Market Overview

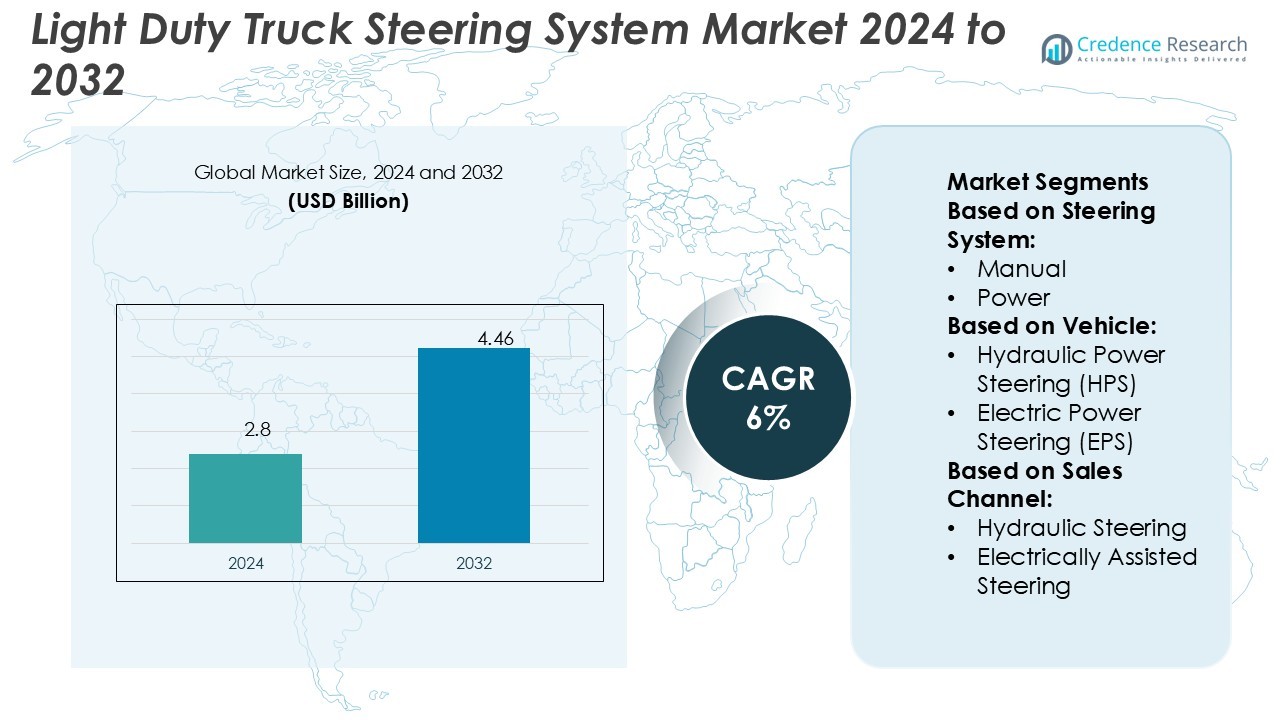

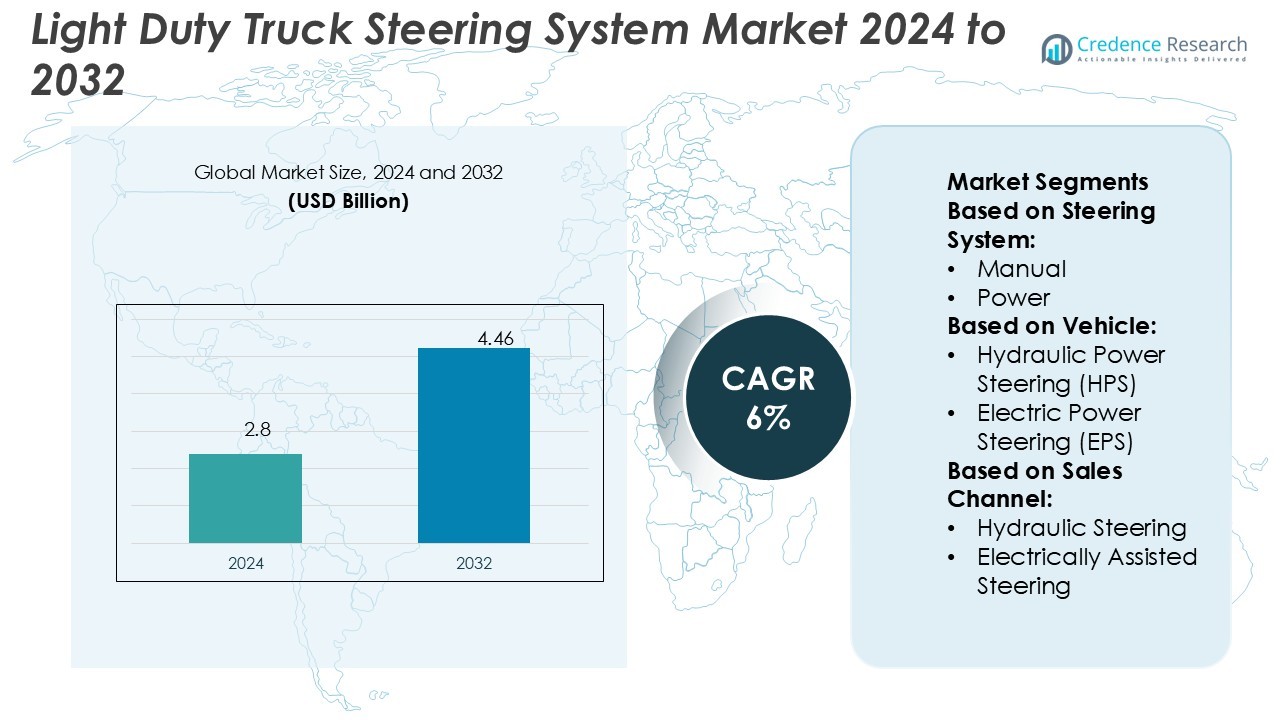

Light Duty Truck Steering System Market size was valued USD 2.8 billion in 2024 and is anticipated to reach USD 4.46 billion by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Light Duty Truck Steering System Market Size 2024 |

USD 2.8 Billion |

| Light Duty Truck Steering System Market, CAGR |

6% |

| Light Duty Truck Steering System Market Size 2032 |

USD 4.46 Billion |

The light duty truck steering system market is highly competitive, with top players including Hyundai, Daimler, Ford, Tata, Volkswagen, GM, Toyota, Renault, Isuzu, and Flat. These companies focus on advancing electric power steering (EPS) and electro-hydraulic power steering (EHPS) to meet growing demand for efficiency, safety, and sustainability. OEMs are integrating steering systems with advanced driver assistance systems to support automation and enhance driving comfort. Regionally, Asia-Pacific leads the market with a 34% share, driven by strong vehicle production, rising urbanization, and increasing adoption of fuel-efficient steering technologies across pickup trucks and vans.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Light Duty Truck Steering System Market size was USD 2.8 billion in 2024 and is projected to reach USD 4.46 billion by 2032, growing at a CAGR of 6% during the forecast period.

- Market growth is driven by rising adoption of electric power steering and electro-hydraulic systems, which improve fuel efficiency, reduce emissions, and enhance driver safety in light duty trucks.

- Key trends include integration of steering systems with advanced driver assistance technologies, increasing automation in pickups and vans, and growing demand from e-commerce logistics and last-mile delivery fleets.

- The competitive landscape features leading companies such as Hyundai, Daimler, Ford, Tata, Volkswagen, GM, Toyota, Renault, Isuzu, and Flat, focusing on innovation, cost-effective production, and expansion in emerging markets.

- Asia-Pacific dominates with a 34% regional share, supported by strong vehicle production and urbanization, while pickup trucks hold the largest vehicle segment share due to high global demand.

Market Segmentation Analysis:

By Steering System

The electric power steering (EPS) segment dominates the light duty truck steering system market with more than 40% share. EPS is preferred due to reduced fuel consumption, lower maintenance costs, and improved maneuverability. Automakers adopt EPS widely to meet stringent emission regulations and enhance driver comfort. Hydraulic power steering (HPS) remains relevant in mid-range trucks, while electro-hydraulic power steering (EHPS) gains ground in hybrid models. Manual steering records minimal demand, restricted to low-cost vehicles, as advanced systems align with global safety and efficiency standards.

- For instance, Hyundai fitted a brushless EPS unit using Hall sensors to the i30 model across generations, and like all EPS systems, this reduces engine parasitic load (improving fuel efficiency and meeting emissions regulations) while enhancing driver comfort.

By Vehicle

Pickup trucks hold the leading position, capturing over 55% of the vehicle segment. This dominance is driven by high demand in North America and Asia-Pacific, where pickups serve personal and commercial use. EPS systems account for the majority of installations in pickups, supported by growing consumer expectations for convenience and safety. Vans contribute significantly, with hydraulic and electric systems used in fleet vehicles. Rising e-commerce logistics and last-mile delivery trends further push steering system integration in vans, with manufacturers shifting toward electric-powered solutions for efficiency and compliance.

- For instance, Daimler Buses replaced conventional, engine-driven hydraulic steering pumps in buses weighing over 7.5 tonnes with an electrohydraulic system, enabling steering assist independent of engine speed via an electric pump.

By Sales Channel

The OEM segment dominates the sales channel with more than 70% share of the market. OEMs lead because manufacturers prefer integrating advanced steering systems during vehicle production to meet global safety and performance standards. Consumers also prioritize OEM-installed systems for reliability and warranty coverage. The aftermarket segment maintains relevance in older trucks, offering replacement and upgrade opportunities, especially in emerging markets. Growing awareness of energy efficiency and vehicle safety continues to influence both channels, with OEMs driving innovation while the aftermarket sustains steady demand through parts replacement.

Key Growth Drivers

Rising Adoption of Electric Power Steering (EPS)

The increasing shift toward electric power steering (EPS) is a major growth driver for the light duty truck steering system market. EPS reduces fuel consumption by eliminating hydraulic components, improves steering precision, and enhances overall driving comfort. Stricter emission standards push automakers to integrate EPS for better efficiency and compliance. Additionally, rising consumer preference for advanced safety and convenience features accelerates its adoption. The widespread use of EPS in pickup trucks and vans strengthens its position as the dominant steering technology across global markets.

- For instance, Tata also sources heavy-duty hydraulic steering gears from WABCO, where the M110 gear housing delivers consistent performance under loads of up to 15 MPa in their assemblies for Tata heavy trucks.

Expansion of E-Commerce and Last-Mile Delivery

The booming e-commerce industry and rising demand for last-mile delivery services drive growth in light duty trucks. Logistics and transportation companies rely on pickups and vans, increasing the need for advanced steering systems. Steering solutions such as EPS and electro-hydraulic systems improve vehicle handling and reduce operational costs for fleet operators. This trend enhances adoption among commercial users seeking efficiency, durability, and comfort. As urban freight and delivery demand expand globally, steering system manufacturers benefit from rising vehicle production and modernization requirements.

- For instance, VW uses model-based design in its EPS development pipeline with Ansys tools—ensuring compliance with ISO 26262 at ASIL-D level and enabling steer-by-wire readiness.

Stringent Safety and Emission Regulations

Global safety and emission regulations are key drivers shaping the steering system market. Automakers are compelled to adopt advanced technologies that improve energy efficiency and reduce emissions. Steering systems such as EPS and EHPS support compliance by reducing engine load and optimizing fuel economy. Furthermore, safety mandates encourage integration of steering assist technologies that improve control and stability. These regulations create long-term opportunities for suppliers and OEMs, particularly in regions like North America, Europe, and Asia-Pacific, where governments enforce strict environmental and road safety norms.

Key Trends & Opportunities

Integration of Advanced Driver Assistance Systems (ADAS)

The integration of steering systems with advanced driver assistance systems (ADAS) represents a major trend. EPS and EHPS technologies are increasingly designed to work with lane-keeping assist, automated parking, and adaptive cruise control. This synergy enhances vehicle safety and supports the transition toward semi-autonomous driving in light duty trucks. Manufacturers see opportunities in supplying steering systems that enable higher levels of automation. As commercial and consumer demand for connected and safer vehicles rises, steering systems aligned with ADAS create significant market potential.

- For instance, GM’s multiple official and technical sources confirm the specific speed range of 37 mph (60 kph) to 112 mph (180 kph) for the system’s steering intervention. While some documentation mentions lower speeds (e.g., 31 mph) for certain vehicle models, the 37-112 mph range is consistently cited for the active steering assist feature.

Shift Toward Electrification and Sustainability

Electrification trends open strong opportunities for steering system suppliers. With electric pickups and vans gaining traction, EPS and EHPS become crucial due to compatibility with electric drivetrains. These systems improve energy efficiency, reduce reliance on hydraulic fluids, and align with global sustainability goals. Automakers are actively investing in electric light duty trucks, particularly in North America and Europe. Steering system manufacturers who innovate lightweight, energy-efficient solutions stand to capture growing demand in the electric vehicle segment, reinforcing their strategic position in the evolving market.

- For instance, Renault equips models like the Austral and Espace with its 4CONTROL Advanced 4-wheel steering. In this system, the rear wheels turn up to 5 degrees opposite the front wheels at low speeds, and up to 1 degree in the same direction at high speeds.

Key Challenges

High Development and Integration Costs

The adoption of advanced steering technologies faces challenges due to high development and integration costs. Designing EPS and EHPS systems requires significant R&D investments, advanced electronics, and robust testing to ensure safety and reliability. OEMs pass these costs to consumers, raising vehicle prices and potentially limiting adoption in cost-sensitive markets. Additionally, suppliers face pressure to balance affordability with performance. This challenge remains critical in emerging regions where manual or basic hydraulic systems continue to dominate due to lower purchase costs.

Maintenance and Reliability Concerns

Despite benefits, electric and electro-hydraulic steering systems raise concerns regarding long-term reliability and maintenance. Advanced electronic components increase the complexity of repairs and replacements, especially in the aftermarket. Fleet operators in commercial segments may hesitate to adopt new systems if downtime and servicing costs rise. Moreover, lack of skilled technicians in certain regions adds to the challenge. Addressing durability, standardization, and training gaps is essential for steering system suppliers to ensure customer trust and long-term adoption across global markets.

Regional Analysis

North America

North America holds a 32% share of the light duty truck steering system market, driven by strong demand for pickup trucks and vans. The U.S. leads with widespread adoption of EPS technology, supported by stringent fuel economy and safety standards. Automakers invest heavily in integrating advanced driver assistance features, increasing reliance on electronic steering systems. The aftermarket also contributes significantly due to a large base of older vehicles requiring replacement parts. Growing logistics, last-mile delivery demand, and the expansion of electric pickups further strengthen North America’s dominant position in the global market.

Europe

Europe accounts for 26% of the light duty truck steering system market, supported by strong regulatory frameworks promoting sustainability and road safety. Countries like Germany, France, and the UK lead in adopting electric and hybrid light duty trucks, accelerating demand for EPS and EHPS systems. OEMs in the region prioritize integrating steering solutions compatible with ADAS and autonomous driving features. Stringent emission reduction targets also push manufacturers to replace traditional hydraulic systems with energy-efficient alternatives. With a mature automotive industry and high innovation levels, Europe continues to shape technological advancements in steering systems globally.

Asia-Pacific

Asia-Pacific dominates with a 34% share of the light duty truck steering system market, fueled by rapid industrialization, urbanization, and rising vehicle production. China and India drive significant demand, with growing adoption of EPS due to regulatory pressure and consumer demand for fuel-efficient vehicles. Japan and South Korea contribute through advanced technology integration and strong focus on electrification. Expanding e-commerce and logistics sectors create strong opportunities for steering system adoption in vans and pickups. OEM collaborations, government policies supporting EVs, and rising aftermarket demand strengthen Asia-Pacific’s leadership and long-term growth trajectory in this market.

Latin America

Latin America represents 5% of the light duty truck steering system market, with Brazil and Mexico leading regional demand. Growth is supported by rising urbanization, infrastructure development, and an increasing preference for light commercial vehicles. Hydraulic power steering remains common, but EPS adoption is gradually expanding as automakers introduce advanced models. The aftermarket segment plays a key role in replacement demand due to aging vehicle fleets. Economic fluctuations and cost-sensitive buyers limit rapid adoption of advanced systems, but government support for cleaner transport solutions opens opportunities for future growth across the region.

Middle East & Africa

The Middle East & Africa account for 3% of the light duty truck steering system market, driven by rising infrastructure projects and fleet expansions. Gulf countries such as the UAE and Saudi Arabia show growing adoption of advanced systems in light commercial vehicles used for logistics and construction. Africa records slower adoption due to price-sensitive consumers, with hydraulic systems still dominant. However, aftermarket demand is rising as fleet operators seek durable and reliable solutions. Gradual electrification initiatives and investments in modern automotive infrastructure are expected to support future steering system upgrades across the region.

Market Segmentations:

By Steering System:

By Vehicle:

- Hydraulic Power Steering (HPS)

- Electric Power Steering (EPS)

By Sales Channel:

- Hydraulic Steering

- Electrically Assisted Steering

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the light duty truck steering system market players such as Hyundai, Daimler, Ford, Tata, Volkswagen, GM, Toyota, Renault, Isuzu, and Flat. The light duty truck steering system market is defined by rapid technological advancements, strong R&D investments, and the push toward electrification. Manufacturers prioritize electric and electro-hydraulic steering solutions to meet global sustainability goals and comply with stringent emission regulations. Integration of steering systems with advanced driver assistance systems (ADAS) is a major focus, enabling features like lane-keeping and automated parking. Companies also compete by expanding their aftermarket presence, ensuring replacement and upgrade opportunities for aging fleets. Strategic partnerships, innovation in lightweight components, and alignment with autonomous driving trends further intensify competition across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Volvo Trucks has unveiled an enhanced version of its Volvo Dynamic Steering system, equipped with a feature that detects tire blowouts and swiftly maneuvers the truck to maintain safe road positioning.

- In February 2025, Chinese manufacturer NIO has chosen ZF to equip its electric flagship, the ET9, with ZFs latest steer-by-wire system. ZF technology group provides the steering wheel actuator, which enhances both steering control and feel, and a redundant steering gear actuator, complete with the necessary software.

- In March 2024, Nissan launched a Kicks SUV. This SUV comes with ADAS and ProPILOT assist system for maximum safety along with touch-sensitive controls for the HVAC, a wireless charging pad, four USB-C ports, wireless Apple CarPlay and Android Auto connectivity, a headrest-mounted BOSE speakers, and a panoramic sunroof.

- In September 2023, Titan has introduced an advanced electronic steering system designed specifically for niche, low-volume vehicle manufacturers. This system is ideal for both commercial vehicles and hypercars.

Report Coverage

The research report offers an in-depth analysis based on Steering System, Vehicle, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward electric power steering as the dominant technology.

- Integration with advanced driver assistance systems will expand steering system functionality.

- Demand for electro-hydraulic systems will grow in hybrid and electric light duty trucks.

- Rising e-commerce and last-mile delivery trends will boost adoption of advanced steering solutions.

- OEMs will continue to lead innovation while the aftermarket supports replacement demand.

- Autonomous driving developments will drive need for more intelligent steering technologies.

- Sustainability goals will push manufacturers toward energy-efficient and lightweight steering components.

- Emerging markets will adopt modern steering systems as urbanization and logistics expand.

- Fleet operators will favor systems offering lower maintenance and improved durability.

- Strategic collaborations and R&D investments will shape competitive positioning in the market.