Market Overview

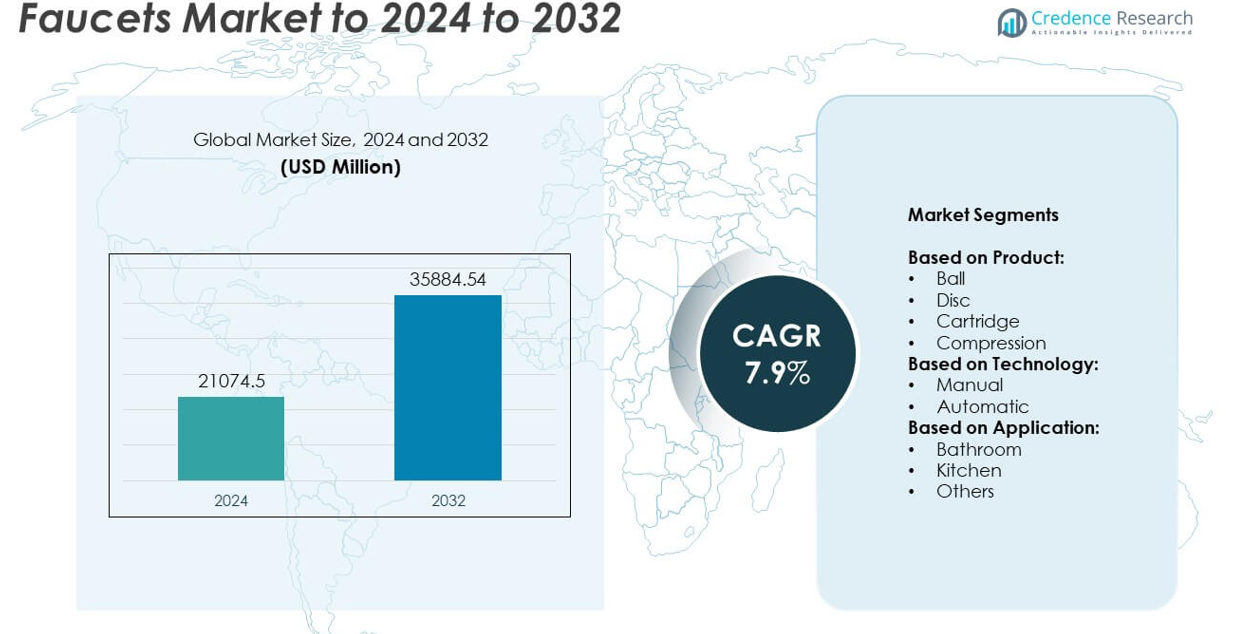

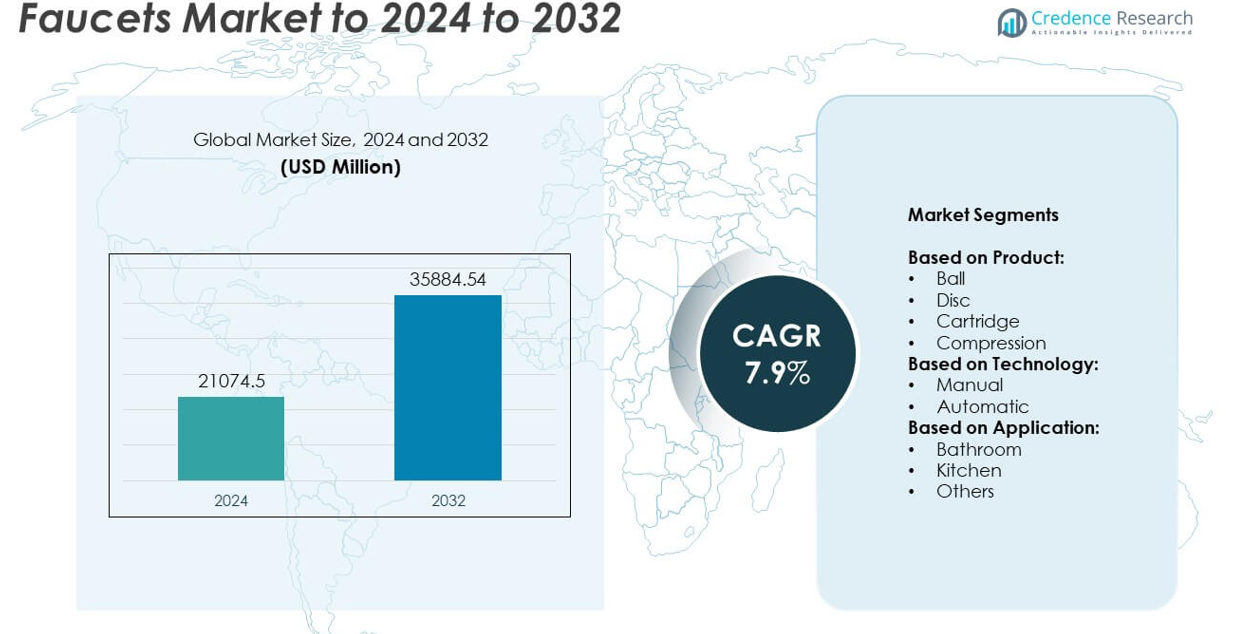

The Faucets Market size was valued at USD 21,074.5 million in 2024 and is anticipated to reach USD 35,884.54 million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Faucets Market Size 2024 |

USD 21,074.5 million |

| Faucets Market, CAGR |

7.9% |

| Faucets Market Size 2032 |

USD 35,884.54 million |

The faucets market is shaped by leading players such as Grohe America Inc., Delta Faucet Company, Kohler Co., Danze Inc., American Standard Brands, Moen Incorporated, Aqua Source Faucet, Masko Corporation, Kraus, USA, and Pfister. These companies focus on expanding product portfolios with smart technologies, sustainable designs, and premium finishes to meet evolving consumer needs. Competitive strategies include investments in research, branding, and global distribution networks. Regionally, Asia Pacific led the market in 2024 with 34% share, supported by rapid urbanization, large-scale infrastructure development, and rising consumer demand for modern housing solutions, making it the fastest-growing region.

Market Insights

- The faucets market size was valued at USD 21,074.5 million in 2024 and is projected to reach USD 35,884.54 million by 2032, growing at a CAGR of 7.9%.

- Growing urbanization, rising residential construction, and demand for water-efficient fixtures are key drivers boosting market expansion across both developed and emerging economies.

- Smart and touchless faucets are gaining traction, driven by hygiene awareness, premiumization trends, and consumer preference for modern, multifunctional designs in bathrooms and kitchens.

- The market is highly competitive, with leading global and regional players focusing on innovation, sustainable product designs, and strengthening distribution through retail and e-commerce, though intense rivalry and raw material price volatility act as restraints.

- Asia Pacific led the market with 34% share in 2024, followed by North America at 32% and Europe at 27%, while the bathroom segment dominated applications with 55% share and ball faucets led product categories with over 35%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Ball faucets held the dominant share of the faucets market in 2024, accounting for over 35% of global demand. Their simple design, durability, and cost-effectiveness make them widely preferred in residential and commercial settings. The one-handle mechanism that controls both temperature and flow ensures user convenience, further boosting adoption. Cartridge faucets are gaining momentum with increased use in modern households due to low maintenance and precise control. Disc and compression faucets remain niche, primarily used in specific applications, but ball faucets continue to drive market leadership through affordability and ease of installation.

- For instance, Delta’s RP70 ball assembly measures a 2-inch stem and 1.5-inch diameter.

By Technology

Manual faucets dominated the market in 2024, capturing more than 70% share, owing to their lower cost, widespread availability, and compatibility across bathrooms and kitchens. Their reliability and simpler installation make them the first choice in developing regions. However, automatic faucets are steadily expanding in share, supported by rising hygiene awareness, water conservation initiatives, and growing smart home adoption. The demand from commercial establishments such as airports, malls, and hotels further strengthens the automatic segment’s growth, yet manual faucets maintain dominance through affordability and long-standing consumer familiarity.

- For instance, the battery life of Sloan BASYS sensor faucets varies. Some models are rated for 3 years at 8,000 cycles per month, while a 5-year service life is possible under certain conditions of 8,000 cycles per month and high water pressure.

By Application

Bathroom applications led the faucets market in 2024, representing nearly 55% of total demand. The dominance is driven by large-scale residential construction, urban housing projects, and remodeling activities focused on improving bathroom aesthetics and water efficiency. Consumers prefer multi-functional faucets with sleek designs, pushing manufacturers to innovate within this segment. Kitchen faucets follow, supported by growing demand for pull-down and touchless features in modern households. The “Others” category, including outdoor and utility faucets, shows steady adoption, but bathroom applications remain the key driver of growth, benefitting from both residential and commercial infrastructure development.

Key Growth Drivers

Rising Urbanization and Residential Construction

Rapid urbanization and expansion of residential projects remain the key growth driver for the faucets market. Growing middle-class populations, increasing disposable incomes, and preference for modern housing fuel demand for advanced bathroom and kitchen fittings. Real estate growth in emerging economies, along with renovation activities in developed markets, supports strong uptake. Consumers are increasingly prioritizing aesthetics, convenience, and water-efficient designs, driving steady adoption across both new installations and replacement markets.

- For instance, Jaquar produces over 45.9 million bath fittings annually and equips 3.3 million bathrooms yearly.

Technological Advancements and Smart Faucets Adoption

The integration of touchless and sensor-based technologies has significantly boosted faucet demand. Automatic faucets that reduce water wastage and enhance hygiene align well with sustainability goals. Commercial spaces such as hotels, malls, and airports are adopting smart faucet systems, creating new revenue streams. Residential customers are also shifting toward digital and voice-activated faucets that integrate with smart home ecosystems. This trend not only enhances convenience but also strengthens manufacturers’ ability to differentiate in a competitive market.

- For instance, while some TOTO EcoPower faucets have a 0.5 GPM flow rate and use 0.09 gallons per 10-second cycle, other models also with a 0.5 GPM flow rate use 0.08 gallons per 10-second cycle.

Water Conservation Regulations and Sustainability Focus

Increasing regulatory pressures and sustainability initiatives strongly drive faucet innovation. Governments and organizations worldwide promote water-efficient fixtures to address water scarcity challenges. Faucets with flow restrictors, aerators, and eco-friendly designs gain traction among environmentally conscious consumers. Certifications such as WaterSense in the U.S. push manufacturers to comply with stricter efficiency standards. This driver accelerates adoption across both commercial and residential sectors, making water conservation a critical factor influencing product development and purchase decisions.

Key Trends & Opportunities

Premiumization and Aesthetic Demand

Rising consumer preference for premium home décor drives demand for stylish and customized faucets. Luxury finishes, designer collections, and multi-functional features are increasingly integrated into modern kitchens and bathrooms. Manufacturers are leveraging this trend by offering differentiated product lines that enhance both utility and aesthetics. This premiumization trend creates strong opportunities for global brands in urban and high-income markets.

- For instance, the Physical Vapour Deposition (PVD) process used for some GROHE StarLight finishes, such as gold or stainless-steel finishes, ensures that the surface composition is 3 times harder and 10 times more scratch-resistant compared to galvanized finishes. The classic chrome finish is produced using a traditional plating process.

Expansion in Emerging Economies

Emerging markets present strong growth opportunities as rising urban populations demand improved sanitation and modern living standards. Governments’ infrastructure investments, especially in Asia-Pacific, fuel faucet adoption in both residential and commercial sectors. Growing retail penetration and e-commerce platforms also increase accessibility for consumers. As disposable incomes rise, adoption of both affordable and advanced faucet systems accelerates in these regions.

- For instance, Roca is present in more than 170 markets, but the number of its factories varies depending on the reporting date. A June 2024 news report mentioned 79 manufacturing facilities, while Roca’s history page on their Indian website states 81 production plants as of a more recent date.

Key Challenges

High Competition and Price Pressure

The faucets market faces intense competition among global and regional manufacturers, leading to price pressure. Large-scale players continuously invest in R&D and branding, while regional suppliers offer cost-effective alternatives. This dynamic squeezes profit margins and creates challenges in product differentiation. To overcome this, companies must focus on innovation, smart technology integration, and effective after-sales services to maintain competitiveness.

Raw Material Price Volatility

Fluctuating costs of raw materials such as brass, stainless steel, and chrome significantly impact production expenses. Price instability affects manufacturers’ profitability, especially in regions with limited supply chain flexibility. Smaller players are particularly vulnerable, as they lack the scale to absorb cost fluctuations. Addressing this challenge requires strategic sourcing, recycling initiatives, and stronger supplier relationships to ensure stable production and cost management.

Regional Analysis

North America

North America accounted for nearly 32% of the faucets market share in 2024, driven by high adoption in residential remodeling and premium housing projects. Strong consumer inclination toward modern designs and smart faucets enhances market expansion in the United States and Canada. The region also benefits from strict water conservation regulations such as WaterSense, pushing demand for eco-efficient products. The commercial sector, including hospitality and retail, further contributes to steady growth. With advanced distribution channels and strong presence of global brands, North America continues to lead in revenue contribution and technological adoption.

Europe

Europe held around 27% of the faucets market share in 2024, supported by rising demand for energy-efficient and sustainable fixtures. Countries such as Germany, the United Kingdom, and France focus on green building standards and aesthetic bathroom upgrades, fueling growth. Renovation activities dominate the regional market, with premium product designs gaining traction among urban consumers. Automatic and touchless faucets are increasingly popular in commercial spaces due to heightened hygiene awareness. European consumers also show strong preference for customized designs and luxury finishes, reinforcing the region’s position as a key market for innovative faucet products.

Asia Pacific

Asia Pacific represented the largest share of the faucets market in 2024, accounting for nearly 34% of global demand. Rapid urbanization, infrastructure expansion, and rising disposable incomes across China, India, and Southeast Asia drive adoption. Large-scale residential construction projects and growing investments in commercial establishments such as hotels and malls enhance demand. The region also benefits from expanding e-commerce distribution channels, increasing accessibility for consumers. Affordable yet durable products dominate sales, while premium faucet demand rises with lifestyle upgrades. Asia Pacific is expected to remain the fastest-growing region, supported by population growth and government housing initiatives.

Latin America

Latin America accounted for close to 4% of the faucets market share in 2024, with Brazil and Mexico leading regional growth. Urbanization, rising middle-class income, and housing development programs support steady adoption of bathroom and kitchen faucets. The demand is primarily driven by affordable products, although premium faucets are gaining ground in high-income groups. Infrastructure development in commercial spaces, including hotels and restaurants, also contributes to growth. However, economic instability and price sensitivity remain limiting factors. Despite challenges, Latin America offers long-term opportunities for manufacturers focusing on cost-effective, stylish, and sustainable faucet solutions.

Middle East and Africa

The Middle East and Africa region held around 3% of the faucets market share in 2024, with growth supported by ongoing infrastructure development and luxury real estate projects in countries such as the United Arab Emirates and Saudi Arabia. High demand for premium and designer faucets stems from strong investments in hospitality and commercial spaces. Africa shows growing potential with increasing urbanization and gradual improvement in housing infrastructure. However, limited consumer awareness and fluctuating economic conditions constrain adoption. The region presents niche opportunities for global and regional players offering innovative, water-efficient, and cost-effective faucet solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product:

- Ball

- Disc

- Cartridge

- Compression

By Technology:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The faucets market is highly competitive, with major players including Grohe America Inc., Delta Faucet Company, Kohler Co., Danze Inc., American Standard Brands, Moen Incorporated, Aqua Source Faucet, Masko Corporation, Kraus, USA, and Pfister. These companies operate in a dynamic environment characterized by continuous innovation, product differentiation, and brand positioning. Competition is shaped by rising consumer demand for advanced designs, smart technologies, and sustainable solutions that meet evolving preferences in both residential and commercial segments. Manufacturers focus on integrating water-saving features, premium finishes, and touchless technologies to gain a competitive edge. Strong distribution networks, global retail partnerships, and expanding e-commerce platforms further intensify competition, ensuring greater product accessibility across regions. Additionally, investment in research and development, sustainability initiatives, and after-sales services play a crucial role in retaining market share. The landscape is expected to remain highly dynamic, with companies increasingly adopting strategies that balance affordability, performance, and design innovation.

Key Player Analysis

Recent Developments

- In 2025, Kohler unveiled the Anthem Digital Valve system as part of its smart home ecosystem, showcased at the Kitchen and Bath Industry Show (KBIS) earlier in the year. This system, available as part of the new Anthem+ smart showering system, allows for digital controls over aspects like water flow, temperature, lighting, and sound through a single interface and the KOHLER Konnect® app.

- In 2025, Moen Incorporated Launched its Instant Hot SIP™ faucets and Instant Hot tank, providing near-boiling water directly from the sink for convenience.

- In 2024, Delta Faucet Company (a Masco Corporation company) Introduced Touch2O with Touchless Technology, a versatile kitchen faucet showcased at the KBIS.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The faucets market will expand steadily, driven by rising urbanization and housing demand.

- Smart faucets with touchless and sensor technologies will gain wider household adoption.

- Bathroom applications will continue to dominate, supported by remodeling and aesthetic upgrades.

- Kitchen faucet demand will rise due to multifunctional designs and advanced pull-down models.

- Water-saving regulations will push manufacturers to design eco-efficient faucet systems.

- Asia Pacific will remain the fastest-growing region, led by infrastructure development and urban growth.

- Premium and luxury faucet designs will attract high-income consumers in developed regions.

- E-commerce platforms will boost market reach and enhance accessibility in emerging economies.

- Competition will intensify, encouraging players to focus on innovation and brand differentiation.

- Rising raw material costs will challenge profitability, pushing manufacturers toward sustainable sourcing.