Market Overview:

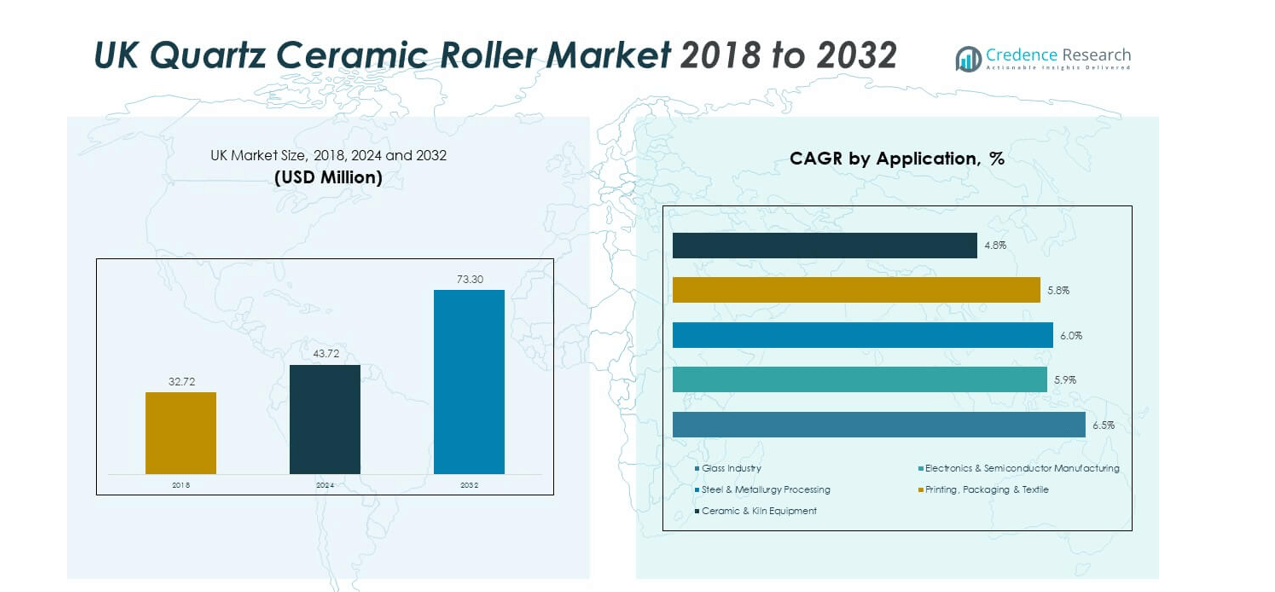

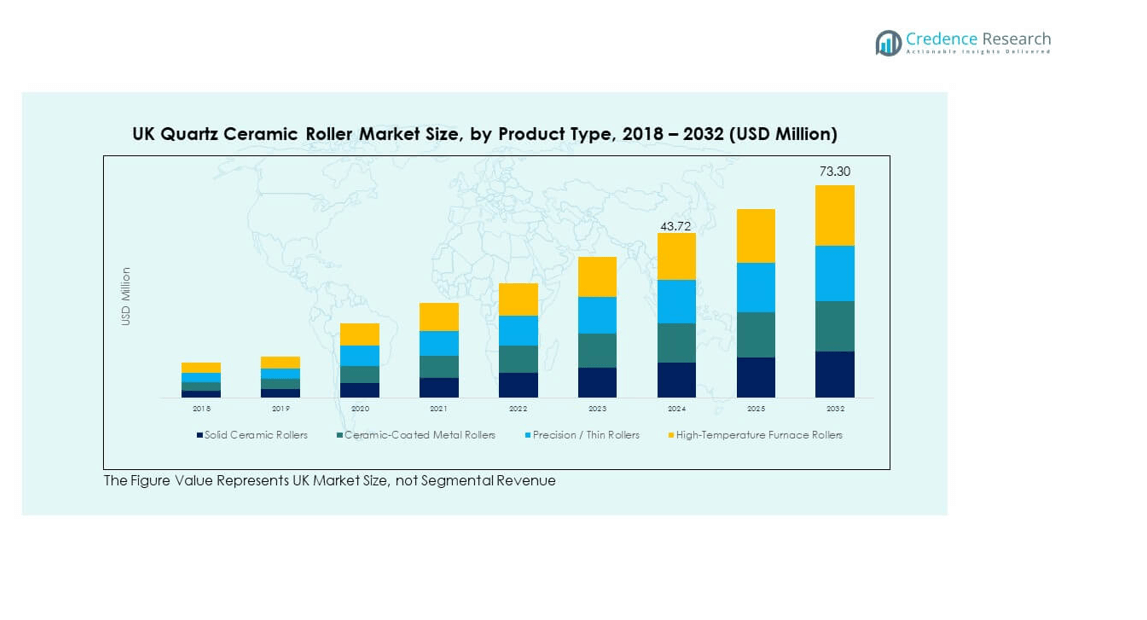

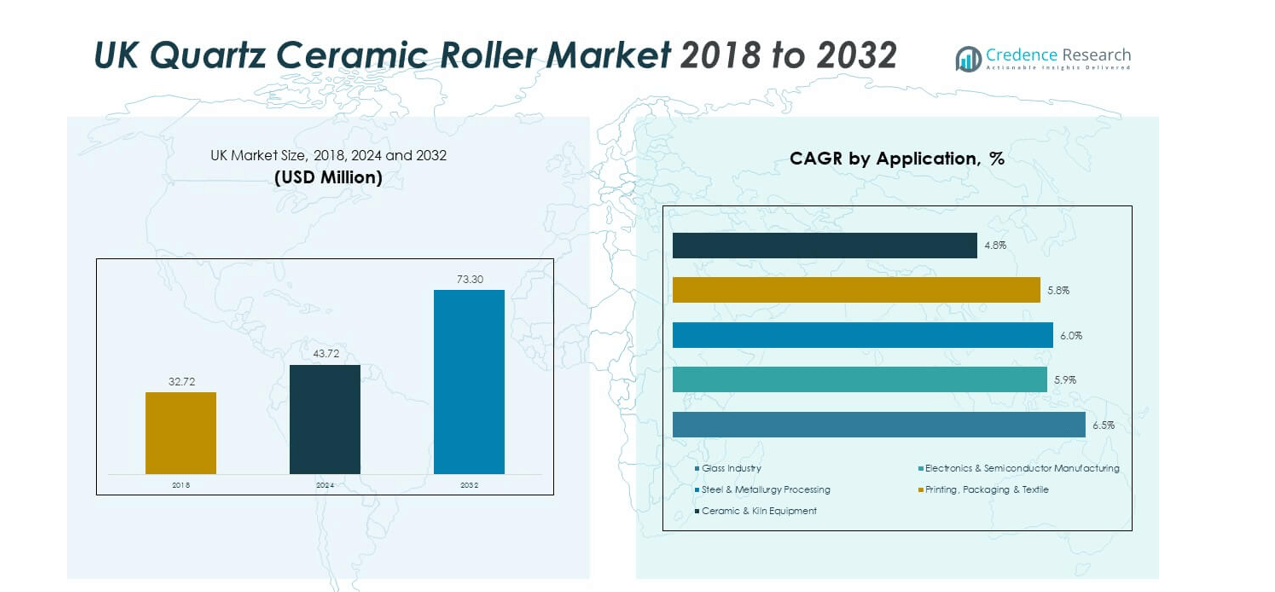

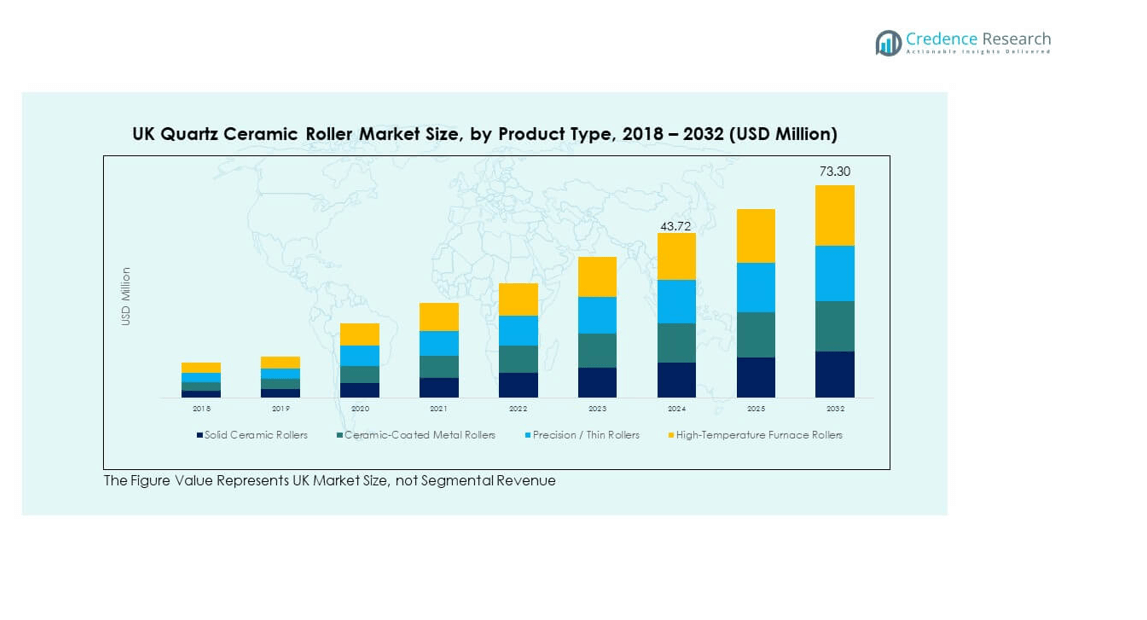

The UK Quartz Ceramic Roller Market size was valued at USD 32.72 million in 2018, increased to USD 43.72 million in 2024, and is anticipated to reach USD 73.30 million by 2032, at a CAGR of 6.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Quartz Ceramic Roller Market Size 2024 |

USD 43.72 million |

| UK Quartz Ceramic Roller Market, CAGR |

6.67% |

| UK Quartz Ceramic Roller Market Size 2032 |

USD 73.30 million |

The market expansion is fueled by increasing glass production and technological advancements in precision ceramics. Manufacturers are focusing on improving product durability and thermal resistance to meet evolving industrial needs. The adoption of energy-efficient processes and automation across the UK’s manufacturing sector also supports demand growth. Moreover, sustainability goals and strict environmental regulations are pushing industries to prefer quartz-based rollers that offer longer life cycles and lower maintenance costs.

Regionally, England holds the largest share due to its advanced industrial base and strong presence of glass and electronics manufacturing hubs. Scotland and Wales are emerging markets, benefiting from rising investments in energy and materials innovation. The UK’s focus on reshoring manufacturing and strengthening supply chains continues to create new opportunities for domestic quartz ceramic roller producers.

Market Insights:

- The UK Quartz Ceramic Roller Market was valued at USD 32.72 million in 2018, increased to USD 43.72 million in 2024, and is projected to reach USD 73.30 million by 2032, expanding at a CAGR of 6.67%.

- England dominated with 58% share in 2024 due to its strong industrial base and technological leadership. Scotland followed with 23%, supported by industrial modernization, while Wales and Northern Ireland together accounted for 19%, driven by niche manufacturing clusters.

- Scotland emerged as the fastest-growing region, driven by investments in renewable energy, metallurgical innovation, and adoption of advanced ceramic technologies.

- By product type, Solid Ceramic Rollers held the largest segment share at 34% in 2024, driven by widespread use in glass and metallurgical applications.

- High-Temperature Furnace Rollers captured 27% share, reflecting increasing demand from continuous furnace and high-heat processing industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand from Glass Manufacturing and Metallurgical Industries

The UK Quartz Ceramic Roller Market experiences steady growth due to strong demand from glass and metallurgical industries. These industries prefer quartz rollers for their ability to handle extreme heat without deformation. The rollers ensure high precision during continuous production lines, improving output quality and consistency. Growth in architectural glass and automotive glass manufacturing drives wider adoption. Producers invest in high-purity materials to improve product lifespan. It also supports cost savings through lower maintenance and energy efficiency. The rising need for defect-free surfaces in glass production further reinforces the demand.

- For instance, Morgan Advanced Materials supplies fused silica rollers specifically engineered for the glass industry, offering patented mechanical end cap systems that enable operation at temperatures up to 700°C and support roller lengths greater than 4 meters, which helps improve high-precision production output in architectural glass manufacturing lines.

Rising Focus on Energy Efficiency and Process Optimization

Industrial manufacturers are shifting toward energy-efficient systems that reduce heat loss and operational downtime. Quartz ceramic rollers enable smoother heat transfer, leading to higher process control and lower emissions. The UK Quartz Ceramic Roller Market benefits from the integration of automation and digital monitoring systems. These upgrades allow better temperature management in kilns and furnaces. Industries adopt such rollers to meet carbon emission targets and improve sustainability compliance. The focus on optimizing industrial processes has accelerated equipment modernization. Demand for durable, efficient rollers continues to expand across production units.

- For instance, Morgan Advanced Materials has deployed advanced energy management systems in its ceramics plants and reports measurable reductions in energy consumption and CO2 emissions through upgraded production lines, directly impacting the energy efficiency of quartz ceramic rollers supplied to UK industrial clients.

Advancements in Ceramic Material Science and Manufacturing Technology

Continuous R&D in ceramic composites enhances roller durability and heat stability. Manufacturers in the UK Quartz Ceramic Roller Market develop advanced sintering methods for greater purity and dimensional accuracy. Modern production technologies help achieve consistent surface finishes and resistance to mechanical stress. Such advancements make quartz rollers suitable for diverse industrial applications, including semiconductor and specialty glass manufacturing. The growing use of computer-aided manufacturing also improves production precision. Companies invest in custom engineering solutions to meet specialized performance needs. The improved reliability of advanced ceramics strengthens long-term market confidence.

Increasing Industrial Automation and Demand for High-Performance Components

Automation across industrial sectors fuels the need for consistent, high-performing materials. Quartz ceramic rollers play a vital role in automated glass and metal processing lines. The UK Quartz Ceramic Roller Market benefits from expanding use in robotics and precision-driven manufacturing systems. It offers minimal thermal distortion and mechanical wear, ideal for continuous operation. The rising use of smart sensors integrated into rollers enhances performance monitoring. Industrial growth in electronics and renewable energy sectors further increases consumption. The focus on minimizing downtime and improving production efficiency keeps demand strong across factories.

Market Trends:

Integration of Smart Monitoring and IoT in Ceramic Roller Systems

Manufacturers are integrating digital monitoring systems and IoT technology to improve roller performance tracking. The UK Quartz Ceramic Roller Market witnesses adoption of smart temperature sensors and predictive maintenance systems. These innovations reduce unplanned maintenance and enhance operational efficiency. Real-time analytics help maintain uniform heating in production lines. The shift toward Industry 4.0 drives interest in connected ceramic components. Smart rollers also support energy optimization and process transparency. Adoption of such technologies strengthens reliability and cost control in industrial operations.

- For instance, leading technical ceramics suppliers are equipping rollers with embedded IoT sensors for real-time temperature tracking, allowing users to achieve up to 30% fewer unplanned maintenance events per year while supporting continuous, uniform heating and increased roller lifespan in automated production environments.

Shift Toward Eco-Friendly Manufacturing and Sustainable Material Use

Growing environmental awareness encourages industries to invest in recyclable and sustainable materials. The UK Quartz Ceramic Roller Market aligns with this trend through eco-friendly production practices. Manufacturers are reducing waste by optimizing raw material usage and recycling defective rollers. Energy-efficient furnaces are used to lower carbon emissions during roller fabrication. Consumers prefer suppliers adhering to green certification standards. Sustainable manufacturing attracts regulatory and financial benefits for producers. The industry’s environmental commitment strengthens brand reputation and long-term competitiveness.

- For instance, Morgan Advanced Materials operates under ISO9000-based continuous improvement programs focused on green manufacturing, leading to a substantive increase in recycled raw material usage and significant reductions in landfill waste from defective roller products over recent reporting periods.

Expansion in Semiconductor and Electronics Manufacturing Applications

The rapid growth of semiconductor production across Europe creates new opportunities for quartz ceramics. The UK Quartz Ceramic Roller Market expands into wafer handling, substrate processing, and high-purity environments. Quartz rollers provide contamination-free operation essential for microelectronics production. Manufacturers upgrade facilities to meet the precision and cleanliness required for these industries. The trend highlights diversification beyond traditional glass or metallurgy sectors. Partnerships between material producers and electronic component firms are increasing. The rising demand from advanced electronics manufacturing boosts long-term growth potential.

Customization and Product Innovation in Roller Design and Application

End-users demand custom-engineered rollers tailored to specific temperature and load conditions. The UK Quartz Ceramic Roller Market responds with innovations in roller dimensions, surface coatings, and structural designs. Manufacturers focus on improving impact resistance and load-bearing capacity. New roller variants offer better adaptability across continuous processing lines. Innovations in composite ceramics allow hybrid roller designs for niche industries. Companies differentiate by providing faster design turnaround and technical support. The growing emphasis on tailored solutions improves customer satisfaction and operational performance.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Requirements

Manufacturing high-quality quartz ceramic rollers involves costly raw materials and advanced fabrication techniques. The UK Quartz Ceramic Roller Market faces pricing pressure due to the energy-intensive production process. Companies must invest heavily in precision equipment and skilled labor. Maintaining consistency across batches remains challenging because of stringent quality standards. Supply chain disruptions affect availability of high-purity quartz materials. Smaller manufacturers struggle to compete with large-scale producers on cost efficiency. The high initial investment requirement limits new entrants and restricts expansion among existing players.

Volatility in Industrial Demand and Limited Domestic Manufacturing Base

Demand fluctuations across glass and metal industries directly affect production cycles. The UK Quartz Ceramic Roller Market encounters slowdowns during periods of reduced industrial activity or energy cost hikes. The market relies on imports for certain raw materials, exposing it to logistical and geopolitical risks. Domestic production capacity remains limited compared to global competitors. Businesses face long lead times for replacement parts and specialized designs. Rising freight costs and regulatory barriers also impact profitability. These factors c hallenge steady supply and increase dependency on foreign manufacturing hubs

Market Opportunities:

Rising Adoption of Advanced Materials in Emerging Manufacturing Sectors

Emerging industries, including renewable energy, aerospace, and semiconductors, are creating new use cases. The UK Quartz Ceramic Roller Market can expand by catering to specialized needs such as high-precision thermal processing. Growth in hydrogen energy and solar panel production encourages adoption of heat-resistant components. Collaboration between research institutions and manufacturers enhances innovation. Firms that invest in advanced materials can strengthen export opportunities. Increasing government support for advanced manufacturing offers funding for R&D expansion. The growing preference for high-performance ceramics opens diverse market pathways.

Growing Demand for Localized Production and Supply Chain Resilience

Companies are focusing on regional production to reduce dependency on foreign suppliers. The UK Quartz Ceramic Roller Market benefits from investment in domestic ceramic processing facilities. Establishing local manufacturing improves delivery timelines and reduces transportation costs. Firms adopting local sourcing models can better manage demand fluctuations. Government incentives for industrial modernization support expansion in this sector. Building resilient supply chains improves national competitiveness in precision materials. This localization trend provides strong long-term opportunities for UK-based producers.

Market Segmentation Analysis:

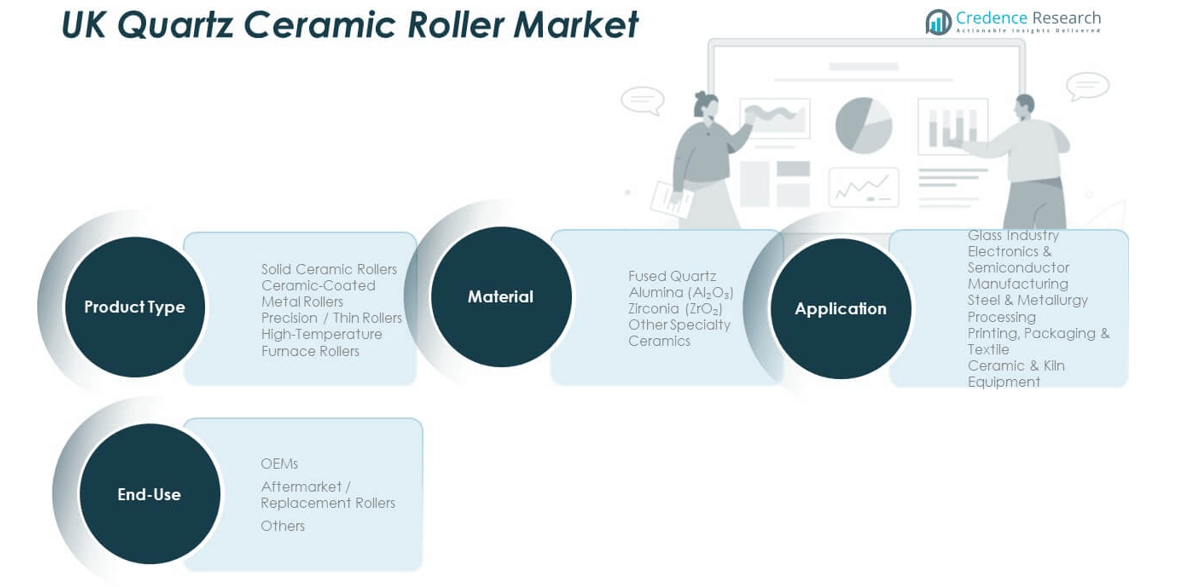

By Product Type

The UK Quartz Ceramic Roller Market is segmented into solid ceramic rollers, ceramic-coated metal rollers, precision/thin rollers, and high-temperature furnace rollers. Solid ceramic rollers lead due to their excellent thermal resistance and dimensional stability in high-temperature glass and metal processing lines. Ceramic-coated metal rollers gain traction for their durability and lower production costs. Precision or thin rollers serve niche applications requiring high accuracy and surface quality. High-temperature furnace rollers witness rising adoption in continuous heat treatment and advanced industrial furnaces.

- For instance, Morgan Advanced Materials’ solid fused silica rollers exhibit nearly zero thermal expansion and lengths over 4 meters, delivering stable operation in continuous high-temperature glass and metallurgy processes for customers in the UK.

By Application

Glass manufacturing remains the dominant application, driven by demand for architectural and automotive glass. Electronics and semiconductor manufacturing segments expand rapidly due to increasing production of microchips and display components. Steel and metallurgy processing utilize rollers for heat-resistant conveyance systems. Printing, packaging, and textile industries adopt them for uniform pressure and temperature control. Ceramic and kiln equipment manufacturers prefer quartz rollers for their long operational life and low contamination risk.

- For instance, Morgan Advanced Materials supplies quartz rollers for architectural glass lines that process over 1,000,000 square meters of glass per year, ensuring 24/7 continuous operation and supporting extremely low rates of thermal deformation during production.

By End-Use

OEMs represent the leading end-use segment, supported by integration into new production systems and equipment lines. The aftermarket or replacement roller segment grows steadily as industries prioritize maintenance efficiency and cost savings. Other end users include research labs and custom material processing units seeking high-precision components.

By Material

Fused quartz dominates the material segment due to superior thermal shock resistance and purity. Alumina and zirconia-based rollers gain use in high-load and corrosive environments. Other specialty ceramics offer tailored performance for advanced or customized industrial processes.

Segmentation:

By Product Type

- Solid Ceramic Rollers

- Ceramic-Coated Metal Rollers

- Precision / Thin Rollers

- High-Temperature Furnace Rollers

By Application

- Glass Industry

- Electronics & Semiconductor Manufacturing

- Steel & Metallurgy Processing

- Printing, Packaging & Textile

- Ceramic & Kiln Equipment

By End-Use

- OEMs

- Aftermarket / Replacement Rollers

- Others

By Material

- Fused Quartz

- Alumina (Al₂O₃)

- Zirconia (ZrO₂)

- Other Specialty Ceramics

Regional Analysis:

England – Dominant Industrial Base and Technological Leadership

England holds the largest share of the UK Quartz Ceramic Roller Market, accounting for 58% of total revenue in 2024. The dominance stems from its advanced industrial infrastructure, strong presence of glass manufacturing plants, and established semiconductor production facilities. The region benefits from ongoing investments in automation, high-temperature processing technologies, and energy-efficient equipment. Major manufacturers and research institutes in the Midlands and South East strengthen product innovation and material engineering capabilities. Demand from the automotive glass, electronics, and metallurgical sectors remains steady, supported by robust export activities. Continuous adoption of Industry 4.0 and sustainability initiatives ensures consistent growth across end-use industries.

Scotland – Emerging Growth Hub with Industrial Modernization

Scotland represents a growing share of around 23% of the UK Quartz Ceramic Roller Market in 2024. The region witnesses steady industrial expansion led by renewable energy, steel, and precision manufacturing sectors. Its growing investment in sustainable materials and clean energy technologies fuels the need for high-performance ceramics. Manufacturers in Scotland focus on modernizing furnace and heat-treatment systems to improve efficiency. The development of industrial clusters around Glasgow and Aberdeen enhances production capacity and supply chain resilience. It also benefits from government incentives supporting local innovation and energy transition. Rising demand for thermally stable components in advanced industries positions Scotland as a strong secondary hub.

Wales and Northern Ireland – Niche Applications and Regional Integration

Wales and Northern Ireland collectively account for 19% of the UK Quartz Ceramic Roller Market in 2024. These regions contribute through niche applications in glass processing, ceramics, and specialty component production. Small and medium enterprises focus on customized roller solutions catering to specific industrial processes. The increasing presence of precision engineering firms supports adoption of quartz-based components. Investments in infrastructure and regional connectivity enable better access to domestic and export markets. Government-backed programs promoting high-value manufacturing are improving competitiveness. The steady growth in demand for advanced ceramics across these regions supports long-term expansion potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The competitive landscape in the UK Quartz Ceramic Roller Market shows a moderate concentration among global and regional players. Leading firms differentiate by investing heavily in R&D, quality control, and custom-engineered solutions. They maintain technical partnerships with glass, semiconductor, and metallurgy customers to tailor products. It competes on delivery time, material purity, and aftersales support. Smaller firms often focus on niche, regional clients or specialty roller designs. Intense pricing pressure arises from imports and scale advantages of established players. The presence of global ceramic material firms raises barriers for new entrants.

Recent Developments:

- In August 2025, Morgan Advanced Materials plc entered into an agreement to sell its global Molten Metals Systems business, which is involved in advanced ceramic and carbon material solutions, to Vesuvius plc. The transaction, which includes key operations in India, China, and Germany, is expected to be completed by early October 2025 and supports Morgan’s strategy to simplify its business structure and focus on growth markets.

- In July 2025, Saint-Gobain S.A. acquired the business assets of Interstar Materials Inc., strengthening its construction chemicals segment in North America, especially in granular pigment manufacturing for concrete applications. Though the acquisition primarily advances Saint-Gobain’s portfolio in Canada and the United States, it signals the group’s ongoing expansion and value creation initiatives, which are relevant to its UK business activities.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, end-use, and material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-purity quartz rollers will rise in advanced manufacturing sectors.

- Manufacturers will increase investments in automation and digital monitoring.

- Tailored roller designs will grow to meet specialized process requirements.

- Material innovations will push performance boundaries further.

- Localized production will expand to reduce reliance on imports.

- Strategic alliances with end-users will become more common.

- Aftermarket replacement demand will rise with aging industrial systems.

- Environmental regulations will favor sustainable roller solutions.

- Export opportunities will grow beyond the UK market.

- New entrants will need strong R&D and niche focus to succeed.