Market overview

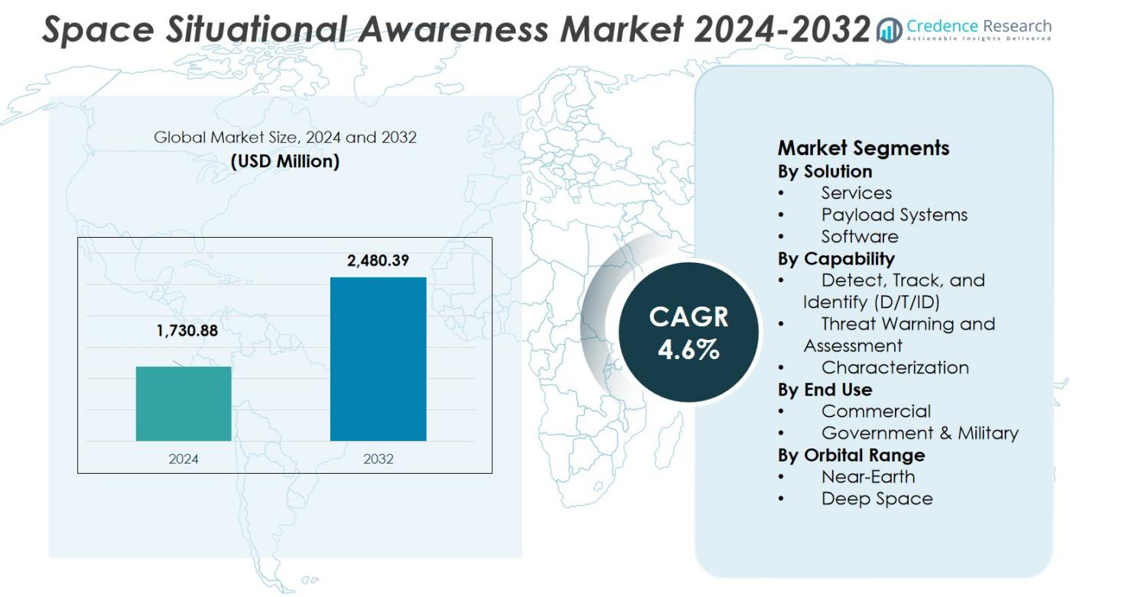

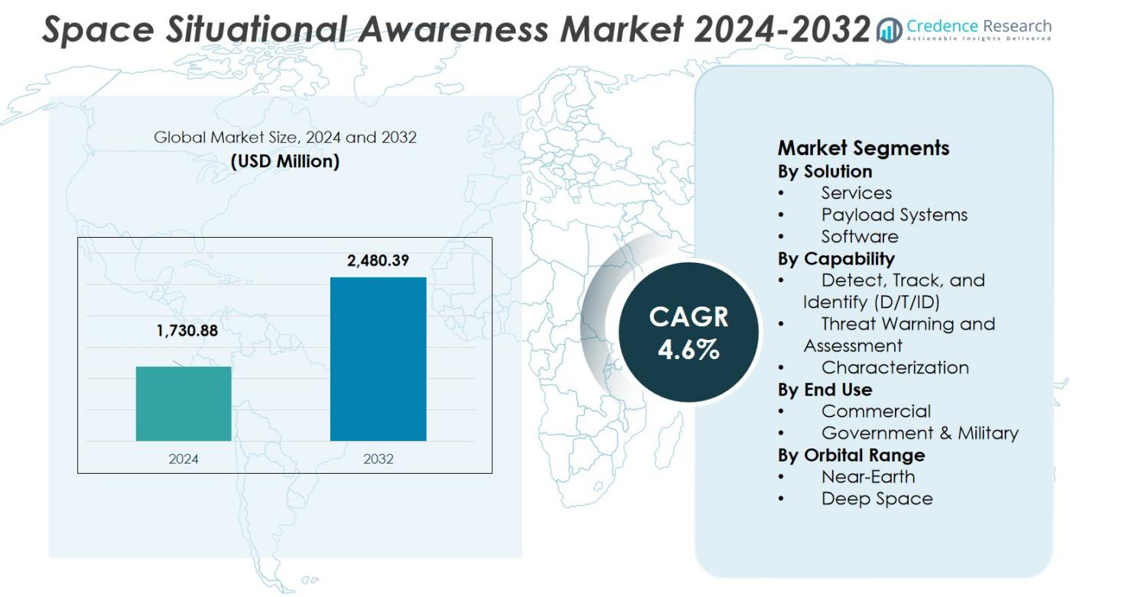

The Space Situational Awareness Market size was valued at USD 1,730.88 Million in 2024 and is anticipated to reach USD 2,480.39 Million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Space Situational Awareness Market Size 2024 |

USD 1,730.88 Million |

| Space Situational Awareness Market, CAGR |

4.6% |

| Space Situational Awareness Market Size 2032 |

USD 2,480.39 Million |

The Space Situational Awareness Market is driven by leading firms such as Lockheed Martin Corporation, L3Harris Technologies, Kratos Defense & Security Solutions, Inc., Parsons Corporation and Exoanalytic Solutions, each offering advanced sensor, software and tracking solutions across commercial and defence sectors. North America emerges as the dominant region, capturing a market share of 41.37% in 2024, thanks to substantial government space‑spending, a mature aerospace‑defence industrial base and extensive ground‑ and space‑based surveillance networks. Combined, the top players and regional dominance underscore a high‑entry‑barrier ecosystem characterised by long‑term contracts, deep R&D investment and growing demand for space‑traffic management and debris‑monitoring capabilities.

Market Insights

- The Space Situational Awareness Market was valued at USD 1,730.88 million in 2024 and is projected to grow to USD 2,480.39 million by 2032 at a CAGR of 4.6%.

- Rapid expansion of satellite constellations and escalating orbital debris are primary growth drivers, boosting demand for monitoring, tracking and collision‑avoidance solutions.

- A major trend lies in the increasing adoption of commercial SSA services and AI‑powered software, where the software segment held 45.3% share in 2024 and governments & military end‑use had 58.7% share.

- Providers face key restraints such as data‑overload from numerous sensors, accuracy issues in object tracking and a fragmented regulatory landscape across jurisdictions.

- Regionally, North America dominated with a share of 41.37% in 2024, while Asia‑Pacific and Middle East are emerging as faster‑growing markets offering new opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution:

The Space Situational Awareness Market by solution is segmented into Services, Payload Systems, and Software. Among these, the software segment holds the largest market share of 45.3% in 2024. This dominance is driven by the growing demand for advanced software tools that facilitate real-time tracking, analysis, and prediction of space debris, satellite health, and other orbital objects. Additionally, increasing investments in AI and machine learning technologies further fuel the adoption of software solutions for efficient data management and decision-making processes in space operations.

- For instance, Lockheed Martin provides real-time space situational awareness software used by agencies like Germany for tracking objects in Earth orbit, enhancing operational safety and responsiveness.

By Capability:

The Space Situational Awareness Market by capability is divided into Detect, Track, and Identify (D/T/ID), Threat Warning and Assessment, and Characterization. The D/T/ID capability leads with the largest market share of 38.2%. This segment’s growth is driven by the increasing need for continuous monitoring of objects in Earth’s orbit, particularly with the rise in satellite launches and the growing concern over space debris. Advanced D/T/ID systems help in identifying potential threats to operational spacecraft, thus ensuring better space traffic management and safety.

- For instance, the U.S. Strategic Command operates the Space Surveillance Network, employing ground-based radar and optical telescopes to track objects as small as 10 cm across various orbits, providing essential real-time data to predict collision risks and safeguard spacecraft.

By End Use:

The Space Situational Awareness Market by end use is categorized into Commercial, Government, and Military sectors. The government and military sector commands the largest share of 58.7% in 2024. This dominance is attributed to the critical importance of space surveillance for national security, satellite defense, and space operations management. Governments globally are investing in advanced space monitoring capabilities to protect strategic assets and maintain space sovereignty, especially with the rising number of space missions and threats from space debris and hostile satellite activities.

Key Growth Drivers

Increasing Space Debris and Satellite Constellations

The rapid growth in space debris and the increasing number of satellite constellations significantly drive the demand for space situational awareness (SSA). As space activities proliferate, particularly with mega-constellations such as SpaceX’s Starlink, the risk of collisions and interference grows. This has heightened the need for robust monitoring systems to track objects in orbit and prevent potential hazards. SSA solutions are crucial for managing orbital traffic and ensuring the safety of satellites, thus propelling market growth.

- For instance, Space surveillance networks, which are used by the European Space Agency (ESA)and international partners, track approximately 40,000 objects in orbit large enough to be detected (generally larger than 10 cm).

Technological Advancements in Detection Systems

Advancements in detection technologies, such as radar, optical sensors, and infrared tracking systems, are key enablers of growth in the SSA market. These technologies provide enhanced capabilities for detecting and tracking objects in space, even in challenging environments. Continuous improvements in AI and machine learning further enhance these systems’ ability to analyze vast amounts of data for predictive analytics and real-time threat assessment. As these technologies evolve, they provide more precise and efficient space situational awareness solutions, boosting market demand.

- For instance, Weibel’s long-range Doppler radars offer precise real-time tracking and collision avoidance services, supporting space traffic management for global space agencies.

Government Investments in Space Security

Governments around the world are increasingly investing in space security, which is a major driver for the SSA market. With growing concerns about space warfare, satellite vulnerabilities, and the need to protect national interests in space, defense and space agencies are prioritizing SSA. Strategic investments in advanced tracking systems, space defense technologies, and international collaborations for space monitoring have led to increased demand for SSA solutions. This government push is expected to continue fueling market growth in the coming years.

Key Trends & Opportunities

Shift Towards Commercial Sector Adoption

While government and military sectors have traditionally dominated the space situational awareness market, there is a notable shift toward commercial sector adoption. With the rise of private space companies launching satellites and mega-constellations, commercial entities are investing in SSA to ensure the safety of their assets in space. This shift presents an opportunity for SSA providers to cater to private companies seeking to mitigate collision risks and protect their satellites, creating a lucrative growth avenue for market players.

- For instance, SpaceX’s Starlink constellation relies on advanced SSA technologies to monitor and manage orbital collision risks across its thousands of broadband satellites.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into SSA systems represents a key opportunity for market expansion. These technologies enable more efficient processing and analysis of large volumes of data generated by space monitoring systems. AI and ML can automate the identification and classification of space objects, predict potential collisions, and provide actionable insights in real-time. As these technologies advance, they present a significant opportunity for SSA companies to offer more advanced and cost-effective solutions, attracting a broader customer base.

- For instance, Slingshot Aerospace applies ML models in its space domain awareness platform to detect anomalous spacecraft behavior and fuse millions of optical observations per year into high-fidelity orbital intelligence for government and commercial users.

Key Challenges

Data Overload and Accuracy Issues

One of the primary challenges facing the space situational awareness market is the management of large amounts of data and ensuring its accuracy. With the rapid increase in satellite launches and space debris, SSA systems are tasked with processing vast volumes of data from various sensors and sources. Ensuring the accuracy and reliability of this data is critical for predicting threats and preventing collisions. However, data overload and inconsistencies across different monitoring systems can lead to inaccurate assessments, posing a challenge to the effectiveness of SSA solutions.

Regulatory and Policy Hurdles

The regulatory landscape surrounding space operations remains fragmented, creating a challenge for SSA providers. Different countries and space agencies have varying regulations regarding satellite operations, space traffic management, and debris mitigation. This lack of standardization in regulations can complicate the development and implementation of global SSA systems. Companies must navigate these regulatory hurdles to provide solutions that are compliant across multiple jurisdictions, which can slow down innovation and limit the scalability of SSA technologies.

Regional Analysis

North America

In 2024, the Space Situational Awareness Market in North America accounted for 41.37% of the global market, reflecting its dominant position. This strong share arises from high government and military space spending, expansive ground‑ and space‑based surveillance networks, and a mature ecosystem of commercial space‑services firms. The United States’ long‑standing leadership in space situational awareness (SSA) infrastructure and private‑sector innovation underpins the region’s robust growth. With ongoing investments in radar, optical sensors, and AI‑driven analytics, North America remains the primary growth engine in the SSA market.

Europe

Europe held 26.00% of the global SSA market share in 2023. The region benefits from collaborative programmes across European Space Agency member states, and the push toward space‑traffic management and orbital‑debris mitigation in the European Union spurs market demand. Europe’s regulatory emphasis on space sustainability, combined with investments in optical and radar sensors and its industrial base in aerospace systems, supports its market share. While growth is steady, Europe’s expansion is driven by defence modernization and private‑sector outsourcing of SSA services.

Asia‑Pacific

Asia‑Pacific emerges as a high‑momentum region in the SSA market, with a share of 19.00%. Growth here is driven by emerging space powers such as China and India which are ramping satellite launches and establishing indigenous tracking infrastructures. Commercial mega‑constellation activity and national initiatives in Japan, South Korea, and Southeast Asia further fuel demand. The region’s dynamic market environment and increasing focus on space domain awareness translate into above‑average growth rates relative to mature regions.

Middle East & Africa

The Middle East & Africa (MEA) region secured 8.00% of the global SSA market in 2024. Its share is supported by nations such as the United Arab Emirates and Saudi Arabia that are deploying space programmes and satellite communications infrastructures requiring situational awareness services. Additionally, Africa’s growing interest in remote‑sensing and satellite‑based connectivity elevates SSA needs. Although the market size is smaller compared to major regions, MEA presents strategic growth potential as regional space strategies mature and investment into tracking and debris‑monitoring systems increases.

Latin America

Latin America accounted for 5.63% of the global SSA market in 2024. The market is nascent compared with other regions but is benefitting from rising satellite deployments in Earth observation and communications. Latin American governments and private operators are increasingly contracting SSA services to secure their orbital assets, monitor space debris, and comply with international best practices. While the growth base is smaller, incremental infrastructure investments and partnerships with global SSA providers signal a positive trajectory for the region.

Market Segmentations:

By Solution

- Services

- Payload Systems

- Software

By Capability

- Detect, Track, and Identify (D/T/ID)

- Threat Warning and Assessment

- Characterization

By End Use

- Commercial

- Government & Military

By Orbital Range

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Space Situational Awareness (SSA) market is shaped by key players including Lockheed Martin Corporation, L3Harris Technologies, Kratos Defense & Security Solutions, Inc., Parsons Corporation and Exoanalytic Solutions. Lockheed Martin leverages its extensive defence‑aerospace footprint and deep R&D investment to deliver integrated sensor networks and command‑and‑control systems. L3Harris focuses on orbit determination, cataloging and deep‑space electro‑optical surveillance, strengthening its offering through advanced algorithms and sensor integration. Kratos emphasizes cost‑efficient, rapid‑deployment SSA solutions for both commercial and government customers, capitalizing on its software and analytics expertise. Parsons integrates geospatial intelligence, threat analytics and launch/flight‑dynamics services to support national space missions. Exoanalytic Solutions brings niche commercial analytics and tracking solutions, enabling data‑driven decision‑making. Together, these firms create barriers to entry through high‑cost infrastructure, regulatory complexity and long‑term contracts, while ongoing partnerships, acquisitions and technology enhancements continue to intensify competitive dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, MDA Space Ltd. partnered with ThothX Group to deliver enhanced space situational awareness data services to Canada’s Department of National Defence.

- In September 2025, ispace Inc. and Digantara announced a joint mission to integrate cislunar situational awareness into lunar operations, combining Digiantara’s SSA analytics with ispace’s lunar‑landing capabilities.

- In June 2025, ABB and HEMERIA entered a collaboration to advance monitoring technology in the low Earth orbit SSA segment by developing innovative sensor systems

Report Coverage

The research report offers an in-depth analysis based on Solution, Capability, Orbital Range, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth will accelerate as satellite launches and orbital object counts rise globally, pushing demand for more comprehensive tracking, cataloguing and collision‑avoidance capabilities.

- Commercial satellite operators will increasingly adopt SSA solutions, creating new revenue streams beyond traditional government defence customers.

- Advances in artificial intelligence, machine learning and data analytics will enable real‑time object identification, threat prediction and anomaly detection in space traffic monitoring.

- Integration of SSA data into broader space traffic management systems and global cooperative frameworks will enhance coverage and reduce risks across orbital regimes.

- Smallsat and mega‑constellation deployments will drive demand for scalable, cost‑efficient SSA payload systems and ground‑segment services to support high‑density operations.

- On‑orbit servicing, debris‑removal and active mitigation missions will create requirements for high‑fidelity SSA sensing and characterisation capabilities.

- Emerging space‑capable nations and commercial entrants will expand regional SSA infrastructure investments, diversifying the addressable market beyond traditional major powers.

- Modular, software‑defined and cloud‑native SSA platforms will accelerate deployment, lower barriers to entry and enable flexible subscription‑based service models.

- Regulatory, standards and data‑sharing frameworks will evolve, driving demand for interoperable SSA systems compliant with multi‑agency and international coordination.

- Sensor fusion across ground‑based radars, optical/infrared telescopes and space‑based detectors will become a competitive differentiator, increasing system reliability and coverage.