Market Overview

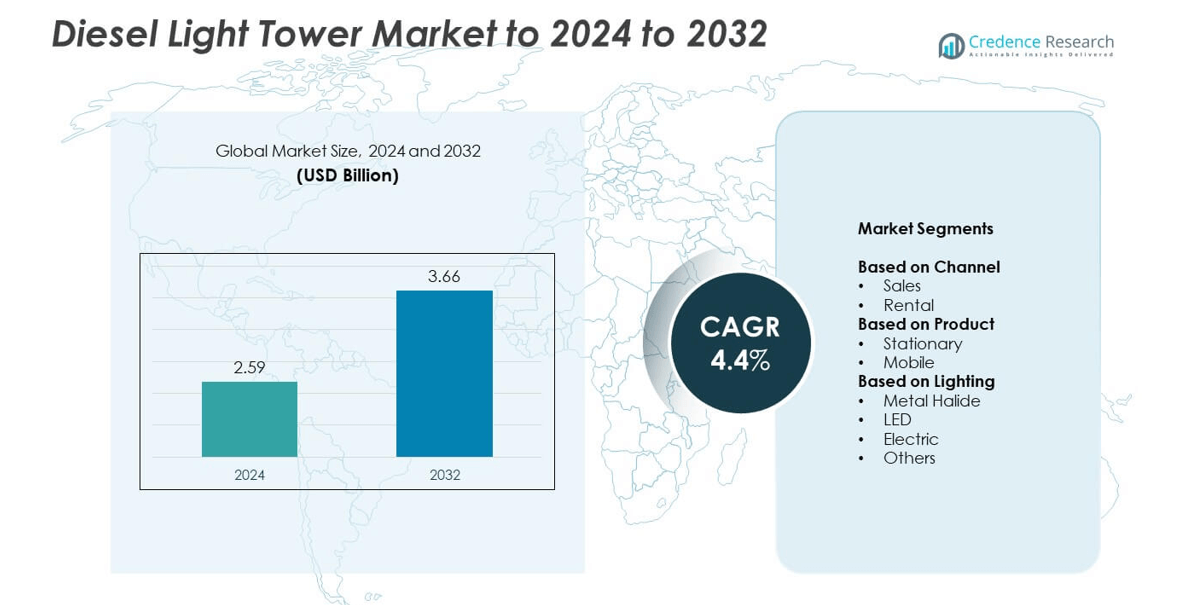

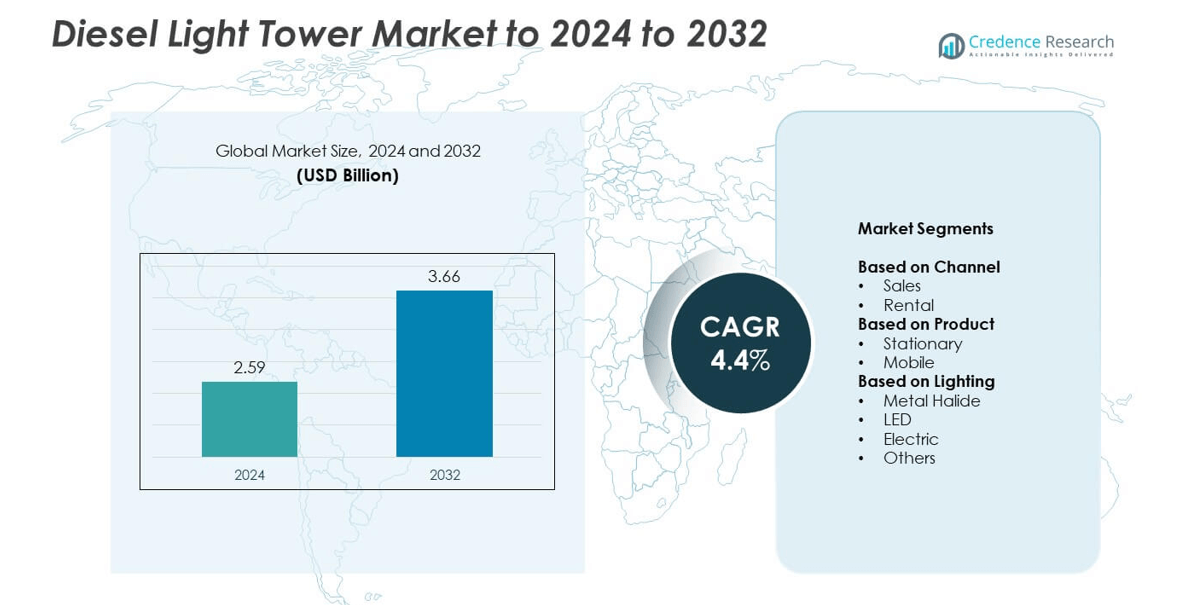

The Diesel Light Tower market size was valued at USD 2.59 billion in 2024 and is anticipated to reach USD 3.66 billion by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Light Tower Market Size 2024 |

USD 2.59 billion |

| Diesel Light Tower Market, CAGR |

4.4% |

| Diesel Light Tower Market Size 2032 |

USD 3.66 billion |

The diesel light tower market is driven by leading companies such as Trime, Generac Power Systems, Atlas Copco, United Rentals, Doosan Portable Power, and Caterpillar, which focus on technological innovation, efficiency, and sustainability. These players are expanding their portfolios with LED and hybrid-powered models to meet emission standards and operational efficiency needs. Strategic collaborations with rental firms and regional distributors further enhance market reach and competitiveness. North America led the global market with a 34% share in 2024, supported by strong infrastructure development, large oilfield projects, and a mature rental ecosystem driving continuous product demand.

Market Insights

- The diesel light tower market was valued at USD 2.59 billion in 2024 and is projected to reach USD 3.66 billion by 2032, growing at a CAGR of 4.4%.

- Growing infrastructure development, oilfield expansion, and increased use in construction and mining sites are key drivers enhancing market demand worldwide.

- The market is witnessing a shift toward LED and hybrid-powered light towers that offer better fuel efficiency, lower emissions, and improved durability.

- Major players are focusing on partnerships with rental service providers and integrating telematics for advanced fleet management, with the mobile segment holding a 68% share in 2024.

- North America dominated the global market with a 34% regional share, followed by Europe at 27% and Asia Pacific at 25%, driven by strong adoption in industrial, energy, and public infrastructure projects across developed and emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Channel

The rental segment dominated the diesel light tower market in 2024 with a share of around 61%. Its growth is driven by rising demand from construction, mining, and emergency services seeking cost-effective and flexible lighting solutions. Rental providers offer equipment with maintenance support and upgraded technology, making them preferred for short-term projects. The sales segment continues to expand in industrial and oilfield applications where continuous lighting is needed for longer durations, supported by ownership benefits and reduced long-term operational costs.

- For instance, Herc Holdings completed its acquisition of H&E Equipment Services in June 2025, expanding its total equipment fleet to approximately $10 billion in original equipment cost and increasing its locations to over 600 nationwide.

By Product

The mobile segment held the largest share of nearly 68% in 2024 due to its high portability and ease of deployment in remote locations. These units are favored for roadwork, mining, and outdoor construction operations requiring rapid setup. Technological advancements, such as hydraulic mast lifting and fuel-efficient engines, further enhance their usability. The stationary segment finds steady use in long-duration applications like infrastructure and oilfield projects, where continuous illumination and stable positioning are prioritized.

- For instance, The Wacker Neuson LTV6K (MH) light tower lists a 23-foot mast, has an illumination coverage of 12,918 ft² at 54 lux, and produces a sound level of 68.3 dB(A) at 7 m.

By Lighting

The LED lighting segment accounted for the dominant 56% market share in 2024, driven by superior energy efficiency, longer lifespan, and lower maintenance costs compared to metal halide or electric alternatives. LED towers provide higher illumination intensity with reduced fuel consumption, supporting sustainability and cost optimization goals. Metal halide remains relevant in large-scale industrial sites requiring broad light coverage, while electric and hybrid variants gain traction in urban and environmentally sensitive projects due to low emissions and quieter operation.

Key Growth Drivers

Rising Construction and Infrastructure Development

Rapid infrastructure expansion across emerging economies is a key growth driver for the diesel light tower market. Large-scale construction of highways, bridges, and urban projects demands continuous illumination, especially for night operations. Government-backed initiatives to modernize public infrastructure further boost equipment utilization. Increasing investments in commercial real estate and mining exploration also strengthen product demand, particularly for portable and durable lighting systems suitable for remote and rugged environments.

- For instance, Atlas Copco HiLight V5+ S has a 25-ft mast and 360° rotation. Wind resistance is rated to 51 mph.

Increasing Demand from Oil, Gas, and Mining Sectors

Oilfield and mining operations require consistent and reliable lighting solutions for extended outdoor activities. Diesel light towers are preferred for their mobility, long fuel runtime, and ability to withstand harsh site conditions. Expanding global exploration and extraction activities drive strong equipment replacement and rental demand. Companies operating in remote zones prioritize diesel units for enhanced visibility, operational safety, and productivity, ensuring steady growth in this segment across major industrial regions.

- For instance, the Doosan LCV6 features a Kubota engine paired with a 6 kW alternator. With its more efficient LED lamps, the unit can achieve a runtime of 210 hours.

Growing Popularity of Rental Solutions

The rising adoption of rental services is another key driver, supported by cost flexibility and reduced maintenance liabilities. Construction contractors, event organizers, and emergency response agencies increasingly rely on rental-based light towers for short-term use. Rental providers offer modern equipment with LED technology and remote monitoring, improving operational efficiency. The availability of rental options with service packages and quick deployment further strengthens the market’s expansion among small and medium enterprises managing temporary or seasonal projects.

Key Trends & Opportunities

Shift Toward LED and Hybrid Technologies

The global market is witnessing a shift toward energy-efficient LED and hybrid-powered diesel light towers. LED models offer higher brightness, lower fuel usage, and minimal maintenance, aligning with sustainability goals. Hybrid variants combining diesel with solar or battery systems provide reduced emissions and quieter operation, making them ideal for environmentally sensitive zones. Manufacturers are investing in advanced lighting control systems and smart telemetry to optimize fuel consumption and extend service intervals.

- For instance, the Trime X-Solar Hybrid integrates an extendable solar panel and features four 100W LED floodlights for zero-emission operation when running solely on battery power.

Expansion in Remote and Emergency Applications

Growing use of light towers in disaster recovery, defense operations, and emergency services presents significant opportunities. Rapid deployment and long operational endurance make diesel-powered systems essential for rescue missions and field camps. Governments and relief agencies increasingly invest in mobile lighting units to ensure safety during crises and power outages. The trend toward compact, trailer-mounted models with extended runtime enhances adaptability across varying field environments.

- For instance, JCB LT9 LED uses 6×240 W LEDs for 180,000 lumens. The hydraulic mast reaches 9 m and rotates 360°.

Integration of Telematics and Digital Monitoring

The incorporation of telematics and remote monitoring systems is transforming fleet management for diesel light towers. Operators can now track fuel levels, runtime, and maintenance schedules in real time, reducing downtime and operational costs. This integration supports predictive maintenance and efficient utilization across multiple sites. Manufacturers focus on developing IoT-enabled models to enhance reliability, minimize idle hours, and deliver data-driven performance insights for rental and end-user companies.

Key Challenges

Environmental Regulations and Emission Standards

Stringent emission norms pose a major challenge for diesel light tower manufacturers. Governments across Europe and North America enforce limits on NOx and particulate emissions from diesel engines, pushing manufacturers to upgrade or redesign models. Compliance increases production costs and delays product launches. The growing shift toward hybrid and electric alternatives also pressures companies to innovate within emission guidelines while maintaining reliability and affordability for traditional diesel units.

High Operational and Maintenance Costs

Diesel light towers involve ongoing expenses related to fuel consumption, engine servicing, and component wear. Frequent use in rugged terrains accelerates mechanical stress, increasing maintenance frequency. These costs often discourage smaller contractors and event organizers from long-term ownership. Fluctuating fuel prices and the need for periodic engine overhauls further strain budgets. Market participants focus on efficiency improvements and rental-based models to reduce total ownership costs and remain competitive.

Regional Analysis

North America

North America held the largest market share of 34% in 2024, driven by strong demand from construction, mining, and oilfield sectors across the United States and Canada. The presence of established rental networks and frequent infrastructure modernization projects boosts product adoption. Government investments in road and energy infrastructure, combined with high safety standards for night operations, sustain demand for mobile diesel light towers. Technological upgrades such as LED integration and telematics-based fleet management further enhance operational efficiency and rental utilization rates across industrial and public sector applications.

Europe

Europe accounted for 27% of the diesel light tower market share in 2024, supported by widespread use in infrastructure rehabilitation, mining, and event management. Countries such as Germany, the United Kingdom, and France emphasize low-emission, energy-efficient lighting equipment due to strict environmental regulations. The region’s growing preference for hybrid and LED-based diesel towers reflects its sustainability goals. Rental demand remains high across public works and utility maintenance, while construction projects in Eastern Europe also contribute to stable regional expansion. Technological innovations and smart control systems are reshaping equipment efficiency and lifecycle performance.

Asia Pacific

Asia Pacific captured 25% of the market share in 2024, fueled by rapid urbanization, ongoing infrastructure expansion, and industrialization in China, India, and Southeast Asia. Large-scale construction projects and mining operations drive the adoption of portable and fuel-efficient light towers. Governments across developing economies prioritize road construction, rail networks, and energy infrastructure, increasing nighttime operations. The expanding rental ecosystem and low-cost manufacturing base further support regional growth. Rising adoption of LED and hybrid models enhances sustainability and operational savings, particularly in remote construction zones and heavy engineering sites.

Latin America

Latin America represented 8% of the global diesel light tower market in 2024, with Brazil and Mexico leading regional demand. The region’s market is strengthened by mining, oilfield exploration, and large-scale civil construction projects. Growth in rental services and infrastructure rehabilitation efforts after weather-related damages also drive usage. Economic recovery and government infrastructure investments improve equipment procurement, especially for mobile lighting systems. Manufacturers target cost-effective, fuel-efficient towers to meet the region’s energy and durability requirements, supporting gradual yet steady adoption across industrial and emergency response applications.

Middle East & Africa

The Middle East and Africa accounted for 6% of the market share in 2024, supported by rising construction, oilfield, and utility sector activities. Gulf countries, including Saudi Arabia and the UAE, are major consumers due to large-scale infrastructure and industrial development projects. Africa shows growing adoption in mining and humanitarian operations requiring long-runtime lighting units. Increasing demand for portable light towers during oil and gas exploration boosts regional sales. Rental service providers continue expanding to meet short-term project needs, promoting further market penetration in remote and harsh environments.

Market Segmentations:

By Channel

By Product

By Lighting

- Metal Halide

- LED

- Electric

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The diesel light tower market is highly competitive, with key players such as Trime, Generac Power Systems, Atlas Copco, United Rentals, Doosan Portable Power, J C Bamford Excavators, Wacker Neuson, Larson Electronics, Allmand Bros, Inmesol Gensets, Colorado Standby, Caterpillar, Aska Equipments, Chicago Pneumatic, and Multiquip leading global operations. The competition focuses on energy efficiency, product reliability, and cost optimization through technological innovation. Companies prioritize developing LED-integrated and hybrid-powered towers to meet emission regulations and operational efficiency goals. Expansion strategies include collaborations with rental service providers, regional distribution partnerships, and localized manufacturing facilities to enhance market presence. Continuous product upgrades featuring telematics integration and advanced lighting control systems are shaping customer preference. Industry leaders invest heavily in research, product design, and fleet management solutions to improve performance and durability, while maintaining competitive pricing and after-sales support to strengthen brand positioning across construction, mining, and industrial segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trime

- Generac Power Systems

- Atlas Copco

- United Rentals

- Doosan Portable Power

- J C Bamford Excavators

- Wacker Neuson

- Larson Electronics

- Allmand Bros

- Inmesol Gensets

- Colorado Standby

- Caterpillar

- Aska Equipments

- Chicago Pneumatic

- Multiquip

Recent Developments

- In 2024, Generac Mobile officially launched its new global series of light towers, the GLT Series.

- In 2024, Allmand Bros Unveiled Hybrid LT-Series concept light tower at The ARA Show.

- In 2023, Atlas Copco announced the launch of HiLight HVT 500, a new hybrid light tower combining diesel and battery technology.

Report Coverage

The research report offers an in-depth analysis based on Channel, Product, Lighting and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The diesel light tower market will experience steady growth driven by ongoing construction and mining activities.

- Increasing demand for energy-efficient LED and hybrid-powered models will reshape product offerings.

- Rental-based business models will continue to dominate due to flexibility and reduced ownership costs.

- Technological integration with IoT and telematics will enhance fleet monitoring and performance optimization.

- Rising infrastructure investments in developing economies will sustain long-term equipment demand.

- Manufacturers will focus on low-emission engines to comply with stricter environmental regulations.

- Portable and mobile light towers will gain traction for rapid deployment in remote operations.

- Expanding emergency response and disaster recovery activities will create new application opportunities.

- Collaboration between OEMs and rental companies will drive market competitiveness and regional expansion.

- Adoption of hybrid and solar-assisted diesel towers will accelerate the market’s shift toward sustainability.