Market Overview:

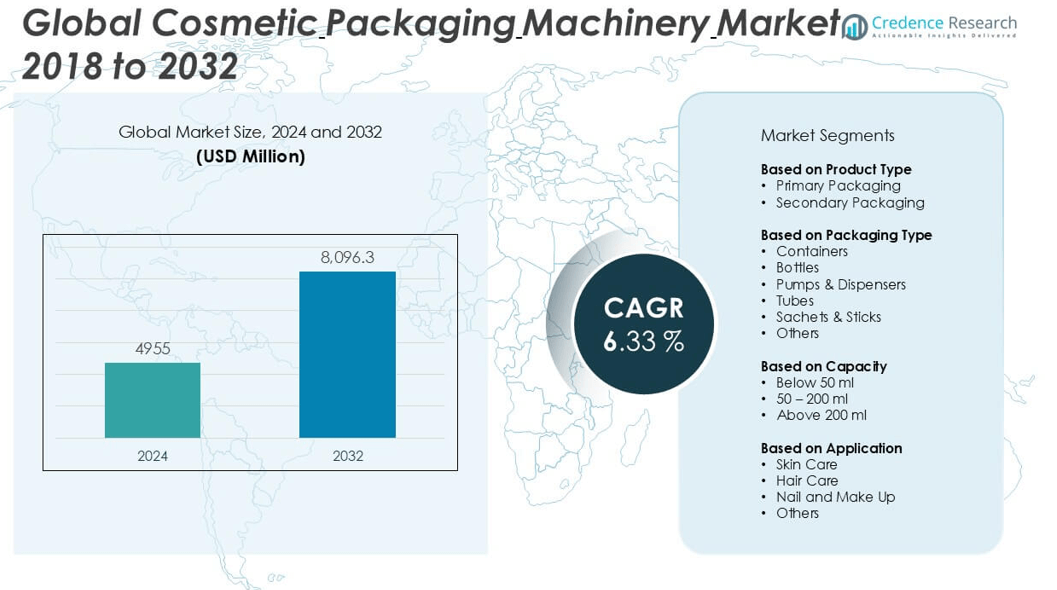

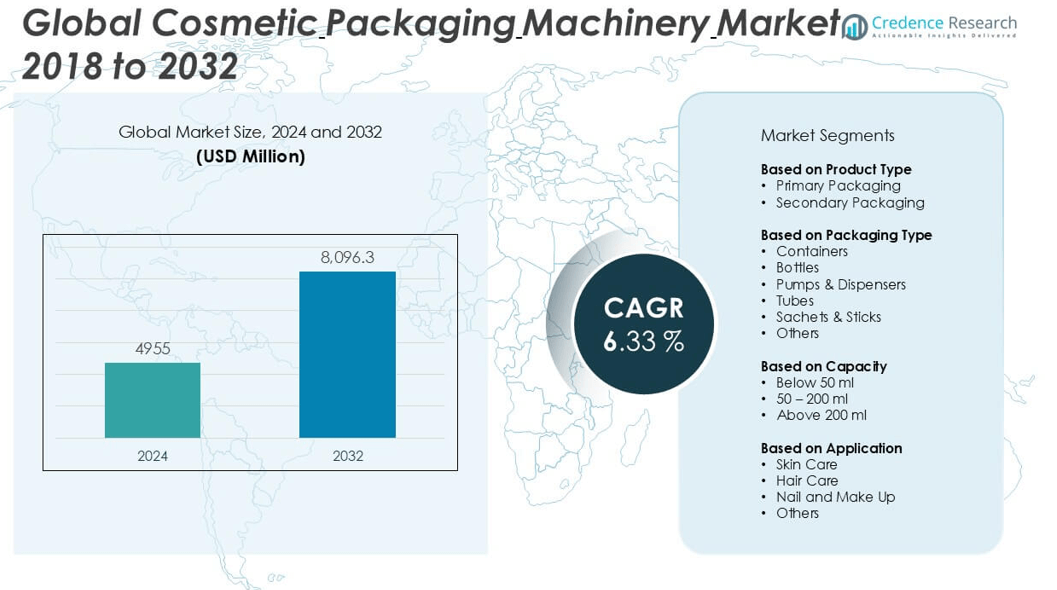

The Cosmetic Packaging Machinery market size was valued at USD 4,955 million in 2024 and is anticipated to reach USD 8,096.3 million by 2032, growing at a CAGR of 6.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Packaging Machinery Market Size 2024 |

USD 4,955 million |

| Cosmetic Packaging Machinery Market, CAGR |

6.33% |

| Cosmetic Packaging Machinery Market Size 2032 |

USD 8,096.3 million |

The cosmetic packaging machinery market is led by prominent players such as Coesia Group, IMA, Marchesini Group, Syntegon Technology, Krones, and Sidel, which collectively command a significant share due to their advanced technological capabilities, global presence, and comprehensive product offerings. These companies focus on automation, precision engineering, and sustainability to meet evolving consumer and industry demands. Asia Pacific emerges as the leading region, holding approximately 32% of the global market share in 2024, driven by strong growth in the cosmetics industry across China, Japan, and South Korea. Europe and North America follow with 25% and 28% shares respectively, supported by high consumer spending, strong regulatory frameworks, and innovation-driven markets.

Market Insights

- The cosmetic packaging machinery market was valued at USD 4,955 million in 2024 and is projected to reach USD 8,096.3 million by 2032, growing at a CAGR of 6.33% during the forecast period.

- Growth is primarily driven by rising demand for customized, premium, and sustainable cosmetic products, leading to increased adoption of automated and flexible packaging machinery.

- Key trends include the shift toward eco-friendly packaging, the rise of e-commerce and direct-to-consumer channels, and the integration of smart technologies like IoT and AI in packaging systems.

- The market is highly competitive, with major players such as Coesia Group, IMA, Marchesini Group, Syntegon Technology, and Krones investing in innovation, sustainability, and global expansion; bottles lead the packaging type segment due to their versatility.

- Asia Pacific holds the largest regional share at 32%, followed by North America at 28%, and Europe at 25%; the 50–200 ml capacity segment dominates due to its high consumer preference.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The cosmetic packaging machinery market, by product type, is segmented into primary and secondary packaging. Among these, primary packaging holds the dominant market share due to its direct contact with cosmetic products, ensuring protection, hygiene, and extended shelf life. The demand for innovative and visually appealing primary packaging solutions drives investments in automated filling, sealing, and capping machinery. Increasing consumer preference for convenience and precision in product usage, especially in skin and hair care categories, further fuels the growth of primary packaging machinery over secondary solutions.

- For instance, Marchesini Group’s Turbo Emulsifier URS 1500 is used in primary packaging lines and can reach an output of up to 2,000 units per hour, enabling manufacturersto scale high-volume cosmetic production with efficiency.

By Packaging Type:

In terms of packaging type, bottles lead the market with the largest share, followed by pumps & dispensers. Bottles are widely used across product categories such as shampoos, lotions, and serums due to their versatility, durability, and ease of handling during automated packaging. The growing popularity of sustainable and aesthetically appealing bottle designs pushes manufacturers to invest in advanced bottle packaging machinery. Additionally, rising consumer demand for hygienic, single-use, and travel-size sachets and sticks has spurred innovations in flexible packaging equipment, though bottles continue to dominate due to their wide application and material compatibility.

- For instance, Sidel’s EvoBLOW eHR system is capable of processing 2,500 bottles per hour per mold, enabling efficient bottle production with integrated heating and blowing technologies.

By Capacity:

Based on capacity, the 50–200 ml segment accounts for the highest market share, driven by its extensive use in skin care and hair care products. This size range is favored for its portability, moderate usage volume, and compatibility with automated filling lines. Manufacturers increasingly focus on optimizing machinery for this capacity range to meet rising demand from premium and mid-range cosmetic brands targeting personal use and travel-size markets. The growing consumer trend towards compact, space-saving packaging also contributes to the dominance of this segment over below 50 ml and above 200 ml options.

Market Overview

Rising Demand for Customized and Premium Cosmetic Products

The increasing consumer preference for personalized and high-end cosmetic products is significantly driving the demand for advanced cosmetic packaging machinery. Brands are focusing on aesthetic appeal and functional design to enhance product differentiation in a highly competitive market. This has led to growing adoption of automated machinery capable of handling diverse packaging formats and materials. The ability to produce unique packaging solutions efficiently supports brand identity and consumer engagement, fueling investment in machinery that offers flexibility, speed, and precision for premium product lines.

- For instance, Coesia’s FlexLink X70 line enables custom labeling and packaging of over 5,000 premium cosmetic units per hour, supporting agile, multi-format production.

Expansion of the Global Cosmetics Industry

The rapid expansion of the cosmetics industry, especially in emerging economies, is a major growth driver for cosmetic packaging machinery. Rising disposable income, evolving beauty standards, and increasing urbanization have amplified the demand for a wide range of cosmetic products. This surge has compelled manufacturers to scale up production capacity and adopt automated packaging systems to ensure speed, accuracy, and consistency. Furthermore, the entry of new players and the rise of direct-to-consumer brands are boosting demand for cost-effective and scalable packaging solutions, thus driving machinery investments globally.

- For instance, IMA’s C360 high-speed cartoner can process 350 cartons per minute, supporting global cosmetic manufacturers in meeting growing output demands.

Technological Advancements in Packaging Automation

Technological innovations in machinery design, such as robotics, IoT integration, and AI-enabled quality control systems, are transforming cosmetic packaging processes. These advancements enable faster changeovers, higher operational efficiency, and real-time monitoring, which significantly reduce downtime and human errors. Smart machines also support sustainable packaging practices by optimizing material use and energy consumption. The ongoing shift toward Industry 4.0 in manufacturing further accelerates the adoption of advanced packaging machinery, allowing cosmetic companies to meet growing product demand while maintaining high quality and safety standards.

Key Trends & Opportunities

Surge in Sustainable and Eco-Friendly Packaging

Sustainability has become a key trend influencing the cosmetic packaging machinery market. With increasing consumer awareness and stricter environmental regulations, cosmetic brands are shifting toward recyclable, biodegradable, and refillable packaging. This trend creates opportunities for machinery manufacturers to innovate systems that can handle eco-friendly materials without compromising efficiency or output quality. Equipment designed for minimal waste generation, lower energy consumption, and compatibility with alternative packaging materials positions companies to tap into this expanding market segment.

- For instance, Syntegon’s Sigpack TTM platform integrates sustainable material handling and uses 30% less energy than conventional machines, aligning with green manufacturing goals.

Growth of E-commerce and Direct-to-Consumer Channels

The booming e-commerce sector and the rise of direct-to-consumer (DTC) brands have created new opportunities in cosmetic packaging machinery. These channels demand highly efficient, compact, and adaptable packaging solutions that can support fast-moving production lines and frequent product launches. Machinery capable of small-batch runs, quick format changes, and personalized packaging is in high demand. As online beauty retailers continue to expand, packaging equipment that ensures product protection, aesthetics, and speed-to-market becomes essential, opening avenues for machinery suppliers to cater to niche and agile production needs.

- For instance, ProMach’s Matrix Mercury vertical form fill seal machine enables quick format changeovers in under 10 minutes, ideal for e-commerce-ready cosmetic packaging.

Key Challenges

High Initial Investment and Maintenance Costs

One of the primary challenges in the cosmetic packaging machinery market is the high capital expenditure required for acquiring and maintaining advanced automated systems. Small and medium-sized enterprises (SMEs) often face financial constraints, limiting their ability to adopt state-of-the-art machinery. Additionally, the ongoing costs associated with training personnel, regular maintenance, and system upgrades further add to the operational burden. These financial hurdles can slow market penetration, especially in developing regions where cost sensitivity is higher.

Complexity of Handling Diverse Packaging Formats

The cosmetic industry features a wide variety of packaging types, including bottles, tubes, pumps, sachets, and more—each requiring different handling techniques and machinery configurations. Adapting machinery to accommodate frequent changes in packaging styles and materials poses technical challenges and can result in production delays. Manufacturers must invest in flexible and modular systems, but this often comes at a higher cost. The complexity also increases the need for skilled operators and specialized maintenance, adding to the operational difficulty.

Stringent Regulatory and Hygiene Standards

Cosmetic packaging machinery must comply with strict regulatory standards concerning hygiene, safety, and product integrity. Meeting these standards requires specialized equipment and frequent quality checks, increasing the complexity and cost of machinery design and operation. Additionally, manufacturers must adapt quickly to evolving global regulations, which can vary across regions. Ensuring compliance without compromising efficiency or increasing waste remains a challenge for machinery providers and cosmetic companies alike.

Regional Analysis

North America

North America holds a significant share of the cosmetic packaging machinery market, accounting for approximately 28% of the global revenue in 2024. The region benefits from a well-established cosmetics industry, high consumer spending, and strong demand for technologically advanced packaging solutions. The U.S. leads the market with a high concentration of premium and organic cosmetic brands driving the adoption of automated machinery. Additionally, regulatory emphasis on packaging safety and sustainability fuels innovation and modernization of equipment. Investments in smart manufacturing technologies and the presence of key machinery manufacturers further support regional market expansion.

Europe

Europe represents around 25% of the global cosmetic packaging machinery market, driven by strong demand for sustainable packaging and stringent environmental regulations. Countries such as Germany, France, and Italy are key contributors, supported by advanced manufacturing infrastructure and the presence of globally recognized cosmetic brands. The push for energy-efficient, recyclable, and customizable packaging has spurred technological developments in machinery across the region. Additionally, Europe’s focus on clean beauty and luxury personal care products increases the need for precise and innovative packaging equipment, making it a hub for both machinery exports and R&D.

Asia Pacific

Asia Pacific dominates the cosmetic packaging machinery market with a leading share of approximately 32% in 2024, fueled by rapid growth in the cosmetics and personal care industries, particularly in China, Japan, South Korea, and India. Rising disposable incomes, urbanization, and shifting beauty trends drive demand for packaged products across various price points. Regional manufacturers are increasingly investing in automated packaging systems to meet the needs of both mass-market and premium segments. The presence of low-cost manufacturing hubs and favorable government policies also enhance production capacity, positioning Asia Pacific as the fastest-growing market globally.

Latin America

Latin America holds about 8% of the global cosmetic packaging machinery market, with Brazil and Mexico being the primary contributors. The regional market is supported by a growing middle-class population and increasing consumer interest in beauty and personal care products. Local and regional brands are expanding their operations, leading to increased demand for cost-effective and flexible packaging solutions. However, market growth is somewhat constrained by limited industrial infrastructure and slower adoption of high-end machinery. Despite these challenges, investments in localized production and rising exports of cosmetic products are expected to drive future growth.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7% of the global cosmetic packaging machinery market. The growth is primarily driven by the expanding beauty sector in countries like the UAE, Saudi Arabia, and South Africa. Increased consumer awareness, rising tourism, and growing preference for luxury and halal-certified cosmetic products support the demand for advanced packaging machinery. However, high equipment costs and limited manufacturing capabilities present challenges. Government efforts to diversify economies and attract foreign investments into non-oil sectors, including cosmetics, are likely to boost the regional market in the coming years.

Market Segmentations:

By Product Type:

- Primary Packaging

- Secondary Packaging

By Packaging Type:

- Containers

- Bottles

- Pumps & Dispensers

- Tubes

- Sachets & Sticks

- Others

By Capacity:

- Below 50 ml

- 50 – 200 ml

- Above 200 ml

By Application:

- Skin Care

- Hair Care

- Nail and Make Up

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cosmetic packaging machinery market is characterized by the presence of both global and regional players striving to enhance their market position through innovation, strategic partnerships, and product diversification. Leading companies such as Coesia Group, IMA, Marchesini Group, and Syntegon Technology dominate the market with their strong technological expertise, extensive global distribution networks, and broad product portfolios. These players continuously invest in research and development to introduce automated, energy-efficient, and flexible machinery tailored to evolving packaging needs. Emerging companies and niche manufacturers like Zhejiang Rigao Machinery Corporation and Prosy’s Innovative Packaging Equipment focus on cost-effective and customizable solutions, catering primarily to small and medium-sized cosmetic producers. The market also witnesses increased collaborations and acquisitions as firms aim to expand regional footprints and technological capabilities. Competitive intensity remains high, with a strong emphasis on sustainability, machinery precision, and adaptability to support growing demand for premium and eco-friendly cosmetic packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- APACKS

- Coesia Group

- Fuji Machinery

- IMA

- Krones

- Liquid Packaging Solutions

- Marchesini Group

- Packsys Global Ltd

- ProMach

- Prosy’s Innovative Packaging Equipment

- Sidel

- Syntegon Technology

- Turbol Packaging Machine

- Vetraco

- Wimco

- Zhejiang Rigao Machinery Corporation

Recent Developments

- In June 2025, ProMach acquired Sentry Equipment & Erectors Inc., expanding conveyor and container handling expertise.

- In May 2025, Syntegon unveiled the Pharmatag 2025 liquid filling line, introducing precision modules relevant to cosmetics.

- In May 2025, Kindeva Drug Delivery and Syntegon installed the first Versynta microBatch system in North America.

- In April 2025, Syntegon launched the MLD Advanced filling machine for ready-to-use syringes at 400 units/minute.

- In April 2025, Syntegon presented a new flow wrapper optimized for cross-market efficiency.

Market Conntration & Characteristics

The Cosmetic Packaging Machinery Market demonstrates moderate to high market concentration, with several key global players controlling a substantial share of revenue. Companies such as Coesia Group, IMA, Marchesini Group, and Syntegon Technology lead the competitive landscape through continuous innovation, strong distribution networks, and established client relationships. It reflects characteristics of a technology-driven industry, where product differentiation, automation capabilities, and customization options play a vital role in defining competitive advantage. The market shows a strong preference for machinery that supports eco-friendly packaging and quick format changes. Demand for flexible, compact, and high-speed systems aligns with evolving production needs from both multinational cosmetic brands and smaller direct-to-consumer players. It also includes a mix of established firms and regional manufacturers offering tailored solutions to local clients. Price sensitivity remains a factor in emerging markets, while developed regions emphasize performance, hygiene standards, and sustainability compliance. The market favors suppliers who invest in R&D, precision engineering, and after-sales service.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging Type, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand due to rising global demand for beauty and personal care products.

- Automation and smart packaging technologies will become more integrated into production lines.

- Demand for eco-friendly and recyclable packaging machinery will increase across all regions.

- Asia Pacific will maintain its position as the fastest-growing region due to large-scale manufacturing and rising consumption.

- Compact and flexible machinery will gain traction among small and mid-sized cosmetic manufacturers.

- Customization capabilities in machinery will be essential to meet diverse product and packaging needs.

- E-commerce and direct-to-consumer brands will drive demand for fast and adaptive packaging solutions.

- Stringent hygiene and safety regulations will push the adoption of advanced machinery with cleanroom compatibility.

- Companies will invest more in R&D to innovate machinery that supports sustainable materials.

- Strategic partnerships, mergers, and acquisitions will shape the competitive dynamics of the market.