Market Overview

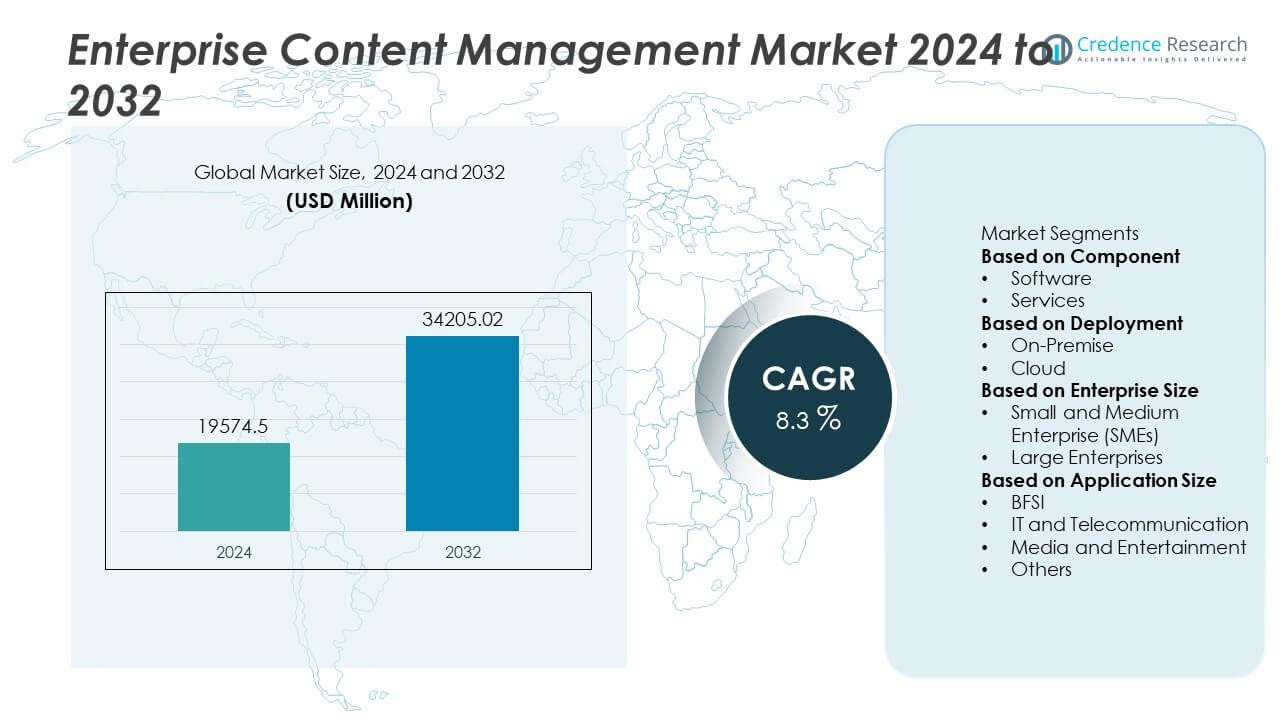

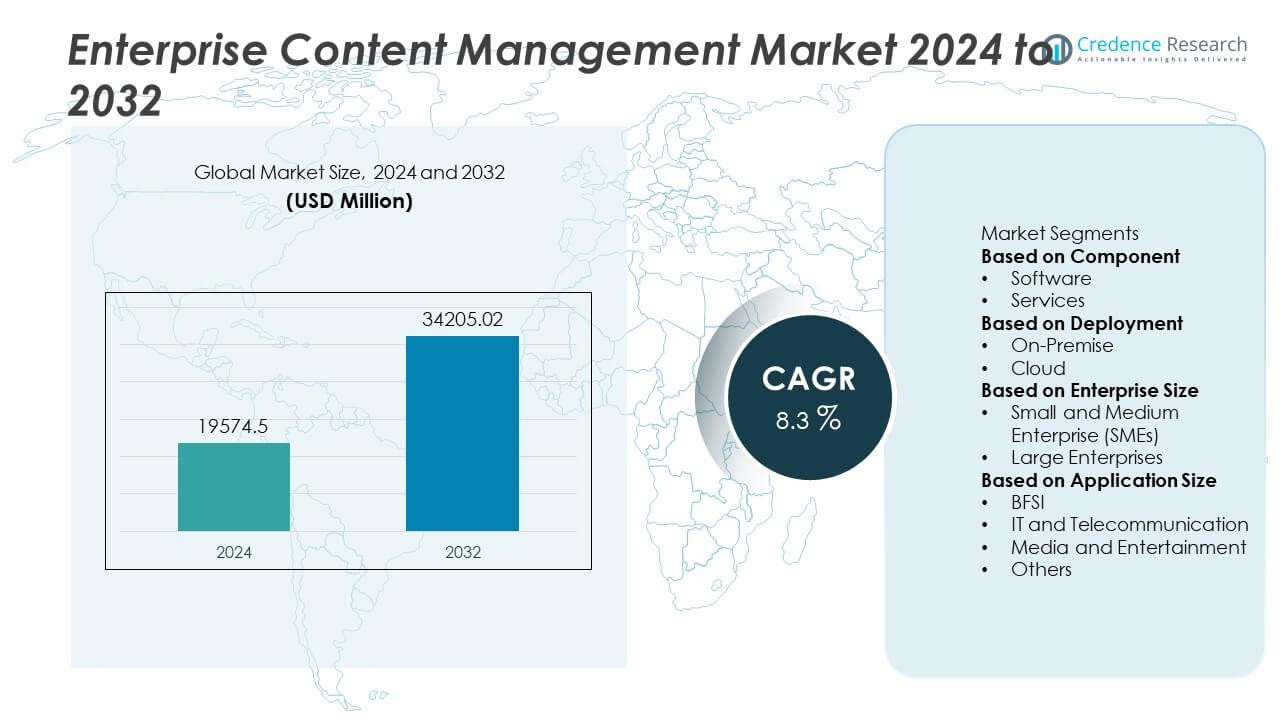

The enterprise content management market size was valued at USD 19,574.5 million in 2024 and is projected to reach USD 34,205.02 million by 2032, expanding at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise Content Management Market Size 2024 |

USD 19,574.5 Million |

| Enterprise Content Management Market, CAGR |

8.3% |

| Enterprise Content Management Market Size 2032 |

USD 34,205.02 Million |

The enterprise content management market is led by top players including Hyland Software, Inc., Oracle Corporation, Alfresco Software, Inc., Box, Inc., IBM Corporation, DocuWare Corporation, Laserfiche, Microsoft Corporation, OpenText Corporation, and M-Files Corporation. These companies strengthen the industry through cloud-first strategies, AI-driven workflows, and scalable platforms that address both large enterprises and SMEs. Microsoft, IBM, and Oracle dominate with enterprise-wide solutions, while OpenText and Hyland deliver strong industry-specific offerings. Regionally, North America held 38% share in 2024, followed by Europe at 30% and Asia Pacific at 22%, while Latin America accounted for 6% and the Middle East & Africa together held 4%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The enterprise content management market was valued at USD 19,574.5 million in 2024 and is projected to reach USD 34,205.02 million by 2032, growing at a CAGR of 8.3%.

- Rising demand for digital transformation and compliance with strict data regulations is driving ECM adoption, with the software segment holding 65% share and services supporting integration and optimization.

- Cloud deployment led with 58% share in 2024, reflecting growing preference for scalable, cost-effective platforms, while on-premise solutions retained importance in sectors requiring high data security.

- Key players including Microsoft Corporation, IBM Corporation, Oracle Corporation, OpenText Corporation, Hyland Software, and M-Files Corporation dominate through AI integration, workflow automation, and hybrid work solutions.

- Regionally, North America led with 38% share, followed by Europe at 30% and Asia Pacific at 22%, while Latin America accounted for 6% and the Middle East & Africa held 4%, reflecting balanced global adoption.

Market Segmentation Analysis:

By Component

The software segment dominated the enterprise content management market in 2024, accounting for 65% of the component share. Its leadership is supported by rising demand for workflow automation, document management, and digital collaboration tools across industries. Businesses increasingly adopt ECM software to improve compliance, secure data, and streamline information flow. The services segment held 35% share, driven by the need for consulting, integration, and managed services. As companies transition toward digital-first operations, software continues to be the backbone of ECM adoption, while services ensure smooth implementation and long-term system optimization.

- For instance, Microsoft Teams reached over 300 million monthly active users in 2023, underscoring the scale of Enterprise Content Management (ECM) adoption facilitated through Microsoft 365’s collaboration tools.

By Deployment

Cloud deployment led the enterprise content management market in 2024, capturing 58% of the deployment share. Its growth stems from scalability, lower upfront costs, and increasing adoption of hybrid work environments. Organizations prefer cloud-based ECM for seamless remote access and real-time collaboration. On-premise deployment retained 42% share, primarily supported by industries with strict compliance and data security requirements, such as banking and government. The ongoing shift toward SaaS platforms reinforces the cloud model’s dominance, with enterprises prioritizing flexibility and reduced infrastructure costs to optimize their content management strategies.

- For instance, Box reported managing over 115 billion files for customers worldwide in 2023, demonstrating the scale of cloud-native ECM deployment.

By Enterprise Size

Large enterprises accounted for 62% of the enterprise content management market share in 2024, benefiting from extensive adoption across sectors such as finance, healthcare, and manufacturing. These organizations rely on ECM solutions to manage high volumes of structured and unstructured data while ensuring regulatory compliance. Small and medium enterprises (SMEs) contributed 38% share, supported by growing affordability of cloud-based ECM solutions and rising awareness of workflow efficiency. SMEs are rapidly embracing ECM tools to enhance productivity, security, and customer service. The expanding digital transformation initiatives across business sizes continue to drive market penetration globally.

Key Growth Drivers

Rising Demand for Digital Transformation

Enterprises are increasingly investing in digital transformation initiatives, fueling the adoption of enterprise content management solutions. Organizations seek to modernize workflows, reduce paper-based processes, and ensure seamless document accessibility. ECM platforms support automation, collaboration, and compliance with evolving regulations. With industries prioritizing efficiency and real-time data access, demand for integrated ECM systems continues to grow. This trend is particularly strong in sectors such as healthcare, banking, and government, where secure content management and compliance with data privacy laws remain critical growth enablers.

- For instance, Hyland provides enterprise content management solutions, including its OnBase platform, to more than 19,000 clients worldwide, a large portion of which are healthcare providers that manage billions of documents related to patients and operations.

Increasing Regulatory Compliance Requirements

The rising complexity of regulatory frameworks across industries drives enterprises to implement ECM solutions. Organizations must comply with strict data retention, privacy, and security standards such as GDPR, HIPAA, and SOX. ECM platforms enable secure storage, access control, and audit trails that ensure compliance while reducing risks of penalties. Enterprises across financial services, healthcare, and government sectors are accelerating ECM adoption to manage sensitive content effectively. The need for governance and transparency positions ECM as a key tool for regulatory adherence, boosting market demand globally.

- For instance, IBM FileNet is used by enterprise clients to manage regulated data, including financial and healthcare records, and offers features like access controls, encryption, and audit trails to help support compliance with regulatory frameworks such as HIPAA and SOX.

Growth of Remote and Hybrid Work Models

The global shift toward remote and hybrid work models has accelerated ECM adoption. Businesses require secure, cloud-based platforms to manage, share, and collaborate on content from distributed locations. ECM solutions provide employees with real-time access to documents while maintaining strict security standards. Features such as version control, digital workflows, and mobile compatibility ensure productivity regardless of location. With enterprises seeking long-term hybrid work strategies, ECM solutions have become essential for operational continuity, data security, and collaboration, fueling sustained growth in the enterprise content management market.

Key Trends and Opportunities

Adoption of Cloud-Based ECM Solutions

Cloud-based enterprise content management solutions are gaining momentum due to scalability, cost efficiency, and accessibility. In 2024, cloud deployment held 58% share, reflecting enterprises’ growing preference for SaaS platforms that reduce infrastructure costs and support flexible work environments. Cloud models also simplify integration with AI and analytics tools, enhancing content insights and automation. This trend creates opportunities for vendors to expand subscription-based offerings and strengthen global presence. Rising adoption among SMEs further highlights cloud ECM as a high-growth opportunity in the coming years.

- For instance, DocuWare Cloud stores more than 100 million documents across 23,000 organizations, enabling compliance-ready workflows in highly regulated industries.

Integration of AI and Advanced Analytics

Artificial intelligence is reshaping enterprise content management by enabling intelligent automation and data-driven insights. AI-powered ECM tools support document classification, natural language search, and predictive analytics, improving workflow efficiency and decision-making. Businesses increasingly leverage AI to enhance compliance, detect anomalies, and extract value from unstructured data. Integration of machine learning with ECM platforms also enhances personalization and user experience. This trend creates new opportunities for ECM providers to differentiate offerings, increase efficiency, and deliver added value to enterprises navigating large volumes of digital content.

- For instance, M-Files integrates its AI assistant “Aino,” which processes metadata from millions of documents monthly to enable intelligent search and contextual recommendations.

Key Challenges

High Implementation and Maintenance Costs

Despite strong adoption, the high cost of implementing ECM solutions remains a barrier for many organizations, especially SMEs. Expenses related to licensing, integration, employee training, and system upgrades increase total ownership costs. On-premise deployments often involve significant upfront investments, while subscription fees for cloud-based ECM may also challenge smaller firms. These cost factors delay adoption and limit penetration in price-sensitive markets. Vendors must address affordability concerns with flexible pricing models and simplified platforms to ensure wider market accessibility and growth.

Data Security and Privacy Concerns

Data security remains a critical challenge in the enterprise content management market. As ECM platforms manage sensitive documents, risks related to cyberattacks, unauthorized access, and data breaches are significant. Enterprises, particularly in banking and healthcare, face heightened concerns due to strict compliance requirements and potential financial losses. Cloud-based deployments, while growing, often amplify security fears among businesses handling confidential information. Building trust through advanced encryption, access control, and compliance certifications is essential. Vendors must prioritize robust security measures to overcome resistance and support sustainable ECM adoption across industries.

Regional Analysis

North America

North America led the enterprise content management market in 2024 with 38% share, supported by advanced IT infrastructure, high cloud adoption, and strong regulatory frameworks. Enterprises in the U.S. and Canada prioritize ECM solutions to ensure compliance with strict data privacy laws and improve digital workflows. The region also benefits from the presence of leading technology providers offering AI-integrated ECM platforms. Growing demand across healthcare, banking, and government sectors further strengthens adoption. As organizations accelerate digital transformation and hybrid work strategies, North America continues to hold the largest share of the global ECM market.

Europe

Europe accounted for 30% of the enterprise content management market share in 2024, driven by increasing regulatory requirements and data protection laws such as GDPR. Enterprises in Germany, France, and the United Kingdom are focusing on secure content management solutions to improve governance and transparency. The region’s strong emphasis on compliance fuels investments in ECM tools for audit trails, document tracking, and secure collaboration. Growing digital transformation across manufacturing, financial services, and healthcare also supports market growth. With a mature IT ecosystem and rising cloud adoption, Europe remains the second-largest market for ECM globally.

Asia Pacific

Asia Pacific captured 22% of the enterprise content management market share in 2024, emerging as the fastest-growing region. Rapid digitalization, rising internet penetration, and increasing cloud deployments drive ECM adoption in countries such as China, India, and Japan. SMEs and large enterprises alike are investing in ECM solutions to enhance productivity, manage growing data volumes, and support hybrid work models. The region also benefits from expanding IT service providers and rising awareness of compliance requirements. With strong economic growth and growing digital-first enterprises, Asia Pacific is expected to be a key growth engine for ECM adoption.

Latin America

Latin America represented 6% of the enterprise content management market share in 2024, led by Brazil and Mexico. Organizations in the region are increasingly adopting ECM solutions to streamline workflows, improve compliance, and reduce reliance on paper-based processes. Cloud-based platforms are gaining momentum due to lower upfront costs and flexibility, making ECM accessible for SMEs. However, challenges such as limited IT infrastructure and economic volatility impact broader adoption. Despite these hurdles, growing digital initiatives and the expansion of regional service providers are creating opportunities for steady ECM growth in the Latin American market.

Middle East and Africa

The Middle East and Africa together held 4% of the enterprise content management market share in 2024, reflecting early but rising adoption. Governments in countries such as the United Arab Emirates and Saudi Arabia are investing in digital transformation initiatives, driving demand for ECM solutions in public administration and financial services. In Africa, South Africa leads adoption, supported by growing IT investments and business modernization efforts. Limited digital infrastructure remains a challenge; however, ongoing investments in cloud services and rising awareness of data security and compliance highlight strong growth potential for ECM across the region.

Market Segmentations:

By Component

By Deployment

By Enterprise Size

- Small and Medium Enterprise (SMEs)

- Large Enterprises

By Application Size

- BFSI

- IT and Telecommunication

- Media and Entertainment

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the enterprise content management market is shaped by key players such as Hyland Software, Inc., Oracle Corporation, Alfresco Software, Inc., Box, Inc., IBM Corporation, DocuWare Corporation, Laserfiche, Microsoft Corporation, OpenText Corporation, and M-Files Corporation. These companies drive market growth through innovations in cloud-based ECM solutions, AI integration, and advanced data security features. Microsoft, IBM, and Oracle dominate with comprehensive enterprise platforms, while OpenText and Hyland focus on strong industry-specific solutions. Box and Laserfiche emphasize collaboration and cloud-first strategies, catering to SMEs and digitally agile enterprises. Alfresco and M-Files are recognized for flexible, user-friendly platforms supporting digital workflows. DocuWare enhances adoption through scalable document management solutions targeted at mid-sized businesses. Collectively, these players compete on innovation, integration, and scalability, with a strong focus on compliance, hybrid work support, and digital transformation initiatives, making the ECM market highly dynamic and innovation-driven.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hyland Software, Inc.

- Oracle Corporation

- Alfresco Software, Inc.

- Box, Inc.

- IBM Corporation

- DocuWare Corporation

- Laserfiche

- Microsoft Corporation

- OpenText Corporation

- M-Files Corporation

Recent Developments

- In April 2025, OpenText released Content Management CE 25.2, adding enhancements to intelligent automation, document control, and tighter enterprise integration.

- In February 2025, Oracle formally announced that its Content Manager Cloud Service would sunset by December 31, 2025, urging customers to migrate or adopt alternate Oracle content offerings.

- In January 2025, M-Files emphasized advances in its AI assistant Aino and no-code automation tool Ment to streamline metadata-driven workflows and intelligent search.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Enterprise Size, Application Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The enterprise content management market will expand steadily with rising digital transformation initiatives.

- Cloud deployment will continue dominating as enterprises seek scalability and flexibility.

- AI integration will enhance document classification, search, and workflow automation.

- Hybrid and remote work models will drive adoption of collaborative ECM solutions.

- Large enterprises will maintain leadership, while SMEs will accelerate adoption through affordable cloud platforms.

- Compliance with strict data privacy regulations will strengthen ECM demand across industries.

- Integration with analytics tools will increase the strategic value of ECM platforms.

- Partnerships and acquisitions will reshape competition and expand solution portfolios.

- Industry-specific ECM solutions will gain traction in healthcare, finance, and government.

- Emerging regions such as Asia Pacific will drive future growth with rapid digital adoption.