Market Overview:

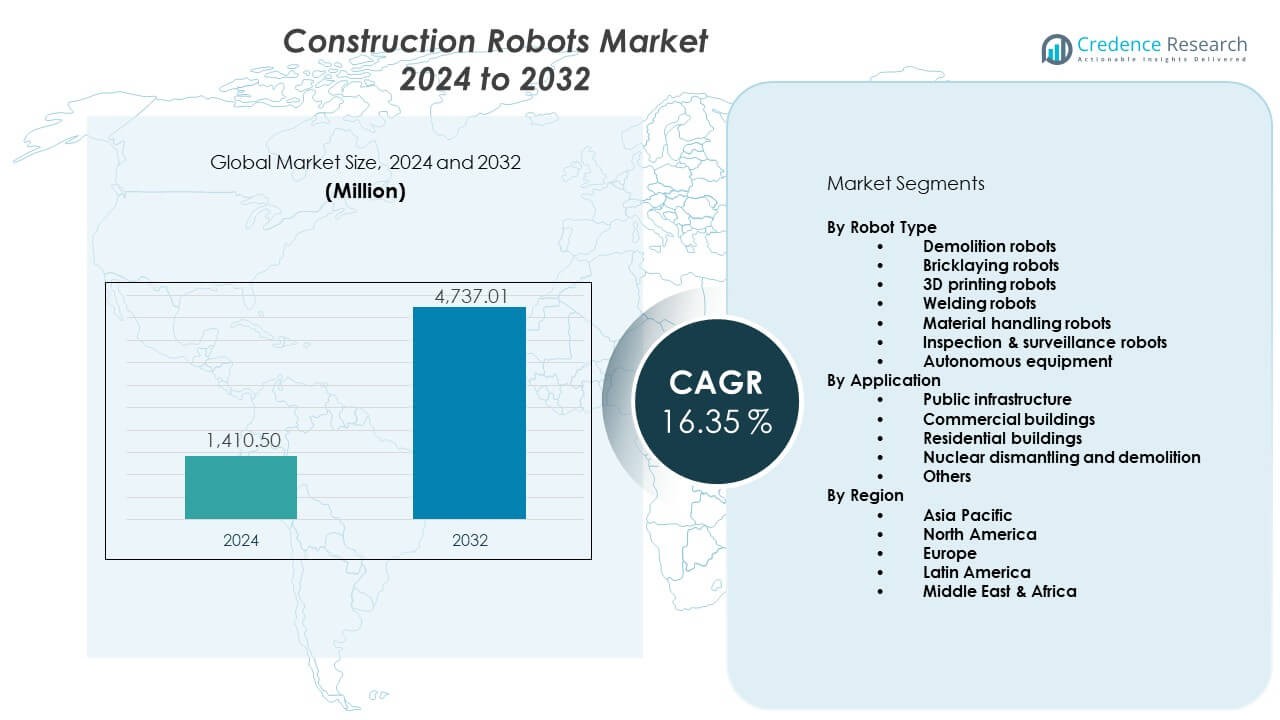

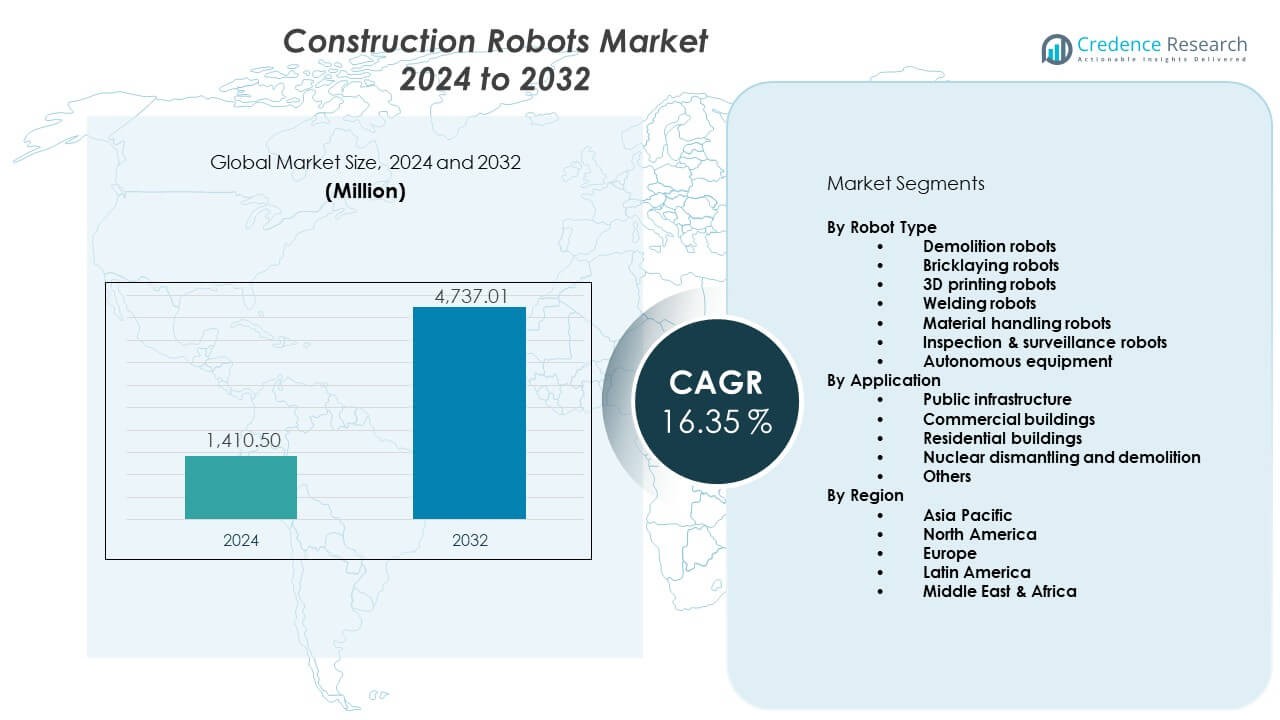

The Construction Robots Market is projected to grow from USD 1,410.5 million in 2024 to an estimated USD 4,737.01 million by 2032, with a compound annual growth rate (CAGR) of 16.35% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Robots Market Size 2024 |

USD 1,410.5 Million |

| Construction Robots Market, CAGR |

16.35% |

| Construction Robots Market Size 2032 |

USD 4,737.01 Million |

Stronger demand for automation pushes adoption across large building sites. Contractors use robots to speed up tasks that demand accuracy and steady output. Firms deploy autonomous machines to reduce safety risks in dense work zones. Robotics support masonry, demolition, and material handling with consistent performance. Companies raise spending on systems that cut delays and labor strain. Technology advances help robots handle complex layouts with better navigation. Higher interest in energy-efficient tools encourages wider acceptance across new projects. These factors keep momentum strong across major construction hubs.

North America leads due to early adoption and strong investment in site automation. Europe follows with steady upgrades in robotic tools for complex infrastructure work. Asia Pacific emerges fast because contractors face pressure from rising urban expansion. China, Japan, and South Korea push wider use through strong tech ecosystems. The Middle East expands adoption as governments invest in modern building programs. Latin America and Africa show early growth as firms explore automation to manage labor gaps. Each region moves at its own pace based on readiness and project scale.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Construction robots market is valued at USD 1,410.5 million in 2024 and is projected to reach USD 4,737.01 million by 2032, supported by a strong 16.35% CAGR driven by automation demand across global construction workflows.

- Asia Pacific leads with 40% share, followed by North America at 28% and Europe at 22%, as these regions invest heavily in advanced machinery, digital construction tools, and large-scale infrastructure programs.

- Asia Pacific stands as the fastest-growing region with 40% share, driven by rapid urbanization, technology readiness, and strong robotics deployment in China, Japan, and South Korea.

- Demolition robots hold the largest share among robot types at 30%, supported by high use in urban redevelopment and risk-prone removal activities.

- Public infrastructure represents the leading application segment with 35% share, supported by major investments in transport corridors, utilities, and large government-led building programs.

Market Drivers:

Rising Demand for Automated On-Site Operations

The Construction robots market gains traction as builders seek faster task cycles. Many developers adopt automated machines to raise accuracy during heavy workflows. Firms prefer robots that support masonry, finishing, and repetitive lifting jobs. Project teams use robotics to reduce pressure on skilled labor during peak timelines. Automation helps crews work with higher safety control in dense zones. Sensors improve task coordination across compact and complex building layouts. Digital tools push higher demand for real-time guidance and error reduction. The system supports stronger output across large public and private projects.

- For instance, Fastbrick Robotics’ Hadrian X achieves automated bricklaying at over 200 blocks per hour, improving throughput on large projects.

Growing Need for Improved Worker Safety and Risk Reduction

Contractors integrate safety-focused robotics to limit exposure to hazardous tasks. Many operators use robots for demolition, heavy removal, and confined-space duties. The Construction robots market benefits from wider interest in safety automation. Companies depend on robotic systems to limit accidents at high-risk points. Sensors help identify unstable loads and risky angles before task execution. Teams replace manual activity in high-elevation zones with stable robotic platforms. Authorities support machines that reduce injury cases in urban developments. These measures encourage broader deployment across major infrastructure environments.

- For instance, Brokk’s electric demolition robots can be equipped with various attachments, such as the BHB 555 breaker which delivers 1,048 joules of impact force, or the MB 1200 breaker which delivers 2,709 joules, all while keeping operators at a safe distance through remote control systems.

Expansion of Large-Scale Infrastructure and Urban Projects

Governments push wider construction upgrades across transport, utilities, and housing. Contractors adopt robots to meet fast deadlines across dense metropolitan corridors. Many teams use autonomous tools to handle repetitive groundwork. Robotics raise consistency during tunnel reinforcement, road alignment, and site maintenance. The Construction robots market gains value from rising city redevelopment cycles. Many builders use site-mapping robots for better scheduling accuracy. Wider urban expansion drives steady interest in productivity automation. These systems help reduce labor gaps that impact large and multi-phase projects.

Technological Advancements in Sensing, Mobility, and AI Integration

Engineers introduce AI-guided robots that handle difficult angles with better precision. Many firms use mobility upgrades to improve access across uneven terrain. Computer-vision tools strengthen alignment during wall finishing and layout scanning. The Construction robots market moves forward through advanced control modules. Robotics offer improved autonomy for complex tasks without heavy supervision. Data analytics improve forecasting for on-site resource needs. System intelligence supports faster error detection and correction cycles. Builders trust these tools to maintain steady performance across shifting site conditions.

Market Trends:

Rising Adoption of Autonomous Mobile Robots Across Large Sites

Contractors deploy mobile robots to move materials across wide project zones. Firms integrate these units with sensor modules for smooth route scanning. The Construction robots market observes higher use of coordinated fleets. Many developers link robots to central control dashboards for real-time checks. These systems reduce congestion across tight access paths. Units follow mapped routes that help crews maintain consistent timing. Mobility upgrades improve travel across mixed surfaces. Teams use these platforms to optimize overall site movement patterns.

- For instance, Boston Dynamics’ Spot robot performs autonomous site walks and captures data with 360° cameras, completing repeat routes up to 30% faster than manual inspection.

Growth of Robot-Enabled 3D Printing and On-Site Fabrication

Builders explore additive construction to lower waste and time. Robots manage precise material layering for structural sections. The Construction robots market benefits from interest in modular production. Automated 3D systems help reduce errors during shaping and placement. Large robotic arms support custom geometries for building shells. Teams use printing units to cut reliance on heavy molds. Fabricators test printing tools for quick part fabrication on location. These features improve workflow continuity during complex builds.

- For instance, Apis Cor’s mobile 3D printing robot completed a full concrete house structure in 24 hours of printing time, demonstrating major cycle-time reductions.

Integration of Digital Twins and Robotics Coordination Platforms

Developers link robots to digital-twin models for live performance tracking. Crew leaders adjust schedules based on synchronized updates. The Construction robots market moves toward better digital alignment. System dashboards improve route planning and task rotation. Many leaders connect drones and ground robots for unified scans. Teams use simulation tools to test task flow before execution. Digital-twin integration reduces planning errors across early phases. Coordination platforms help streamline the full construction cycle.

Rising Use of Collaborative Robots for Task Sharing

Construction crews use cobots to support workers during precision tasks. Shared workflows improve efficiency during layout marking, component placement, and fittings. The Construction robots market sees strong interest in compact collaborative units. Lightweight designs help operators deploy systems without major setup needs. Sensors enhance safe operation during human-robot proximity. Cobots maintain rhythm across repetitive workloads. Many developers train teams to use cobots for daily routines. This shift encourages higher on-site robotic adoption.

Market Challenges Analysis:

High Initial Costs and Limited Access to Skilled Technical Teams

Many firms delay purchases due to the high setup cost of advanced robotics. The Construction robots market faces hurdles when buyers lack financial flexibility. Companies struggle when they cannot train teams for complex calibration. Limited technical capacity slows integration across developing regions. Maintenance needs push expenses higher for long-term use. System downtime impacts schedules when spare parts arrive late. Smaller contractors hesitate to deploy machines without strong ROI clarity. These barriers limit adoption across early-stage markets.

Operational Complexities and Site Variability Constraints

Construction environments change daily, which complicates robotic navigation. Many builders face difficulty aligning robots with shifting site layouts. The Construction robots market experiences slow uptake where ground stability fluctuates. Uneven surfaces reduce mobility in heavy-duty segments. Harsh outdoor conditions increase stress on sensitive robotic parts. Software calibration becomes harder when frequent layout updates occur. Connectivity gaps affect task precision in remote zones. These issues restrict smooth adoption across large infrastructure ecosystems.

Market Opportunities:

Expansion of Robotics in Prefabrication and Modular Construction

Prefabrication units use robots to increase accuracy during component shaping. Many firms adopt automated arms for welding, cutting, and assembling. The Construction robots market gains new momentum through modular building growth. Robotics shorten component cycles inside controlled factory environments. System integration supports higher precision for advanced structural blocks. Teams reduce rework when robots handle repetitive fabrication lines. These improvements strengthen project timelines for large-volume developments. Opportunities expand across regions investing in modular housing.

Adoption of AI-Driven Inspection and Predictive Maintenance Robotics

Builders use inspection robots to identify cracks, moisture pockets, and alignment faults. AI modules support quicker detection and clearer reporting. The Construction robots market grows as teams shift toward predictive repair planning. Inspection tools reduce downtime during long construction cycles. Many authorities endorse robotics for safer structure checks. Predictive systems help teams anticipate service needs early. These technologies improve lifecycle visibility across long-term assets. Strong demand rises from sectors that target higher operational reliability.

Market Segmentation Analysis:

By Robot Type

The Construction robots market expands through strong demand for advanced robot classes. Demolition robots lead adoption because crews need safer removal work. Bricklaying robots support steady wall alignment and reduce strain on workers. 3D printing robots help teams create complex forms with fewer errors. Welding robots improve joint strength in large steel structures. Material handling robots move heavy loads with stable motion across busy sites. Inspection and surveillance robots improve fault detection with clear visual data. Autonomous equipment supports full-site mobility and raises workflow efficiency across long project cycles.

- For instance, Trimble’s robotic total stations deliver layout precision within 2 millimeters, boosting accuracy for autonomous equipment alignment.

By Application

Public infrastructure projects drive high deployment because teams face tight schedules. Many builders depend on robotic support for bridges, tunnels, and transit upgrades. The Construction robots market grows as commercial buildings adopt automation for precision tasks. Residential projects use robots to speed layout work and reduce manual effort. Nuclear dismantling and demolition use robots for high-risk duties that need safe distance. Other applications depend on robotic platforms for routine checks and stable lifting work. Automation improves project flow across mixed environments with fewer delays. These segments push broader use across both small and large construction programs.

- For instance, Hilti’s Jaibot layout robot improves MEP installation productivity by up to 50%, supporting faster completion across large building footprints.

Segmentation:

By Robot Type

- Demolition robots

- Bricklaying robots

- 3D printing robots

- Welding robots

- Material handling robots

- Inspection & surveillance robots

- Autonomous equipment

By Application

- Public infrastructure

- Commercial buildings

- Residential buildings

- Nuclear dismantling and demolition

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

The Construction robots market records strong momentum in Asia Pacific with a market share of 40%. China leads due to rapid site automation and strong robotics manufacturing capacity. Japan and South Korea support growth through advanced engineering ecosystems and fast adoption cycles. Contractors invest in demolition, inspection, and autonomous equipment to meet dense urban demands. Governments encourage robotics integration to improve efficiency during major infrastructure programs. Firms deploy robots to reduce labor gaps across high-volume construction corridors. The region maintains steady expansion as builders upgrade workflows with digital and automated tools.

North America

North America holds a market share of 28% and benefits from early adoption of site automation. The Construction robots market gains support from strong investment in commercial and infrastructure upgrades. Firms in the United States deploy robots for demolition, layout tasks, and material movement with higher precision. Canada expands adoption through rising interest in energy-efficient construction and safer site practices. Builders integrate AI-driven inspection tools to improve maintenance cycles on large assets. Many companies combine digital twins with autonomous systems to raise productivity. The region sustains growth through consistent funding for large-scale modernization projects.

Europe, Latin America, and Middle East & Africa

Europe secures a market share of 22% driven by strict safety rules and strong interest in robotics for complex engineering work. Many contractors use automated systems to reduce manual strain in dense city redevelopment plans. Latin America holds 5% share and expands gradually through government-driven transport upgrades and rising interest in automated demolition. Middle East & Africa maintain a combined 5% share supported by large infrastructure corridors and smart-city investments. The Construction robots market progresses in these regions through demand for precision and reduced downtime. Firms across Europe and emerging regions deploy robots to optimize workflows during multi-phase construction activities. Adoption strengthens where digital planning and advanced equipment integration improve structural quality and site safety.

Key Player Analysis:

- Komatsu

- Caterpillar

- Doosan Robotics

- Hyundai CE

- Built Robotics

- Trimble

- DJI

- Leica Geosystems

- Hilti

- Brokk

- Boston Dynamics

- ABB

- Volvo CE

- Husqvarna

- SANY

- Construction Robotics

- Advanced Construction Robotics, Inc.

- Ekso Bionics

- Autonomous Solutions, Inc.

- Fastbrick Robotics

- Conjet

- Fujita Corporation

- TopTec Spezialmaschinen GmbH

- Apis Cor

- nLink

- Yingchuang Building Technique Co.

Competitive Analysis:

The Construction robots market shows strong rivalry among global equipment makers, robotics firms, and digital technology providers. Companies compete through product upgrades that improve autonomy, accuracy, and mobility. Leaders invest in AI-driven platforms to enhance task precision across dynamic site conditions. Firms expand alliances with construction contractors to strengthen field integration. New entrants focus on compact robots that handle layout marking, lifting, and routine inspection tasks. Established brands advance sensor systems to improve navigation in dense environments. Many players pursue modular designs to reduce setup time. The market moves forward through steady innovation across both hardware and software layers.

Recent Developments:

- Boston Dynamics, owned by Hyundai Motor Group, remains a key player with its multi-task robots like Spot used for construction site inspection and data collection. Hyundai’s acquisition of Boston Dynamics highlights a strategic move toward automation synergies across mobility and construction markets.

- Built Robotics is gaining traction by converting traditional excavators and bulldozers into near-autonomous robotic platforms. They have agreements such as with the contractor Mortenson to deploy fully autonomous construction equipment, particularly aimed at addressing labor shortages in renewable energy projects.

- Komatsu also announced two new excavator models, PC220LC-12 and PC220LCi-12, featuring advanced operator comfort and intelligent machine control automation, launched in September 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Robot Type and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Automation adoption rises as builders seek advanced tools for complex tasks.

- AI-enhanced robots push stronger accuracy across large infrastructure projects.

- Demand grows for autonomous equipment that operates with minimal supervision.

- Inspection robots gain wider use for early fault detection and long-term asset checks.

- 3D printing robots expand through rising interest in modular building methods.

- Material handling robots gain traction across dense construction corridors.

- Demolition robots strengthen adoption due to safety needs in high-risk zones.

- Digital twins integrate with robotics to support better planning and task mapping.

- Collaborative robots enter more project phases to support precision-based duties.

- Contractors increase investment in systems that reduce delays and labor pressure.