Market Overview:

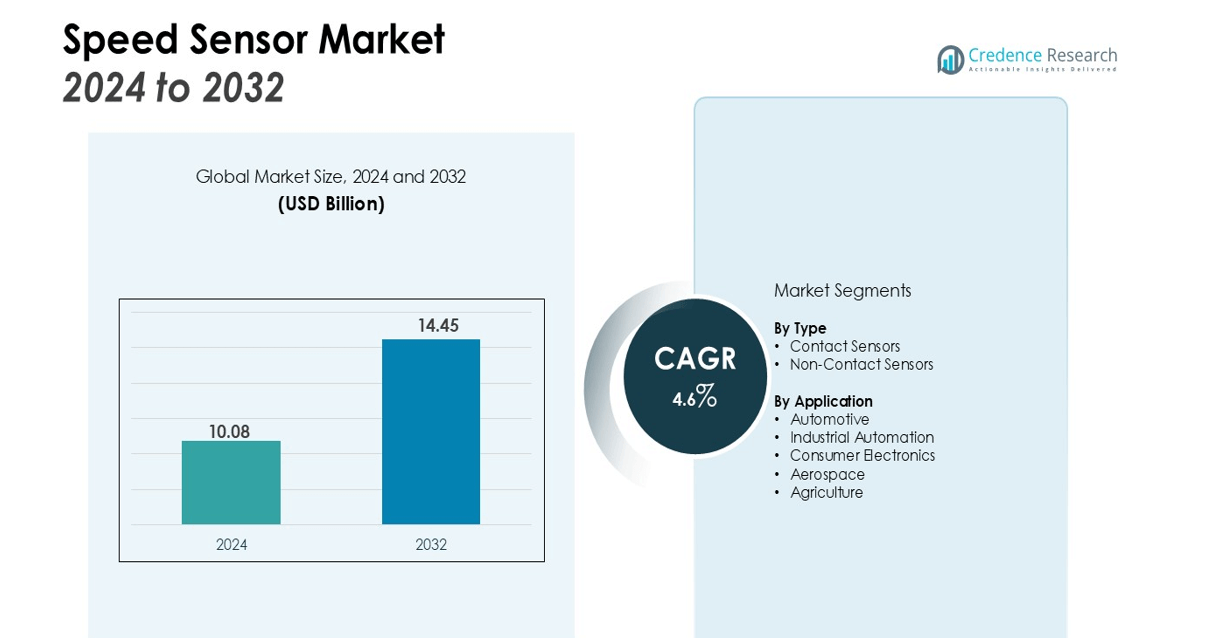

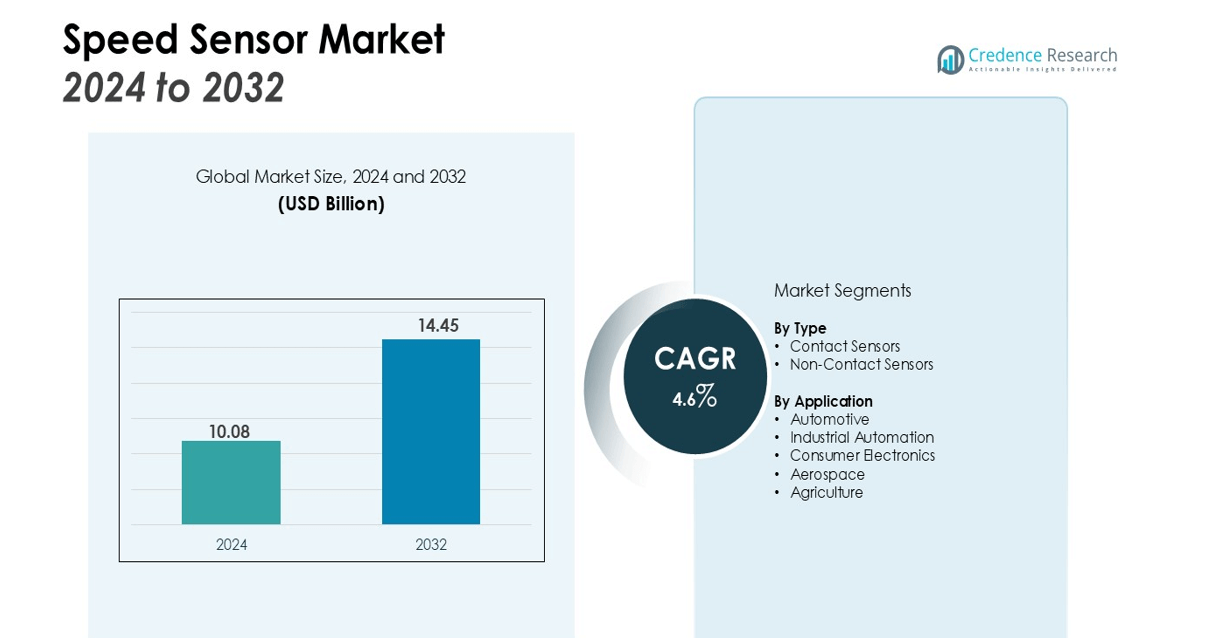

The Speed Sensor Market size was valued at USD 10.08 billion in 2024 and is anticipated to reach USD 14.45 billion by 2032, at a CAGR of 4.6% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Speed Sensor Market Size 2025 |

USD 10.08 billion |

| Speed Sensor Market, CAGR |

4.6% |

| Speed Sensor Market Size 2032 |

USD 14.45 billion |

Key drivers fueling market expansion include the rising adoption of electric vehicles (EVs), advancements in automotive safety systems, and the growing need for industrial automation. Speed sensors play a crucial role in enhancing vehicle performance, improving fuel efficiency, and ensuring safety by providing real-time data for control systems. Furthermore, the integration of Internet of Things (IoT) technology and smart sensors in industries to monitor equipment performance is contributing to the demand for speed sensors in industrial automation.

Regionally, North America dominates the speed sensor market, supported by strong automotive and industrial sectors. The presence of key manufacturers and advancements in autonomous vehicle technologies are driving growth in this region. Europe follows closely due to the increasing demand for speed sensors in electric vehicles and stringent safety regulations. The Asia Pacific region is expected to experience the highest growth, driven by rapid industrialization, automotive advancements, and the expansion of manufacturing facilities.

Market Insights:

- The Speed Sensor Market was valued at USD 10.08 billion in 2024 and is projected to reach USD 14.45 billion by 2032, with a CAGR of 4.6%.

- The rising adoption of electric vehicles (EVs) drives significant demand for high-precision speed sensors for motor control and performance monitoring.

- Automotive safety systems, including ADAS technologies, increase the demand for speed sensors to enable features like collision avoidance and adaptive cruise control.

- Industrial automation continues to grow, with speed sensors enhancing machinery efficiency, reducing downtime, and enabling predictive maintenance in manufacturing.

- Technological advancements, such as wireless connectivity and IoT integration, improve the performance and versatility of speed sensors across various sectors.

- North America holds a 38% market share, driven by its strong automotive and industrial sectors, particularly with EVs and autonomous driving technologies.

- Asia Pacific, with a 28% market share, is set to experience the highest growth due to rapid industrialization, automotive production, and smart manufacturing advancements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Electric Vehicles (EVs)

The increasing adoption of electric vehicles (EVs) is a significant driver for the speed sensor market. EVs require advanced control systems for efficient operation, where speed sensors play a crucial role in monitoring vehicle speed, performance, and energy consumption. The need for precision and reliability in electric motors further enhances the demand for high-quality speed sensors, as they help in optimizing power usage and maintaining smooth driving experiences. As EV adoption continues to rise globally, it will further drive the demand for speed sensors in the automotive sector.

- For instance, in July 2025, Bosch released a software update for its Performance Line CX Gen 5 motors used in e-bikes. This update increased the motor’s maximum torque to 100 Nm, enhancing the performance and responsiveness for riders.

Growth of Industrial Automation and Smart Manufacturing

The ongoing trend toward industrial automation is contributing to the market’s growth. Speed sensors are essential for monitoring the performance of machinery and equipment in automated production lines. They enable real-time data collection and performance monitoring, helping industries enhance productivity and reduce downtime. It improves the efficiency of operations in sectors like manufacturing, aerospace, and energy, where machinery operates at varying speeds. The shift towards smart manufacturing technologies increases the reliance on sensors to monitor key parameters, including speed, across production environments.

- For instance, Honeywell enhanced its industrial sensor portfolio with the DG Smart Sensor for optimizing combustion systems. This device provides precise monitoring with a 4-20mA NAMUR Analog output and features MODBUS TCP digital communication to improve integration within smart factory ecosystems.

Advancements in Automotive Safety Systems

Automotive safety systems are another key factor fueling demand for speed sensors. With the rise of autonomous driving technologies and advanced driver assistance systems (ADAS), the need for precise and reliable speed sensors is critical. These sensors monitor and adjust vehicle speed to enhance safety by integrating with other systems like collision avoidance, adaptive cruise control, and stability control. It contributes to improving vehicle performance and driver safety, which increases the demand for innovative speed sensor technologies in the automotive sector.

Technological Advancements in Sensor Technologies

Technological advancements in sensor technologies have made speed sensors more accurate, durable, and adaptable to a wide range of applications. The development of smart sensors that offer wireless connectivity, IoT integration, and high-resolution data processing has enhanced their performance in various sectors, including automotive and industrial equipment. It allows for better integration with other systems, offering enhanced functionality and reliability. As sensor technologies evolve, it supports the growing adoption of speed sensors in modern machines and vehicles, further expanding the market.

Market Trends:

Integration of Speed Sensors with IoT and Smart Technologies

The integration of speed sensors with Internet of Things (IoT) technologies and smart systems is a notable trend in the market. By connecting speed sensors to cloud-based platforms, industries can gather real-time data, analyze performance metrics, and make informed decisions for maintenance and operation optimization. This trend is particularly prominent in industrial automation and automotive applications, where real-time data monitoring enhances the efficiency of operations. IoT-enabled speed sensors improve predictive maintenance, reduce downtime, and help in optimizing vehicle and machine performance. The growing adoption of smart manufacturing technologies further pushes the demand for interconnected, high-performance speed sensors, particularly in sectors like automotive, aerospace, and energy.

- For instance, New York City implemented a real-time traffic monitoring solution by deploying an IoT communication backbone to 14,000 intersections.

Miniaturization and Improved Sensor Performance

Another significant trend is the miniaturization of speed sensors while maintaining or enhancing their performance. The growing demand for compact, lightweight, and high-performance sensors is driven by the need for more efficient space utilization, especially in automotive and consumer electronics applications. Smaller, more efficient speed sensors enable their use in various applications, from electric vehicles to mobile devices, without compromising their accuracy or durability. Improved sensor performance, including higher resolution and faster response times, makes them increasingly valuable in precision monitoring systems, where reliable data is crucial for operational success. The continued development of miniaturized and high-performance speed sensors is expected to drive innovation across a wide range of industries.

- For instance, Race Technology’s SPEEDBOX MINI, a high-accuracy non-contact speed sensor, achieves a speed accuracy of 0.02m/s, this compact sensor is designed for professional automotive testing and utilizes a 20Hz PurePhase GPS solution for its precise measurements.

Market Challenges Analysis:

High Costs of Advanced Speed Sensors

One of the primary challenges facing the speed sensor market is the high cost of advanced sensors. These sensors, particularly those with high precision and additional features such as wireless connectivity or integration with IoT systems, tend to be more expensive. The cost of raw materials, development, and manufacturing processes significantly impacts the price of these sensors. Smaller manufacturers, particularly in emerging markets, may struggle to afford these high-end solutions, which limits market access. Balancing performance with affordability remains a critical challenge, especially as industries seek cost-effective solutions without compromising on quality.

Varying Standards and Compatibility Issues

The lack of standardized regulations and compatibility issues between different sensor models present challenges in the speed sensor market. Variations in sensor specifications, design, and communication protocols across manufacturers can create difficulties in ensuring seamless integration with existing systems. The absence of industry-wide standards complicates the widespread adoption of speed sensors, especially in industries like automotive and industrial automation. For many organizations, integrating sensors with legacy systems without disruptions remains a hurdle. Addressing these compatibility issues requires both technical innovation and the development of global standards to ensure smooth market expansion.

Market Opportunities:

Expansion in Electric Vehicle and Autonomous Driving Applications

The rapid growth of the electric vehicle (EV) market presents a significant opportunity for the speed sensor industry. EVs rely heavily on accurate speed monitoring for efficient power management, vehicle performance, and safety features. Speed sensors play an essential role in controlling the motor speed, regenerative braking, and overall energy efficiency in electric drivetrains. As the demand for EVs continues to rise, there will be an increasing need for advanced speed sensors that can meet the performance and durability requirements of these vehicles. Autonomous driving technology further expands the market for these sensors, as they are crucial for the precise operation of control systems in self-driving vehicles.

Growth of Industrial Automation and Smart Manufacturing

The industrial automation sector offers significant growth opportunities for the speed sensor market. As industries continue to adopt smart manufacturing solutions, the need for accurate, real-time data becomes increasingly important. Speed sensors enable precise control of machinery and equipment, helping to optimize production processes, reduce downtime, and enhance overall efficiency. As manufacturers strive for more advanced and automated systems, the demand for high-performance speed sensors that integrate with IoT platforms and support predictive maintenance will continue to rise. This trend will open new avenues for growth across various industries, including automotive, aerospace, and energy.

Market Segmentation Analysis:

By Type

The Speed Sensor market is primarily divided into two types: contact and non-contact sensors. Contact sensors are widely used in automotive applications for monitoring wheel speed, engine speed, and transmission speed. These sensors rely on physical contact with rotating parts, offering precise measurements. Non-contact sensors, on the other hand, use technologies like optical or magnetic sensing and are increasingly favored for their durability and longer lifespan. Non-contact sensors are preferred in harsh industrial environments due to their ability to measure speed without physical wear and tear, making them ideal for applications where reliability is crucial.

- For instance, Honeywell’s SNDH-T Series Hall-effect speed sensors are designed for high-resolution applications, featuring an operational air gap of up to 2 mm for enhanced performance and accuracy in automotive environments.

By Application

In terms of application, the Speed Sensor market spans across automotive, industrial, and consumer electronics sectors. In the automotive sector, speed sensors are essential for monitoring vehicle speed, engine performance, and safety systems such as adaptive cruise control and stability control. In industrial automation, speed sensors are critical for monitoring machinery, ensuring operational efficiency, and preventing equipment failures. In consumer electronics, these sensors are integrated into devices like smartphones and wearables to track movement and speed. The growing demand for automation and smart devices continues to drive the need for accurate and reliable speed sensors across all sectors.

- For instance, the Siemens SITRANS WM100 non-contact speed sensor is built for harsh industrial use, operating reliably in temperatures from -40°C to +60°C and monitoring equipment with a dynamic range of up to 3,000 pulses per minute.

Segmentations:

By Type

- Contact Sensors

- Non-Contact Sensors

By Application

- Automotive

- Industrial Automation

- Consumer Electronics

- Aerospace

- Agriculture

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of 38% in the speed sensor industry. The region’s advanced automotive and industrial sectors drive strong demand for speed sensors. The U.S. automotive industry, in particular, heavily relies on these sensors for vehicle performance, safety, and efficiency. With the growing adoption of electric vehicles (EVs) and autonomous driving technologies, the need for advanced sensors continues to increase. The presence of key players and the region’s focus on technological advancements, such as IoT integration, further contribute to its market leadership. Robust infrastructure and high adoption of industrial automation support steady growth in North America.

Europe

Europe commands a market share of 30% in the speed sensor industry. Significant demand arises from both the automotive and industrial automation sectors. The region’s strong automotive manufacturing base, with investments in EVs and smart technologies, increases the need for precision sensors. Stringent vehicle safety and emissions regulations in the European Union further drive demand for advanced speed sensors. The emphasis on Industry 4.0 and the digitalization of manufacturing processes also supports the growing demand for automation solutions. Key markets like Germany, France, and the UK continue to lead the growth due to their established industrial and automotive sectors.

Asia Pacific

Asia Pacific accounts for 28% of the global market share in the speed sensor industry. The region is poised for the highest growth, driven by rapid industrialization and increased automotive production. Countries like China, Japan, and India are seeing substantial growth in both traditional and electric vehicle markets, driving demand for speed sensors. The adoption of industrial automation in China and South Korea further accelerates the need for high-performance sensors. Government investments in infrastructure development and smart manufacturing solutions enhance market growth potential. The Asia Pacific region is expected to be a key player in the speed sensor market’s future expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Speed Sensor market is highly competitive, with key players such as Honeywell International Inc., Bosch, Continental AG, and Delphi Technologies leading the way. These companies focus on enhancing sensor performance and expanding product portfolios to meet the rising demand from automotive and industrial automation sectors. They invest in research and development to improve accuracy, durability, and integration with emerging technologies like IoT and advanced driver-assistance systems (ADAS). Strategic partnerships with OEMs and automakers help integrate speed sensors into electric vehicles and autonomous driving systems. Companies also target expansion in regions like Asia Pacific, driven by growing automotive production and industrial automation. This competitive landscape continues to evolve, with advancements in sensor technology shaping future market trends.

Recent Developments:

- In September 2025, SICK AG expanded its digital portfolio with the introduction of new sensor models for simulation within the NVIDIA Omniverse platform.

- In May 2025, Allegro MicroSystems and Wodeer signed a strategic partnership to co-develop technology and pursue joint growth in the automotive and industrial sectors.

- In February 2025, NXP Semiconductors N.V. announced a definitive agreement to acquire Kinara, Inc., a specialist in discrete neural processing units (NPUs), for $307 million in an all-cash deal.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for speed sensors will continue to grow due to the increasing adoption of electric vehicles (EVs) and autonomous driving technologies.

- Technological advancements, such as IoT integration and wireless connectivity, will enhance the functionality and efficiency of speed sensors.

- The automotive sector will remain the largest application area, with a focus on enhancing vehicle performance, safety, and energy efficiency.

- Industrial automation will increasingly rely on speed sensors for real-time monitoring, predictive maintenance, and optimizing machinery performance.

- Demand for non-contact speed sensors will rise due to their durability, precision, and suitability for harsh industrial environments.

- The growing trend of smart manufacturing and Industry 4.0 will create new opportunities for speed sensors in automated production lines.

- Asia Pacific will continue to experience the highest growth, driven by rapid industrialization and expanding automotive markets in China, India, and Japan.

- Europe and North America will remain key markets, supported by advancements in automotive technologies and strong industrial sectors.

- The integration of speed sensors with advanced driver assistance systems (ADAS) and autonomous vehicles will spur innovations in automotive safety.

- Increased focus on sustainability and energy efficiency will push for the development of eco-friendly, high-performance speed sensors in various applications.