Market Overviews

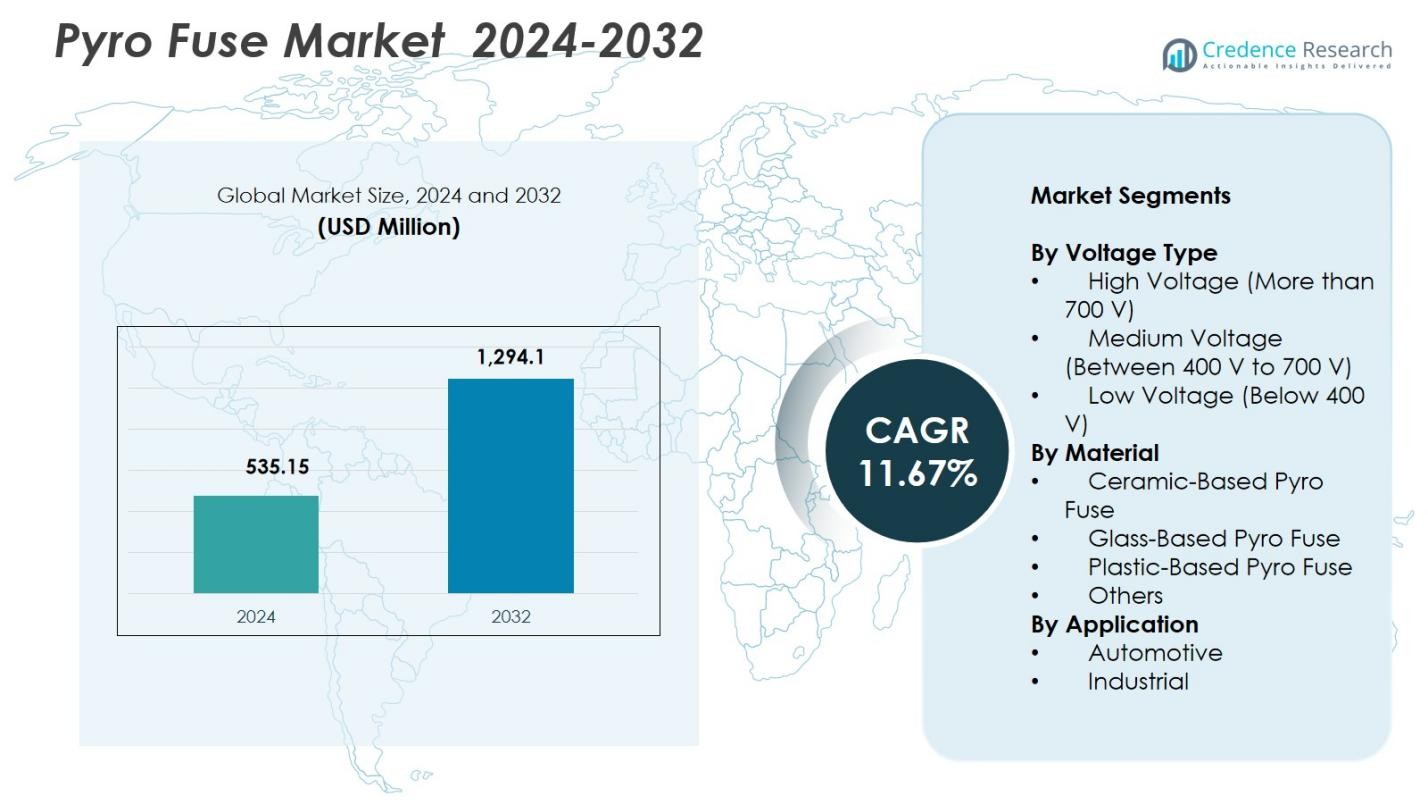

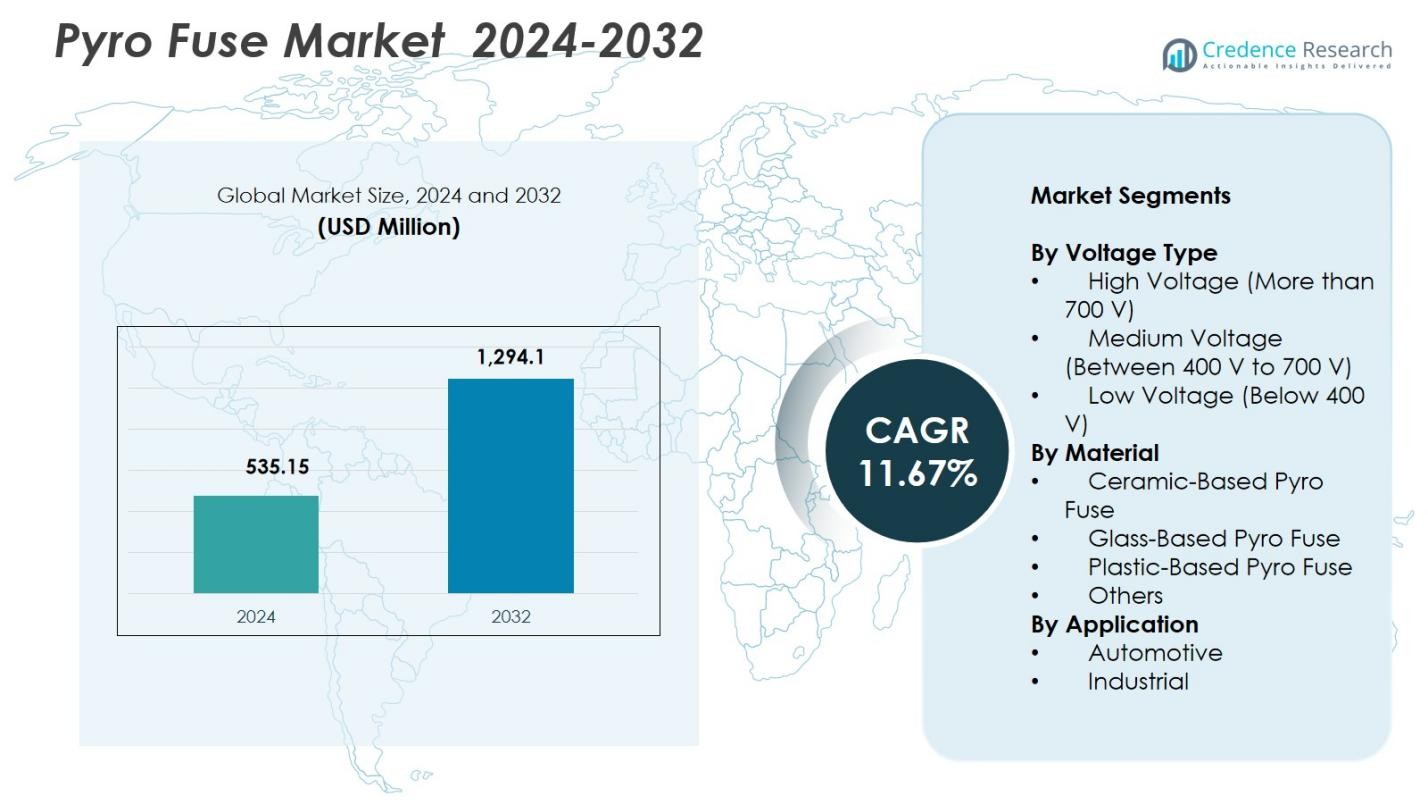

Pyro Fuse Market size was valued at USD 535.15 Million in 2024 and is anticipated to reach USD 1,294.1 Million by 2032, at a CAGR of 11.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pyro Fuse Market Size 2024 |

USD 535.15 Million |

| Pyro Fuse Market, CAGR |

11.67% |

| Pyro Fuse Market Size 2032 |

USD 1,294.1 Million |

Pyro Fuse Market is driven by major players such as Joyson Electronic, MTA Group, Eaton, Hangzhou Chauron Technology, Daicel Corporation, Littelfuse, Mersen, Miba AG, Xi’an Sinofuse Electric, and Pacific Engineering Corporation (PEC), all focusing on advanced high-voltage protection solutions for EVs, industrial systems, and energy storage applications. These companies strengthen their positions through product innovation, safety-focused designs, and expanded manufacturing capabilities to meet rising global electrification demands. Asia-Pacific leads the Pyro Fuse Market with 33.9% share in 2024, followed by North America at 31.4%, supported by strong EV adoption, battery production, and rapid integration of high-voltage architectures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Pyro Fuse Market was valued at USD 535.15 Million in 2024 and will grow at a CAGR of 11.67% through 2032.

- Market growth is driven by rising EV production, adoption of high-voltage powertrains, and increased deployment of energy storage systems, boosting demand for rapid-response circuit isolation solutions.

- Key trends include advancement in solid-state protection, miniaturized fuse designs, and integration of smart diagnostic features aligned with next-generation battery architectures.

- Leading players such as Joyson Electronic, MTA Group, Eaton, Daicel Corporation, Littelfuse, and Mersen enhance their positions through product innovation, material upgrades, and expanded OEM partnerships, with the High Voltage segment holding 46.8% share in 2024.

- Asia-Pacific commands 33.9% regional share, North America holds 31.4%, and Europe captures 28.7%, supported by strong EV penetration, regulatory safety mandates, and rapid industrial electrification across major economies.

Market Segmentation Analysis:

By Voltage Type:

The Pyro Fuse Market by voltage type is dominated by the High Voltage segment, holding 46.8% share in 2024, driven by rising adoption of high-voltage electric powertrains in EVs, hybrid vehicles, and advanced industrial systems requiring fast-disconnect protection. High-voltage pyro fuses support reliable isolation during thermal or electrical faults, enhancing safety standards across automotive OEMs and energy storage systems. Medium Voltage accounts for 33.4% share, supported by its role in commercial EVs and industrial automation, while Low Voltage, with 19.8% share, caters to auxiliary circuits and compact electronic protection applications.

- For instance, Daicel’s Pyro-Fuse delivers instantaneous shutdown of high-voltage currents in EV battery systems, supporting up to 1000Vdc architectures for rapid fault isolation and enhanced vehicle safety.

By Material:

The Ceramic-Based Pyro Fuse segment leads the market with 41.2% share in 2024, driven by its superior thermal resistance, mechanical strength, and ability to withstand high fault currents in EV battery packs and industrial energy systems. Glass-Based fuses hold 27.6% share, benefiting from stable insulation properties and precise rupture control in controlled environments. Plastic-Based fuses capture 21.5% share due to their lightweight and cost-efficient structure, while the Others category accounts for 9.7% share, addressing niche requirements in specialty electronics and emerging safety designs.

- For instance, Mersen employs ceramic external isolation in its EV/HEV pyro fuses, paired with silver, copper, or tin conductive elements and sand filler, enabling use as main battery fuses with reliable performance in high-voltage setups.

By Application:

The Automotive segment dominates the Pyro Fuse Market with 58.3% share in 2024, propelled by accelerating global EV production, stringent vehicle safety mandates, and increasing deployment of high-capacity lithium-ion batteries requiring rapid isolation during thermal runaway. Automakers integrate pyro fuses to protect battery modules, power electronics, and charging systems. The Industrial segment holds 41.7% share, supported by rising demand for protective components in robotics, renewable energy installations, heavy machinery, and energy storage systems, where reliable fault interruption and operational safety remain critical performance drivers.

Key Growth Drivers

Rising Adoption of Electric and Hybrid Vehicles

The rapid expansion of global EV and hybrid vehicle manufacturing significantly drives the Pyro Fuse Market, as automakers prioritize advanced safety systems for high-capacity lithium-ion batteries and power electronics. Pyro fuses provide instantaneous circuit isolation during thermal runaway or collision events, aligning with stringent automotive safety regulations. Increasing integration of high-voltage platforms, fast-charging architectures, and energy-dense battery modules strengthens demand for robust fault-protection components. As EV penetration accelerates across passenger cars, commercial fleets, and autonomous mobility, pyro fuses gain wider adoption as essential battery safety mechanisms.

- For instance, Daicel Corporation’s Pyro-Fuse instantly interrupts high-voltage currents in emergencies, leveraging airbag inflator technology to prevent electric shock and secondary accidents in EVs with larger-capacity batteries.

Expansion of Energy Storage and Renewable Power Systems

Growth in stationary energy storage systems and renewable energy installations fuels demand for reliable high-voltage protection, positioning pyro fuses as critical components in safeguarding battery arrays and power conversion units. Their ability to rapidly disconnect circuits under abnormal current conditions supports operational stability and prevents cascading system failures. Grid modernization initiatives, rising deployment of utility-scale storage, and microgrid expansion further stimulate adoption. As global decarbonization efforts intensify, energy infrastructure operators increasingly rely on advanced pyro fuse technologies to enhance safety, efficiency, and long-term system resilience.

- For instance, Mersen’s χp hybrid pyro-fuse series targets battery energy storage and PV installations, offering self-triggering operation up to 1000V DC and 800A with breaking capacities from 0 to 30kA in a compact footprint.

Increasing Focus on Vehicle and Industrial Safety Standards

Tightening global safety frameworks across automotive and industrial sectors boosts demand for pyro fuses due to their precision-driven fault response and ability to prevent catastrophic failures. Automakers integrate these devices to meet evolving crash-safety protocols, battery protection guidelines, and high-voltage isolation requirements. In industrial environments, stricter equipment protection mandates and rising automation reinforce adoption in robots, power systems, and heavy machinery. Continuous regulatory upgrades and OEM-driven design standardization ensure sustained market growth, as pyro fuses become indispensable for meeting compliance and performance expectations.

Key Trends & Opportunities

Advancement of Solid-State and Smart Safety Technologies

A major trend shaping the Pyro Fuse Market is the integration of smart sensing and solid-state switching capabilities that enhance accuracy, response time, and diagnostic functionality. Manufacturers increasingly embed intelligent monitoring to detect micro-faults, thermal deviations, or abnormal current spikes, enabling predictive protection in EVs and industrial systems. Miniaturized designs and adaptive architectures support compatibility with next-generation battery packs and compact power modules. This technological shift creates strong opportunities for high-performance, digitally enabled pyro fuses that align with connected vehicle and Industry 4.0 ecosystems.

- For instance, Eaton launched its dual-trigger pyro fuse (F40A model) in 2025, which combines battery management system (BMS) triggering with a self-triggering backup function to separate short circuits independently, mimicking thermal fuse behavior for added EV safety layers.

Growing Opportunity in High-Voltage EV Platforms and Fast-Charging Systems

The transition toward 800-volt and 1000-volt EV architectures presents a significant opportunity for pyro fuse manufacturers, as higher system voltages require advanced protection elements with superior thermal and mechanical durability. Rapid expansion of ultra-fast charging infrastructure and high-output battery systems further increases the need for precise, high-capacity fault-isolation components. OEM investments in premium safety solutions and new EV platforms create a favorable environment for pyro fuse advancements. Companies offering high-voltage-rated, lightweight, and thermally stable fuses are well positioned to capture emerging demand.

- For instance, Sensata Technologies’ STPS500 series PyroFuse handles up to 1000V with a high breaking capacity of 18kA at 10µH and continuous current up to 500A. Launched for high-voltage safety in automotive and charging systems, it achieves disconnection in less than 1ms with post-interruption insulation resistance exceeding 50MΩ at 1000V.

Key Challenges

High Manufacturing Complexity and Cost Constraints

The Pyro Fuse Market faces challenges arising from sophisticated engineering requirements, precision materials, and stringent quality validation processes that increase production costs. Manufacturers must ensure flawless operation during high-energy fault events, necessitating rigorous testing and advanced fabrication technologies. This elevates overall component cost, limiting adoption among budget-sensitive OEMs and industrial users. Balancing high performance with cost-efficiency remains a persistent challenge, especially as EV and energy storage applications scale rapidly and require affordable yet highly reliable protection solutions.

Limited Standardization and Design Integration Issues

A major challenge is the lack of uniform standards for pyro fuse integration across diverse EV platforms, battery chemistries, and industrial architectures. Variations in powertrain design, voltage ratings, and system layouts require customized fuse configurations, increasing design complexity and extending product development cycles. Inconsistent global regulatory frameworks further complicate standardization. These hurdles impact large-scale adoption and create compatibility issues for manufacturers seeking broader market penetration. Enhanced industry collaboration and harmonized safety norms are necessary to streamline integration and reduce engineering barriers.

Regional Analysis

North America

North America holds 31.4% share of the Pyro Fuse Market in 2024, driven by strong electric vehicle adoption, advanced battery manufacturing capabilities, and increasing deployment of stationary energy storage systems. The U.S. leads regional growth with expanding EV production lines, government-backed clean energy initiatives, and heightened safety requirements for high-voltage systems. Automakers and industrial operators integrate pyro fuses to enhance fault protection across power electronics and energy infrastructure. Growing R&D investment in next-generation EV platforms and grid modernization projects further strengthens regional demand for high-performance, high-voltage pyro fuse solutions.

Europe

Europe accounts for 28.7% share in 2024, supported by stringent automotive safety regulations, rapid electrification across passenger and commercial fleets, and expansion of renewable power installations. Countries such as Germany, France, and the U.K. accelerate EV production and battery ecosystem development, increasing adoption of pyro fuses for enhanced battery protection and compliance with high-voltage safety standards. Industrial automation and renewable integration also contribute to market demand. Strong policy mandates targeting carbon neutrality and the rise of 800-volt EV architectures position Europe as a critical hub for advanced pyro fuse deployment.

Asia-Pacific

Asia-Pacific dominates the global Pyro Fuse Market with 33.9% share in 2024, driven by large-scale EV manufacturing, significant battery production capacity, and rapid industrial expansion. China leads with strong domestic OEM activity and extensive deployment of high-voltage platforms, followed by Japan and South Korea with robust R&D ecosystems and advanced semiconductor and materials capabilities. The region benefits from strong government incentives for electrification and renewable energy integration. Growing demand for power storage systems, fast-charging networks, and industrial automation reinforces Asia-Pacific’s position as the fastest-growing market for pyro fuses.

Rest of the World

The Rest of the World holds 6.0% share in 2024, with growth driven by increasing electrification initiatives across Latin America, the Middle East, and Africa. Expanding renewable energy projects, adoption of utility-scale energy storage systems, and rising interest in EV infrastructure support market penetration. Industrial modernization in emerging economies contributes to the demand for high-voltage protection components. While development rates vary across countries, improving regulatory frameworks and growing investment in clean energy technologies create long-term opportunities for pyro fuse suppliers targeting new and underserved markets.

Market Segmentations:

By Voltage Type

- High Voltage (More than 700 V)

- Medium Voltage (Between 400 V to 700 V)

- Low Voltage (Below 400 V)

By Material

- Ceramic-Based Pyro Fuse

- Glass-Based Pyro Fuse

- Plastic-Based Pyro Fuse

- Others

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Pyro Fuse Market features key players including Joyson Electronic, MTA Group, Eaton, Hangzhou Chauron Technology, Daicel Corporation, Xi’an Sinofuse Electric, Miba AG, Littelfuse, Mersen, and Pacific Engineering Corporation (PEC) leading advancements in high-voltage protection technologies. Market participants focus on developing compact, high-response pyro fuses tailored for electric vehicles, energy storage systems, and industrial power applications. Companies increasingly invest in material innovation, precision engineering, and automated manufacturing to enhance reliability and thermal endurance. Strategic collaborations with automotive OEMs and battery manufacturers strengthen product integration, while expansions in testing facilities help meet evolving global safety standards. As EV platforms shift toward 800-volt and higher architectures, manufacturers emphasize performance optimization, lightweight designs, and extended lifecycle validation. Continuous R&D, portfolio diversification, and geographic expansion remain central strategies as companies work to capture growing demand from electrification, industrial automation, and renewable power sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Joyson Electronic

- MTA Group

- Eaton

- Hangzhou Chauron Technology

- Daicel Corporation

- Xi’an Sinofuse Electric

- Miba AG

- Littelfuse

- Mersen

- Pacific Engineering Corporation (PEC)

Recent Developments

- In April 2025, Sensata Technologies launched its STPS500 series PyroFuse to enhance high-voltage safety in automotive, industrial, and charging applications.

- In September 2025, Littelfuse introduced its 828 and 827 Series high-voltage fuses rated up to 1,000 VDC for onboard chargers and EV power distribution units.

- In April 2025 Eaton introduced a new dual-trigger pyro fuse to its EV circuit protection line, enhancing safety and reliability for electric vehicles.

Report Coverage

The research report offers an in-depth analysis based on Voltage Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as global EV production accelerates and high-voltage safety requirements strengthen.

- Adoption of 800-volt and next-generation EV architectures will increase demand for advanced high-performance pyro fuses.

- Energy storage systems and renewable installations will drive higher integration of pyro fuses for fault protection.

- Material innovations will enhance thermal resistance, durability, and miniaturization of fuse structures.

- Smart and sensor-enabled pyro fuses will gain traction for real-time monitoring and predictive safety functions.

- Manufacturers will strengthen partnerships with automotive OEMs and battery suppliers for platform-level integration.

- Rapid grid modernization and industrial automation will boost usage in high-capacity power systems.

- Regulatory upgrades will promote adoption of precise fault-isolation components across safety-critical applications.

- Production expansion in Asia-Pacific will reshape supply chains and reduce manufacturing costs.

- R&D efforts will increasingly focus on solid-state switching and hybrid protection technologies for emerging applications.