Market Overview

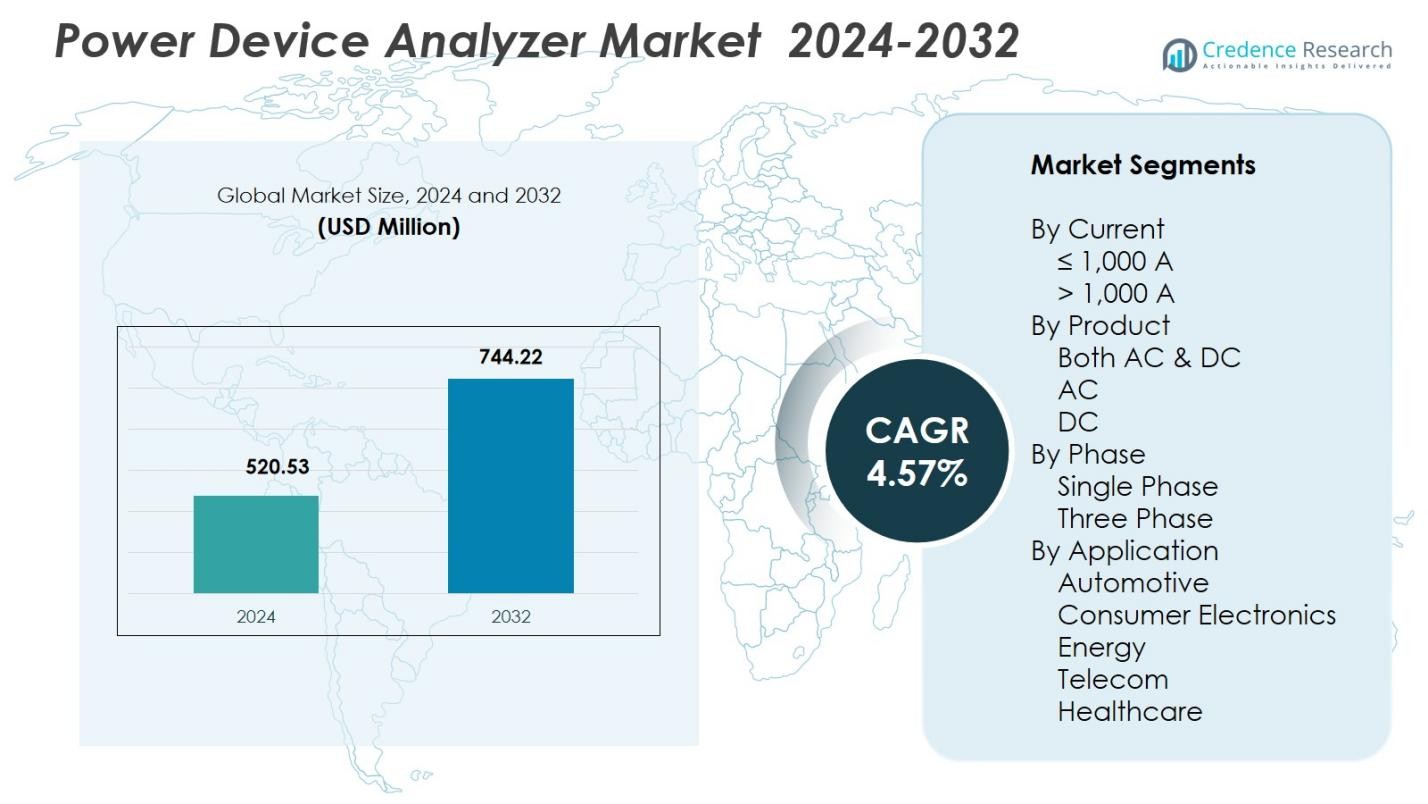

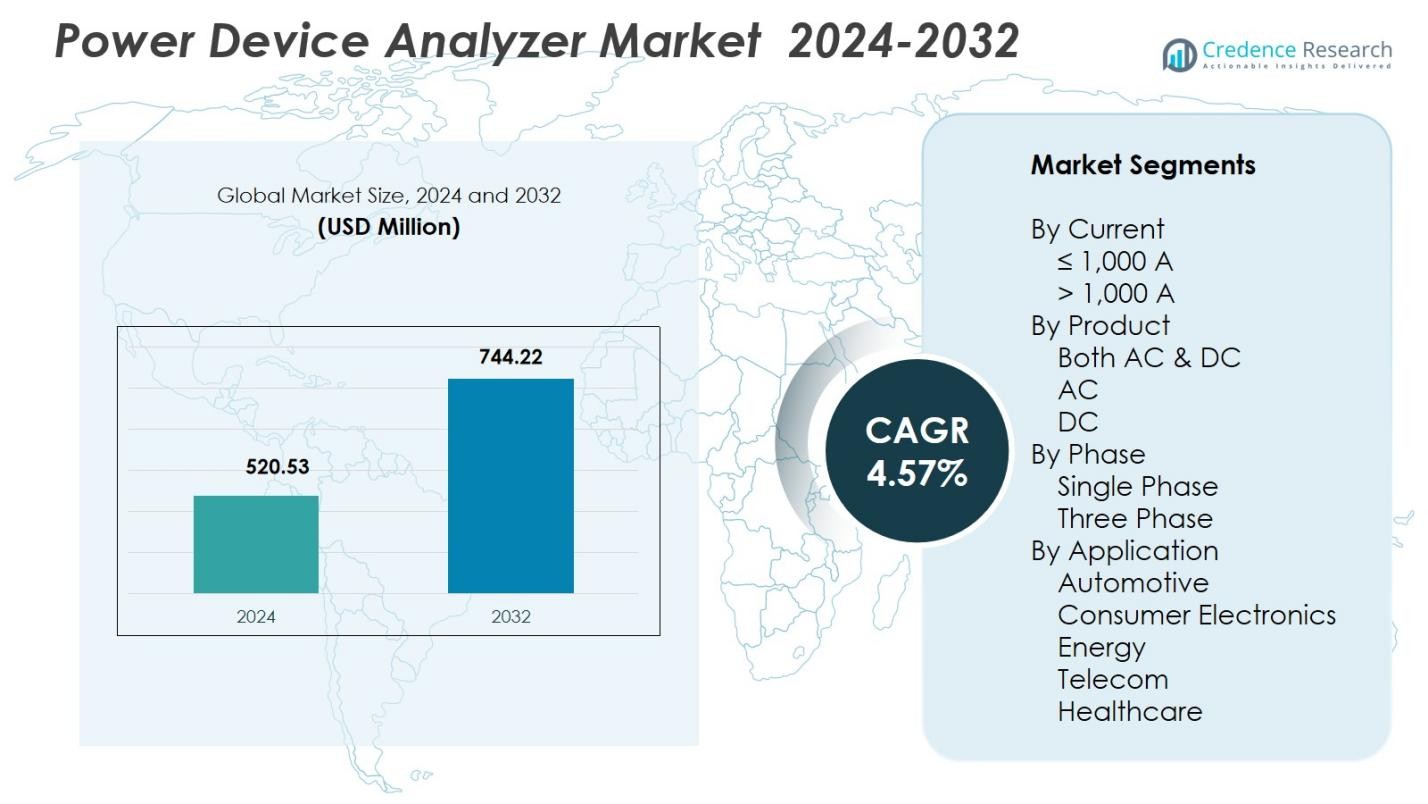

Power Device Analyzer Market size was valued at USD 520.53 Million in 2024 and is anticipated to reach USD 744.22 Million by 2032, at a CAGR of 4.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Device Analyzer Market Size 2024 |

USD 520.53 Million |

| Power Device Analyzer Market, CAGR |

4.57% |

| Power Device Analyzer Market Size 2032 |

USD 744.22 Million |

Power Device Analyzer Market is characterized by strong participation from leading players such as DEWETRON, Carlo Gavazzi, Chroma ATE, Dewesoft, HIOKI E.E. CORPORATION, Fluke Corporation, Circutor, Arbiter Systems, Delta Electronics, and B&K Precision Corporation, each advancing high-accuracy measurement technologies to support evolving power electronics applications. These companies focus on enhancing bandwidth, precision, and AC/DC multifunctionality to address growing demand across automotive, renewable energy, and industrial sectors. Regionally, Asia-Pacific led the market with a 34.1% share, supported by large-scale electronics manufacturing and rapid EV expansion, followed by North America and Europe, which remain major hubs for advanced testing infrastructure and power system innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Power Device Analyzer Market reached USD 520.53 Million in 2024 and will grow at a CAGR of 4.57% through 2032, driven by rising demand for precision measurement.

- Market growth is supported by strong adoption of analyzers in EV systems, renewable inverters, and industrial automation, with the ≤1,000 A segment holding 63.4% share due to broad applicability across testing environments.

- Key trends include increasing use of SiC and GaN semiconductor devices, which accelerates demand for high-frequency, multi-channel analyzers offering advanced measurement accuracy.

- Leading players such as DEWETRON, Chroma ATE, HIOKI, Fluke, and Delta Electronics expand portfolios with enhanced AC/DC capabilities and smart, software-driven test automation.

- Regionally, Asia-Pacific leads with 34.1% share, followed by North America at 32.6% and Europe at 28.4%, while Latin America and Middle East & Africa show emerging adoption aligned with industrial modernization and renewable expansion.

Market Segmentation Analysis:

By Current

The ≤1,000 A segment held a 63.4% share in 2024, emerging as the dominant category in the Power Device Analyzer Market due to its extensive adoption across electronics testing, industrial automation, power supply validation, and renewable system monitoring. Its strong position is driven by the rising penetration of compact electronic devices and mid-range power systems requiring high-accuracy measurements within manageable current levels. Manufacturers increasingly integrate multifunctional analyzers in this range to support efficiency evaluations, design optimization, and compliance testing, reinforcing sustained demand across laboratories, R&D centers, and production environments.

- For instance, Keysight’s N6705C power analyzer supports multifunctional testing for industrial power supply validation, combining accuracy with compact design.

By Product

The Both AC & DC segment accounted for a 58.7% share in 2024, making it the leading product category as industries require analyzers capable of evaluating mixed-signal power systems in EV charging stations, solar inverters, UPS systems, and industrial drives. This segment grows strongly because engineers prefer unified analyzers that eliminate the need for separate AC- and DC-only devices, improving operational efficiency and reducing testing complexity. As hybrid energy systems expand globally, multifunctional AC/DC analyzers enable comprehensive performance validation, power efficiency measurements, and regulatory compliance, accelerating adoption across research, manufacturing, and grid applications.

- For instance, Tektronix’s PA4000 series offers integrated AC/DC power analysis, allowing manufacturers to test EV chargers’ complex waveforms with improved accuracy and reduced setup time.

By Phase

The Three Phase segment commanded a 61.9% share in 2024, dominating the market due to broad usage in heavy industrial machinery, energy distribution networks, renewable power plants, and high-capacity motor and drive testing. This segment benefits from increasing deployment of three-phase electrical infrastructure and rising emphasis on efficiency benchmarking for large-scale equipment. Engineers rely on these analyzers for harmonic evaluation, load balancing, system optimization, and high-precision fault detection. Growing modernization of industrial facilities and expansion of smart grid projects further strengthen demand for three-phase power device analyzers requiring advanced accuracy and multi-channel measurement capabilities.

Key Growth Drivers

Increasing Demand for High-Precision Power Measurement

Growing emphasis on energy efficiency, system optimization, and regulatory compliance is driving strong adoption of high-precision power device analyzers across industrial, automotive, and electronics sectors. Manufacturers increasingly rely on advanced analyzers to validate inverter efficiency, assess switching device performance, and measure real-time power quality under dynamic load conditions. The rising integration of power electronics in EVs, renewable energy, and automation systems further accelerates demand, as accurate electrical characterization becomes essential for improving reliability, extending operational life, and achieving performance certification.

- For instance, HIOKI launched the PW8001 Power Analyzer featuring eight-channel, high-bandwidth measurement to support EV inverter validation with superior accuracy.

Expansion of Renewable Energy and Smart Grid Infrastructure

The rapid expansion of solar, wind, and energy storage installations significantly boosts the requirement for power device analyzers capable of evaluating AC/DC hybrid systems. Utilities and developers depend on these analyzers to monitor inverter output, optimize grid integration, perform harmonic analysis, and ensure system stability under fluctuating generation conditions. Smart grid modernization initiatives also strengthen adoption as operators need advanced tools for load flow analysis, power factor correction, and real-time fault diagnostics. This infrastructure transformation enhances long-term demand for accurate and multifunctional power measurement solutions.

- For instance, Chroma ATE introduced its 8000 ATS platform to support high-precision PV inverter testing aligned with international grid-tie standards.

Accelerating Electrification in Automotive and Industrial Sectors

Electrification trends, including EV adoption, factory automation, and robotics deployment, are creating substantial need for analyzers that validate power electronics such as converters, batteries, and motor drives. Automotive OEMs use these analyzers to measure efficiency, switching behavior, and thermal performance of power modules across development and production cycles. Industrial users rely on them for motor control verification, predictive maintenance, and energy management. The rising use of semiconductor-based power devices like SiC and GaN amplifies demand for advanced testing capabilities, reinforcing the segment’s strong growth trajectory.

Key Trends & Opportunities

Shift Toward High-Frequency and Wide-Bandgap Device Testing

A major trend shaping the market is the transition to wide-bandgap semiconductor technologies, particularly SiC and GaN, which enable faster switching speeds and higher efficiency in power systems. This shift creates strong opportunities for analyzers capable of handling high-frequency harmonics, transient behaviors, and rapid switching dynamics. Manufacturers are introducing enhanced bandwidth and sampling-rate capabilities to support next-generation semiconductor testing. As industries adopt WBG devices for EV chargers, renewable inverters, and industrial drives, demand for advanced analyzers tailored to these applications continues to expand rapidly.

- For instance, Infineon Technologies has developed SiC MOSFETs that support higher voltage handling, simplifying designs for high-voltage DC/DC converters and DC/AC inverters used in electric vehicles and renewable energy systems.

Integration of IoT, Cloud Analytics, and Automation in Measurement Systems

Digital transformation is opening significant opportunities as power device analyzers integrate IoT connectivity, cloud-based data analytics, and automated testing workflows. These enhancements allow remote monitoring, real-time performance visualization, and predictive diagnostics, improving efficiency in R&D labs and production environments. Automated test sequencing reduces manual intervention, supporting repeatability and high-throughput validation for semiconductor and electronics manufacturing. Growing demand for connected test environments in smart factories and automotive electronics labs accelerates adoption, enabling deeper insights and faster decision-making through centralized data management and AI-enabled analysis.

- For instance, Tektronix has introduced automated test sequencing in their power analyzers, significantly reducing manual test interventions and enhancing throughput in semiconductor validation processes.

Key Challenges

High Cost of Advanced Power Device Analyzers

One of the major challenges is the high cost associated with advanced analyzers featuring multi-channel capability, high bandwidth, and wide dynamic measurement ranges. These units require sophisticated hardware, precision components, and specialized software, making them expensive for small laboratories and emerging manufacturers. Budget constraints often delay procurement or restrict upgrades, particularly in developing economies. The cost challenge also affects large-scale testing environments requiring multiple units. Vendors must innovate in modular designs and cost-optimized models to improve accessibility without compromising measurement accuracy or performance.

Complexity of Testing Advanced Power Electronics

The increasing sophistication of power electronics—especially systems based on SiC, GaN, and high-frequency switching architectures—creates substantial testing complexity. Engineers require deep expertise to analyze harmonics, switching losses, transient responses, and thermal interactions accurately. Misinterpretation of measurements or improper configuration can lead to incorrect system evaluations. Additionally, integrating analyzers with other lab instruments, automation platforms, and simulation tools adds operational challenges. The need for skilled professionals and extensive training slows adoption, making ease-of-use improvements essential for broader market penetration.

Regional Analysis

North America

North America held a 32.6% share in 2024, driven by strong adoption of advanced power testing solutions across automotive electrification, semiconductor R&D, and renewable energy expansion. The region benefits from extensive investments in EV charging infrastructure, power electronics innovation, and grid modernization programs that require high-precision measurement tools. U.S. and Canadian manufacturers increasingly integrate SiC and GaN device testing into product development cycles, strengthening demand for multi-channel, high-frequency analyzers. Supportive energy efficiency regulations and a well-established industrial base further reinforce the region’s leadership in technology adoption.

Europe

Europe accounted for a 28.4% share in 2024, supported by rapid advancements in renewable energy systems, industrial automation, and electric mobility. Countries including Germany, France, and the U.K. drive strong demand for power device analyzers to support inverter testing, grid stability assessments, and high-efficiency motor validation. The region’s stringent energy performance standards accelerate adoption in research laboratories and manufacturing facilities. Growing deployment of solar, wind, and storage technologies, along with widespread electrification initiatives under EU climate targets, continues to create significant opportunities for high-precision AC/DC and multi-phase analyzers.

Asia-Pacific

Asia-Pacific dominated with a 34.1% share in 2024, emerging as the fastest-growing region due to large-scale electronics manufacturing, rapid EV production expansion, and extensive renewable energy deployment. China, Japan, South Korea, and India are major contributors, leveraging advanced analyzers for semiconductor device validation, power converter efficiency testing, and industrial automation. Increasing investments in smart grid infrastructure and high-capacity power systems accelerate adoption across utilities and engineering facilities. The region’s strong semiconductor ecosystem, coupled with widespread adoption of SiC and GaN technologies, drives high demand for next-generation measurement solutions.

Latin America

Latin America represented a 2.6% share in 2024, with demand primarily supported by industrial modernization, energy infrastructure upgrades, and renewable project development in Brazil, Mexico, and Chile. The region is increasingly adopting power device analyzers for motor drive testing, power quality assessment, and inverter performance analysis as industries transition toward energy-efficient equipment. Growing solar and wind installations require precise AC/DC measurement capabilities, particularly for grid integration. While adoption is emerging, government-led energy reforms and increased foreign investment are strengthening the market’s long-term growth potential across utilities and manufacturing sectors.

Middle East & Africa

The Middle East & Africa accounted for a 2.3% share in 2024, driven by rising adoption of power analyzers in utility-scale renewable energy projects, industrial automation, and infrastructure expansion. Countries such as the UAE, Saudi Arabia, and South Africa are investing heavily in solar, hydrogen, and grid modernization initiatives, creating demand for precision testing tools. Growth is further supported by increased deployment of high-capacity motors, power distribution equipment, and advanced converters across oil & gas, mining, and manufacturing sectors. Despite relatively smaller market size, technology adoption is accelerating due to energy diversification efforts.

Market Segmentations:

By Current

By Product

By Phase

By Application

- Automotive

- Consumer Electronics

- Energy

- Telecom

- Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Power Device Analyzer Market includes major players such as DEWETRON, Carlo Gavazzi, Chroma ATE, Dewesoft, HIOKI E.E. CORPORATION, Fluke Corporation, Circutor, Arbiter Systems, Delta Electronics, and B&K Precision Corporation. The market reflects strong innovation dynamics as companies focus on advanced measurement accuracy, wider bandwidth capabilities, and integrated AC/DC testing platforms to support next-generation power electronics. Vendors actively expand product portfolios targeting applications such as EV powertrains, renewable inverters, semiconductor device characterization, and industrial automation. Strategic investments in high-frequency measurement technologies enable players to address growing demand for SiC and GaN device testing. Manufacturers also integrate IoT connectivity, automated test sequences, and cloud-enabled data analytics to enhance workflow efficiency in R&D and production environments. Partnerships with automotive OEMs, grid operators, and semiconductor firms further strengthen market penetration while continuous R&D ensures improved functionality, durability, and measurement reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DEWETRON

- Carlo Gavazzi

- Chroma ATE

- Dewesoft

- HIOKI E.E. CORPORATION

- Fluke Corporation

- Circutor

- Arbiter Systems

- Delta Electronics

- B&K Precision Corporation

Recent Developments

- In October 2025, Hioki E.E. Corporation launched the PW4001 Power Analyzer, a compact and field-ready instrument designed for accurate inverter and EV-power electronics testing under real-world conditions.

- In April 2025, DEWETRON entered a new growth phase by partnering with ANRITSU following separation from TKH Group, reflecting a strategic decision to accelerate its global expansion in test and measurement for EV, renewable-energy and battery testing markets.

- In May 2025, Chroma ATE announced upgrades to its 3650-S2 power-testing platform, including a forthcoming HTMU board integrating AI-guided test flows for power-chip evaluation.

Report Coverage

The research report offers an in-depth analysis based on Current, Product, Phase, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as industries increasingly adopt advanced power electronics across automotive, renewable energy, and industrial automation.

- Demand for analyzers with high-frequency capability will rise due to wider use of SiC and GaN semiconductor devices.

- R&D labs and manufacturers will prioritize multifunctional AC/DC analyzers to streamline complex testing environments.

- Integration of IoT and cloud-based analytics will enhance real-time monitoring and remote testing efficiency.

- Automated test systems will gain traction as production lines seek higher throughput and repeatability.

- EV growth will significantly boost demand for analyzers used in battery, inverter, and motor drive validation.

- Grid modernization initiatives will strengthen adoption by utilities for power quality, fault detection, and system optimization.

- Miniaturized and portable analyzers will grow in demand to support field diagnostics and onsite performance evaluation.

- Adoption in emerging economies will accelerate as industries upgrade electrical infrastructure and testing standards.

- Vendors will strengthen innovation in accuracy, bandwidth, and software intelligence to address evolving measurement challenges.