Market Overview

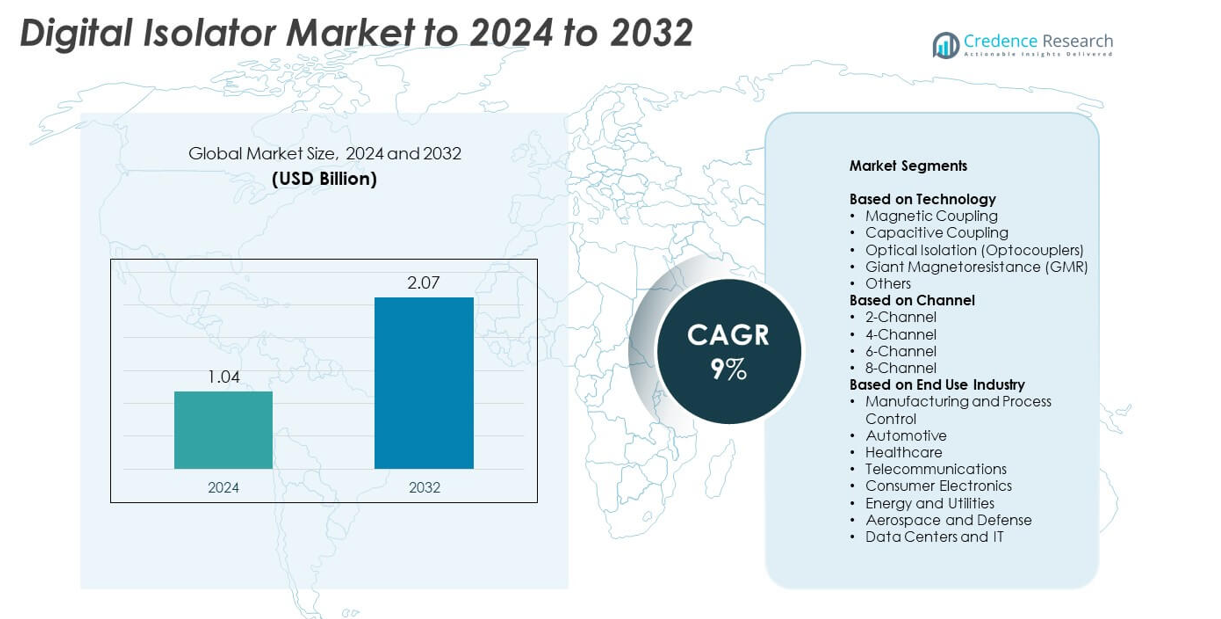

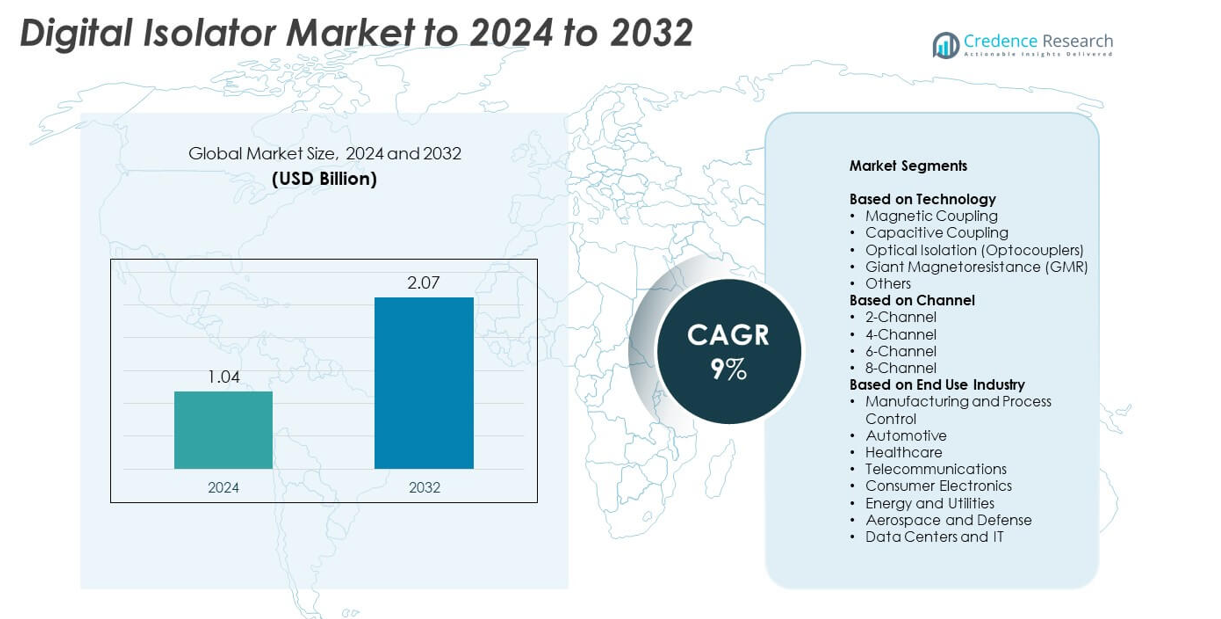

Digital Isolator Market size was valued at USD 1.04 billion in 2024 and is anticipated to reach USD 2.07 billion by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Isolator Market Size 2024 |

USD 1.04 billion |

| Digital Isolator Market, CAGR |

9% |

| Digital Isolator Market Size 2032 |

USD 2.07 billion |

The Digital Isolator market is dominated by major players such as NXP Semiconductors, Murata Manufacturing Co., Ltd., Renesas Electronics Corporation, Analog Devices, Inc., Power Integrations, Texas Instruments, Inc., ON Semiconductor, Infineon Technologies AG, Broadcom Inc., and Maxim Integrated Products, Inc. These companies focus on developing high-speed, energy-efficient isolators to serve industrial automation, automotive, and data center applications. North America led the global market in 2024 with a 36% share, driven by strong demand from electric vehicle production, industrial control systems, and renewable energy infrastructure. Europe and Asia Pacific followed, supported by rising semiconductor production and automation expansion.

Market Insights

- The Digital Isolator market was valued at USD 1.04 billion in 2024 and is projected to reach USD 2.07 billion by 2032, growing at a CAGR of 9%.

- Rising adoption in industrial automation, electric vehicles, and renewable power systems drives market expansion, supported by growing demand for high-speed and energy-efficient data transmission solutions.

- Emerging trends include the shift toward capacitive and GMR-based technologies, integration of IoT-enabled power systems, and increasing innovation in compact, low-power isolator designs.

- The market is highly competitive, with key players focusing on R&D, advanced semiconductor materials, and strategic partnerships to strengthen global presence and product reliability.

- North America held the largest share of 36% in 2024, followed by Europe at 28% and Asia Pacific at 29%, while the magnetic coupling segment dominated the market with a 46% share across major industrial and automotive applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The magnetic coupling segment dominated the Digital Isolator market in 2024 with a 46% share. This technology offers superior signal integrity, high noise immunity, and low power loss compared to optocouplers. Magnetic coupling isolates high-speed digital signals efficiently, making it ideal for industrial automation and automotive electronics. Growing use in motor drives, battery management systems, and power converters enhances its demand. Increasing preference for robust and compact isolation solutions in harsh environments continues to strengthen magnetic coupling’s position as the leading technology in digital isolators.

- For instance, Analog Devices’ ADuM340E supports 150 Mbps and 180 kV/µs CMTI.

By Channel

The 4-channel segment led the market in 2024, accounting for nearly 39% of the total share. Its versatility and balance between performance and cost make it suitable for a wide range of applications, including power supply circuits, data communication, and industrial controls. The 4-channel isolators offer compact design and reduced board space, supporting multi-signal isolation in embedded systems. Rising integration in automotive safety electronics and factory automation systems further boosts adoption. The growing focus on high-density, energy-efficient designs in industrial automation reinforces this segment’s leadership.

- For instance, Texas Instruments’ ISO6741 is a quad-channel digital isolator that supports a data rate of 50 Mbps.

By End Use Industry

The manufacturing and process control segment held the largest market share of around 31% in 2024. The dominance is driven by rising adoption of digital isolators in programmable logic controllers, motor drives, and power monitoring systems. These isolators enhance operational reliability by preventing ground loops and protecting sensitive electronics from voltage transients. The shift toward Industry 4.0 and smart factory initiatives further accelerates usage across automation networks. Increasing demand for noise-resistant communication interfaces in high-voltage industrial setups continues to support strong growth within the manufacturing and process control sector.

Key Growth Drivers

Rising Adoption in Industrial Automation

The increasing use of digital isolators in industrial automation is a key growth driver. Industries are rapidly upgrading to automated systems that require reliable isolation for data communication and power management. Digital isolators offer high-speed signal transmission, lower power consumption, and enhanced safety compared to traditional optocouplers. Growing investments in smart factories and Industry 4.0 technologies are accelerating the integration of digital isolators in motor control, programmable logic controllers, and power inverters, strengthening their demand across global manufacturing facilities.

- For instance, Silicon Labs’ Si88x4x delivers a data rate of 0–100 Mbps and an isolated power of up to 5 W. However, achieving the full 5 W power output may require external components, depending on the specific model and voltage conversion.

Growing Demand for Electric and Hybrid Vehicles

The expanding electric vehicle industry significantly boosts the digital isolator market. Automakers use isolators in battery management systems, onboard chargers, and powertrain electronics to ensure safe and efficient operation. These isolators protect low-voltage control circuits from high-voltage systems and enable precise signal transmission in EV architectures. The global shift toward sustainable mobility and increasing EV production by major automotive brands continue to drive demand for high-reliability isolation solutions designed for harsh operating environments.

- For instance, onsemi’s NCP51561 provides 5 kVrms isolation and 4.5 A/9 A peak drive.

Increasing Integration in Data Centers and Power Systems

Rapid expansion of data centers and renewable power systems is another key growth driver. Digital isolators are used in power converters, communication buses, and high-speed interface modules to ensure data integrity and prevent electrical interference. As global data traffic grows, operators seek efficient power isolation solutions for server protection and uninterrupted operation. Similarly, renewable power generation systems rely on isolators for inverter control and grid connectivity. The rising focus on energy efficiency and safe signal transmission fuels strong adoption in these applications.

Key Trends & Opportunities

Shift Toward Capacitive and GMR-Based Isolation Technologies

A major trend in the digital isolator market is the shift toward capacitive and giant magnetoresistance (GMR) technologies. These newer designs offer higher data rates, lower power usage, and smaller footprints compared to optical systems. Manufacturers are focusing on developing next-generation isolators that deliver better electromagnetic compatibility and withstand extreme industrial conditions. As end users move away from optocouplers, this transition opens opportunities for high-performance isolators optimized for precision control, power management, and fast data communication across critical sectors.

- For instance, Skyworks’ Si864x series reaches 150 Mbps and up to 5 kVrms isolation.

Emergence of IoT and Smart Power Devices

Growing adoption of IoT and smart power systems creates major opportunities for digital isolator manufacturers. These isolators are essential for ensuring secure data transmission between sensors, controllers, and communication modules. The proliferation of smart grids, energy storage units, and connected industrial devices drives continuous demand for efficient isolation components. Additionally, IoT-based monitoring systems in healthcare, manufacturing, and utilities increasingly rely on digital isolators to maintain data accuracy and prevent signal distortion in complex, high-noise environments.

- For instance, Maxim Integrated’s MAX14934 offers four channels and 5 kVrms isolation to 125 °C.

Key Challenges

High Design Complexity and Cost Constraints

One major challenge for the digital isolator market is the complexity and cost of advanced isolation technologies. Designing isolators that deliver both high-speed data transfer and robust noise immunity requires specialized materials and intricate circuitry. These requirements raise manufacturing costs, particularly for high-performance and automotive-grade products. Smaller manufacturers struggle to match the cost-efficiency and reliability standards of leading suppliers, limiting market entry and adoption in cost-sensitive sectors such as consumer electronics and low-voltage industrial devices.

Competition from Alternative Isolation Technologies

The market faces challenges from competing technologies such as advanced optocouplers and hybrid isolation systems. While digital isolators offer superior performance, optocouplers remain preferred in low-cost and low-speed applications. Some industries still favor established solutions due to their long-term reliability and lower integration risk. Additionally, continuous innovation in optical and transformer-based isolation limits the pace of complete market transition. Overcoming this competition requires manufacturers to emphasize reliability, scalability, and long-term energy savings in digital isolator designs.

Regional Analysis

North America

North America dominated the digital isolator market in 2024 with a 36% share. The region’s leadership is driven by strong demand from industrial automation, electric vehicles, and data center applications. The United States remains a major hub for semiconductor innovation and advanced electronics manufacturing. Growing adoption of isolation technologies in automotive battery systems and power management units also supports market expansion. Additionally, investments in renewable energy infrastructure and the integration of Industry 4.0 solutions strengthen the region’s dominance, with Canada contributing significantly through its expanding energy and industrial equipment sectors.

Europe

Europe held a 28% share of the digital isolator market in 2024, driven by strong regulatory focus on energy efficiency and industrial safety. Countries such as Germany, France, and the United Kingdom lead adoption across automotive, manufacturing, and renewable energy sectors. Increasing deployment of isolators in EV powertrains, smart grids, and process automation supports consistent demand. The presence of established semiconductor companies and growing investments in power electronics research further enhance technological development. Rising demand for low-emission transportation and smart factory systems continues to position Europe as a key growth region for digital isolators.

Asia Pacific

Asia Pacific accounted for nearly 29% of the global market share in 2024. Rapid industrialization, expanding consumer electronics manufacturing, and high EV production rates in China, Japan, and South Korea drive strong growth. The region benefits from the presence of major semiconductor foundries and large-scale electronics suppliers supporting mass adoption of digital isolators. Growing government support for smart manufacturing and renewable energy further propels market expansion. Increasing demand for high-speed, low-power isolation solutions in telecommunication and automation applications continues to reinforce Asia Pacific’s position as a key emerging market.

Latin America

Latin America captured about 4% of the digital isolator market in 2024. The region’s growth is led by expanding industrial automation in Brazil and Mexico, along with modernization of power generation facilities. Growing adoption of energy-efficient technologies and smart grid systems supports market penetration. Local demand for automotive electronics and renewable energy infrastructure is gradually increasing. However, limited semiconductor manufacturing capacity and slower digital transformation in smaller economies restrict faster growth. Continued foreign investment and government focus on infrastructure modernization are expected to strengthen the regional outlook.

Middle East and Africa

The Middle East and Africa region represented nearly 3% of the global digital isolator market in 2024. Growth is primarily driven by industrial automation projects, renewable energy installations, and modernization of oil and gas facilities. The Gulf countries are increasingly investing in smart energy and power management technologies to enhance operational safety and efficiency. South Africa and the United Arab Emirates are emerging as key adopters in manufacturing and data center infrastructure. However, limited local production and dependency on imports restrain large-scale adoption, though gradual digitalization is creating steady opportunities across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Technology

- Magnetic Coupling

- Capacitive Coupling

- Optical Isolation (Optocouplers)

- Giant Magnetoresistance (GMR)

- Others

By Channel

- 2-Channel

- 4-Channel

- 6-Channel

- 8-Channel

By End Use Industry

- Manufacturing and Process Control

- Automotive

- Healthcare

- Telecommunications

- Consumer Electronics

- Energy and Utilities

- Aerospace and Defense

- Data Centers and IT

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Digital Isolator market is characterized by strong competition among leading global semiconductor manufacturers, including NXP Semiconductors, Murata Manufacturing Co., Ltd., Renesas Electronics Corporation, Analog Devices, Inc., Power Integrations, Texas Instruments, Inc., ON Semiconductor, Infineon Technologies AG, Broadcom Inc., and Maxim Integrated Products, Inc. The market players focus on developing high-speed, energy-efficient isolation solutions with advanced noise immunity and compact design to meet the needs of industrial, automotive, and data center applications. Continuous innovation in magnetic coupling and capacitive isolation technologies drives differentiation and market expansion. Companies are investing heavily in R&D to support next-generation applications such as electric vehicles, renewable power systems, and high-performance computing. Strategic collaborations, capacity expansions, and product portfolio diversification are key strategies used to strengthen global presence. Furthermore, the shift toward integrated isolation modules and mixed-signal systems is creating new opportunities for long-term market competitiveness.

Key Player Analysis

- NXP Semiconductors

- Murata Manufacturing Co., Ltd.

- Renesas Electronics Corporation

- Analog Devices, Inc.

- Power Integrations

- Texas Instruments, Inc.

- ON Semiconductor

- Infineon Technologies AG

- Broadcom Inc.

- Maxim Integrated Products, Inc.

Recent Developments

- In 2025, Analog Devices, Inc. (ADI) At the SPS 2025 trade show, ADI highlighted its role in enabling intelligent automation with solutions for robotics and software-defined automation.

- In 2024, Broadcom Inc. Partnered with Google to enhance data center solutions. Digital isolators are crucial for the high-speed data transmission and noise immunity required in advanced data centers.

- In 2023, Infineon Technologies AG Launched the ISOFACE 2DIBx4xxF, a new family of dual-channel digital isolators for robust high-voltage applications. This product is pin-to-pin compatible with competitors and offers certified insulation life and high common-mode transient immunity (CMTI)

Report Coverage

The research report offers an in-depth analysis based on Technology, Channel, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising adoption of digital isolators in electric and hybrid vehicles will drive steady growth.

- Expanding industrial automation and robotics applications will boost demand for reliable isolation solutions.

- Integration with renewable energy systems and smart grids will enhance long-term deployment.

- Growing preference for compact, low-power isolators will shape product innovation.

- Increased use of capacitive and GMR-based technologies will replace traditional optocouplers.

- Advancements in semiconductor design will enable faster data transmission and better noise immunity.

- Rising digitalization in healthcare and telecommunications will expand application areas.

- Data center expansion and edge computing growth will create new market opportunities.

- Collaboration between manufacturers and automotive OEMs will strengthen next-generation design adoption.

- Growing focus on energy efficiency and system safety will continue to drive global demand.