Market Overview

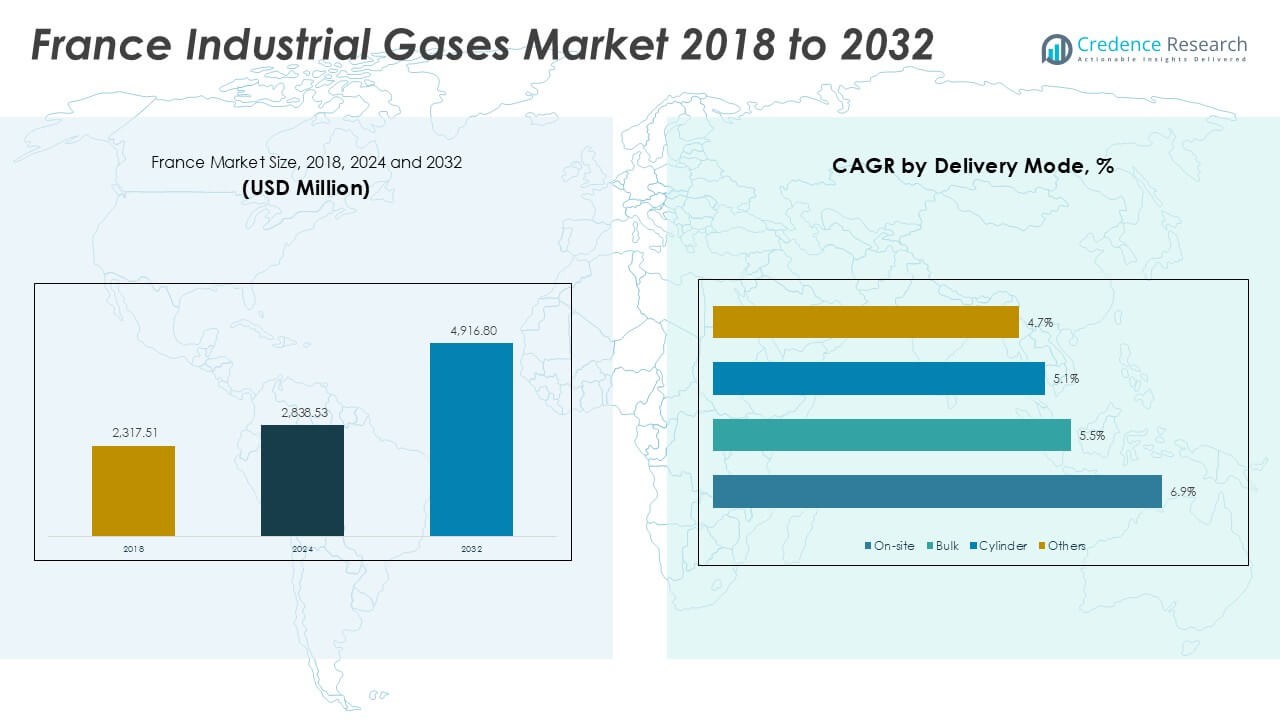

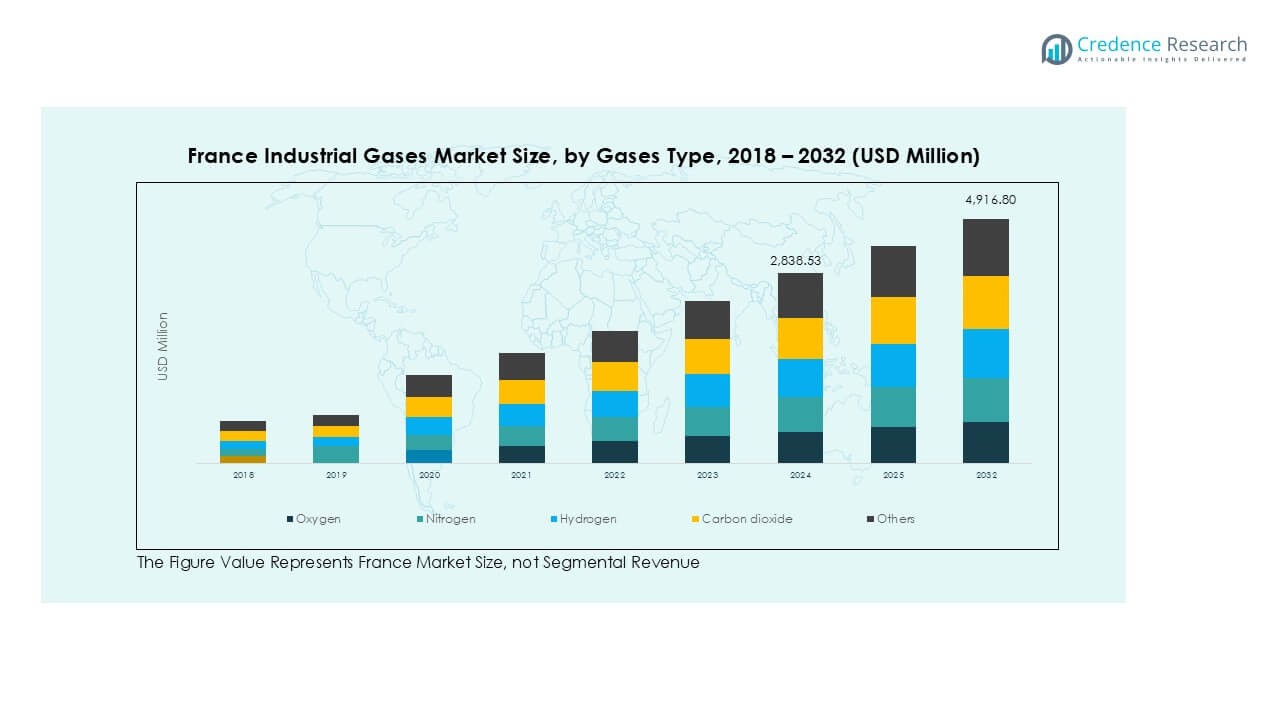

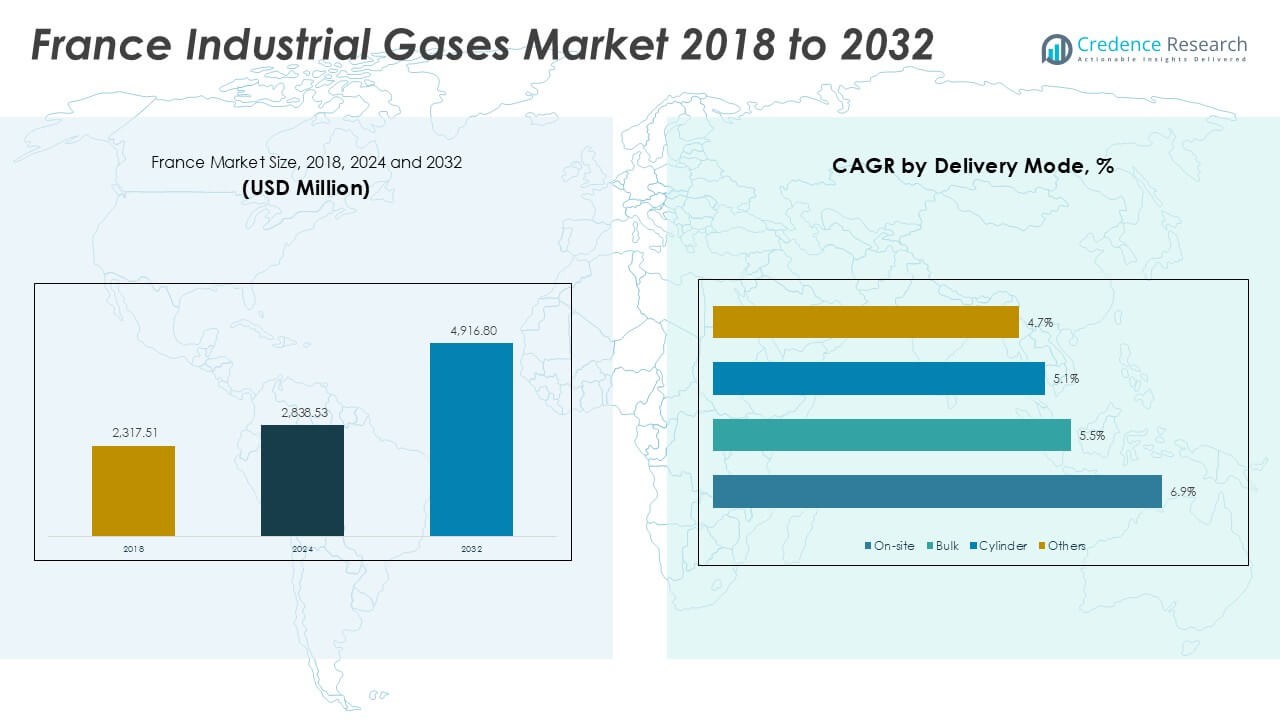

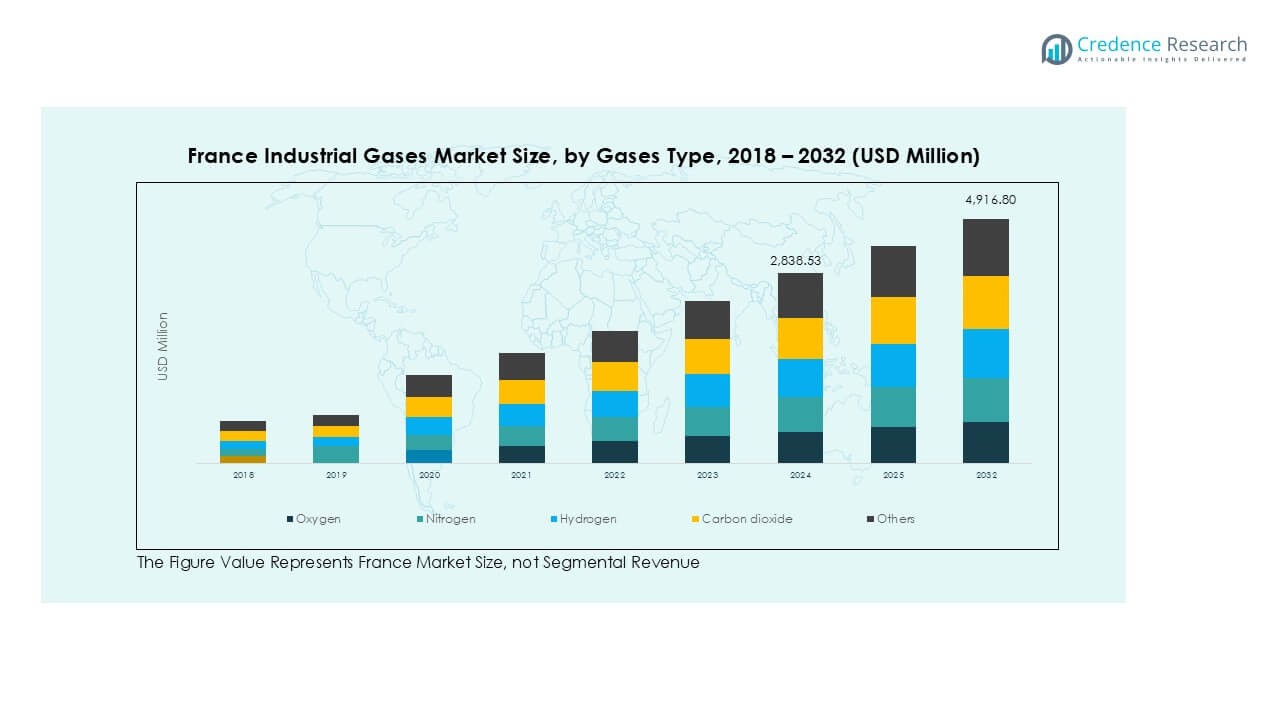

France Industrial Gases market size was valued at USD 2,317.51 million in 2018 and grew to USD 2,838.53 million in 2024. The market is anticipated to reach USD 4,916.80 million by 2032, registering a CAGR of 7.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Industrial Gases Market Size 2024 |

USD 2,838.53 Million |

| France Industrial Gases Market, CAGR |

7.11% |

| France Industrial Gases Market Size 2032 |

USD 4,916.80 Million |

The France industrial gases market is led by major players such as Air Liquide S.A., Linde plc, Air Products France, Messer France, and SOL France, with Air Liquide S.A. holding the largest share due to its strong production capacity and extensive distribution network. These companies focus on expanding hydrogen infrastructure, developing on-site gas generation solutions, and supporting decarbonization initiatives. North France leads the market with 32% share, driven by its strong manufacturing and port activities, followed by South France at 20%, supported by aerospace and petrochemical industries. West, Central, and Eastern France collectively contribute the remaining share, ensuring nationwide demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France industrial gases market was valued at USD 2,838.53 million in 2024 and is projected to reach USD 4,916.80 million by 2032, growing at a CAGR of 7.11% during the forecast period.

- Demand is driven by healthcare expansion, rising oxygen consumption for medical use, and growing manufacturing and metal fabrication activities requiring oxygen, argon, and acetylene for cutting and welding.

- Key trends include the growth of green hydrogen projects, adoption of cryogenic gases in pharmaceuticals and semiconductors, and increased investment in digital monitoring for on-site gas generation systems.

- The market is moderately consolidated, led by Air Liquide S.A., Linde plc, and Air Products France, with companies focusing on sustainability, mergers, and partnerships to strengthen market share.

- North France leads with 32% share, followed by South France at 20%, while oxygen dominates gas type segments with over 30% share due to its widespread industrial and medical applications.

Market Segmentation Analysis:

By Gases Type

Oxygen holds the dominant share of over 30% in the France industrial gases market in 2024. Its widespread use in steelmaking, chemical processing, and healthcare drives demand. Oxygen supports combustion in metal cutting and welding, enhancing efficiency in manufacturing operations. Growing investments in France’s healthcare infrastructure further boost medical-grade oxygen consumption, particularly for respiratory therapies and surgical procedures. Rising demand from wastewater treatment plants for oxidation processes and increasing focus on energy-efficient industrial operations contribute to sustained growth for oxygen, keeping it the leading gas type across diverse end-use sectors in the country.

- For instance, Air Liquide is building the Normand’Hy project in the Port-Jérôme industrial zone, a large-scale electrolyzer with a capacity of at least 200 MW.

By Application

Cutting & welding is the dominant application segment, accounting for more than 28% of the market in 2024. France’s strong automotive, shipbuilding, and heavy machinery sectors fuel demand for industrial gases used in welding, brazing, and metal fabrication. The rise of automated welding solutions in manufacturing plants has increased gas consumption per process. Growth in infrastructure projects and aerospace production has also supported this segment. The demand for shielding gases like argon and oxygen blends is expanding, improving weld quality and efficiency, making cutting & welding the key driver for France’s industrial gas consumption.

- For instance, Linde commissioned a new hydrogen production facility in Chalampé, France, in the first half of 2024 to supply BASF. The facility doubles Linde’s hydrogen capacity in the area and also supplies local merchant customers.

By End-User Industry

Healthcare is the leading end-user segment with over 25% market share in 2024. Expanding hospital infrastructure, rising surgical procedures, and increased home healthcare adoption are major contributors to medical gas demand. Oxygen and nitrous oxide remain essential for anesthesia, ventilation, and emergency care. The COVID-19 pandemic accelerated oxygen capacity expansions, creating a lasting impact on supply chains and hospital storage systems. Ongoing government investments in public health and the growing prevalence of chronic respiratory diseases will continue driving demand for reliable medical gas supply, solidifying healthcare as the most significant consumer of industrial gases in France.

Key Growth Drivers

Expanding Healthcare and Medical Gas Demand

France’s growing healthcare sector is a major driver for industrial gases. Rising hospital admissions, surgical volumes, and emergency care needs fuel demand for medical oxygen, nitrous oxide, and specialty gases. The government’s investments in healthcare infrastructure and aging population boost consumption for respiratory therapies. Home healthcare adoption is also increasing, creating steady demand for portable oxygen cylinders. Regulatory focus on quality standards for medical gases ensures consistent market growth. Together, these factors make healthcare the most significant driver for industrial gas suppliers in the country.

- For instance, in 2024, Messer did invest approximately €0.9 billion in new plants and asset maintenance, particularly focusing on expansion in the US and Asia.

Industrial Manufacturing and Metal Fabrication Growth

France’s strong manufacturing base supports the demand for industrial gases in metal fabrication, automotive, and aerospace sectors. Gases like oxygen, argon, and acetylene are critical for cutting, welding, and forming operations. The expansion of electric vehicle production and aerospace projects increases reliance on precision welding processes, driving gas consumption per unit output. Growth in infrastructure development, including construction and energy projects, further supports this demand. The shift toward automation and robotic welding enhances gas flow efficiency while still contributing to higher aggregate consumption in industrial manufacturing operations nationwide.

- For instance, Messer France commissioned a 3,000 Nm³/h argon and oxygen supply system at Stellantis’ Mulhouse plant in 2024, supporting robotic welding for 1,400 vehicle bodies daily.

Shift Toward Clean Energy and Sustainability

The transition toward renewable energy and decarbonization initiatives is driving demand for hydrogen and carbon dioxide utilization. France is actively investing in green hydrogen production projects, supported by EU funding for energy transition goals. Industrial gases play a critical role in supporting carbon capture and storage (CCS) and power-to-gas projects, aligning with climate targets. Adoption of low-carbon steel production techniques and sustainable manufacturing boosts oxygen and hydrogen demand. These initiatives position industrial gas suppliers as key enablers of France’s decarbonization journey, unlocking long-term growth opportunities for sustainable gas solutions.

Key Trends & Opportunities

Growth of Hydrogen Economy

Hydrogen is emerging as a high-potential segment in France’s industrial gas market. Government initiatives like the €7 billion National Hydrogen Strategy aim to make the country a leader in green hydrogen by 2030. Industrial gas companies are investing in electrolyzer capacity and distribution infrastructure to meet rising demand from mobility, refining, and power generation sectors. Hydrogen fuel cell adoption in heavy transport and public mobility fleets is also growing. These developments create an opportunity for suppliers to expand production and develop integrated hydrogen supply networks.

- For instance, Air Liquide commissioned a 20 MW PEM electrolyzer in Bécancour in 2024, producing 8.2 tons of renewable hydrogen daily for use in public bus fleets and industrial applications.

Advancements in Cryogenic and Specialty Gases

Demand for cryogenic gases and specialty gas mixtures is rising across pharmaceutical, electronics, and research sectors. France’s strong pharmaceutical industry relies on cryogenic nitrogen for drug storage and biotechnology processes. Semiconductor production also drives growth for ultra-high-purity gases. Increasing R&D investments in life sciences and chemical synthesis create opportunities for niche gas suppliers. Technological advances in air separation units and digital monitoring systems improve reliability and reduce energy consumption, making specialty and cryogenic gases an attractive high-margin growth area for producers.

- For instance, Sanofi announced major investments in 2024 to increase its biomanufacturing capabilities in France, including a new vaccine production site in Neuville-sur-Saône and additional capacity in Lyon.

Key Challenges

High Production and Energy Costs

Industrial gas production is energy-intensive, making it highly sensitive to electricity and natural gas prices. Rising energy costs in Europe, coupled with carbon emission charges, put pressure on profit margins. Producers must invest in energy-efficient technologies and renewable-powered production plants to remain competitive. Fluctuating power prices and supply chain disruptions also increase operational risks. Passing these costs to end-users is challenging in competitive segments like manufacturing, limiting overall market growth potential despite rising demand across industries.

Strict Regulatory and Safety Compliance

France has stringent safety regulations for the production, transport, and storage of industrial gases. Compliance with standards for handling hazardous gases, ensuring cylinder integrity, and maintaining medical gas purity requires continuous monitoring and investment. Regulatory audits and certifications increase operational complexity for suppliers. Non-compliance can lead to legal liabilities and supply disruptions, creating financial risk. These strict requirements raise barriers for smaller players and may slow capacity expansion if compliance processes become time-consuming or cost-prohibitive, challenging overall market scalability.

Regional Analysis

North France

North France holds the largest share of around 32% in the France industrial gases market. The region benefits from a strong concentration of automotive, steel, and shipbuilding industries, which drive demand for oxygen, argon, and acetylene. Major ports such as Le Havre and Dunkirk support logistics and intermodal operations, boosting consumption in cutting and welding applications. Expanding healthcare facilities in cities like Lille increase medical oxygen demand. Investment in offshore wind projects and hydrogen hubs further stimulates the market. North France remains a strategic hub for industrial gas suppliers due to its strong manufacturing and export-oriented industrial base.

West France

West France accounts for nearly 18% of the market, driven by its growing food and beverage, agriculture, and aquaculture sectors. Industrial gases are widely used for packaging, carbonation, and preservation processes, supporting the region’s strong dairy and seafood production industries. Ports such as Nantes-Saint-Nazaire facilitate gas imports and distribution, enhancing supply chain efficiency. Growing investments in renewable energy projects, including green hydrogen production, create additional opportunities for gas suppliers. The presence of research centers and pharmaceutical facilities also drives demand for specialty gases, making West France a steadily expanding market for diversified industrial gas applications.

Central France

Central France represents about 15% of the market, supported by its manufacturing and chemical industries. The region is a hub for glass production, metal processing, and energy-intensive sectors that consume significant amounts of oxygen, nitrogen, and hydrogen. Healthcare infrastructure in major cities contributes to steady demand for medical gases. Growing investment in bioenergy and carbon capture projects enhances the role of industrial gases in sustainable manufacturing. Central France’s well-connected logistics network supports gas distribution across the country, making it a crucial supply point. This region shows stable growth driven by industrial modernization and energy transition initiatives.

South France

South France holds nearly 20% of the France industrial gases market, driven by its strong aerospace, petrochemical, and port activities. Toulouse, known as a European aerospace hub, fuels demand for argon, nitrogen, and specialty gases used in precision welding and testing. The petrochemical sector along the Mediterranean coast further drives demand for hydrogen and oxygen. Ports like Marseille-Fos serve as major entry points for LNG and industrial gases, strengthening supply capacity. Growing tourism and healthcare infrastructure expansion boost medical gas usage. The region benefits from ongoing renewable hydrogen projects, aligning with France’s national decarbonization strategy and energy goals.

Eastern France

Eastern France contributes around 15% of the market, driven by its proximity to Germany and Switzerland, which encourages cross-border industrial trade. The region has a strong presence of metallurgy, automotive, and chemical manufacturing industries that rely heavily on oxygen, acetylene, and nitrogen. Strasbourg and Mulhouse are key industrial clusters supporting high gas consumption. Expanding pharmaceutical and biotech sectors in the region boost demand for ultra-high-purity gases. Eastern France is also witnessing investments in hydrogen mobility corridors, which support the adoption of fuel-cell vehicles. This cross-industry demand positions the region as an important contributor to overall market growth.

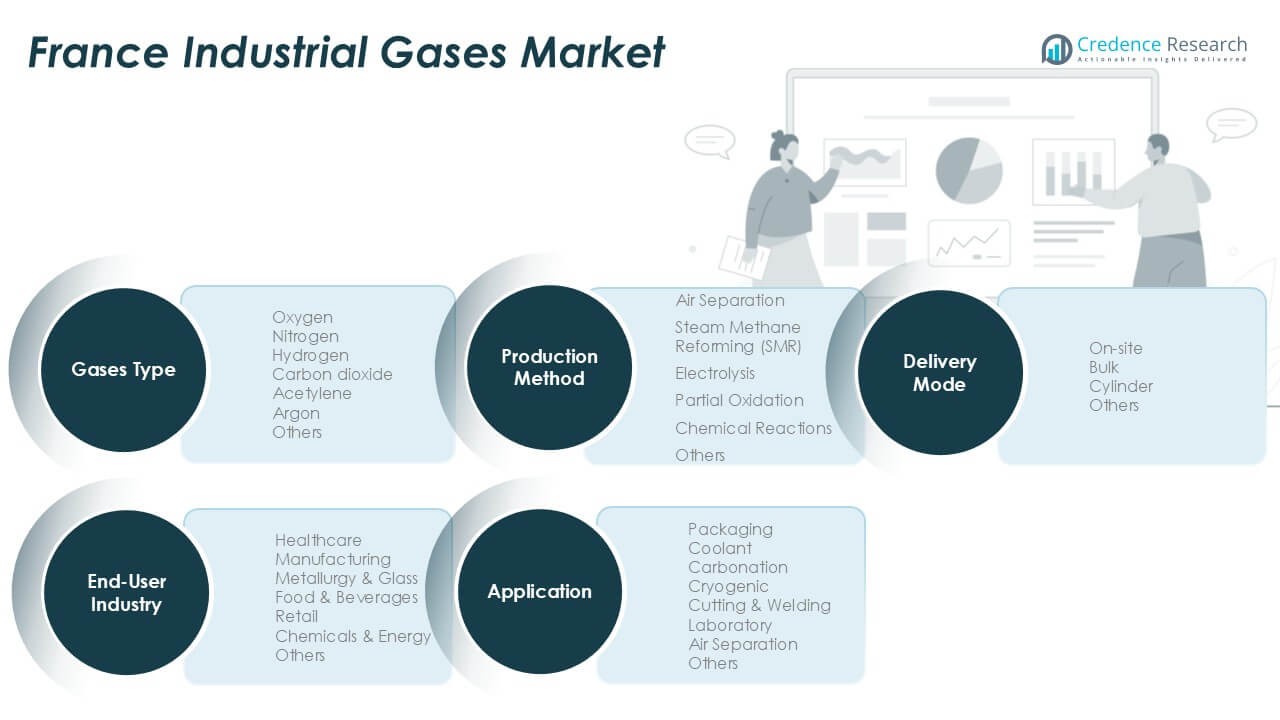

Market Segmentations:

By Gases Type

- Oxygen

- Nitrogen

- Hydrogen

- Carbon Dioxide

- Acetylene

- Argon

- Others

By Application

- Packaging

- Coolant

- Carbonation

- Cryogenic

- Cutting & Welding

- Laboratory

- Air Separation

- Others

By End-User Industry

- Healthcare

- Manufacturing

- Metallurgy & Glass

- Food & Beverages

- Retail

- Chemicals & Energy

- Others

By Production Method

- Air Separation

- Steam Methane Reforming (SMR)

- Electrolysis

- Partial Oxidation

- Chemical Reactions

- Others

By Delivery Mode

- On-site

- Bulk

- Cylinder

- Others

By Geography

- North France

- West France

- Central France

- South France

- Eastern France

Competitive Landscape

The France industrial gases market is moderately consolidated, with leading players including Air Liquide S.A., Linde plc, Air Products France, Messer France, and SOL France. Air Liquide S.A. holds a dominant position, leveraging its extensive production facilities, strong distribution network, and diversified product portfolio across healthcare, manufacturing, and energy sectors. Linde plc and Air Products focus on advanced hydrogen solutions and cryogenic applications, strengthening their presence in clean energy initiatives. Regional players like SIAD France and Westfalen France cater to niche applications and provide customized solutions, intensifying competition. Companies are investing in digital monitoring, on-site gas generation, and renewable-powered production plants to meet sustainability targets and reduce carbon footprints. Strategic mergers, acquisitions, and partnerships are common as players aim to expand market reach and enhance technological capabilities. Competitive pricing, reliability of supply, and adherence to stringent safety regulations remain key differentiators driving market share in this evolving industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Air Liquide S.A.

- Linde plc

- Air Products France

- Messer France

- SOL France

- SIAD France

- Airgas/AL France

- Westfalen France

- Praxair France

- Messer Group

Recent Developments

- In October 2024, Air Liquide announced to supply oxygen to LG Chem for their electric vehicle battery plant in the U.S. Supplying oxygen to LG Chem’s future cathode active material plant, the Group will be supporting the growth of the battery ecosystem in the U.S. This investment will increase the Group’s footprint in a key region and support the development of its industrial merchant market.

- In October 2024, Linde announced an agreement with Tata Steel to obtain and manage two additional Air Separation Units (ASUs) and enhance industrial gas supply to Tata Steel in Odisha, India. This arrangement will more than double Linde’s on-site capacity at Tata Steel’s Kalinganagar facility, where it presently runs two plants. The new ASUs, anticipated to be operational by 2025, will deliver oxygen, nitrogen, and argon to aid Tata Steel’s expansion project and cater to the local merchant market. Linde has additionally acquired renewable energy agreements to lower its scope emissions, in line with its 2035 GHG reduction goals.

- In July 2024, Air Liquide announced an investment of USD 104.914 million to support Aurubis AG, a major global provider of non-ferrous metals and one of the largest recyclers of copper worldwide, in Bulgaria and Germany. This investment will finance a new Air Separation Unit (ASU) in Bulgaria and the upgrading of four existing units in Germany. Besides supplying substantial amounts of oxygen and nitrogen for the rising copper and other metal production by Aurubis, these facilities will also assist in the growth of industrial merchant markets in both areas.

- In January 2024, Air Products, a company in industrial gases and clean hydrogen projects, announced the opening of its expanded Project Delivery Centre in Vadodara, India.

- In July 2023, Nippon Sanso Holdings Corporation announced that Matheson Tri-Gas, Inc, NSHD’s U. S. operating entity, has entered into a gas supply contract with PointFive to deliver oxygen for the carbon capture, utilization, and sequestration company’s inaugural Direct Air Capture (DAC*) facility in Texas. MATHESON will invest in and set up an Air Separation Unit to provide oxygen to “Stratos,” PointFive’s DAC facility currently under construction in Ector County, Texas. The oxygen is utilized in the DAC process to generate a pure stream of CO2, which is subsequently securely sequestered in geological reservoirs.

Report Coverage

The research report offers an in-depth analysis based on Gases Type, Application, End-User Industry, Production Method, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France industrial gases market will grow steadily with rising demand from healthcare and manufacturing sectors.

- Adoption of green hydrogen will accelerate as France invests in clean energy and decarbonization projects.

- Expansion of on-site gas generation systems will improve cost efficiency and reduce supply chain dependence.

- Demand for specialty and high-purity gases will rise with growth in pharmaceuticals and semiconductor manufacturing.

- Digitalization and remote monitoring technologies will enhance operational efficiency and safety across production sites.

- Investments in carbon capture and storage will boost oxygen and carbon dioxide utilization.

- Strategic partnerships and mergers will increase as companies seek to expand regional footprints.

- Sustainability regulations will encourage producers to adopt renewable-powered gas production facilities.

- Growth in aerospace and automotive industries will drive higher consumption of welding and shielding gases.

- Regional demand will remain strongest in North and South France, supporting market expansion nationwide.