Market Overview

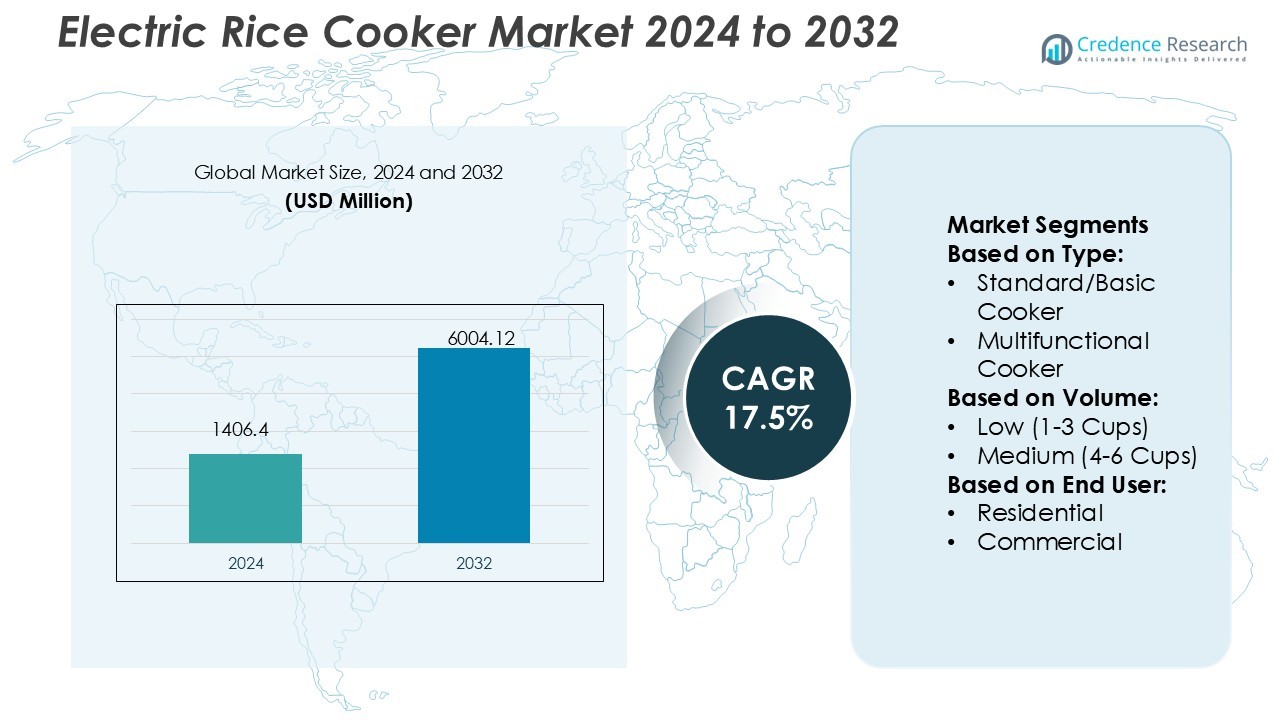

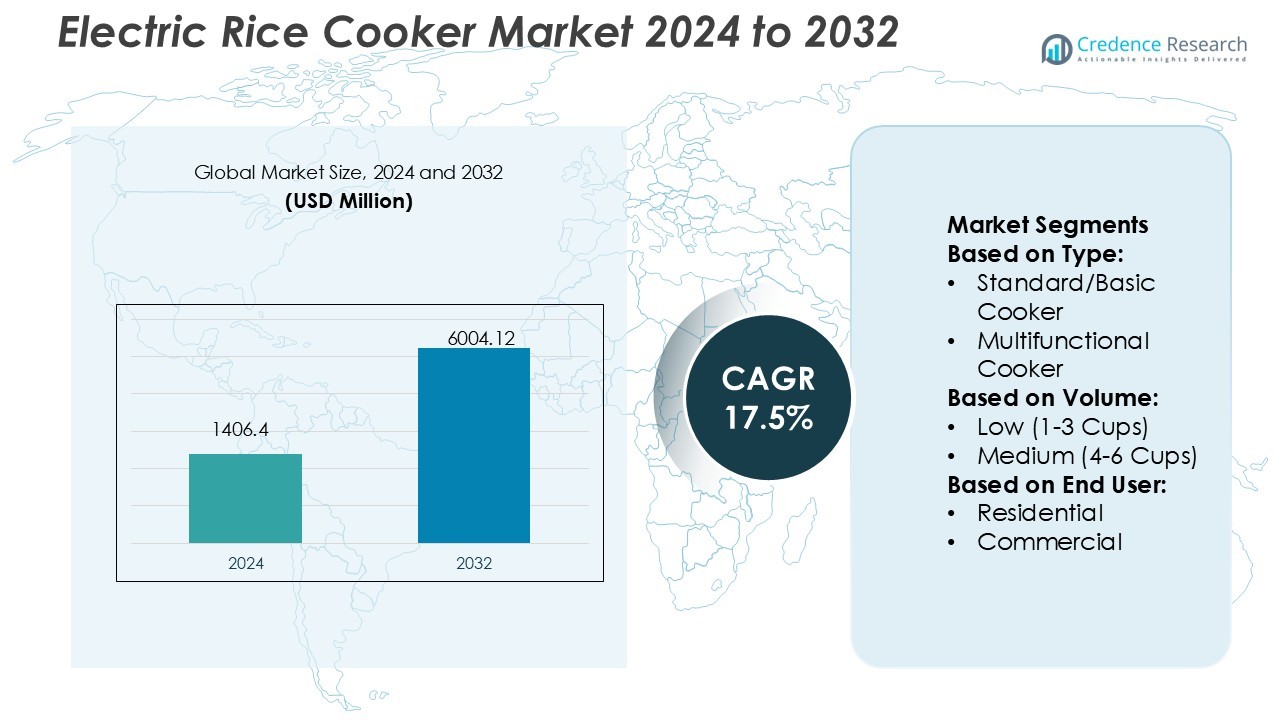

Electric Rice Cooker Market size was valued USD 1406.4 million in 2024 and is anticipated to reach USD 6004.12 million by 2032, at a CAGR of 17.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Rice Cooker Market Size 2024 |

USD 1406.4 Million |

| Electric Rice Cooker Market, CAGR |

17.5% |

| Electric Rice Cooker Market Size 2032 |

USD 6004.12 Million |

The Electric Rice Cooker Market is driven by major players such as Hitachi Limited, Midea Group Company, Cuckoo Electronics Company, Koninklijke Philips NV, Breville Group Limited, Mitsubishi Electric Corporation, Electrolux AB, Aroma Housewares Company, Hamilton Holdings Company, and Black & Decker. These companies compete through advanced technologies, energy-efficient designs, and product diversification targeting both residential and commercial users. Asia Pacific leads the global market with a 46% share in 2024, supported by high rice consumption, strong manufacturing presence, and rising middle-class income. Regional leaders continue to innovate with multifunctional and smart cookers that meet evolving consumer preferences across urban and semi-urban households.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Rice Cooker Market was valued at USD 1406.4 million in 2024 and is projected to reach USD 6004.12 million by 2032, growing at a CAGR of 17.5% during the forecast period.

- Market growth is driven by rising urbanization, increasing disposable income, and demand for time-saving, energy-efficient cooking appliances across residential and commercial sectors.

- The industry is witnessing strong trends toward smart, multifunctional, and eco-friendly cookers integrated with AI and IoT technologies for enhanced convenience and energy efficiency.

- Intense competition among leading brands promotes innovation in design, functionality, and sustainability, though high product costs and limited rural awareness remain key restraints.

- Asia Pacific dominates with a 46% market share, led by China, Japan, and India, while the medium-capacity (4–6 cups) segment holds the largest share due to its balance between capacity, efficiency, and consumer affordability in both developing and developed regions.

Market Segmentation Analysis:

By Type

The Standard/Basic Cooker segment dominated the Electric Rice Cooker Market with a major share in 2024. This segment remains popular due to its affordability, simplicity, and energy efficiency, making it ideal for small households and budget-conscious consumers. Manufacturers are improving heating efficiency and introducing automatic shut-off features to enhance usability. For instance, Panasonic’s SR-WA18 model offers a durable anodized aluminum pan and advanced thermostat control, ensuring consistent performance and reliability. The standard cooker segment continues to drive sales in emerging markets due to increasing household electrification and rising demand for time-saving kitchen appliances.

- For instance, Hitachi’s RZ-V100EM model features advanced microcomputer control that utilizes a pressure and steam heating system to automatically adjust temperature and cooking time for optimal rice preparation.

By Volume

The Medium (4–6 Cups) segment accounted for the largest market share in 2024, favored for its balance between capacity and energy consumption. It is widely used by nuclear families and small restaurants requiring efficient meal preparation. Growing urbanization and the popularity of compact kitchen appliances support this segment’s dominance. For instance, Toshiba’s RC-10JFM model delivers a 5-cup capacity with fuzzy logic technology for precise temperature control. Such technological integration enhances convenience, making medium-volume cookers the preferred choice in both developed and developing economies.

- For instance, Breville Set & Serve (BRC210) model accommodates up to 8 cups of uncooked rice, yielding up to 16 cups cooked. It uses an automatic, sensor-based system to switch from cooking to a “keep warm” mode. It holds rice warm for up to 5 hours.

By End User

The Residential segment led the market in 2024, driven by rising adoption among working families and students seeking convenient cooking solutions. Increased disposable income, changing dietary habits, and compact product designs strengthen residential demand. For instance, Zojirushi’s NP-NWC10 rice cooker allows multiple grain settings and induction heating, catering to diverse meal preferences. The growing trend of smart homes and energy-efficient appliances further supports the segment’s expansion. Meanwhile, the commercial segment grows steadily with demand from restaurants, catering services, and institutional kitchens emphasizing large-volume and programmable models.

Key Growth Drivers

Rising Urbanization and Changing Lifestyles

The growing urban population and busier lifestyles are fueling the adoption of electric rice cookers. Consumers seek quick, energy-efficient cooking solutions for daily meals. Compact designs and automated features such as keep-warm and preset timers appeal to working professionals and students. For instance, Panasonic and Philips offer one-touch cooking models suited for compact kitchens. The increasing number of nuclear families and the shift toward convenient cooking solutions are further accelerating product penetration in both developed and emerging markets.

- For instance, Hamilton Beach’s 90-cup commercial rice cooker (model 37590) operates at 2,500 W output and uses double-wall stainless steel construction to hold internal temperature for 8 hours under load.

Technological Advancements and Smart Features

Innovations in heating technologies and integration of smart controls are major growth drivers. Advanced models now feature fuzzy logic, induction heating, and IoT-enabled connectivity for precise temperature control and energy efficiency. For example, Toshiba’s multi-function cookers allow app-based control and recipe customization. These innovations enhance user experience and reduce cooking time. Growing consumer interest in multifunctional appliances that combine rice cooking, steaming, and slow-cooking capabilities continues to boost global demand for technologically advanced rice cookers.

- For instance, Cuckoo’s CRP-DHSR0609F model offers Smart Induction Heating at 1,090 W for a 6-cup (uncooked) capacity, and supports voice navigation in Korean, English, and Chinese.

Expanding Middle-Class Population and Rising Disposable Income

Increasing disposable income in developing economies is encouraging consumers to upgrade kitchen appliances. The expanding middle class across Asia Pacific and Latin America drives demand for electric rice cookers offering better design and functionality. Leading manufacturers such as Zojirushi and Cuckoo are launching affordable yet feature-rich models targeting middle-income households. The trend of home-cooked meals and greater awareness of health benefits associated with controlled cooking methods further propel market growth. This socioeconomic shift strengthens long-term sales potential across price segments.

Key Trends & Opportunities

Growing Popularity of Smart and Connected Appliances

The surge in smart home adoption presents a strong opportunity for connected electric rice cookers. IoT-enabled devices with voice and app control functions are gaining traction in tech-savvy households. Brands like Xiaomi and Sharp have introduced Wi-Fi-compatible cookers that sync with digital assistants for remote operation. These innovations support energy optimization and personalized cooking. The expansion of e-commerce platforms and the increasing integration of AI-driven features are reshaping how consumers interact with kitchen appliances globally.

- For instance, the NJ-EE107H rice cooker uses 5 heaters around the pot, with a 1.0 L capacity and a 1200 W power draw, and features a Binchotan charcoal-coated inner pot for even heating.

Increasing Demand for Energy-Efficient and Eco-Friendly Designs

Consumers are showing growing interest in sustainable kitchen solutions. Manufacturers are developing energy-efficient and eco-friendly rice cookers with improved insulation, recyclable materials, and low standby power consumption. For instance, Tiger Corporation’s JAX-T series features non-toxic coatings and efficient thermal management. Government initiatives promoting energy conservation and consumer awareness of environmental impact drive this trend. The shift toward sustainable manufacturing and eco-label certification offers significant market differentiation opportunities for global and regional brands.

- For instance, Philips’ HD3170/33 mini rice cooker supports packaging made of over 90 % recycled materials and offers 12-hour keep-warm. The model has a 0.85 L capacity, runs at 400 W, and uses a 4-layer inner pot with fuzzy logic control.

Expanding Penetration in Emerging Markets

Emerging economies in Asia, Africa, and Latin America are witnessing rising demand for electric rice cookers due to rapid electrification and improved distribution networks. Affordable pricing and localized features tailored to regional cooking habits attract first-time buyers. For example, Bajaj Electricals and Prestige focus on low-capacity models suited for Indian households. Retail expansion through supermarkets and online channels is boosting visibility. The growth potential in rural and semi-urban areas remains high, offering untapped opportunities for global manufacturers.

Key Challenges

High Competition and Price Sensitivity

The electric rice cooker market faces intense competition due to numerous regional and international players. Price sensitivity among consumers in developing nations limits the adoption of premium models. Local manufacturers often offer low-cost alternatives, intensifying pricing pressure on global brands. Companies must balance affordability with quality and innovation to maintain margins. The challenge also lies in differentiating products through branding, features, and after-sales services to sustain long-term competitiveness in a saturated market.

Limited Consumer Awareness in Rural Areas

Despite growing urban demand, rural regions still show limited awareness of electric cooking appliances. Many households rely on traditional methods due to cultural preferences and irregular power supply. This restricts product penetration, particularly in Asia and Africa. Manufacturers face challenges in educating consumers about energy efficiency, convenience, and safety features. Expanding awareness campaigns, improving rural distribution networks, and offering low-power models are crucial strategies to overcome this limitation and achieve balanced market growth.

Regional Analysis

North America

North America accounted for 22% of the global Electric Rice Cooker Market share in 2024, driven by rising consumer demand for convenient and energy-efficient kitchen appliances. The United States leads the region due to high adoption of multifunctional and smart home devices. Growing preference for healthy, home-cooked meals supports market expansion. Manufacturers such as Instant Brands and Aroma Housewares focus on IoT-enabled models with advanced safety and temperature control systems. Increasing popularity of Asian cuisines and expanding e-commerce distribution further contribute to steady regional growth across residential and small commercial kitchens.

Europe

Europe captured 19% of the global market share in 2024, fueled by strong consumer awareness of sustainable and energy-efficient cooking technologies. The United Kingdom, Germany, and France represent key markets due to high urbanization and preference for automated appliances. Manufacturers emphasize eco-friendly materials, minimal energy consumption, and smart features to meet EU efficiency standards. Growing Asian population and rising cross-cultural culinary interest also support product adoption. Companies like Philips and Tefal strengthen their regional presence through product innovation and expanding retail partnerships across online and offline distribution channels.

Asia Pacific

Asia Pacific dominated the global market with a 46% share in 2024, making it the leading regional segment. Countries such as China, Japan, South Korea, and India drive growth due to high rice consumption and deep-rooted cooking traditions. Rising disposable incomes and expanding middle-class populations accelerate demand for advanced models with multiple cooking modes. Key players including Zojirushi, Panasonic, and Cuckoo lead the market through technological innovation and localized product offerings. Rapid urbanization and widespread electrification in Southeast Asia further enhance the market’s growth trajectory across residential and commercial segments.

Latin America

Latin America accounted for 7% of the global market share in 2024, supported by increasing adoption of modern cooking appliances among urban households. Brazil and Mexico represent the largest contributors, driven by growing middle-class income and urban lifestyle shifts. Regional manufacturers are focusing on affordable models with versatile features suited for local cuisines. Expanding online retail and improved product availability are driving consumer engagement. International brands are also investing in marketing and after-sales support to strengthen distribution networks, catering to the growing demand for convenient and efficient kitchen solutions.

Middle East & Africa

The Middle East & Africa region held 6% of the global Electric Rice Cooker Market share in 2024, with growing adoption in urban centers such as the UAE, Saudi Arabia, and South Africa. Market growth is fueled by rising expatriate populations, especially from Asia, and increasing acceptance of modern cooking appliances. Improved electricity access and expanding retail infrastructure further support adoption. Leading brands are introducing durable, compact models suitable for varied voltage conditions. Government-led modernization initiatives and growing awareness of energy-efficient appliances are expected to create new opportunities across residential and hospitality sectors.

Market Segmentations:

By Type:

- Standard/Basic Cooker

- Multifunctional Cooker

By Volume:

- Low (1-3 Cups)

- Medium (4-6 Cups)

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Rice Cooker Market features key players such as Hitachi Limited, Breville Group Limited, Midea Group Company, Hamilton Holdings Company, Cuckoo Electronics Company, Mitsubishi Electric Corporation, Koninklijke Philips NV, Aroma Housewares Company, Electrolux AB, and Black & Decker. The Electric Rice Cooker Market is characterized by strong innovation, expanding product portfolios, and increasing focus on smart cooking technologies. Manufacturers are investing in IoT-enabled devices, energy-efficient heating systems, and multifunctional designs to meet evolving consumer preferences. Companies are enhancing product durability, safety, and performance while maintaining affordability to capture both premium and budget-conscious segments. Strategic collaborations, mergers, and regional distribution expansion play a crucial role in strengthening global presence. Additionally, growing emphasis on sustainability and the use of recyclable materials are shaping product development strategies, positioning brands for long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi Limited

- Breville Group Limited

- Midea Group Company

- Hamilton Holdings Company

- Cuckoo Electronics Company

- Mitsubishi Electric Corporation

- Koninklijke Philips NV

- Aroma Housewares Company

- Electrolux AB

- Black & Decker

Recent Developments

- In October 2024, Berkeley-based startup Copper launched a full-size, battery-equipped induction stove that plugs into a standard 120-volt outlet. The New York City Housing Authority ordering 10,000 units for retrofit projects.

- In August 2024, TOSHIBA launched its latest innovation, the Dew Series. This series features the world’s first rice cooker equipped with advanced Japanese-style steam replenishment technology, designed to elevate the daily dining experience by making it easier to cook sweet and chewy rice.

- In August 2024, Xiaomi introduced its latest kitchen appliance, the Mijia Rice Cooker N1. This 4-liter rice cooker offers nine cooking modes, each with precise temperature control to optimize rice texture and flavor.

- In August 2023, Wonderchef, the famous Indian cookware and high-quality kitchen appliance company, launched its 26th dedicated store in Mumbai, India. By 2025, the company aims to open 50 exclusive stores across the country.

Report Coverage

The research report offers an in-depth analysis based on Type, Volume, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for smart and connected rice cookers will continue to grow globally.

- Manufacturers will integrate AI-driven cooking modes to enhance precision and convenience.

- Energy-efficient and eco-friendly designs will gain higher consumer preference.

- Asia Pacific will remain the leading regional market due to strong household adoption.

- Product diversification into multi-cuisine and multifunctional models will increase rapidly.

- Online retail channels will play a larger role in driving global sales.

- Compact and portable cookers will see rising demand among urban consumers.

- Strategic collaborations between brands and e-commerce platforms will strengthen distribution.

- Smart home integration through app-based control and voice assistance will become standard.

- Sustainable materials and recyclable components will define future product innovation.