatibility of machines with recyclable and biodegradable materials. Strategic expansions, collaborations, and acquisitions strengthen global presence, while localized manufacturing and service support improve competitiveness across diverse regions. With rising demand for automation and eco-friendly packaging solutions, the competitive landscape remains dynamic, pushing companies to deliver differentiated technologies and cost-effective solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Heidelberger Druckmaschinen

- Komori

- Highcon

- SANWA

- BOBST

- DeltaModTech

- Winkler+Dünnebier

- Yawa Printing Machinery

- Sysco Machinery

- Koenig & Bauer

- Masterwork Machinery

- Duplo International

- Berhalter

- ASAHI MACHINERY

- DIMO TECH

- Hunkeler

Recent Developments

- In 2024, Bobst showcased the NOVACUT 106 E flatbed die-cutter, At a company open house in Pune, India.

- In 2024, Highcon announced significant advancements at the drupa trade fair, including an upgraded Beam 2C that offers higher productivity for corrugated customers.

- In 2023, Berhalter Unveiled its new Swiss Die-Cutter B4 at Labelexpo Europe, emphasizing precision technology for the converting and printing industry.

Report Coverage

The research report offers an in-depth analysis based on Mode of operation, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The flatbed die cutter market will grow steadily, supported by rising packaging demand.

- Automatic machines will continue to dominate due to efficiency and precision benefits.

- E-commerce expansion will drive higher need for boxes, cartons, and labeling solutions.

- Sustainability goals will increase adoption of die cutters compatible with eco-friendly materials.

- Asia Pacific will remain the fastest-growing region, led by large-scale manufacturing.

- North America and Europe will sustain demand through automation and digital integration.

- Labeling and branding applications will expand, driven by product differentiation needs.

- Integration of IoT and smart technologies will enhance operational efficiency and monitoring.

- High equipment costs may restrain adoption among small and medium enterprises.

- Competition from rotary and laser cutting technologies will challenge flatbed die cutter suppliers.