Market Overview:

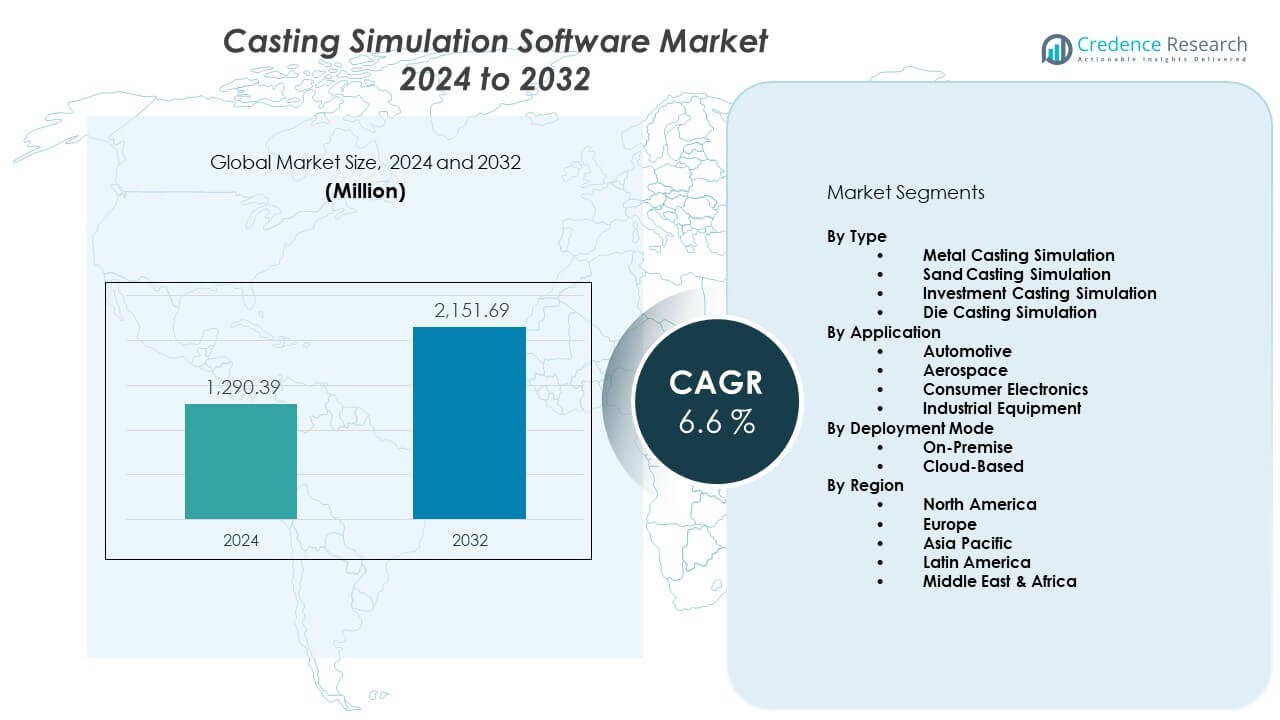

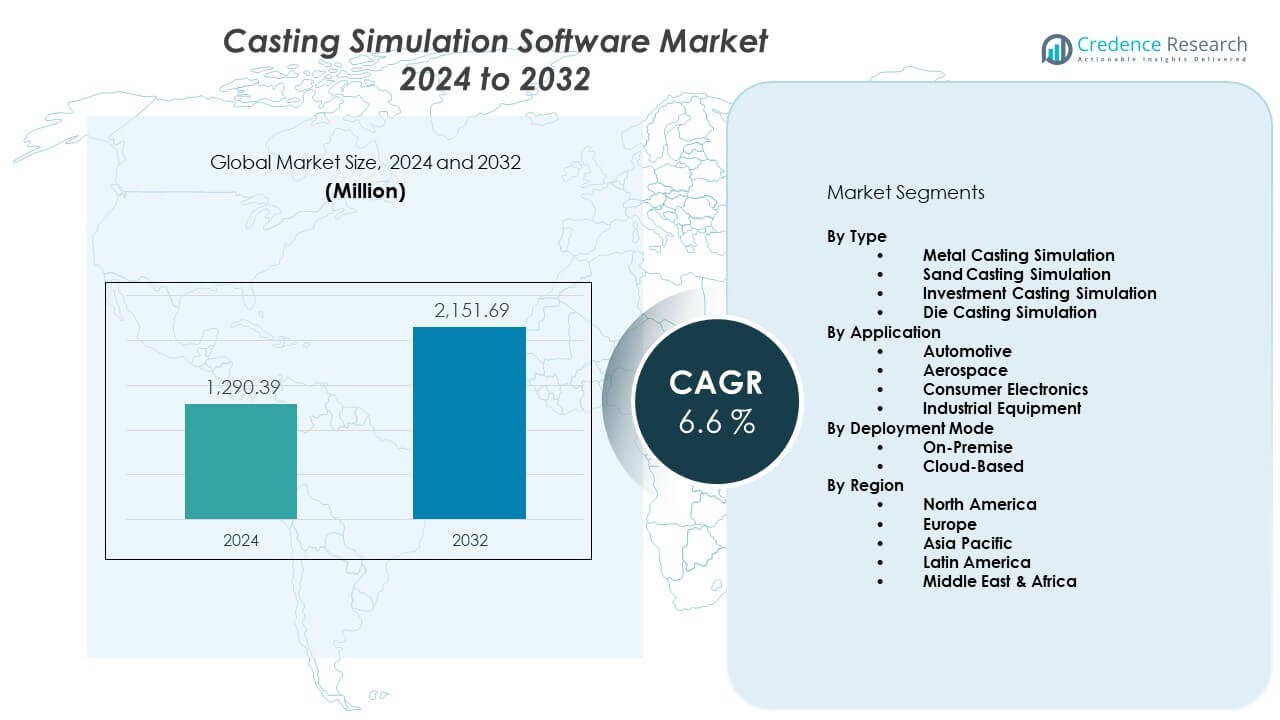

The Casting Simulation Software Market is projected to grow from USD 1,290.39 million in 2024 to an estimated USD 2,151.69 million by 2032, with a compound annual growth rate (CAGR) of 6.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Casting Simulation Software Market Size 2024 |

USD 1,290.39 Million |

| Casting Simulation Software Market, CAGR |

6.6% |

| Casting Simulation Software Market Size 2032 |

USD 2,151.69 Million |

Growing demand for defect-free metal components drives wider use of advanced casting tools. Manufacturers adopt digital systems to predict shrinkage, porosity, and flow issues during production. Automotive suppliers rely on simulation to shorten design cycles and reduce waste. Aerospace firms use virtual testing to improve part integrity. Foundries upgrade operations to avoid rework and raise process efficiency. Engineers prefer platforms that support faster iterations. The rise of complex alloy structures increases software adoption. Digital design goals encourage broader integration across industries.

North America leads the adoption due to strong use across automotive and aerospace plants. Europe follows with high uptake from advanced manufacturing clusters. Asia Pacific emerges as the fastest-growing region due to rapid industrial expansion. Countries with rising metalworking output increase their focus on design accuracy. Growing investment in digital tools pushes wider acceptance across local foundries. Mature markets show stable growth due to steady upgrades. Emerging regions raise demand as industries shift toward precision casting.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Casting simulation software market reached USD 1,290.39 million in 2024 and is projected to hit USD 2,151.69 million by 2032, supported by a steady 6% CAGR driven by rising digital adoption in casting operations.

- North America (34%), Europe (29%), and Asia Pacific (28%) dominate the market due to strong manufacturing bases, advanced simulation adoption, and high demand for defect-free metal components.

- Asia Pacific, holding 28%, remains the fastest-growing region as automotive, electronics, and industrial equipment producers accelerate digital manufacturing and invest in precise simulation workflows.

- Metal Casting Simulation accounted for the largest share at around 40%, supported by its heavy use across automotive, aerospace, and industrial machinery applications.

- On-Premise deployment held about 60% share, driven by demand for secure high-performance computing environments in large manufacturing and engineering organizations.

Market Drivers:

Growing Need for Defect-Free Metal Components

The Casting simulation software market gains strength from rising pressure to improve component quality. Firms in automotive and aerospace sectors use simulation to predict defects early in the design stage. Engineers focus on reducing porosity, shrinkage, and thermal stress. The shift toward lighter alloys increases the need for accurate modelling. Manufacturers push digital workflows to avoid waste during tooling. Simulation supports faster validation cycles across foundries. Teams rely on advanced solvers to meet tighter tolerance demands. It helps industries maintain efficiency during high-volume production.

- For instance, a MAGMASOFT project for a two-cylinder compressor part helped a manufacturer (WEG) reduce the scrap rate from an initial 25% to 4% after modifying the overflows. The scrap rate was further cut to 0.5% after implementing additional cooling channels in the side cores.

Expanding Role of Digital Manufacturing Ecosystems

Digital manufacturing adoption drives broader interest in simulation platforms. Industries shift toward virtual testing to shorten development schedules. The Casting simulation software market benefits from strong investment in modelling tools. Engineers depend on automated functions to optimize gating and riser design. Digital twins influence real-time decision workflows. Software vendors enhance integration with CAD and PLM systems. Production units need improved accuracy during alloy transitions. It strengthens process control across multiple stages of casting.

- For instance, Shiva Tool Tech reported an 80% reduction in die design time after adopting Altair Inspire Cast for method development.

Strong Push for Cost Reduction Across Foundries

Foundries adopt simulation to reduce scrap and rework. Teams use data-driven models to predict performance issues. The Casting simulation software market supports efforts to cut operational waste. Simulation lowers the number of physical trials. Tooling suppliers depend on accurate flow and solidification studies. Digital insights help stabilize large-batch production. Predictive capability limits failures during complex jobs. It drives measurable cost savings across metal-processing units.

Rising Adoption in Complex and High-Precision Applications

Demand grows in aerospace, medical, and energy components. Firms require highly precise structures that demand strong predictive capabilities. The Casting simulation software market supports modelling for complex geometries. Simulation enhances structural analysis during advanced part development. High-precision sectors rely on strong metallurgical prediction features. Engineers look for software that simulates microstructural behavior. It enables better decision-making in temperature-intensive tasks. Industries choose advanced tools to handle next-generation components.

Market Trends:

Growing Integration of Cloud-Based Simulation Platforms

Vendors shift toward cloud deployment to support distributed teams. Users gain flexible access without heavy local hardware. The Casting simulation software market sees steady adoption of cloud modules. Remote collaboration enables faster design reviews. Cloud platforms offer improved scalability during intensive workloads. Teams share simulation data across multi-site operations. Centralized storage supports traceable design workflows. It improves project visibility throughout development.

- For instance, MAGMASOFT users have reported scrap reductions of up to 70% and weight savings of 8% after digitally optimizing casting geometry, benefits that scale well across multi-site teams.

Increased Use of AI and Automation in Simulation Tasks

AI-driven solvers reduce manual setup effort. Automated mesh generation speeds routine tasks. The Casting simulation software market benefits from AI-enabled optimization. Predictive tools guide parameter selection. Intelligent algorithms increase accuracy during flow and cooling prediction. Engineers use automation to validate multiple design changes. AI supports faster identification of defect zones. It strengthens consistency in simulation output.

- For instance, studies on Flow-3D Cast show shrinkage defects reduced by up to 40% and casting yield improved to 85% when gating systems are optimized through automated simulation workflows.

Growing Demand for High-Fidelity Metallurgical Modelling

Industries require deeper insight into metal behavior. Vendors improve microstructure prediction features. The Casting simulation software market expands with advanced metallurgical modules. Simulation now captures detailed grain evolution. High-fidelity models support stricter quality standards. Engineers analyze cooling paths with greater precision. Foundries adopt advanced tools to meet certification requirements. It supports better reliability in safety-critical components.

Rising Adoption of Integrated Simulation-to-Production Workflows

Manufacturers move toward unified design-to-casting pipelines. Simulation integrates with process monitoring tools. The Casting simulation software market grows as firms seek seamless workflows. Digital twins support continuous improvement across production lines. Integrated solutions reduce gaps between tooling and shop-floor execution. Teams track process deviation more effectively. Data exchange standards improve system compatibility. It enhances operational transparency in casting environments.

Market Challenges Analysis:

High Software Costs and Skilled Workforce Requirements

The Casting simulation software market faces issues tied to pricing. Many firms struggle with initial licensing and training expenses. Smaller foundries delay adoption due to limited budget flexibility. Engineers require advanced computational knowledge to run accurate simulations. Talent shortages slow broader implementation. Frequent version upgrades add cost pressure. Integration needs specialized IT support across facilities. It limits adoption among resource-constrained organizations.

Complexity in Modelling Advanced Materials and Geometries

Growing demand for intricate components introduces modelling challenges. High-performance alloys require advanced thermal and metallurgical predictions. The Casting simulation software market must address accuracy gaps in extreme conditions. Engineers face difficulty validating simulations for unusual designs. Limited material databases affect prediction precision. Complex geometry increases solver load during analysis. Long simulation times reduce workflow speed. It creates barriers during fast-paced production cycles.

Market Opportunities:

Emerging Demand from Rapidly Industrializing Regions

Growing metalworking activity in developing economies creates wide scope. The Casting simulation software market can expand through localized support models. Regional manufacturers seek modern tools to replace outdated methods. Digitalization initiatives encourage stronger simulation usage. Energy and automotive plants adopt advanced casting methods. Growing supplier networks raise demand for predictive platforms. It supports stronger penetration across new industrial clusters.

Rising Interest in Sustainable and Energy-Efficient Casting Processes

Industries shift toward processes that reduce material waste. The Casting simulation software market benefits from tools supporting low-energy designs. Teams analyze thermal patterns to cut fuel demand. Simulated trials limit scrap generation. Sustainable production goals encourage deeper reliance on virtual testing. Vendors offer modules that optimize resource use. It strengthens alignment with global environmental standards.

Market Segmentation Analysis:

By Type

Metal casting simulation leads adoption due to strong use in high-precision metal component development. Sand casting simulation holds steady demand across foundries that run large-batch production. Investment casting simulation gains traction in aerospace and medical parts that require tight structural control. Die casting simulation shows fast growth where lightweight alloys and complex molds remain essential. The Casting simulation software market benefits from rising complexity across all casting methods. It supports improved accuracy across flow, solidification, and defect prediction. Type-based expansion stays strong across modern manufacturing units. It encourages wider use of predictive tools in varied casting workflows.

- For instance, ESI ProCAST covers sand, die, and investment casting processes and helps users ensure right-first-time casting by predicting filling, solidification, and porosity with high accuracy.

By Application

Automotive holds the largest share due to high need for error-free metal components. Aerospace depends on strong simulation features for critical parts in engines and structural systems. Consumer electronics uses simulation to support compact and lightweight housing parts. Industrial equipment demands stable modelling accuracy for heavy-duty components. Each application group depends on reliable prediction tools to cut rework and gain better efficiency. Software vendors design specialized modules for sector-specific tasks. It supports precise design cycles across complex shapes. Adoption trends remain strong across diverse end-user clusters.

- For instance, a U-Shin case study showed porosity in zamak castings reduced from 0.45 mm³ to 0.03 mm³ after using Altair Inspire Cast, directly supporting quality targets in automotive supply chains.

By Deployment Mode

On-premise deployment dominates where firms require high data control and secure internal workflows. Large manufacturers prefer on-site systems for extensive simulation loads. Cloud-based deployment grows fast due to flexible access and lower setup costs. Remote teams benefit from scalable computing and shared design environments. Cloud tools reduce hardware strain during high-intensity simulation tasks. It allows teams to speed collaboration across sites. Deployment trends show a shift toward hybrid usage patterns. Growth aligns with stronger digital adoption across industries.

Segmentation:

By Type

- Metal Casting Simulation

- Sand Casting Simulation

- Investment Casting Simulation

- Die Casting Simulation

By Application

- Automotive

- Aerospace

- Consumer Electronics

- Industrial Equipment

By Deployment Mode

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America (Market Share ~34%)

North America holds the largest share due to strong technology adoption across major manufacturing hubs. The Casting simulation software market benefits from steady demand in automotive and aerospace clusters that prioritize defect-free metal parts. Regional firms invest in advanced simulation to reduce waste and improve operational accuracy. Cloud-based platforms gain traction as engineering teams expand remote collaboration. High digital maturity enables faster integration of simulation-to-production workflows. Vendors strengthen support services across the U.S. and Canada to meet rising customization needs. It maintains stable leadership through consistent upgrades in industrial design practices.

Europe (Market Share ~29%)

Europe follows with robust use among advanced metalworking and machining industries. Strong regulatory standards encourage deeper adoption of simulation tools for quality assurance tasks. The Casting simulation software market sees reliable growth due to high investment in precision casting for automotive and industrial machinery. Germany, France, and the U.K. lead deployment due to strong engineering capabilities. Industry players adopt digital twins to streamline process optimization and tooling validation. Regional manufacturers show preference for high-fidelity metallurgical simulation modules. It sustains momentum through strong focus on sustainability and energy-efficient casting processes.

Asia Pacific (Market Share ~28%)

Asia Pacific emerges as the fastest-growing region due to rapid industrial expansion. China, Japan, India, and South Korea increase adoption to support rising output in automotive, electronics, and machinery sectors. The Casting simulation software market gains strong traction as manufacturers shift toward digital manufacturing ecosystems. Local firms invest in simulation to reduce scrap and support high-volume metal component production. Demand accelerates where export-driven manufacturing requires strict quality checks. Regional governments support industrial digitalization, boosting the need for simulation tools. It expands quickly as industries prefer scalable and cost-efficient platforms.

Key Player Analysis:

Competitive Analysis:

The Casting simulation software market features strong competition among global and regional developers focused on precision modeling and advanced process control. Vendors invest in deeper metallurgical simulation, improved solvers, and AI-based automation to support high-performance workflows. Firms strengthen partnerships with automotive, aerospace, and heavy-industry users to expand long-term adoption. Market leaders differentiate on accuracy, integration capability, and cloud scalability. Smaller players gain ground by offering cost-efficient tools tailored for specific casting processes. Software providers compete through upgrades that support complex alloys and multi-stage casting paths. It maintains a competitive landscape shaped by innovation and strong customer service networks across key regions.

Recent Developments:

- In 2025, Magmasoft showcased its leadership in casting process optimization at GIFA Southeast Asia 2025, held in October in Bangkok. The company presented real customer case studies, casting defects discussions, and live demonstrations of simulation in various casting methods, emphasizing how Magmasoft’s simulation software helps reduce scrap and improve yield by linking virtual simulations with real production results.

- Magmasoft also participated in BUTECH 2025 in Busan during May, where they introduced the latest features of MAGMASOFT®, including digital prediction and analysis of complex phenomena in casting such as porosity, shrinkage, and heat treatment. The focus was on demonstrating economic benefits and ease of use for diverse casting methods, enabling foundries to improve product design and production processes early on.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- AI-driven simulation tools will expand automated defect prediction.

- Cloud platforms will gain wider use among distributed engineering teams.

- Integration with digital twins will drive faster design-to-production workflows.

- High-precision sectors will adopt deeper metallurgical modeling functions.

- Regional vendors will grow through cost-effective localized tools.

- Sustainability goals will raise demand for waste-reduction simulation modules.

- Hybrid deployment models will strengthen due to security and flexibility needs.

- Advanced solvers will support complex geometries and multi-alloy tasks.

- User demand for real-time process insights will increase integration with shop-floor systems.

- Simulation adoption will rise in emerging manufacturing clusters across Asia and Latin America.