Market Overview:

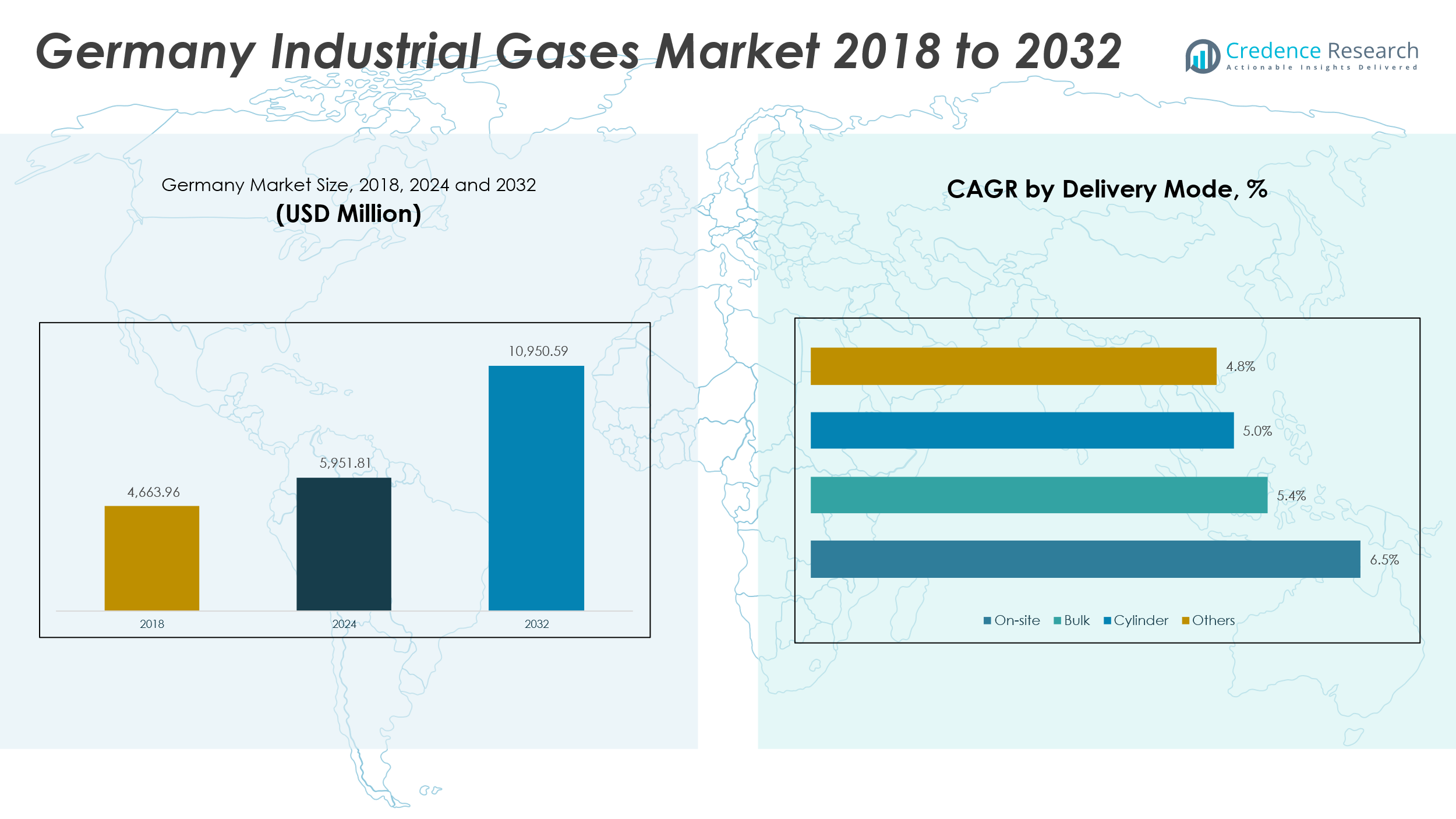

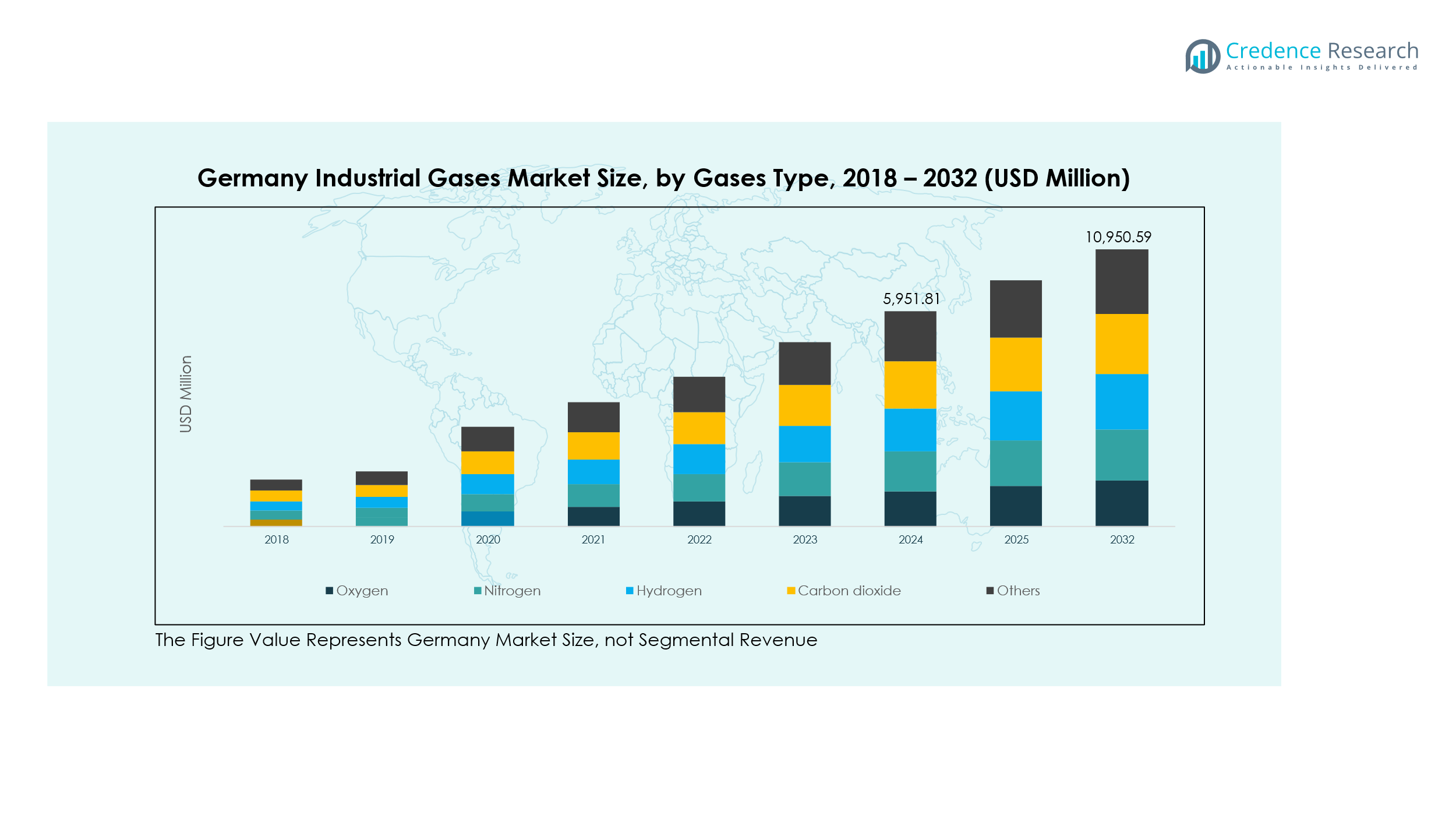

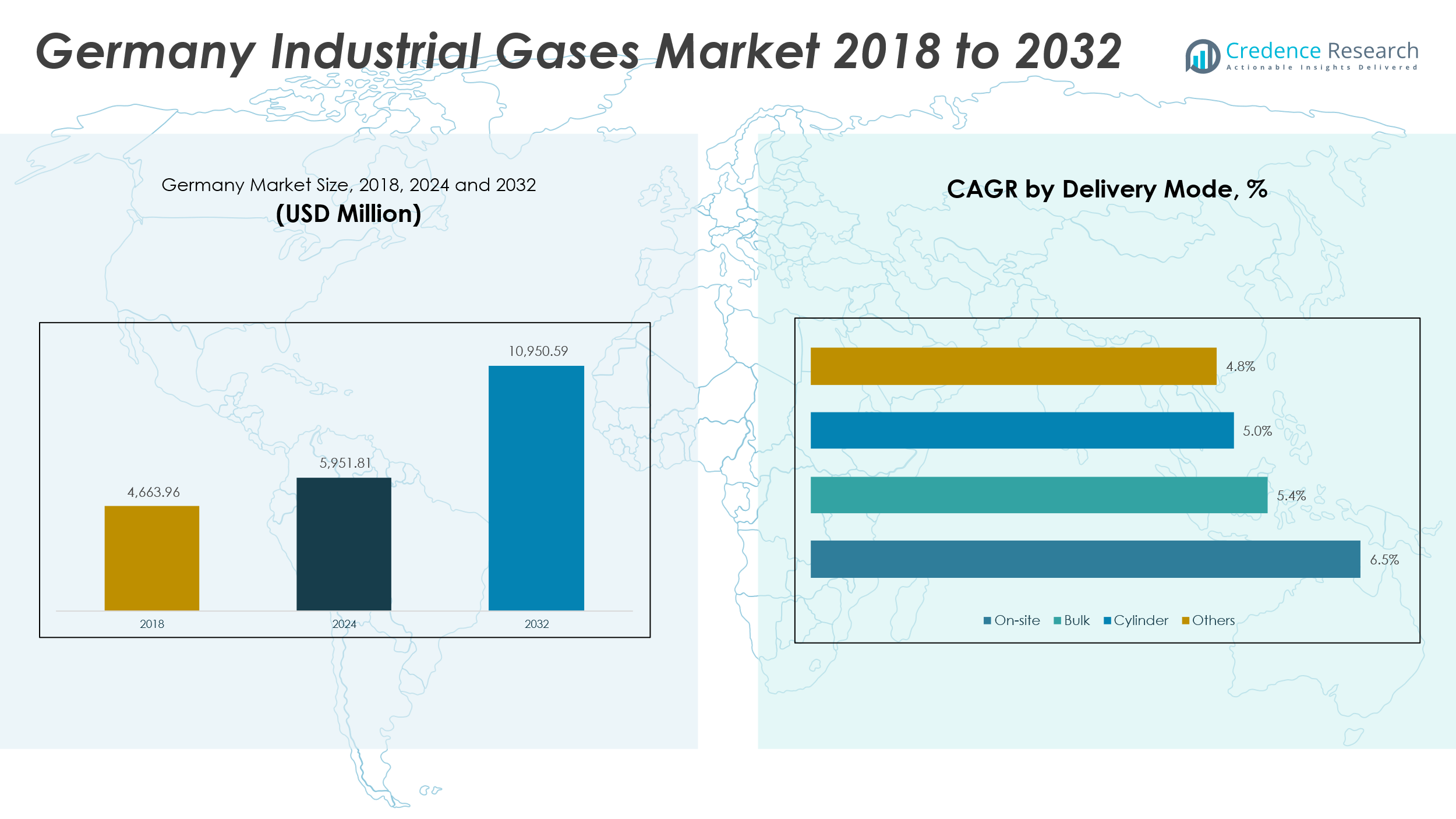

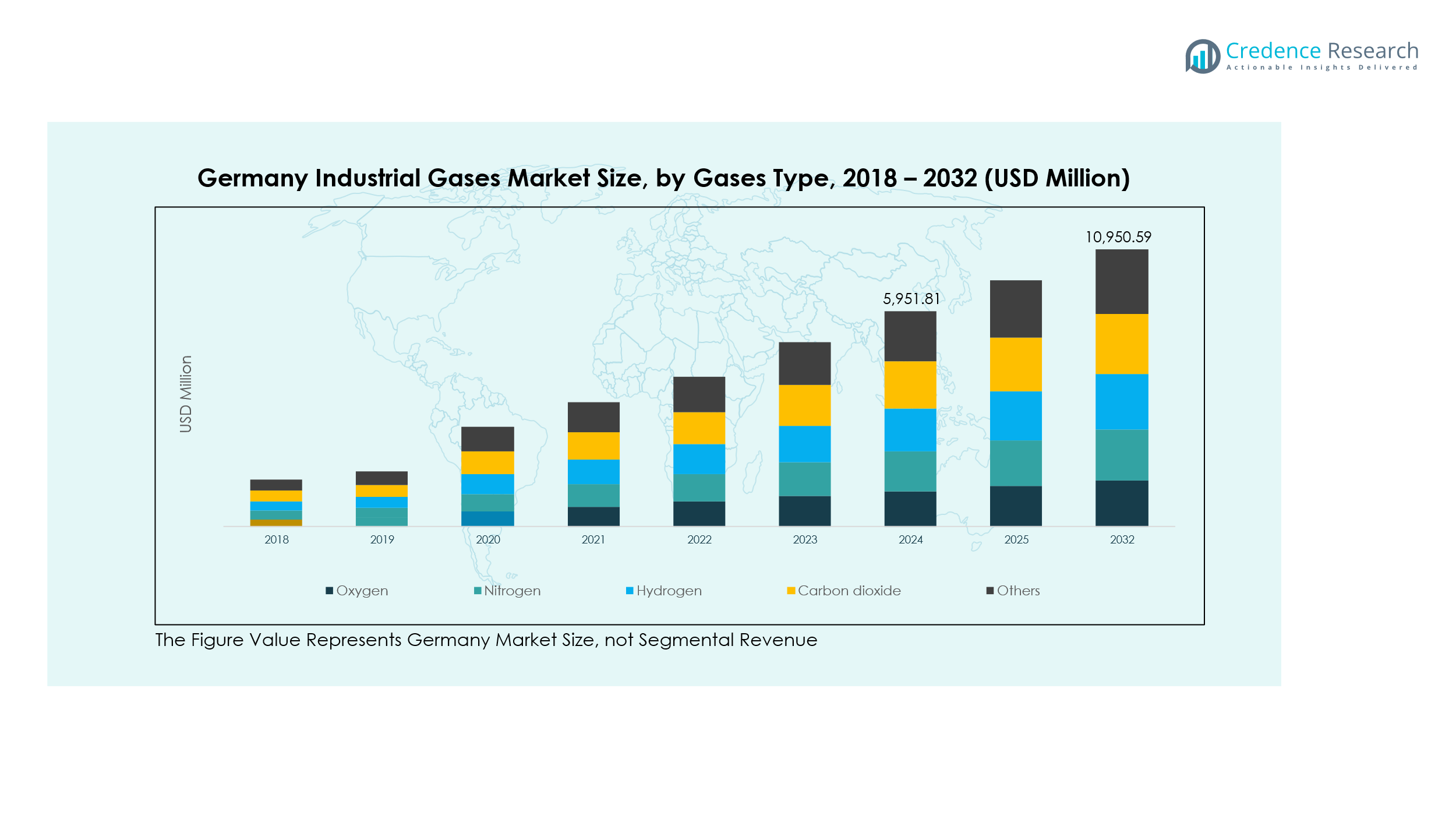

The Germany Industrial Gases Market size was valued at USD 4,663.96 million in 2018, increased to USD 5,951.81 million in 2024, and is anticipated to reach USD 10,950.59 million by 2032, expanding at a CAGR of 7.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Industrial Gases Market Size 2024 |

USD 5,951.81 million |

| Germany Industrial Gases Market, CAGR |

7.92% |

| Germany Industrial Gases Market Size 2032 |

USD 10,950.59 million |

Rising demand from manufacturing, chemicals, metallurgy, and healthcare sectors is fueling the growth of the Germany Industrial Gases Market. Increasing adoption of industrial gases for welding, cutting, cooling, and medical applications strengthens its market expansion. The country’s focus on sustainable industrial practices, adoption of green hydrogen, and rising investments in energy transition projects further drive consumption. Major gas suppliers are optimizing infrastructure and expanding on-site generation to enhance operational efficiency and meet rising demand from industrial clusters.

Regionally, Western and Southern Germany hold a leading position due to the presence of strong automotive, electronics, and healthcare industries. Northern Germany is emerging as a key growth area with large-scale renewable and hydrogen energy projects driving gas demand. Eastern regions are witnessing gradual expansion, supported by infrastructure upgrades and new investments in chemicals and metal fabrication industries. These regional dynamics collectively contribute to the country’s dominant role within the European industrial gases market landscape.

Market Insights:

- The Germany Industrial Gases Market was valued at USD 4,663.96 million in 2018, reached USD 5,951.81 million in 2024, and is expected to hit USD 10,950.59 million by 2032, expanding at a CAGR of 7.92% during 2024–2032.

- Western Germany (41%), Southern Germany (28%), and Northern Germany (18%) together dominate the national market due to their concentration of automotive, manufacturing, and renewable energy industries. Strong infrastructure and dense industrial clusters sustain their leadership positions.

- Eastern Germany (13%) emerges as the fastest-growing region, supported by expanding semiconductor and clean energy production facilities that increase industrial gas consumption across new manufacturing zones.

- In 2024, oxygen accounted for nearly 34% of total market revenue, driven by strong demand from healthcare, metallurgy, and chemical industries.

- Nitrogen contributed around 26% share, reflecting its widespread use in packaging, electronics, and industrial cooling applications across Germany’s manufacturing landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Manufacturing and Automotive Sectors

The Germany Industrial Gases Market experiences strong growth due to increasing applications in automotive and manufacturing industries. Gases such as oxygen, nitrogen, and argon support processes like welding, cutting, and metal fabrication. The country’s robust automotive sector drives steady consumption to support assembly lines and component manufacturing. Expanding use of industrial gases in additive manufacturing and precision engineering further strengthens market growth. Manufacturers are adopting on-site gas generation systems to improve operational efficiency. This industrial expansion aligns with Germany’s commitment to advanced manufacturing technologies. It continues to drive steady adoption across key production sectors.

- For instance, Linde Material Handling Germany showcased its latest AI-controlled automation systems and new electric forklift trucks capable of handling up to 2 metric tons at LogiMAT 2025, highlighting the integration of digital twins and real-time material flow optimization for advanced manufacturing applications.

Growing Role of Healthcare and Pharmaceuticals

Demand for medical-grade gases like oxygen, carbon dioxide, and nitrous oxide rises with the healthcare sector’s expansion. Hospitals and research facilities rely on continuous gas supply for diagnostics, respiratory therapy, and sterilization. The growing pharmaceutical industry boosts the need for gases in synthesis, packaging, and cryogenic storage. It supports stringent purity and quality standards defined by European regulations. Increased investments in life sciences and biotechnology strengthen domestic gas distribution networks. The COVID-19 pandemic accelerated medical oxygen production and infrastructure upgrades nationwide. The Germany Industrial Gases Market benefits from these developments, reinforcing its critical role in healthcare and life sciences. Continuous advancements in cryogenic and cylinder technologies ensure reliability and safety in gas delivery systems.

- For instance, Messer Healthcare Germany complies with national and European Pharmacopoeia standards, providing reliable supply for medically regulated gases through regulated consultations, installation, and ongoing maintenance of supply systems. The company is recognized for maintaining extremely high supply reliability and direct distribution to hospitals across Germany.

Shift Toward Renewable Energy and Hydrogen Economy

Germany’s energy transition policies encourage the use of green hydrogen and renewable-based gas solutions. Industrial gases play a major role in hydrogen production, storage, and distribution. The government supports pilot projects that integrate hydrogen into power generation and transportation. It helps industries cut carbon emissions and align with EU decarbonization targets. Major gas suppliers are investing in electrolysis facilities and renewable power integration. Industrial clusters are adopting low-carbon gases to improve sustainability metrics. This shift toward cleaner production methods fuels innovation and infrastructure development. The Germany Industrial Gases Market positions itself as a central enabler of the national energy transition.

Expansion of Electronics, Food, and Chemical Processing Industries

The electronics, chemical, and food processing industries rely heavily on industrial gases for precision and preservation. Semiconductor manufacturing uses ultra-high purity gases to ensure quality and yield efficiency. Food and beverage processors use nitrogen and carbon dioxide for packaging, freezing, and carbonation. Chemical manufacturers employ oxygen, hydrogen, and ammonia gases in synthesis and refining. It ensures consistent performance, safety, and environmental compliance across production cycles. Growing domestic and export demand strengthens gas production capacity in these sectors. Companies are enhancing gas recovery and purification systems to meet rising sustainability goals. This industrial diversification continues to sustain the Germany Industrial Gases Market momentum.

Market Trends:

Advancement in Cryogenic Storage and Distribution Technologies

The Germany Industrial Gases Market is witnessing rapid innovation in cryogenic storage and distribution. Modern gas delivery systems now feature enhanced insulation, automation, and IoT integration. These upgrades improve operational efficiency, reduce losses, and ensure supply continuity. The adoption of smart monitoring systems optimizes logistics for industrial and medical customers. Energy-efficient vaporization units are being integrated into existing networks to minimize carbon footprint. Companies are also introducing mobile cryogenic units for smaller industrial users. The rising emphasis on sustainability promotes lightweight, recyclable storage materials. These innovations collectively modernize gas handling and strengthen supply chain resilience.

- For instance, Air Liquide is renowned in Germany for developing cryogenic containers with advanced insulation and lightweight composite materials, enabling longer storage and reduced thermal losses for healthcare and scientific research applications. Their collaborations with leading materials science partners in Germany are acknowledged as best practices in cryogenic technology innovation.

Adoption of Digitalization and Industry 4.0 Integration

Digital transformation reshapes gas manufacturing, storage, and supply operations. Automation and predictive analytics enable real-time process control and demand forecasting. Industrial gas producers integrate digital twins and AI tools for equipment maintenance and optimization. It supports improved safety, energy management, and product traceability. Digital control systems enhance collaboration between suppliers and end-users. Smart sensors and connected infrastructure reduce downtime and operational costs. Companies in Germany increasingly invest in digital platforms for order tracking and customer service. The trend reflects the nation’s broader Industry 4.0 strategy that drives efficiency and competitiveness.

- For instance, Linde Material Handling Germany won the “materialfluss Product of the Year 2025” award in Software and Sensor Technology for its Reverse Assist Radar system, which automatically prevents collision in industrial vehicles by alerting operators and overriding drive commands when necessary—ensuring up to a braking effect of 3 m/s², regardless of lighting conditions.

Sustainability and Low-Carbon Gas Solutions

Environmental sustainability influences every level of industrial gas production. The shift toward green hydrogen and carbon capture utilization promotes cleaner industrial ecosystems. Gas suppliers are transitioning to renewable-powered production and low-emission logistics. It aligns with the national climate-neutral targets under Germany’s energy framework. Research in CO₂ reuse technologies and circular economy models is expanding. Producers are deploying renewable feedstocks and closed-loop recovery systems to reduce waste. Corporate customers prefer low-carbon gases for branding and compliance purposes. This transition toward sustainability defines a core long-term trend in the Germany Industrial Gases Market.

Rise of Strategic Partnerships and M&A Activities

The market shows growing collaboration between gas manufacturers, technology providers, and industrial clients. Strategic partnerships accelerate innovation in hydrogen infrastructure, renewable applications, and advanced materials. Acquisitions expand regional presence and diversify gas portfolios across industrial sectors. It encourages sharing of resources and enhances supply reliability. Companies are forming alliances with automotive and chemical firms for long-term contracts. These partnerships also enable faster deployment of green and specialty gases. Mergers among leading suppliers strengthen pricing stability and operational scale. The Germany Industrial Gases Market benefits from these consolidations and cooperative frameworks.

Market Challenges Analysis:

High Energy Costs and Stringent Environmental Regulations

The Germany Industrial Gases Market faces pressure from rising energy costs and strict emission norms. Gas production, particularly air separation and liquefaction, demands significant electricity input. Fluctuating energy prices directly affect profit margins and pricing stability. Environmental policies under EU and national frameworks impose carbon taxes and operational restrictions. Producers must invest in renewable energy integration and cleaner production technologies to remain compliant. These upgrades require high capital expenditure and extended payback periods. Smaller suppliers struggle to compete due to limited financial and technological resources. Maintaining competitiveness while achieving sustainability targets remains a primary challenge for the industry.

Infrastructure Limitations and Supply Chain Vulnerabilities

Infrastructure constraints and logistics issues hinder market scalability and responsiveness. Limited pipeline networks restrict efficient gas transport between industrial clusters. High dependency on road transport adds costs and environmental burden. Supply disruptions caused by energy shortages, geopolitical tensions, or raw material delays affect production schedules. Cryogenic storage and distribution systems require continuous maintenance to ensure reliability. The transition toward hydrogen-based infrastructure adds complexity and regulatory barriers. The Germany Industrial Gases Market must enhance storage capacity, expand regional networks, and adopt digital logistics for resilience. Strengthening domestic infrastructure is essential to support future industrial gas demand sustainably.

Market Opportunities:

Growth in Hydrogen and Renewable Energy Applications

The transition toward clean energy unlocks major opportunities for industrial gas suppliers. Hydrogen’s role in power generation, fuel cells, and mobility expands rapidly. Government initiatives like the National Hydrogen Strategy promote large-scale production and investment. The Germany Industrial Gases Market can capitalize by developing electrolyzer networks and renewable-powered facilities. Partnerships with automotive, chemical, and logistics firms strengthen long-term hydrogen integration. Rising exports of clean hydrogen to other EU nations enhance commercial potential. It supports Germany’s ambition to become a leader in sustainable energy solutions.

Expansion of High-Tech Manufacturing and Healthcare Sectors

Emerging demand from advanced industries creates strong growth potential for gas suppliers. The semiconductor, biotechnology, and pharmaceutical sectors require ultra-pure gases for precision processes. Increasing healthcare investments fuel demand for medical oxygen, carbon dioxide, and specialty gases. The shift toward localized production supports stable supply chains and reduces dependency on imports. The Germany Industrial Gases Market benefits from automation and digitization in production facilities. Strategic investments in R&D and regional infrastructure will accelerate growth and technological competitiveness. This diversification across high-value industries ensures long-term market sustainability.

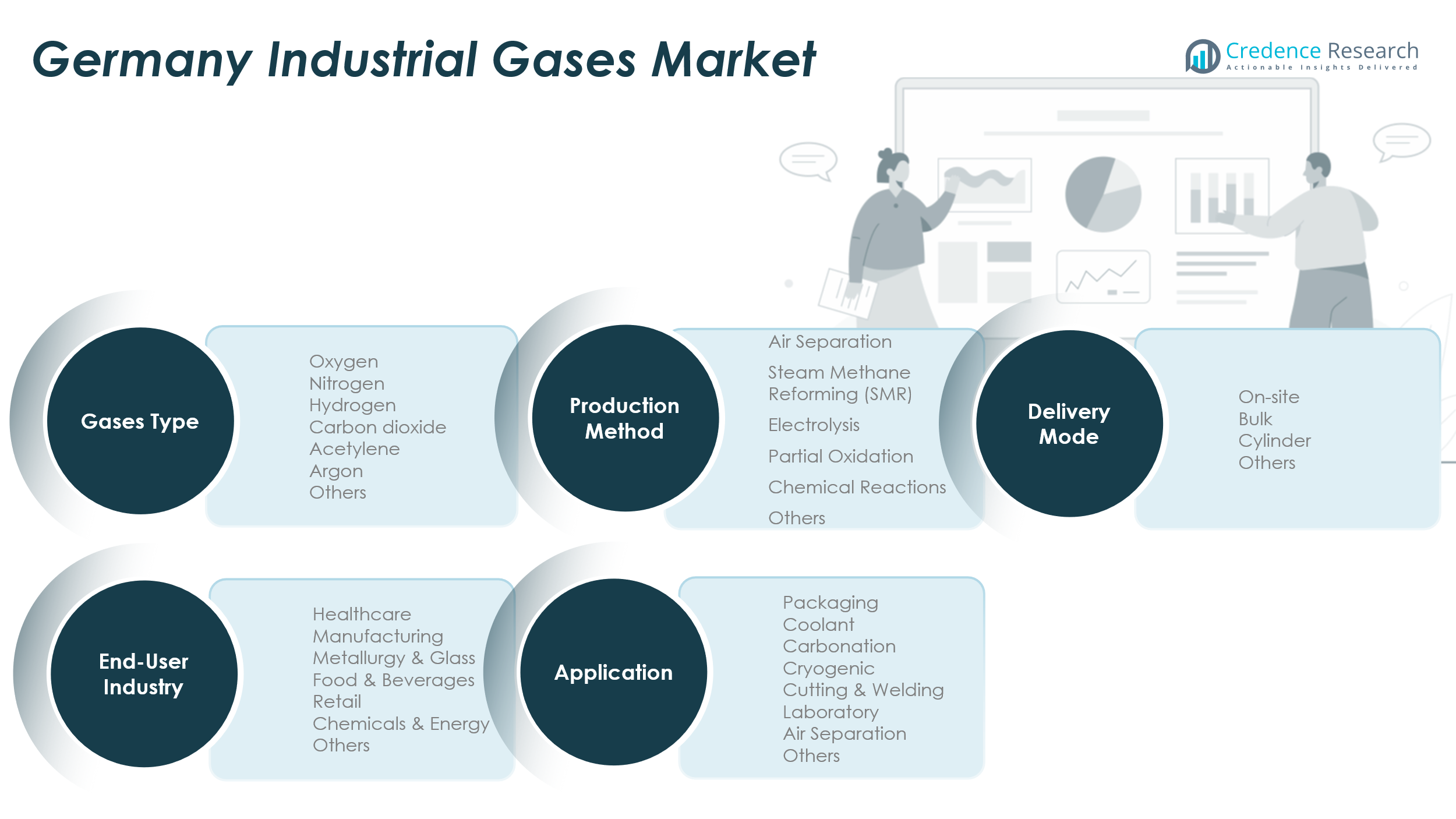

Market Segmentation Analysis:

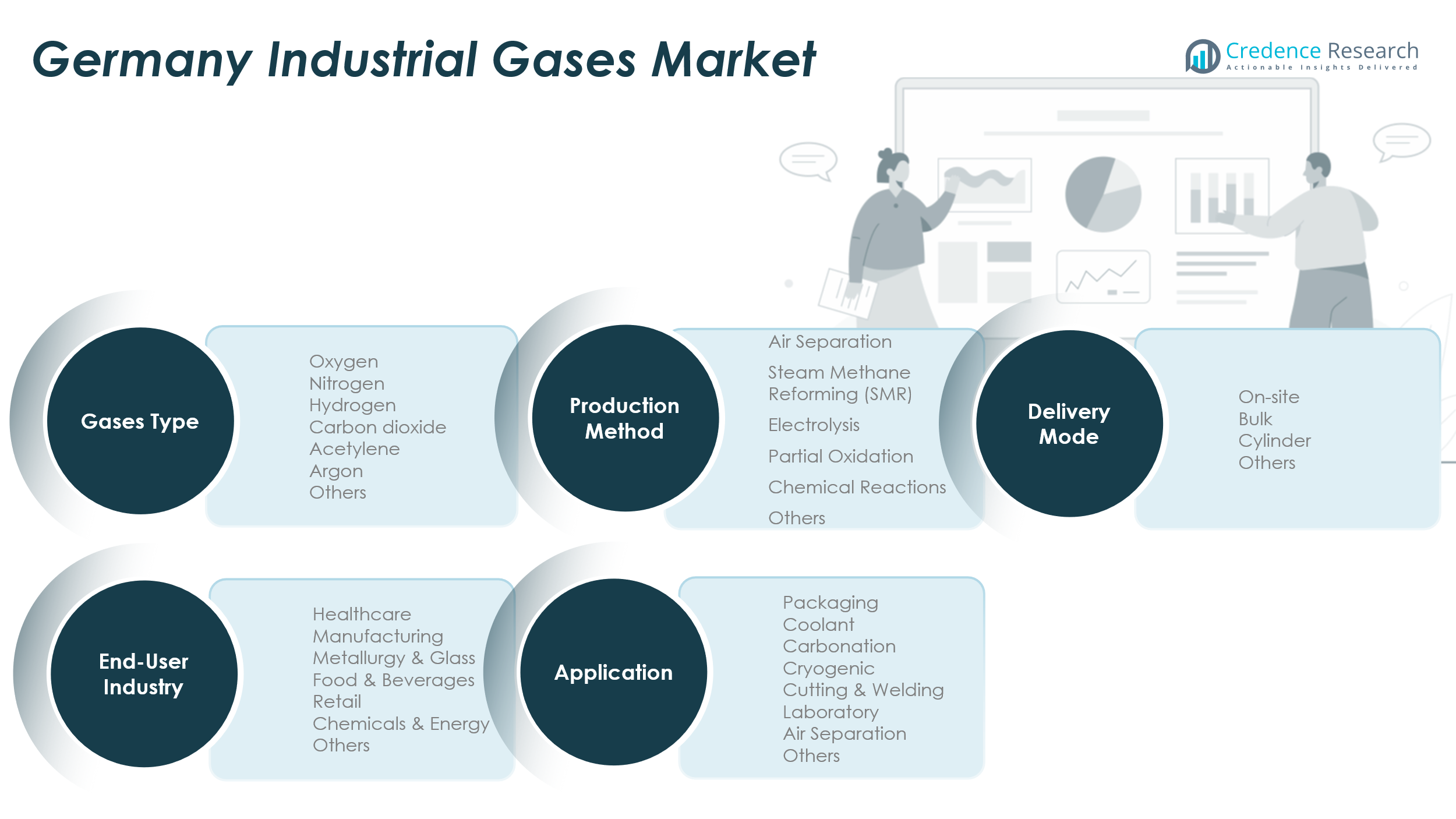

By Gases Type

The Germany Industrial Gases Market is segmented into oxygen, nitrogen, hydrogen, carbon dioxide, acetylene, argon, and others. Oxygen and nitrogen hold major shares due to their extensive use in manufacturing, metal processing, and healthcare. Hydrogen gains traction with the nation’s shift toward renewable and clean energy. Carbon dioxide supports food processing, packaging, and beverage carbonation, while argon and acetylene are essential for welding and specialty industrial processes. The growing demand for ultra-high-purity gases from electronics and research applications drives further diversification across gas types.

- For instance, Messer entered a long-term agreement in 2025 with QatarEnergy to supply high-purity helium, used by German firms for MRI scanners, quantum computing, and semiconductor manufacturing, marking a major technological step in securing advanced gas supply for high-tech industry.

By Application

Key applications include packaging, coolant, carbonation, cryogenic, cutting and welding, laboratory, and air separation processes. Cutting and welding dominate due to the strong manufacturing and automotive sectors. Cryogenic and air separation processes contribute significantly to industrial gas recovery and purification. Laboratory and packaging applications expand with healthcare and food industries demanding precision and purity. The diverse application landscape sustains consistent growth across end-user industries.

- For instance, Linde gases are actively used by German auto parts manufacturers to improve precision and consistency in components, helping the sector achieve enhanced standards in part production and quality control through verified supply partnerships in 2025.

By End-User Industry, Production Method, and Delivery Mode

End-users include healthcare, manufacturing, metallurgy and glass, food and beverages, retail, chemicals, and energy sectors. Healthcare and manufacturing lead consumption supported by Germany’s advanced industrial ecosystem. Production methods such as air separation, steam methane reforming, and electrolysis drive efficient output aligned with clean energy goals. Delivery modes include on-site, bulk, and cylinder supply, ensuring flexibility across large and small-scale operations. This segmentation underscores the versatility and industrial depth of the Germany Industrial Gases Market.

Segmentation:

By Gases Type

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

By Application

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

By End-User Industry

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

By Production Method

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

By Delivery Mode

- On-site

- Bulk

- Cylinder

- Others

Regional Analysis:

Western Germany – Industrial Powerhouse with 41% Market Share

Western Germany dominates the Germany Industrial Gases Market, accounting for 41% of the national share in 2024. The region’s strong industrial ecosystem, including automotive, chemical, and electronics manufacturing hubs, drives consistent gas consumption. Cities such as Düsseldorf, Cologne, and Dortmund host major production and distribution facilities that support both domestic and export demand. The presence of leading industrial gas suppliers and integrated infrastructure networks ensures reliable supply and cost efficiency. Strong government focus on decarbonization and green hydrogen adoption supports expansion across energy-intensive industries. It continues to lead innovation through investment in on-site generation and renewable-powered facilities.

Southern Germany – High-Tech and Automotive Cluster with 28% Market Share

Southern Germany holds 28% of the total market share, driven by its advanced automotive and machinery manufacturing base. Regions like Bavaria and Baden-Württemberg account for significant gas consumption in metal fabrication, healthcare, and semiconductor industries. The presence of global automotive manufacturers and high-tech production facilities creates steady demand for oxygen, nitrogen, and argon. Energy-efficient production methods and the rise of hydrogen fuel initiatives strengthen its role in Germany’s energy transition. It also benefits from dense R&D networks and industrial partnerships promoting sustainable gas solutions. Southern Germany’s combination of innovation and industrial strength continues to anchor its position in the national market.

Northern and Eastern Germany – Emerging Renewable and Industrial Growth Regions (31% Combined Share)

Northern and Eastern Germany collectively represent 31% of the market share, emerging as key growth regions in renewable energy and logistics-driven industrial development. Northern Germany benefits from major hydrogen and offshore wind projects that create rising demand for clean gases. Industrial ports such as Hamburg and Bremen facilitate large-scale import and export activities for cryogenic and liquefied gases. Eastern Germany, led by Saxony and Brandenburg, is expanding its semiconductor, chemical, and energy production facilities. It experiences growing investment in air separation and gas storage infrastructure. The continuous industrial diversification across these regions enhances supply resilience and supports balanced nationwide market growth within the Germany Industrial Gases Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Messer Group GmbH

- Linde plc

- Air Products Germany

- SOL Deutschland (SOL Group)

- SIAD Deutschland (SIAD S.p.A. operations)

- Westfalen Group

Competitive Analysis:

The Germany Industrial Gases Market is characterized by a highly consolidated competitive landscape led by global and domestic players such as Linde plc, Messer Group GmbH, Air Products Germany, SOL Deutschland, SIAD Deutschland, and Westfalen Group. These companies maintain strong positions through advanced gas technologies, extensive distribution networks, and long-term contracts with major industries. It focuses on capacity expansion, innovation in green hydrogen, and digital optimization to strengthen competitiveness. Strategic collaborations with automotive, energy, and chemical sectors enhance product reach and operational efficiency. Continuous investment in sustainability and renewable integration remains a key differentiator in market leadership.

Recent Developments:

- In September 2025, Messer Group GmbH secured a significant long-term partnership with QatarEnergy, one of the world’s largest producers of helium. This agreement ensures a robust and diversified supply of high-purity helium to Messer’s global customer base, enhancing reliability for industrial users in Germany and worldwide.

- In August 2024, Air Products Germany was part of a major portfolio transaction when Honeywell completed its acquisition of Air Products’ liquefied natural gas (LNG) process technology and equipment business.

- In July 2025, SOL Deutschland, a subsidiary of the SOL Group, finalized the acquisition of 100% of Freyco, a German technical gases company. This move was part of a series of acquisitions consolidating SOL Group’s presence in the European industrial and medical gases markets with particular focus on specialized segments.

Report Coverage:

The research report offers an in-depth analysis based on gases type, application, end-user industry, production method, and delivery mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Hydrogen production expansion will strengthen Germany’s shift toward a clean energy economy.

- Demand from healthcare and life sciences will sustain growth in medical gases.

- Automation and digitalization will improve efficiency in gas supply and monitoring systems.

- Adoption of electrolysis and low-carbon production will accelerate sustainability goals.

- Industrial collaboration will enhance infrastructure for hydrogen and renewable gases.

- Growth in semiconductor and electronics manufacturing will drive demand for high-purity gases.

- Cryogenic and on-site supply models will gain traction among industrial clients.

- Energy transition policies will encourage investment in carbon capture and reuse projects.

- Domestic manufacturing recovery will boost oxygen and nitrogen consumption rates.

- The Germany Industrial Gases Market will continue evolving through innovation and green technology integration.