Market Overview:

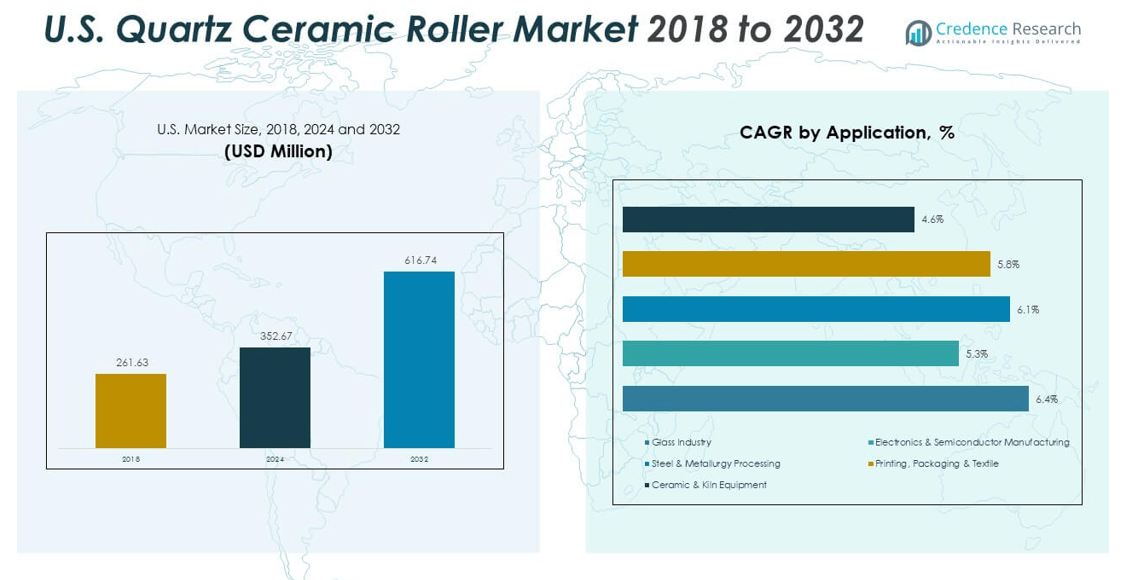

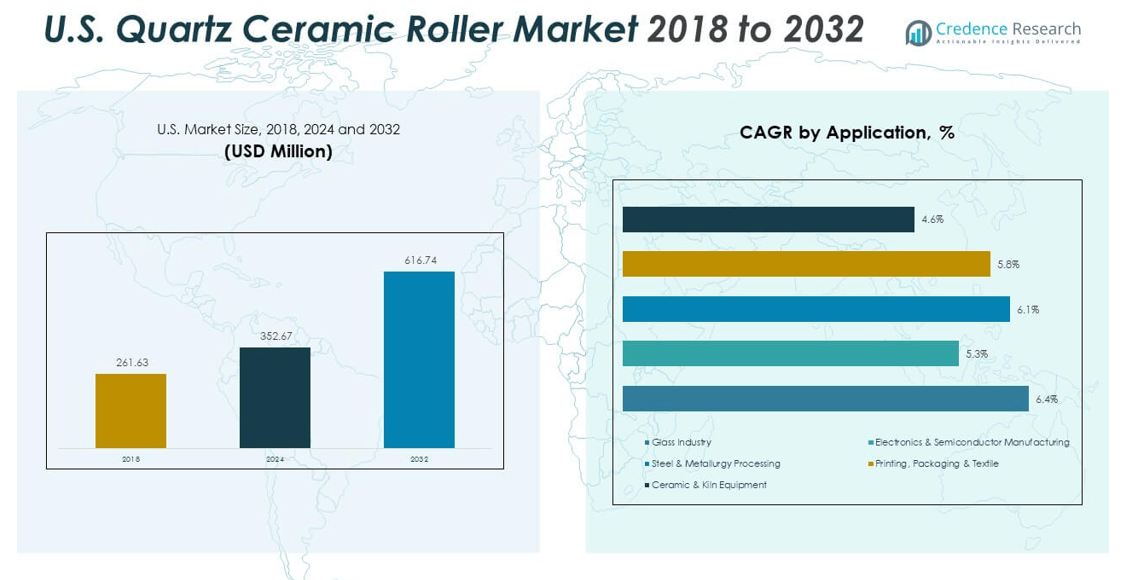

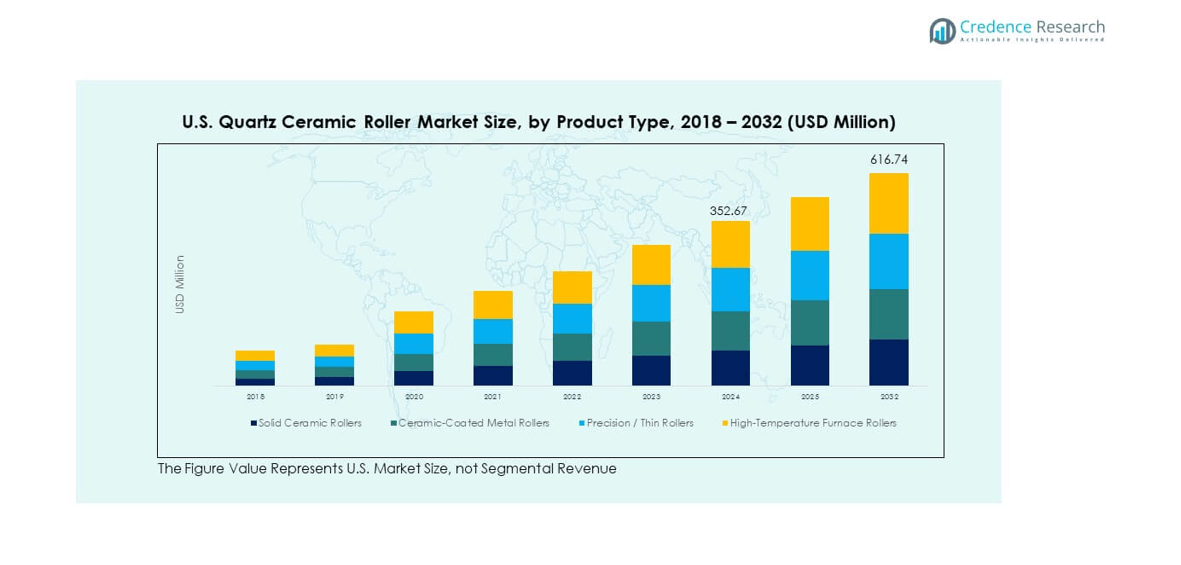

The U.S. Quartz Ceramic Roller Market size was valued at USD 261.63 million in 2018, increased to USD 352.67 million in 2024, and is anticipated to reach USD 616.74 million by 2032, at a CAGR of 7.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Ceramic Roller Market Size 2024 |

USD 352.67 million |

| U.S. Quartz Ceramic Roller Market, CAGR |

7.24% |

| U.S. Quartz Ceramic Roller Market Size 2032 |

USD 616.74 million |

The market growth is driven by rising adoption of quartz ceramic rollers in glass manufacturing, solar energy, and semiconductor industries. Increasing focus on high-temperature performance, corrosion resistance, and dimensional stability fuels demand. Manufacturers emphasize automation, precision engineering, and advanced composite integration to enhance product quality and operational efficiency. Expanding solar panel production and technological advancements in float glass lines further support the market expansion.

Regionally, the western United States leads due to the presence of major glass and solar equipment manufacturers. The Midwest region shows steady growth, supported by strong industrial infrastructure and demand from the construction and electronics sectors. The southern states are emerging as key growth hubs, driven by manufacturing investments, renewable energy projects, and supply chain expansion for high-performance materials.

Market Insights:

- The U.S. Quartz Ceramic Roller Market was valued at USD 261.63 million in 2018, increased to USD 352.67 million in 2024, and is projected to reach USD 616.74 million by 2032, expanding at a CAGR of 7.24% during 2024–2032.

- The Western U.S. led the market with 38% share in 2024 due to strong glass, solar, and semiconductor production bases. The Midwest followed with 27%, supported by industrial infrastructure, while the South accounted for 22%, driven by solar expansion and manufacturing investments.

- The Southern region is expected to record the fastest growth, fueled by renewable energy projects, favorable business conditions, and rising high-tech manufacturing capacity.

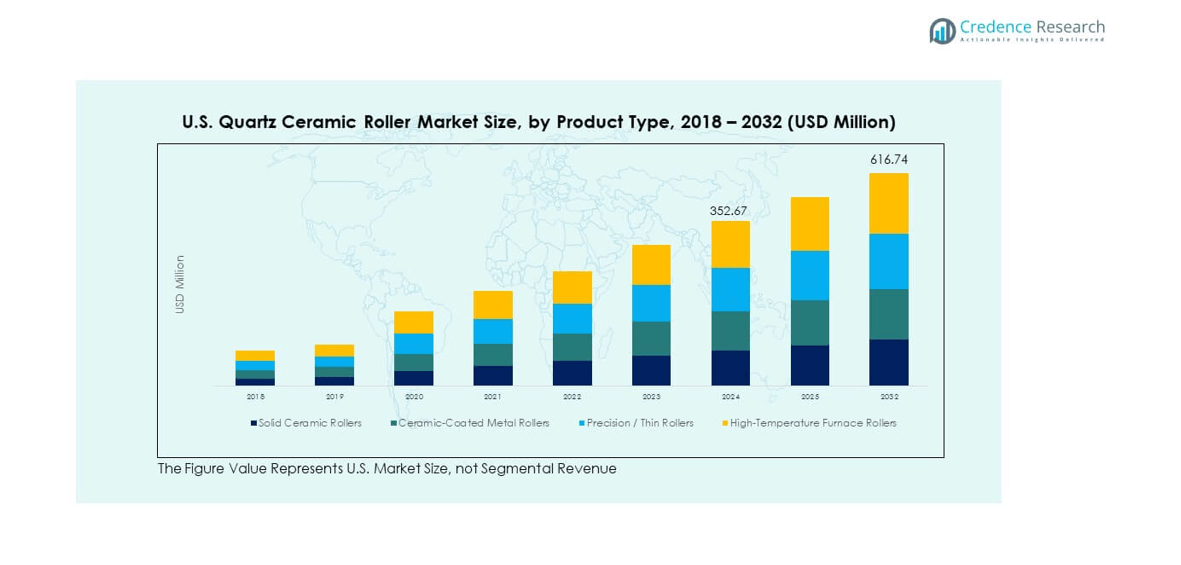

- Solid Ceramic Rollers held the largest product share at 34% in 2024, supported by their superior thermal stability and durability in continuous high-temperature applications.

- High-Temperature Furnace Rollers represented 27% of the market, gaining traction in float glass, steel, and solar module manufacturing for their enhanced resistance and long operational lifespan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Glass Manufacturing and Solar Energy Industries

The U.S. Quartz Ceramic Roller Market benefits from increasing use in glass manufacturing and solar module processing. Quartz ceramic rollers provide high-temperature resistance, thermal shock durability, and chemical stability, which are vital for modern production lines. Expanding solar energy infrastructure across the U.S. drives demand for precise heat-handling components. It supports efficient float glass production and photovoltaic glass tempering. Manufacturers rely on these rollers to maintain product uniformity under extreme thermal conditions. Growing investments in renewable energy and advanced manufacturing technology accelerate this adoption. The trend aligns with national energy transition goals and industrial efficiency standards.

- For instance, Saint-Gobain’s fused quartz rollers used in float glass and photovoltaic applications consistently maintain purity above 99.95%, enabling high-quality glass production at continuous operating temperatures above 1,100°C, and supporting a 25% reduction in operational downtime for U.S. customers due to enhanced thermal resistance and chemical stability.

Integration of Advanced Materials and Manufacturing Techniques

Rising focus on material innovation strengthens market growth through enhanced roller composition and coating technologies. Companies develop hybrid rollers combining fused silica and zircon-based ceramics for improved mechanical strength. It ensures longer operational life and reduced downtime in high-volume production. Automation and CNC-based precision shaping improve product consistency. Manufacturers invest in laser-assisted surface treatments and non-porous finishes to resist microcracks. These improvements enhance roller stability during high-speed furnace operations. Adoption of robotics in fabrication also reduces human error and increases throughput efficiency.

- For instance, CoorsTek has developed over 400 proprietary ceramic materials; recent U.S. innovations include hybrid rollers with non-porous, laser-finished surfaces that demonstrate a threefold increase in mechanical durability compared to standard coatings, directly reducing equipment maintenance requirements in high-volume plants.

Growing Semiconductor and Electronics Manufacturing Demand

The semiconductor sector’s expansion in the U.S. drives steady demand for quartz ceramic rollers. These rollers play a key role in wafer processing, annealing, and thermal treatment systems. It supports precise temperature control critical for advanced microchip production. Rising investments in domestic semiconductor manufacturing under U.S. CHIPS Act stimulate consumption. Manufacturers prefer quartz ceramics due to their purity, low thermal expansion, and insulation properties. The surge in electronic component production encourages sustained product innovation. Continuous upgradation of cleanroom standards also enhances roller quality requirements.

Sustainability and Energy Efficiency Driving Product Adoption

Focus on sustainable production and energy conservation promotes wider use of quartz ceramic rollers. The material’s ability to withstand higher operational cycles without replacement reduces waste and maintenance frequency. It contributes to lower lifecycle costs for manufacturing facilities. Energy-efficient glass furnaces increasingly depend on thermal-stable rollers to maintain consistent temperatures. The integration of eco-friendly raw materials aligns with green manufacturing policies. Regulatory emphasis on low-emission processes supports the use of quartz ceramics over metal rollers. This shift enhances performance reliability while meeting environmental compliance norms.

Market Trends:

Shift Toward Automated Production and Smart Monitoring Technologies

Automation and digital monitoring technologies are reshaping the U.S. Quartz Ceramic Roller Market. Manufacturers adopt IoT-enabled systems to track roller wear, alignment, and temperature. It enhances predictive maintenance and reduces production downtime. Smart sensors integrated into furnaces improve operational precision. Robotics and AI-based control systems optimize heating cycles and process stability. This shift toward Industry 4.0 boosts production yield and product uniformity. Companies adopting digital quality control systems gain a competitive edge through real-time data analytics. Such technology-driven practices enhance process reliability and cost-effectiveness.

- For instance, manufacturers in the advanced ceramics sector have implemented IoT-based predictive maintenance systems using sensors to monitor real-time equipment conditions like temperature and vibration.

Development of Custom Engineered Rollers for Specialized Applications

Demand for custom-engineered quartz ceramic rollers rises in sectors like aerospace, optics, and advanced glass coating. Manufacturers tailor roller size, porosity, and surface finish to specific process environments. It enables improved handling of specialized materials requiring unique thermal properties. Design customization enhances application flexibility and supports niche manufacturing needs. This trend encourages collaborations between suppliers and OEMs to develop precision solutions. Emerging small-scale producers also capitalize on this customization demand. The growing need for differentiation drives investment in rapid prototyping and simulation tools.

Increased Focus on Domestic Manufacturing and Supply Chain Localization

The U.S. market experiences a transition toward local sourcing and domestic roller production. Supply disruptions during global crises highlight the importance of secure local manufacturing. It leads to capacity expansion by domestic producers and re-shoring of critical component manufacturing. Partnerships between regional glassmakers and quartz ceramic producers strengthen local ecosystems. Government-backed initiatives for manufacturing resilience further reinforce this trend. Companies benefit from reduced import dependency and shorter lead times. Enhanced local infrastructure also supports innovation and employment in advanced materials.

Advancement in Coating and Surface Treatment Technologies

Manufacturers are focusing on innovative coating techniques to extend roller lifespan. Advanced surface treatments such as nano-coating and plasma sealing minimize friction and contamination. It improves roller efficiency and reduces defects in end products. Enhanced coating technologies also improve heat distribution and minimize wear. This development ensures consistent performance in demanding high-temperature environments. The growing emphasis on quality control standards in solar and electronics production encourages adoption. Companies investing in coating R&D strengthen their market competitiveness through superior product reliability.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The U.S. Quartz Ceramic Roller Market faces cost-related challenges due to energy-intensive manufacturing and material precision requirements. Producing high-purity quartz involves advanced melting, shaping, and annealing processes that require costly infrastructure. It increases capital and operational expenses for manufacturers. Raw material price fluctuations further strain profitability. Small and mid-sized producers struggle to maintain competitiveness against global suppliers. Skilled labor shortages in high-precision ceramics manufacturing limit scalability. High equipment maintenance costs also affect long-term operational sustainability. These challenges encourage players to optimize process efficiency and explore alternative cost-control methods.

Limited Substitution Options and Market Entry Barriers

The specialized nature of quartz ceramic rollers creates significant barriers for new entrants. It demands high technical expertise, strict quality control, and long R&D cycles. Established players dominate the market through proprietary technologies and certifications. Limited substitutes exist for high-temperature and contamination-free applications, restricting material flexibility. It leads to dependence on a few global suppliers for raw materials. Regulatory compliance and certification requirements raise production costs. Market entrants face challenges in achieving economies of scale, which restrains competition and innovation within smaller firms.

Market Opportunities:

Expansion in Renewable Energy and High-Tech Manufacturing Sectors

The U.S. Quartz Ceramic Roller Market holds strong opportunities in solar, semiconductor, and advanced glass production. Growth in renewable energy accelerates the demand for solar panel components that rely on high-performance rollers. It benefits from the rising number of float glass and thin-film manufacturing plants. Federal incentives for domestic semiconductor production also create sustained demand. Technological innovation in sustainable materials widens application scope across high-temperature processes. Increasing R&D collaborations between manufacturers and research institutions further strengthen market growth potential.

Adoption of Sustainable and Circular Manufacturing Practices

The transition toward sustainable manufacturing offers significant long-term potential. Companies adopting closed-loop systems to recycle quartz materials reduce waste and improve cost-efficiency. It aligns with national sustainability objectives and environmental compliance norms. Investment in green production processes attracts new partnerships and funding opportunities. Demand for eco-friendly, durable rollers grows across sectors focused on carbon reduction. Such initiatives create new business avenues for manufacturers prioritizing responsible production and material recovery strategies.

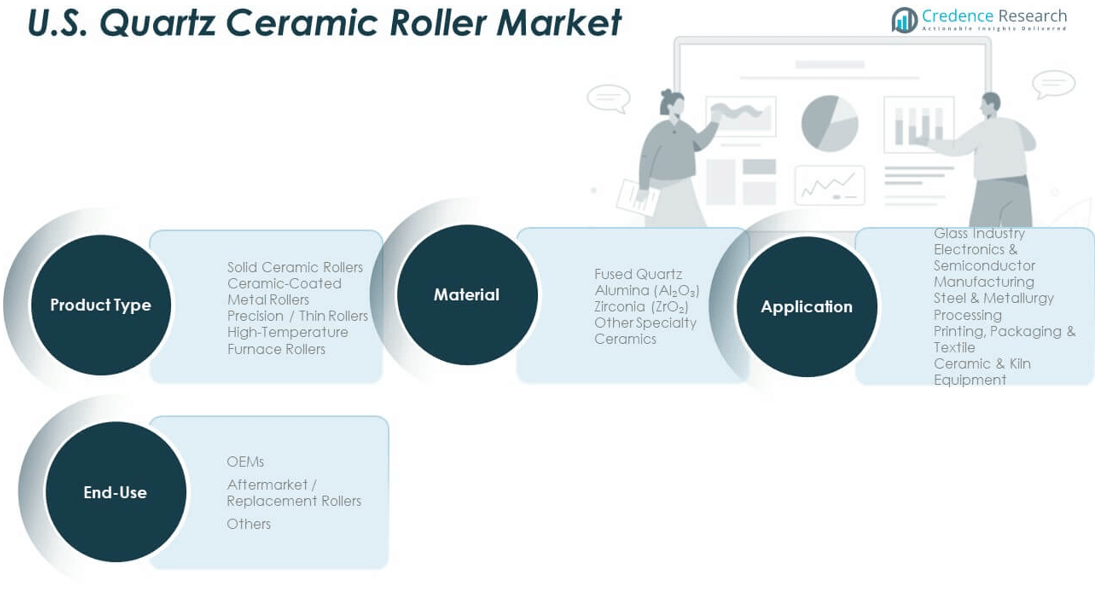

Market Segmentation Analysis:

By Product Type

The U.S. Quartz Ceramic Roller Market is segmented into solid ceramic rollers, ceramic-coated metal rollers, precision/thin rollers, and high-temperature furnace rollers. Solid ceramic rollers dominate due to their superior thermal resistance and mechanical strength. Ceramic-coated metal rollers gain traction in cost-sensitive operations requiring durability and stability. Precision rollers support applications demanding dimensional accuracy, particularly in semiconductor processing. High-temperature furnace rollers find use in extreme environments such as float glass and metallurgical furnaces, driven by their long operational lifespan and minimal thermal deformation.

- For instance, solid ceramic rollers from Saint-Gobain and CoorsTek are verified to withstand above 1,100°C for float glass and metallurgical furnaces; precision rollers manufactured via CNC methods achieve ±2 micron tolerances, while latest ceramic-coated metal rollers maintain effective operations in glass facilities for more than 18 consecutive months without degradation.

By Application

The glass industry remains the leading application segment, supported by demand from architectural and automotive glass production. Electronics and semiconductor manufacturing follow, where purity and heat tolerance are critical. Steel and metallurgy processing adopt these rollers for consistent temperature handling and reduced maintenance. Printing, packaging, and textile sectors use them for smooth material transfer. Ceramic and kiln equipment applications expand due to improved firing efficiency and reduced downtime.

- For instance, The U.S. glass industry utilizes advanced quartz ceramic rollers for high-temperature applications like horizontal tempering, where they contribute to the high-volume processing of float and architectural glass. The semiconductor industry relies on ultra-pure materials, including specialized ceramics, to prevent trace metal contamination, which can be measured in the low parts-per-billion (ppb) range in process materials. Meanwhile, improvements in ceramic coatings have been used in steel and metallurgy furnaces to increase the longevity and durability of components under extreme conditions.

By End-Use

OEMs dominate the end-use segment due to large-scale integration in production equipment. The aftermarket segment grows steadily with periodic roller replacement and maintenance requirements. Other smaller industries contribute through niche applications in laboratory and specialty manufacturing setups.

By Material

Fused quartz leads due to high purity and thermal shock resistance. Alumina (Al₂O₃) offers strong mechanical stability for high-load environments. Zirconia (ZrO₂) supports extreme temperature applications through enhanced toughness. Other specialty ceramics, including hybrid composites, gain adoption for customized industrial solutions.]

Segmentation:

By Product Type:

- Solid Ceramic Rollers

- Ceramic-Coated Metal Rollers

- Precision / Thin Rollers

- High-Temperature Furnace Rollers

By Application:

- Glass Industry

- Electronics & Semiconductor Manufacturing

- Steel & Metallurgy Processing

- Printing, Packaging & Textile

- Ceramic & Kiln Equipment

By End-Use:

- OEMs

- Aftermarket / Replacement Rollers

- Others

By Material:

- Fused Quartz

- Alumina (Al₂O₃)

- Zirconia (ZrO₂)

- Other Specialty Ceramics

Regional Analysis:

Western United States – Technological and Industrial Dominance

The western region holds the largest share in the U.S. Quartz Ceramic Roller Market, accounting for nearly 38% of the total revenue in 2024. Strong presence of glass manufacturing facilities, solar energy projects, and semiconductor fabrication plants drives demand. States such as California, Arizona, and Nevada lead due to large investments in clean energy and advanced material production. It benefits from proximity to major solar panel manufacturers and high-tech electronics producers. Industrial modernization programs and strict energy efficiency regulations encourage adoption of high-performance quartz rollers. The region’s strong infrastructure and R&D presence continue to support innovation and market expansion.

Midwestern United States – Manufacturing and Engineering Core

The Midwest represents about 27% of the market share in 2024, driven by its robust industrial ecosystem. States such as Ohio, Illinois, and Michigan host large-scale glass, steel, and automotive manufacturing units that rely on thermal processing technologies. It benefits from well-established supply chains, skilled labor availability, and consistent manufacturing output. Growing investments in advanced ceramics and furnace modernization projects boost demand. Local producers emphasize cost-effective production and process optimization to strengthen competitiveness. Continuous integration of quartz ceramic rollers into metallurgical and precision engineering operations fuels regional growth.

Southern and Northeastern United States – Emerging Growth Centers

The southern region contributes around 22% of total revenue, supported by expanding solar infrastructure and industrial construction projects. Texas and North Carolina lead adoption, with growing installations in renewable energy and advanced manufacturing sectors. It gains traction due to favorable business conditions and expanding infrastructure for heavy industries. The northeastern region, holding 13% of the market, benefits from advanced glass and electronics manufacturing clusters in New York, Pennsylvania, and Massachusetts. Strong emphasis on sustainable production and import substitution enhances demand for locally produced quartz rollers. Combined, these regions represent emerging frontiers for future market development through technology-driven investments and regional diversification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Quartz Ceramic Roller Market is moderately consolidated, with key players including CoorsTek Inc., 3M Company, Saint-Gobain S.A., Corning Incorporated, and Morgan Advanced Materials plc. These companies focus on innovation, quality improvement, and supply chain efficiency to maintain a competitive edge. It emphasizes product development in thermal stability, precision performance, and durability for high-temperature applications. Strategic mergers, acquisitions, and R&D investments strengthen market presence and enhance technological capabilities. Global brands dominate high-value segments, while domestic manufacturers compete in mid-range categories through localized production and cost efficiency.

Recent Developments:

- In July 2024, CTS Corporation completed the acquisition of SyQwest, LLC, a designer and manufacturer of sonar and acoustic sensing solutions, strengthening CTS’s footprint in U.S. defense and advanced ceramics-related markets.

- In April 2023, Saint-Gobain Advanced Ceramic Composites (ACC) announced it would expand production of continuous oxide and quartz fiber products. This strategic shift aims to meet demand from the U.S. aerospace and industrial sectors, as confirmed in industry publications in early 2024.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, end-use, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand from solar and semiconductor industries will continue to boost product adoption.

- Increasing focus on precision manufacturing will drive innovations in roller design.

- Energy-efficient glass production will remain a major growth catalyst.

- Domestic production will expand due to supply chain localization efforts.

- Integration of smart monitoring and predictive maintenance will improve roller longevity.

- New coating technologies will enhance product durability and surface stability.

- R&D investments in composite ceramics will create new market opportunities.

- Sustainability and recycling practices will become a competitive differentiator.

- Partnerships between OEMs and material suppliers will strengthen innovation cycles.

- Growth across southern and western states will define regional expansion trends.