Market Overview

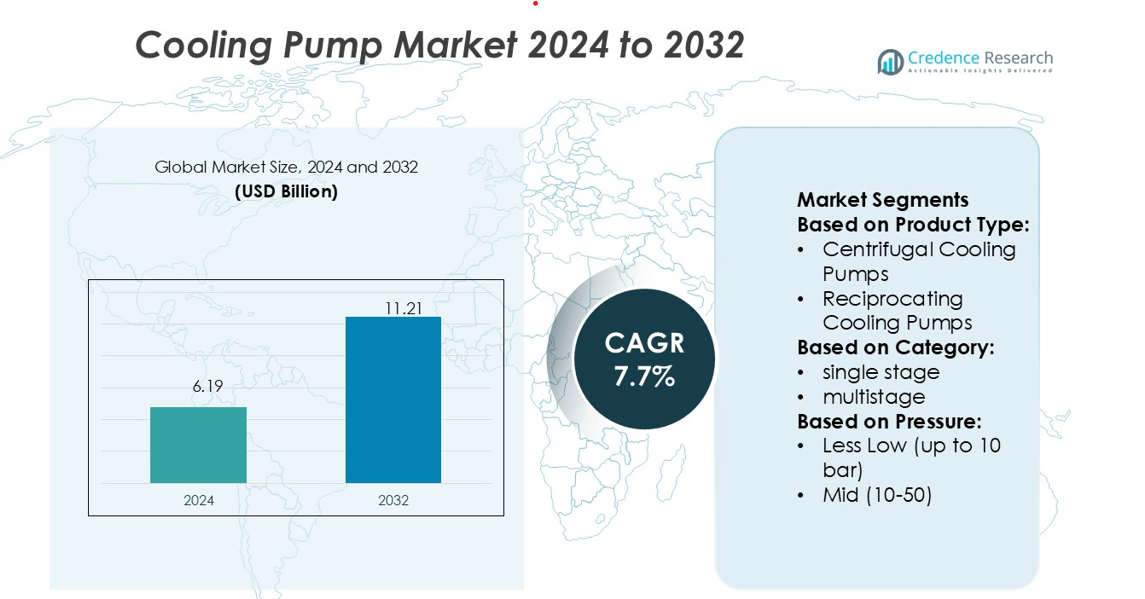

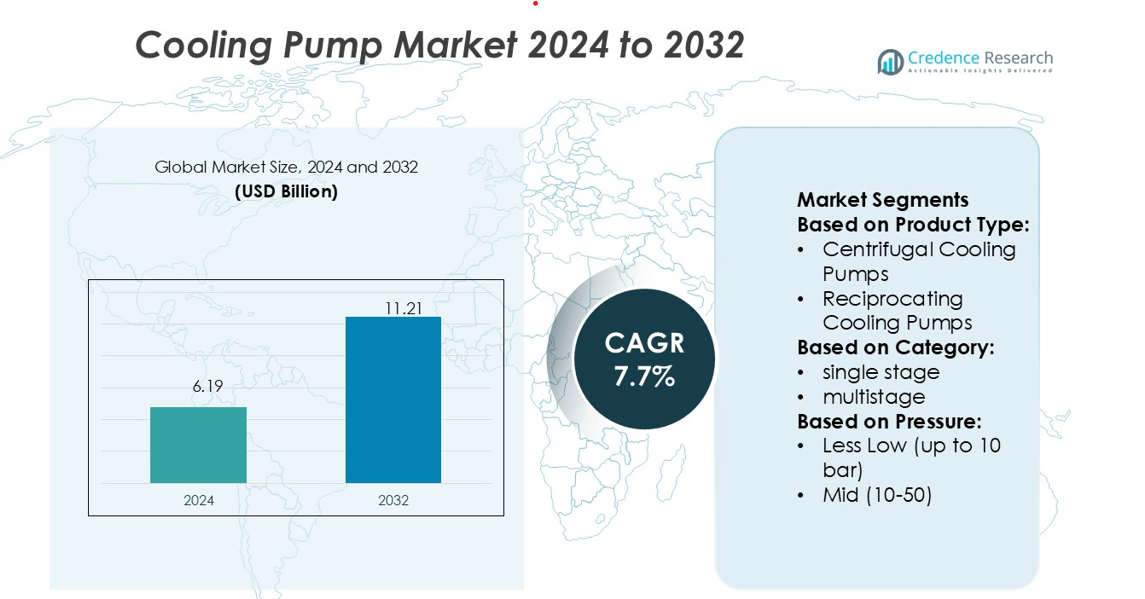

Cooling Pump Market size was valued USD 6.19 billion in 2024 and is anticipated to reach USD 11.21 billion by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cooling Pump Market Size 2024 |

USD 6.19 billion |

| Cooling Pump Market, CAGR |

7.7% |

| Cooling Pump Market Size 2032 |

USD 11.21 billion |

The cooling pump market is characterized by strong competition among major players such as Pentair, Flowserve Corporation, ITT Inc., Grundfos Holding A/S, The Weir Group PLC, EBARA Corporation, Xylem, KSB SE & Co. KGaA, Vaughan Company, and Ingersoll Rand. These companies emphasize technological innovation, digital integration, and energy-efficient product lines to strengthen their global footprint. Grundfos and Xylem lead in smart pump systems, while Flowserve and KSB dominate industrial and high-pressure applications. Asia-Pacific remains the leading region, accounting for 36% of the global market share, driven by rapid industrialization, expanding data centers, and rising investments in sustainable cooling infrastructure across China, India, and Southeast Asia.

Market Insights

- The Cooling Pump Market was valued at USD 6.19 billion in 2024 and is projected to reach USD 11.21 billion by 2032, registering a CAGR of 7.7% during the forecast period.

- Growing demand for energy-efficient cooling systems in manufacturing, power generation, and HVAC applications is driving market expansion globally.

- Smart and IoT-enabled cooling pumps are shaping market trends as industries focus on digital monitoring, automation, and sustainability goals.

- Competitive activity remains high, with key players investing in product innovation and strategic partnerships; Grundfos and Xylem dominate smart solutions, while Flowserve and KSB lead in industrial applications.

- Asia-Pacific holds a 36% market share, leading global demand due to rapid industrialization, infrastructure development, and growth in data centers; centrifugal pumps remain the dominant segment, supported by their efficiency and widespread use across commercial and industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Centrifugal cooling pumps dominate the market with a share exceeding 45%, driven by their energy efficiency and versatility across HVAC, industrial, and power generation applications. These pumps handle large volumes of fluid with low maintenance requirements, making them ideal for continuous operations. Reciprocating cooling pumps find use in high-pressure applications, while axial flow pumps are preferred in cooling towers and marine systems. Emerging designs, such as magnetic-driven pumps, are gaining traction due to their leak-free construction and reliability in sensitive environments like chemical and semiconductor manufacturing.

- For instance, Flowserve’s VCT vertical mixed-flow pumps, for example, deliver up to 150,000 m³/h at heads around 20 m in low-pressure cooling circuits. Reciprocating pumps handle high-pressure workloads.

By Category

Single-stage pumps hold the leading share of the market, accounting for nearly 60%, owing to their simplicity, compact design, and cost-effectiveness. They are extensively deployed in HVAC and industrial cooling systems where moderate head and flow are sufficient. Multistage pumps, however, are witnessing rising demand in power plants and heavy industries that require high pressure and efficiency. Manufacturers are focusing on multistage configurations with enhanced impeller designs to improve hydraulic performance, reduce noise, and extend service life, especially for large-scale cooling circuits.

- For instance, ITT’s Goulds 3430 single-stage double-suction pump handles flows up to 65,000 GPM (≈ 14,763 m³/h) and heads to 745 ft (227 m) for process cooling services.

By Pressure

The mid-pressure segment (10–50 bar) leads the market, representing over 50% share, supported by widespread adoption in industrial cooling, process plants, and commercial facilities. These pumps balance efficiency and pressure capability, making them suitable for both open and closed-loop cooling systems. Low-pressure pumps (up to 10 bar) are widely used in small-scale systems and water circulation, while high-pressure models (above 50 bar) serve in specialized industrial and energy applications. The growing focus on high-efficiency systems is encouraging the use of mid-pressure pumps with advanced seals and variable frequency drives.

Key Growth Drivers

Rising Demand for Industrial Cooling Systems

The increasing need for efficient heat management in manufacturing, power generation, and chemical processing drives market growth. Industries are installing advanced cooling pumps to maintain equipment performance and reduce downtime. Growing production in metal, cement, and petrochemical sectors supports steady demand. Power plants and refineries increasingly rely on centrifugal cooling pumps for continuous circulation and temperature regulation, boosting energy efficiency and system reliability.

- For instance, Weir’s Wear Reduction Technology (WRT®) upgrades on existing installed pumps (WARMAN® and ENVIROTECH® lines) deliver 3–5 % energy savings and increase component lifespan by 30–50 %.

Expansion of HVAC and Data Center Infrastructure

Rapid urbanization and the surge in commercial building projects have increased the installation of HVAC systems requiring reliable cooling pumps. Data centers, which operate under strict thermal control conditions, further drive this demand. Leading operators are investing in energy-efficient pumping systems integrated with variable frequency drives (VFDs) to optimize cooling performance. The expanding IT and cloud infrastructure globally strengthens the market for durable and low-maintenance cooling pumps.

- For instance, EBARA’s EVMSU vertical multistage pump supports HVAC circulation with these specs: flow up to 607 GPM, head up to 930 ft, and working pressure up to 435 psi (30 bar).

Adoption of Energy-Efficient and Smart Pumping Solutions

Governments and industries are focusing on reducing energy consumption and carbon emissions, encouraging the adoption of smart, energy-efficient pumps. Advanced cooling pumps equipped with IoT-enabled monitoring and control systems are improving operational efficiency. Manufacturers are developing pumps that use high-efficiency motors and adaptive control technologies to minimize energy losses. This shift toward digitalized and eco-friendly systems fuels long-term growth in both industrial and commercial applications.

Key Trends & Opportunities

Integration of Variable Frequency Drives (VFDs)

The growing use of VFDs in cooling pumps enables precise speed control and reduces energy wastage. This integration improves system reliability and lowers operational costs. Many industries are upgrading legacy pump systems to VFD-compatible designs, enhancing performance while meeting sustainability goals. Manufacturers offering intelligent VFD-integrated solutions are gaining strong market traction.

- For instance, Xylem’s Bell & Gossett line now offers the e-1510 pump paired with a built-in VFD and IoT intelligence, rated up to 30 HP (22 kW). This “all-in-one” solution combines pump, motor, and VFD in one unit to simplify installation and reduce lifetime costs.

Shift Toward Renewable Cooling Solutions

Rising emphasis on sustainable operations is driving the use of solar and geothermal-powered cooling systems. These systems utilize energy-efficient pumps designed for renewable integration. Companies in manufacturing and commercial real estate are investing in renewable-based cooling infrastructure to meet green certification standards. This trend creates opportunities for innovative, eco-friendly cooling pump designs.

- For instance, KSB has invested in the Austrian heat pump developer ecop, acquiring nearly 20 % of the company to access industrial heat pumps with thermal outputs from 500 kW to 10 MW.

Technological Advancements in Materials and Design

Advances in impeller geometry, corrosion-resistant materials, and magnetic drive technology are improving pump durability and performance. These developments extend service life in demanding environments such as seawater and chemical processing. Manufacturers focusing on modular and maintenance-friendly designs are gaining a competitive edge by offering improved lifecycle cost benefits.

Key Challenges

High Initial and Maintenance Costs

Despite energy savings, the upfront cost of high-efficiency cooling pumps and smart monitoring systems remains a major barrier. Small and medium enterprises often hesitate to invest due to limited budgets. In addition, specialized components and maintenance requirements increase long-term operational costs, particularly in high-pressure and continuous-use systems.

Fluctuating Raw Material Prices and Supply Chain Disruptions

Volatile prices of metals like stainless steel, bronze, and cast iron affect production costs for pump manufacturers. Global supply chain disruptions further delay equipment delivery and increase procurement expenses. These uncertainties limit profit margins and challenge companies striving to maintain stable pricing in competitive markets.

Regional Analysis

North America

North America holds a 28% share of the cooling pump market, driven by strong industrial and commercial adoption. The United States leads due to its expanding data center infrastructure, HVAC modernization, and energy-efficient retrofits. Industries such as oil and gas, food processing, and power generation increasingly rely on centrifugal and multistage cooling pumps. Federal energy regulations and corporate sustainability goals encourage the use of variable frequency-driven systems. Canada’s mining and manufacturing sectors also contribute to steady demand, supported by ongoing investments in eco-friendly and digitally monitored pumping systems.

Europe

Europe accounts for 25% of the market share, supported by stringent energy efficiency standards and decarbonization goals. Countries such as Germany, France, and the U.K. are upgrading industrial cooling infrastructure to comply with the EU’s Energy Efficiency Directive. Growth is fueled by advanced HVAC systems, renewable-powered cooling plants, and rising adoption of magnetic-driven pumps in chemical and water treatment industries. Manufacturers in Europe are focusing on low-noise, corrosion-resistant, and recyclable components, aligning with circular economy principles. Industrial retrofitting and smart pump integration continue to strengthen regional competitiveness.

Asia-Pacific

Asia-Pacific dominates the cooling pump market with a 36% share, led by China, Japan, India, and South Korea. The region’s rapid industrialization, large-scale construction projects, and rising energy demand are major growth factors. Expanding manufacturing bases and semiconductor facilities drive demand for precision cooling solutions. Government incentives for industrial automation and sustainable production are boosting adoption of high-efficiency and IoT-enabled cooling pumps. China leads in large-scale deployment, while India and Southeast Asian countries are emerging as fast-growing markets due to infrastructure upgrades and investments in commercial cooling systems.

Latin America

Latin America holds a 6% market share, driven by the growth of industrial and commercial sectors across Brazil, Mexico, and Chile. Expanding energy, mining, and petrochemical projects increase the need for reliable cooling equipment. The region is witnessing gradual adoption of centrifugal and multistage pumps in HVAC and process cooling applications. Government programs promoting manufacturing development and infrastructure modernization further support demand. However, economic instability and limited technological awareness restrain faster adoption. Companies focusing on cost-effective and energy-efficient pump designs are gaining a competitive edge in this evolving market.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the global share, supported by strong demand from oil, gas, and desalination industries. The UAE and Saudi Arabia are leading adopters, integrating advanced cooling pump systems in industrial plants, data centers, and district cooling networks. Africa’s market is gradually expanding with industrialization in South Africa and Nigeria. Regional initiatives for energy diversification and sustainable water management drive investment in efficient pumping technologies. However, high capital costs and maintenance challenges continue to limit market penetration in several developing economies.

Market Segmentations:

By Product Type:

- Centrifugal Cooling Pumps

- Reciprocating Cooling Pumps

By Category:

By Pressure:

- Less Low (up to 10 bar)

- Mid (10-50)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cooling pump market features key players such as Pentair, Flowserve Corporation, ITT Inc., Grundfos Holding A/S, The Weir Group PLC, EBARA Corporation, Xylem, KSB SE & Co. KGaA, Vaughan Company, and Ingersoll Rand. The cooling pump market is highly competitive, with companies focusing on technological innovation, energy efficiency, and product reliability to strengthen their market presence. Manufacturers are investing in smart pumping systems integrated with IoT and variable frequency drives to enhance performance and reduce operational costs. The growing demand for energy-efficient and low-noise solutions across industrial, commercial, and HVAC applications has driven advancements in pump materials, impeller designs, and control systems. Strategic collaborations, product diversification, and regional expansions remain key strategies to capture emerging opportunities, particularly in Asia-Pacific and the Middle East, where infrastructure and industrial projects are rapidly expanding.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pentair

- Flowserve Corporation

- ITT Inc.

- Grundfos Holding A/S

- The Weir Group PLC

- EBARA Corporation

- Xylem

- KSB SE & Co. KGaA

- Vaughan Company

- Ingersoll Rand

Recent Developments

- In June 2025, Sentinel launched as a dedicated pump solutions provider, offering a wide range of systems for industries such as water treatment, chemicals, and manufacturing. Backed by MechaTronics industry expertise, the company focuses on tailored solutions, dependable service, and high-quality products. With a strong supply network and technical support, Sentinam aims to deliver efficient and reliable pumping solutions.

- In October 2024, Ingersoll Rand expanded its portfolio by acquiring APSCO, Blutek, and UT Pumps, strengthening its presence in compressed air and fluid management. These acquisitions enhance its technological capabilities and market reach across key sectors like wastewater and biogas. The move aligns with the company’s strategy to drive long-term, high-return growth through targeted investments.

- In July 2024, Flowserve Corporation obtained the intellectual assets and ongoing research, and development associated with cryogenic Liquefied Natural Gas (LNG) submerged pump technology, packaging, and systems from NexGen Cryogenic Solutions, Inc., a company based in Arizona that specializes in the design, engineering, and testing of LNG pumps and turbines.

- In June 2024, China commissioned the Heqi-1 industrial nuclear steam project at Tianwan nuclear power plant, designed to supply tonnes of steam annually to petrochemical operations, showcasing integrated cooling system applications.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Category, Pressure and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see growing adoption of energy-efficient and variable speed cooling pumps.

- Smart and IoT-enabled pump systems will become standard in industrial and commercial use.

- Demand will increase in data centers and HVAC applications due to urban expansion.

- Manufacturers will focus on low-maintenance, corrosion-resistant materials for long service life.

- Renewable-powered cooling systems will gain traction to support sustainability goals.

- The integration of predictive maintenance technologies will enhance operational reliability.

- Asia-Pacific will continue to lead global demand with strong industrial development.

- Government energy regulations will accelerate replacement of outdated pump systems.

- Mergers and partnerships will expand product portfolios and market reach.

- Custom-designed modular pumps will grow in use for flexible cooling applications.