Market Overview

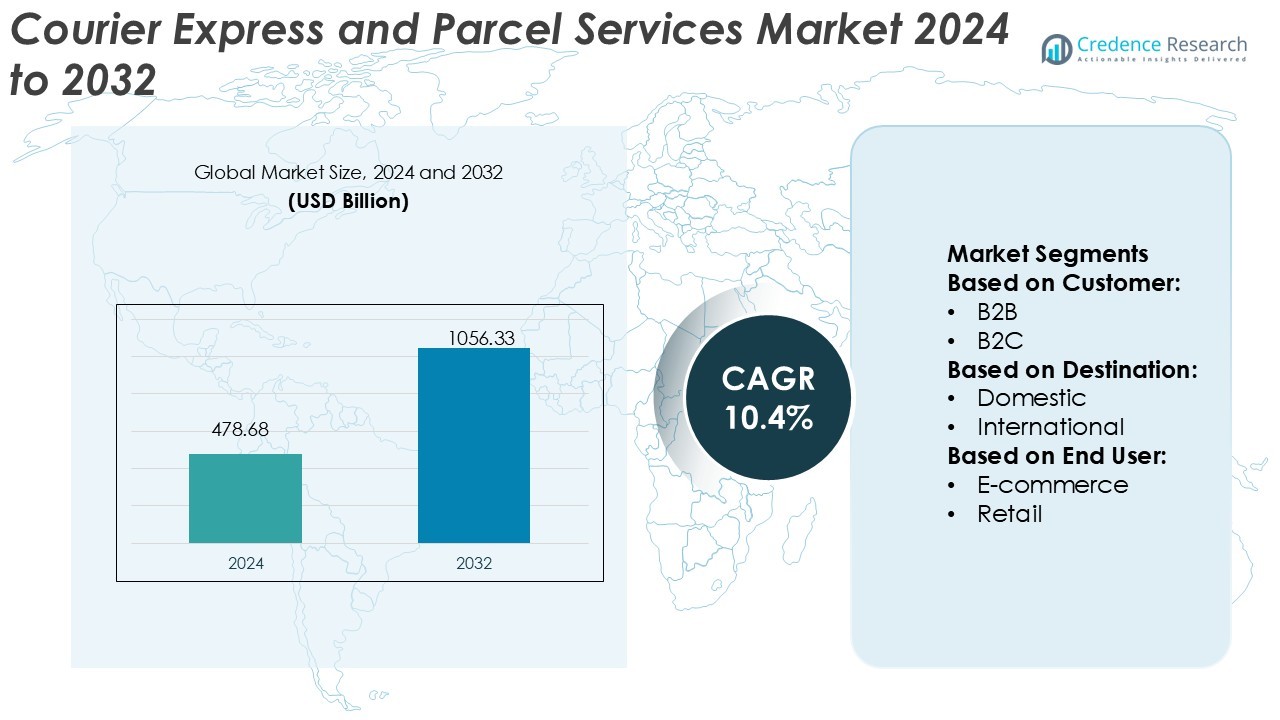

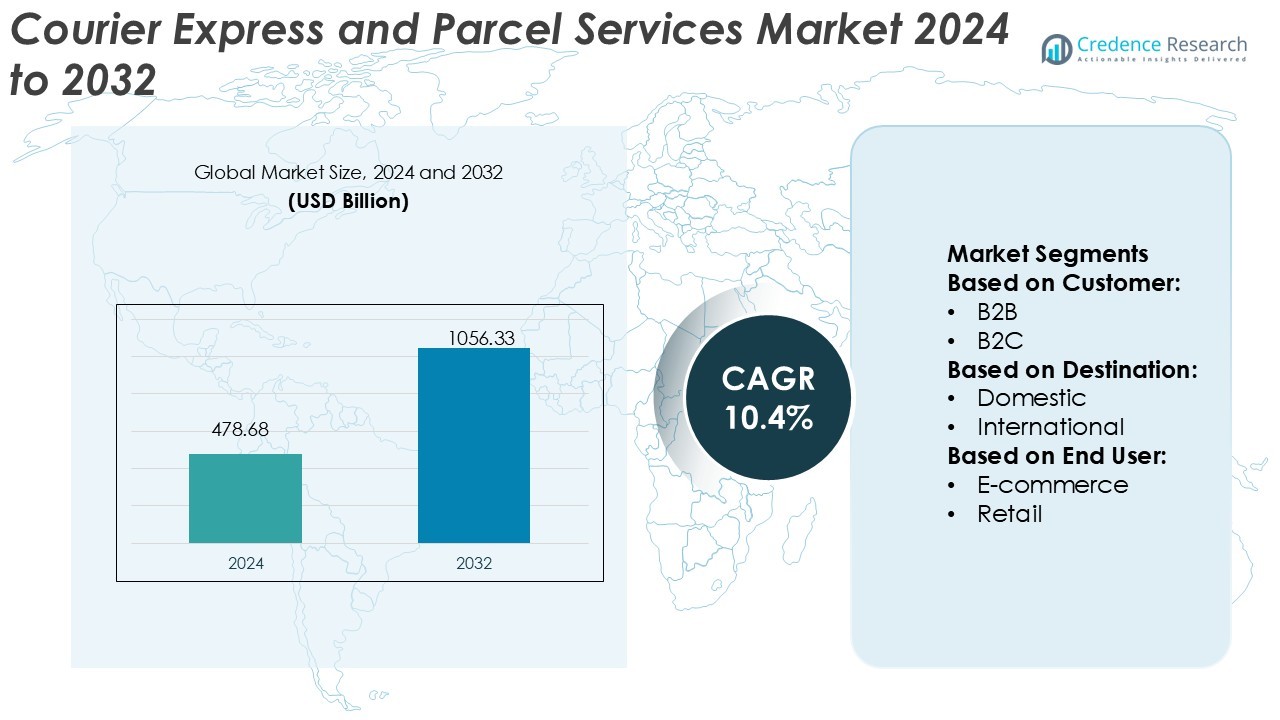

Courier Express and Parcel Services Market size was valued USD 478.68 billion in 2024 and is anticipated to reach USD 1056.33 billion by 2032, at a CAGR of 10.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Courier Express and Parcel Services Market Size 2024 |

USD 478.68 Billion |

| Courier Express and Parcel Services Market, CAGR |

10.4% |

| Courier Express and Parcel Services Market Size 2032 |

USD 1056.33 Billion |

The Courier, Express, and Parcel (CEP) Services Market is led by major players such as Blue Dart Express, DB Schenker, Royal Mail Group, FedEx Corporation, Aramex, Japan Post Group, GLS Group, DHL Express, La Poste Group, and United Parcel Service (UPS). These companies dominate through extensive logistics networks, digital transformation initiatives, and sustainable delivery solutions. They focus on automation, predictive analytics, and last-mile innovation to enhance operational efficiency and service quality. Asia-Pacific leads the global market with a 35% share, driven by booming e-commerce, rapid urbanization, and strong investments in logistics infrastructure. The region’s dominance is reinforced by large-scale parcel volumes, government-backed digital logistics programs, and expanding cross-border trade activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Courier, Express, and Parcel Services Market was valued at USD 478.68 billion in 2024 and is projected to reach USD 1056.33 billion by 2032, growing at a CAGR of 10.4% during the forecast period.

- The market is driven by strong e-commerce growth, rising demand for same-day delivery, and technological advancements in route optimization and warehouse automation.

- Key trends include increased adoption of green logistics, AI-based tracking systems, and digital freight management to improve delivery efficiency and sustainability.

- Competitive dynamics are shaped by major players focusing on automation, predictive analytics, and global network expansion to strengthen market presence.

- Asia-Pacific leads the market with a 35% share, driven by rapid urbanization and logistics investment, while the B2C segment dominates globally, supported by expanding online retail activity and growing consumer preference for fast and flexible parcel delivery solutions.

Market Segmentation Analysis:

By Customer

The B2C segment dominated the Courier, Express, and Parcel (CEP) Services Market in 2024 with a significant market share. The growth stems from the surge in e-commerce platforms and online retail transactions. Companies increasingly rely on last-mile delivery optimization, real-time tracking, and flexible delivery options to meet consumer demand. Expanding online shopping behavior, supported by digital payment solutions and same-day delivery expectations, continues to drive strong adoption. Major logistics providers invest in automation and warehouse robotics to ensure faster and more efficient order fulfillment for end consumers.

- For instance, DB Schenker deployed over 100 autonomous mobile robots (AMRs) in its Rudna, Czech Republic warehouse, with each robot carrying up to 500 kg and recharging within ten minutes, supporting 162 packing stations and a 3,000 m conveyor line.

By Destination

The Domestic segment held the leading market share in 2024 due to strong intra-country trade and retail delivery growth. Rising e-commerce penetration and same-day delivery preferences have boosted local parcel volumes. Regional logistics networks are expanding with AI-driven route optimization and smart dispatching systems that reduce transit times and operational costs. Enhanced national infrastructure and increased collaborations between retailers and courier providers are strengthening service coverage, ensuring reliability and faster turnaround times across urban and rural markets.

- For instance, Royal Mail deployed the technology across its assets. It tagged its fleet of 850,000 wheeled containers, known as “Yorks,” with Wiliot ambient tags.

By End-User

The E-commerce sector dominated the CEP market in 2024, driven by rapid digital retail transformation and high order frequency. Online retailers demand efficient, scalable logistics solutions for large parcel volumes. Advanced technologies like warehouse automation, predictive analytics, and API-based delivery integration support smooth operations. Additionally, the rise of omnichannel retail strategies and cross-border trade reinforces demand for flexible courier networks. Major logistics players are partnering with e-commerce giants to enhance delivery efficiency and customer satisfaction through real-time updates and reliable return management.

Key Growth Drivers

E-commerce Expansion and Digital Retail Growth

The rapid rise of e-commerce platforms continues to fuel demand for courier, express, and parcel services. Consumers increasingly expect fast, reliable, and cost-effective delivery options. Logistics companies are investing in last-mile solutions and automated sorting centers to handle high parcel volumes efficiently. The surge in online retail sales, coupled with improved mobile payment systems, strengthens market growth. Additionally, SMEs entering online retail contribute to consistent parcel movement across domestic and cross-border channels, ensuring steady growth momentum in the sector.

- For instance, FedEx Cologne (Germany) air network location.The robotic arm processes documents and small parcels (up to 4 kg) at a rate of up to 1,000 pieces per hour. The system manages shipments to around 90 destinations simultaneously.

Advancements in Logistics Automation and Technology Integration

Automation, artificial intelligence, and IoT-enabled systems are revolutionizing parcel handling and delivery efficiency. Automated warehousing, real-time shipment tracking, and predictive route planning improve operational accuracy and reduce costs. Companies are adopting robotics and digital twins to streamline operations and forecast demand fluctuations. Integration of cloud-based logistics platforms also enhances transparency and customer experience. These advancements enable faster order processing, minimize human error, and improve asset utilization, positioning technology adoption as a core driver of competitive advantage in the CEP industry.

- For instance, Aramex launched an automated sorting hub at Jeddah Islamic Port with 120 robotic guided vehicles across three feeding lines, enabling throughput of 4,000 shipments per hour and 96,000 shipments daily.

Rising Cross-Border Trade and Global Supply Chain Networks

Expanding global trade activities are driving the need for efficient international parcel delivery systems. Businesses are increasingly relying on express delivery networks to meet tight schedules and global customer expectations. The growth of SMEs in export markets and cross-border e-commerce has boosted parcel traffic across major trade corridors. Governments supporting customs digitization and simplified trade agreements further enhance international logistics efficiency. Global CEP providers are expanding air freight capacity and integrating data analytics for smoother cross-border operations, ensuring consistent growth in international parcel flows.

Key Trends & Opportunities

Sustainability and Green Logistics Adoption

Sustainability is emerging as a central trend in the CEP industry. Companies are shifting toward electric delivery vehicles, biodegradable packaging, and carbon-neutral operations. Consumers and regulators demand eco-friendly logistics practices, pushing service providers to innovate in route optimization and renewable energy integration. Firms adopting green supply chain models gain brand loyalty and regulatory advantages. This transition creates opportunities for logistics providers to differentiate their services and attract sustainability-conscious clients while contributing to broader climate goals and operational efficiency.

- For instance, in Las Vegas and Ontario, California, GLS installed automated sortation systems that process over 5,000 parcels per hour, combining weighing, measuring, scanning and routing logic, and halved manual sorting time.

Omnichannel Fulfillment and Last-Mile Innovation

The expansion of omnichannel retailing has led to new opportunities in flexible delivery and return management. Retailers are integrating online and offline sales channels, requiring seamless logistics support. Courier firms are leveraging micro-fulfillment centers, crowdsourced delivery, and AI-based routing to optimize last-mile efficiency. Innovations like parcel lockers and drone deliveries improve customer convenience and reduce delivery costs. This shift toward technology-driven, customer-centric delivery models opens new growth opportunities for companies enhancing responsiveness and reliability in dynamic market conditions.

- For instance, DHLBot robotic arm automates parcel sorting at up to 1,000 small parcels per hour with 99 % accuracy, raising throughput in busy last-mile hubs.

Emerging Market Expansion and SME Logistics Demand

Rapid urbanization and economic development in emerging regions are expanding the addressable market for courier and parcel services. Growing SME participation in e-commerce platforms fuels parcel traffic from tier-two and tier-three cities. Logistics providers are establishing regional hubs and partnerships to enhance network accessibility. Affordable delivery solutions and digital payment integration further support inclusivity in the supply chain. This growing participation from developing economies presents significant opportunities for CEP firms to diversify revenue streams and build long-term market presence.

Key Challenges

Rising Operational Costs and Infrastructure Constraints

High transportation costs, fuel price volatility, and limited infrastructure pose major challenges for market players. Urban congestion and last-mile inefficiencies increase delivery time and expenses. Maintaining fast delivery expectations with shrinking margins pressures profitability. Companies must invest in automation, electric fleets, and smart logistics systems to offset these costs. However, capital-intensive upgrades can strain smaller operators. Overcoming infrastructure and cost hurdles remains crucial for sustaining competitiveness and scalability in both developed and emerging markets.

Complex Regulatory Compliance and Customs Procedures

Strict international trade regulations and varying customs policies complicate cross-border delivery processes. Delays in clearance and inconsistent documentation requirements increase lead times and operational risks. Compliance with data privacy, labor, and environmental laws further burdens service providers. The complexity of adhering to multiple regulatory frameworks can limit expansion and profitability. Companies are adopting digital customs solutions and AI-based compliance tools to minimize risks, but achieving uniform regulatory alignment across markets remains a persistent challenge for global CEP operators.

Regional Analysis

North America

North America held a 32% market share in the Courier, Express, and Parcel (CEP) Services Market in 2024, driven by strong e-commerce growth and advanced logistics infrastructure. The United States leads with widespread adoption of automation, AI-driven route optimization, and robust last-mile delivery networks. Canada’s expanding cross-border trade and online retail penetration further support regional growth. Major CEP providers such as FedEx, UPS, and Amazon Logistics dominate through advanced fleet management and same-day delivery solutions. Continuous investment in green logistics and warehouse robotics enhances operational efficiency and customer satisfaction across urban and suburban delivery networks.

Europe

Europe accounted for 27% of the global market share in 2024, supported by the region’s strong regulatory framework and growing emphasis on sustainable logistics. The United Kingdom, Germany, and France lead the regional market, driven by high e-commerce penetration and efficient parcel infrastructure. The European Union’s focus on carbon neutrality encourages adoption of electric delivery vehicles and smart warehouses. Investments in cross-border delivery optimization, digital tracking systems, and automated sorting facilities strengthen operational reliability. Demand for B2C parcel services remains high, supported by omni-channel retail growth and well-established transportation networks across key European economies.

Asia-Pacific

Asia-Pacific dominated the global market with a 35% share in 2024, led by China, India, and Japan. Rapid urbanization, booming e-commerce, and a large consumer base are key growth factors. China’s logistics sector benefits from advanced digital platforms and government-backed smart logistics initiatives. India’s expanding retail ecosystem and growing demand for hyperlocal delivery strengthen regional parcel movement. Japan and South Korea emphasize technological integration and service precision. Major players like SF Express, Japan Post, and Blue Dart are enhancing same-day delivery capabilities. The region’s strong manufacturing output and rising cross-border trade continue to accelerate market growth.

Latin America

Latin America captured a 4% market share in 2024, with Brazil and Mexico leading due to rising e-commerce and digital payments. The region’s CEP market is evolving as logistics companies modernize infrastructure to address delivery inefficiencies and expand rural coverage. Investments in warehouse automation and data-driven route planning improve service reliability. Economic reforms and trade liberalization foster cross-border parcel movement. Local startups and global players are collaborating to enhance express delivery networks. Despite infrastructural challenges, the region shows strong growth potential driven by increasing online retail adoption and improving last-mile logistics capabilities.

Middle East and Africa

The Middle East and Africa accounted for a 2% market share in 2024, supported by emerging logistics hubs and e-commerce expansion. The United Arab Emirates and Saudi Arabia dominate regional growth due to advanced transport infrastructure and government-backed digital transformation programs. Africa’s market, led by South Africa and Nigeria, benefits from rising smartphone penetration and growing online retail activity. CEP companies are investing in automation, warehousing, and cross-border connectivity to enhance delivery efficiency. Strategic partnerships between global and local logistics firms are improving reliability and scalability across developing economies, driving steady regional market expansion.

Market Segmentations:

By Customer:

By Destination:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Courier, Express, and Parcel (CEP) Services Market is characterized by intense competition among leading players, including Blue Dart Express, DB Schenker, Royal Mail Group, FedEx Corporation, Aramex, Japan Post Group, GLS Group, DHL Express, La Poste Group, and United Parcel Service (UPS). The Courier, Express, and Parcel (CEP) Services Market is highly competitive, driven by rapid technological advancement and expanding global logistics networks. Companies are investing heavily in automation, real-time tracking, and AI-powered route optimization to enhance delivery speed and accuracy. The growing influence of e-commerce and cross-border trade continues to fuel competition among service providers. Strategic initiatives such as fleet electrification, warehouse automation, and digital logistics platforms are transforming operational efficiency. Firms are also prioritizing sustainability, adopting green transport solutions, and optimizing last-mile delivery systems to reduce carbon emissions while maintaining profitability and customer satisfaction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, FedEx partnered with and invested in Nimble, an AI robotics and autonomous e-commerce fulfillment technology company, to scale FedEx Fulfillment with their fully autonomous 3PL model. FedEx offered a comprehensive approach to help e-commerce and omnichannel brands make faster, smarter supply chain decisions.

- In August 2024, Indonesia’s J&T Express officially launched its parcel delivery service in Saudi Arabia, marking a significant expansion into the Middle Eastern logistics market. The new service, named J&T SPEED, aims to provide efficient and reliable delivery solutions for both businesses and individual customers across the Kingdom.

- In August 2024, The Uttar Pradesh State Transport Corporation (UPSRTC) announced plans to launch courier and parcel delivery services starting in September 2024. This initiative aims to utilize approximately 11,000 buses, which include both air-conditioned and ordinary vehicles.

- In February 2024, Emirates Post Group, rebranded as 7X, unveiled EMX, a new subsidiary dedicated to reshaping the courier, express, and parcel (CEP) industry in the UAE. Leveraging cutting-edge technologies, EMX aims to deliver unparalleled logistics solutions, prioritizing speed, reliability, and customer-centric services.

Report Coverage

The research report offers an in-depth analysis based on Customer, Destination, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness continued growth driven by expanding e-commerce and online retail demand.

- Automation and AI adoption will enhance delivery efficiency and route optimization.

- Cross-border parcel volumes will rise due to increasing global trade and digital platforms.

- Sustainable logistics practices will gain traction with electric vehicles and green packaging.

- Last-mile delivery innovation will focus on drones, lockers, and micro-fulfillment centers.

- Cloud-based logistics management systems will improve transparency and real-time tracking.

- Strategic collaborations will strengthen global supply chain integration and service reach.

- Customer expectations for same-day and next-day delivery will drive infrastructure upgrades.

- Emerging markets in Asia-Pacific and Africa will present strong growth opportunities.

- Data analytics and predictive logistics will play a key role in improving service reliability.