Market Overview:

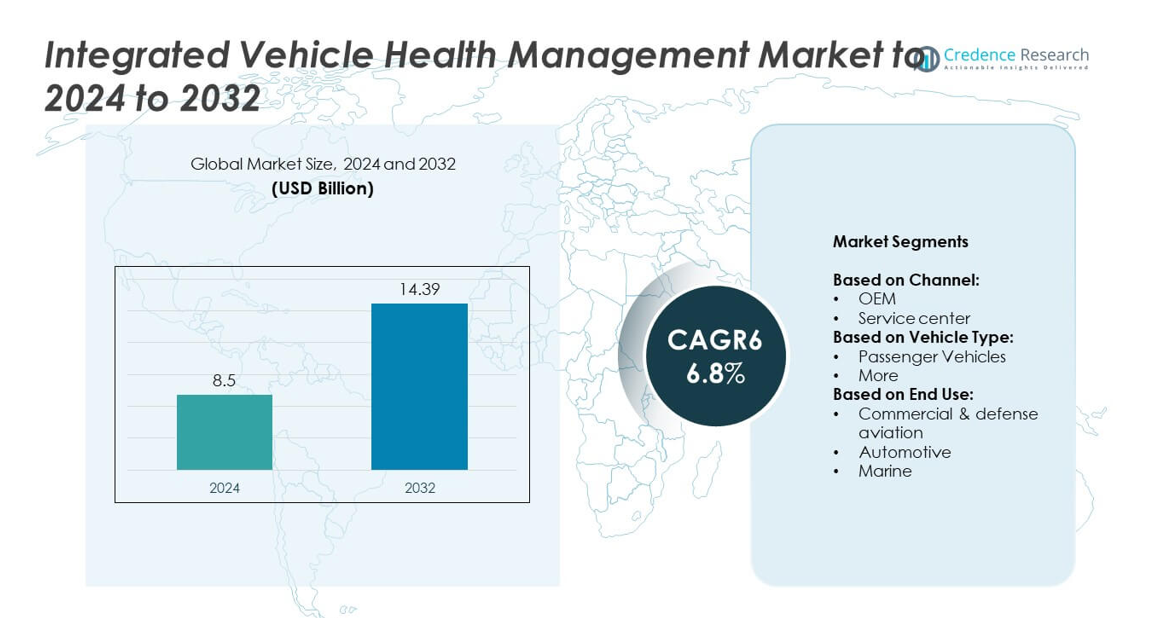

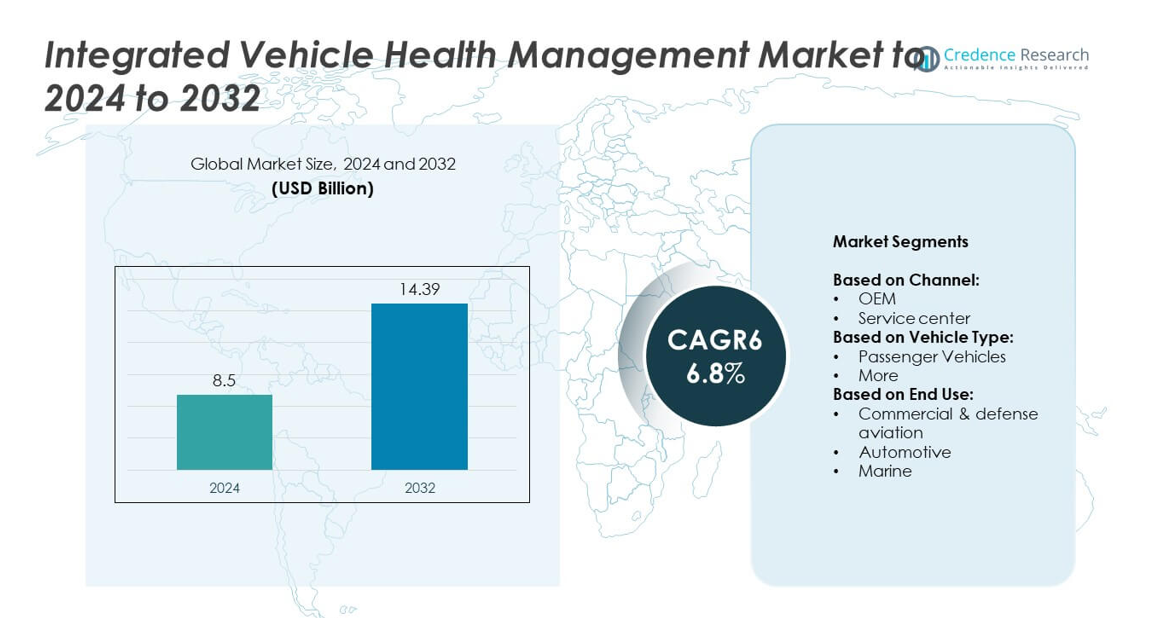

The Integrated Vehicle Health Management market was valued at USD 8.5 billion in 2024 and is anticipated to reach USD 14.39 billion by 2032, expanding at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Integrated Vehicle Health Management Market Size 2024 |

USD 8.5 billion |

| Integrated Vehicle Health Management Market, CAGR |

6.8% |

| Integrated Vehicle Health Management Market Size 2032 |

USD 14.39 billion |

The Integrated Vehicle Health Management market is shaped by leading players such as Caterpillar, ZF, Bosch, Boeing, IBM, Honeywell, Aptiv, Acellent Technologies, Cummins, Continental AG, GE, and Intangles Lab, who are driving advancements in predictive diagnostics, telematics, and AI-enabled monitoring platforms. These companies focus on developing connected solutions that reduce downtime, optimize maintenance, and ensure compliance with safety and emission standards. Regionally, North America dominated the market in 2024 with a 35% share, supported by strong OEM presence, early adoption of connected vehicles, and regulatory initiatives. Europe followed with 28% share, driven by sustainability mandates and advanced automotive infrastructure, while Asia Pacific accounted for 25%, benefiting from rising vehicle production and growing adoption of smart mobility solutions.

Market Insights

- The Integrated Vehicle Health Management market was valued at USD 8.5 billion in 2024 and is projected to reach USD 14.39 billion by 2032, growing at a CAGR of 6.8%.

- Rising demand for predictive maintenance and growing adoption of connected and electric vehicles are the key drivers boosting market expansion across automotive, aviation, and marine sectors.

- Integration of AI, IoT, and telematics into vehicle health systems is a strong trend, enabling real-time monitoring, fault detection, and improved fleet efficiency across industries.

- The market is highly competitive, with OEMs leading adoption at over 60% share, while key players invest heavily in partnerships, R&D, and digital platforms to strengthen their global presence.

- North America led the market with 35% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while Latin America and Middle East & Africa together accounted for around 12%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Channel

The OEM segment dominated the Integrated Vehicle Health Management market in 2024, accounting for over 60% share. OEMs lead due to their direct integration of advanced diagnostic systems during vehicle production, ensuring reliability and regulatory compliance. Their ability to provide end-to-end solutions and seamless connectivity strengthens their dominance. Growth is further driven by rising demand for predictive maintenance and safety features embedded at the design stage. Service centers hold a smaller share but are expanding as vehicles age and aftermarket solutions grow in importance.

- For instance, TBC news release (Midas was owned by TBC until 2025) mentions Midas operating in 20 countries, with about 1,200 stores in the U.S. and Canada.

By Vehicle Type

Passenger vehicles captured the largest share of the market in 2024, exceeding 55%. The dominance is attributed to rising adoption of connected car technologies and demand for real-time monitoring to enhance safety and reduce maintenance costs. Increasing production of passenger cars in emerging markets and growing consumer awareness about preventive diagnostics are strong drivers. Commercial vehicles are also witnessing notable adoption, particularly in logistics fleets, as operators seek to minimize downtime and optimize operational efficiency through predictive health management solutions.

- For instance, the My BMW and MINI apps were being used by more than 13 million customers worldwide as of 2024, enabling seamless driver-car communication.

By End Use

The automotive sector dominated the market in 2024, securing nearly 50% of the share. Widespread vehicle electrification, stringent emission regulations, and consumer demand for enhanced safety accelerate adoption. Automakers integrate health management systems to support predictive diagnostics and remote monitoring, reducing warranty claims and maintenance costs. Commercial and defense aviation represents another key segment, with airlines adopting these systems to improve fleet safety and minimize operational risks. The marine sector is also adopting integrated health monitoring for engine performance and fuel optimization, but at a comparatively smaller scale.

Key Growth Drivers

Rising Demand for Predictive Maintenance

Predictive maintenance is a major growth driver for the Integrated Vehicle Health Management market. Fleet operators and individual owners seek solutions that reduce downtime and extend vehicle life. Predictive tools enable early detection of system faults, avoiding costly breakdowns and enhancing safety. Growing adoption in passenger vehicles and commercial fleets, supported by advanced sensors and IoT integration, strengthens this trend. Regulatory push for safety compliance further accelerates uptake, making predictive maintenance a critical factor in market expansion.

- For instance, Hitachi Rail offers advanced predictive maintenance platforms, such as the HMAX digital asset management suite, to monitor rolling stock and infrastructure. As of 2024, HMAX solutions were implemented on over 2,000 trains.

Expansion of Connected and Electric Vehicles

The growing penetration of connected and electric vehicles significantly drives market growth. These vehicles rely heavily on digital diagnostics and monitoring systems to ensure performance, battery health, and safety. Automakers integrate health management platforms to improve user experience and reduce warranty costs. Rising EV adoption across North America, Europe, and Asia-Pacific fuels this demand. Government incentives and emissions reduction goals also encourage integration of advanced health monitoring solutions, establishing connected and electric vehicles as a central growth engine for the market.

- For instance, BYD sold more than 3.02 million new energy vehicles (NEVs) globally in 2023, encompassing both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

Regulatory Push for Safety and Emission Standards

Strict global regulations on safety and emissions form a key driver in this market. Governments mandate enhanced monitoring systems to ensure compliance and minimize risks. Automotive and aviation industries, in particular, face growing pressure to integrate diagnostics that support real-time health tracking. These systems reduce operational hazards and meet sustainability goals by optimizing fuel use and maintenance. Such regulatory support compels OEMs and operators to invest in Integrated Vehicle Health Management technologies, directly contributing to higher adoption rates and long-term growth.

Key Trends & Opportunities

Integration of AI and IoT Technologies

Integration of artificial intelligence and IoT in vehicle health systems is a major trend. AI-driven analytics process large volumes of real-time data, enabling accurate fault detection and predictive insights. IoT connectivity ensures seamless data transfer between vehicles, service centers, and cloud platforms. This technological convergence enhances decision-making, reduces operational risks, and supports autonomous vehicle readiness. With growing R&D investments from OEMs and tech firms, AI- and IoT-enabled solutions offer significant opportunities for future innovation in Integrated Vehicle Health Management.

- For instance, Bosch states that since it began manufacturing them 27 years ago, it has produced more than 18 billion MEMS sensors, and that “there are an average of 22 of them in every car.

Growing Adoption in Aviation and Defense Sectors

The adoption of integrated health management in aviation and defense is expanding rapidly. Airlines and defense fleets demand real-time monitoring to ensure safety, reduce maintenance downtime, and comply with strict regulatory standards. Predictive diagnostics improve aircraft availability and operational readiness, making them highly valuable in commercial and military applications. Increased defense budgets and modernization programs worldwide present further opportunities. This cross-industry adoption beyond automotive highlights the versatility and scalability of Integrated Vehicle Health Management systems as a long-term growth avenue.

- For instance, Lockheed Martin confirmed in 2023 that more than 600 F-35 aircraft were supported by its Prognostics and Health Management (PHM) system, providing real-time health data and predictive maintenance insights.

Key Challenges

High Implementation and Maintenance Costs

One of the key challenges is the high cost of implementing integrated vehicle health management systems. Advanced diagnostic hardware, software, and connectivity infrastructure require significant investment, limiting adoption among small fleets and cost-sensitive markets. Ongoing maintenance and system updates further add to operational expenses. While large OEMs and aviation operators can absorb these costs, smaller players often delay integration. This cost barrier restricts widespread adoption, particularly in emerging markets, despite the evident long-term benefits of predictive and preventive health management.

Data Security and Integration Complexities

Data security concerns and system integration issues remain a key challenge in this market. Vehicle health management systems collect and transmit sensitive operational data, raising risks of cyberattacks and unauthorized access. Ensuring secure data handling across multiple platforms is critical for user trust. Additionally, integrating health management tools with legacy systems poses technical challenges, particularly in older fleets. These complexities create barriers for seamless adoption and demand stronger cybersecurity protocols and standardized integration frameworks to unlock the full potential of the technology.

Regional Analysis

North America

North America accounted for the largest share of the Integrated Vehicle Health Management market in 2024, holding around 35%. The region benefits from advanced automotive infrastructure, early adoption of connected technologies, and strong presence of leading OEMs. High demand for predictive maintenance across commercial fleets and passenger vehicles further drives growth. The U.S. dominates within the region due to rising investments in electric vehicles and government-backed safety initiatives. Canada also contributes significantly through aviation and defense adoption. Ongoing regulatory emphasis on emissions and safety standards reinforces North America’s leadership in the global market.

Europe

Europe held a market share of about 28% in 2024, supported by stringent vehicle safety regulations and strong focus on sustainability. Automakers in Germany, France, and the UK are leading adopters of vehicle health management technologies, integrating advanced diagnostics into connected and electric vehicles. The European Union’s regulatory framework drives compliance-based adoption across both automotive and aviation sectors. Rising demand for fleet optimization in logistics and public transportation further supports market expansion. Continuous R&D investments and cross-industry partnerships enable Europe to maintain a strong position in the global competitive landscape.

Asia Pacific

Asia Pacific captured nearly 25% of the market share in 2024, driven by rising vehicle production and growing adoption of smart mobility solutions. China, Japan, and South Korea lead regional demand, supported by strong EV penetration and technological advancements. Increasing investments in connected car platforms and aviation modernization programs also fuel adoption. The region benefits from cost-effective manufacturing and expanding infrastructure for telematics and diagnostics. With large-scale logistics fleets and rapid urbanization, Asia Pacific presents significant growth potential, making it one of the fastest-growing regions in the Integrated Vehicle Health Management market.

Latin America

Latin America represented around 7% of the global market in 2024. Growth in this region is supported by increasing adoption of fleet management systems in commercial transportation and gradual shift toward connected vehicles. Brazil and Mexico dominate demand, driven by investments in automotive manufacturing and infrastructure modernization. Although market penetration is relatively lower compared to developed regions, rising awareness of predictive maintenance benefits and safety compliance is improving adoption. Limited financial capacity among smaller fleet operators remains a challenge, but steady advancements position Latin America as an emerging contributor to the global market.

Middle East and Africa

The Middle East and Africa accounted for nearly 5% of the market share in 2024. The region is witnessing gradual adoption, led by investments in aviation, defense, and high-end automotive markets. Countries like the UAE and Saudi Arabia are integrating vehicle health management systems to support modern fleets and smart mobility initiatives. In Africa, growth is slower due to limited infrastructure and affordability challenges, though commercial transport adoption is rising. Government initiatives in defense and aerospace create opportunities, while partnerships with global OEMs are expected to drive steady but moderate growth in the region.

Market Segmentations:

By Channel:

By Vehicle Type:

By End Use:

- Commercial & defense aviation

- Automotive

- Marine

By Geography:

- orth America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Caterpillar, ZF, Bosch, Boeing, IBM, Honeywell, Aptiv, Acellent Technologies, Cummins, Continental AG, GE, and Intangles Lab are among the prominent companies shaping the competitive landscape of the Integrated Vehicle Health Management market. The competition is marked by strong investments in predictive diagnostics, telematics, and data-driven maintenance platforms. Companies are focusing on integrating AI and IoT technologies to improve real-time monitoring, reduce downtime, and enhance overall vehicle performance. Strategic collaborations with OEMs and fleet operators are central to expanding market reach and securing long-term contracts. R&D efforts are directed toward developing cost-efficient, scalable solutions that can serve both high-end automotive and aviation applications. Market players are also pursuing digital platforms that support seamless connectivity across vehicles, service centers, and cloud ecosystems. The competitive environment reflects an ongoing shift toward intelligent, software-driven systems that address regulatory requirements, improve safety compliance, and align with the global trend of connected and electrified vehicles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar

- ZF

- Bosch

- Boeing

- IBM

- Honeywell

- Aptiv

- Acellent Technologies

- Cummins

- Continental AG

- GE

- Intangles Lab

Recent Developments

- In 2025, Continental AG Partnered with Samsara, a fleet management platform, to integrate its ContiConnect truck tire monitoring system. This enabled real-time tire health insights for fleets in the U.S. and Canada, supporting proactive maintenance and improved operational efficiency.

- In 2025, Cummins Inc. Partnered with Platform Science, a fleet management platform, to launch Vehicle Health Intelligence.

- In 2024, Bosch unveiled the Vehicle Health Certificate, a solution for assessing used cars by analyzing vehicle data for trouble codes, battery capacity, and more, initially rolling out in Europe.

Report Coverage

The research report offers an in-depth analysis based on Channel, Vehicle Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand for predictive maintenance solutions.

- Integration of AI and IoT will strengthen diagnostic accuracy and real-time monitoring capabilities.

- OEMs will continue to dominate adoption as they embed systems in new vehicle models.

- Electric and connected vehicles will create strong opportunities for advanced health management tools.

- Aviation and defense sectors will increase adoption to enhance fleet safety and readiness.

- Asia Pacific will emerge as the fastest-growing region due to rising vehicle production.

- Data security will remain a critical concern, requiring stronger cybersecurity frameworks.

- High implementation costs will challenge adoption in cost-sensitive and emerging markets.

- Partnerships between OEMs and technology providers will drive system innovation.

- Regulations on safety and emissions will accelerate global deployment of vehicle health management systems.