Market Overview

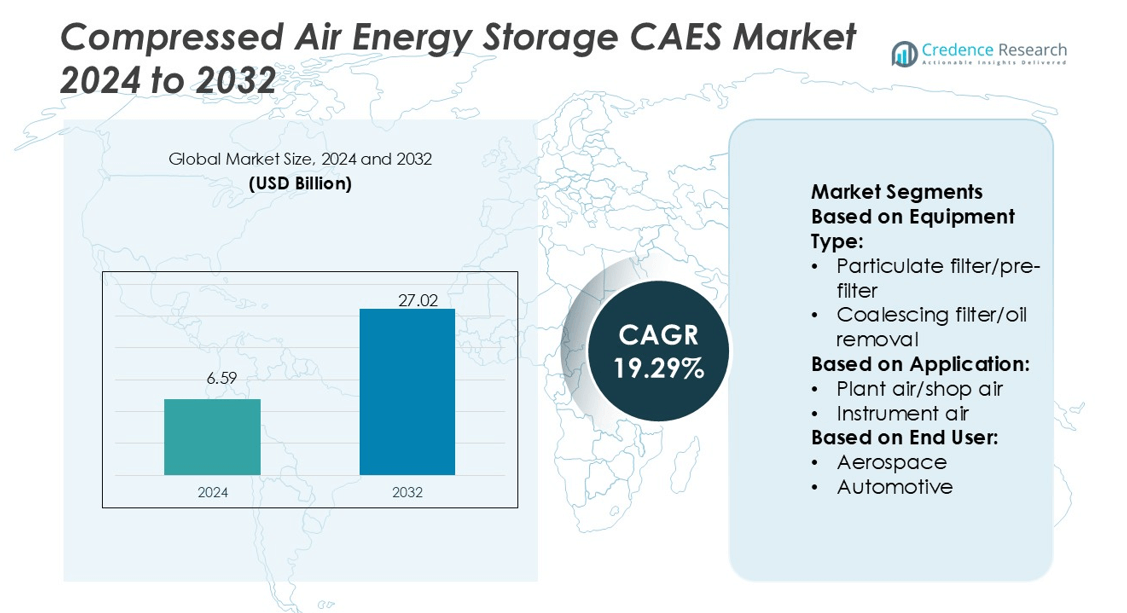

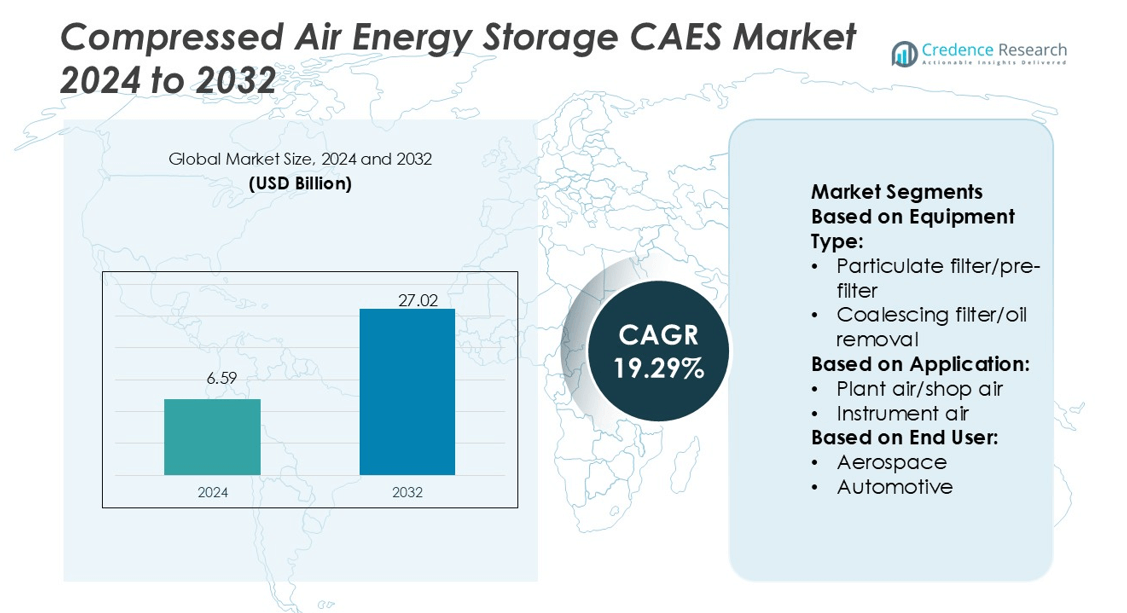

Compressed Air Energy Storage CAES Market size was valued USD 6.59 billion in 2024 and is anticipated to reach USD 27.02 billion by 2032, at a CAGR of 19.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compressed Air Energy Storage (CAES) Market Size 2024 |

USD 6.59 billion |

| Compressed Air Energy Storage (CAES) Market, CAGR |

19.29% |

| Compressed Air Energy Storage (CAES) Market Size 2032 |

USD 27.02 billion |

The Compressed Air Energy Storage (CAES) market features prominent players such as Hydrostor, Energy Dome, Corre Energy, Cheesecake Energy, APEX CAES, AUGWIND Energy, ALACAES, Green-Y Energy, Pacific Gas and Electric Company, and Sherwood Power. These companies focus on expanding large-scale and modular storage systems to enhance renewable integration and grid reliability. Hydrostor leads in advanced adiabatic CAES projects, while Energy Dome pioneers CO₂-based storage solutions with higher round-trip efficiency. Corre Energy and Cheesecake Energy emphasize flexible, decentralized energy systems for industrial and community applications. North America dominates the global CAES market with a 37% share, supported by significant renewable energy projects, strong government incentives, and ongoing infrastructure investments aimed at achieving long-duration energy storage and carbon neutrality goals.

Market Insights

- The Compressed Air Energy Storage (CAES) market was valued at USD 6.59 billion in 2024 and is projected to reach USD 27.02 billion by 2032, growing at a CAGR of 19.29%.

- Rising renewable energy integration and increasing need for grid stability drive the adoption of CAES systems across industrial and utility sectors.

- Technological advancements in adiabatic and CO₂-based CAES designs enhance storage efficiency and support large-scale renewable deployment globally.

- North America dominates the market with a 37% share, followed by Europe at 29%, supported by policy incentives and infrastructure modernization.

- Leading players such as Hydrostor, Energy Dome, and Corre Energy strengthen market competition through strategic partnerships and pilot projects, while high installation costs and geological limitations remain key restraints in expanding large-scale CAES adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment Type

The filters segment dominates the Compressed Air Energy Storage (CAES) market with a market share of 42%. Within filters, the coalescing filter/oil removal type holds the leading position due to its efficiency in removing oil aerosols down to 0.01 microns. These filters are essential for maintaining turbine and compressor reliability by preventing oil contamination. For instance, Parker Hannifin’s OIL-X coalescing filters achieve ISO 8573-1 Class 1 oil removal performance, ensuring high air purity. The growing adoption of advanced filtration systems enhances operational efficiency and extends equipment lifespan in CAES facilities.

- For instance, Parker Hannifin’s OIL-X coalescing filters include different grades with specific performance characteristics tested under ISO 12500-1. The high-efficiency Grade AA filters deliver a downstream oil carryover of 0.01 mg/m³ when tested with a 10 mg/m³ upstream oil aerosol challenge.

By Application

Plant air/shop air applications account for the largest share of 46% in the CAES market. This dominance is driven by the need for clean and dry air in mechanical operations, pneumatic tools, and compressor systems. CAES facilities depend heavily on controlled plant air systems to maintain stable energy conversion processes. For instance, Atlas Copco’s GA series compressors integrate variable speed drive and energy recovery systems, reducing power consumption by up to 50%. The demand for energy-efficient compressed air solutions across industrial operations sustains the strong growth of this application segment.

- For instance, Hydrostor’s Goderich A-CAES facility in Ontario, Canada, operates with a discharge capacity of 1.75 MW, a charge rate of 2.2 MW, and energy storage capability exceeding 10 MWh.

By End User

The automotive industry represents the dominant end-user segment, holding a 33% market share in the CAES market. Automakers increasingly rely on compressed air for paint application, assembly automation, and tire inflation systems. The shift toward energy-efficient and sustainable manufacturing practices fuels adoption. For instance, BMW Group’s Leipzig plant employs high-efficiency compressed air networks with Siemens energy monitoring, reducing leakage losses by 15%. The industry’s push toward carbon-neutral production and precision automation continues to drive CAES technology integration across global automotive facilities.

Key Growth Drivers

Rising Demand for Grid Stability and Renewable Integration

The increasing penetration of renewable energy sources drives the adoption of CAES systems for grid stability. These systems balance power supply by storing excess wind and solar energy for later use. For instance, Siemens Energy’s 100 MW CAES project in Germany provides grid support with round-trip efficiency of 70%. Governments promote large-scale energy storage to address intermittency in renewables. The flexibility and scalability of CAES systems make them vital for achieving stable, low-carbon power networks worldwide.

- For instance, Cheesecake Energy’s eTanker system—a modular hybrid of thermal and compressed air storage—uses repurposed off-the-shelf hardware and has a design life of up to 25 years while avoiding rare or toxic materials.

Advancements in High-Efficiency Compression and Expansion Technologies

Technological progress in turbomachinery and thermal management boosts CAES performance and energy efficiency. Modern systems feature advanced compressors and expanders capable of high pressure ratios and lower energy losses. For instance, Hitachi Energy’s high-speed isothermal compressors enhance energy density and reduce operational costs by up to 12%. Innovations in heat recovery further minimize waste and improve overall efficiency. Such developments make CAES a cost-effective and sustainable alternative to conventional peaking power plants.

- For instance, Pacific Gas & Electric (PG&E) initiated plans and received funding for a 300 MW / 10-hour CAES demonstration in California around 2011, the project appears to be stalled or canceled.

Government Incentives and Investment in Energy Infrastructure

National policies promoting clean energy transition accelerate CAES adoption across major economies. Incentive programs and infrastructure funding support large-scale energy storage deployment. For example, the U.S. Department of Energy allocated over USD 400 million in 2024 for long-duration energy storage demonstrations, including CAES facilities. Similar initiatives in Europe and China encourage partnerships between utilities and technology providers. These supportive measures enhance investor confidence and expedite the commercialization of advanced CAES technologies.

Key Trends & Opportunities

Emergence of Adiabatic and Isothermal CAES Systems

Next-generation adiabatic and isothermal systems are emerging as efficient alternatives to conventional diabatic CAES. These systems store and reuse heat generated during compression, improving energy efficiency to above 70%. Companies like Hydrostor and RWE are developing commercial-scale adiabatic CAES projects using advanced thermal energy storage materials. The shift toward these systems aligns with carbon-neutral targets and offers significant cost savings over time. The growing focus on sustainable energy storage creates strong opportunities for technology developers.

- For instance, Energy Dome’s CO₂-based “carbon battery” demonstrator in Sardinia operates at 2.5 MW / 4 MWh capacity and claims a 75% round-trip efficiency, by storing heat in a thermal reservoir and re-injecting it into cold gas before expansion.

Integration with Hydrogen and Hybrid Energy Storage Systems

The integration of CAES with hydrogen and battery technologies is gaining momentum. Hybrid systems combine the long-duration capacity of CAES with the rapid response of batteries and hydrogen fuel cells. For instance, Mitsubishi Power’s hybrid storage projects couple CAES with green hydrogen electrolysis for multi-day energy supply. This synergy improves grid flexibility, enhances energy security, and supports decarbonization goals. As hybrid infrastructure expands, CAES technologies will play a crucial role in multi-energy storage ecosystems.

- For instance, Corre Energy’s Green Hydrogen Hub Denmark (GHH DK1) plans a fully integrated system with 320 MW CAES capacity, 350 MW electrolyzer capacity, and 200 GWh hydrogen storage alongside underground CAES.

Key Challenges

High Capital Investment and Infrastructure Complexity

CAES projects require substantial upfront investment for underground storage caverns, compressors, and turbines. The site selection process adds complexity, as only certain geological formations like salt caverns are suitable. For example, large-scale CAES installations can exceed USD 1,000 per kW in capital costs. Such financial barriers limit small-scale deployments and deter new market entrants. Overcoming these challenges demands policy support, modular designs, and improved cost-sharing frameworks among utilities and technology developers.

Thermal Management and Efficiency Limitations

Maintaining consistent temperature control during compression and expansion remains a major technical challenge. Inefficient thermal storage reduces overall round-trip efficiency and increases energy loss. Traditional diabatic systems waste heat, lowering efficiency to 40–50%. For instance, some early CAES plants required supplemental natural gas heating to maintain output levels. Advances in adiabatic designs and heat recovery systems are addressing these limitations, but large-scale implementation still faces engineering and cost hurdles that slow market growth.

Regional Analysis

North America

North America holds the largest share of the Compressed Air Energy Storage (CAES) market at 37%. The region benefits from a well-developed renewable energy infrastructure and strong government incentives for grid stability. The U.S. leads investments in large-scale CAES projects for wind and solar integration. For instance, Hydrostor’s 500 MW Willow Rock project in California enhances long-duration storage capabilities. The growing demand for cleaner backup systems in data centers and industrial facilities further supports market growth, while strategic initiatives by the U.S. Department of Energy promote innovation and commercialization of advanced CAES technologies.

Europe

Europe accounts for 29% of the CAES market, driven by the EU’s energy transition goals and carbon neutrality targets. Germany and the U.K. lead regional adoption with projects focused on balancing intermittent renewable generation. For instance, RWE’s ADELE project in Saxony-Anhalt uses adiabatic compression for thermal efficiency. The European Commission’s energy storage directives and Horizon Europe funding strengthen technology development. Increasing offshore wind integration in the North Sea, along with initiatives for cross-border energy balancing, enhances CAES demand across the region, establishing Europe as a major hub for advanced storage innovation.

Asia Pacific

Asia Pacific represents 23% of the CAES market, led by China, Japan, and South Korea. Rapid renewable expansion and industrial power demand are fueling CAES adoption. For instance, China’s Institute of Engineering Thermophysics operates a 100 MW/400 MWh CAES plant in Jiangsu, the world’s largest non-salt cavern facility. Government policies promoting grid modernization and energy resilience further accelerate deployment. Japan’s focus on hydrogen integration and South Korea’s technology innovation in hybrid storage systems enhance regional competitiveness. Growing urbanization and increased reliance on sustainable energy sources continue to drive Asia Pacific’s market growth momentum.

Latin America

Latin America captures 4% of the CAES market, with Brazil, Chile, and Mexico emerging as early adopters. Increasing renewable penetration—especially in wind and solar—drives the need for efficient grid balancing technologies. For instance, Brazil’s energy research company EPE is evaluating compressed air storage for hybrid renewable microgrids in the Northeast region. Supportive regulatory frameworks and partnerships with European technology firms foster adoption. Although deployment remains at an early stage, the region’s abundant renewable resources and growing investment in grid storage solutions are expected to expand CAES adoption across Latin America.

Middle East & Africa (MEA)

The Middle East & Africa region holds a 7% share of the CAES market, supported by growing renewable initiatives and grid reliability needs. Countries like Saudi Arabia and the UAE are investing in pilot projects to stabilize fluctuating solar power output. For instance, the King Abdullah City for Atomic and Renewable Energy (K.A.CARE) has explored CAES integration with desert-based solar plants. South Africa is also assessing CAES as part of its Integrated Resource Plan for energy diversification. With rising renewable capacity and infrastructure modernization, MEA presents long-term potential for scalable CAES deployment.

Market Segmentations:

By Equipment Type:

- Particulate filter/pre-filter

- Coalescing filter/oil removal

By Application:

- Plant air/shop air

- Instrument air

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Compressed Air Energy Storage (CAES) market includes key players such as Green-Y Energy, Sherwood Power, Hydrostor, Cheesecake Energy, Pacific Gas and Electric Company, Energy Dome, Corre Energy, APEX CAES, AUGWIND Energy, and ALACAES. The competitive landscape of the Compressed Air Energy Storage (CAES) market is defined by rapid technological innovation and strategic collaboration. Companies are investing heavily in large-scale storage systems that support renewable energy integration, grid stability, and carbon neutrality goals. The market is witnessing a shift toward advanced adiabatic and isothermal designs, which enhance efficiency and reduce energy losses. Several players are forming partnerships with utilities and governments to deploy pilot and commercial-scale projects, particularly in regions emphasizing clean energy transition. Competitive advantage increasingly depends on optimizing cost per kilowatt-hour, extending storage duration, and integrating digital monitoring systems for real-time performance analysis. As nations expand renewable energy capacity, CAES providers continue to compete through innovation, scalability, and operational reliability, solidifying the technology’s role in the long-term energy storage ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Green-Y Energy

- Sherwood Power

- Hydrostor

- Cheesecake Energy

- Pacific Gas and Electric Company

- Energy Dome

- Corre Energy

- APEX CAES

- AUGWIND Energy

- ALACAES

Recent Developments

- In January 2025, The U.S. DOE issued a conditional loan guarantee to Hydrostor Willow Rock Energy Storage Center, marking the largest federal commitment to compressed air energy storage market deployment.

- In August 2024, Gardner Denver launched the PureAir T/TVS 90-355 kW Series, highlighting its advancements in compressor technology. Designed with innovative software and expertise in oil-free compression, the series sets new standards in performance.

- In June 2024, ELGi Equipments introduced its latest compressed air products at INTEC 2024 in India. Highlights included the EG SP “Super Premium” Range, EG PM (Permanent Magnet) Range, TS15LD Direct Drive Piston Compressor, EN11-7.5VFD Encapsulated Screw Air Compressor, and AB Series 22 kW Oil-Free Screw Air Compressor. These products enhance flexibility, productivity, and durability for various industries.

- In January 2023, Ingersoll Rand Inc., acquired SPX FLOW’s Air Treatment business through an all-cash transaction valued at around addition of SPX FLOW’s Air Treatment business brings in a synergistic product portfolio featuring energy-efficient compressed filters, air dryers, and other consumables, complementing Ingersoll Rand’s core compressor product offering with a high attachment rate

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The CAES market will expand with growing renewable energy integration and grid stability needs.

- Advanced adiabatic and isothermal storage technologies will improve efficiency and reduce energy losses.

- Governments will increase funding for long-duration energy storage pilot projects and commercialization.

- Hybrid systems combining CAES with battery and hydrogen storage will gain strong adoption.

- Industrial and utility-scale users will drive demand for reliable, emission-free power backup solutions.

- Digital monitoring and predictive maintenance systems will enhance operational reliability and performance.

- Declining equipment and maintenance costs will make CAES more economically competitive.

- Strategic partnerships between technology developers and power utilities will accelerate deployment.

- Regions with high renewable potential, such as Asia Pacific and Europe, will lead market growth.

- Innovation in modular and underground CAES designs will enable flexible applications across industries.